|

|

|

AGENDA

Council Meeting

|

|

I hereby give notice that a Meeting of the Kapiti

Coast District Council will be held on:

|

|

Date:

|

Thursday, 25 June 2020

|

|

Time:

|

9.30am

|

|

Location:

|

Council Chamber

Ground Floor, 175 Rimu Road

Paraparaumu

|

|

Wayne Maxwell

Chief Executive

|

|

Council

Meeting Agenda

|

25 June 2020

|

Kapiti Coast District Council

Notice

is hereby given that a meeting of the Kapiti Coast District Council will be

held in the Council Chamber,

Ground Floor, 175 Rimu Road, Paraparaumu, on Thursday 25 June 2020, 9.30am.

Council Members

|

Mayor K Gurunathan

|

Chair

|

|

Deputy Mayor Janet Holborow

|

Deputy

|

|

Cr Angela Buswell

|

Member

|

|

Cr James Cootes

|

Member

|

|

Cr Jackie Elliott

|

Member

|

|

Cr Gwynn Compton

|

Member

|

|

Cr Jocelyn Prvanov

|

Member

|

|

Cr Martin Halliday

|

Member

|

|

Cr Sophie Handford

|

Member

|

|

Cr Robert McCann

|

Member

|

|

Cr Bernie Randall

|

Member

|

2 Council

Blessing

“As we deliberate on the

issues before us, we trust that we will reflect positively on the

communities we serve. Let us all seek to be effective and just, so that with

courage, vision and energy, we provide positive leadership in a spirit of

harmony and compassion.”

I a mātou e whiriwhiri ana

i ngā take kei mua i ō mātou aroaro, e pono ana mātou ka

kaha tonu ki te whakapau mahara huapai mō ngā hapori e mahi nei

mātou. Me kaha hoki mātou katoa kia whaihua, kia tōtika

tā mātou mahi, ā, mā te māia, te tiro whakamua me te

hihiri ka taea te arahi i roto i te kotahitanga me te aroha.

3 Apologies

4 Declarations

of Interest Relating to Items on the Agenda

Notification from Elected

Members of:

4.1 – any interests that

may create a conflict with their role as an elected member relating to the

items of business for this meeting, and

4.2 – any interests in

items in which they have a direct or indirect pecuniary interest as provided

for in the Local Authorities (Members’ Interests) Act 1968

5 Public

Speaking Time for Items Relating to the Agenda

6 Members’

Business

(a)

Public Speaking Time Responses

(b)

Leave of Absence

(c)

Matters of an Urgent Nature (advice to be provided to the Chair prior to

the commencement of the meeting)

7 Mayor's

Report

Nil

8 Reports

8.1 Setting

of Rates, Due Dates and Penalties Regime

Author: Vicky

Silk, Rates Manager

Authoriser: Mark

de Haast, Group Manager Corporate Services

Purpose of Report

1 This

report requests that Council set the rates, due dates and penalties regime for

the 2020/21 financial year.

Delegation

2 Only

Council can set the rates, due dates and penalties regime for the 2020/21

financial year.

Background

3 The

Council must first adopt its 2020/21 Annual Plan before it can legally set the

rates in accordance with the relevant provisions of the Funding Impact

Statement Rating Policies for the 2020/21 financial year and its Revenue and

Financing policy.

Considerations

Policy

considerations

4 This

report is governed by the provisions of the Funding Impact Statement –

Rating Policies. No policy changes are proposed

Legal

considerations

5 The

Funding Impact Statement - Rating Policies and this report have been subject to

a full and detailed legal review from Simpson Grierson.

6 The

Hautere/Te Horo water supply rate category has been amended to “Fixed

charge per unit of allocation” to provide clarity to the basis of

charging for the closed Hautere water supply scheme.

Financial

considerations

7 The

total rates revenue requirement for the 2020/21 financial year is

$81.65 million (inclusive of GST). This represents an average rates

increase of 2.6% when compared to the 2019/20 financial year (excluding the

water conservation device loan rate).

8 A

recommendation was made to Council on 30th April 2020 that the

districtwide water supply fixed rate and districtwide water supply volumetric

rates would remain the same as those rates set for 2019/20.

9 The

districtwide water supply fixed rate is invoiced at a daily rate for

convenience. The daily rate for 2020/21 will change due to the 2019/20

financial year being a leap year containing 366 days and the 2020/21 financial

year contains only 365 days.

Tāngata

whenua considerations

10 There

are no tāngata whenua considerations arising from this report.

Strategic

considerations

11 There

are no strategic considerations arising from this report.

Significance and Engagement

Significance

policy

12 The

setting of rates for the 2020/21 financial year follows the 2020/21 Annual Plan

and is not in itself a matter that triggers the Council's significance and

engagement policy

Publicity

13 A

media release is planned subsequent to the Council adopting its 2020/21 Annual

Plan.

|

Recommendations

13 That

Council set the following rates under Section 23 of the Local Government

(Rating) Act 2002, on rating units in the Kāpiti Coast District

(District) for the financial year commencing on 1 July 2020 and ending 30

June 2021.

(1) Districtwide General Rate

A

Districtwide general rate set under section 13(2)(b) of the Local Government

(Rating) Act 2002 on all rateable rating units, assessed on a differential

basis on all rateable rating units in the District as follows:

· a

rate of 0.43834 cents in the dollar (inclusive of GST) of land value on every

rating unit in the urban rating areas of the District as per the

Council’s rating area maps;

· a

rate of 0.16657 cents in the dollar (inclusive of GST) of land value on every

rating unit in the rural rating areas of the District as per the

Council’s rating area maps with an area less than 50 hectares,

excluding those properties in the rural village differential rating areas;

· a

rate of 0.09643 cents in the dollar (inclusive of GST) of land value on every

rating unit in the rural rating areas of the District as per the

Council’s rating area maps with an area equal to or greater than

50 hectares plus rating units less than 50 hectares where a combination

of these properties total greater than 50 hectares and form part of one

farming operation, excluding those properties in the rural village

differential rating areas;

· a

rate of 0.30684 cents in the dollar (inclusive of GST) of land value on every

rating unit in the rural rating areas of the District which is located in the

rural village differential rating areas as per the Council’s rating

area maps.

(2) Districtwide

Community Facilities Rate

A Districtwide targeted rate for community facilities, set under

section 16(3)(a) and 16(4)(b) of the Local Government (Rating) Act 2002,

assessed on a differential basis on all rateable rating units in the District

as follows:

· all

rateable rating units other than Accommodation/Hospitality and Motels and

camping grounds - $702.00 (inclusive of GST) per separately used or inhabited

part of a rating unit.

· Accommodation/Hospitality

(other than motels and camping grounds) - $1,404.00

(inclusive of GST) per separately used or inhabited part of a rating unit.

· Motels

and camping grounds - $210.60 (inclusive of

GST) per separately used or inhabited part of a rating unit.

(3) Districtwide Roading Capital Value

Rate

A

Districtwide targeted rate for roading, set under section 16(3)(a) and

16(4)(b) of the Local Government (Rating) Act 2002, assessed on all rateable rating

units in the District as follows:

· a

rate of 0.05745 cents in the dollar (inclusive of GST) of capital value on

all rateable rating units in the District

(4) Districtwide Roading Land Value Rate

A

Districtwide targeted rate for roading, set under section 16(3)(a) and

16(4)(a) of the Local Government (Rating) Act 2002, assessed on all rateable

rating units in the District as follows:

· a

rate of 0.03028 cents in the dollar (inclusive of GST) of land value on all

rateable rating units in the District.

(5) Districtwide Stormwater Rate

A

Districtwide targeted rate for stormwater, set under section 16(3)(b) and

16(4)(a) of the Local Government (Rating) Act 2002, on all rateable rating

units in the District's stormwater drainage areas as per the Council’s

stormwater drainage rating area maps as follows:

· a

rate of 0.02131 cents in the dollar (inclusive of GST) of capital value on

all rating units.

(6) Districtwide

Water Supply Fixed Rate

A Districtwide targeted rate set under section 16 of the Local

Government (Rating) Act 2002, assessed on all rating units connected or

capable of being connected to the District’s water supply, assessed on

a differential basis as below. The Districtwide water supply fixed rate

is invoiced as a daily rate for convenience.

· General

- $222.00 (inclusive of GST) per separately used or inhabited part of a

rating unit.

· Medium

Scale - $199.80 (inclusive of GST) per separately used or inhabited part of a

rating unit.

· Large

Scale - $177.60 (inclusive of GST) per separately used or inhabited part of a

rating unit.

· Accommodation/Hospitality

– $444.00 (inclusive of GST) per separately used or inhabited part of a

rating unit.

· Serviceable

- $222.00 (inclusive of GST) per rating unit not connected to the

district’s water supply, but within 100 metres of a water main and

capable of being connected.

(7) Districtwide

Water Supply Volumetric Rate

A

Districtwide targeted rate set under Section 19(2)(a) of the Local Government

(Rating) Act 2002 on each rating unit which is provided with a metered water

supply service.

· Volumetric

rate of water consumed or supplied - $1.19 (inclusive of GST) per cubic

metre.

(8) Hautere/Te

Horo Water Supply Rate

A targeted rate for water supply

set under section 19(2)(a) of the Local Government (Rating) Act 2002 per unit

of water supplied by the Hautere/Te Horo water supply.

· A

fixed charge of $225.00 (inclusive of GST) per unit of allocation to the

Hautere/Te Horo water supply (annual allocation of 1 unit = 1 cubic metre of

water per day).

(9) Districtwide Wastewater Disposal Rate

A Districtwide targeted rate for

wastewater disposal, set under section 16(3)(b) and 16(4)(b) on rating units

in the Waikanae, Paraparaumu, Raumati and Ōtaki rating areas, as per the

Council’s rating area maps.

|

· General

- $407.00 (inclusive of GST) per rating unit connected to the sewerage

system. A rating unit used primarily as a residence for one household

shall not be treated as having more than one water closet or urinal.

· Community

- $203.50 inclusive of GST) per water closet or urinal connected to the

sewerage system.

|

|

· Educational

– $183.15 (inclusive of GST) per water closet or urinal connected to

the sewerage system.

|

|

· Recreational

- $101.75 (inclusive of GST) per water closet or urinal connected to the

sewerage system.

|

|

· Large

Scale Commercial/Residential - $203.50 (inclusive of GST) per water closet

or urinal connected to the sewerage system, where there is more than one

water closet or urinal.

|

|

· Serviceable

- $203.50 (inclusive of GST) per rating unit not connected to the sewerage system

but within 30 metres of a sewer main and capable of being connected.

|

(10) Paraparaumu/Raumati Community Rate

A targeted

rate set under section 16(3)(b) and 16(4)(a) of the Local Government (Rating)

Act 2002 as follows:

· a

rate of 0.00114 cents in the dollar (inclusive of GST) of capital value on

all rating units in the Paraparaumu and Raumati urban and rural rating areas

as per the Council’s rating area maps.

(11) Waikanae Community Rate

A targeted

rate set under section 16(3)(b) and 16(4)(a) of the Local Government (Rating)

Act 2002 as follows:

· a

rate of 0.00227 cents in the dollar (inclusive of GST) of capital value on

all rating units in the Waikanae urban and rural rating areas as per the

Council’s rating area maps.

(12) Ōtaki Community Rate

A targeted

rate set under section 16(3)(b) and 16(4)(a) of the Local Government (Rating)

Act 2002 as follows:

· a

rate of 0.00316 cents in the dollar (inclusive of GST) of capital value on

all rating units in the Ōtaki urban and rural rating areas as per the

Council’s rating area maps.

(13) Paekākāriki Community Rate

A targeted

rate set under section 16(3)(b) and 16(4)(a) of the Local Government (Rating)

Act 2002 as follows:

· a

rate of 0.01002 cents in the dollar (inclusive of GST) of capital value on

all rating units in the Paekākāriki urban and rural rating areas as

per the Council’s rating area maps.

(14) Commercial

Rate

A targeted

rate set under section 16(3)(b) and 16(4)(a) of the Local Government (Rating)

Act 2002 as follows:

· a

rate of 0.02891 cents in the dollar (inclusive of GST) of capital value

assessed on all rateable rating units used principally or exclusively for

commercial purposes.

(15) Water

Conservation Device Loan Rate

A targeted rate on those rating

units that have received an interest free loan (up to $5,000 plus GST) for

approved water conservation devices from the Council that has not yet been

fully repaid, set at 10% of the amount of the original loan plus GST.

14 That

all property rates (including Hautere/Te Horo Water Supply Rate, but

excluding Districtwide Water supply fixed and volumetric rates) be payable in

four equal instalments due on:

Instalment Due

Dates Penalty

Dates

Instalment

One 9

September 2020 10

September 2020

Instalment

Two 9

December 2020 10

December 2020

Instalment

Three 9

March 2021 10

March 2021

Instalment

Four 9

June 2021 10

June 2021

All payments

made will be receipted against the earliest outstanding rate amounts in

accordance with authorised accounting procedures.

15 That

water rates (excluding Hautere/Te Horo Water Supply Rate) be invoiced

separately on a quarterly basis dependent on when the relevant meter is read.

Due dates for each area are specified below:

|

Area

|

Water meters read during

|

Due date

|

Penalty date

|

|

Paraparaumu/Raumati/

Raumati Beach/Raumati South/ Paekākāriki

|

Jul-20

|

27-Aug-20

|

28-Aug-20

|

|

Oct-20

|

27-Nov-20

|

30-Nov-20

|

|

Jan-21

|

2-Mar-21

|

3-Mar-21

|

|

Apr-21

|

31-May-21

|

1-Jun-21

|

|

Otaki/Peka Peka/

Waikanae Beach

|

Aug-20

|

28-Sep-20

|

29-Sep-20

|

|

Nov-20

|

6-Jan-21

|

7-Jan-21

|

|

Feb-21

|

29-Mar-21

|

30-Mar-21

|

|

May-21

|

28-Jun-21

|

29-Jun-21

|

|

Waikanae/Nikau Valley/

Otaihanga/

Paraparaumu Beach

|

Sep-20

|

29-Oct-20

|

30-Oct-20

|

|

Dec-20

|

9-Feb-21

|

10-Feb-21

|

|

Mar-21

|

27-Apr-21

|

28-Apr-21

|

|

Jun-21

|

29-Jul-21

|

30-Jul-21

|

16 That

Council apply the following penalties on unpaid rates in accordance with

sections 57 and 58 of the Local Government (Rating) Act 2002:

· a

charge of ten per cent (10%) on so much of any property rate instalment that

has been assessed after 1 July 2020 and which remains unpaid after the due

dates as per paragraph 14, to be added on the penalty dates above.

· a

charge of ten per cent (10%) on so much of any property rates (including

previously applied penalties) assessed before 1 July 2020 which remain unpaid

on 2 July 2020. The penalty will be added on 3 July 2020.

· a

charge of ten per cent (10%) will be added to any portion of a current water

rates invoice that remains unpaid after the due date specified. Penalty will

be added on the penalty dates shown as per paragraph 15.

17 That

property and water rates be payable by cash, cheque and eftpos at any of the

following places:

· Paraparaumu,

Civic Building, 175 Rimu Road, Paraparaumu

· Waikanae

Service Centre, Mahara Place, Waikanae

· Ōtaki

Service Centre, Ōtaki Library, Main Street, Ōtaki

· New

Zealand Post, countrywide

· Westpac

Bank, countrywide (excluding water supply rates)

· Greater

Wellington Regional Council, Shed 39, 2 Fryatt Quay, Pipitea, Wellington

· Greater

Wellington Regional Council, 35-37 Chapel Street, Masterton

18 Alternatively,

payment of the due rates can be made to the Council by direct debit, internet

banking, direct credit, telephone banking and credit card (subject to a

convenience fee) through the Council’s website.

|

Appendices

Nil

8.2 Adoption

of 2020/21 Annual Plan

Author: Chris

Pearce, Manager, Corporate Planning & Reporting

Authoriser: Mark

de Haast, Group Manager Corporate Services

Purpose of Report

1 This

report seeks the Council’s adoption of the 2020/21 Annual Plan.

Delegation

2 Only

the Council can adopt an Annual Plan under the Local Government Act 2002.

Background

3 The Local Government Act

2002 (the LGA) requires councils to prepare and adopt an Annual Plan before

setting their rates, for each financial year in between their Long Term Plans.

4 The Toitū

Kāpiti Long Term Plan 2018-38 (LTP) adopted in June 2018 set the

Council’s strategic direction for three years, and the significant

decisions about the Council’s work programme for 2020/21 have already

been made and consulted on in that context. Therefore, the starting point

for the 2020/21 Annual Plan was focused on delivering the third and final year

of the LTP.

5 During February, March and

April 2020, Elected Members and Officers participated in workshops to develop

the 2020/21 Annual Plan. A number of financial adjustments were proposed

to keep average rates increases as low as possible. The most impactful of

these adjustments was the removal of inflation from operating budgets, and

maintaining the level of non-funded depreciation (instead of reducing

it). The average rates increase for 2020/21 resulting from these changes

is 2.6% (lower than the 3.8% forecast in the LTP). Further discussion on these changes are covered in the

report to Council on 30 April 2020 (see agenda

item 8.2).

6 Whilst there are some

differences included in the 2020/21 budget (discussed at paragraph 12 of this

report), there are no significant new spending proposals or changes in service

levels included in the 2020/21 Annual Plan. Therefore, Council did not formally

consult on the draft 202/21 Annual Plan but instead, undertook an information

campaign to inform the community of the draft Annual Plan content. Feedback was

invited and further detail on the feedback received is included at paragraphs

19 to 22 of this report.

7 At the meeting of 28 May

2020, Council approved the fees and charges schedule for 2020/21. This

was approved earlier than the Annual Plan itself to allow Council to

communicate some charges for 2020/21 to customers as early as possible.

Some minor amendments to the schedule were approved which are detailed in the

report presented at the meeting on 28 May (see agenda

item 8.1).

Issues and Options

8 This section discusses the

following key issues for the 2020/21 Annual Plan:

· Major

capital projects planned in 2020/21;

· Key

drivers of the rates increase for 2020/21;

· The

2020/21 Capital Works Programme and “shovel ready” projects;

· Further

budget reviews planned in light of COVID-19; and

· Engagement

on the draft 2020/21 Annual Plan.

Major

capital projects planned in 2020/21

9 The following table

outlines the major capital projects planned for 2020/21 which had already been

signalled in the LTP and therefore are presented as information only; Council

is not required to approve these projects through the Annual Plan process.

|

Activity/project

|

Description

|

Capital cost ($000)

|

|

Drinking water safety and resilience

|

Start Hautere/Te Horo drinking water

safety upgrades.

|

1,300

|

|

Complete upgrade of Ōtaki water treatment

plant.

|

3,600

|

|

Continue to deliver the Waikanae Stage 2

treatment plant.

|

1,900

|

|

Wastewater

|

Complete inlet works for Paraparaumu

wastewater treatment plant

|

1,800

|

|

Stormwater

|

Start stormwater projects to protect

homes from flooding and improve downstream flow.

This includes: Kena Kena asset

upgrades; Moa Road flood wall; upgrades for Riwai Street, Sunshine Avenue and

Titoki Street; Kakariki Stream and Amohia Street stage 1 stream works; Amohia

catchment diversion stage 1 and Otaki Beach stage 2; and asset renewals in

Paraparaumu catchment.

|

4,300

|

|

Access and Transport

|

Continue SH1 revocation works.

|

1,400

|

|

Increase footpath renewals due to additional

NZ Transport Agency funding.

|

1,700

|

|

Paekākāriki seawall

rebuild

|

Begin the tender process for the construction

contract.

|

160

|

|

Otaraua Park development

|

Begin construction of stage 1 including an

amenity block - $1.5 million over the next two years.

|

701

|

|

Kāpiti Island Gateway Centre

|

Complete design and other preparatory work for the building of

the Gateway.

|

255

|

Key drivers

of the rates increase for 2020/21

10 In addition to the work programme

already included in the LTP, a number of amendments to the draft operating

budget for the 2020/21 Annual Plan were proposed in workshops 1 & 2

(February 11 & 13).

11 These amendments reflect

Council’s response to several changes in the operating environment,

including new central government requirements (proposed new water regulations),

and increased costs of managing assets.

12 Most of these

items were proposed prior to the COVID-19 situation and are still considered necessary

for the Council to continue delivering services at current levels throughout

2020/21. Additional COVID-19 related funding has also been included to

support ratepayers and businesses affected financially by COVID-19 and to

support Council’s Recovery Plan actions. The following table

details these changes.

|

Activity/project

|

Description / reason for

change

|

Cost ($000)

|

|

Water supply

|

Increase funding to prepare for

requirements of increased regulation and reporting as part of the Drinking

Water & Safety resilience programme

|

83

|

|

Economic

Development

|

Additional funding for Provincial Growth Fund liaison and to ensure Elevate Ōtaki

support is budgeted.

|

110

|

|

Community

Facilities

|

Increase the level of

maintenance on our housing portfolio

|

78

|

|

Additional net cost increase to

manage Waikanae Library medium term solution

|

40

|

|

Parks & Open

Spaces

|

Additional costs to carry out

parks maintenance and operations including new reserves to maintain, and CWB

work on local routes.

|

232

|

|

Reduced lease revenue budget to

align with current levels (top-up to now be funded by rates).

|

58

|

|

Recreation &

Leisure

|

Reflect actual resourcing

requirements and revenue levels, and

ensure adequate library casual staffing budget.

|

192

|

|

Coastal Adaptation

|

Additional funding required to

deliver the community-led coastal adaptation programme.

|

300

|

|

Governance

|

Increased remuneration for

Elected Members (as required by the Remuneration Authority).

|

124

|

|

Asset Management

Improvement

|

Increased resourcing to focus on

asset management improvement recommendations.

|

190

|

|

Information &

Communications

|

Deliver increased ICT capability

as part of ICT Strategy implementation.

|

200

|

|

COVID-19 related

funding

|

Continue support for ratepayers

and businesses affected by COVID-19

|

233

|

|

Budget to support

Council’s COVID-19 Recovery Plan actions

|

250

|

|

Subtotal

|

2,090

|

The 2020/21

capital works programme and “shovel ready” projects

13 The total amount of the capital works

programme for 2020/21 is $37.5 million (the upper limit of the financial

strategy is $38 million), including capex carryovers from 2019/20, partly as a

result of project delays due to the Covid-19 lockdown. Details of all

planned capital spending is included on pages 74 to 80 of the Annual Plan

attached at Appendix 1 to this report.

14 In April 2020, Council submitted

projects to Crown Infrastructure Partners (CIP) to be considered for Government

funding by the Infrastructure Industry Reference Group. The five projects

in the table below have progressed for consideration by the Government.

|

Projects

|

Estimated cost

|

|

Paraparaumu Link Road. To alleviate congestion

on Kapiti Road and connect key transport routes.

|

$24.5 million

|

|

Paekakariki Marine

Parade Seawall. To replace the deteriorating seawall (almost 1km in length).

|

$21 million

|

|

Districtwide Stormwater

upgrades. Carry out work to protect homes and commercial buildings from flooding.

|

$25 million

|

|

Water safety and

resilience project. To upgrade our drinking water supply infrastructure.

|

$20.1 million

|

|

Maclean Park

Development stage 2. To continue redevelopment of the park as a regional

destination.

|

$11 million

|

15 If any of Council’s projects are

successful in receiving funding from the Government, Officers will discuss the

financial implications with Council.

Further budget reviews planned

in light of COVID-19

16 It should be noted that the impacts of

COVID-19 on the Kāpiti Coast community are dynamic and the full impacts

will not be known for some time. In acknowledgement of this, Officers

will continue to monitor the COVID-19 situation to determine whether any budgets

should be reviewed throughout the year to identify potential

re-allocations.

Engagement on

the draft 2020/21 Annual Plan

17 During May 2020

Council informed the community about the draft 2020/21 Annual Plan,

highlighting the changes proposed in paragraph 12 as well as the major projects

planned and Council’s initiatives to respond to COVID-19.

18 Information on the draft 2020/21

Annual Plan was communicated to ratepayers via the fourth quarter rates

notices, the Kāpiti News, as well as the Council’s email newsletter

and Facebook. The community was invited to give feedback via email or to

get in touch with Elected Members.

19 We received feedback from six

individuals and specific requests from five organisations. Councillors

and Community Board chairs were provided with all feedback/requests in full on

5 June 2020, and feedback was discussed in a briefing with Councillors and

Community Board Chairs on 16 June 2020.

20 The central theme of the feedback from

the six individuals was a desire for Council to reduce costs to further reduce

the rates requirement for 2020/21, and same in future years.

21 The five organisations that submitted

requests through the draft 2020/21 Annual Plan were:

· Kāpiti

College (for Te Raukura ki Kāpiti, Performing Arts Centre);

· Kāpiti

Equestrian Advocacy Group;

· Paekākāriki

Surf Lifeguards Incorporated;

· Kāpiti

Cycling Action; andf

· NZ Festival of the

Arts

22 These requests ranged from requesting

collaboration with future activities to direct funding support for large

projects. For requests with a financial implication, Officers propose

that, unless Council has already communicated its position on a proposal

previously, that these are investigated as part of the development of the next

Long Term Plan for potential inclusion in future years.

Considerations

Policy

considerations

23 There

are no proposed changes to the Council’s existing policies contained in

the 2018-38 Toitū Kāpiti Long Term Plan.

Legal

considerations

24 By

adopting the Annual Plan the Council will fulfil its obligations under the

Local Government Act 2002.

25 The

Annual Plan is required to be published within one month after it is

adopted. The final document will be made available on the Council website

and in service centres and libraries.

Financial

considerations

26 The

overall financial considerations of the Annual Plan have been previously

discussed with Council in workshops and at the Council meeting on 30 April

2020. All three key elements of Council’s financial strategy, being

rates, capital expenditure and borrowings, remain within their respective upper

limits of the Council’s LTP financial strategy.

27 The

final 2020/21 Annual Plan includes the best estimate of likely capex costs that

need to be carried over from 2019/20 to 2020/21 and an additional $130,000 of

operating costs for increased insurance costs from Council’s recent

insurance programme renewal in May 2020. To maintain the average rates increase

at 2.6%, Officers have adjusted the annual depreciation budget to offset this

increase. Officers’ plan to further review depreciations costs during the

year.

28 Inflation has been added to capital

expenditure budgets ($739,000) to allow Council to meet its obligations on

contractual prices. The resultant interest cost on this adjustment is $18,000,

and has also been offset by an adjustment to the annual depreciation budget.

29 The

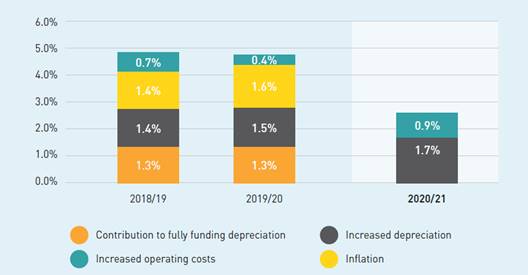

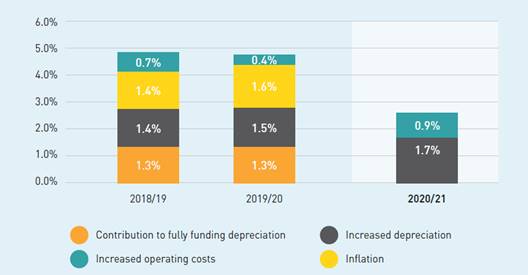

average rates increase for the 2020/21 financial year is 2.6% with a growth

component of 0.4%. This is made up of:

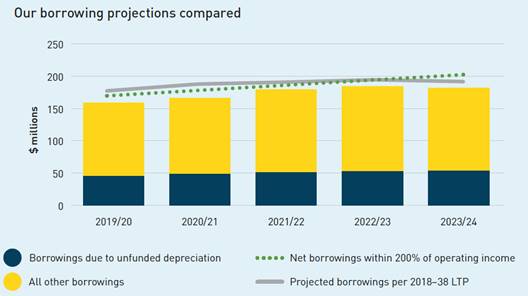

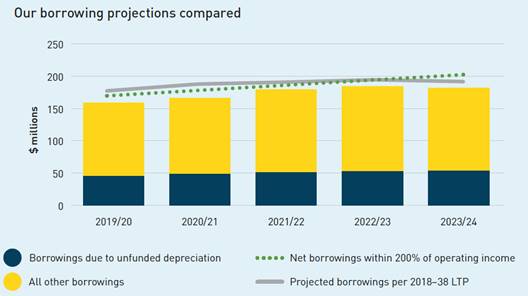

30 Council’s net borrowings are

planned to be $167 million or 189% of Council’s operating income at 30

June 2021. This is below $188 million forecast in the LTP.

Tāngata

whenua considerations

31 There

are no issues for consideration relating to iwi or the Treaty of Waitangi.

32 Council

will work with iwi as part of the COVID-19 recovery phase to identify

opportunities for community and central government funding to support

tāngata whenua/iwi through COVID-19, and to mitigate impacts of rates

increases as much as possible to support our communities in recovery.

Strategic

considerations

33 This Annual Plan is focused on

sustaining the community through an unprecedented disruption to its social and

economic environment. Therefore, the 2020/21 Annual Plan should be viewed in

context of the following long term goals:

· A

resilient community that has basic needs and feels safe and connected; and

· Wise

management of public resources and sustainable funding of Council services

34 It

should be noted that the deferment of depreciation funding will adversely

affect Council’s financial position in the short term, which will inhibit

achievement of one of the three-year focus outcomes - Improved financial

position against financial constraints.

Significance and Engagement

Significance

policy

35 This

matter has a low level of significance under Council’s Significance and

Engagement Policy.

Consultation

already undertaken

36 Community

Boards provided their input to the 2020/21 Annual Plan process through the

public workshops held in February and March 2020.

Engagement

planning

37 Council

has notified the community about the draft 2020/21 Annual Plan and received

feedback during May 2020.

Publicity

38 A

media advisory will be released following the adoption of the 2020/21 Annual

Plan.

Other

Considerations

39 Setting

the rates for 2020/21 is the subject of a separate report on the agenda for the

Council meeting on 25 June 2020.

|

Recommendations

It is recommended that the

Council:

40 Notes

the feedback received on the draft 2020/21 Annual Plan outlined at paragraphs

19 to 22 of this report.

41 Notes

the proposed approach to carry feedback requests that have financial

implications into the next Long Term Plan process, where applicable.

42 Notes

that the fees and charges schedule for 2020/21 was approved by the Council on

28 May 2020.

43 Adopts

the 2020/21 Annual Plan attached as Appendix 1 to this Report.

44 Delegates

to both the Mayor and the Chief Executive, the authority to make minor editorial

changes as required, to the 2020/21 Annual Plan attached as Appendix 1 to

this report, prior to its publication.

45 Notes

that the final 2020/21 Annual Plan will be published within one month after

adoption. It will be available on the Council website and in service

centres and libraries.

46 Notes

that the decision to set the rates for 2020/21 is part of a separate report

on the agenda of this Council meeting.

|

Appendices

1. Annual

Plan 2020/21 (under separate cover)

8.3 Kapiti

Coast Economic Development Strategy

Author: Darryn

Grant, Economic Development Manager

Authoriser: James

Jefferson, Group Manager Place and Space

Purpose of Report

1 To

request approval to seek public feedback on the draft Kapiti Coast Economic

Development Strategy and Implementation Plan 2020-23.

Delegation

2 Council

has authority to make this decision.

Background

3 The

Kapiti Economic Development Strategy 2015-2018 was approved by the Environment

and Community Development Committee in December 2014. The strategy was

developed in collaboration with iwi and the business community and was endorsed

by the Kapiti Chamber of Commerce in January 2015. The strategy identified four

areas of focus over the three period:

· Leadership &

Responsiveness,

· Open for Business

(Council),

· Building

Capability and

· Positioning

Kapiti.

4 In

May 2015, a one-year transitional approach to governance of economic development

activity in Kapiti was approved, with a new community led governance structure

confirmed in July 2016. This governance arrangement has now ended, with no

leadership structure currently in place.

5 In

late 2018, a decision was made to refresh the current Economic Development

Strategy. The refresh process commenced with a number of partner / stakeholder

workshops to understand key concerns / issues with the current strategy and

economic development activity in the district. Feedback from these initial

workshops identified that the four existing focus areas were generally well

supported and remained relevant in the current environment, which was supported

by the economic data. The primary concerns identified in the workshops were in

relation to the delivery and leadership of economic development activities in

the district.

6 To

support the refresh of the Economic Development Strategy, a drafting group was

established and comprised the following membership:

· Councillor Angela

Buswell, representing Council

· Heather Hutching,

representing Kapiti Chamber of Commerce

· Jenna-Lea

Phillpott, initially representing Kapiti Economic Development Agency, later

independent representative.

· Liz Koh,

representing Kapiti Economic Development Agency (member since May 2019).

7 The

initial refresh process was supported by an external consultant in coordination

with the acting Council Economic Development Manager. However, this arrangement

discontinued in May 2019, with facilitation of the refresh transferred to the

Economic Development Team within Council, who worked directly with the drafting

group and other partners / stakeholders.

8 Regular

meetings were held with the drafting group over the period of the refresh of

the strategy. In addition, partner / stakeholder workshops were held, along

with meetings with iwi, individual businesses and business groups, community

boards and advisory groups. Workshops included specific sessions for each of

the identified Pou / pillars.

9 In

order to ensure that there was general agreement about the key areas of focus

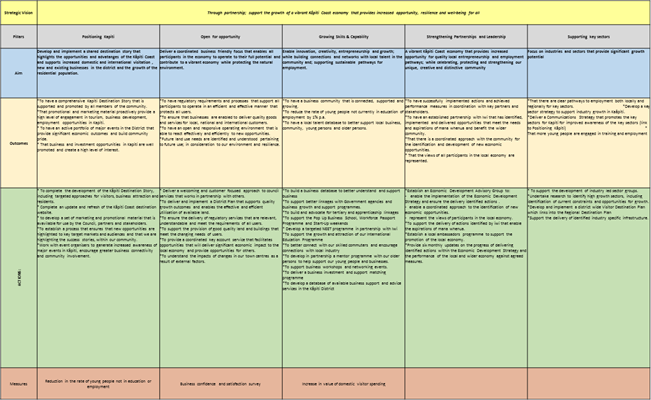

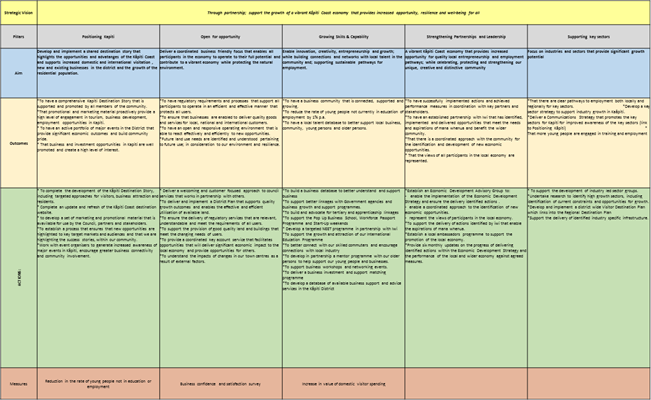

for the strategy, a plan on a page was developed to help easily share the key

information. This included the vision, pillars, aims and key actions. An

example of this is shown below, a final version of this document will be

developed based on the final approved strategy.

Issues and Options

Issues

Delivery and Leadership

10 The

previous Economic Development Strategy was approved in December 2014 and it was

identified very early in the refresh process that many of the focus areas

identified previously still remained relevant now.

11 As

mentioned above, two key issues were raised early in the partner / stakeholder

workshops as being of significant concern, these were in relation to the

delivery and leadership of economic development activity in the district. A

community led governance arrangement had previously been approved and

established however the structure did not continue long term and as a result

there is now no formal coordinated approach to economic development activity in

the district.

12 Currently

economic development activities in the Kapiti Coast are primarily delivered by

two organisations; the Council and Wellington NZ, the economic development

agency for the Wellington region. There are also a number of volunteer /

membership based organisations involved in economic development / business

support and advocacy activities in the district including the Kapiti Coast

Chamber of Commerce (Chamber) and the Kapiti Economic Development Agency

(KEDA), as well as other local business or sector groups, which are generally

volunteer based organisations.

13 While

there are a number of parties involved in these activities there has been

limited coordination of activity and leveraging of skills and resources across

the various organisations. This has caused a high level of frustration and

mistrust for some members of the community and makes it difficult for groups to

sustain their activities.

14 In

developing the refreshed strategy, a number of steps are proposed to help

address the current situation and ensure a more coordinated and inclusive

approach to economic development activity. Firstly, the following vision has

been developed:

Through

partnership, support the growth of a vibrant, diverse Kapiti Coast economy that

provides increased opportunity, resilience and well-being for all.

15 The

vision was developed to recognise the need for a collaborative approach to

delivery of the strategy but also that there needs to be collective benefit

from the outcomes in the strategy in order to support long term growth.

Consideration needs to be given to all participants of the economy including

iwi, residents, business and visitors. The vision aligns with Council’s

vision of: thriving environment, vibrant economy, strong communities –

toitu Kapiti – the lifestyle choice.

16 In

addition, a specific Pou / Pillar has been proposed: Kotahitanga /

Strengthening partnerships and Leadership. A priority action is the

establishment of an independent Governance Board: Economic Development

Kotahitanga Board. In order for the strategy to be successful there needs to be

clear accountability, with a focus on:

· Independent

governance

· Clear

prioritisation

· Implementation

· Monitoring and

reporting

· Review and

adaption

17 Subject

to approval of the strategy, a separate Terms of Reference will be developed

for the Board, with key points for inclusion including

· the appointment of

an independent Chair and board members.

· full iwi

representation

· appointment of

members based on capability and not representation

· ex-officio

representation of Council via a Council appointed elected representative

· Council to provide

officer and resource support to the board.

18 Initial

responsibilities for the board will include overseeing the implementation of

the strategy, advocating for the district and economic activities in the

district and being a relationship broker, with a focus on establishing and

strengthening strategic relationships to progress economic development

opportunities.

Focus Areas

19 The

following Pou / Pillars were identified as part of the strategy refresh:

· Whakapapa /

Positioning the Kapiti Coast

· Kaitiakitanga /

Open for Opportunity

· Whanau / Growing

skills and capability

· Kotahitanga /

Strengthen partnerships and Leadership

· Manaakitanga /

Supporting key sectors

20 Under

each of the Pou / Pillars, an Whāinga / Aim and Key Actions were

identified along with short and medium term outcomes. A number of key actions

were identified in each Pou with an implementation plan developed to help

prioritise delivery of actions and identify lead organisations and key partners.

21 There

was one additional Pou identified for inclusion in the refreshed strategy:

Manaakitanga / Supporting key sectors. This was included after feedback was

received that there needed to be a greater understanding of the key sectors in

the district and a more targeted approach taken in coordination with industry

to unlock potential opportunities or roadblocks. A review of economic data

supports this approach and has been further supported following the different

impacts being felt across the different sectors as a result of covid-19.

22 Tourism

was identified as a sector that offered significantly more growth potential

given our rich cultural history, unique natural environment, proximity to large

domestic markets and currently low level of market penetration. In order to

support this sector, a proposed priority action is the development of a

Destination Plan in year 1 of the strategy. Although the tourism sector has

been impacted by Covid-19, we are not reliant on a high level of international

visitation, which has been a significant issue for destinations such as

Queenstown, Auckland or Rotorua. The opportunity to develop the Destination

Plan will unable as to work with industry to better understand and adapt to the

current environment and prepare for the recovery of the

sector.

23 There

was significant feedback about non delivery of actions during the refresh

process. In order to help ensure this doesn’t continue, key actions have

been outlined in the implementation plan to help assist organisations with

their future planning and activity prioritisation.

24 It

is noted that there are a number of activities with Council remaining the lead

delivery partner, while there was considerable support and willingness for

parties such as the Chamber or KEDA to lead the delivery of more actions, both

organisations raised concerns about their ability to deliver given they are

both volunteer based organisations with funding limitations.

25 It

will be necessary as part of the implementation process to understand the

support required by organisations such as the Chamber and KEDA to deliver

actions and the best ways to provide support for this going forward. This is

also the same for sector based industry groups, which are primarily volunteer

based.

26 The

following actions were identified as priority actions in year one of the

strategy:

· Deliver the Kapiti

Story

· Provide a

coordinated approach to the facilitation of key opportunities, such as the

attraction of new businesses and government agencies

· Develop a Kapiti

Coast Workforce Plan

· Establish an

Economic Development Kotahitanga Board and support the development and delivery

of a Covid 19 Recovery Plan

· Develop a Kapiti

Coast Destination Plan and a strategy for one other key sector

· Finalise the

monitoring and reporting framework for the Economic Development Strategy.

Covid – 19 Pandemic

27 In

March this year, New Zealand was impacted by the Covid – 19 Pandemic,

which is causing significant health, economic, social and cultural issues

globally. In response to the pandemic, the New Zealand Government put in place

a number of lock down restrictions, with some of these still remaining in place

now, such as restricted international border access into New Zealand.

Restrictions included the closure of all non-essential services and businesses,

which not only effected the businesses directly but the workers in those

organisations.

28 An

initial economic report on the impacts of Covid 10 has been received from

Infometrics and shows negative impacts across the district with reductions in

GDP and employment growth forecasted. Impacts are not consistent across sectors

or the workforce and initial forecasts indicate that sectors such hospitality,

tourism and retail will be impacted more than others. The report also shows

that a higher proportion of young people, Maori and low skilled workers are

forecasted to be impacted.

29 The

full impacts of Covid – 19 are not yet known and are unlikely to be fully

understood for some time. In order to support the recovery from impacts of the

pandemic, a separate recovery plan is to be developed for the district which

will include a work stream focused on economic recovery.

Outcomes and Impacts

30 In

order to measure the success of the strategy a number of medium and long term

outcomes have been included under each Pou / pillar. In addition to the

outcomes, four impacts have been proposed for measurement over the term of the

strategy:

· Employment Growth

– increase in local employment options and pathways

· Mean Income Growth

– increase in higher paying local employment and income generating

opportunities

· Business Unit

Growth – increase in businesses establishing, expanding and moving to the

district

· GDP Growth –

increased growth of the local economy and key sectors

31 Where

possible wellbeing outcomes have been taken into consideration however because

there is no consistent measure of economic wellbeing, more traditional measures

such as GDP growth have had to be utilised.

32 Given

the economic impacts of Covid 19, it is not considered appropriate to set

measures at the current point in time. As mentioned above the ongoing impacts

of Covid 19 are not yet fully known and control over many of these is outside

the influence of the actions in this strategy and linked more to the current

Macroeconomic environment.

33 Following

the establishment of the governance board, performance measures will be agreed

with the board. If there is still a significant level of uncertainty it is

proposed that a trend based approach is taken, with comparisons made against

other local and regional measures to see how the district’s economy is

tracking.

Strategy Format and feedback

34 A

copy of the draft Kapiti Coast Economic Development Strategy and Implementation

Plan 2020-2023 is appended to this paper. The strategy is in a draft layout

while feedback is received, with the final design and layout to completed once

approved by Council.

35 As

part of the final design process it is proposed that a short and long form

version of the strategy are developed, with an accompanying one-page document

to also be completed (Plan on a Page).

36 A

communications plan has been developed to support the feedback process. This

will include the use of Council’s social media and other channels to

create awareness about the opportunity to provide feedback on the strategy.

37 Drop

in sessions will also be organised so that people are able to come and talk

with officers or members of the drafting group about the strategy.

38 These

sessions will be targeted at the public given the engagement that has already

occurred to date with the business community and partners, however

opportunities will also be provided to ensure that iwi and other partners and

stakeholders have the opportunity to provide any additional feedback.

Considerations

Policy

considerations

39 There

are no policy considerations at this stage of the strategy.

Legal

considerations

40 There

are no legal considerations at this stage of the strategy and the strategy is

not required to follow the special consultative procedures set out in the Local

Government Act.

Financial

considerations

41 The

implementation of the strategy in year one will be funded from the existing

Economic Development budget. This will require reprioritisation of the existing

budget allocations to ensure alignment with the final agreed actions identified

in the strategy.

42 Further

activities / projects arising from these and other actions in year two and

three will need to be considered as part of the Long Term Plan process.

Tāngata

whenua considerations

43 In

addition to the existing Kapiti Economic Development Strategy there is also a

separate Strategy for Maori Economic Development and Wellbeing which was

adopted in July 2013. The purpose of the strategy is to set out how Council

will support Maori Economic Development in Kapiti. As part of this process,

discussions were held with iwi representatives about a combined strategy moving

forward which was generally supported by representatives.

44 During

the development of the strategy there have been briefings with Te Whakaminenga

o Kapiti. In addition to these briefings, individual workshops were offered

with representatives of all three iwi, with sessions held with representative

of Ngati Toa Rangatira and Te Ati Awa ki Whakarongotai.

45 Partnership

has been a core principal through the development of the strategy and this is

also correct in the delivery of the strategy. In order to support this

partnership and following feedback from members of Te Whakaminenga o Kapiti,

representation is proposed for all three iwi on the governance board for the

strategy; Economic Development Kotahitanga Board.

Strategic

considerations

46 The

draft Kapiti Coast Economic Development Strategy and Implementation Plan

2020-23 has been developed in line with the 2018 – 38 Long Term Plan,

with a focus on contributing to the development of a vibrant Kapiti Coast

economy.

Significance and Engagement

Significance

policy

47 This

matter has a low degree of significance under Council’s Significance and

Engagement Policy.

Consultation

already undertaken

48 As

outlined previously, during the development of the strategy, various different

forms of engagement and consultation were undertaken with different business

groups, stakeholders and partners.

49 The

engagement process included the formation of a specific refresh Drafting Group,

comprising of Council and community representation. Stakeholder and pillar

workshops were also held, along with attendance at business group meetings,

community board meetings and advisory group meetings. In addition, individual

meetings were also held with a variety of businesses and members of the

community.

|

Recommendations

50 That

the Council approves the draft Kapiti Coast Economic Development Strategy and

Implementation Plan 2020-23 for public feedback.

51 That

the Council acknowledges the input of the Drafting Group members in

completing the draft Kapiti Coast Economic Development Strategy and

Implementation Plan 2020-23

· Councillor

Angela Buswell

· Heather Hutching

· Jenna-Lea

Phillpott

· Liz Koh

|

Appendices

1. Draft

Kapiti Coast Economic Development Strategy and Implementation Plan 2020-23 ⇩

|

Council

Meeting Agenda

|

25 June 2020

|

Kapiti Coast Economic Development

Strategy and Implementation Plan 2020-2023

Draft Report

18

June 2020

|

Foreword 1

Executive

Summary 3

Introduction 10

Our

Economy and community 14

Strategic

Framework 20

Implementation

and Delivery 26

Governance

and Accountability 33

|

|

Appendix

1 : Our Economy 35

Appendix

2 : Definitions 47

|

tables

|

Table 1: Positioning the Kāpiti Coast – Key

Actions 27

Table 2: Open for Opportunity – Key Actions 28

Table 3: Growing Skills and Capability – Key Actions 29

Table 4: Strengthening Partnerships and Leadership –

Key Actions 30

Table 5: Supporting Key Sectors – Key Actions 32

Table 6: Year 1 – Priority Key Actions 34

|

figures

|

Figure 1: Our Strategic Pillars and Focus 6

Figure 2: Our Foundations for Success 11

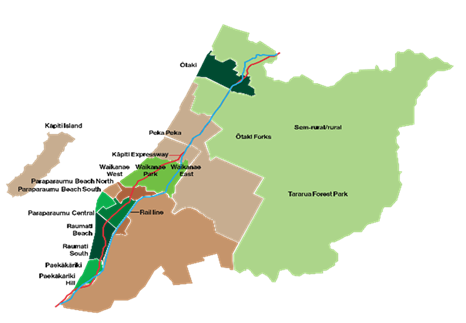

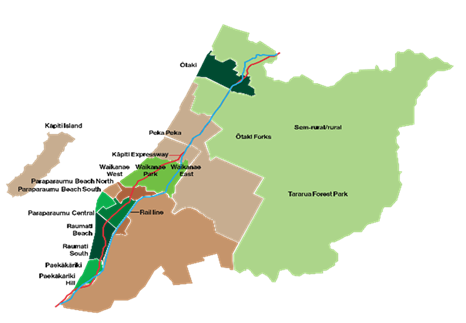

Figure 3: Geography of the Kāpiti Coast 14

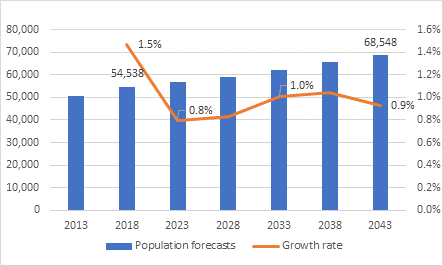

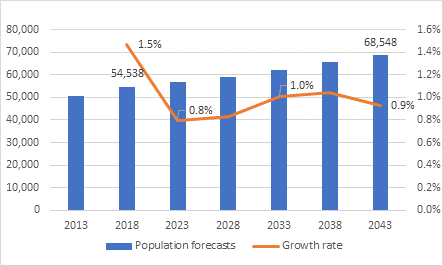

Figure 4: Population forecasts Kāpiti Coast 2013-2043 15

Figure 5: Ngā Pou 21

Figure 6: Kāpiti Coast Economic Development Strategy

– Strategic Framework 23

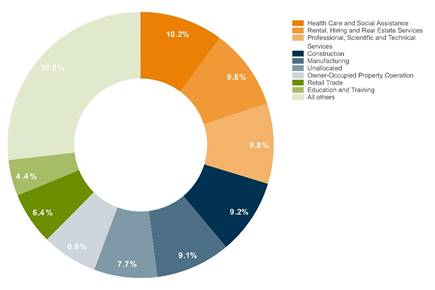

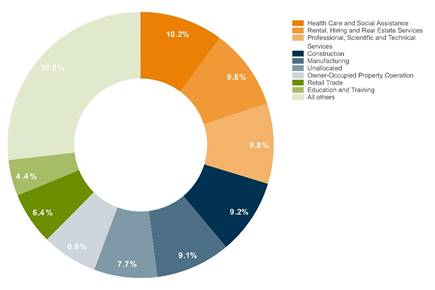

Figure 8: Proportion of GDP 2019 35

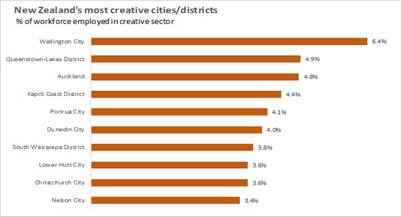

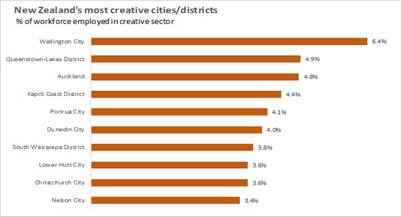

Figure 9: Wellington Region Creative Industries Employment 38

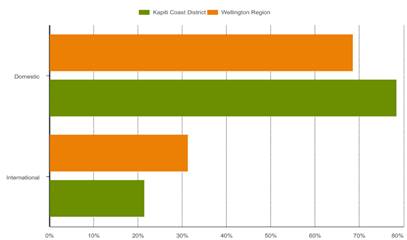

Figure 10: Domestic and International tourism expenditure 2019 40

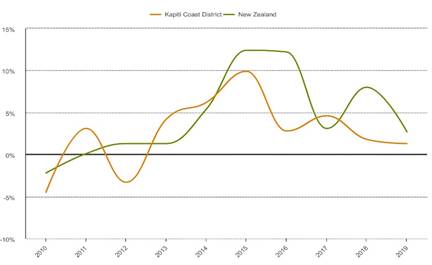

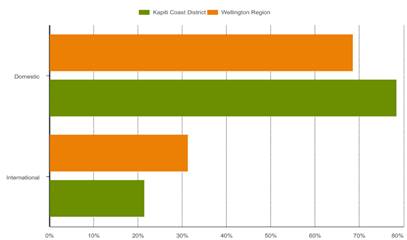

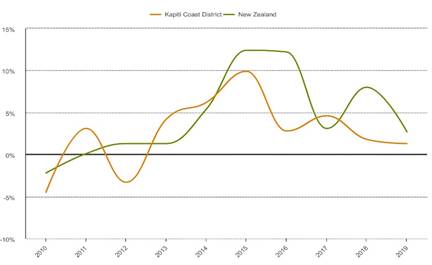

Figure 11: Tourism spending growth 2010-2019 40

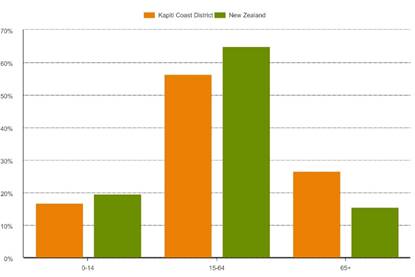

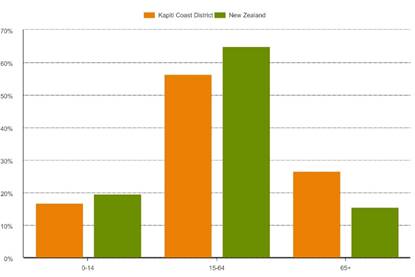

Figure 12: Age demographics Kāpiti Coast District compared

to New Zealand 2019 41

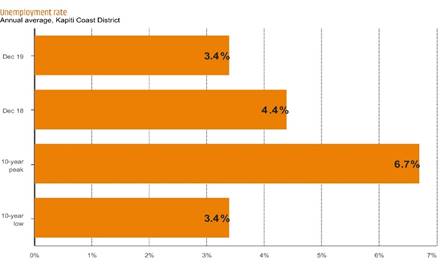

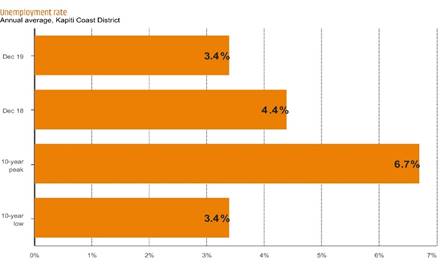

Figure 13: Unemployment rate, annual average 2018 and 2019 43

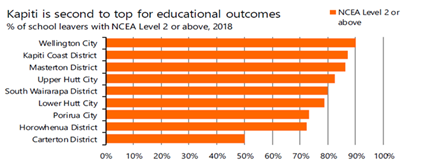

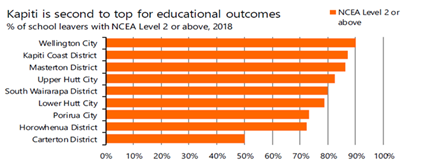

Figure 14: Percentage of school leavers with NCEA Level 2 or

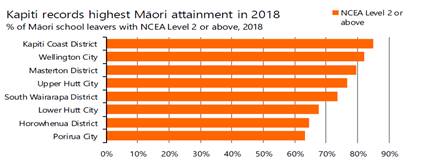

above 2018 43

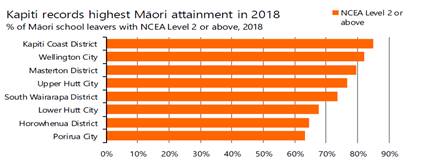

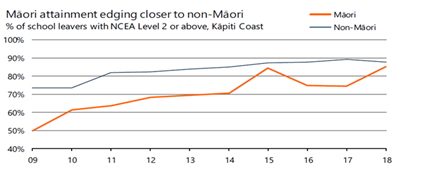

Figure 15: Percentage of Māori school leavers with NCEA

Level 2 or above 2018 44

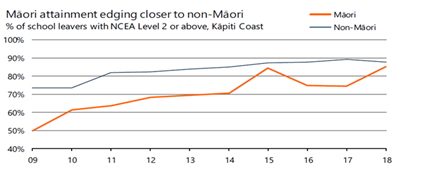

Figure 16: Percentage of Māori school leavers with NCEA

Level 2 or above 2009-2018 44

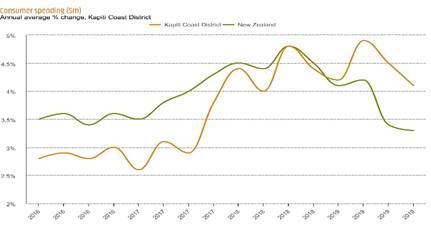

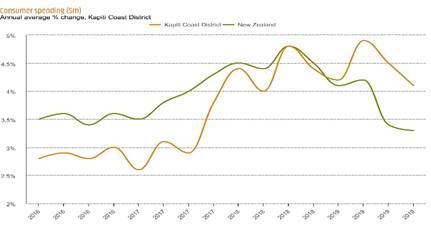

Figure 17: Consumer spending 2016 - 2019 45

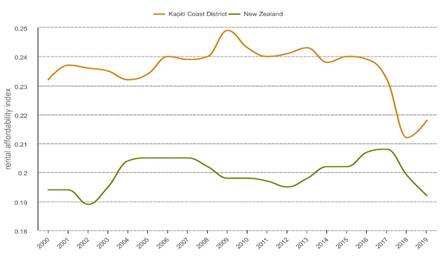

Figure 18: Rental affordability index 2000-2019 46

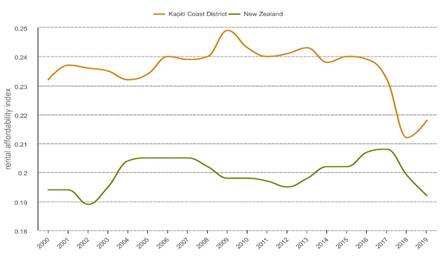

|

he wāhinga

kōrero Foreword

Nō mātou te maringa nui kia whakaputa atu tēnei mahere

rautaki, mahere whakamahinga. He mea whakawhanake tēnei nā ngā

iwi o te kotahitanga ki te tonga (ART), ngā hunga whaipānga me te

hāpori whānui. He kaupapa tāwharau tēnei i te koke whakamua

o te ōhanga puta noa i te hāpori o Kapiti. He hononga tōna ki te

mahere pae tawhiti (‘Long Term Plan’) o te Kaunihera o Kapiti, kia

kotahi mai ngā hāpori katoa o te rohe.

Mā te Poari Whakawhanake

Ōhanga Kotahitanga (Economic Development Kotahitanga Board) e whakahaere

te rautaki nei. Mā te mahi tahi e tautoko ai i te whakamahinga me te

tutukinga o ngā whainga matua. Me rite ka tika nā te nui o ngā

wero, ngā piki me ngā heke, hei tautoko i tō tātou

ōhanga me te hāpori mai i ngā wero pēnei i te Mate

Urutā (COVID19), aha atu, aha atu.

Ko te anga whakamua o te mahere rautaki nei hei

whakakotahi mai i te rohe whānui o Kapiti me ngā tari kāwana.

Hei tūāpapa mō te oranga tonutanga mō te hāpori

whānui mai Paekākāriki ki Ōtaki, mai i ngā maunga ki

te moana.

Te Whakaminenga o Kāpiti

I am pleased to present the Kāpiti Coast Economic

Development Strategy and Implementation Plan 2020-2023 that has been developed,

and will be delivered, in partnership with iwi, key partners, stakeholders, and

the community. The strategy has been developed with the overarching priority of

enhancing the economic wellbeing for all on the Kāpiti Coast. Our district

is alive with opportunity and the vision and outcomes of this strategy align to

that of our Long Term Plan, and focus on ‘building a stronger Kāpiti

Coast together’.

The implementation of this strategy will be overseen

by an Economic

Development Kotahitanga Board. This will be a collaborative governance model

which will not only support the delivery of our priority actions but will also

help ensure we can react to internal and external economic opportunities and

impacts, such as the Covid19 pandemic. We need to be able adapt to these

challenges and ensure that all participants in our economy are supported.

The next three years will see important and

significant changes, including the opening of major new transport

infrastructure, which will increase the attractiveness of the district to

visitors, new residents, and businesses. As a community we need to ensure we

can take advantage of this investment.

The approach outlined in the Strategy demonstrates the

importance of partnership and working together as a district along with other

regional and central government agencies to deliver on our proposed actions.

These provide firm foundations, enhancing our district and the economic

well-being of residents from Paekākāriki to Ōtaki, from the

beachfront to the hillside. We will tread carefully but deliberately, which

means taking specific, incremental steps that give us increased choices in the

future.

Mayor K Gurunathan

Introduction

As a district, the Kāpiti Coast is primed for

growth, significant new infrastructure is nearing completion, our population is

growing, and our attractiveness to the business and investment community is

only increasing. Opportunities for local partners to work together and for the

district to work more closely and strategically with our neighbouring regions

are happening and these collaborations are necessary to ensure better economic

outcomes and more inclusive growth.

This Economic Development Strategy and Implementation

Plan (the Strategy) provides a framework for growing the Kāpiti

Coast’s economy for the benefit of current and future residents, iwi,

communities and businesses. The Strategy covers the period 2020–2023 and

replaces the previous Kāpiti Coast Economic Development Strategy

2015-2018. The Strategy has been developed in kotahitanga / partnership and

will be delivered through kotahitanga / partnership. This will be fundamental

to our success and to building strong foundations and community well-being over

the next three years.

At this current moment, a key economic and well-being

concern for us all is the Covid-19 pandemic and how this will impact our

businesses and communities. The virus has already impacted many parts of our

economy, and it is expected that further impacts will emerge over time. A

separate recovery plan is being prepared for the district and this will be

guided by our longer-term aspirations, as well as the immediate impacts in our

community.

Wider strategic context

In developing this Strategy, we have also considered

the wider strategic context and the need for strong cooperation and commitment

at a national and regional level. This will be important to ensure effective

implementation and delivery and we will continue to pursue opportunities

associated with Central Government and other sources funding which can provide much

needed investment in the district as we continue to grow.

The Strategy’s objectives and actions also

recognise the importance of delivering inclusive and sustainable growth and we

are committed to enhancing the well-being of all our residents and communities

in the district.

Areas of opportunity

There are significant opportunities to further grow

and develop the Kāpiti Coast economy, including:

· increasing the awareness of the Kāpiti Coast as a

great place to live, visit and do business; highlighting our quality of life,

improved infrastructure, rich culture and resilience in order to attract more

residents, businesses and investment, and increase visitor spend and guest

nights

· enabling increased higher paying local job

opportunities in our communities, creating more employment and training

pathways for our young people / rangatahi including those not in education,

employment, or training (NEET’s), and facilitating opportunities for

industry to connect to the skills, talent and expertise of older people and

people with disabilities in the district.

· highlighting our key sectors and environment,

including what we have to offer in terms of manufacturing and service based

industries, creative industries, productive lands and niche & artisan

producers, attractions and parks, and working with iwi to unlock opportunities

for Māori-owned land and businesses.

· supporting and encouraging more businesses to start up

and establish in the district. Kapiti already has a high percentage of

self-employed residents, 27.9% compared to 16.2% nationally and the opportunity

exists to support further growth of these existing businesses, as well as

helping new businesses establish and feel welcomed.

Areas we need to improve

1.

There are also areas we need to

improve, including:

· continuing to develop and make the case for additional

efficient, effective, and resilient transport infrastructure across all of the

Kāpiti Coast and improving our connectivity to other centres

· developing, attracting, and retaining a skilled and

competitive workforce, based on an understanding of current and future

workforce needs, addressing skills gaps and shortages and facilitating greater

connections between businesses, education and training providers and our

communities

· improving community well-being including providing

pathways to higher income jobs and enabling local career progression,

supporting our young people / rangātahi with sustainable pathways to

employment and further training and encouraging entrepreneurship and

innovation. Ensuring older people and people with disabilities in our community

have the opportunity to contribute their skills and experience in a way that

recognises the unique contribution that they can bring as we continue to grow

and adapt.

· placing greater focus on growing and supporting our

partnerships with iwi, business and the community and providing strong

leadership and transparency, strengthening communication between groups and

building trust.

· support for key sectors and having a better

understanding of their potential for

growth and how best to facilitate and support this in partnership with the

sector. Initial focuses would include sectors such as Tourism and Creative

Industries.

Ngā Moemoea / Our vision

As a community we have developed a strategic vision,

Ngā Moemoea, that is at the heart of this strategy and highlights the

importance of partnership in our approach and inclusive growth for all members

in our community.

Through partnership, support the growth of a vibrant,

diverse Kāpiti Coast economy that provides increased opportunity,

resilience, and well-being for all.

To achieve this vision, our partners, businesses, and

communities have told us that we need to work together to:

· Celebrate our rich culture and identity and highlight

the opportunities and advantages of the Kāpiti Coast and attract domestic and international visitors,

residents, and businesses to the district.

· Adopt a business-friendly focus that enables all participants in the economy to

operate to their full potential and contribute to a vibrant economy while

protecting our natural environment.

· Enable innovation, creativity and entrepreneurship by continuing to build connections and networks with

local talent and supporting sustainable pathways for our current and future

employment requirements, with increased Maori employment pathways and business

initiatives.

· Strengthen partnerships and leadership, providing increased opportunity for quality local

entrepreneurship, growth and collaboration, while celebrating, protecting, and

strengthening our unique and distinctive community.

· Focus our efforts to grow those industries and sectors

that provide the most potential for

the Kapiti Coast economy and our community.

Our strategic pillars

The above vision and priorities shape the five

pillars, Ngā Pou, of this strategy, which are illustrated below in Figure 1.

Figure

1: Our

Strategic Pillars and Focus

|

Ngā

Moemoea / Vision

|

Through partnership, support the growth

of a vibrant, diverse Kāpiti Coast economy

that provides increased opportunity,

resilience, and well-being for all

|

|

Ngā

Pou / Pillar

|

WHAKAPAPA / Positioning the Kāpiti

Coast

|

KAITIAKITANGA /

Open for opportunity

|

WHĀNAU /

Growing skills and capability

|

KOTAHITANGA / Strengthening partnerships

and Leadership

|

MANAAKITANGA /

Supporting key sectors

|

|

Ngā

Whāinga / Aim

|

Celebrate our rich culture and identity and highlight the opportunities and advantages of the

Kāpiti Coast

|

Facilitate quality growth

|

Enable employment, innovation, creativity and

entrepreneurship and improve capacity for mana whenua participation

|

Delivery and implementation through strengthened partnerships

and leadership and recognises the significant relationship with iwi as mana

whenua

|

Grow industries and sectors that provide the most

potential for supporting improved economic well-being

|

|

Ngā Mahi /

Actions

|

Develop and deliver the Kāpiti Coast Story

Facilitate and support major events

Build awareness of Kāpiti Coast’s

resiliency and our climate change focus

|

Ensure a welcoming and customer focused approach to

council services

Have a coordinated approach to the facilitation of

key opportunities

Ensure effective regulations that support growth and

protect our environment, including the District Plan

Attract new businesses and agencies to the

Kāpiti Coast

|

Develop a Workforce Plan including a Youth Initiative

and opportunities for Maori, older people and people with disabilities.

Facilitate growth of international education

Advocate for local tertiary and apprenticeship

linkages

Enhance business networking and training opportunities

Develop a business investment and support matching

programme

|

Establish an Economic Development Kotahitanga Board

and finalise the monitoring and reporting framework for the Strategy

Support the development and delivery of a Covid 19

recovery plan

Support actions that enable mana whenua aspirations

Advocate for new and improved essential

infrastructure including electrification of rail to Ōtaki

Support unique economic opportunities in our

communities

Advocate for increased access to affordable housing

to support the growth and retention of local residents

|

Identify opportunities and barriers

experienced by key sectors, including high growth sectors

Develop a district wide Destination Plan to support

the growth of the visitor economy, including strengthened air linkages and

supporting infrastructure such as the Kāpiti Gateway.

Support the development and delivery of a Kāpiti

Creative Industries Plan

Encourage the reduction of waste and emissions

Support development of industry led groups

|

|

Ngā whakaputa

nga takawaenga / Medium term outcomes

|

Increased awareness of the Kāpiti Coast as a

destination

Increase in number of attendees at major events

delivered

|

Businesses recognise Kapiti as a great place to

establish and grow

Key industries and businesses feel supported

More businesses and organisations actively

considering the Kāpiti Coast

|

Improved match between workforce needs and skills

available

Increase in employment and training pathways for

young people and Maori

Increased business networking and awareness of

training and support

|

Increased business engagement

Increased advocacy for Kāpiti Coast

Increase in Government investment into district

|

Targeted actions to support growth of key industries

Growth of visitor economy

Improved resilience and climate awareness across key

industries and businesses

Industry led business groups established

|

|

Ngā whakaputa

nga roroa / Longer term outcomes

|

Increase in visitor numbers and expenditure

Increase in new businesses establishing in district

|

Growth of key industries and businesses

Economic impacts and opportunities of key projects

understood and realised Relocation

of Government Offices to Kāpiti Coast (combined 200+ FTE)

|

Increase level of qualification attainment

Decrease in proportion of NEETs

Decreased rates of unemployment

Increase in investment into key industries and

businesses

|

Increased infrastructure investment in Kāpiti

Coast

Manu whenua aspirations realised

|

Growth of key industries and businesses

Reduction in emissions and increased climate

resilience

Sustainable multi-sector partnership and

collaboration

|

|

Impacts

|

Employment Growth – increase in local

employment options and pathways

|

Mean Income Growth – increase in higher paying

local employment and income generating opportunities

|

Business Unit Growth – increase in businesses

establishing, expanding and moving to the district

|

GDP Growth – increased growth of the local

economy and key sectors.

|

|

|

|

|

|

|

|

|

|

Governance

and delivery

2.

The ongoing arrangements for governance

and delivery of this strategy are as important as the proposed actions. This

governance needs to be consistent, continuous, and effective.

3.

Recognising this, it is agreed

that:

· the Economic Development Kotahitanga Board is

established

· an independent chair is appointed by Council to build

trust, pull together a strong board and provide a unified strategic direction

· the board will be selected based on capability and

board members need to be able to work productively with multiple partners and stakeholders

within and outside the district

· a council representative will be an ex-officio member

of the board

· local iwi will be fully represented on the board

· council will provide support to the board.

· A separate Terms of Reference Agreement will be

developed and agreed with the Board.

4.

It is proposed that the initial

core responsibilities of the Board would focus on overseeing the Economic

Development Strategy and Implementation Plan, advocating for Kāpiti Coast

and for economic development activities in the district, and being a

relationship broker, with a focus on the establishment of strategic

relationships to progress economic development opportunities. The Board will also play an important role

in finalising and agreeing the monitoring and reporting framework for the

Strategy. This recognises that given the Covid-19 pandemic, there is a need to

understand more fully the economic impacts on the local economy and how these

will effect our economic performance and growth.

Priorities for year 1

5.

The implementation plan contains a

significant number of actions that will be progressed by the Board, Council and

its key partners over the coming years. In year 1 our priorities are to:

· Deliver the Kāpiti Story – which supports our positioning the Kāpiti Coast

pillar.

· Provide a coordinated approach to the facilitation of

key opportunities, such as the attraction of new businesses and government

agencies. – which supports our

open for opportunity pillar.

· Develop a Kāpiti Coast Workforce Plan– which supports our growing skills and

capability pillar.

· Establish an Economic Development Kotahitanga Board and support the development and delivery of

a Covid 19 Recovery Plan – which supports our strengthening

partnerships and leadership pillar and recognises the significant relationship with iwi as mana whenua.

· Develop a Kāpiti Coast Destination Plan, which

includes a focus on increasing opportunities for Maori business and a strategy