|

|

|

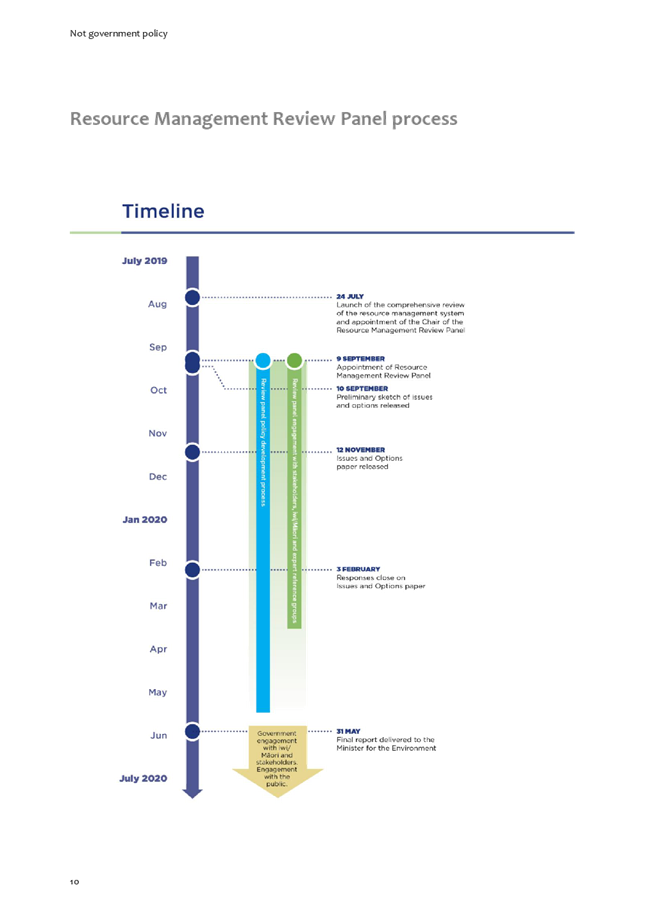

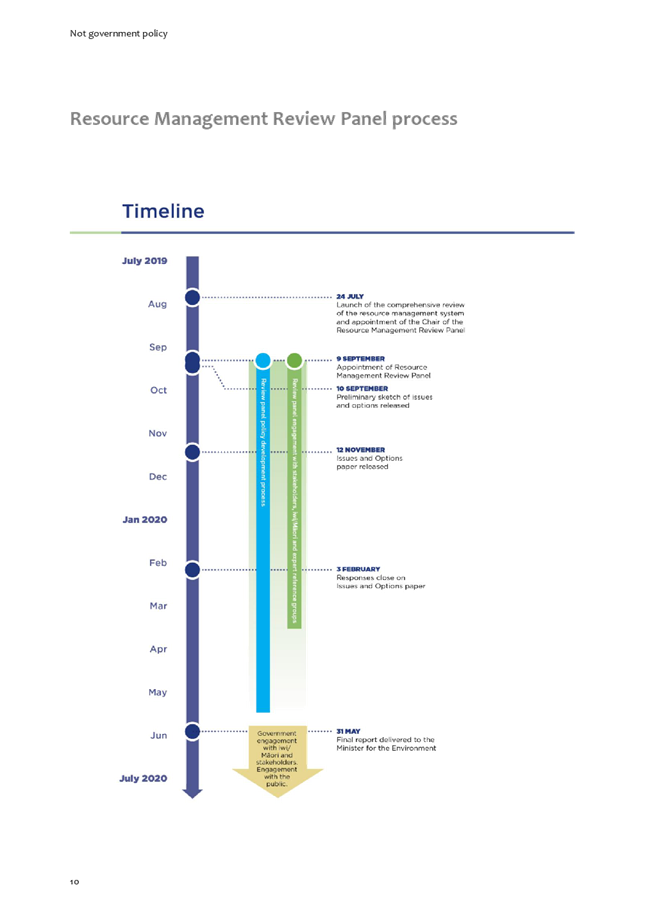

AGENDA

Council Meeting

|

|

I hereby give notice that a Meeting of the Kapiti

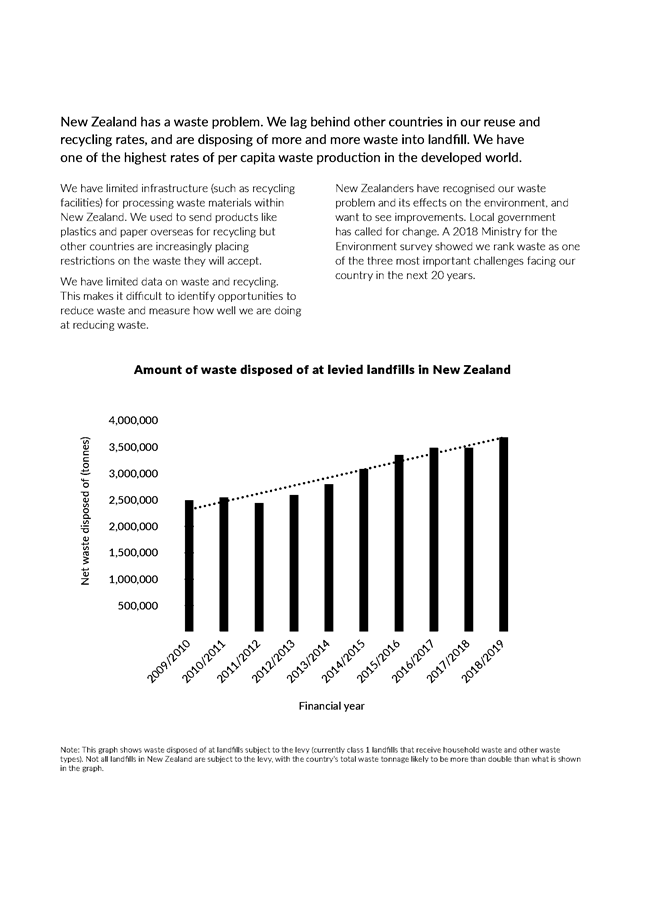

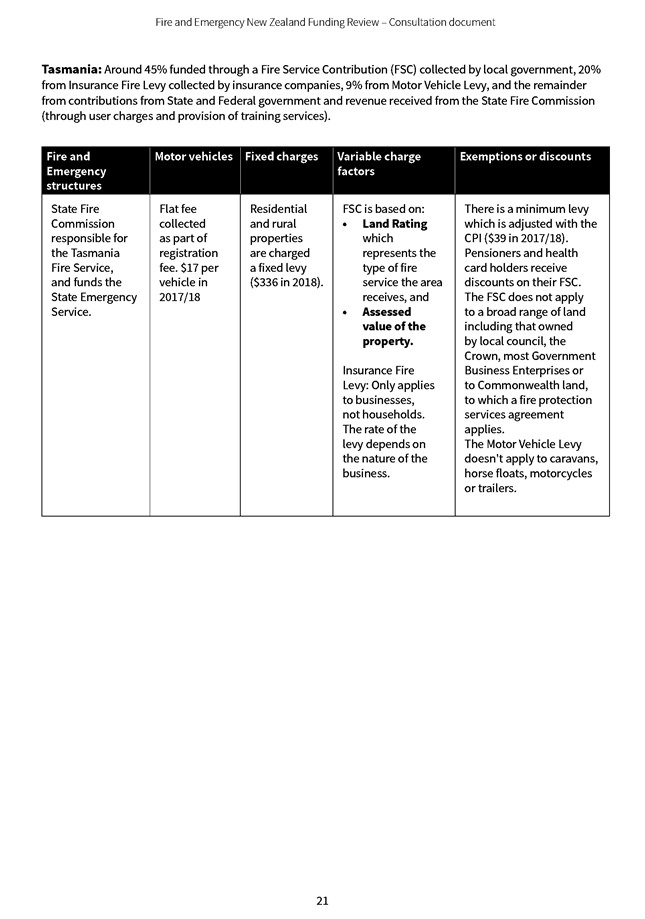

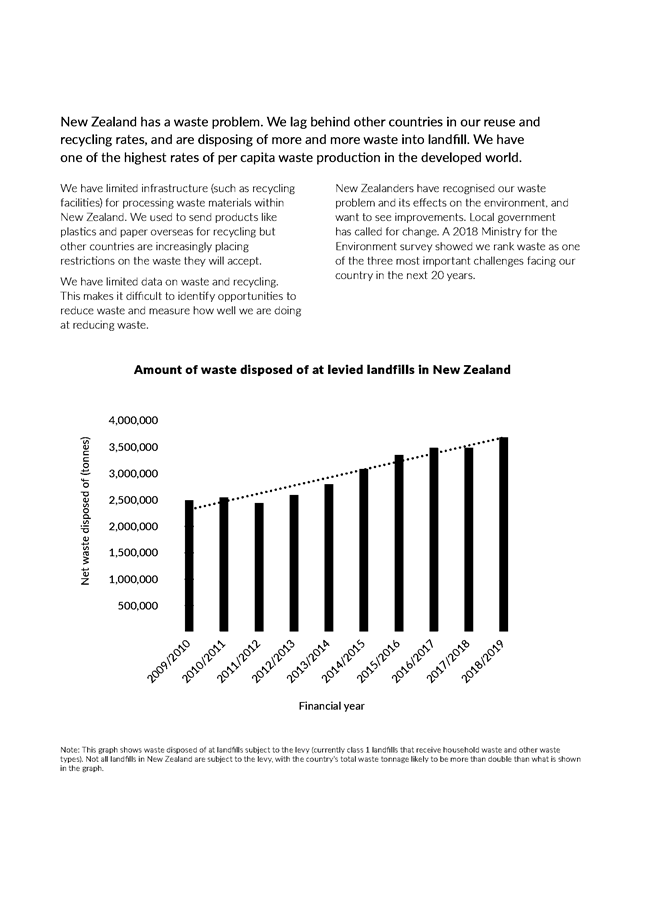

Coast District Council will be held on:

|

|

Date:

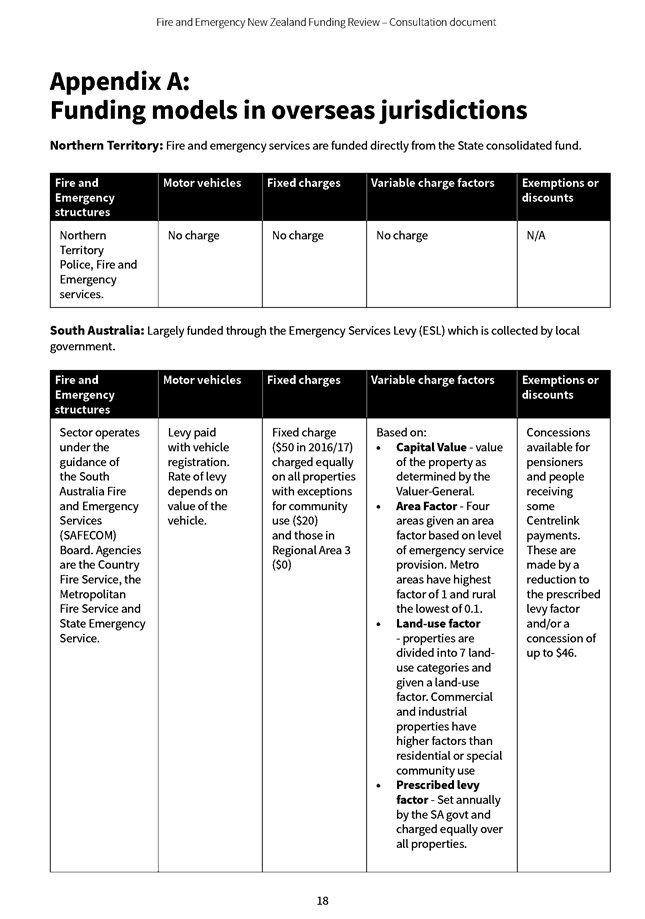

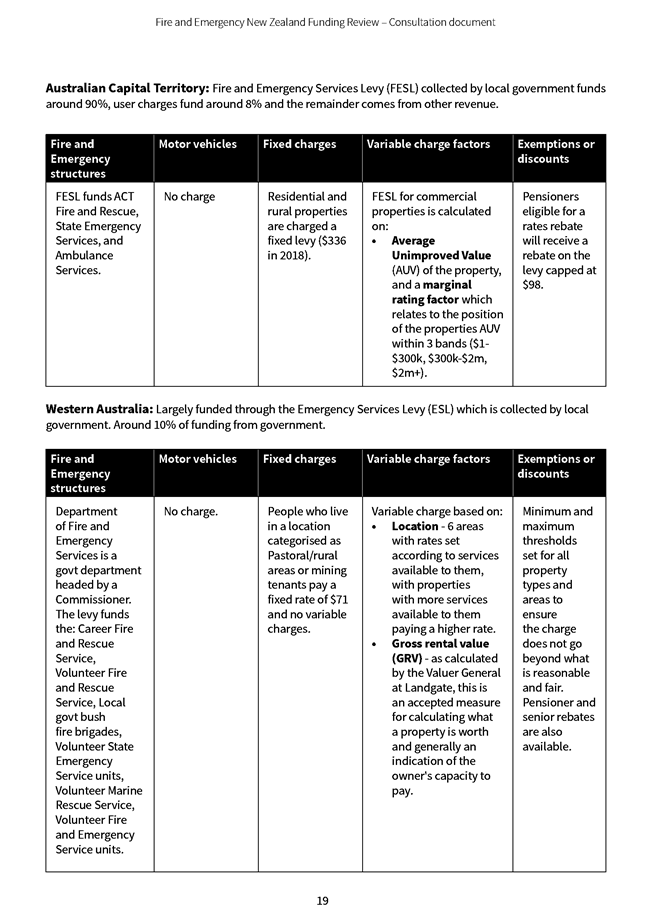

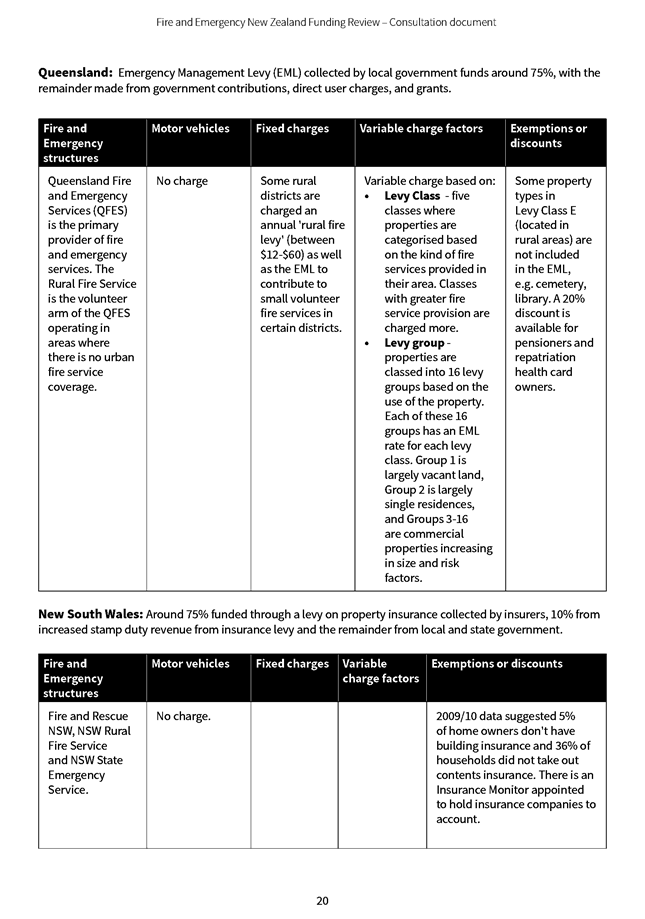

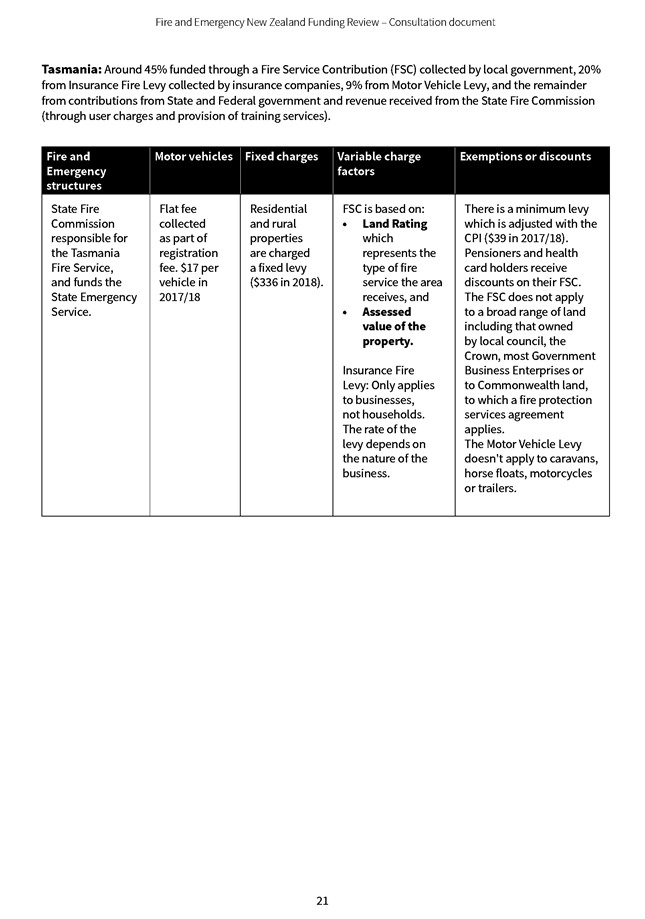

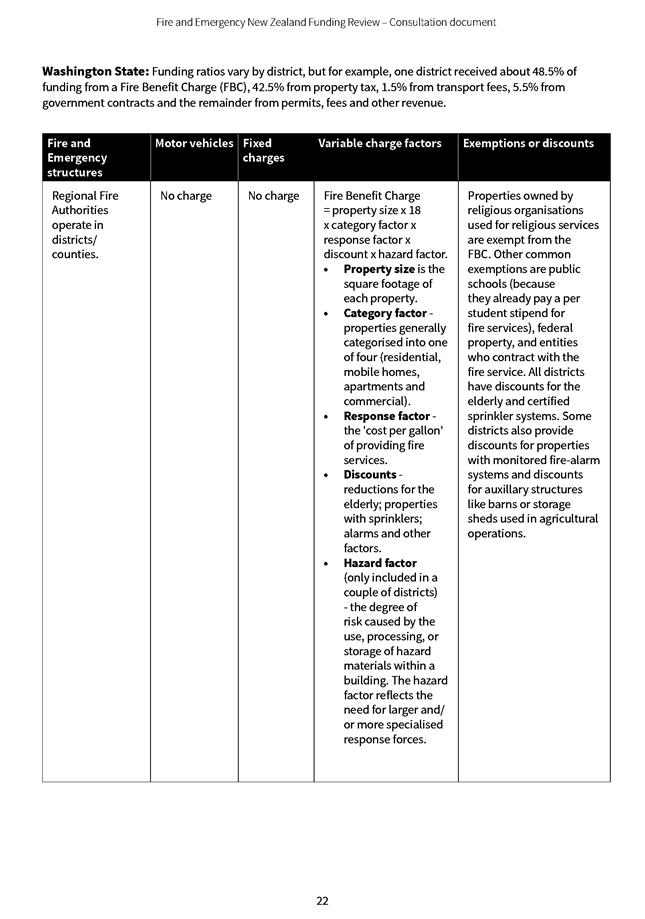

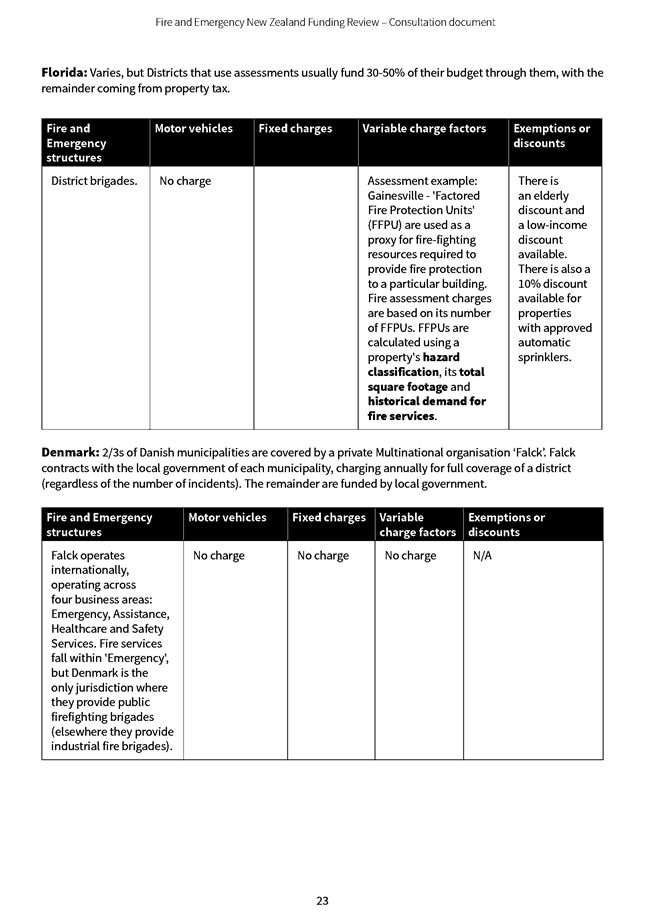

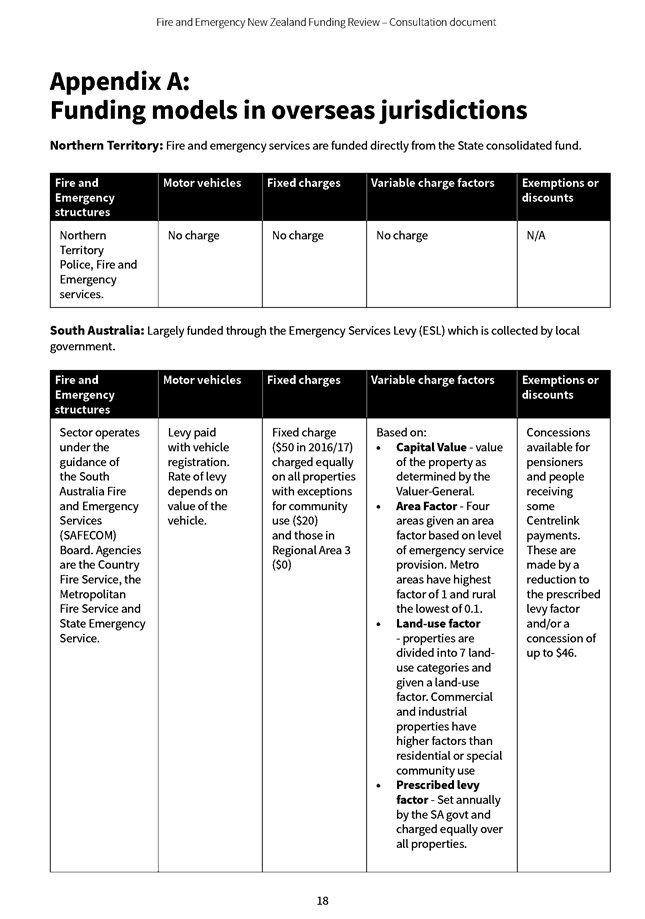

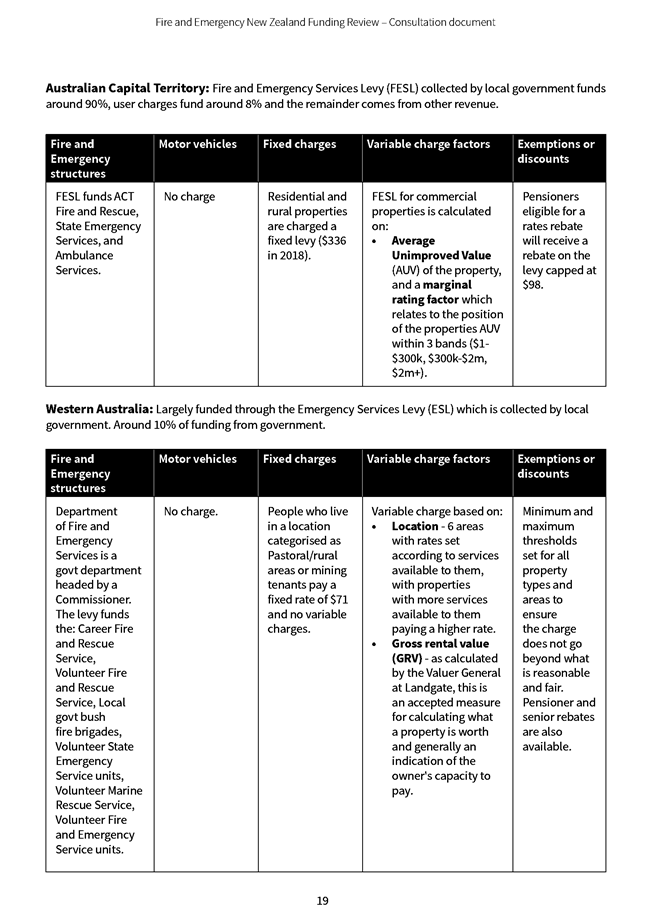

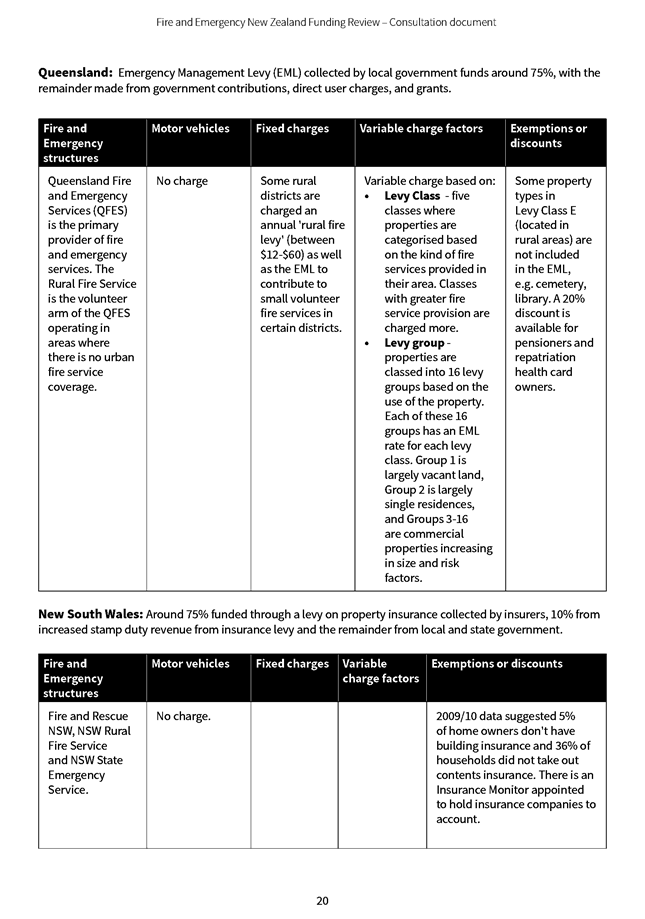

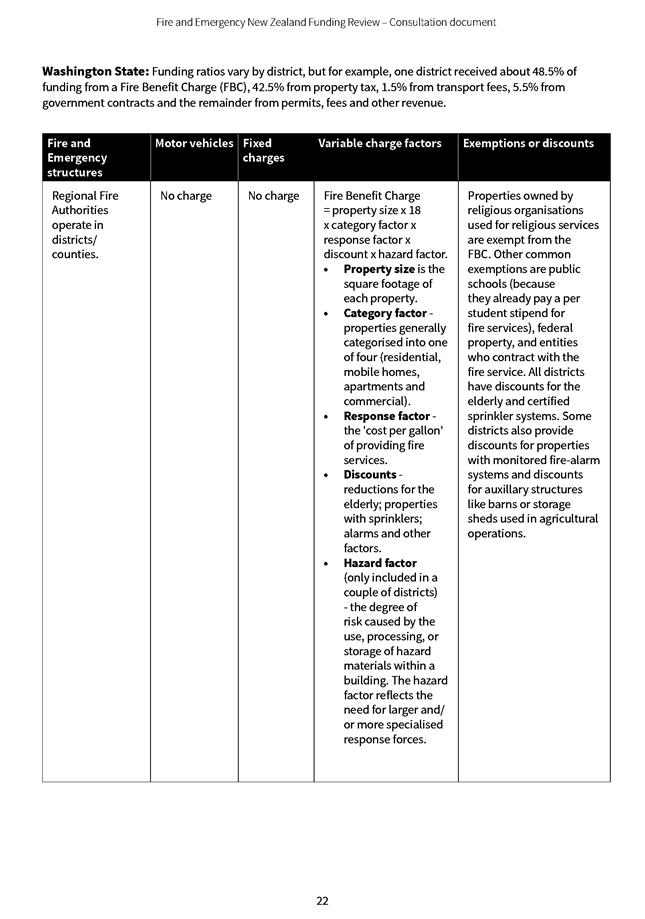

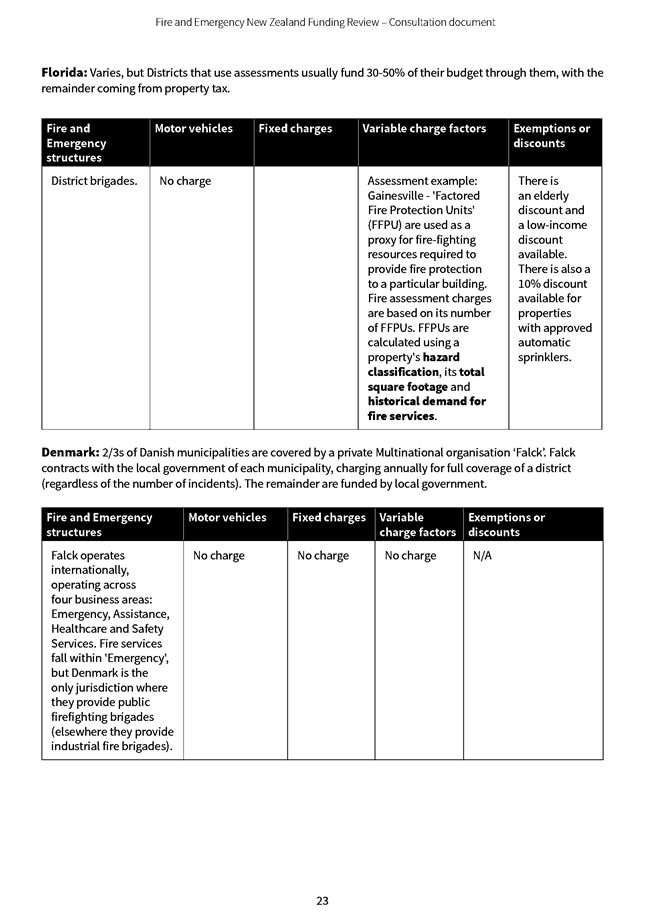

|

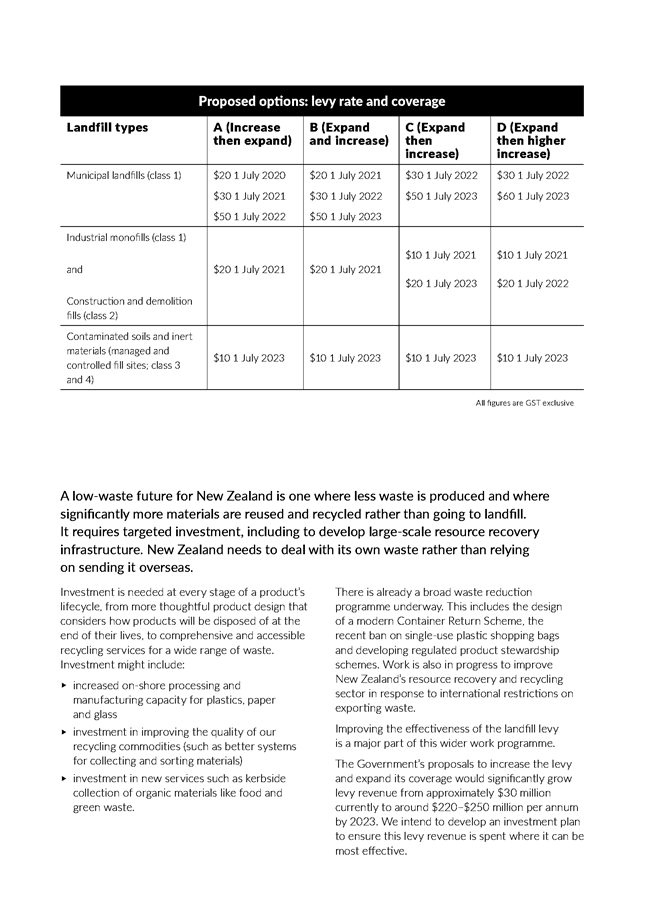

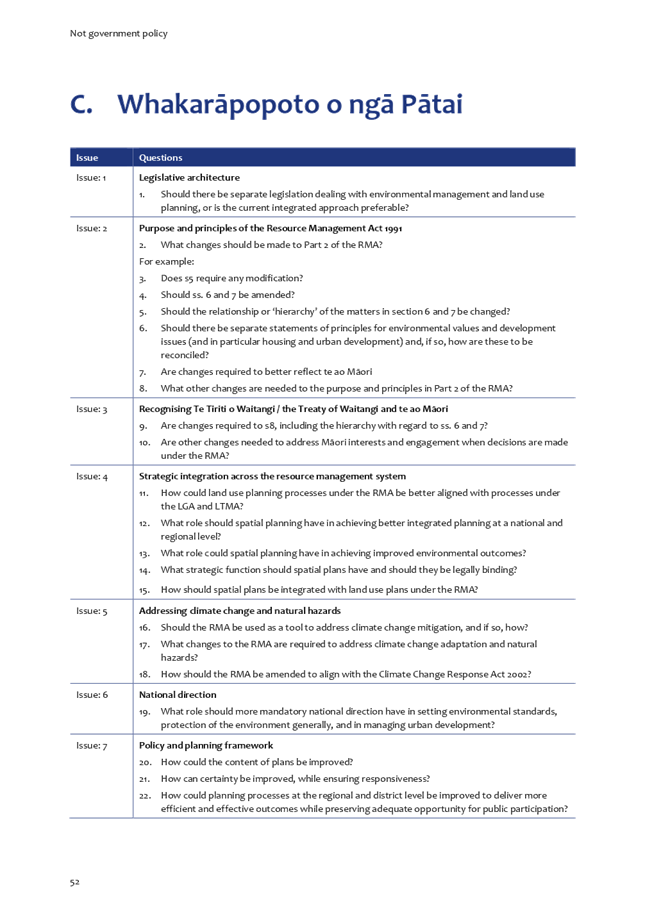

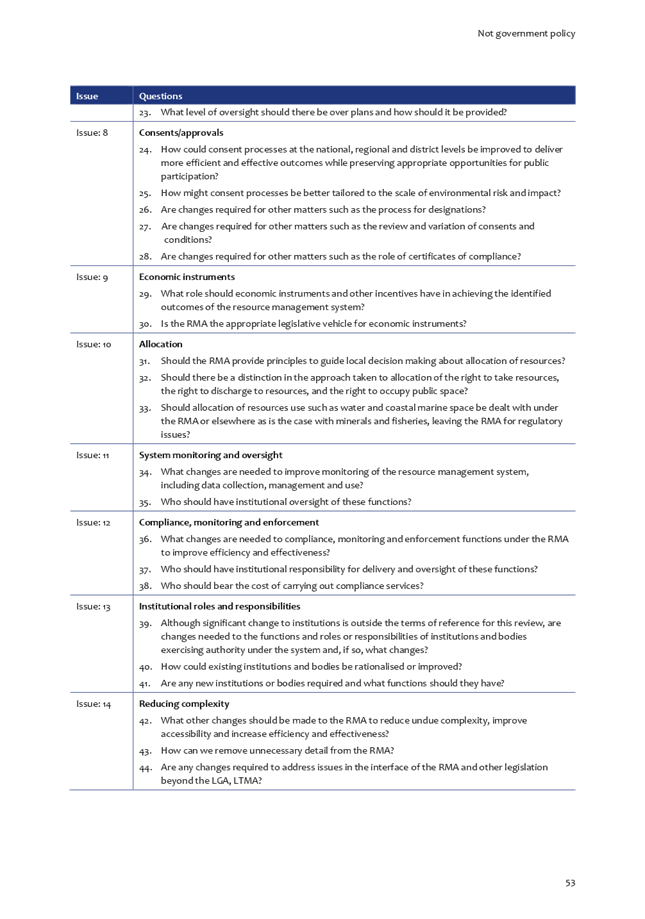

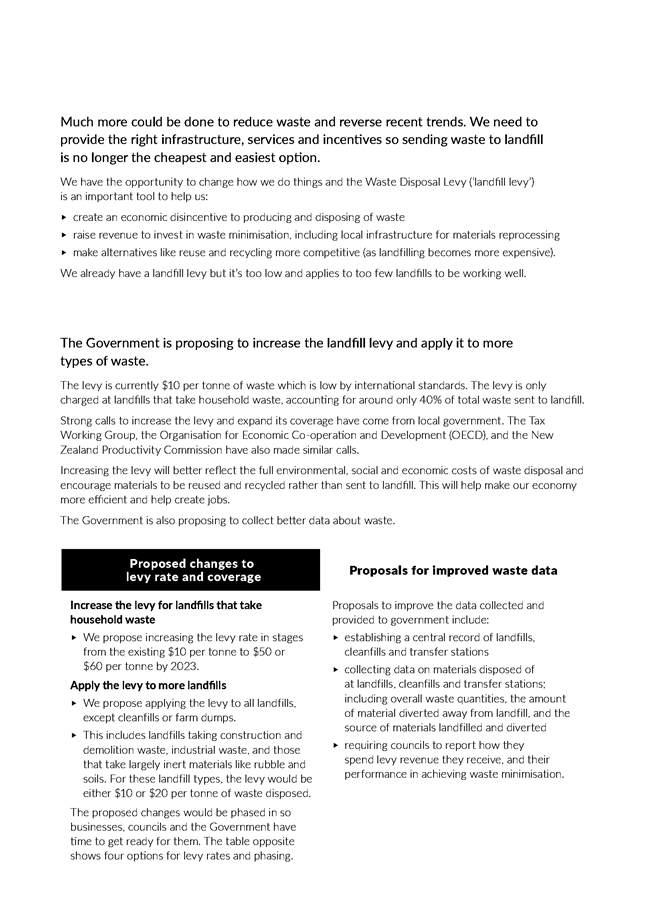

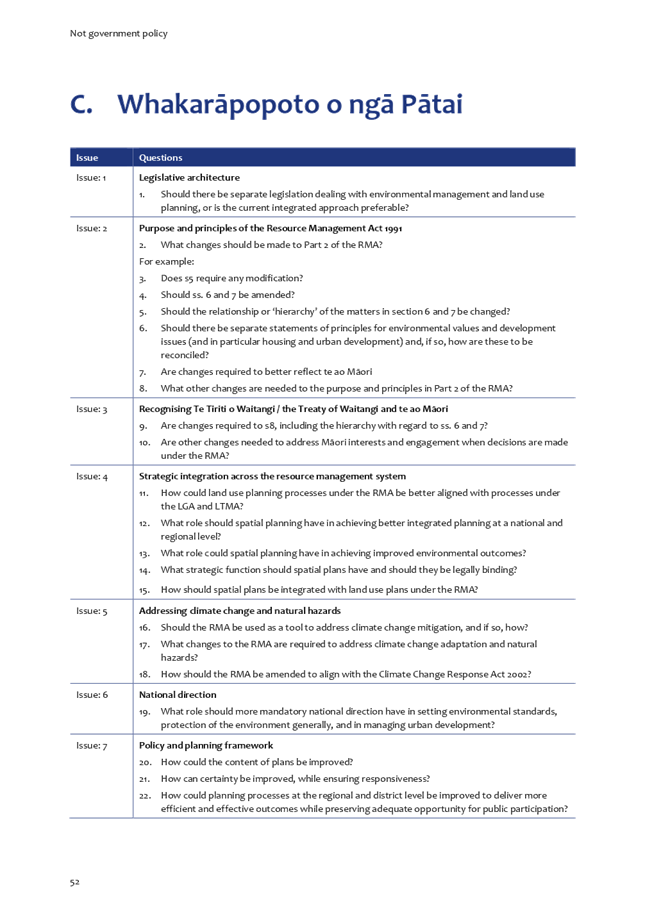

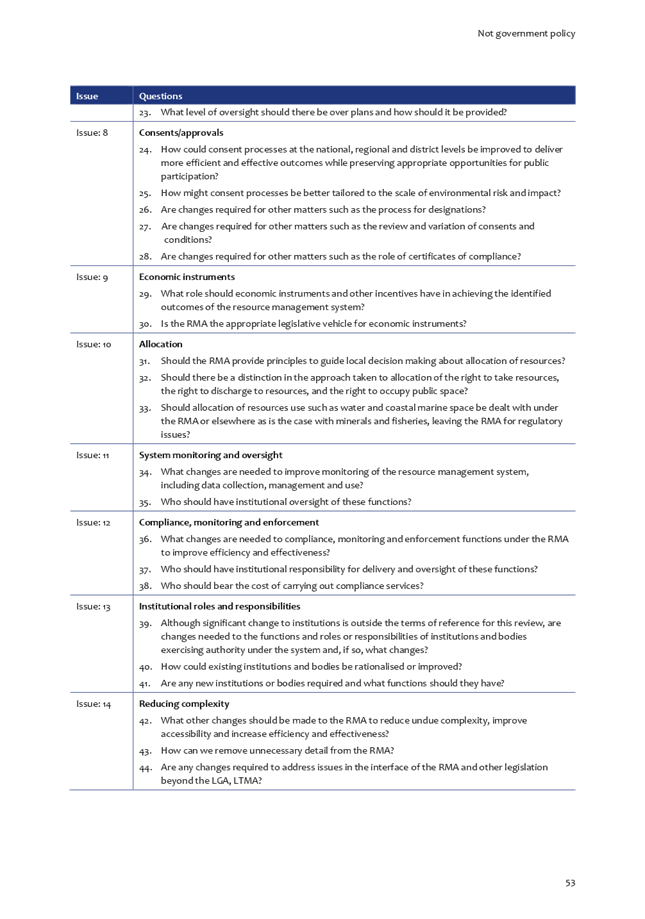

Thursday, 30 January

2020

|

|

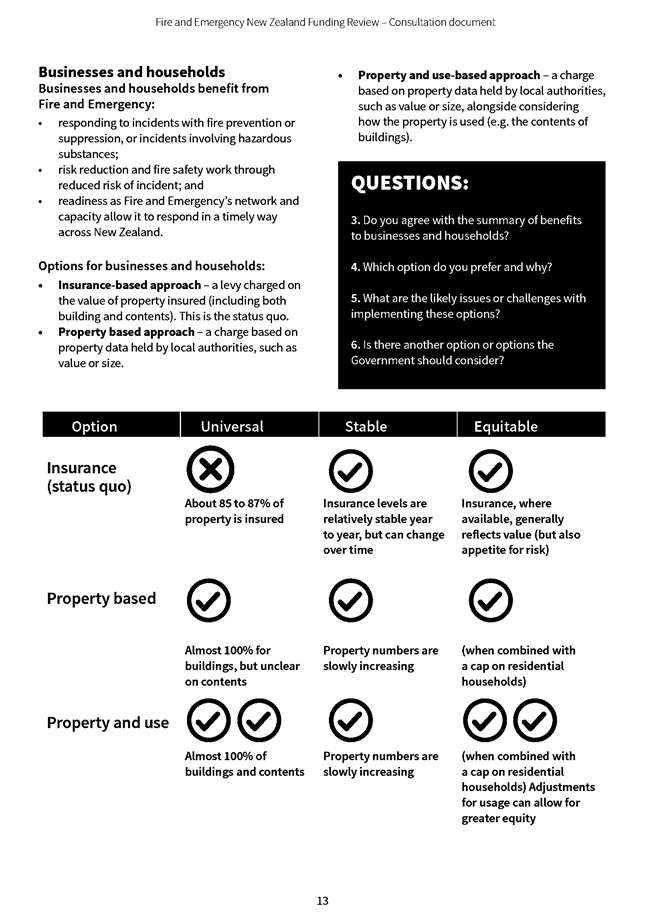

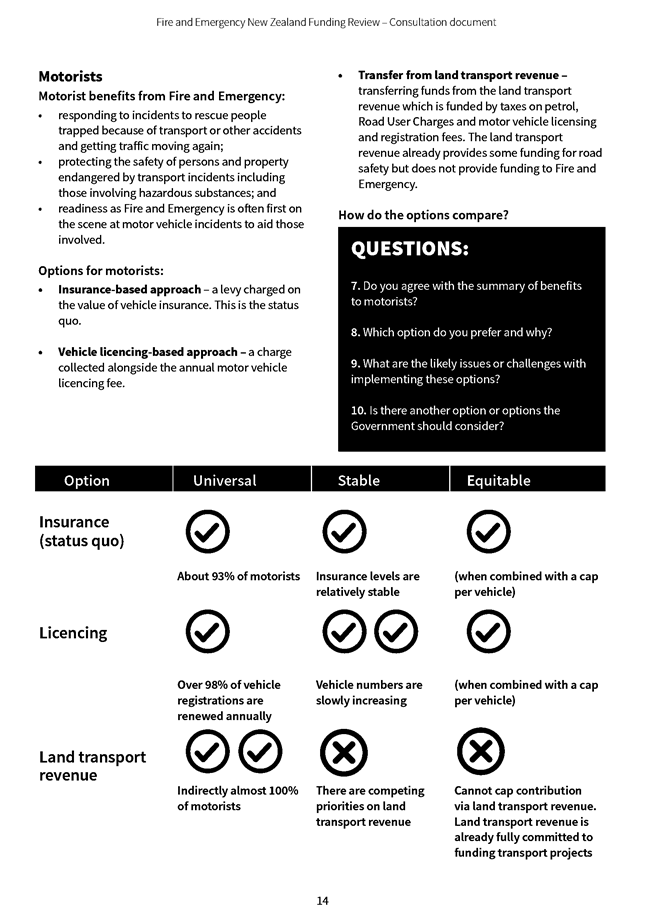

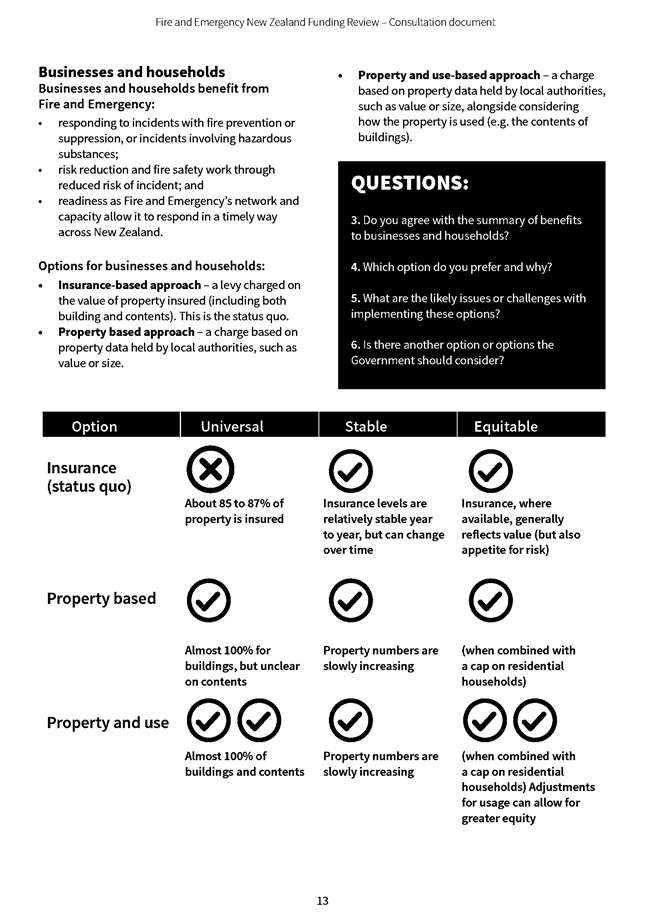

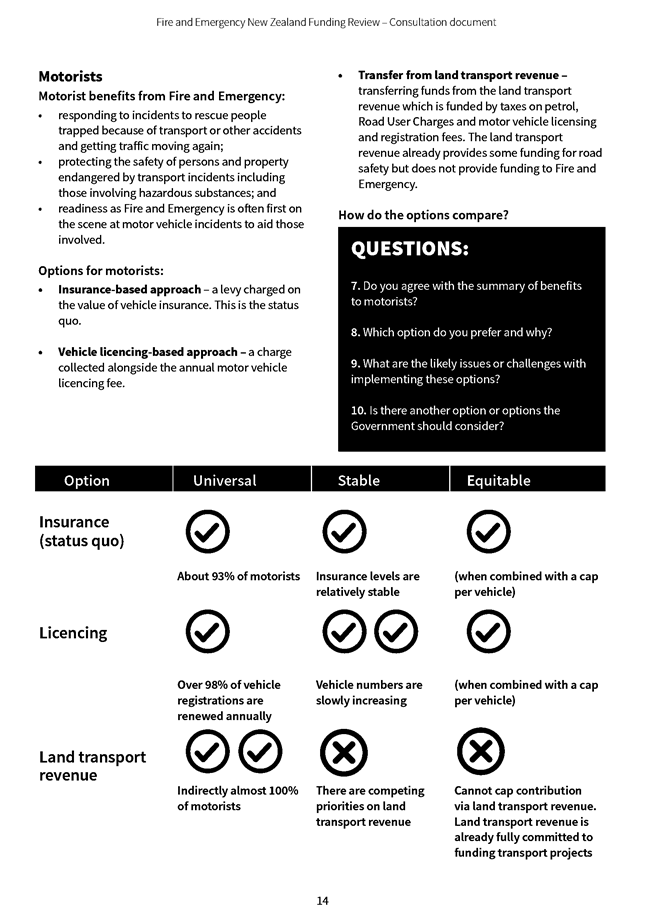

Time:

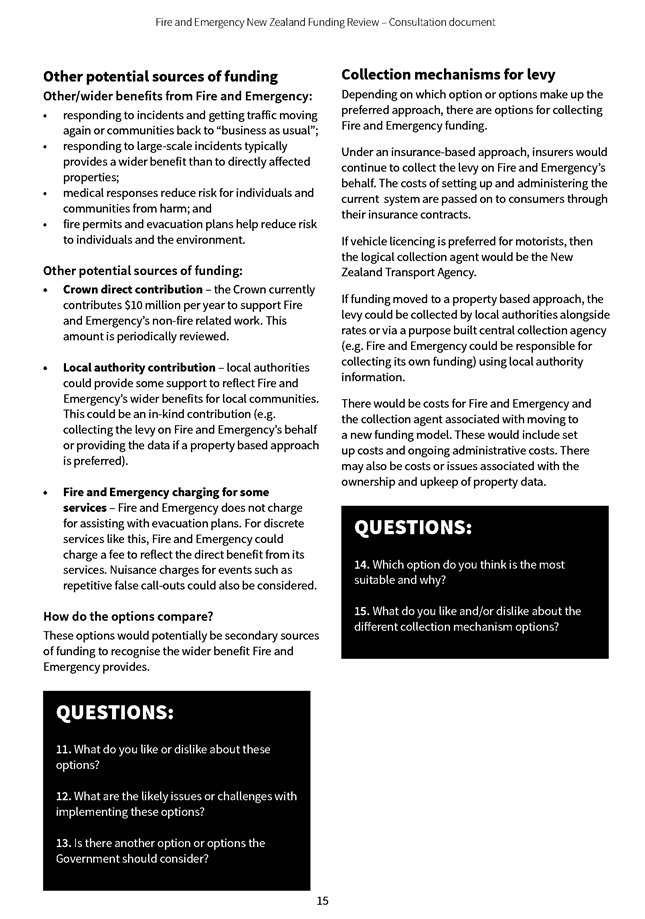

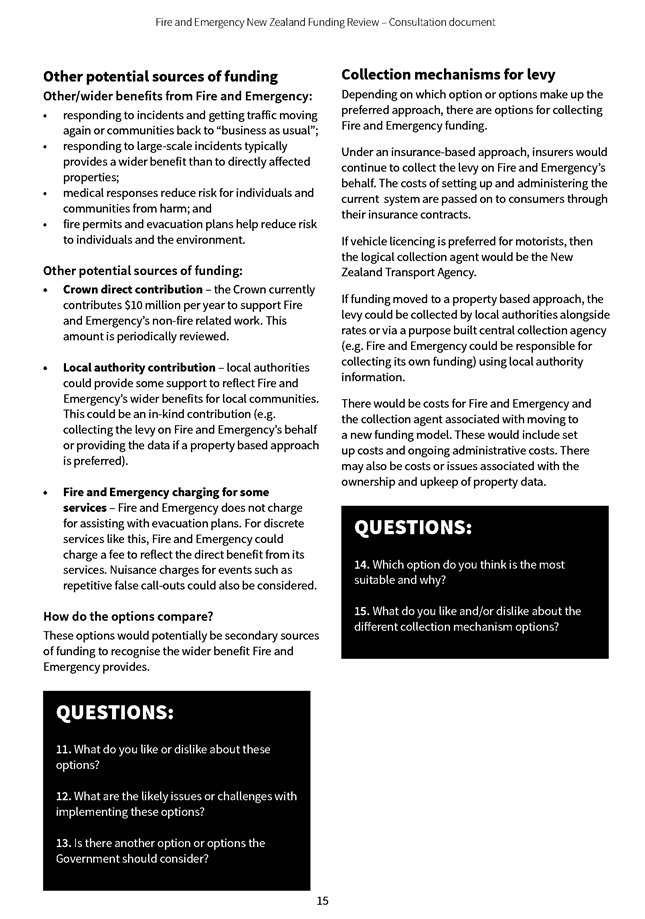

|

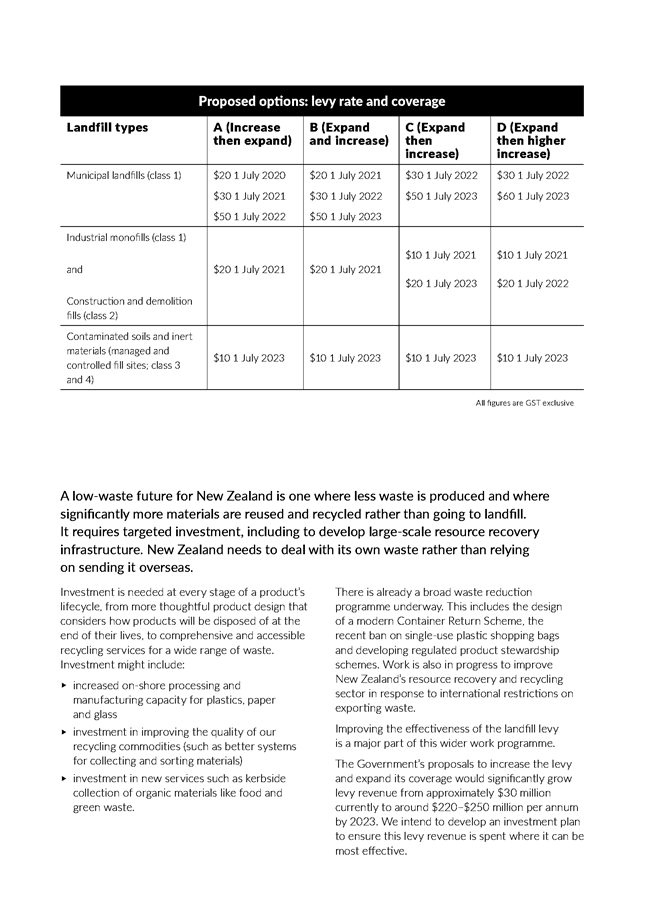

9.30am

|

|

Location:

|

Council Chamber

Ground Floor, 175 Rimu Road

Paraparaumu

|

|

Wayne Maxwell

Chief Executive

|

|

Council

Meeting Agenda

|

30 January 2020

|

Kapiti Coast District Council

Notice

is hereby given that a meeting of the Kapiti Coast District Council will be

held in the Council Chamber,

Ground Floor, 175 Rimu Road, Paraparaumu, on Thursday 30 January 2020, 9.30am.

Council Members

|

Mayor K Gurunathan

|

Chair

|

|

Deputy Mayor Janet Holborow

|

Deputy

|

|

Cr Angela Buswell

|

Member

|

|

Cr James Cootes

|

Member

|

|

Cr Jackie Elliott

|

Member

|

|

Cr Gwynn Compton

|

Member

|

|

Cr Jocelyn Prvanov

|

Member

|

|

Cr Martin Halliday

|

Member

|

|

Cr Sophie Handford

|

Member

|

|

Cr Robert McCann

|

Member

|

|

Cr Bernie Randall

|

Member

|

2 Council

Blessing

“As we deliberate on the

issues before us, we trust that we will reflect positively on the

communities we serve. Let us all seek to be effective and just, so that with

courage, vision and energy, we provide positive leadership in a spirit of

harmony and compassion.”

I a mātou e whiriwhiri ana

i ngā take kei mua i ō mātou aroaro, e pono ana mātou ka

kaha tonu ki te whakapau mahara huapai mō ngā hapori e mahi nei

mātou. Me kaha hoki mātou katoa kia whaihua, kia tōtika

tā mātou mahi, ā, mā te māia, te tiro whakamua me te

hihiri ka taea te arahi i roto i te kotahitanga me te aroha.

3 Apologies

4 Declarations

of Interest Relating to Items on the Agenda

Notification from Elected

Members of:

4.1 – any interests that

may create a conflict with their role as an elected member relating to the

items of business for this meeting, and

4.2 – any interests in

items in which they have a direct or indirect pecuniary interest as provided

for in the Local Authorities (Members’ Interests) Act 1968

5 Public

Speaking Time for Items Relating to the Agenda

6 Members’

Business

(a)

Public Speaking Time Responses

(b)

Leave of Absence

(c)

Matters of an Urgent Nature (advice to be provided to the Chair prior to

the commencement of the meeting)

7 Mayor's

Report

Nil

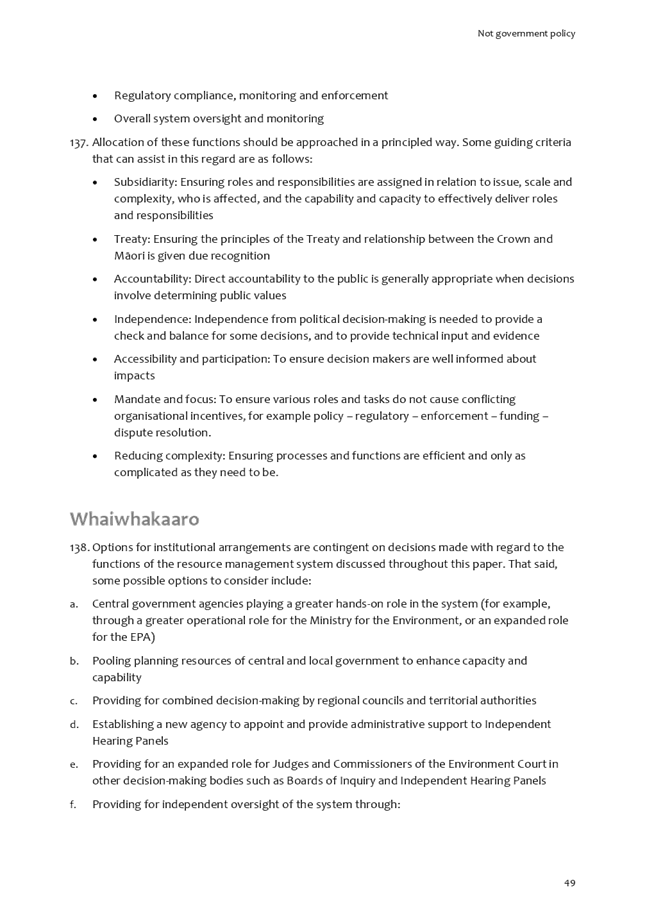

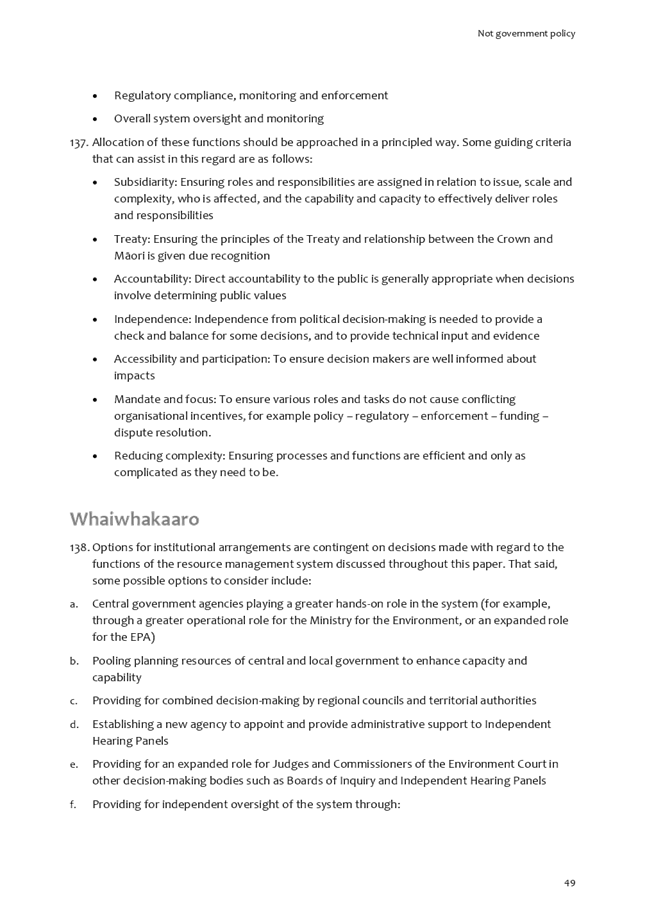

8 Reports

8.1 Submission

to the Department of Internal Affairs on the Fire and Emergency New Zealand

Funding Review

Author: Brandy

Griffin, Principal Advisor Research & Policy

Authoriser: Hamish

McGillivray, Manager Research & Policy

Purpose of Report

1 This

report requests Council approval of the draft submission to the Department of

Internal Affairs’ Fire and Emergency New Zealand Funding Review (attached

as Appendix 1 to this report).

Delegation

2 Council

has the authority to consider this matter.

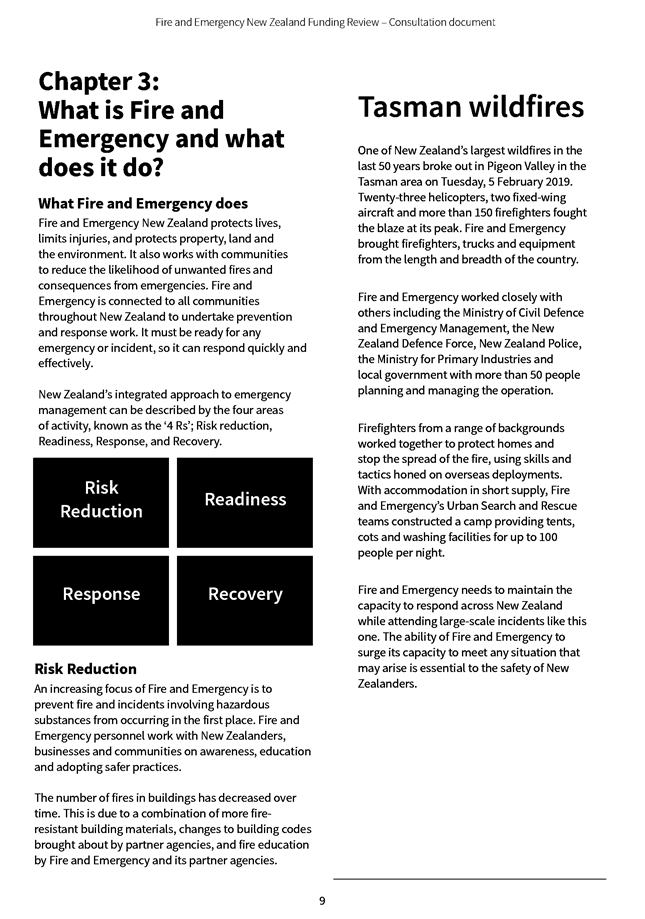

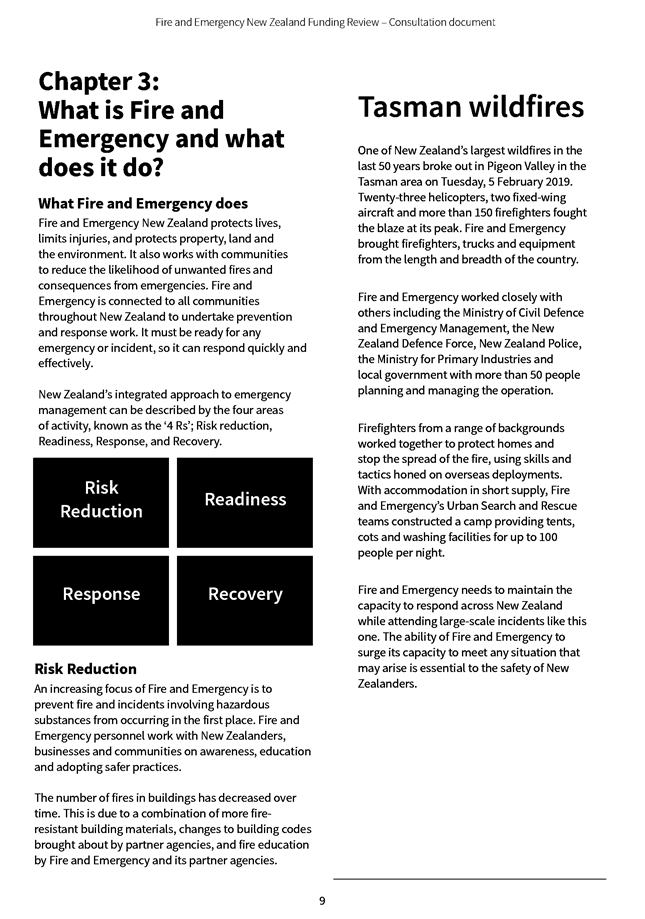

Background

3 Fire

and Emergency New Zealand (FENZ) was established via the Fire and Emergency New

Zealand Act 2017, as an amalgamation of the former rural and urban fire

authorities.

4 FENZ

is the national body for all fire and emergency services in New Zealand.

It provides fire and emergency services 24 hours a day, seven days a week, from

652 fire stations across New Zealand, and responds to incidents through a mixed

model that includes 1,800 career fire fighters in concentrated urban areas,

partnerships with other agencies, and 11,800 volunteers across New Zealand.

5 FENZ

is mainly funded through a levy on insurance for commercial property,

residential property, and motor vehicles. The Government has commissioned the

Department of Internal Affairs (DIA) to undertake a review to consider whether

there are more suitable funding regimes.

6 The

review of the FENZ funding regime will be carried out in two phases.

Phase One (March 2019 to February 2020) will collect high-level information on

various funding models; while Phase Two (March 2020 onwards) will further

assess specific options in order to select a preferred funding

model.

7 In

December 2019, the DIA released the Fire and Emergency New Zealand Funding

Review: Consultation document (attached as Appendix 2 to this report). This

consultation document is part of Phase One, and submissions are due by 5

February 2020.

Issues and Options

Issues

with the current funding regime

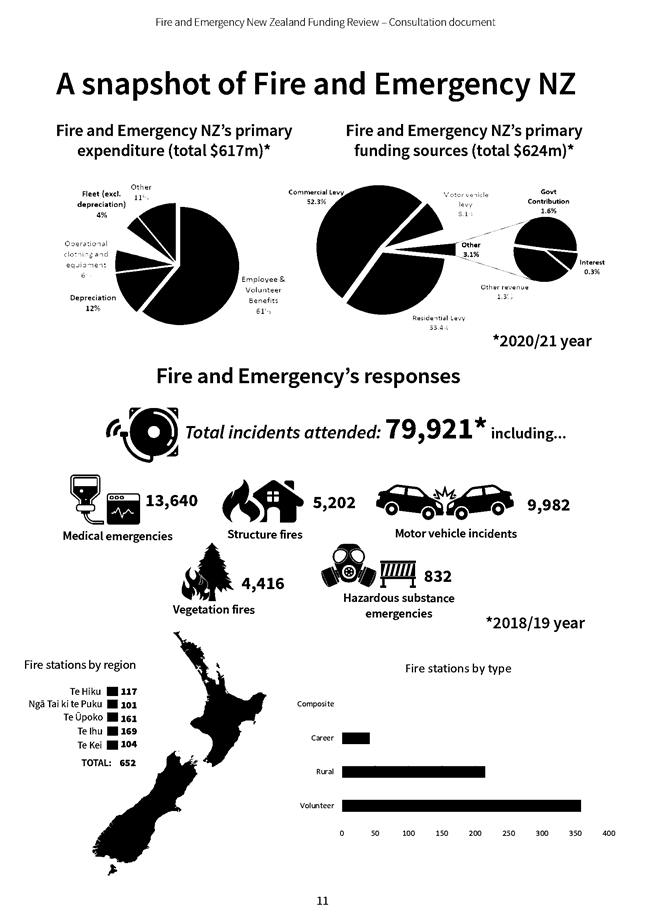

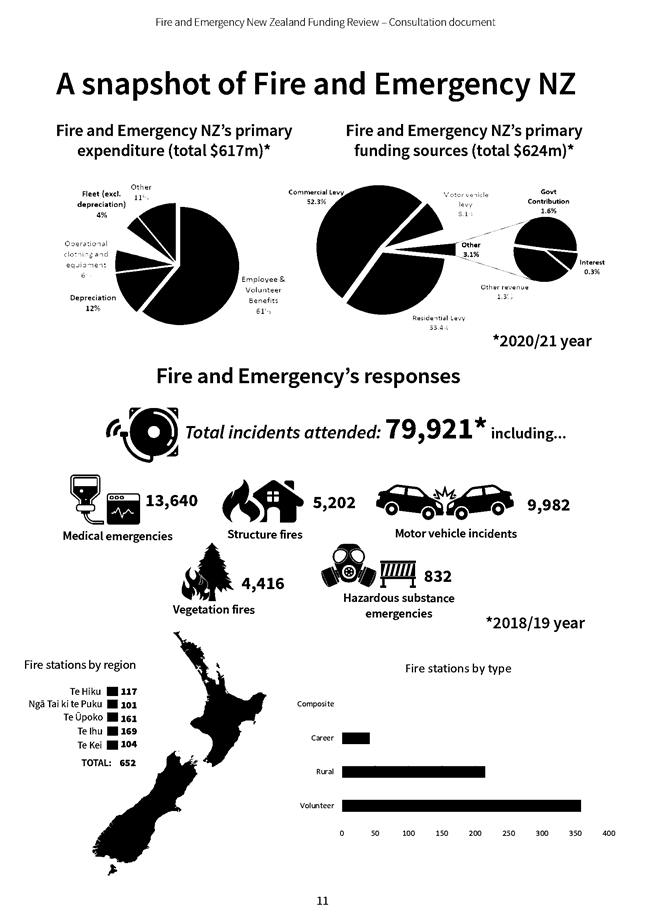

8 For

the 2020/21 financial year, the estimated primary expenditure for FENZ will be

$617 million (p11). During this same time period, 52.3% of FENZ’s

anticipated income will be sourced from commercial levies, 33.4% from

residential levies, and 8.1% from motor vehicle levies. The remaining

6.5% will be sourced from Government contributions and other revenue

(additional government contributions and interest income).

9 As

the consultation document notes, there are a number of benefits to the existing

funding model (p7). Those benefits include:

9.1 The

current system is established and works well to fund FENZ;

9.2 People

understand and are used to working with the current system;

9.3 Moving

to a new system would involve some costs and risks, and a degree of

uncertainty;

9.4 Insurance

levels are relatively stable year to year, although they can change over time;

and

9.5 Insurance,

where available, generally reflects value (albeit this is not considered the

case for properties in the Wellington Region due to the higher perceived risks

to natural disasters following the 2016 Kaikoura earthquake).

10 There

are, however, some limitations to the current system (p7). For example:

10.1 Property

owners who do not insure still benefit from FENZ’s services, thereby

“free-riding” on those who do insure;

10.2 Levels

of insurance are market-driven and can change over time, and do not necessarily

match the benefit that FENZ’s services provide;

10.3 Charging

a levy on insurance increases the overall cost of insurance, which may stop

some people from getting insurance;

10.4 Levy

systems can be complex to administer for insurers;

10.5 The

complexity of insurance contracts can result in similar properties paying

different amounts; and

10.6 The

commercial sensitivity of insurance contracts can prevent information about

some of these limitations being shared with the Government, which can make it

hard to know how significant these problems are based on the information

available.

11 The

Fire and Emergency New Zealand Act 2017 included some changes to the

insurance-based levy regime to update and modernise it. These changes

will not go into effect until 2024, but even then, they will only be in place

until a preferred funding regime is adopted (p8).

12 Many

international fire and emergency services have moved away from an

insurance-based model. For example, Queensland, South Australia, Western

Australia, and Victoria have moved to a property-value based model, with levies

collected via local councils. Meanwhile, Northern Territory funds its

fire service entirely from Commonwealth funds.

13 The

key question the Government is asking in this phase of the review is, how best

to split the cost of funding FENZ between those who would benefit (e.g.

businesses and households, urban, rural and remote communities, and motorists),

given the different level of benefit they receive from FENZ (p12).

14 It

is important to note that the following are out of scope for this review:

14.1 FENZ

expenditure;

14.2 FENZ

operations;

14.3 Legislative

settings not related to funding FENZ;

14.4 Funding

arrangements for other emergency services; and

14.5 Funding

FENZ predominantly through general taxation (p6).

Considerations

of other funding models

15 The

Fire and Emergency Act 2017 sets out the following funding principles:

15.1 A

stable source;

15.2 Universal,

so that costs are shared among all who benefit;

15.3 Equitable,

so that the costs are commensurate with benefit;

15.4 Predictable;

and

15.5 Flexible.

16 The

consultation document asks submitters to consider (i) whether there are any

other principles that need to be considered, and (ii) which principles are the

most important and why.

17 The

consultation document also seeks to summarise the benefits that businesses,

households and motorists derive from FENZ, and consider the funding options

that might be most appropriate for each group.

18 In

a sub-section entitled ‘other potential sources of funding’, the

document suggests that one option might be for local authorities to provide

support in order to reflect the wider benefits to local communities

(p15).

19 Lastly,

the consultation document considers collection mechanisms. The document

suggests that, should a property-based approach be preferred, the levy could be

collected via local authorities.

Council’s

draft submission

20 Council

argues that affordability should be a key principle used to evaluate the

various funding regime options. In addition, Council strongly believes that the

main source of funding should be from general taxation, a funding model that

should and can be very simple and, presumably, could be implemented and

initiated at low cost by the Inland Revenue Department.

21 Council

does not support a funding model based on property value and/or property use as

this does not satisfy all of the proposed funding principles and Council does

not support an additional arrangement whereby Council would be required to

collect FENZ funding from its ratepayers.

Considerations

Policy

considerations

22 There

are no policy considerations arising from this submission.

Legal

considerations

23 There

are no legal considerations arising from this submission.

Financial

considerations

24 There

are no financial considerations arising from this submission.

Tāngata

whenua considerations

25 Tāngata

whenua have not been involved in the development of this submission.

Strategic

considerations

26 The

wise management of public resources and sustainable funding of Council services

is a long term goal of Toitū Kāpiti. Therefore, it is

important that Council advocate for a funding regime that will have a

favourable impact on Council resources and funding.

Significance and Engagement

Significance

policy

27 In

accordance with Council’s Significance and Engagement Policy, this

submission on Phase One of the review does not have any strategic or financial

implications, does not have any implications for mana whenua’s

relationship with land and water, and there are no legislative requirements to

submit. Therefore, this matter has a low degree of significance under

Council’s Significance and Engagement Policy.

Consultation

already undertaken

28 No

public consultation was undertaken for the development of this submission.

Engagement

planning

29 An

engagement plan is not required for this submission.

Publicity

30 Following

the Council’s approval, the final submission will be uploaded to the

'Submissions we have made' section of the Council website.

|

Recommendations

31 That

Council receives and approves the draft submission to the Department of

Internal Affairs’ Fire and Emergency New Zealand Funding Review, as

attached as Appendix 1 to this report.

|

Appendices

1. Draft

submission to Fire and Emergency New Zealand Funding Review ⇩

2. Fire

and Emergency New Zealand Funding Review: Consultation document ⇩

|

Council

Meeting Agenda

|

30 January 2020

|

30 January 2020

Fire Funding Review

Department of Internal Affairs

PO Box 805

Wellington 6140

Email: firefundingreview@dia.govt.nz

FIRE AND EMERGENCY NEW

ZEALAND FUNDING REVIEW

1. Kāpiti

Coast District Council supports the Government’s commitment to selecting

a preferred funding model for Fire and Emergency, and appreciates the

opportunity to submit on the Fire and Emergency New Zealand Funding Review.

2. Fire

and Emergency provides a crucial set of services to New Zealand, and it is

important that ample time is given for this review. With this in mind,

Council considers that the timeframe for the Phase One consultation is

inadequate. The consultation document was released in late November, and

the submissions close on 5 February. While a two-and-a-half-month

consultation period would normally be sufficient, the timeframe for this

consultation is unsympathetic to the Christmas, New Year, and Summer holidays.

Over this time period, staff across most organisations are on leave for

sizeable periods of time, which means that many organisations have not had

sufficient time to adequately review and respond to the consultation document.

This is problematic for services as crucial as those provided by Fire and

Emergency New Zealand.

3. It

is also important that a full range of funding options be considered. For

this reason, Council considers that ‘funding Fire and Emergency

predominantly through general taxation’ should be included in the scope

of this review (p6). Council contends that general taxation funding is

one of the only options that meets all of the principles set out in Chapter 4

of the Consultation document. This is discussed further below.

What principles should be used to assess the options?

· Are there other

principles the Government should consider?

· Which principles

are the most important to you and why?

4. Council

agrees that the preferred funding regime should be universal, equitable,

stable, predictable and flexible; however, Council notes that the consultation

document repeatedly refers to the importance of a ‘fair and affordable’

model, but the principle of affordability is not carried through.

5. As

an example, the document states:

The Government

wants to ensure Fire and Emergency can continue to deliver the fire and

emergency services that New Zealanders need and expect. To do this, Fire

and Emergency must have a stable and secure funding model. At the same

time, the costs associated with this need to be shared in a way that is fair

and affordable for households and businesses (page 7, emphasis added); and

In looking for

better ways to fund Fire and Emergency, the Government is aware of the need to

consider the costs in moving to a new system, both in terms of how it is set up

and administered, and in how affordable the new model is for everyone

(page 8, emphasis added).

6. Council

contends that affordability should be added as an important principle for

assessing options, and argues that affordability is one of the most important

principles because the stability and predictability of the funding regime will

be undermined if New Zealanders simply cannot afford to pay, regardless of the

preferred funding model.

Businesses and households

· Do you agree with

the summary of benefits to businesses and households?

· Which option do

you prefer and why?

· What are the

likely issues or challenges with implementing these options?

· Is there another

option or options the Government should consider?

7. Council

agrees with the summary of benefits to businesses and households (page 13), but

has a number of concerns regarding the three options proposed.

8. Insurance-based

approach - While the consultation document identifies a number of

limitations to the existing insurance-based approach (page 7), Council would

like to offer two additional limitations. First, an insurance-based

approach can have a perverse effect in that it can incentivise some homeowners

to underinsure their homes. Second, an insurance-based approach will not

be able to collect levies from properties that are uninsurable, and this is

becoming increasingly common for properties at risk to natural hazards.[1] In particular,

we are aware of many Body Corporates in Wellington City either reducing their

insurance cover or not re-insuring due to the high cost of insurance for

properties in Wellington City.

9. The

discussion document states that the insurance-based approach is not universal

because only 85 to 87% of property is insured (page 13). If the number of

insurable properties continues to decline further, then the insurance-based

approach will not only continue to fail the universality principle, but also

fail the stability and equitability principles. So too will the affordability

principle (suggested above) fail should the status quo funding model be

retained.

10. Property-based

approach & property and use-based approach - As the discussion document

states, a number of jurisdictions overseas are shifting towards a

property-based approach or a property and use-based approach.

11. While

there are clearly some benefits to a property-based approach or a property and

use-based approach, there are also three limitations we would like to

raise.

12. Firstly,

on the surface a property-based approach might appear to be more universal,

equitable, and stable than an insurance-based approach; however, a property-based

approach is unlikely to pass the affordability test because many property

owners will experience this as an additional cost, and this will be especially

unaffordable if they are currently underinsured or uninsured due to the high

cost of insurance.

13. Secondly,

on a more practical level, if the allocation of cost is required to be based on

property use, it may be more difficult for all councils to maintain accurate

information because property use may not be a factor in setting their current

rates.

14. Thirdly,

because the most likely collection mechanism would be for local authorities to

collect this charge as a rate, local authorities would be held accountable for

what is likely to be perceived by the property owners as “unaffordable

rates increases” and/or “little to no value for money”.

As LGNZ note in their submission, collection by local authorities

“diminishes public accountability and scrutiny as business and

householders are unlikely to distinguish the relative share of their property taxes

going to their council from FENZ. Any concerns people have about the level of

property taxes will inevitably be raised with the local authority, not

FENZ”.

15. An

alternative option, simply funding from general taxation (by way of a fixed

charge per household, for example) would best meet all of the funding

principles. Council urges the Department of Internal Affairs to remove this

exclusion from the scope of this review, and consider this as a funding option.

Motorists

· Do you agree with

the summary of benefits to motorists?

· Which option do

you prefer and why?

· What are the

likely issues or challenges with implementing these options?

· Is there another option

or options the Government should consider?

16. Council

agrees with the summary of benefits to motorists (page 14). In regards,

to the proposed options, Council questions whether the vehicle

licencing-based approach is equitable as the consultation document suggests

(page 14). Clearly there are non-vehicle owners who benefit from Fire and

Emergency’s transport-related services, even if the percentage is small.[2] This means that the

vehicle-licensing based approach, in particular, would place a slightly

disproportionate share of costs on vehicle owners. For this reason,

Council maintains that an alternative option of simply funding from general

taxation would best meet all of the funding principles.

17. Other

potential sources of funding

· What do you like

or dislike about these options?

· What are the

likely issues or challenges with implementing these options?

· Is there another

option or options the Government should consider?

18. Council

has made clear in this submission that it strongly believes that the main

source of funding should be from general taxation, a funding model that should

and can be very simple and, presumably, could be implemented and initiated at

low cost by the Inland Revenue Department. This should be in addition to Crown

direct contributions and/or Fire and Emergency charging for some

services (e.g. nuisance charges for repetitive false call-outs).

19. The

Council does not support local authority contributions because this

would need to be rates funded, again bringing back the arguments already

discussed in paragraph 12 above.[3]

20. In

addition, since the Fire and Emergency New Zealand Act 2017 absorbed rural fire

authorities into Fire and Emergency, local authorities no longer have a direct

role in fire and emergency services, which weakens the argument for local

authority contributions.

Collection mechanisms

· Which option do

you think is the most suitable and why?

· What do you like

and/or dislike about the different collection mechanism options?

21. Once

again, Council maintains that Fire and Emergency should be primarily funded

from general taxation via the Inland Revenue Department.

Conclusion

22. Council

supports Government’s commitment to reviewing and selecting a principle

based funding model for Fire and Emergency services.

23. Moreover,

because there are wide benefits for local communities from FENZ, this review

provides an opportunity for local and central government collaboration so

Council would be keen to discuss this submission directly with the Department

of Internal Affairs at a mutually convenient time.

24. Thank

you once again for the opportunity to submit on this review.

Yours sincerely

K (Guru) Gurunathan

MAYOR

|

Council Meeting Agenda

|

30 January 2020

|

8.2 Council

submission to Ministry for the Environment consultation on "Reducing

waste: a more effective landfill levy'.

Author: Nienke

Itjeshorst, Sustainability & Resilience Manager

Authoriser: Sean

Mallon, Group Manager Infrastructure Services

Purpose of Report

1 This

report seeks approval of the Council submission on the proposed changes to the

Landfill Levy notified by the Ministry for the Environment in November 2019.

Delegation

2 Council

has the authority to make a Council submission to a proposal put forward by

Central Government.

Background

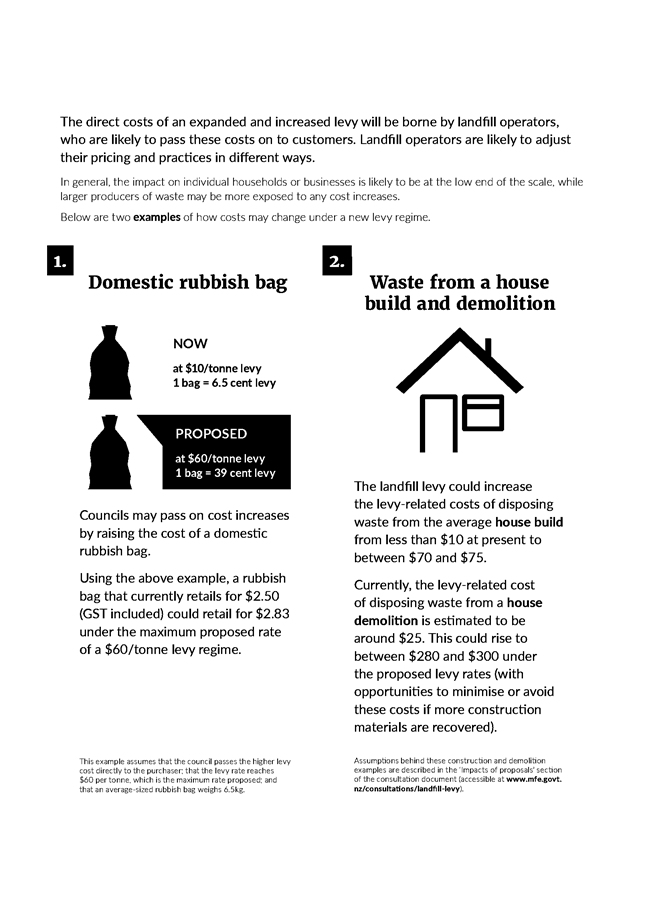

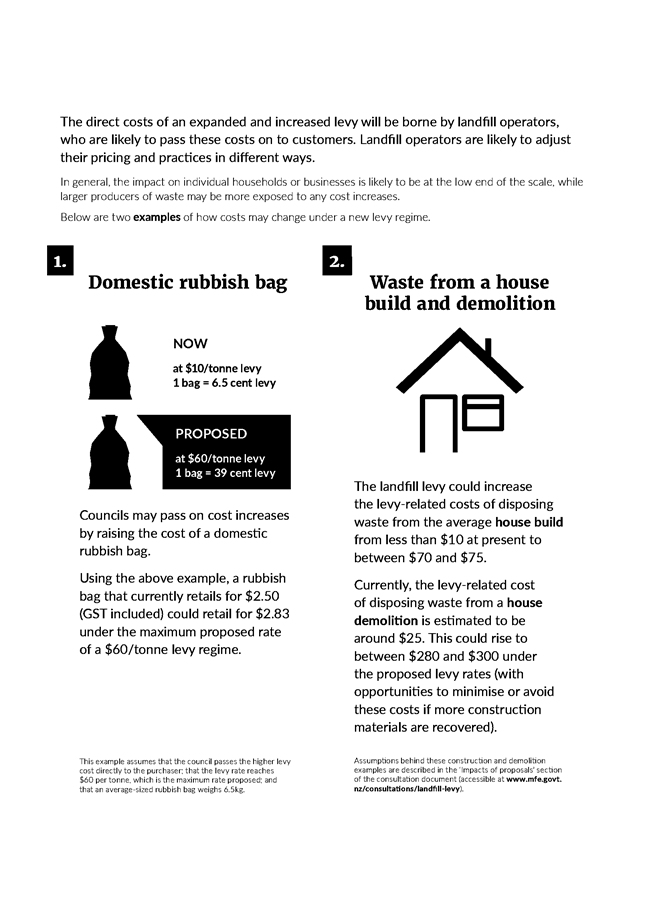

3 On

27 November 2019 the Ministry for the Environment released the document

“Reducing waste: A more effective landfill levy” for public

consultation, which closes on 3 February 2020.

4 In

2009 a $10 levy to each tonne to landfill was introduced under the Waste

Minimisation Act 2008. The levy currently applies to municipal landfills and

transfer stations that accept all types of waste. The disposal facility

operators pay the levy to the Ministry and have – in general –

passed this cost on to their customers through disposal fees.

5 The

levy was introduced to encourage New Zealanders to start taking responsibility

for the waste they produce and to find more effective and efficient ways to

reduce, reuse, recycle and reprocess waste. It also creates funding

opportunities for waste minimisation initiatives.

6 Half

of the levy revenue is passed on to territorial authorities to spend on

promoting or achieving the waste minimisation activities set out in their Waste

Management and Minimisation Plans. The remaining levy revenue is put into the

Waste Minimisation Fund which is a national contestable fund for waste

minimisation activities in New Zealand.

7 The

Minister is required to review the effectiveness of the levy at least every

three years. Reviews were carried out in 2011, 2014 and 2017 (interim review).

The recommendations from these reviews are captured in the proposal for a more

effective landfill levy

8 Despite

the purpose of the levy, since its introduction in 2009 the amount of waste

disposed of at levied municipal landfills across NZ has increased from 2.5

million tonnes to over 3.6 million tonnes in 2019.

9 Only

a small portion of New Zealand’s waste is currently reused or recycled,

because

· it has become much

more difficult to send waste overseas for recycling with recent restrictions on

importing waste for recycling, and dramatic price falls for materials for

recycling in international market

· there is limited

infrastructure in New Zealand for recycling and re-using waste

· many products are

not designed to be reused or recycled and

· it’s often

much cheaper and easier to dispose of materials to landfill than to reuse them.

10 A

workprogramme at the Ministry for the Environment is underway, with improving

the effectiveness of the landfill levy being a key part of this workprogramme.

11 The

current levy of $10 per tonne is low by international standards and it only

applies to municipal landfills, which take around 45% of the waste disposed of

in New Zealand, excluding waste disposed of into cleanfills.

12 A

number of organisations, including the Territorial Authorities’ Officers

Forum within WasteMINZ (a waste sector representative group) and Local

Government NZ have recommended an increase and expansion of the levy.

LGNZ passed a remit in 2018

calling for the Government to expand the waste levy and progressively raise the

levy rate in order to reduce total waste to landfills. LGNZ also adopted a

waste manifesto in 2018, which cites research on a range of scenarios for

increasing the levy over time that concluded that a rate of $140 per tonne

would bring the most benefits.

discussion

13 The

consultation document gives an overview of the current waste situation

(‘New Zealand has a problem with waste’), emphasises that there is

a need for change, that more can be done to reduce waste and that the levy is

seen as a significant catalyst for change.

14 The

consultation document seeks feedback on proposals to:

· Increase the levy

for municipal landfills (landfills that take all types of waste including

household waste)

· Apply the new levy

to all types of landfill except cleanfills (accepting only virgin excavated

natural materials) and farm dumps

· Apply the levy at

different rates for different landfill types, to reflect different

environmental and social costs of disposal, and different opportunities for

recovery of different materials.

15 The

proposal also seeks feedback on

· the development of

a Waste Levy Investment Plan

· improved data

collection (including regulations)

· what changes

Council would like to see considered if the Waste Minimisation Act 2008 was

reviewed in the future

· cost estimates

expected for collecting, storing and reporting proposed increased data and

challenges expected

· the main costs and

benefits for Council of the proposals.

16 The

full proposal can be accessed via this link https://www.mfe.govt.nz/publications/waste/reducing-waste-more-effective-landfill-levy-consultation-document

17 The

summary document of the proposal provided by the Ministry is attached to this

report as Appendix 1.

18 The

proposal seeks feedback in the form of 16 questions that have been captured in

an electronic submission form, which is the Ministry’s preferred way to

receive submissions.

The draft submission has been set up using the form and is attached as Appendix

2 to this report.

19 In

summary the Council submission states that Council under

· Question 1: Agrees

that the current situation of increasing waste to landfill needs to change and

that Council believes that urgent action is needed

· Question 2: Agrees

that the introduction of the levy has not resulted in a decrease of waste to

landfill or an increase of diverted materials

· Question 3: Agrees

that the landfill levy needs to be progressively increased to higher rates in

the future and beyond 2023

· Question 4:

Supports expanding the levy to more landfills including industrial monofills,

non-hazardous construction and demolition landfills and contaminated soils and

inert materials landfills

· Questions 5 and 6

: Agrees that (compliant) farm dumps should be excluded from the levy but does

not agree that cleanfills should be excluded as this will incentivise disposal

of inappropriate materials at these sites

· Question 7:

Prefers the rate of $60 per tonne (and not $50) for municipal landfills

· Question 8: Agrees

that the highest levy should be for municipal landfills and a lower levy for

other types of landfills. Council does not believe there should be a lower levy

for specified by-products of recycling-operations as waste is waste regardless

of the source. Council also believes a $5 levy should be applied to all

Cleanfill sites

· Question 9:

Supports the ‘increase then expand’ phasing but suggests a

variation to the proposal that would be more effective than the proposed

options (refer to Appendix 2, question 9).

The 14% increase referred to in the submission relates to a national average

landfill fee of $75 per tonne which means that an initial $10 increase results

in a 14% expected increase of gate fees. In Kāpiti, the current gate fee

at the Otaihanga Resource Recovery Facility is $191.20, which means a 5% fee

increase if the increase was passed on to the customer at the gate by the

operators. For average domestic kerbside collections the impact would be

approximately $3 per annum. This is based on the average 6kgs of household

waste produced per household per week.

· Questions 10 and

11: Supports better management and collection of data from levied operators.

· Question 12 :

Believes that an effective and fit for purpose Levy Investment Plan is critical

if Aotearoa/New Zealand is to achieve sustainable waste minimisation and

transition to a circular economy. The Waste Minimisation Fund should be better

targeted to create onshore resource recovery capability and projects that

support Territorial Local Authorities (TLA’s). Council doesn’t see a

need for the Levy Investment Plan to ‘inform’ TLA’s how to

spend their share of the levy money as there is a democratic decision-making

process in place through the development of Waste Management and Minimisation

Plans. Council requests that the Minister recognises the essential role

TLA’s play in waste minimisation practices and services and requests that

TLA’s are invited to participate in partnership with the Ministry in the

development of the Levy Investment Plan and

· Question 13:

Believes that the Waste Minimisation Act 2008 (the Act) in itself is generally

fit for purpose because it provides opportunity for effective waste

minimisation subject to the political will to use the instruments provided in

the Act to drive waste minimisation. A future review should consider increased

Local Government representation on the Waste Advisory Board because of the

essential role TLA’s play in the delivery of waste minimisation and

services. Another matter that should be reviewed is the definition of waste

used in the Act which excludes diverted materials, as this has led to Council

being unable to licence collectors of diverted materials and obtain data from

these collectors. That is an example of where the Act itself through its

definitions does not support one of the purposes of the Act which is to enable

data gathering through licensing.

· Questions 14 and

15: Agrees that having accurate data is crucial for effective planning and

identifying gaps and opportunities. Council thinks that using data to measure

the success of waste minimisation projects and strategies should be approached

with caution and there is no direct link between changed behaviour and data

collected at the disposal end. Those data do not account for reduction or

reuse. More detail is needed o the reasons for collecting data and setting more

requirements and this will have to be weighed against the costs associated with

implementing more data collection processes

· Question 16: With

regard to the main costs and benefits of the proposal believes that more costs

will be incurred in the form of increased staff time for data collection,

reporting and delivering more education and promotion. Council also expects

increased staff time and expenditure as a result of an increase of illegal

dumping as the higher levy leads to increased collection and transfer station

fees.

Council notes that to pro-actively enforce compliance, TLA’s need to be

sufficiently resourced and supported by legislation. Enforcement based on the

Litter Act is currently difficult as there is a high threshold for the evidence

required to issue an infringement, and the cost of chasing fines often

outweighs the fine itself. It’s necessary to review the Litter Act in

line with the introduction of the expanded waste levy for that reason.

· The benefits of

the proposal that Council envisages are the establishment of onshore processing

capacity, additional levy funding received by TLA’s that enable

TLA’s to introduce new, or expand existing waste diversion facilities, an

improved cost/benefit ratio of waste diversion activities such as timber

recovery and concrete crushing, greater clarity around landfill categories and

appropriate use of landfills and enhanced data will enable better decision

making.

Considerations

Policy

considerations

20 The

intended outcome of the proposal to increase and expand the current waste levy

to ultimately decrease waste going to landfills aligns with Council’s

long-term goals as set out in the 2017 Waste Management and Minimisation Plan

(WMMP).

Legal

considerations

21 There

are no legal considerations.

Financial

considerations

22 Apart

from an expected increase in illegal dumping of waste and associated

enforcement costs (which is discussed in the submission), Council needs to be

aware that an increased waste levy is likely to impact negatively on

Council’s operational budgets. The budgets that cover disposal of waste

to landfill from Council services will have to be increased as waste collectors

and operators of waste facilities increase their fees. If the Minister is able

to make a decision in the timeframe that has been proposed (before 1 July

2020), this may mean that increases may start to impact on these budgets during

the 2020/21 financial year. The budgets that will be affected are the budgets

for disposal of biosolids to landfill (estimated $17,000 increase) and other

infrastructure budgets like for public litter bin collections, illegal dumping

and road sumps and street cleaning (estimated total increase for these budgets

$8300). The total potential increase for operational budgets with a disposal to

landfill component is $25,249.

Tāngata

whenua considerations

23 The

time frame associated with the submission process has not allowed for

meaningful engagement with our Iwi partners on this issue. However the Waste

Taskforce, which included Iwi representation, intended to submit their own

independent submission to the Waste Levy Consultation process in support of an

increased and expanded levy regime.

Strategic

considerations

24 Increasing

the waste levy for disposal to landfill is intended to provide a better

incentive for reusing, recycling and composting instead of landfilling and

increase levy revenue to invest in options to reprocess diverted materials

onshore, ultimately leading to less waste to landfills.

This is in line with Council’s 2017 WWMP goal of reducing waste to

landfill by 30% by 2026. It also contributes to Councils 10 year outcome in the

Toitū Kāpiti Long Term Plan of ‘an effective response to

climate change’ as it will reduce emissions produced by the landfilling

of waste.

Significance and Engagement

Significance

policy

25 This

matter has a low level of significance under Council’s Significance and

Engagement Policy.

Consultation

already undertaken

26 No

consultation has been undertaken.

Engagement

planning

27 No

further engagement on the submission has been planned.

Publicity

28 No

publicity is proposed.

|

Recommendations

29 That

the Council approves that the submission as presented in Appendix 2 of this

report is adopted as a submission of Council to the Ministry for the

Environment on the consultation document “Reducing waste: a more

effective landfill levy”

|

Appendices

1. Summary

of the consultation document Reducing waste: a more effective landfill levy ⇩

2. Draft

submission on consultation document Reducing waste a more effective landfill

levy ⇩

|

Council

Meeting Agenda

|

30 January 2020

|

|

Council Meeting Agenda

|

30 January 2020

|

Submission of Kāpiti Coast District

Council

on the

Proposed Changes to the Solid Waste Levy

notified

November 2019

1. Question 1 – “Do you agree the current

situation of increasing amounts of waste going to landfill needs to

change?”

Yes, Kāpiti

Coast District Council believes that urgent action is required to address the

increasing amounts of waste going to landfill in Aotearoa/New Zealand and to

transition from the current Linear Economy (take, make, dispose) to a Circular

Economy model of material re-use and recovery.

2. Question 2 – “Do you have any comments

on the preliminary Review of the effectiveness of the waste disposal levy

outlined in appendix A”

Council agrees with

the assessment in Table 7 of Appendix A that since the last review of the levy

the amount of waste disposed of in New Zealand has not decreased and that the

amount of waste reused, recycled, or recovered in New Zealand has not

increased.

3. Question 3 – “Do you think the

landfill levy needs to be progressively increased to higher rates in the future

(beyond 2023)?”

Yes, Council

believes the current levy rate of $10 per tonne and the application of the levy

only to waste accepted at Municipal Solid Waste (Class 1) Landfill has resulted

in:

· Minimal financial incentive on customers to commit to reduction or

diversion of waste.

· Insufficient funding at Local Government level to create and support

effective waste minimisation.

Council supports

the proposed levy increases through to 2023 and supports additional levy

increases beyond 2023. Kāpiti Coast District Council believes that

clear levy increase signals beyond 2023 will provide certainty and drive

investment in effective waste reduction and resource recovery.

Council is acutely

aware that increased funding from the Waste Levy to Territorial Local

Authorities will be necessary to support sustainable local and regional waste

diversion actions and initiatives.

At the same time

Council is aware that significant investment may be required at a national levy

to create capacity for effective recovery of specific resources and the Waste

Levy funds is an appropriate mechanism for seed funding such investment as the

country transitions to the Circular Economy model.

Council believes

that the proposed Levy Investment Plan to guide government investment decisions

on the WMF must balance the potentially conflicting demand of national

infrastructure investment and funding of effective local and regional waste

diversion.

For this reason,

and given Territorial Local Authorities experience as the principal enablers of

the Waste Minimisation Act to date, the Council wishes to ensure TLA

representatives are involved in the development of the Levy Investment Plan.

4. Question 4 – “Do you support expanding

the landfill levy to more landfills, including:

i. “waste disposed of at industrial

monofills (class 1)

Yes

ii. “non-hazardous construction, demolition waste

(eg, rubble, concrete, plasterboard, timber) (class 2)

Yes

iii. “contaminated soils and inert materials (class 3

and 4) (whether requiring restrictions on future use of site or not)?”

Yes

Council is aware

that the current practice of applying the levy only to Class 1 MSW landfills

has resulted in significant and inappropriate diversion of waste to

construction and demolition sites.

5. Question 5 – “Do you think that some activities,

sites, or types of waste should be excluded from the landfill levy, including:

i. “cleanfills (class 5)

No, as discussed in

our response to Q.6

ii. “farm dumps

Yes, as discussed in

our response to Q.6

iii. “any others (eg, any exceptional circumstances)? If

so, please specify.”

No, cleanfills (i)

and any other (iii) should NOT be excluded. See notes under question 6 below.

Farm Dumps - Council

supports the inclusion of Farm Dumps in the Landfill Classification included in

the consultation document and supports compliant Farm Dumps being excluded from

the levy. See further comments under question 6.

6. Question 6 – “Do you have any views on

how sites that are not intended to be subject to a levy should be defined (eg,

remediation sites, subdivision works)?”

Cleanfill (Class 5) – The exclusion of Cleanfill sites creates

two specific challenges to the waste levy application:

· Virgin excavated natural materials are in themselves a

“resource” with potential for reuse (e.g. Peat, topsoil, clay,

rock, soils).

· The exclusion of cleanfill sites will incentivise

inappropriate disposal of other “borderline” materials at these

sites.

Council proposes the application of a $5 per tonne levy to these

sites.

Farm Dumps: Council is concerned that any reference to

“permitted activity in council plans” in further defining Farm

Dumps may introduce ambiguity. Council proposes that for the purpose of

the levy classification “Waste that should be accepted at these

sites” (Table 3.) the criteria for Farm Dumps should be the same as

Controlled Fill (Class 4).

Any Others - Council notes the intent on page 29 of the consultation

document that the levy not be applied to cover:

· Site remediation (e.g. filling in a quarry after it

ceases operation)

· Movement of soil during subdivision (e.g. creation of

engineered contours as part of site development

Council supports the intent that the levy not be applied to the

volume neutral movement of soil during subdivision or infrastructure

development such as new road projects. Council does not believe such

practices fall under the definitions of landfill and should therefore not be

included.

Council is concerned that “Site Remediation” may provide

an opportunity for avoidance of appropriate levies. In particular, the

remediation of quarry sites (quarry sites have been commonly used as landfill

sites) using waste which would otherwise be classified as suitable for Class 4

landfills and attract a levy.

Council is also aware that closed landfill sites require ongoing remediation

such as the re-contouring of capping, topsoil and grassing.

Council supports a clear definition of Site Remediation to inform

the levy regulations and agrees that one determining factor may be the payment

(including offsetting of costs) to dispose of material at the site should such

payment exceed the cost of the remediation works.

7. Question 7 – “Do you prefer the

proposed rate for municipal (class 1) landfills of:

i. $50 per tonne

ii. $60 per tonne

iii. other (please specify, eg, should the rate be

higher or lower?)”

ii. Council prefers the proposed

rate of $60 per tonne.

8. Question 8 – “Do you think that the

levy rate should be the same for all waste types? If not:

i. “should the levy be highest for municipal

landfills (class 1)?

Yes

ii. “should the levy be lower for industrial

monofills (class 1) than municipal landfills (class 1)?

Yes

iii. “should the levy be lower for construction

and demolition sites (class 2) than municipal landfills (class 1)?

Yes

iv. “should the levy be lowest for contaminated soils

and other inert materials (class 3 and 4)?

Yes

v. “ should a lower levy apply for specified

by-products of recycling operations?”

No, Council believes

that waste is waste regardless of the source.

Council

believes that question 8 may better be posed as “Do you think that the

levy rate be the same for all Landfill types” with the acceptance

criteria for each landfill defining the appropriate levy.

Further to the above and as discussed in our response to Question 6,

Council believes a further levy of $5 be applied to Cleanfill sites.

9. Question 9 – “Do you support phasing

in of changes to the levy, and if so, which option do you prefer –

increase then expand (option A); expand and increase (option B); expand then increase

(option C); expand then higher increase (option D); or none of the

above?”

Council supports

the “increase then expand” phasing however suggests that the

following table would be more effective than the proposed options:

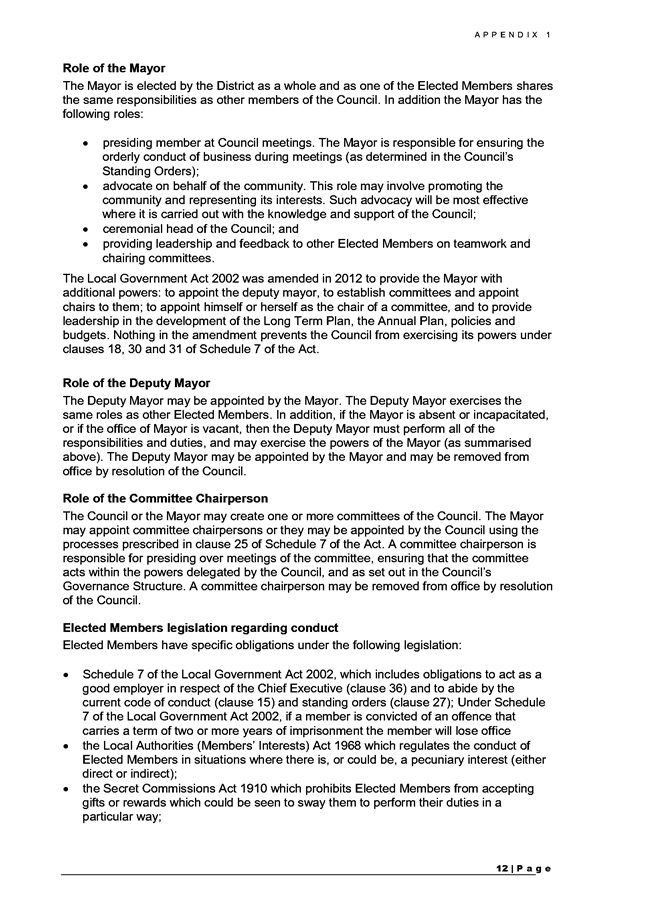

|

Landfill type

|

Increase then expand

|

|

Municipal landfills (class 1)

|

$20 1 July 2020

$30 1 July 2021

$40 1 July 2022

$60 1 July 2023

|

|

Industrial monofills (class 1)

|

$20 1 July 2022, $25 July 2023

|

|

Construction and demolition fills (class 2)

|

|

Contaminated soils and inert materials (managed and controlled

fill sites; class 3 & 4)

|

$10 1 July 2022, $15 July 2023

|

|

Cleanfill (class 5)

|

$5 1 July 2022, $7 July 2023

|

Council believes the above phasing provides the following benefits:

An increase to Municipal landfills in 2020 is appropriate given the

collection and reporting processes are already in place.

The increase to other landfill sites may better be introduced in

2022 (rather than earlier) to allow the following:

· Provide time for the data collection methodologies

(e.g. weighbridge, volumetric measure at entry or periodic fill survey and

density conversion) development of reporting systems, and establishment of an

effective and fully resourced compliance body.

· Provide time for operators of these landfills to

establish appropriate waste diversion activities to support the intent of the

levy

· Given that the application of a $20 levy to an

existing construction and demolition landfill may result in an immediate

increase in disposal fees of up to 200% (compared to a net 14% increase for

waste to municipal landfills with a move from $10 to $20) delaying the

introduction of levies will allow developers and contractors time to explore

other waste diversion activities.

The inclusion of a $5 levy for cleanfill in the table has been

discussed earlier in this submission.

10. Question 10 – “Do you think any changes are

required to the existing ways of measuring waste quantities in the Waste

Minimisation (Calculation and Payment of Waste Disposal Levy) Regulations

2009?”

Council supports

better measurement and collection of data. Council notes that changes to

customer requirements, weighbridge requirements, and data collection,

verification and analysis, will take time and funding to enable.

11. Question 11 – “Do you think any changes are

required to the definitions in the Waste Minimisation (Calculation and Payment

of Waste Disposal Levy) Regulations 2009?”

No

12. Question 12 - “What do you think about the levy

investment plan?”

Council believes

that an effective, fit for purpose levy investment plan is critical if

Aotearoa/New Zealand is to achieve sustainable waste minimisation and

transition to a Circular Economy.

In this respect

council is concerned that while the broad principles of the investment plan and

the identification of priority areas are included in the consultation document

we are effectively being asked to consult on something that has yet to be developed sufficiently to enable robust analysis.

A levy investment

plan is necessary to ensure that the Waste Minimisation Fund is better targeted

to create onshore resource recovery capability and projects that support TLA

initiatives and services. Current contestable Waste Minimisation Fund

spending has not resulted in any major waste minimisation activity or

infrastructure that’s has had significant benefits for New Zealand and

this does need to be addressed.

Council strongly

supports that the main focus of the investment plan is on government levy spend

through the Waste Minimisation Fund. Council doesn’t see a need for the

investment plan to ‘inform’ TLA’s how to spend their share of

the levy. As stated in the document, under the Act TLA’s have to

develop a WMMP where they include how their levy share will be spent. This is a

democratic decision making process that’s already in place and that is

suitable to enable local and regional services, actions and initiatives desired

by communities to which local and regional authorities are accountable.

Council requests

that the Minister recognises the essential role that TLA’s play

in waste

minimisation practices and services (as listed below)

and requests that TLA’s are invited to participate in partnership with

the Ministry in the development of the Levy Investment Plan. TLA

representation may be via Local Government NZ and the TLA Officers Forum of the

Waste Management Institute of New Zealand.

In support of this

proposal Council notes the essential role of TLA’s in the delivery of

Waste Minimisation:

· Local Waste Management and Minimisation Plans (as required by the

WMA 2008)

· Establishment of Solid Waste Bylaws to guide and regulate waste

minimisation practices in their district/s

· Provision of Waste Minimisation education, engagement and promotion

in the absence of the provision of these services at a national level

· Provision of residential recycling services via kerbside collection,

recycling stations and diversion facilities at transfer stations and green

waste composting operations

· Supporting and promoting other waste minimisation activities beyond

TLA’s operational involvement such as diversion of Construction &

Demolition wastes.

· Investment of ratepayer funds, additional to funds received via the

WMF, in waste minimisation activities.

With regard to the “priority areas for investment”

stated in the consultation document Council generally supports these priorities

but does not support addressing ‘legacy’ waste disposal

practices. Councils’ concerns here are that the WMA’s primary

role is to establish and support effective waste minimisation in Aotearoa/New

Zealand.

Any diversion from this goal to address or fund legacy issues e.g.

landfills at risk from Climate Change, would distract from the primary goal of

the Act which should remain forward looking and focussed on minimisation.

Council acknowledges the importance of the Levy Investment Plan with

regard to supporting the establishment of onshore waste materials

(re)processing capacity and other initiatives to enable transition to a

Circular economy model.

At the same time TLA’s will be involved in the provision of

maintaining and expanding local infrastructure and services to ensure provision

of recovered feedstock for reprocessing. Council is concerned that there

is potential for the Levy Investment Plan to compromise local minimisation

actions should the plan not achieve an appropriate balance between enhanced

processing capability and the enhanced local facilities and services which will

support these.

Council further notes that the administration and enforcement of the

expanded waste levy will require significant additional Ministry

resources. Resourcing of the Ministry (and the funding of resourcing vis

the WMF) in order to achieve effective compliance will be essential.

In the past, the fund has returned 50% of the WMF to

TLA’s. Given the need to invest in onshore (re)processing and to

support effective compliance with the expanded levy, Council acknowledges that

this percentage may no longer be appropriate.

In summary, Council believes that the Levy Investment Plan is

critical to the success of achieving effective waste management and that

genuine collaboration through partnership with the Ministry and Local

Government in developing the Plan will be required.

13. Question 13 – “If the Waste Minimisation Act 2008

were to be reviewed in the future, what are the changes you would like a review

to consider?”

Council believes

that the Act itself is generally fit for purpose in that it provides

opportunity for effective waste minimisation subject to the political will to

use the instruments provided in the Act to drive waste minimisation.

Council believes

that a future review should consider increased Local Government representation

on the Waste Advisory Board for the same reasons as those listed in our

response to Question 12 above.

Another matter that

should be reconsidered is the definition of waste that is used in the Act, more

specifically the exclusion of diverted materials that are not being disposed or

discarded. As a result of this definition Council has not been able to licence

collectors of diverted materials that operate in our District, losing the

opportunity to obtain data from these collectors on diverted materials through

the licence. This is an example of where the Act itself does not support the

purpose as set out in section 56 (3) (b) (data gathering) and in general does

not support one of the main drivers of this levy proposal which is to improve

waste data.

Should the Waste

Minimisation Act be reviewed in the future Council would welcome an opportunity

to provide feedback and submissions into a future consultation process.

14. Question 14 – “Do you agree that waste data needs

to be improved?”

Yes

15. Question 15 – “If the waste data proposals

outlined are likely to apply to you or your organisation, can you estimate any

costs you would expect to incur to collect, store and report such information?

What challenges might you face in complying with the proposed reporting

requirements for waste data?”

Council agrees that

having accurate waste data is crucial to inform effective planning for waste

minimisation initiatives. It will help identify gaps and opportunities in waste

minimisation activities and support more robust investment decision making.

Using waste data

(disposal and collection data) to measure the “success of waste

minimisation projects and strategies” should be approached with caution

though as in practice (and as part of the levy reporting to the Minister) it

has proven to be almost impossible to establish a viable link between

‘success’ and the data that are available to measure that success.

Data collected at the disposal end do not provide any objective proof that

participants/residents have changed their behaviour as a result of education,

simply because it doesn’t measure what they have done to reduce and reuse

their waste in the first instance. Only recycling and end disposal are

measurable through waste disposal facilities and there is an array of factors

that influences whether there is an increase or a decrease of ‘waste per

capita’, of which education is only a very small portion. Whether

behaviour change has been established on a household or business scale can only

be measured by way of surveys, which is not practical for many reasons.

Council feels that

more detail is needed on the reasons for collecting the data, how (specifically

commercially sensitive data and geographic source data) will be collected and

what for the data are going to be used. This applies to data being provided by

operators and collectors as well as for data reporting delivered to the

Minister by TLA’s. Council has been submitting data reports since 2010

but is unaware that this has ever been used to inform policy or investment

decisions.

A requirement for

more data on composition and geographic source data will inevitably require

further staff resourcing. While Council supports the proposal to improve waste

data, there is a need to define what level of detail will provide valuable

insights to the Ministry, and weigh this benefit against the costs associated

with implementing more regulated data collection processes.

At this stage and

given the actual data collection scope has yet to be finalised we are unable to

respond to the cost section of this question with any accuracy.

Overall challenges

for data improvement will be dependent on the nature of the processes developed

to support the data gathering (e.g. interfaces with landfill/transfer station

data collection systems) and the practicality of the scope (e.g. accurate

determination of geographic waste sources may pose challenges).

16. Question 16 – “What are the main costs and

benefits for you of the proposals to increase the levy rate for municipal

landfills, expand the levy to additional sites and improve waste data?”

Costs –

Council believes that the following costs will be incurred by Council:

· Increased staff time in data collection and reporting

· Increased staff time in education, information and promotion in

support of the increased diversion of recoverable materials

· Increased staff time and expenditure in responding to illegal

dumping subsequent to the expansion of the levy to cover landfills other than

the current MSW sites

· Potentially significant adjustments to existing collection practices

and infrastructure to align with the requirements of proposed new collection

and processing guidelines necessary to support expanded onshore reprocessing.

· Potential capital investment (potentially in public/private

partnership) in establishing new resource recovery initiatives

With regard to compliance and

enforcement (bullet point 3 above) Council would like to add that as

acknowledged in the document, it’s likely that expansion of the levy will

lead to increased illegal dumping. To proactively enforce compliance,

TLA’s need to be sufficiently resourced and supported by legislation.

Under the Litter Act 1979, TLA’s are the primary regulators within their

territorial boundaries for illegal dumping activities. It’s very

difficult to enforce the provisions of the Litter Act as it currently stands,

as there is a high threshold for the evidence required to issue an

infringement, and the cost of chasing fines often outweighs the fine itself. On

this basis, it is necessary to review the Litter Act in line with the

introduction of the expanded waste levy to enable more effective enforcement.

Furthermore, with

limited resources Council always has to consider enforcement priorities, of

which illegal dumping is just one. Regular monitoring will also be necessary.

While the proposal suggests that enforcement activities can be funded through

Council’s levy share (by listing Bylaws in their WMMPs), a bylaw for

enforcement of illegal dumping would be established under the Litter Act, not

the Waste Management Act 2008 (WMA) to which the fund relates. The document

lists the Christchurch bylaw that established a licensing regime for cleanfills

and as such licence conditions as set under that bylaw can be enforced under

that bylaw. Christchurch’s Waste Management Bylaw 2009 regulates

illegal dumping and in the enforcement section the bylaw refers to the Litter

Act. Council considers this a poorly used example in the proposal and wants the

Minister to clarify what (legal and monetary) provision will be made for the

increased requirement for monitoring and enforcement of illegal dumping.

Benefits –

Council envisages the following benefits:

· The establishment of onshore reprocessing capacity will provide

greater certainty and clarity for councils in determining which products may be

recovered at best cost and guide investment and promotion decisions.

· Additional levy funding received by councils (assuming this is

sufficient) will enable councils to introduce new, or expand existing, waste

diversion facilities (potentially in public/private partnership)

· The expansion of the levy will result in an improved cost/benefit of

waste diversion activities such as concrete crushing and recovery of waste

timbers and reusable soils

· Greater clarity around landfill categories and levy reporting

requirements may reduce the current inappropriate practice of diversion of MSW

to non-levied landfills

· Enhanced data will enable better decision making

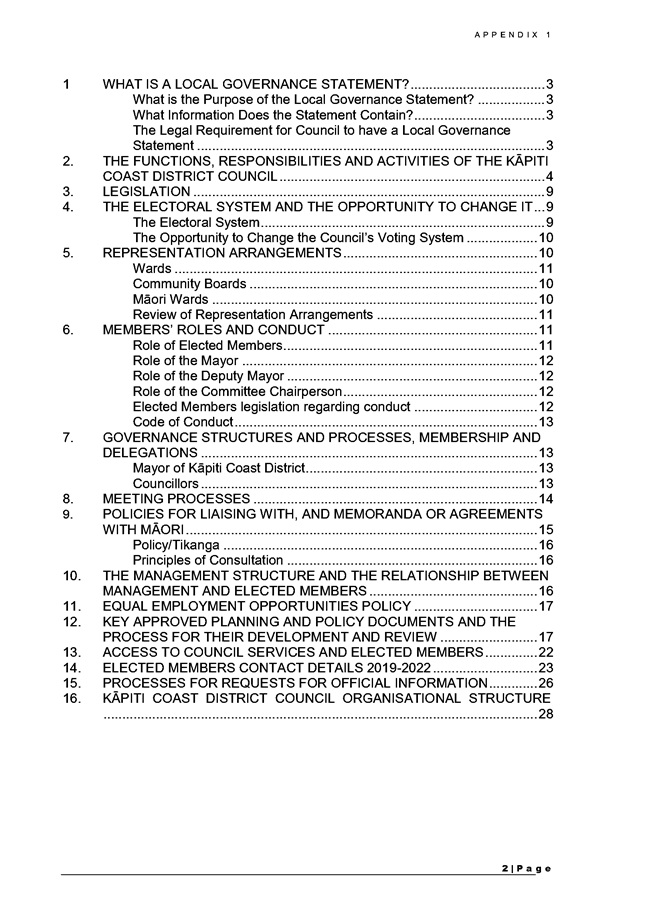

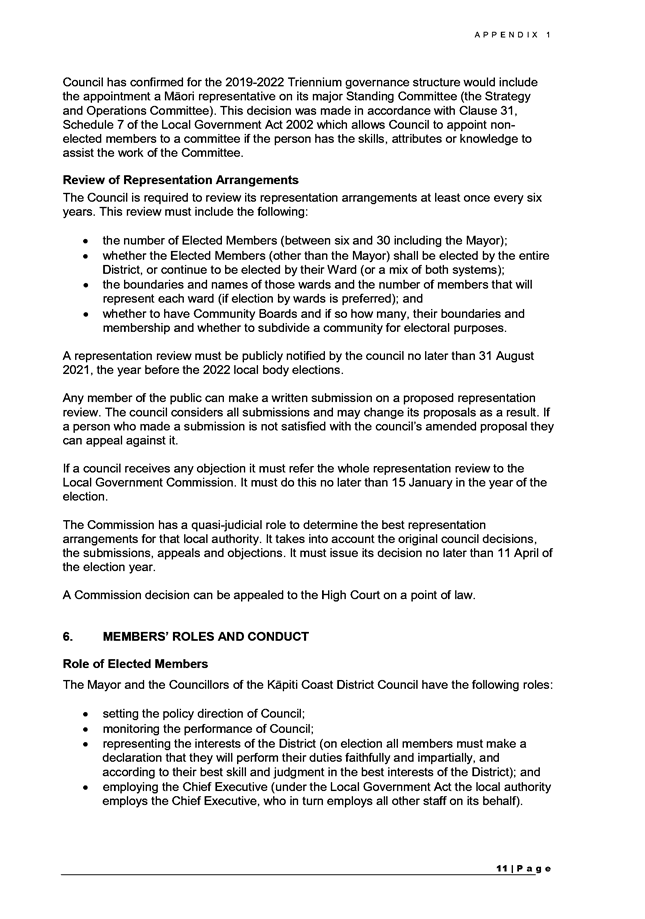

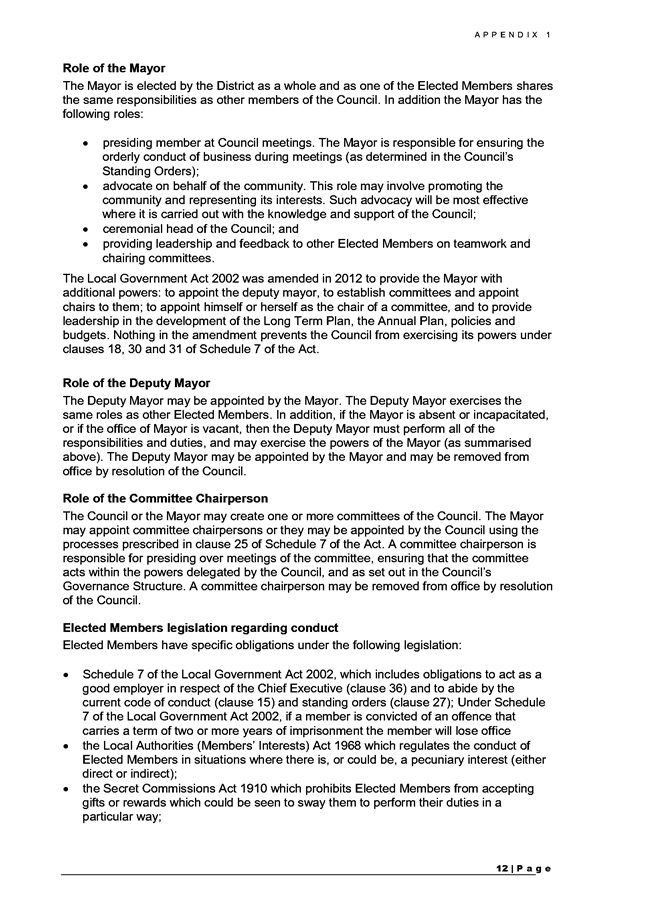

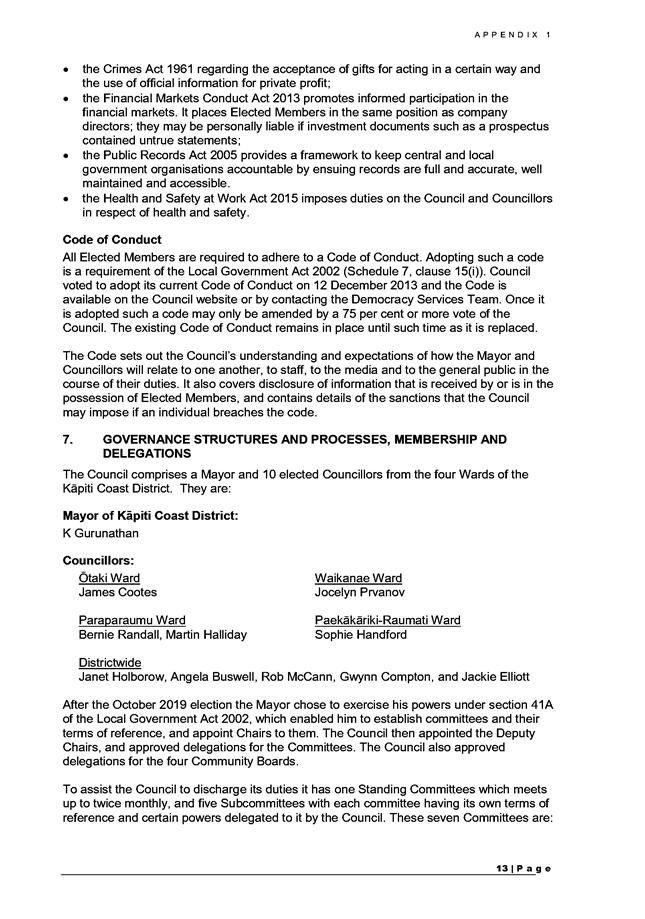

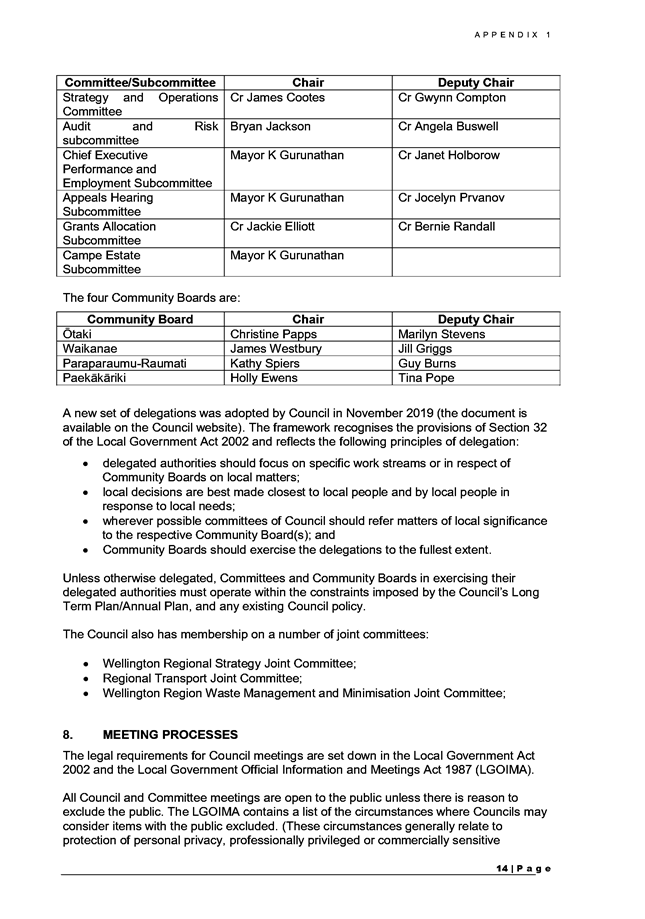

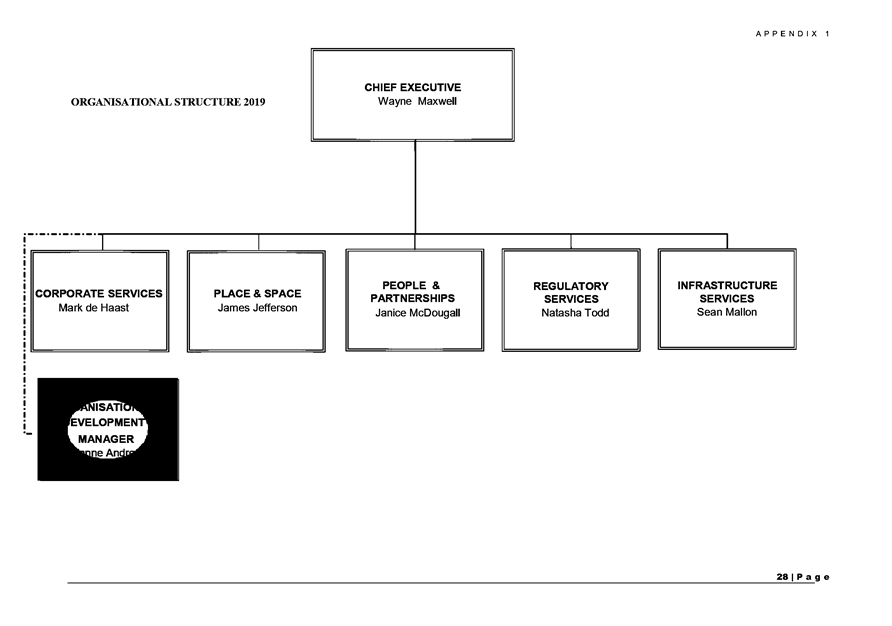

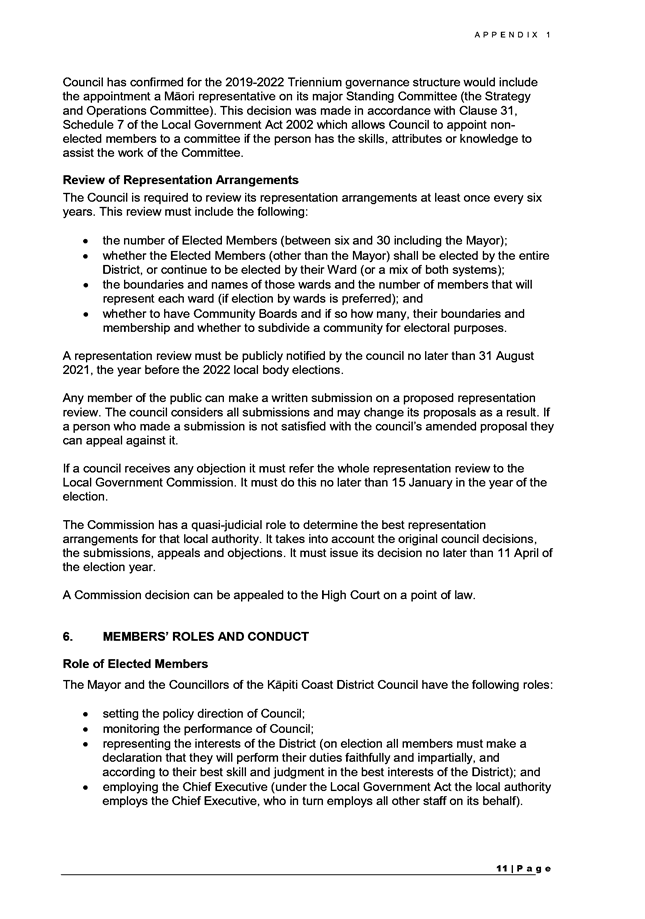

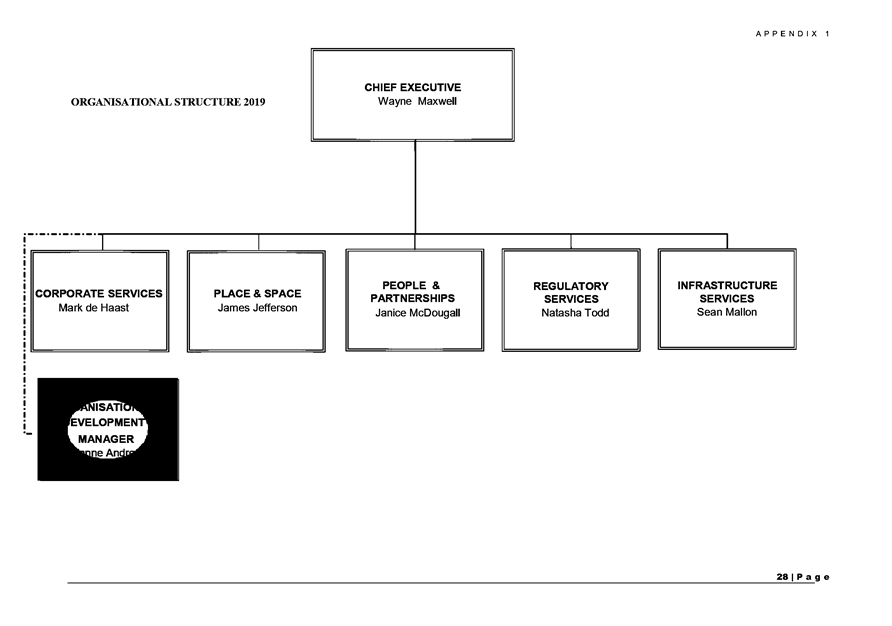

8.3 Governance

Statement 2019-2022 Triennium

Author: Leyanne

Belcher, Democracy Services Manager

Authoriser: Janice

McDougall, Group Manager

Purpose of Report

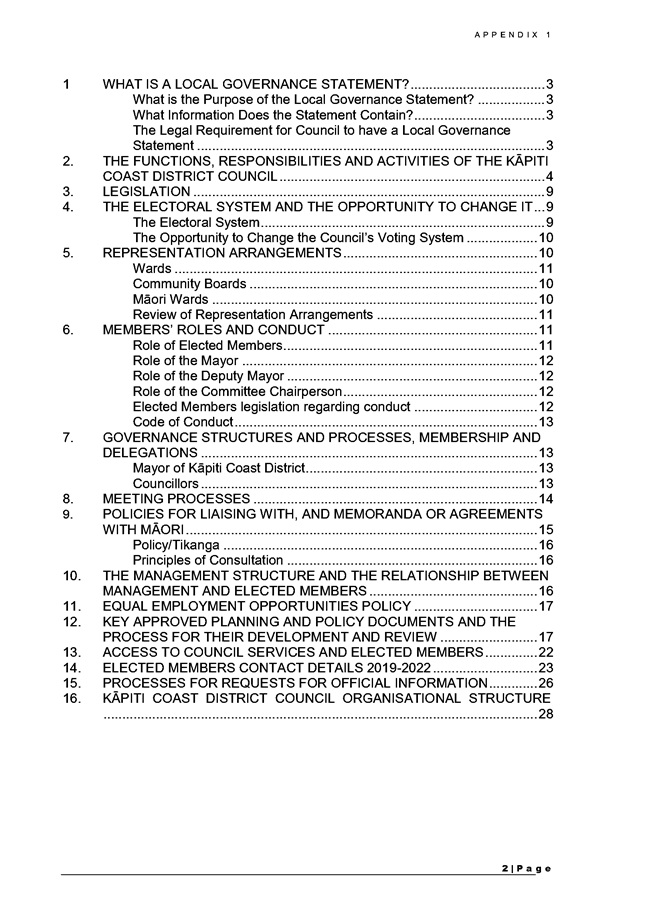

1 The

Council is presented with an updated Local Government Statement for adoption in

accordance with the requirements of Section 40(1) of the Local Government Act

2002.

Delegation

2 Only

Council may consider this matter.

Background

3 A

Local Governance Statement is a collection of information about the processes

through which the Council engages with its community, how the Council makes

decisions, and how the community can influence those decisions.

4 The

first Governance Statement was adopted by Council in 2003. Since then there have

been a number of amendments to reflect changes in the Governance structure and

the most recent version is from 26 January 2017.

Issues and Options

Issues

5 Council

needs to adopt and make publicly available an updated Governance Statement

before 8 April 2020 in order to comply with the provisions of the Local

Government Act 2002.

Considerations

Policy

considerations

6 There

are no policy considerations.

Legal

considerations

7 There

are no legal considerations.

Financial

considerations

8 There

are no financial considerations.

Tāngata

whenua considerations

9 Governance

statements must include information on policies for liaising with, and

memoranda or agreements with, Māori.

Significance and Engagement

Significance

policy

10 As

this is a document mandated by statute it has a low level of significance under

the Council’s Significance and Engagement policy.

Engagement

planning

11 An

engagement plan is not needed to implement this decision.

Publicity

12 Once

adopted the Statement will be made publicly available on the Council website.

|

Recommendations

13 That

in accordance with Section 40(1) of the Local Government Act 2002, the

Council adopts and makes publicly available the Governance Statement for the

2019-2022 Triennium as at Appendix 1 of this report.

14 That

the Council authorises the Chief Executive to make administrative update to

the Governance Statement as necessary throughout the Triennium in respect of

any subsequent changes in circumstances or amendments the council might make

to the individual policies contained or referenced in the Governance

Statement.

|

Appendices

1. Governance

Statement 2019 - 2022 ⇩

|

Council

Meeting Agenda

|

30 January 2020

|

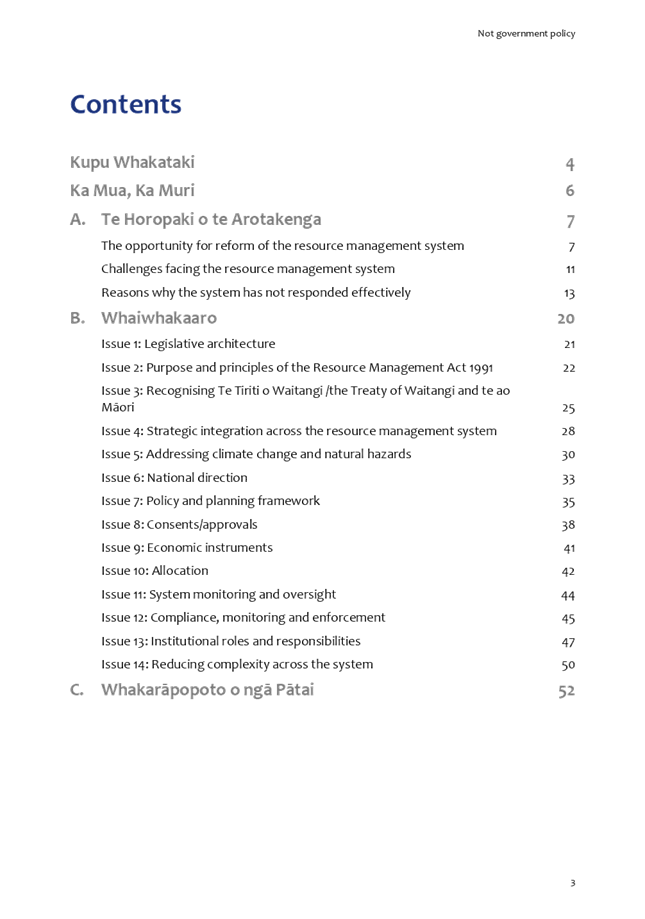

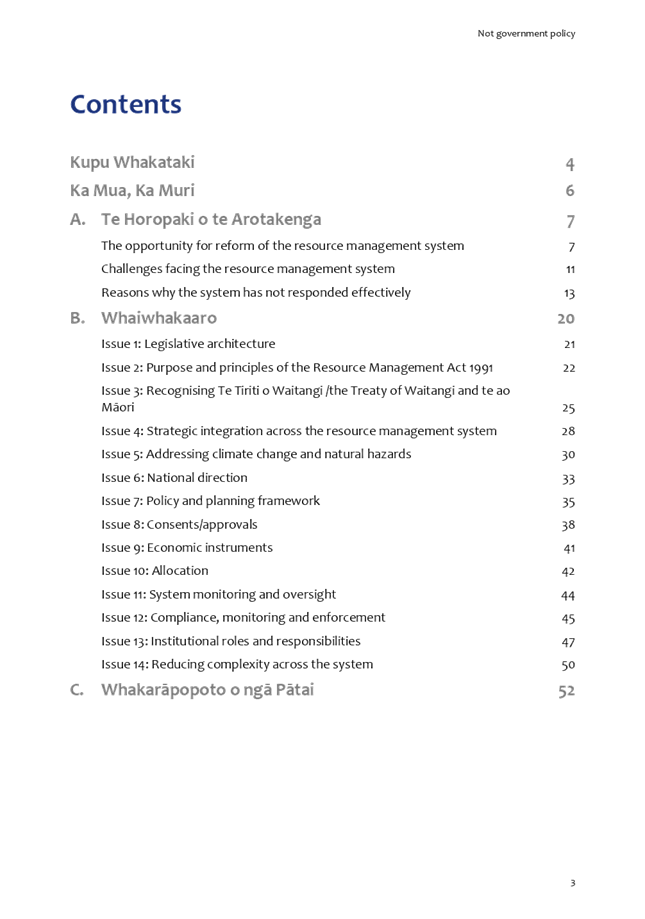

8.4 RMA

Issues and Options Draft Submission January 2020

Author: Jason

Holland, District Planning Manager

Authoriser: Natasha

Tod, Group Manager

Purpose of Report

1 To

seek Council approval of the draft submission on the Issues and Options

Paper for Transforming the Resource Management System, which is attached as

Appendix 1 to this report.

Delegation

2 Council

has the authority to consider this matter.

Background

3 On

13 November 2019, the Resource Management Review Panel released the Issues

and Options Paper for Transforming the Resource Management System (Issues

and Options Paper). The Issues and Options Paper is attached as Appendix 2.

4 The Resource Management Review Panel[4]

has been established by the Government to undertake a comprehensive review of

the Resource Management Act (RMA) and other significant legislation comprising

the resource management system.

5 The

RMA was introduced in 1991 and has been the subject of ongoing change and

adjustment since. In recent years, more frequent questions have been asked on

its ability of the RMA to meet the current needs to support urban growth and to

protect the environment. This sits alongside long-running issues around the

costs and timeframes for processes under the RMA.

6 The

government is undertaking a comprehensive review of the resource management

system with an aim “to improve environmental outcomes and enable better

and timely urban and other development within environmental limits”.

7 The

review will hopefully help resolve debate on key issues, including the

possibility of separating statutory provision for land use planning from

environmental protection. It will consider a wide range of options, including

whether important principles in the Resource Management Act 1991 should be in a

separate piece of legislation and apply more broadly across the resource

management system.

8 The

scope of the review includes looking at the RMA and how it interfaces with

the:

· Local Government Act 2002

· Land Transport Management Act 2003

· Climate Change Response Act

9 The scope also includes spatial planning, which has

the potential to support more strategic decisions about resources and

infrastructure over longer timeframes.

10 While

institutional reform is not a driver of the review, the review will consider

which entities are best placed to perform resource management functions in

making its recommendations.

11 The

Resource Management Review Panel has been established by the government to lead

the review and has asked for comments on the issues and option paper no later than Monday 3 February

2020. The Panel is chaired by QC Tony Randerson.

12 The panel will provide a report to the Environment

Minister with its recommendations on reforming the RMA. This will include

detailed policy proposals and indicative drafting of legalisation for key

provisions. It is due in June 2020. The Government plans to consult on the

proposals once finalised.

Issues and Options Paper

13 The

Issues and Options paper identifies 14 issues to be addressed in the reform

process and offers possible ways in which they might be addressed. It also

poses a series of questions for interested parties to consider and respond to.

In our submission we have commented on 8 issues which we believe are most

relevant to our Council.

14 In

particular, the paper looks at what changes are proposed to fix the system to

ensure we have liveable urban and rural areas, that Māori have an

effective role in the resource management system, that we improve our

deteriorating freshwater quality and biodiversity, and that we respond to the

effects of climate change.

15 The

proposals are indicative of the range of possibilities. For example, whether

the RMA’s core purpose of sustainable management should change or if

legislation dealing with urban development and environmental management should

be separated.

Issues / Discussion

Legislative

Architecture

16 The

Issues and Options paper asks whether there should there be separate legislation

dealing with environmental management and land use planning for development, or

whether the current integrated approach is preferable.

17 Council’s

submission supports the current integrated approach, although has reservations

about its effectiveness on balance, given the declining state of the

environment on a number of measures. It suggests greater clarity is needed within

the RMA framework about how tensions in balancing growth and environmental

concerns ought to be managed.

Purpose and Principles

18 The

Issues and Options paper asks what changes should be made to Part 2 (Purpose

and Principles) of the RMA.

19 Council’s

submission supports the addition of a positive obligation to maintain and

enhance the environment, and the addition of matters relating to climate change

within Part 2. The submission also suggests that a clearer distinction of

priorities within Part 2 would enable consistent implementation between

Councils.

Māori Participation

20 The

Issues and Options paper asks if changes should be made to the RMA regarding

the recognition of the Treaty of Waitangi, Māori interests, and Māori

engagement.

21 Council’s

submission suggests that iwi as mana whenua hold significant expertise, and

barriers preventing iwi from contributing this expertise should be removed. Barriers

to meaningful iwi engagement and participation are identified.

Strategic Integration across

the Resource Management System

22 The

Issues and Options paper asks how better strategic integration across the

Resource Management System could be achieved, including the possibilities for

spatial planning.

23 Council's

submission agrees that, with appropriate integration into the RMA, spatial

planning provides possibilities for better consideration of economic,

environmental, social, cultural and wellbeing matters across the RMA system and

relevant elements of the Land Transport Management Act and Local Government

Act.

Addressing Climate Change and

Natural Hazards

24 The

Issues and Options paper asks whether the RMA should be used to address climate

change mitigation, and if so, what changes and integration are required to

achieve this.

25 Council's

submission suggests that greater national direction, funding and support as

well as specific legal mechanisms around climate change and natural hazard

mitigation would achieve better outcomes and help reduce the risk of legal

challenge against councils as they try to implement measures to address climate

change through their plans and other tools. This will also help ensure local conversations

were more targeted.

National Direction

26 The

Issues and Options paper asks what role should mandatory national direction

have.

27 Council’s

submission suggests that local governments need national direction tools (and

other support) to provide assistance for contentious or critical issues,

particularly around climate change and natural hazard management, as such

contention can result in drawn out and expensive plan change processes which

may not ultimately be successful.

Policy and Planning Framework

28 The

Issues and Options paper asks how planning processes can be improved, to better

the content of plans, increase certainty, and achieve efficient and effective

outcomes with adequate public participation.

29 Council’s

submission recommends that the ability for local government to front-load

community engagement in exchange for limited appeal rights would result in a

more timely and cost-efficient plan making process which retains adequate

public participation. Council has also made several technical recommendations.

Consents / Approvals

30 The

Issues and Options paper asks how the consenting process could be improved to

deliver more efficient and effective outcomes while preserving appropriate

public participation.

31 Council’s

submission has a number of suggestions in response, and holds the following

positions:

· The simplification

of activity status categories is not necessary.

· The direct

referral system is beneficial and should be retained.

· Flexibility in

information requirements for consenting is necessary where appropriate, but

this is already applied in practice.

· Greater certainty

around notification requirements is beneficial.

· The publishing of

all resource consent decisions and applications would not provide a net benefit

to the public.

· Online processing

would not improve processing times significantly and would result in increased

costs.

· The designation

process should be reviewed and streamlined.

System Monitoring and Oversight

32 The

Issues and Options paper asks what changes are needed to improve the monitoring

and oversight of the Resource Management System.

33 Council’s

submission suggests a streamlined, simplified and consistent system would

enable better reporting to the Ministry for the Environment (MfE) as the systems

Council currently use do not have the functionality required to provide MfE

with the necessary information in an efficient manner.

Compliance, Monitoring and

Enforcement (CME)

34 The

Issues and Options paper asks what changes are needed to improve efficiency,