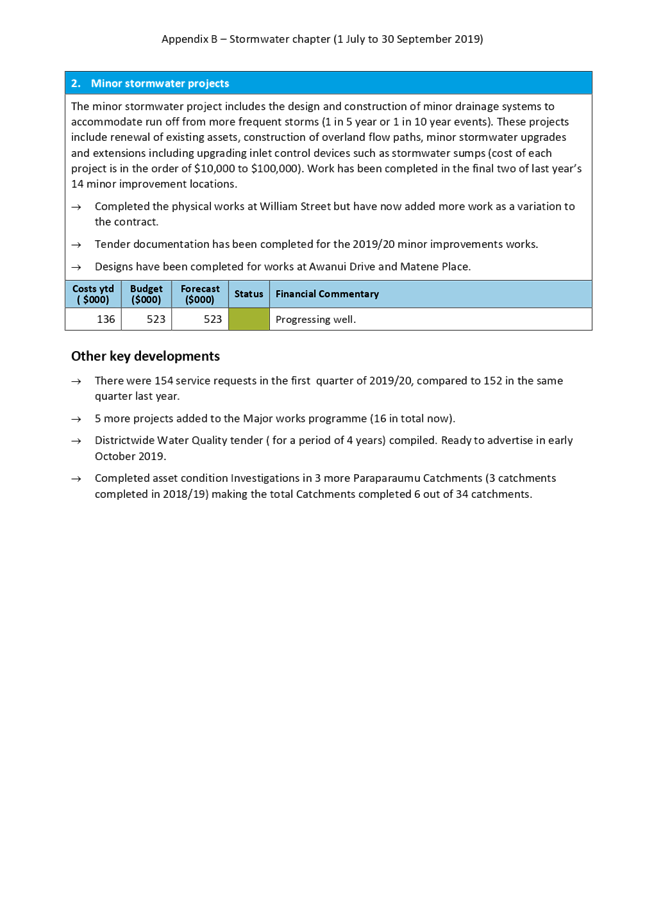

|

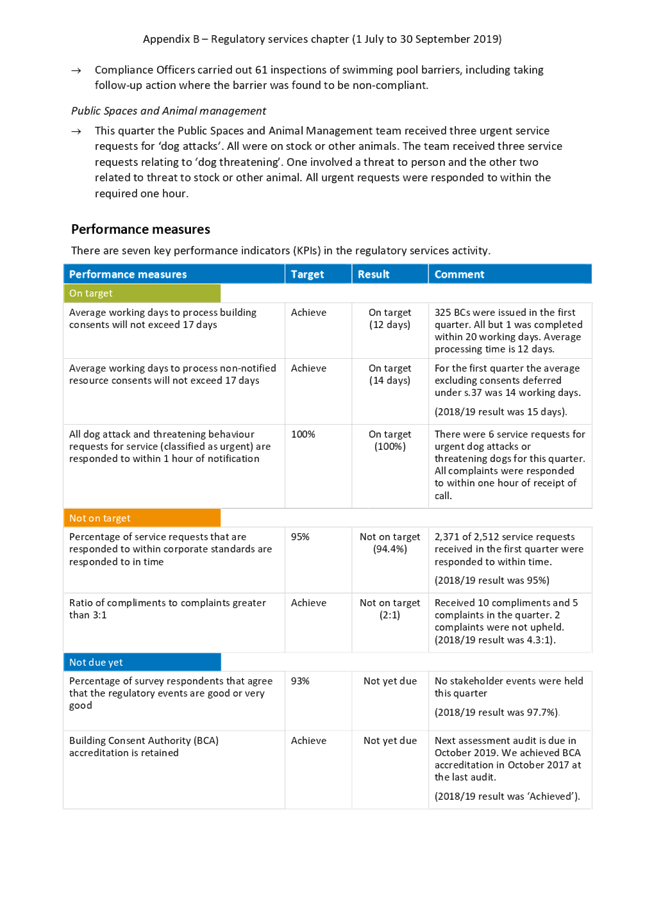

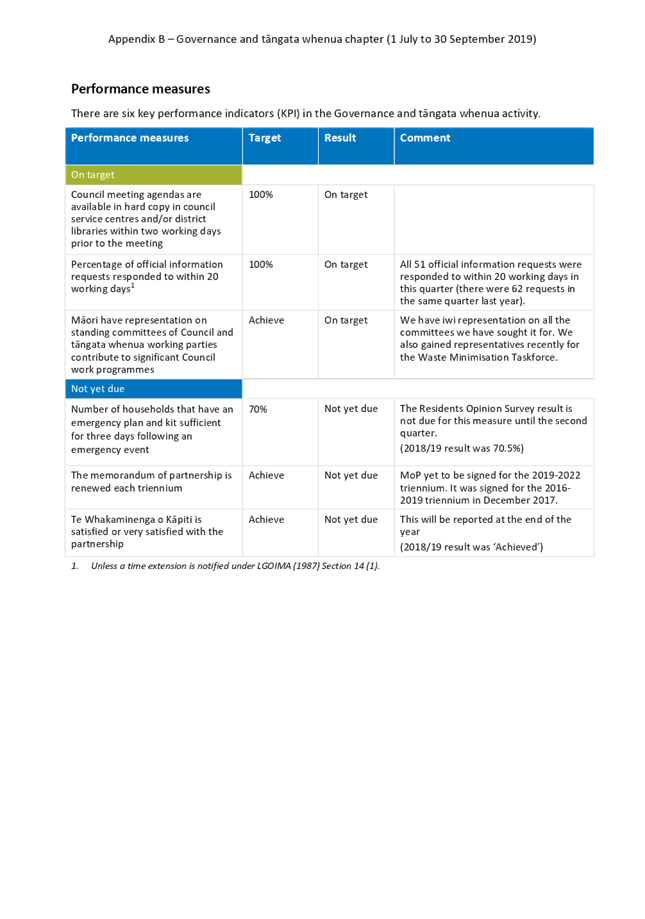

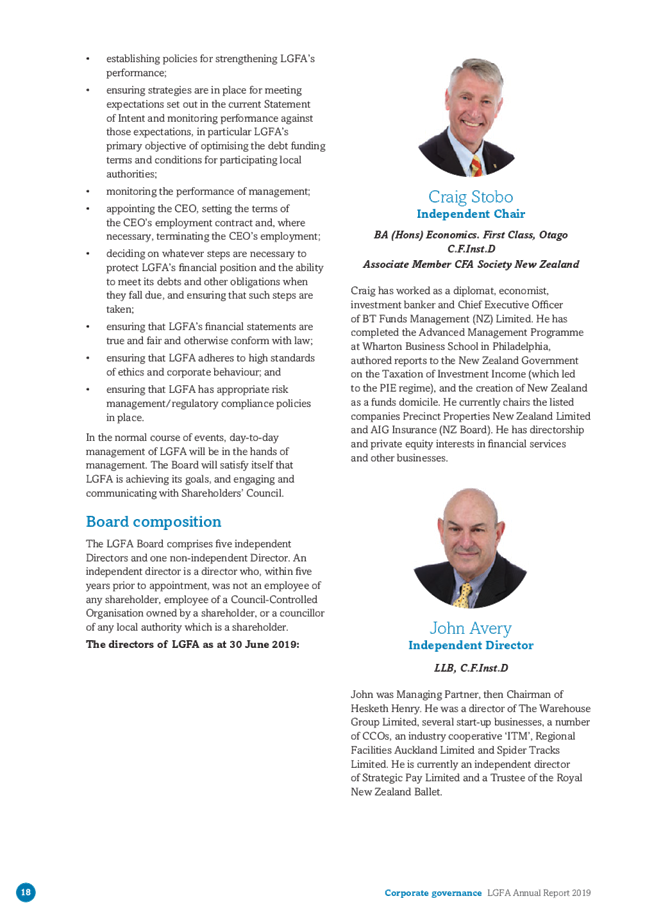

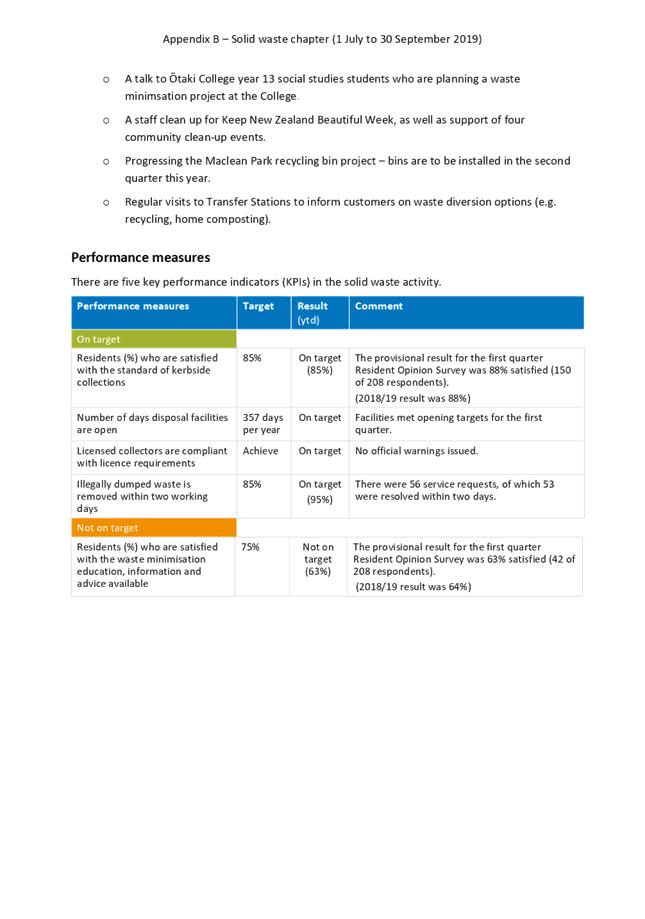

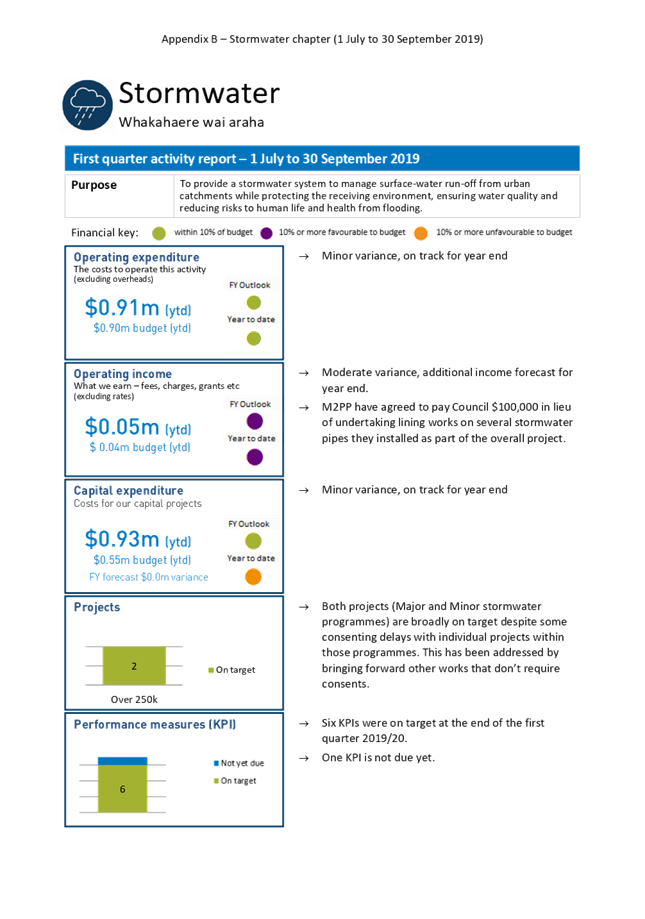

|

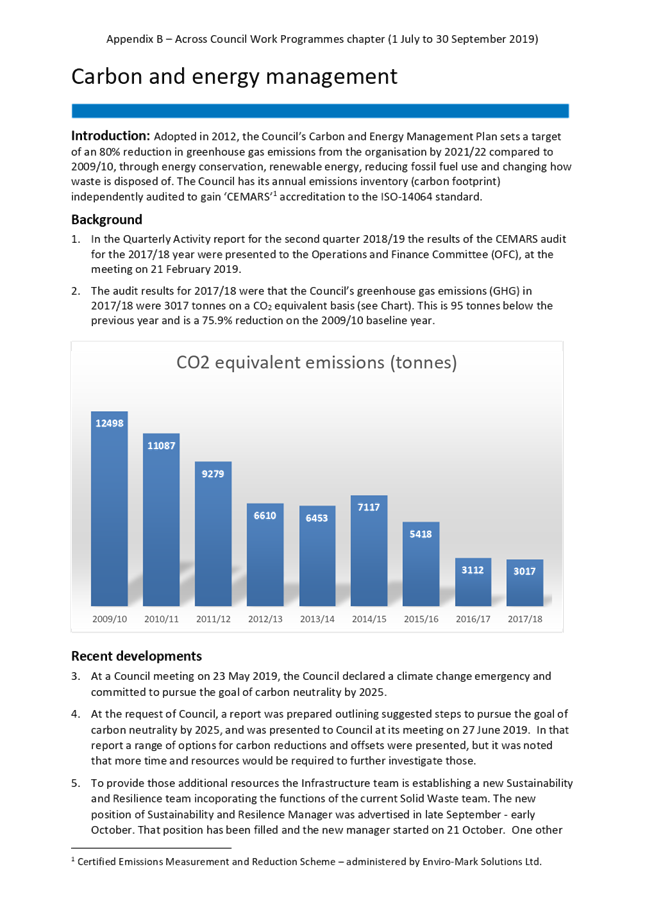

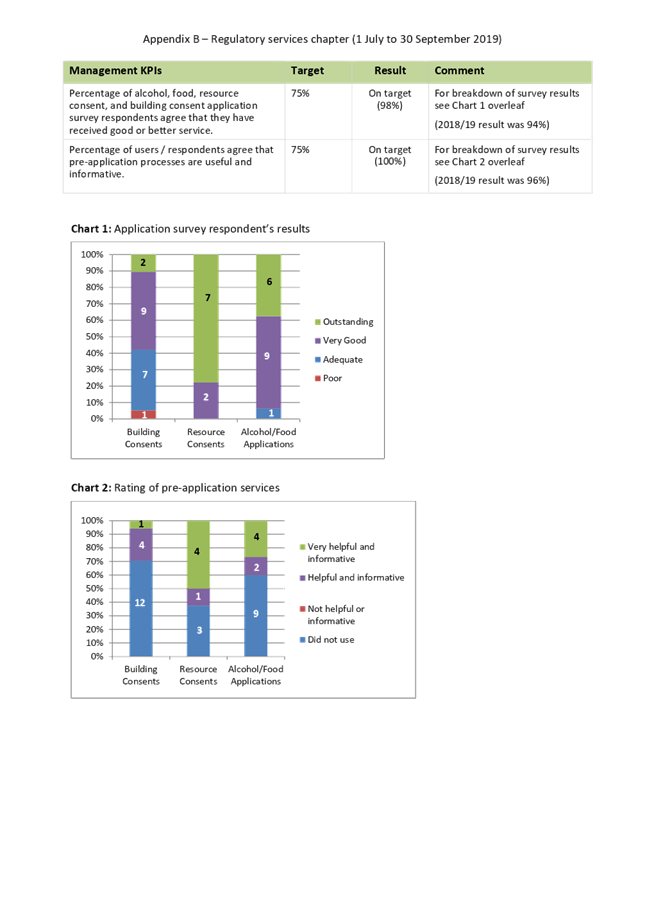

|

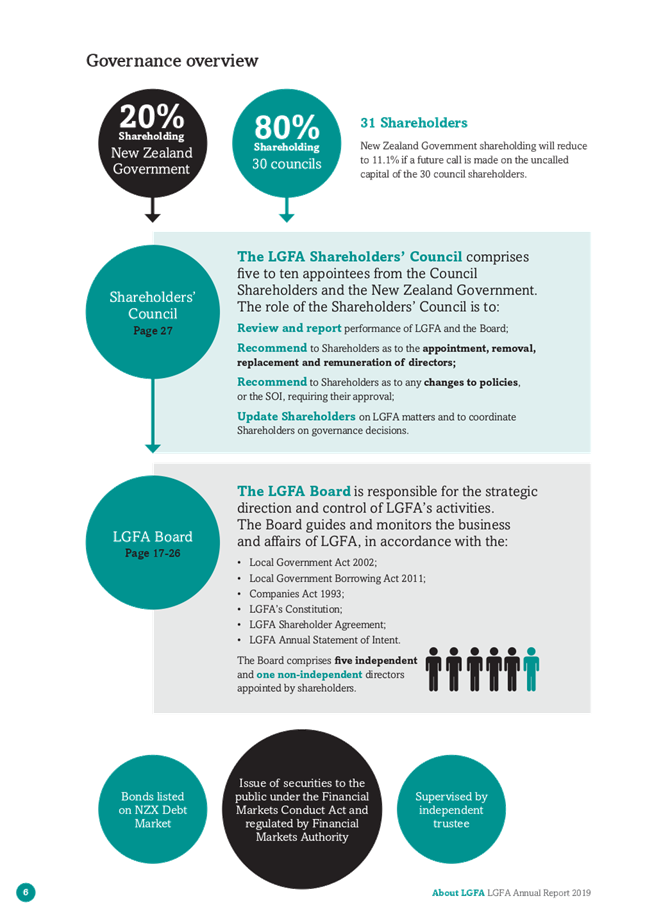

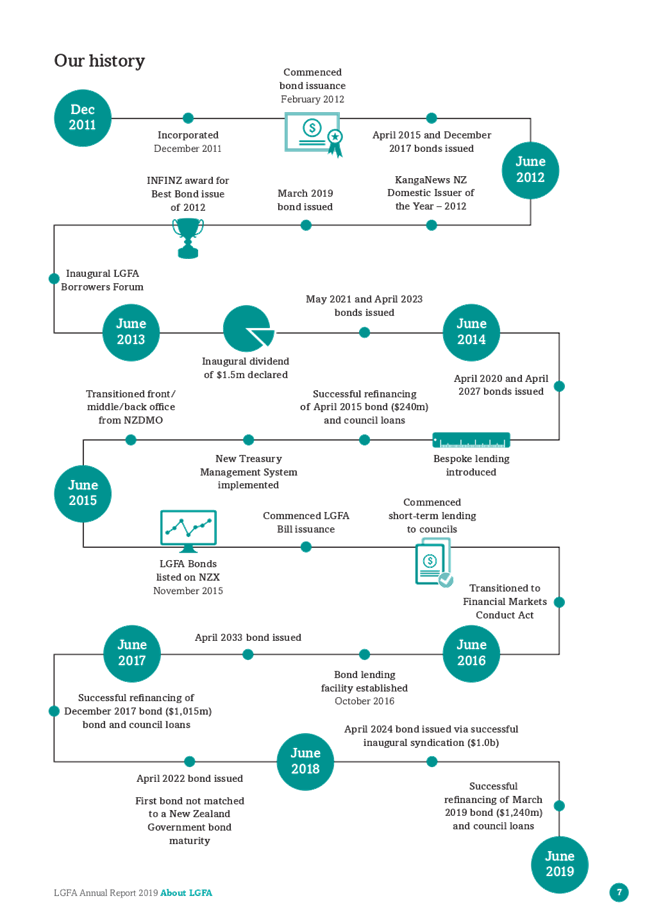

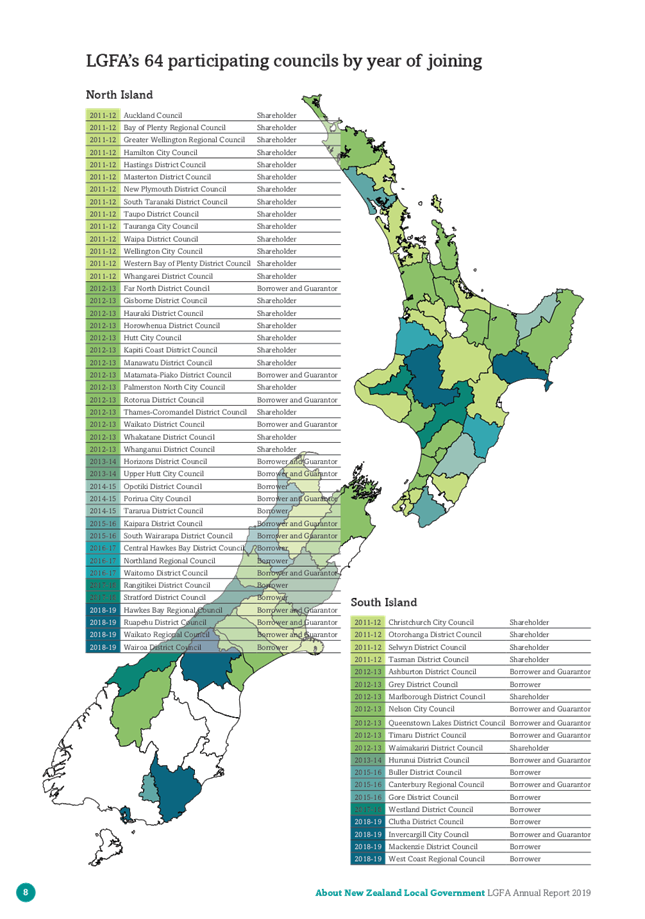

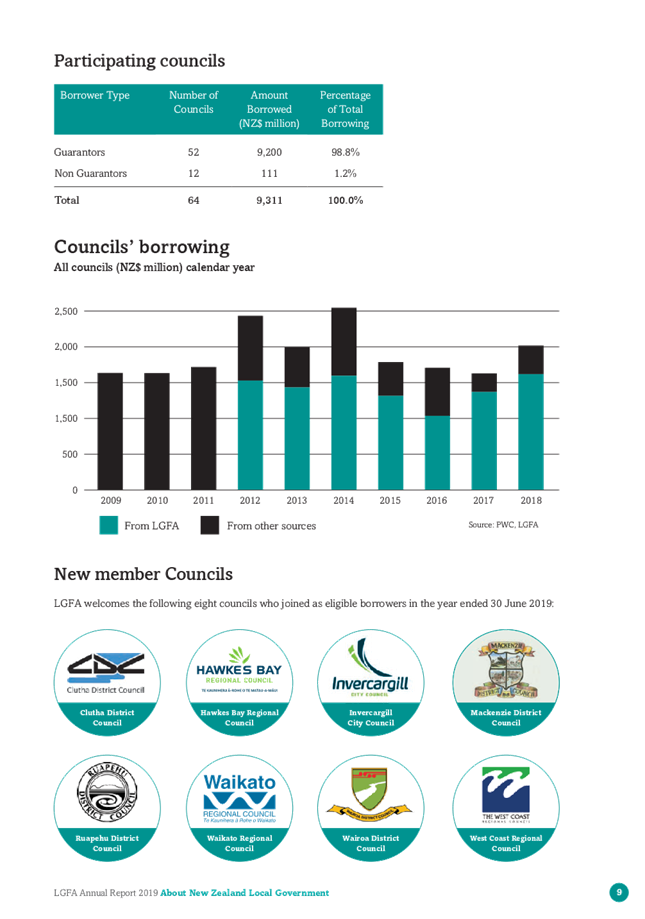

AGENDA

Strategy and Operations Committee Meeting

|

|

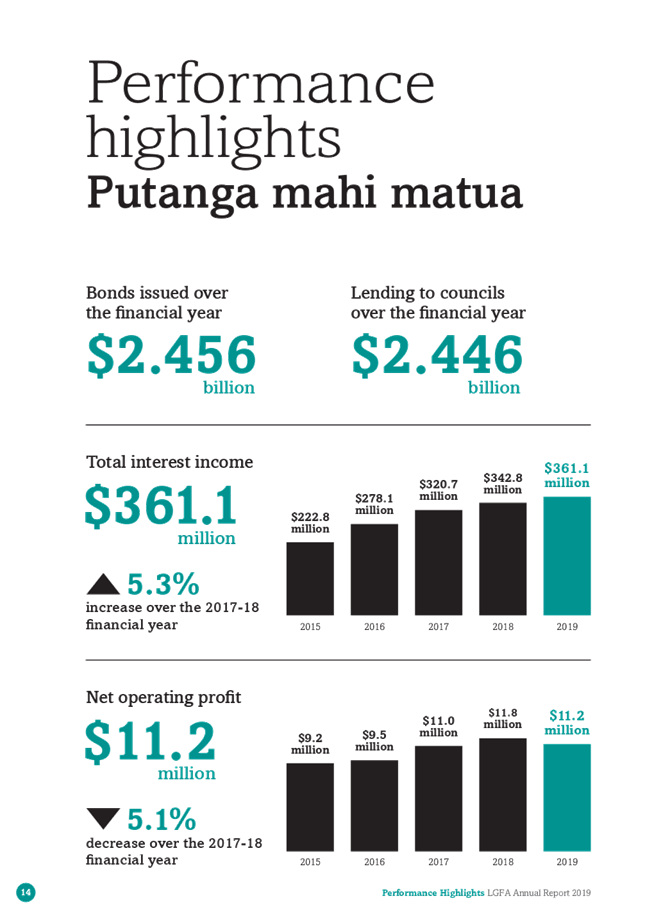

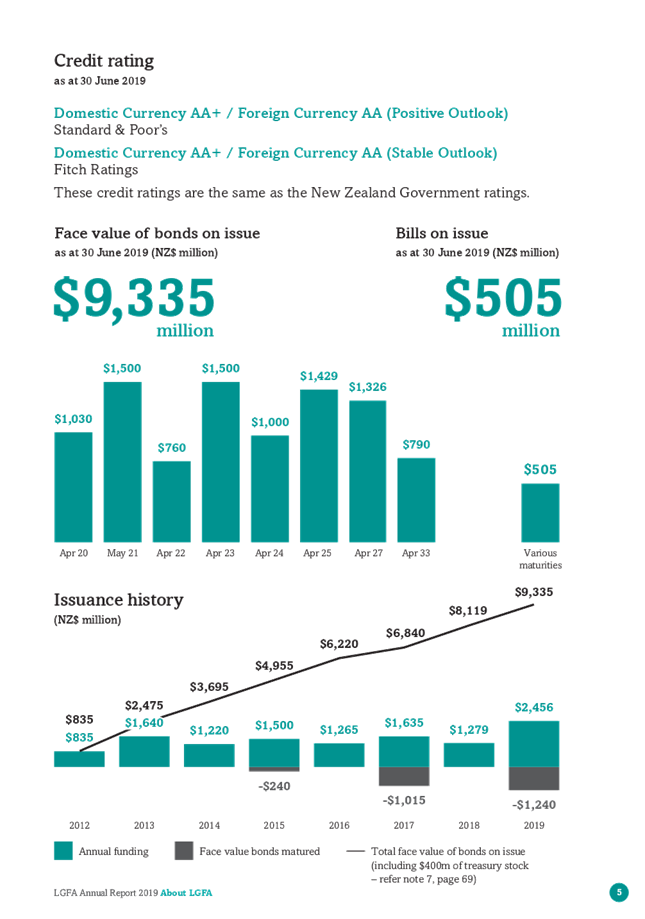

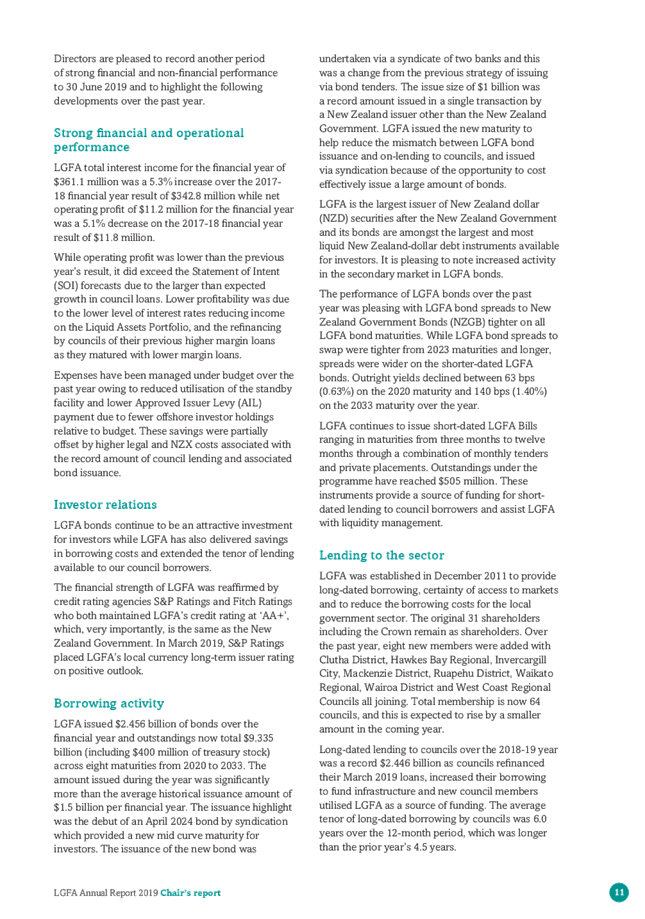

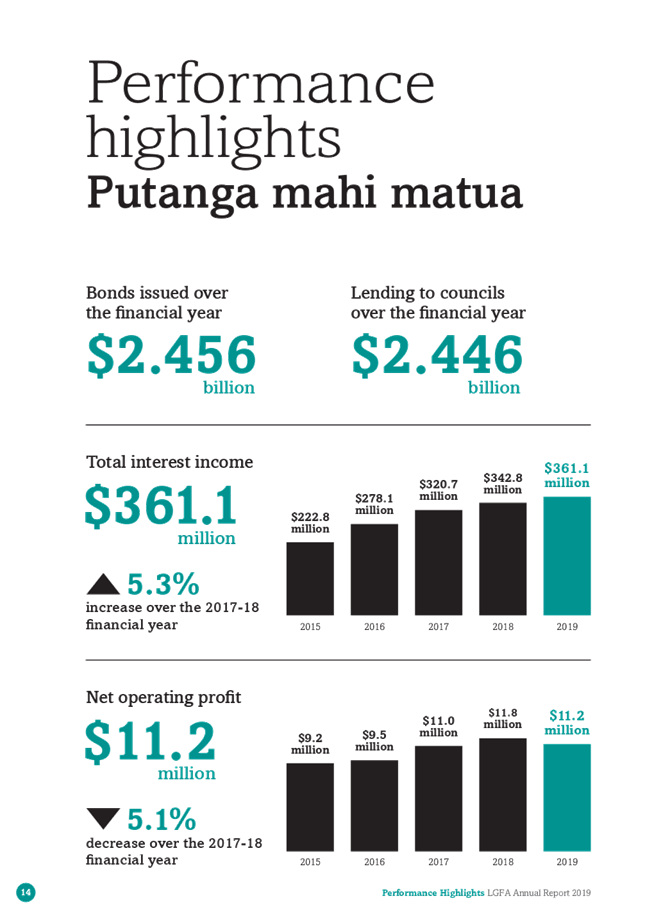

I hereby give notice that a Meeting of the Strategy and Operations Committee will be held on:

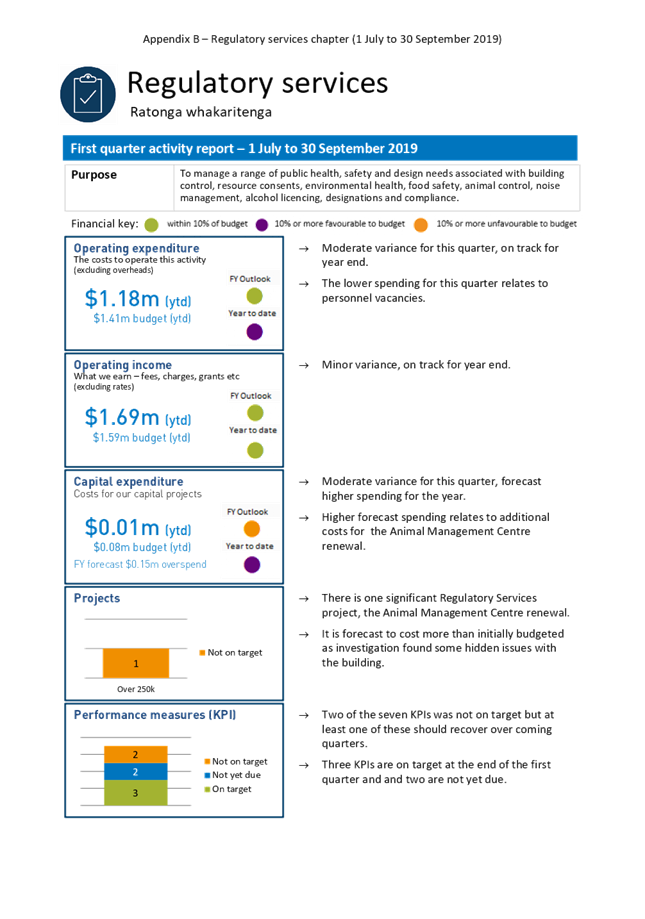

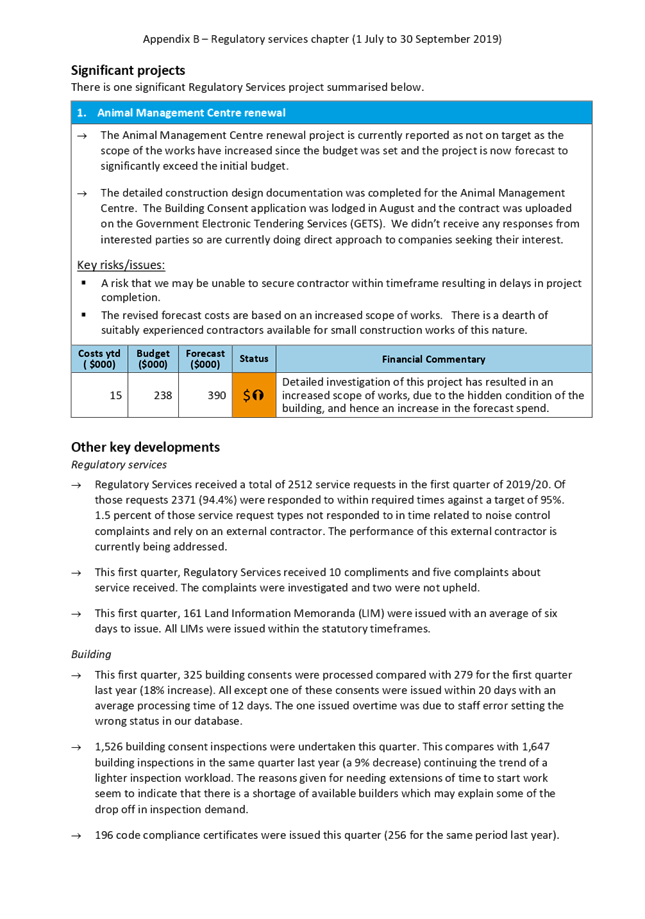

|

|

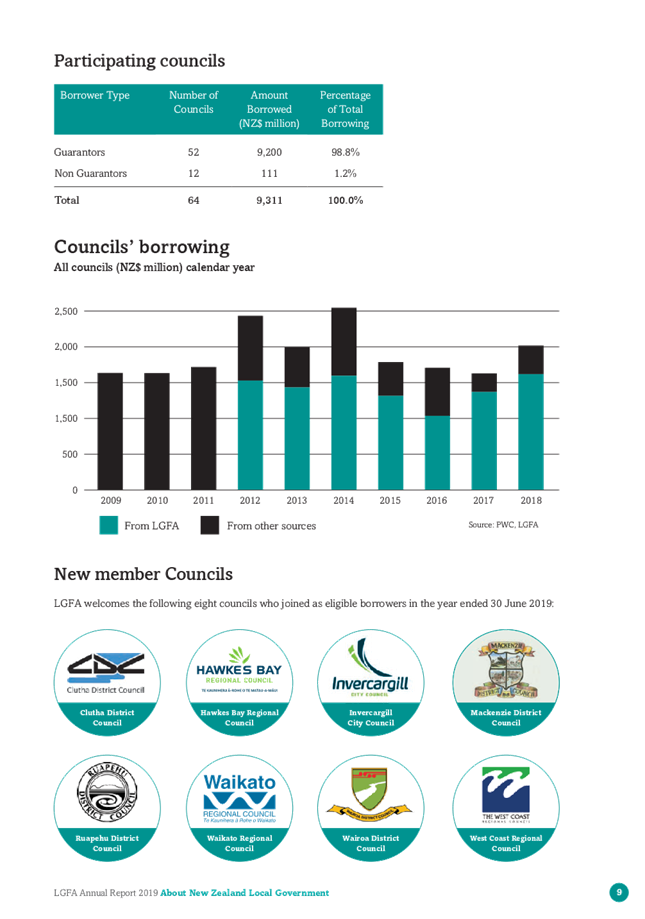

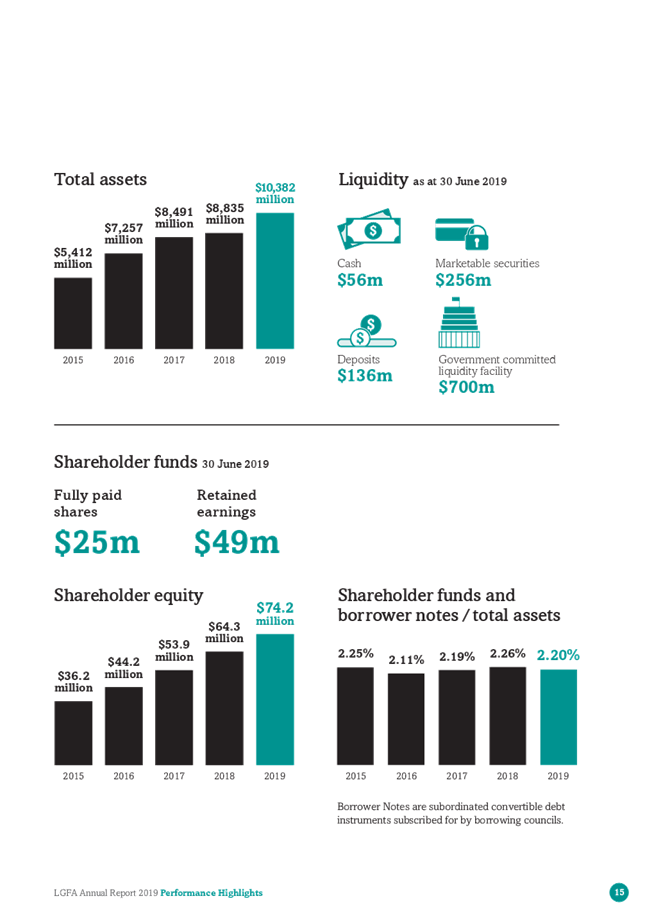

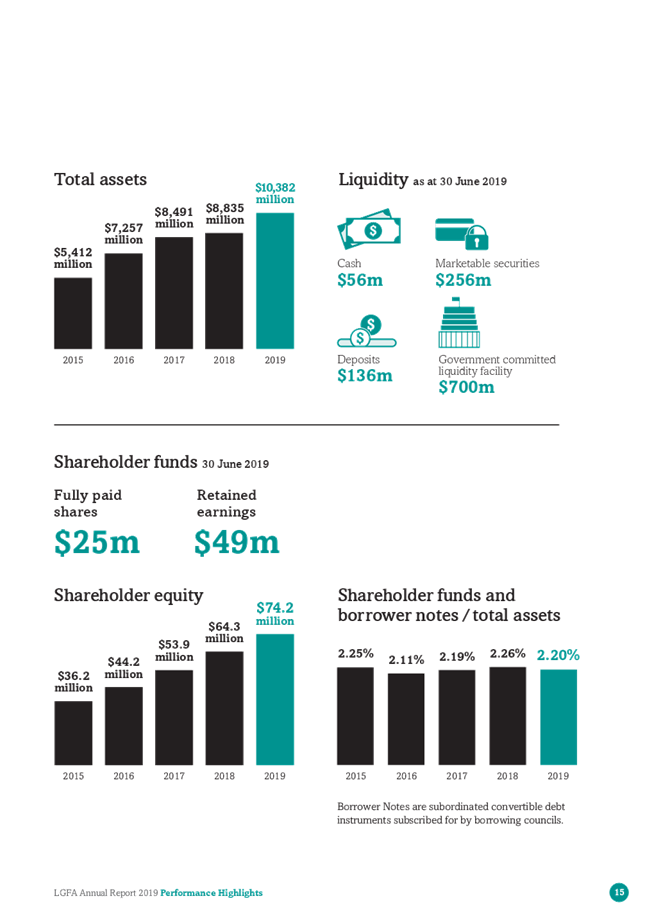

Date:

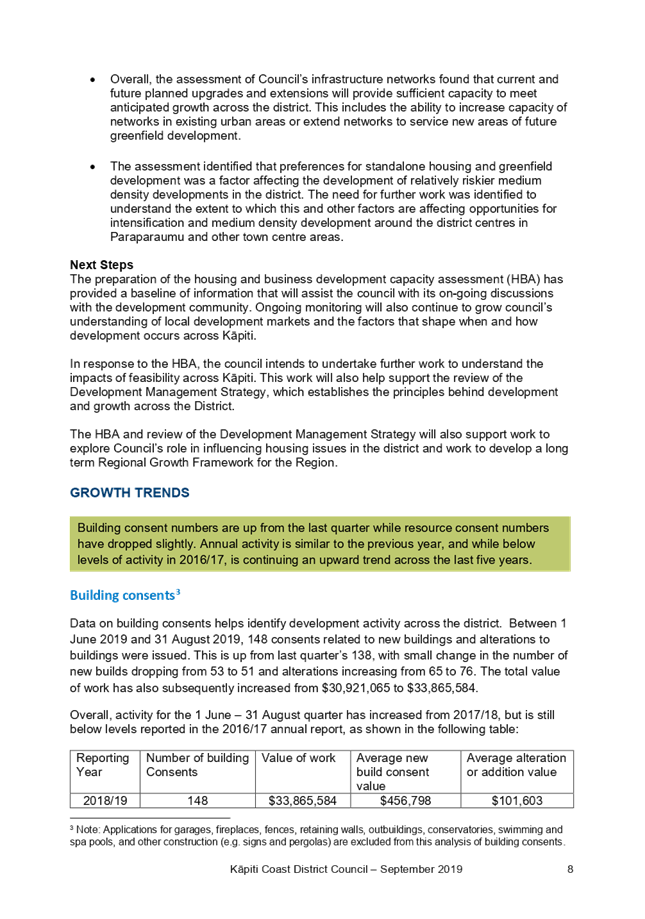

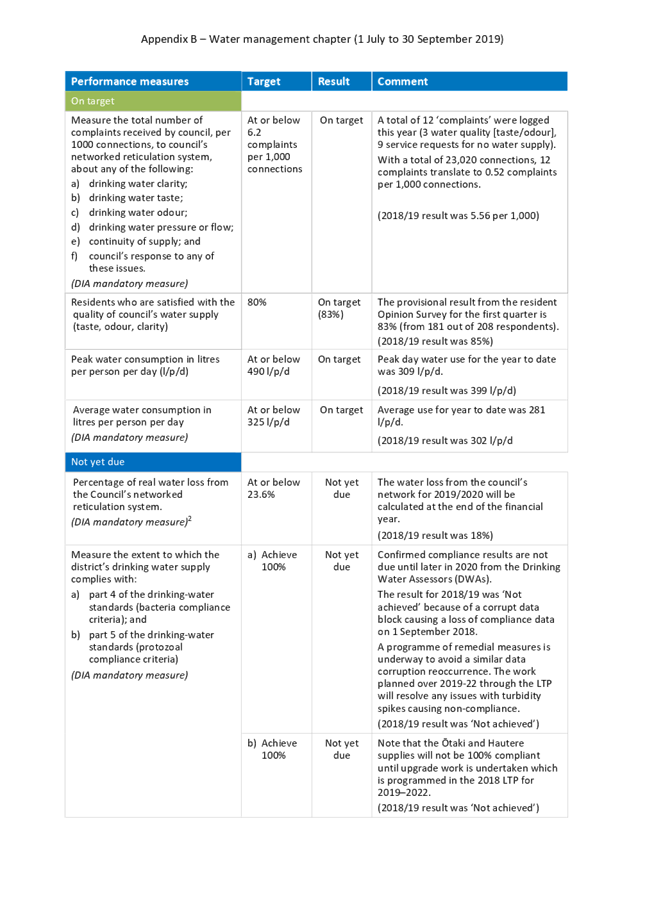

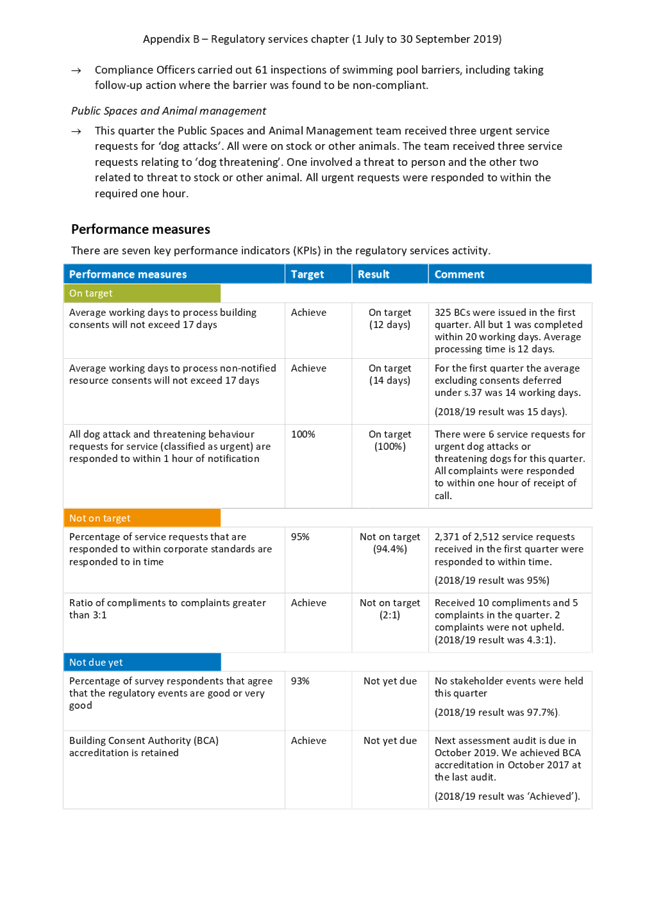

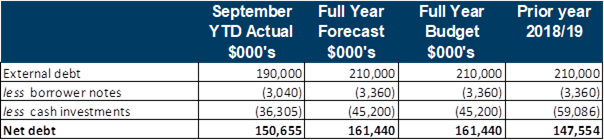

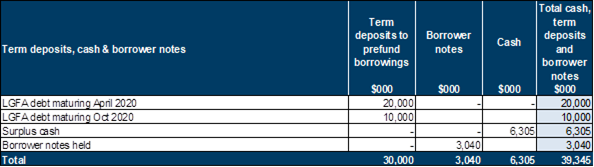

|

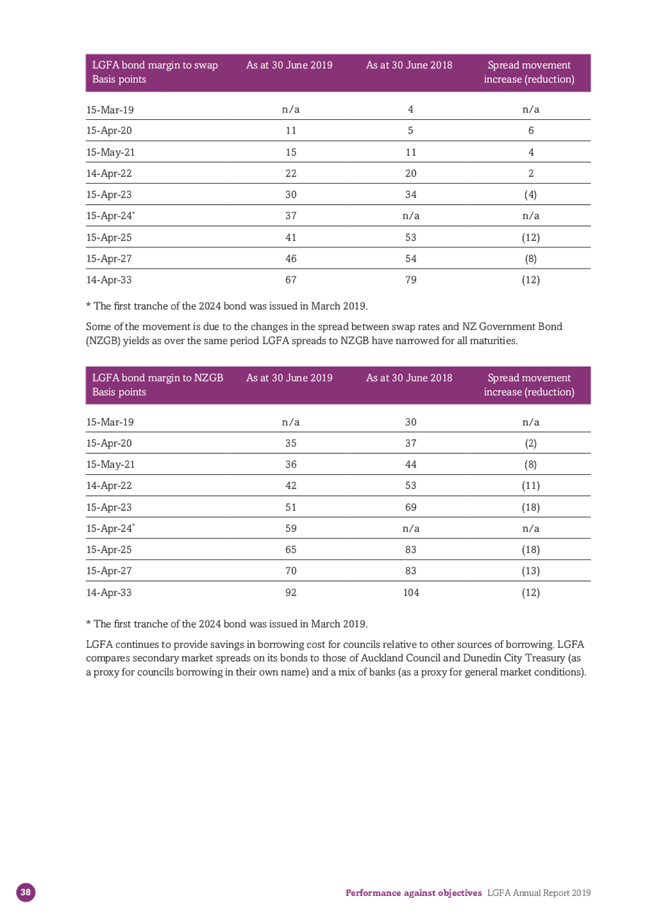

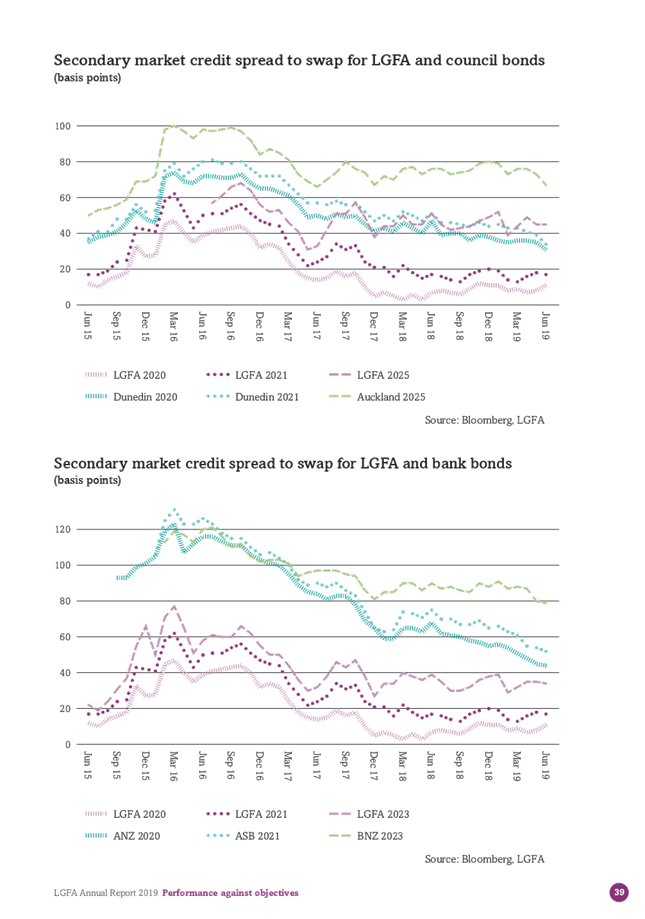

Thursday, 5 December

2019

|

|

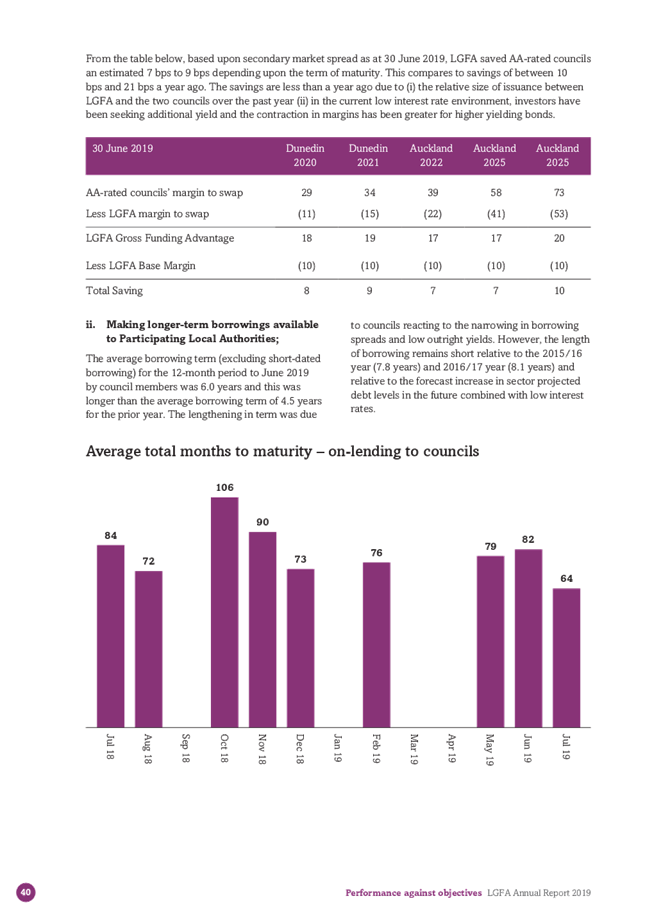

Time:

|

9.30am

|

|

Location:

|

Council Chamber

Ground Floor, 175 Rimu Road

Paraparaumu

|

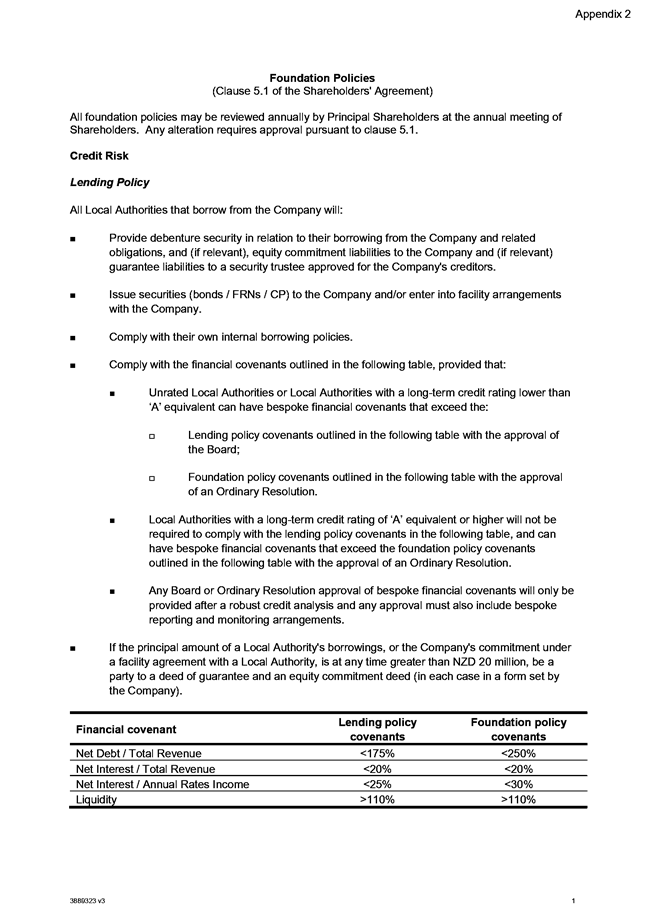

|

James Jefferson

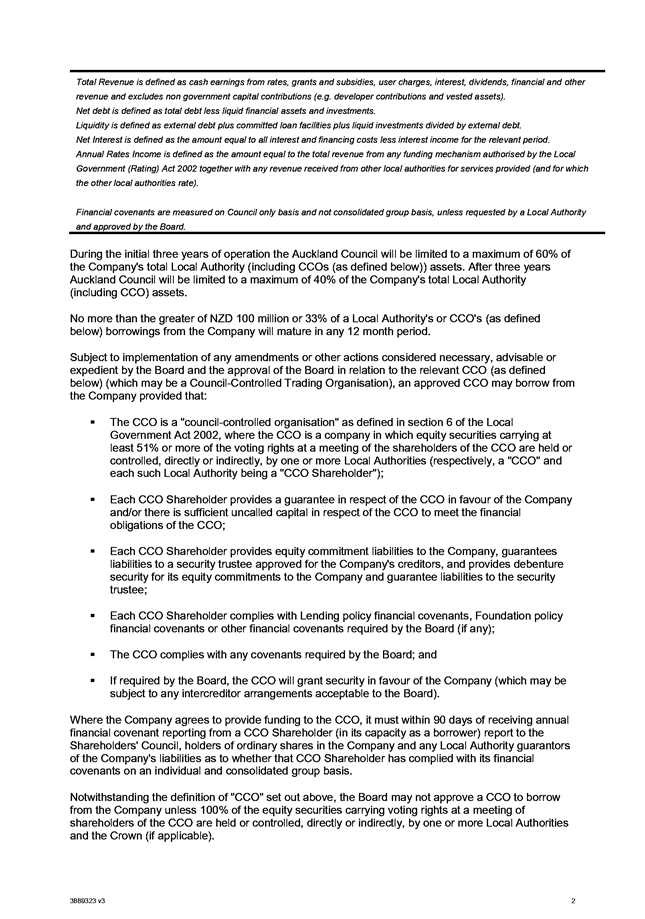

Group Manager Place and

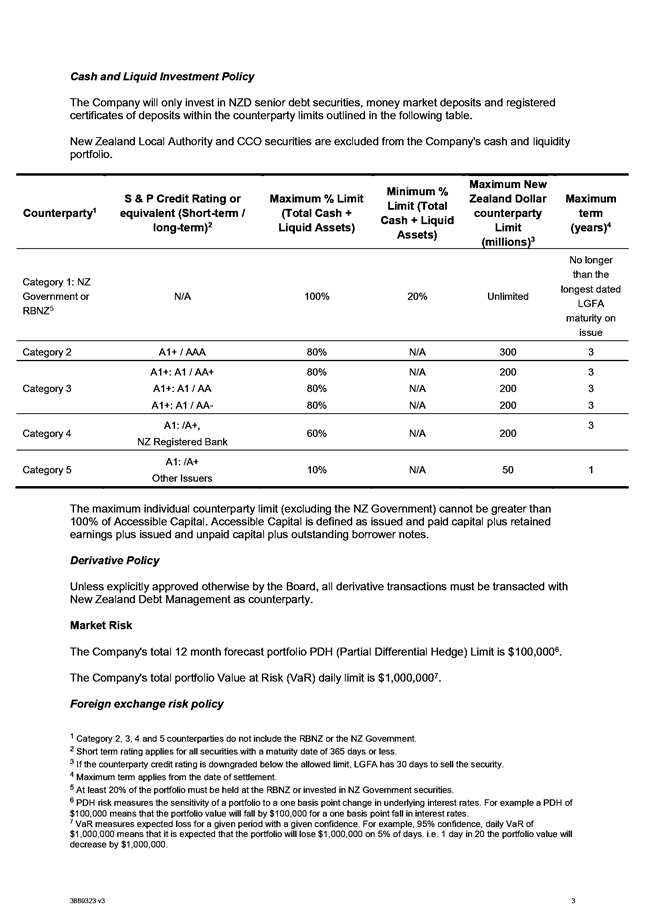

Space

|

|

Strategy

and Operations Committee Meeting Agenda

|

5 December 2019

|

Kapiti Coast District Council

Notice

is hereby given that a meeting of the Strategy and Operations Committee will be held in the Council

Chamber, Ground Floor, 175 Rimu Road, Paraparaumu, on Thursday 5 December 2019,

9.30am.

Strategy and

Operations Committee Members

|

Mayor K Gurunathan

|

Member

|

|

Cr James Cootes

|

Chair

|

|

Deputy Mayor Janet Holborow

|

Member

|

|

Cr Angela Buswell

|

Member

|

|

Cr Gwynn Compton

|

Deputy

|

|

Cr Jackie Elliott

|

Member

|

|

Cr Martin Halliday

|

Member

|

|

Cr Sophie Handford

|

Member

|

|

Cr Jocelyn Prvanov

|

Member

|

|

Cr Robert McCann

|

Member

|

|

Cr Bernie Randall

|

Member

|

2 Council

Blessing

“As we deliberate on the

issues before us, we trust that we will reflect positively on the

communities we serve. Let us all seek to be effective and just, so that with

courage, vision and energy, we provide positive leadership in a spirit of

harmony and compassion.”

I a mātou e whiriwhiri ana

i ngā take kei mua i ō mātou aroaro, e pono ana mātou ka

kaha tonu ki te whakapau mahara huapai mō ngā hapori e mahi nei

mātou. Me kaha hoki mātou katoa kia whaihua, kia tōtika

tā mātou mahi, ā, mā te māia, te tiro whakamua me te

hihiri ka taea te arahi i roto i te kotahitanga me te aroha.

3 Apologies

4 Declarations

of Interest Relating to Items on the Agenda

Notification from Elected

Members of:

4.1 – any interests that

may create a conflict with their role as an elected member relating to the

items of business for this meeting, and

4.2 – any interests in

items in which they have a direct or indirect pecuniary interest as provided

for in the Local Authorities (Members’ Interests) Act 1968

5 Public

Speaking Time for Items Relating to the Agenda

6 Members’

Business

(a)

Public Speaking Time Responses

(b)

Leave of Absence

(c)

Matters of an Urgent Nature (advice to be provided to the Chair prior to

the commencement of the meeting)

7 Updates

Nil

8 Reports

8.1 The

2009 Beach Bylaw Review Project

Author: Brandy

Griffin, Senior Policy Advisor

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

1 This

report provides the Committee with a progress update of the 2009 Beach Bylaw

Review Project.

Delegation

2 Section

B1 of the Governance Structure and Delegations for the 2019-2022 Triennium

states that the Strategy and Operations Committee is responsible for the

development and review of strategies, plans, policies, and bylaws.

Background

3 The

Beach Bylaw Review is on the Council-approved Policy Work Programme, and

commenced in February 2019.

4 Bylaw

reviews are generally carried out in three phases:

4.1 Phase

1 includes:

4.1.1 pre-consultation

engagement, data collection, and analysis;

4.1.2 the

identification of issues and options; and

4.1.3 the

development of proposed revisions to the existing bylaw.

4.2 Phase

2 includes the development of a draft Bylaw and public consultation on any

proposed revisions, carried out in accordance with the LGA 2002 requirements

for special consultative procedures.

4.3 Phase

3 involves the analysis of written and oral submissions, leading to a final

draft of the revised bylaw, which is then presented to Council for final

consideration and adoption.

5 This

progress update provides information on the data collection and analysis that

has been undertaken to date, and the proposed approach and timeframes for the

remainder of the review.

DISCUSSION

Phase 1: pre-consultation data

collection and analysis

6 The

pre-consultation phase seeks to identify issues with the existing Bylaw to be

considered in the review.

7 To

date, Council Officers have completed the following:

7.1 Analysis

of service requests, emails, and other correspondence that Council received in

relation to the existing Beach Bylaw from January 2017 to December 2018;

7.2 Analysis

of beach patrol data from the summer of 2016/17 to the present;

7.3 Initiated

a legal review to better understand several aspects of the Bylaw, particularly

in relation to legislative requirements and jurisdiction of other government

agencies;

7.4 Completed

a review of other coastal Councils to understand how they address similar

issues; and

7.5 Carried

out some initial discussions with New Zealand Police and Greater Wellington

Regional Council (GWRC) to discuss jurisdiction and implementation.

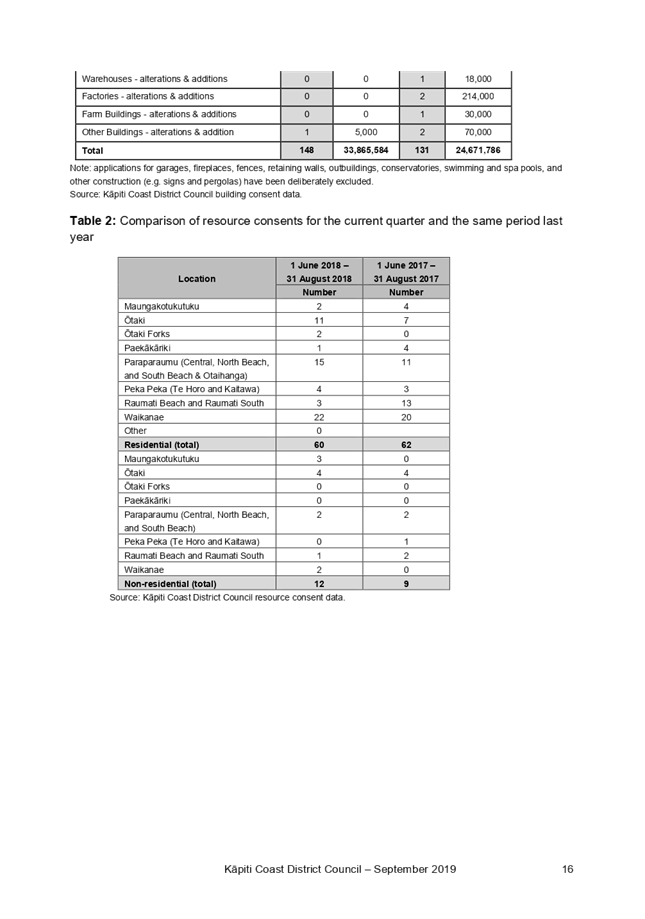

8 Table

1 below lists the key issues that were identified from the review of

Council’s service requests. Service requests from 1 January 2019 to 31

October 2019 are currently being analysed.

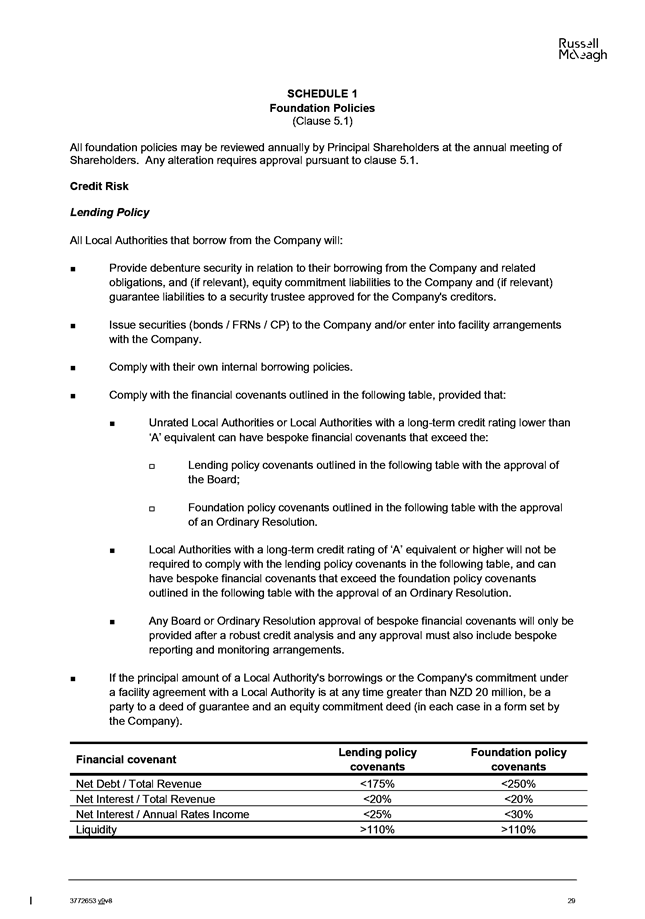

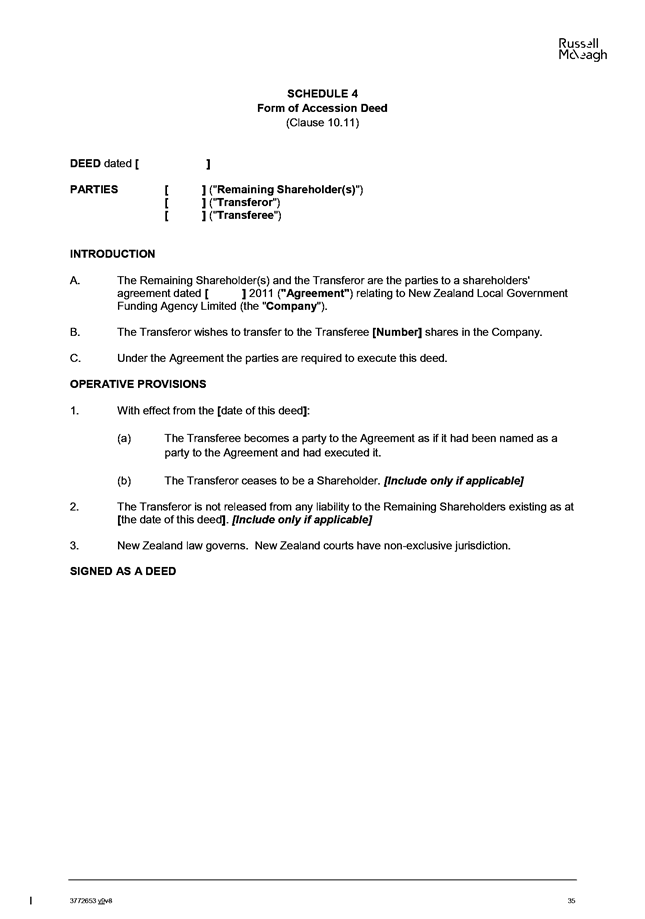

Table 1: Issues

raised in service requests, January 2017 to December 2018

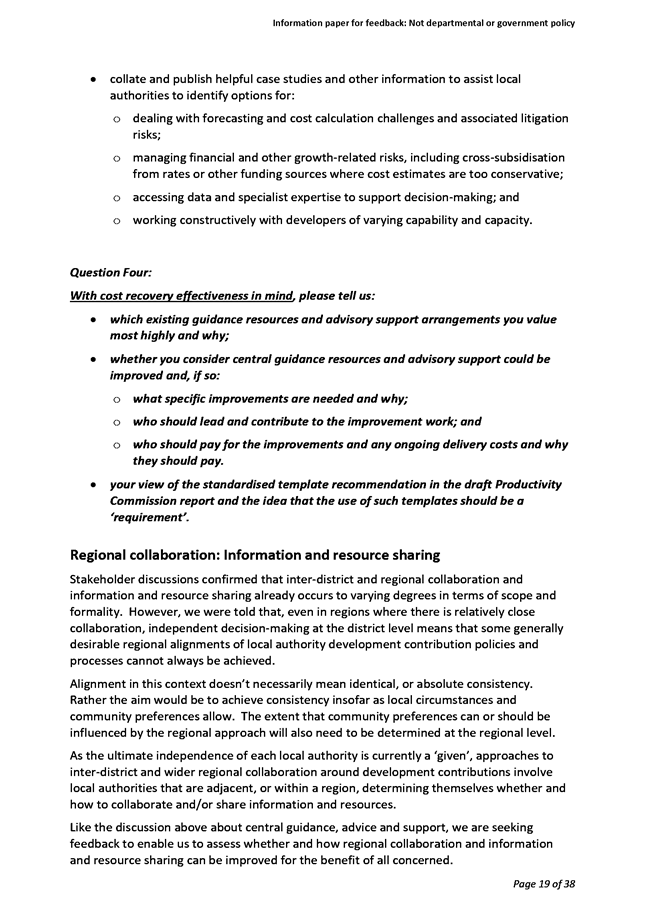

|

Issue

|

Number of service requests

|

Percentage of total*

|

|

Vehicles on beaches -

concerns about pedestrian safety and/or harm to the natural environment

|

76

|

72%

|

|

45

(59%) of these were in the area between the Kapiti Boating Club and the

Waikanae Boating Club.

|

|

Beach access areas -

improvements requested for beach access ways, parking, signage, and boat

ramps

|

31

|

30%

|

|

Horses on beaches -

some callers raising complaints about the presence of horses on the beach,

while others wanted to see improvements to facilitate horse riding on the

beaches

|

8

|

8%

|

|

Total number of service requests

|

105

|

-

|

*

Note: percentages add to more than 100% because some service requests included

more than one issue.

9 During

the summer beach patrols, Officers collected information on 281 cars and spoke

to 173 drivers (62%). Of the 173 drivers, most were not familiar

with the rules for cars on beaches. Common non-compliant activities

included: watching the surf, fishing, surfing (further north), parking (without

a disability permit or boat launch), dog walking, and freedom camping.

For those that identified where they were from, 47% were from Kāpiti, 31%

were from the wider Greater Wellington region, 12% were from Horowhenua and

Manawatu, and 10% were from elsewhere in New Zealand. Table 2 below lists

the locations where the beach patrol data was collected.

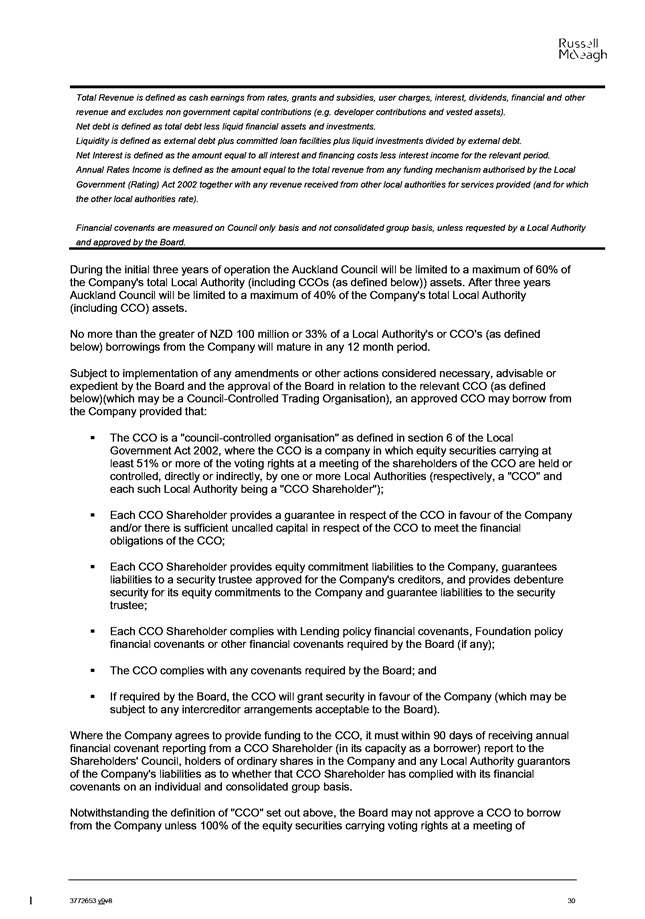

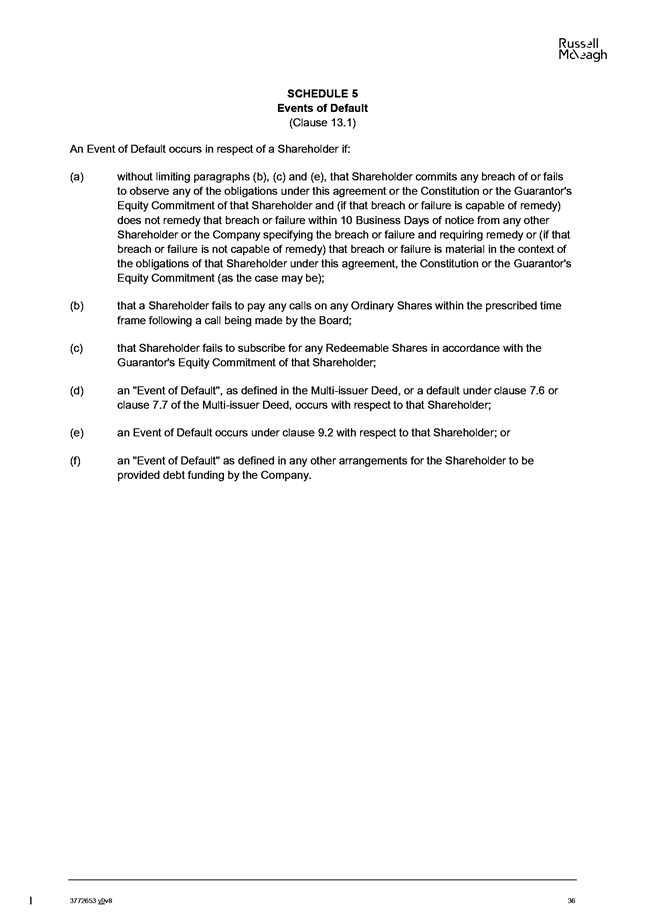

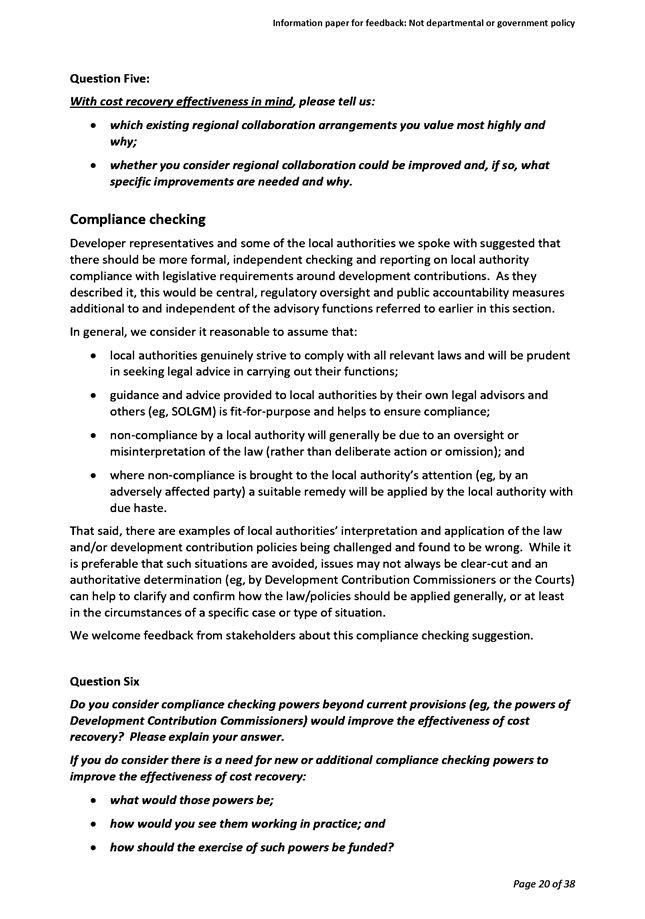

Table 2: Beach

patrol data (2016 to the present)

|

Location

|

Number of cars (n=281)

|

Percentage of total

|

|

Ōtaki

|

21

|

8%

|

|

Te Horo

|

18

|

7%

|

|

Waikanae (North of boating

club)

|

16

|

6%

|

|

Raumati

|

10

|

3%

|

|

Paraparaumu (Boating club

to WSR)

|

216

|

76%

|

10 The

reviews of emails and other correspondence, as well as discussions across

Council and with the New Zealand Police and GWRC, suggest that other issues

requiring further consideration in this review will include:

10.1 Promoting

safety around the use of kontiki longline fishing systems;

10.2 Protection

of sensitive sites;

10.3 Permitting

for special events; and

10.4 Implementation

and enforcement.

11 Data

collection and analysis will continue throughout the review, primarily in

response to any new issues that become identified that require further

information.

Next steps for early engagement

12 It

is important that early engagement occurs with our iwi partners, key

stakeholders, and members of the public before a draft Bylaw is

developed.

13 Council

Officers have worked with the Iwi Relationships Team to seek advice and

guidance from each of the three iwi on how they would like to work with us on

this project.

14 As

for engagement with the community and key stakeholders, a detailed engagement

plan has been developed.

15 Table

3 below provides a general overview of the engagement planned.

Table 3: Planned

engagement and timeframes

|

Type of engagement

|

Target Timeframes

|

|

Meetings with iwi partners

|

|

Iwi partners

|

To be determined.

|

|

Meetings with key stakeholders

|

|

Governance partners (e.g., GWRC, MPI,

DOC, Police)

|

November to December 2019, with the

understanding that some discussions will carry over into the new year

depending on the number of meetings required and/or stakeholder availability

|

|

Emergency responders

|

|

Residents’ associations

|

|

Community Boards

|

|

Special topic interest and/or advisory

groups (KEAG, CWB, OPC, etc)

|

|

Boating clubs

|

|

Commercial operators and other

businesses

|

|

Environmental groups

|

|

Recreation groups

|

|

Mass communications + ongoing meetings with key

stakeholders

|

|

On-line survey (4 weeks), with widespread

advertising and promotion

|

13 Jan – 9 Feb 2020

|

|

Information pop-ups (Paraparaumu Beach

Market, Waikanae Surf Club, Paekākāriki and Ōtaki)

|

18 Jan 2020 (Sat)

25 Jan 2020 (Sat)

|

|

Beach walks

|

19 Jan 2020 (Sun)

26 Jan 2020 (Sun)

|

|

Facilitated workshops in Ōtaki, Waikanae, Paraparaumu, and Paekākāriki (4x)

|

February 2020 (exact dates TBD)

|

Phases 2 and 3

16 The

information collected during Phase 1 will be used to develop a draft 2019 Bylaw

and Statement of Proposal that will be released for public consultation in

accordance with the LGA 2002 requirements for special consultative

procedures.

17 During

this formal consultation period (Phase 2), some public drop-ins will be held to

ensure the public has had sufficient opportunity to provide feedback and

hearings will be held to ensure that submitters are given an opportunity to

speak to their submissions. More information on the public drop-in

sessions and hearings will be provided when the draft 2019 Bylaw and Statement

of Proposal are presented to Council.

18 The

information collected from the formal consultation period will then be considered

and will input into a final draft 2019 Bylaw, which will be presented to

Council for final consideration and adoption (Phase 3).

19 The

proposed timeframes for Phases 2 and 3 are outlined in Table 4 below.

Table 4: Tentative

timeframes for the Beach Bylaw review for Phases 2 and 3

|

Action

|

Target Dates¹

|

|

Briefing to Council, with a

focus on the initial results of the early engagement phase and next steps

|

27 February 2020

|

|

Briefing to Council on the

development of the Draft Bylaw and Statement of Proposal

|

26 March 2020

|

|

Council approves special

consultative procedure on Draft 2020 Bylaw and Statement of Proposal to

Council

|

28 May 2020

|

|

Special consultative

procedure, including discussions with Community Boards and public drop-in(s)

|

8 June to 5 July 2020

|

|

Hearings

|

30 July 2020

|

|

Report to Council for

adoption of Beach Bylaw 2020

|

23 September 2020

|

¹

These dates are tentative. The nature of the

feedback received during Phase 1 will impact the proposed timeframes.

Considerations

Policy

considerations

20 There

are no policy considerations in addition to those outlined in this report.

Legal

considerations

21 The

current Beach Bylaw was adopted on 7 May 2009. In accordance with s159 of

the Local Government Act 2002 (LGA 2002), the Bylaw was due to be reviewed by 7

May 2019.

22 Because

the review was not completed by 7 May 2019, s160A of the LGA 2002 has come into

effect which states the Bylaw will be revoked automatically if the review is

not completed by 7 May 2021.

Financial

considerations

23 This

review will be carried out within existing budgets.

Tāngata

whenua considerations

24 It

is important that we work with our iwi partners on this review, and we have

been in contact with each of the three iwi to learn how they would like to

participate in this project.

Strategic

considerations

25 Toitū

Kāpiti includes aspirations for strong, safe communities and a

thriving environment. The Beach Bylaw assists in the attainment of these

aspirations because it seeks to enhance the safety of the public on the beach,

while also protecting the beach natural environment.

SIGNIFICANCE

AND ENGAGEMENT

Significance

policy

26 In

accordance with the LGA 2002, a special consultative procedure will be required

for this Bylaw review.

Consultation

already undertaken

27 Conversations

have started with New Zealand Police, GWRC, DOC, MPI, and emergency responders.

|

Recommendations

It is recommended that the

Strategy & Operations Committee note this progress update on the 2009

Beach Bylaw Review Project.

|

Appendices

Nil

8.2 2018-2021

Policy Work Programme Update

Author: Brandy

Griffin, Senior Policy Advisor

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

1 This

report provides the Committee with a progress update on the 2018-2021 Policy

Work Programme (PWP), and requires Committee approval of proposed changes to

the PWP.

Delegation

2 The

Committee has delegation to consider this matter under Section B.1 of

Governance Structure & Delegations 2019-2022 Triennium, which states that a

key responsibility of this Committee will include “Setting and approving

the policy and strategy work programme.”

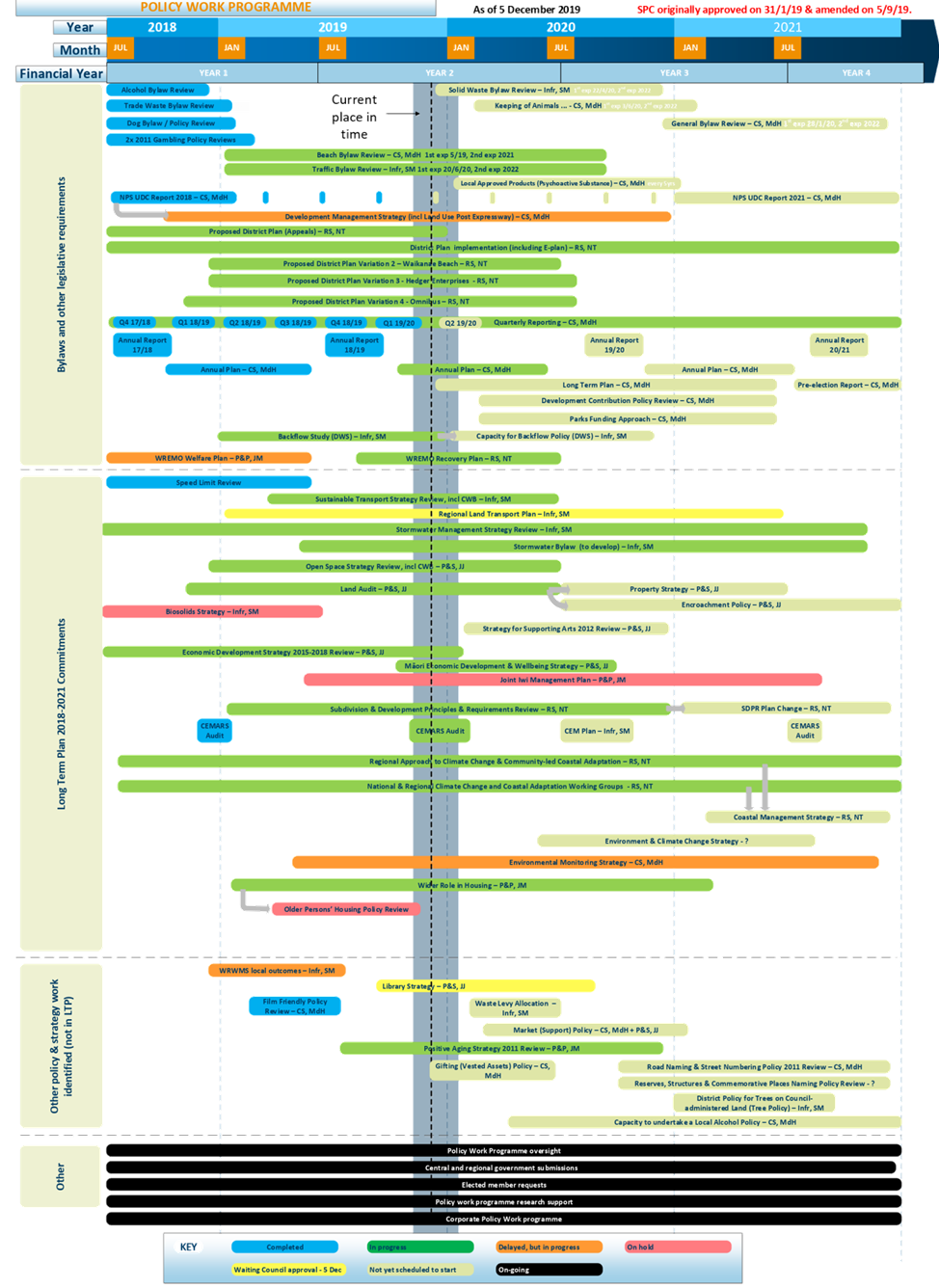

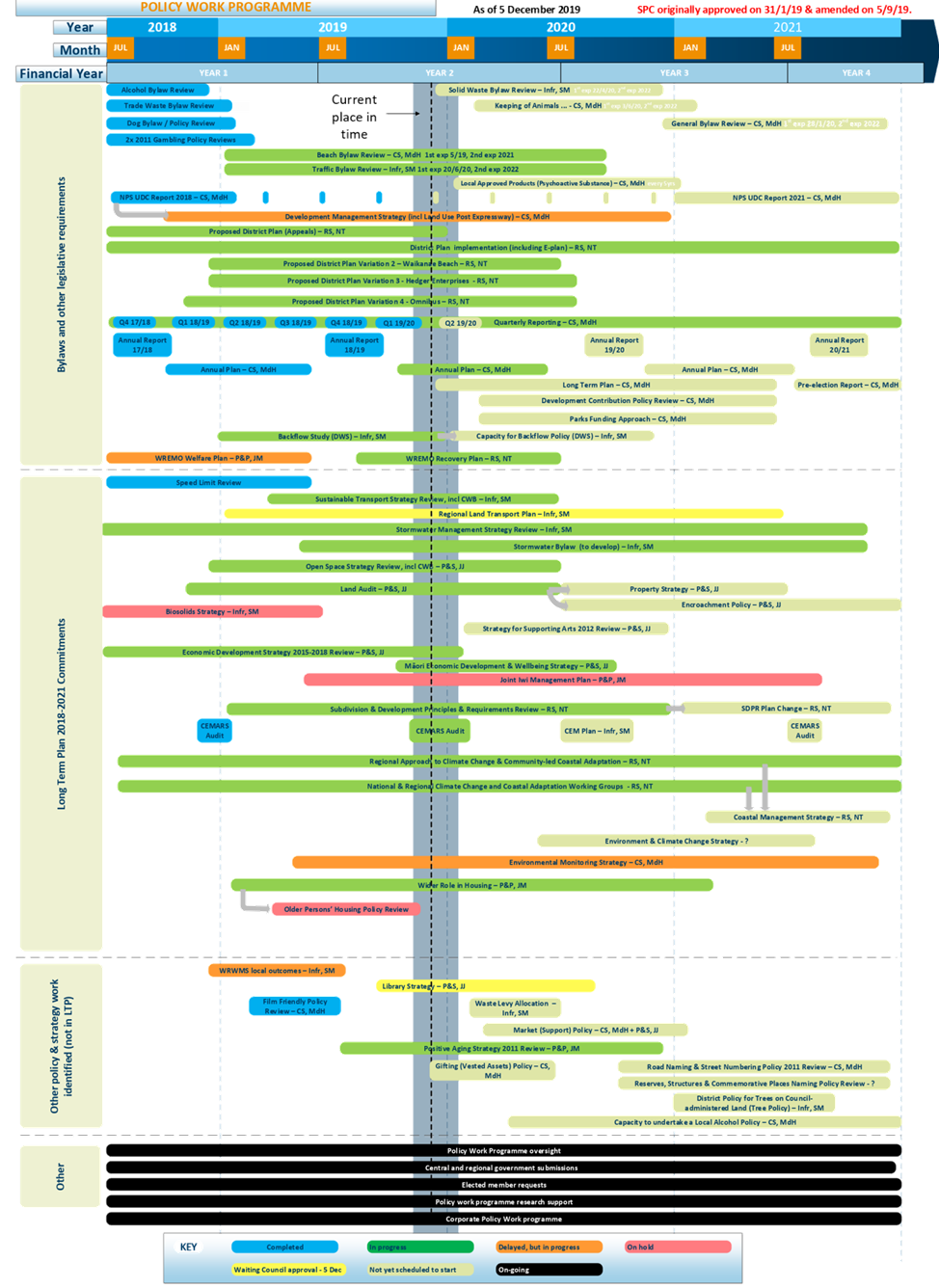

Background

3 On

31 January 2019, the Strategy and Policy Committee, a Committee of the previous

term, approved the Council’s PWP from 1 July 2018 to 30 June

2021.

4 At

its meeting on 5 September 2019, the Strategy and Policy Committee considered a

PWP progress update, approved revised timeframes to five existing policy

projects, and approved two new policy projects (i.e. Market Support Policy and

Gifting of Vested Assets Policy).

5 This

progress update to the PWP reports on projects that:

5.1 have

been completed;

5.2 are

in process with no known concerns;

5.3 are

in process with some delays;

5.4 are

currently on hold; and

5.5 are

proposed as new additions to the PWP.

DISCUSSION

Completed projects

6 Since

1 July 2018, 13 projects on the PWP have been completed (see Table 1 below, and

those that are marked as blue in Appendix 1 to this report).

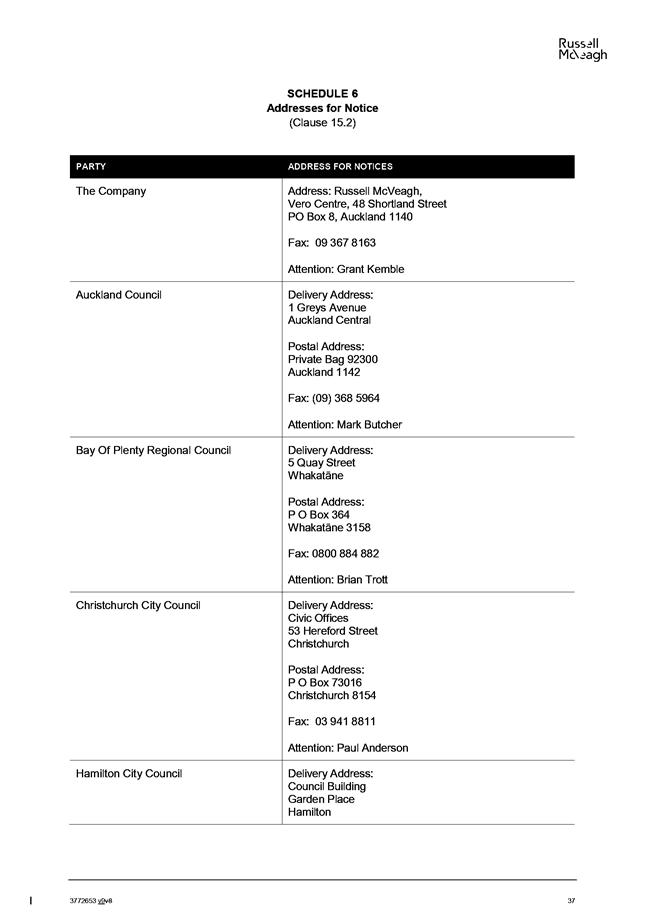

Table

1: Completed projects

|

Project

|

Completion date

|

|

1.

|

Annual Report 2017/18

|

27 September 2018

|

|

2.

|

Alcohol in Public Places

Bylaw

|

6 December 2018

|

|

3.

|

Trade Waste Bylaw Review

|

24 January 2019

|

|

4.

|

CEMARS

|

31 January 2019

|

|

5.

|

Dog Bylaw and Policy

Review

|

14 March 2019

|

|

6.

|

Class 4 Gambling and TAB

Venue Gambling Policy Reviews

|

11 April 2019

|

|

7.

|

Annual Plan 2019-20

|

23 May 2019

|

|

8.

|

Speed Limit Review

|

13 June 2019

|

|

9.

|

Film Friendly Policy &

Screen Wellington MoU

|

5 September 2019

|

|

10.

|

Annual Report 2018/19

|

26 September 2019

|

|

11.

|

Housing & Business

Development Capacity Assessment (HBA)

|

8 November 2019

|

|

12.

|

On-going NPS UDC quarterly

reports

|

Five quarters ending 31

August 2018, 30 November 2018, 28 February 2019, 31 May 2019, and 31 August

2019

|

|

13.

|

On-going quarterly

activity reports

|

Six quarters ending 30

June 2018, 30 September 2018, 31 December 2018, 31 March 2019, 30 June 2019,

and 30 September 2019

|

Projects

currently in process with no known concerns

7 There

are currently 26 policy projects in process, with no known concerns (see those

marked as green and yellow in Appendix 1 to this report).

Projects

currently in process with some delays

8 There

are four policy projects in process that are experiencing some delays (see

Table 2 below, and those marked as amber in Appendix 1 to this report).

Table

2: Projects in process,

with some delays

|

Project

|

Current status

|

Impact on completion date

|

|

Development Management

Strategy Review

|

Commencement of this review

was delayed because it was dependent on the completion of the HBA. The

HBA report for the Wellington Region has now been publicly released, and a

project plan is currently being developed for the Development Management

Strategy Review.

|

No change

|

|

Welfare Plan

|

The Kāpiti Plan has

been drafted, but will not be finalised until the Wellington Regional Welfare

Plan has been completed.

|

The expected completion date

for the Wellington Regional Welfare Plan is March 2020.

|

|

Environmental Monitoring

Strategy

|

The Research & Policy

team is reviewing the existing Strategy in order to recommend next steps on

this project.

|

No change

|

|

Regional Waste Management

and Minimisation Plan (RWMMP) Local Outcomes Plan

|

The Plan has been drafted,

but will not be completed until the Mayoral Waste Minimisation Taskforce

completes its report to Council recommending the prioritisation of the waste

minimisation actions under the RWMMP.

|

The Taskforce will present

a report to Council on 12 December 2019.

|

Projects on hold

9 There

are three policy projects that are currently on hold (see Table 3 below, and

those marked as pink in Appendix 1 to this report).

9.1 Two

policy projects are on hold while discussions occur with iwi; and

9.2 One

policy project is on hold awaiting the outcome of the Housing Programme

Assessment.

Table

3: Projects that are on

hold

|

Project

|

Status

|

Reason for hold

|

|

Biosolids Strategy

|

A considerable amount of

work has been undertaken over the last two years through the Lower North

Island Collective Biosolids Strategy Study, which received significant MfE

funding.

|

The management of waste in

our District (and, in particular, the impact on land and water) is of

significant interest to tāngata whenua, and will be progressed when

capacity within iwi allows.

|

|

Joint Iwi Management Plan

|

This is a project that Te

Whakaminenga o Kāpiti (TWOK) requested. There has been no active

conversation with iwi on this plan in 2019. Te Ātiawa Ki

Whakarongotai published their Kaitiakitanga Plan in June 2019.

|

The Iwi Partnerships Team

will discuss this item with TWOK to determine whether there is still an

appetite to develop this Plan.

|

|

Older Persons’

Housing Policy Review

|

Internally, responsibility

for this work is to be determined as well as its relationship to the wider

housing programme.

|

This project is

on hold, awaiting the outcome of the Housing

Programme Assessment.

|

New policy projects proposed for approval

10 Since

the last PWP progress update, two additional policy projects have been

identified (see those marked as yellow in Appendix 1 to this report):

10.1 the

Regional Land Transport Plan; and

10.2 the

Library Strategy.

Regional Land Transport Plan

11 Regional

land transport plans (RLTPs) are six year plans that document the regions' land

transport objectives, policies, and measures as well as providing a statement

of transport priorities for the region. The plans incorporate programmes of

regional land transport activities, including those activities proposed for

inclusion in the National Land Transport Programme. They are reviewed after

three years.

12 The

review of the Wellington RLTP is in progress, and it was recently determined

that the RLTP should be moved from the ‘list of submissions in process

for regional government’ to the PWP in order to reflect the workload

associated with its development.

13 The

RLTP commenced in January 2019, with an expected completion date of June 2021.

The Library Strategy

14 The

Library Strategy is also in progress, having commenced in October 2019 with an

expected completion date of August 2020.

15 The

Library Strategy will identify possible future library services across the

District, reflecting the increased ‘social investment’ approach

that accompanies the reintroduction of the four well-beings into the Local

Government Act.

CONSIDERATIONS

Policy

considerations

16 There

are no policy considerations in addition to those already outlined in this

report.

Legal

considerations

17 Legal

Counsel has reviewed and confirmed the timeframes for the review of all

policies and bylaws.

18 Section

159 of the Local Government Act 2002 (LGA02) requires bylaws to be reviewed

within ten years. The Beach Bylaw 2009 was adopted on 7 May 2009 and was due

for review by 7 May 2019; however, section 160A of the LGA02 provides that a

bylaw is revoked if it has not been reviewed within two years of the date on

which the bylaw should have been reviewed. Thus, the Beach Bylaw remains

valid and legally binding until 7 May 2021. Council is focussed on

ensuring this bylaw is fully reviewed and a new bylaw is adopted within this

timeframe.

Financial

considerations

19 There

are no financial considerations arising from this report.

Tāngata

whenua considerations

20 This

report will be presented to Te Whakaminenga o Kāpiti at their next meeting

in February 2020.

21 As

the implementation of the PWP is carried out, planning is undertaken to ensure

that individual policy projects are created in partnership with tāngata

whenua.

Significance and Engagement

Significance

policy

22 While

some individual policy projects will have a medium to high level of

significance, this progress report on the overall PWP has a low level of

significance under Council’s Significance and Engagement Policy.

Other

Considerations

23 The

Beach Bylaw Review is currently in process with no known concerns, but the

discussions with governance partners (i.e. Greater Wellington and New Zealand

Police) about jurisdiction are ongoing, so the completion date for this project

has been amended from June 2020 to September 2020 to ensure sufficient time for

these discussions.

24 The

Traffic Bylaw Review is currently in process with no known concerns, but the

Sustainable Transport Strategy Review is a priority, so the completion date for

this project has been amended from June 2020 to September 2020 to ensure

sufficient time.

25 The

PDP Variation 2 – Waikanae Beach is in process, but it has taken the

Court some time to issue a decision on the application for immediate legal

effect. This will delay the completion of the variation. Whereas

the current PWP indicated that this variation would be completed by February

2020, the completion date for this project has been amended to July 2020 to

account for the time taken by the Court to issue a decision.

26 The

Open Space Strategy Review is currently in process with no known concerns.

Consultation was tentatively scheduled for March 2020, but will now be April

2020 to allow sufficient time to develop the draft strategy. The

completion date will be June 2020, and the PWP has been updated to reflect

this.

27 The

Land Audit is currently in process with no known concerns. The expected

completion date for this project was March 2020 but, since this is a sizeable

piece of work, June 2020 is considered to be more likely, and this will have

flow on effects for the Property Strategy and Encroachment Policy. The

PWP has been updated to reflect this.

28 When

the PWP was approved in January 2019, it was thought that the CEMARS review (Certified

Emissions Measurement and Reduction Scheme) occurred once every 3 years.

It is now understood that there is a 3-yearly plan, accompanied by a yearly

audit so the PWP has been updated to reflect this detail.

29 The

Waste Levy Allocation Policy is not required until the grant application period

opens in June 2020. The timeframe for the Waste Levy Allocation Policy

Review has been updated so the review will commence once the update from

central government on available funding has been received (estimated in

February 2020) and be completed by June 2020.

|

Recommendations

30 It

is recommended that the Strategy & Operations Committee note the projects

on the PWP that:

30.1 have

been completed;

30.2 are

in process with no known concerns;

30.3 are

in process with some delays; and

30.4 are

currently on hold.

31 It

is recommended that the Strategy & Operations Committee approve the

following proposed amendments to the 2018-2021 Policy Work Programme:

31.1 Review

of the Regional Land Transport Strategy be added, with the understanding that

the project commenced in January 2019 and has an expected completion date of

June 2021; and

31.2 Review

of the Library Strategy be added, with the understanding that the project

commenced in October 2019 and has an expected completion date of August 2020.

32 It

is recommended that the Strategy & Operations Committee note the

following updates to the 2018-2021 Policy Work Programme:

32.1 The

Beach Bylaw Review expected completion date is September 2020;

32.2 The

Traffic Bylaw Review expected completion date is September 2020;

32.3 The

PDP Variation 2 – Waikanae Beach expected completion date is July 2020;

32.4 The

Open Space Strategy Review expected completion date is June 2020;

32.5 The

Land Audit expected completion date is June 2020;

32.6 CEMARS

(Certified Emissions Measurement and Reduction Scheme) is comprised of a

3-yearly plan, accompanied by a yearly audit; and

32.7 The

Waste Levy Allocation Policy is expected to commence in February 2020 and be

completed by June 2020.

|

Appendices

1. Council

Cross Policy Work Program ⇩

|

Strategy

and Operations Committee Meeting Agenda

|

5 December 2019

|

8.3 NPS-UDC

Quarterly Monitoring Report with annual update

Author: Hamish

McGillivray, Senior Policy Advisor

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

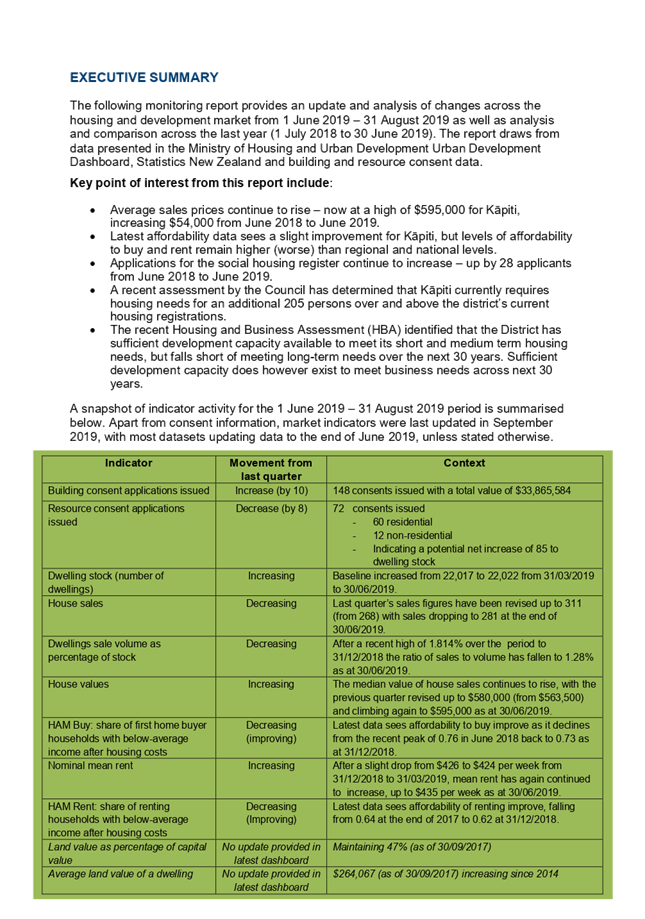

1 To

provide the Committee with a National Policy Statement on Urban Development

Capacity (NPS-UDC) quarterly monitoring report from 1 June to 31 August 2019,

including an annual update from 1 July 2018 to 30 June 2019.

2 The

full monitoring report is attached as Appendix 1 to this report.

Delegation

3 The

Strategy and Operations Committee has the authority to consider this matter

under section B.1 of the Governance structure and delegations 2019-2022.

Background

4 The

(NPS – UDC was introduced in 2016 and requires Council to assess housing

and business demand and capacity across the district. It also requires Council

to undertake quarterly monitoring and reporting of a range of market indicators

published by the Ministry of Housing and Urban Development (HUD).

5 The

first quarterly report was completed in September 2017 with subsequent reports

repeated each quarter (December, March and June). The first report in September

2017 provided context and commentary of the current and future make-up of the

district and some of the challenges and pressures that presents, particularly

the affordability of housing.

6 Subsequently,

an annual update has been provided each September to provide more in depth

analysis across the last year, with the other ‘interim’ quarterly

reports, focussing more on changes to key indicators between quarters.

7 Previous

monitoring reports are available on our ‘Urban development

capacity’ webpage at https://www.kapiticoast.govt.nz/our-district/the-kapiti-coast/urban-development-capacity/.

8 The

following monitoring report provides an update and analysis of changes across

the housing and development market for the last quarter, from 1 June 2019

– 31 August 2019, as well as analysis and comparison across the last

year. The report draws from data presented in the Ministry of Housing and Urban

Development Urban Development Dashboard, Statistics New Zealand and building

and resource consent data.

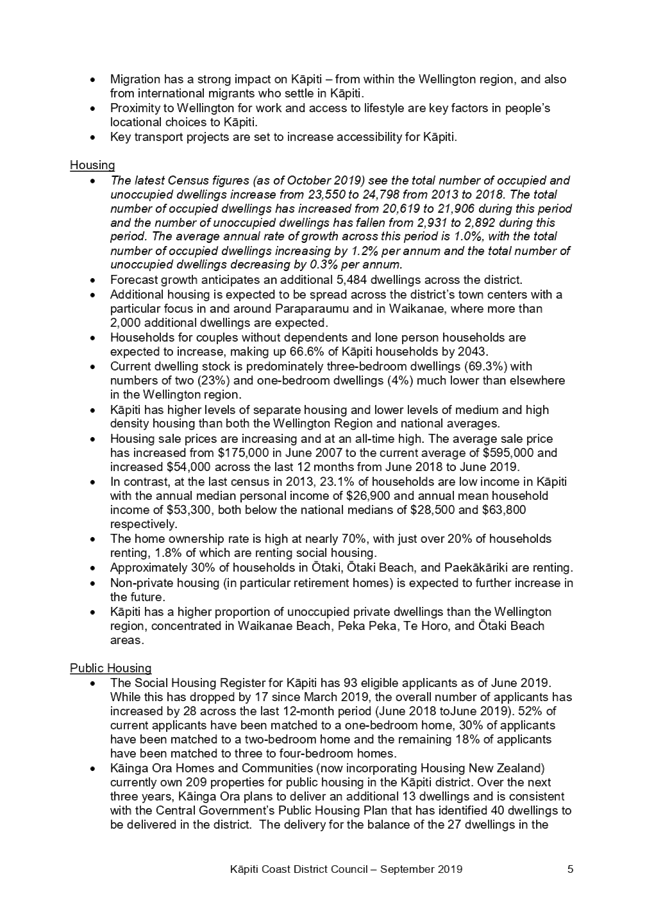

Points of Interest

9 Key

points of interest from this report include:

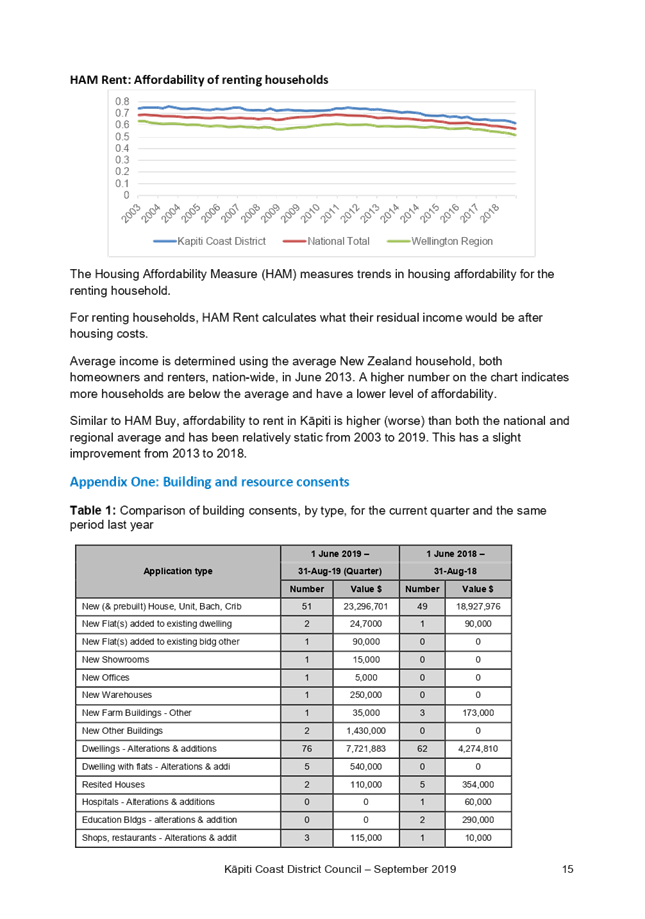

· Average

sales prices continue to rise – now at a high of $595,000 for

Kāpiti, increasing $54,000 from June 2018 to June 2019.

· Latest

affordability data sees a slight improvement for Kāpiti, but levels of

affordability to buy and rent remain higher (worse) than regional and national

levels.

· Applications

for the social housing register continue to increase – up by 28

applicants from June 2018 to June 2019.

· A

recent assessment by the Council has determined that Kāpiti currently

requires housing needs for an additional 205 persons over and above the

district’s current housing registrations.

· NPS-UDC

monitoring has been used to inform the recently published Wellington Housing

and Business Development Capacity Assessment (HBA). This has identified that

the district has sufficient development capacity available to meet its short

and medium term housing needs, but falls short of meeting long-term needs over

the next 30 years. Sufficient development capacity does however exist to meet

business needs across next 30 years.

Considerations

Policy

considerations

10 The

HBA is required to be completed every three years, with the next one due by the

end of December 2021.

11 Both

the NPS-UDC monitoring and the HBA will be used to inform the review of the

Development Management Strategy. The Development Management Strategy

establishes the development and settlement patterns for the Kāpiti Coast

district and informs the approach to development management under the Proposed

District Plan. The Strategy was last updated in 2007. Work is currently underway

to scope the process to review the Development Management Strategy, which is

currently expected to be undertaken across the next 12-18 months

12 Some

early Census 2018 data has recently started to be released, but full datasets

are not expected to be available until mid-2020. Key statistics will be

included in monitoring reports as they become available, with next year’s

annual update able to provide updated data and context across the full set of

Census 2018 data.

Legal

considerations

13 Appendix

1 to this report meets the NPS-UDC 2016 requirements to monitor and publish

monitoring results.

Financial

considerations

14 There

are no financial considerations arising from this report.

Tāngata

whenua considerations

15 We

have not engaged directly with iwi on this report. Te Whakaminenga o Kāpiti will be provided an update on the findings at their next

meeting in February 2020.

Strategic

considerations

16 Toitū

Kāpiti reflects aspirations for a vibrant and thriving Kāpiti,

with strong and safe communities that are connected to our natural environment.

Monitoring under the NPS-UDC supports Council to adapt and respond to evidence

about urban development, market activity and the social, economic, cultural and

environmental wellbeing of people and communities and future generations, in a

timely way.

Significance and Engagement

Significance

policy

17 This

matter has a low level of significance under Council’s Significance and

Engagement Policy.

Publicity

18 This

monitoring report will be published on the Council’s ‘Urban

Development’ webpage alongside previous reports and the recently

completed HBA. An email will also be distributed to a list of stakeholders who

have expressed an interest in the reports and to receive future updates.

|

Recommendations

19 Note

the contents of the NPS-UDC quarterly monitoring report for the period 1 June

to 31 August 2019, including the annual update from 1 July 2018 to 30 June

2019, as attached as Appendix 1 to this report.

|

Appendices

1. NPS-UDC

Quarterly monitoring report including annual update September 2019 ⇩

|

Strategy

and Operations Committee Meeting Agenda

|

5 December 2019

|

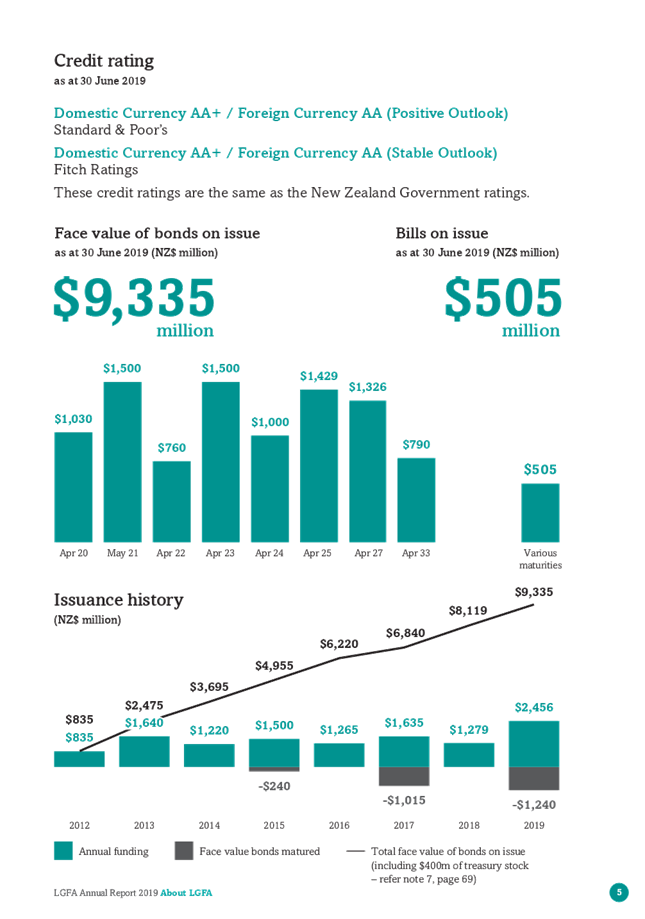

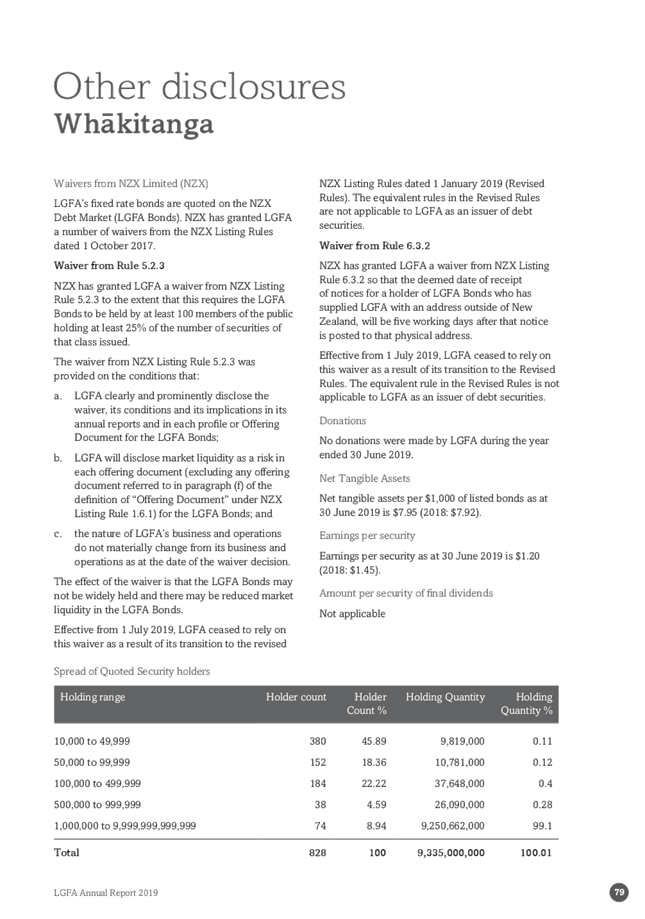

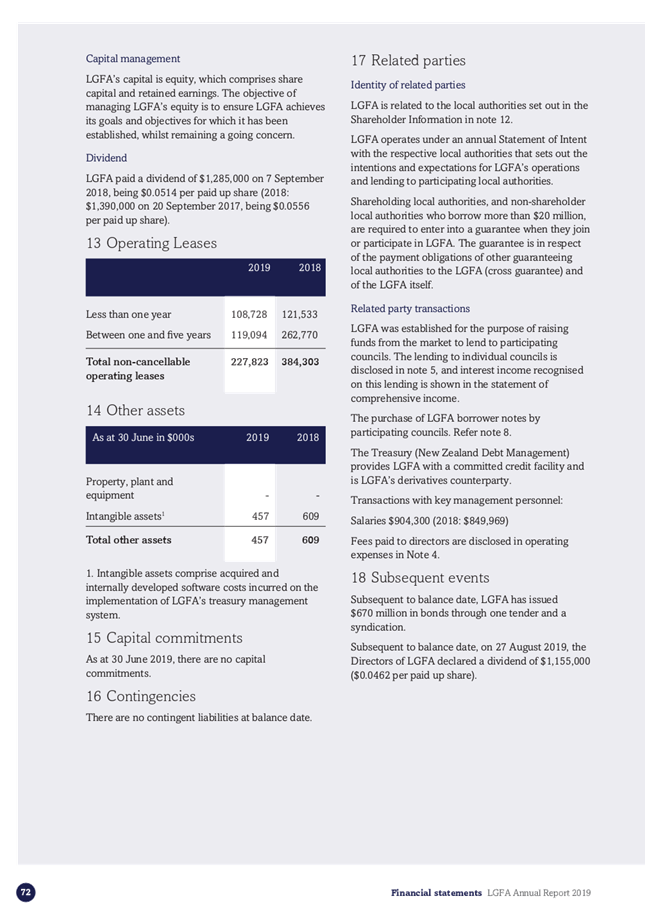

8.4 THE

LOCAL GOVERNMENT FUNDING AGENCY 2018/19 ANNUAL REPORT

Author: Jacinta

Straker, Chief Financial Officer

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

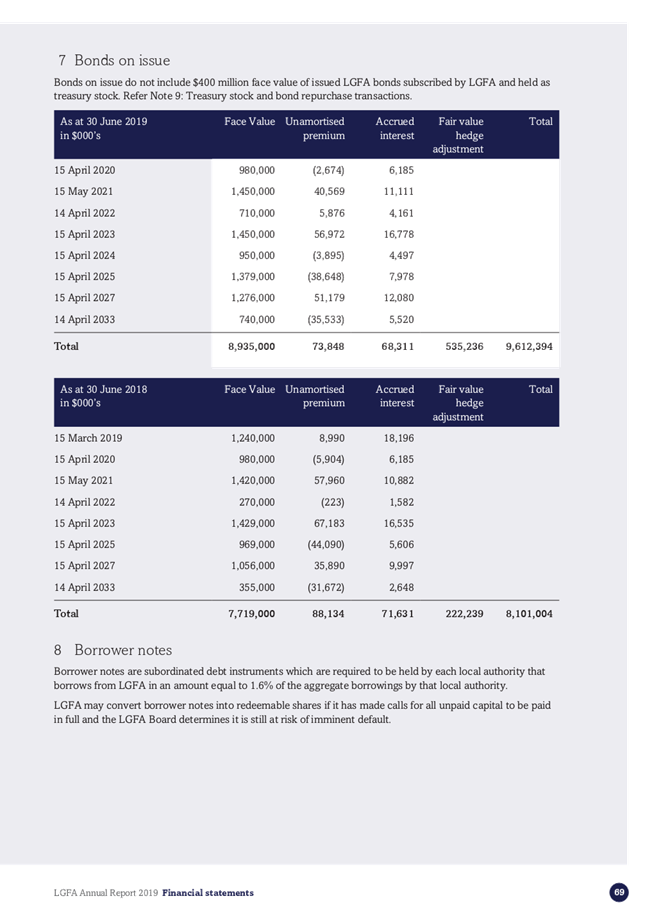

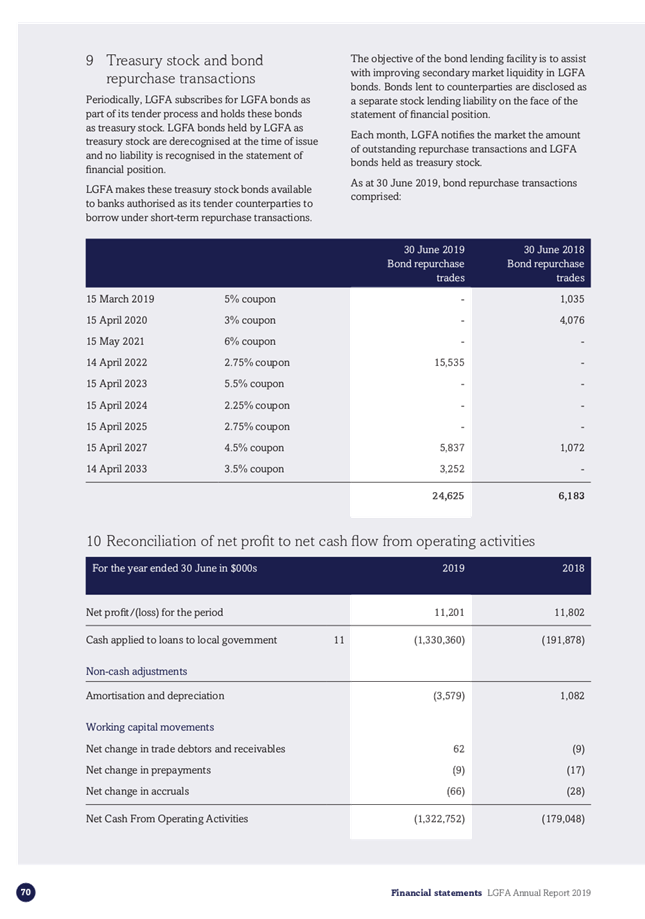

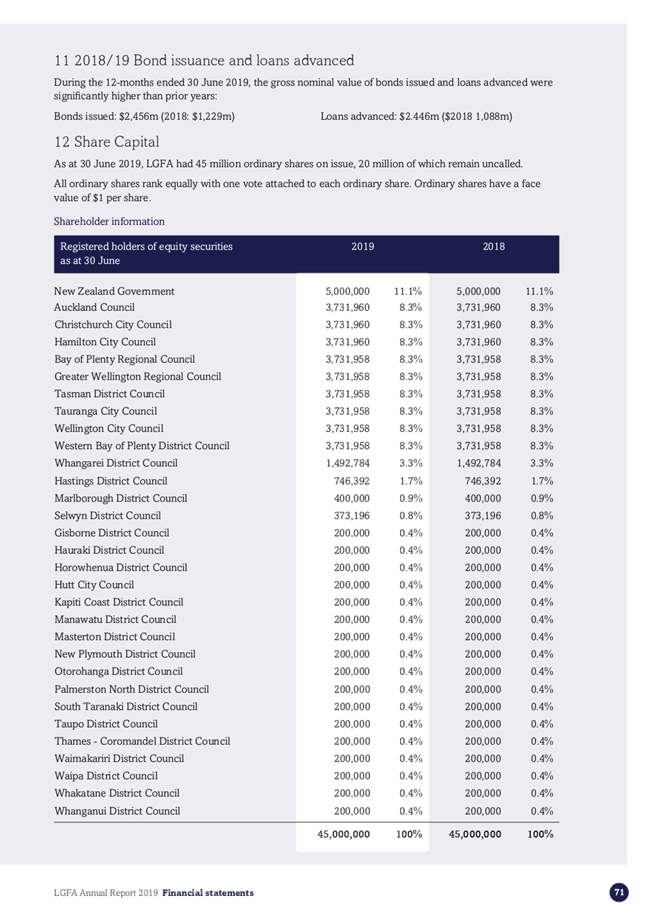

1 The

purpose of this report is to update the Strategy and Operations Committee on

the Local Government Funding Agency (LGFA) 2018/19 Annual Report.

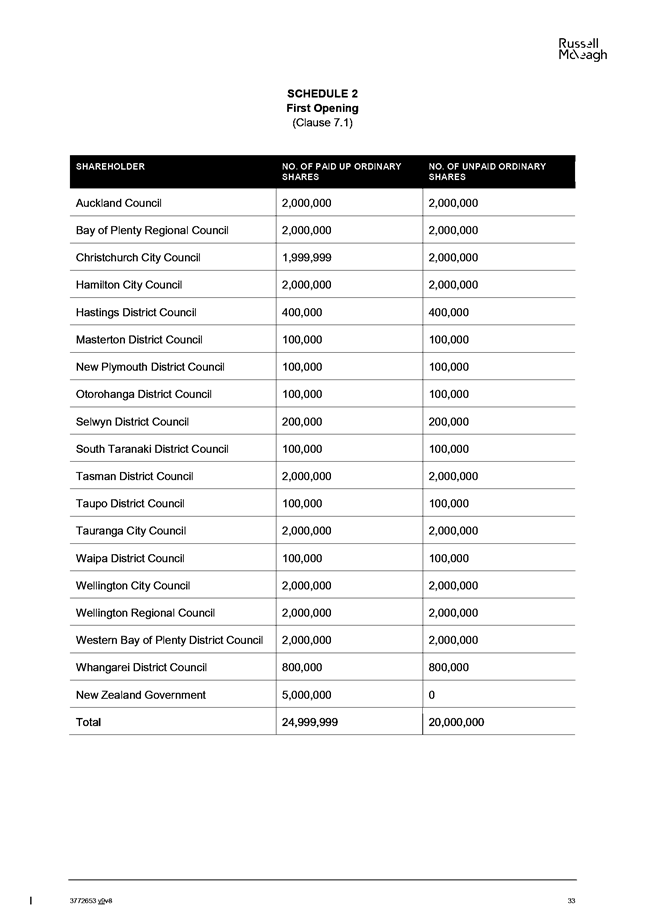

Delegation

2 While

noting that this report is for information, the Strategy and Operations

Committee, with its broad role of financial management, including risk

mitigation, has the delegation to consider this report.

Background

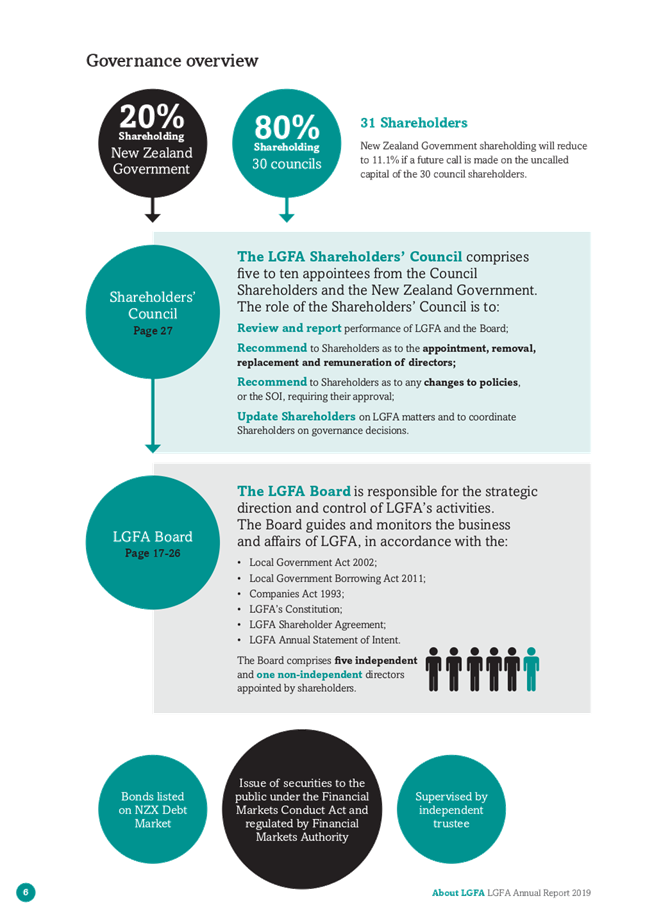

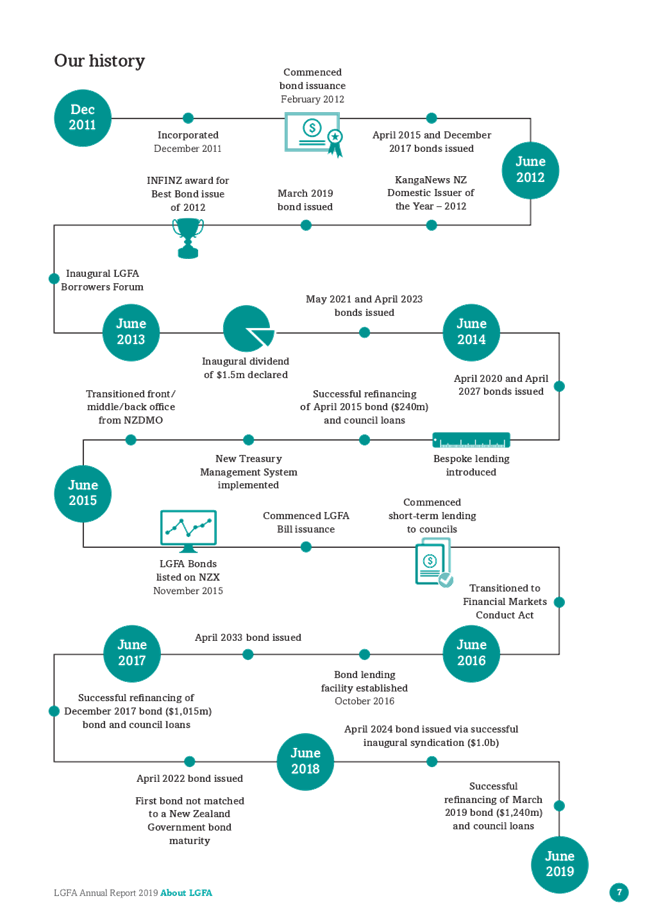

3 The

LGFA was established in December 2011 to provide long-dated borrowing,

certainty of access to markets and to reduce the borrowing costs for the local

government sector. On 30 November 2012, the Council became a Principal

Shareholding Local Authority in the LGFA.

4 The

LGFA issues bonds to wholesale and retail investors and on-lends the funds

raised to participating local authorities with borrowing needs. The quality of

the LFGA’s credit rating, and the liquidity created by issuing homogenous

local authority paper, ensures that participating councils can raise funds on

better terms than if they were issuing in their own name.

5 The

LGFA meets the Local Government Act (LGA) 2002 definition of a Council

Controlled Organisation (CCO) as one or more local authorities have the right,

directly or indirectly, to appoint 50% or more of the directors.

6 As

a shareholder in a CCO, the Council must regularly undertake performance

monitoring of that organisation to evaluate its contribution to the achievement

of the Council’s desired outcomes.

Issues and Options

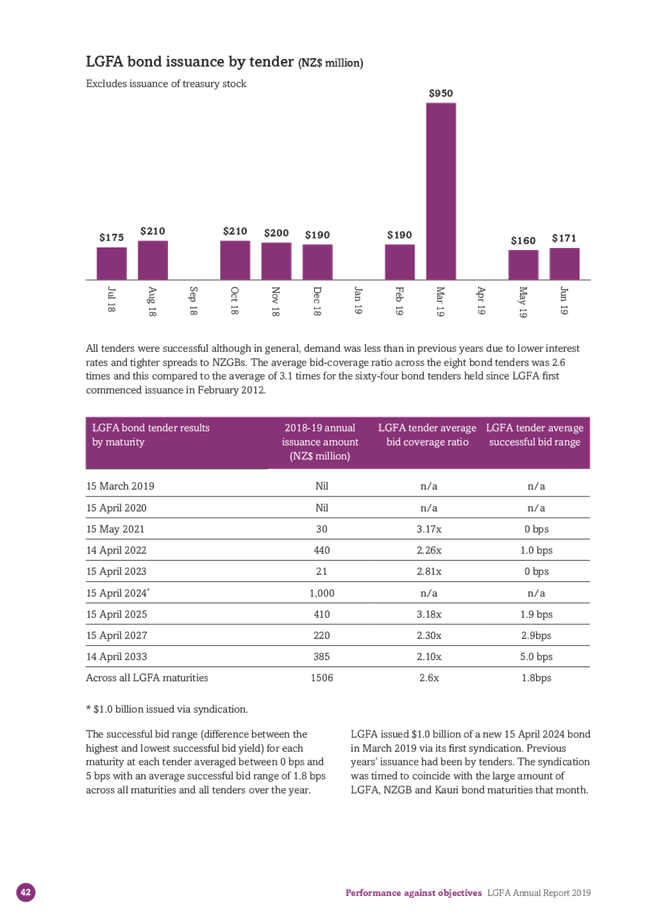

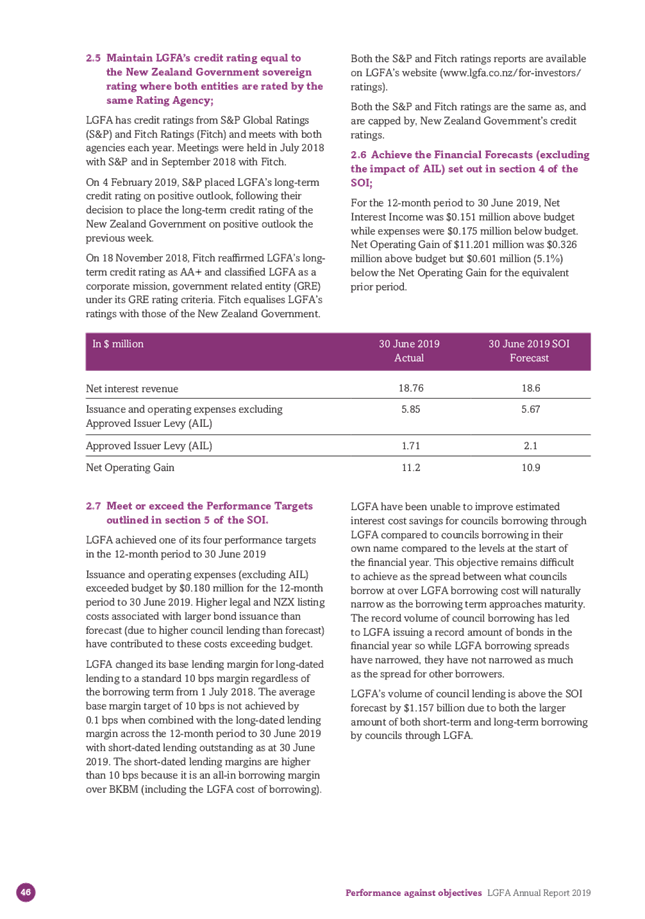

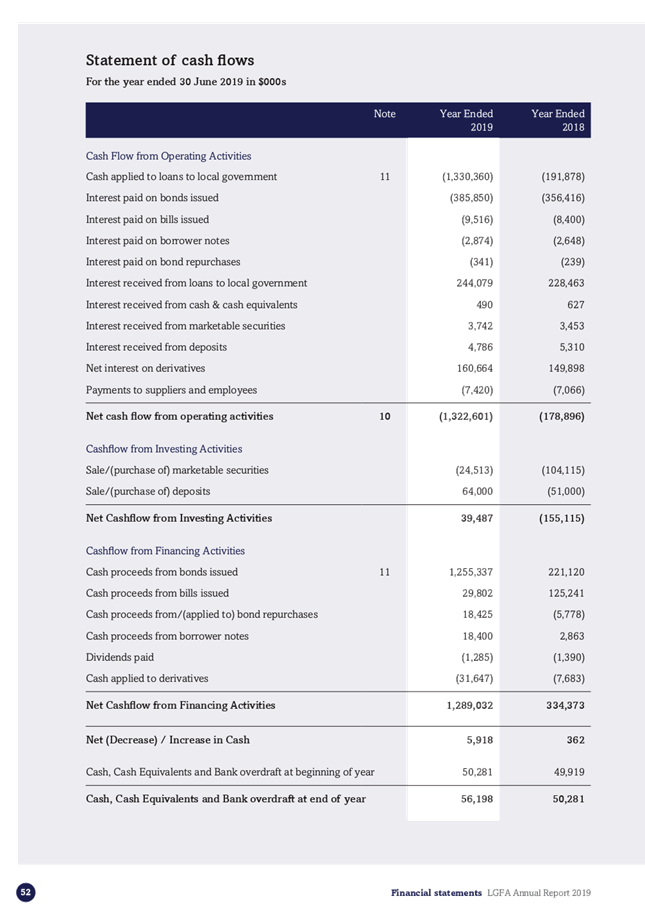

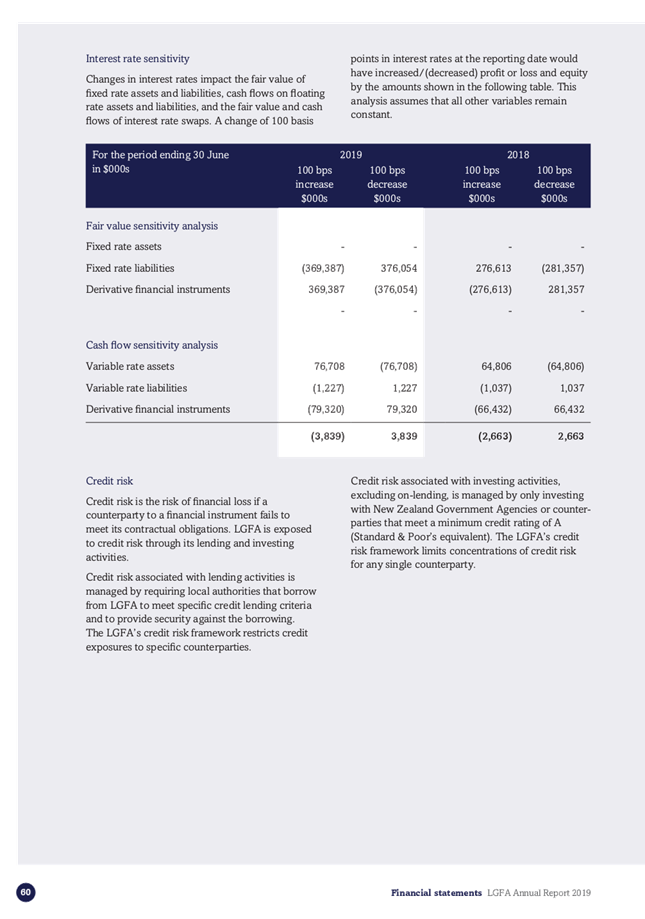

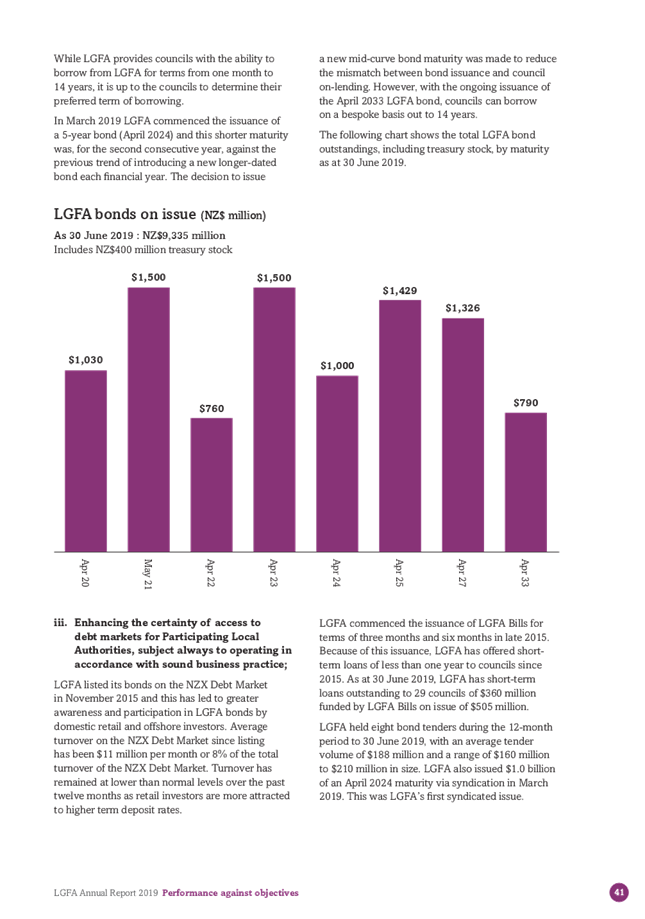

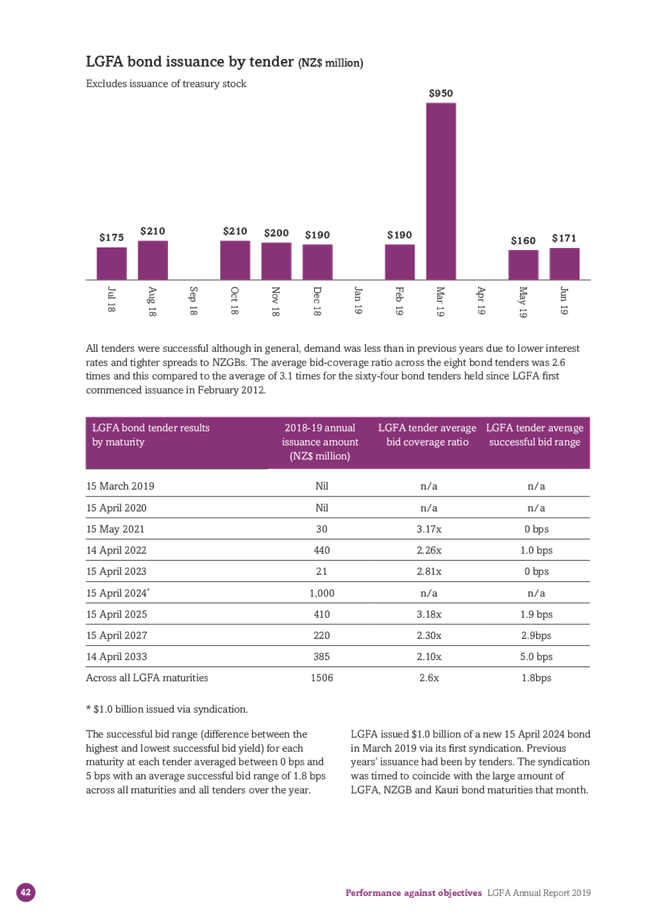

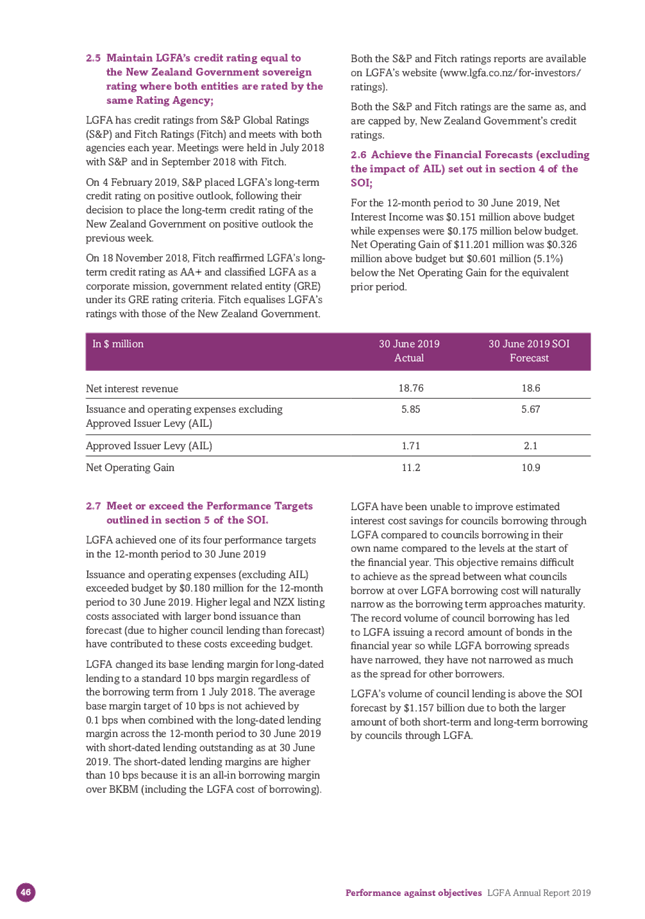

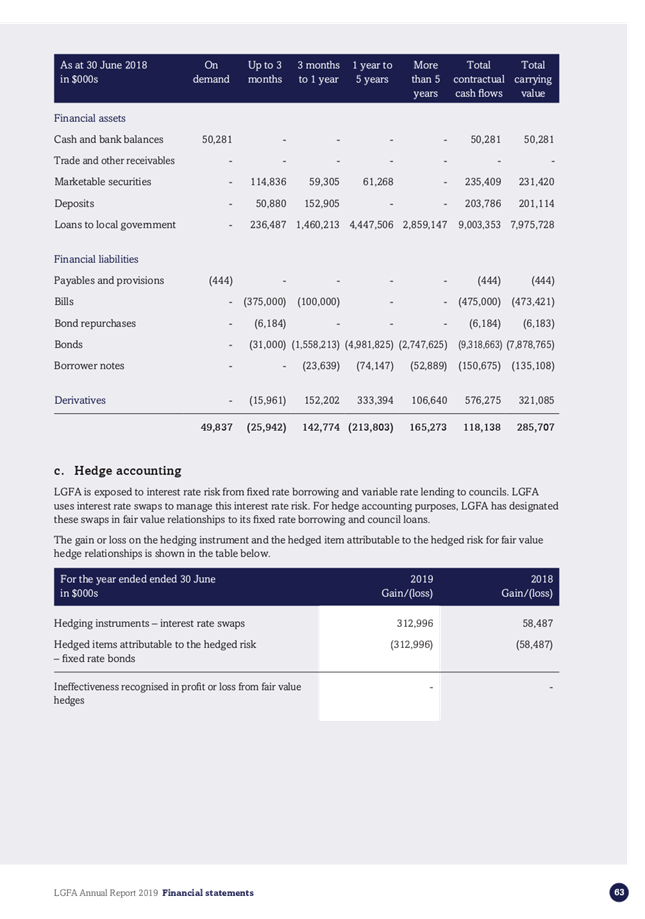

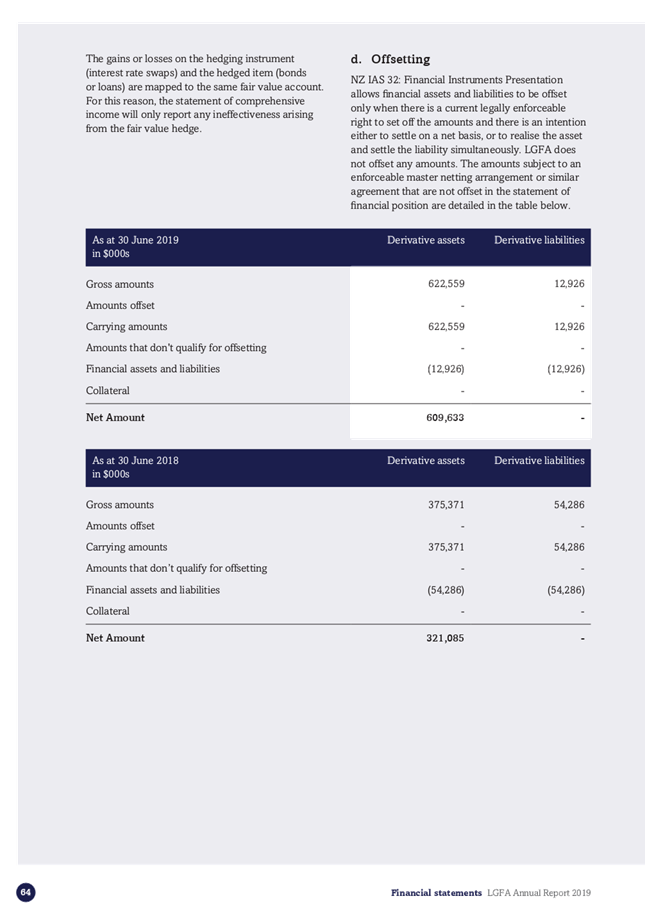

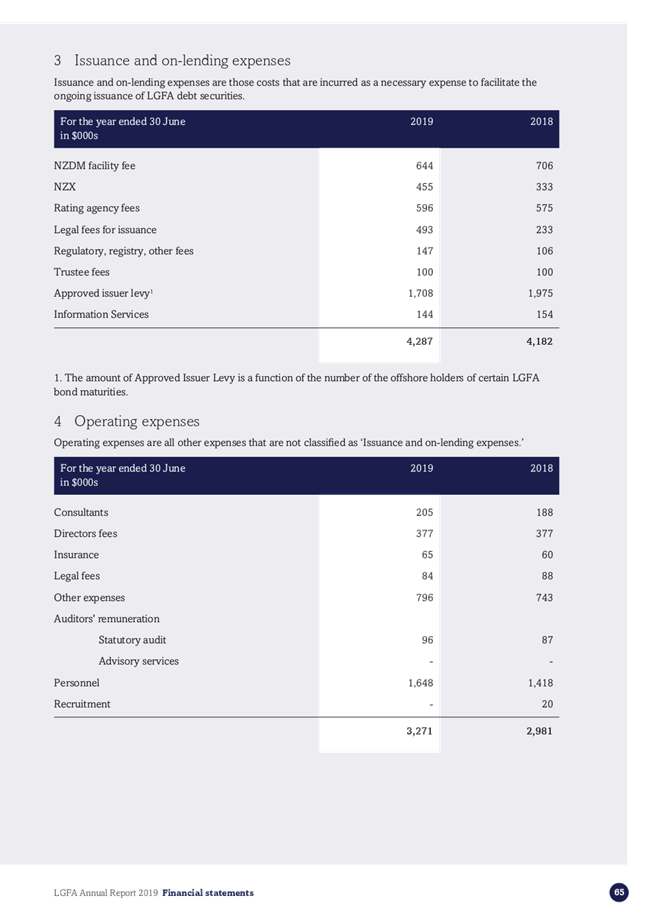

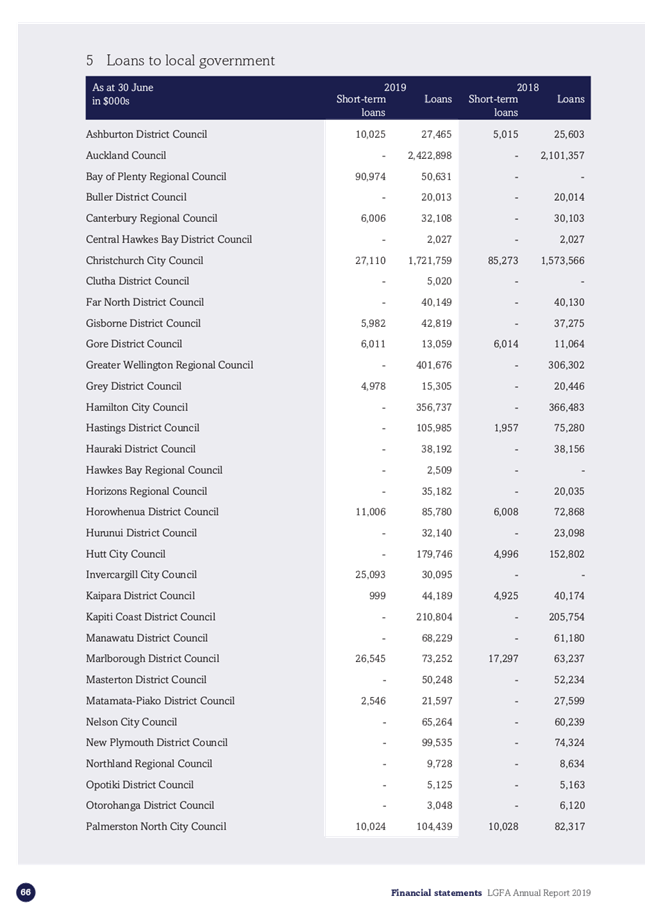

LGFA performance for the 2017/18 year

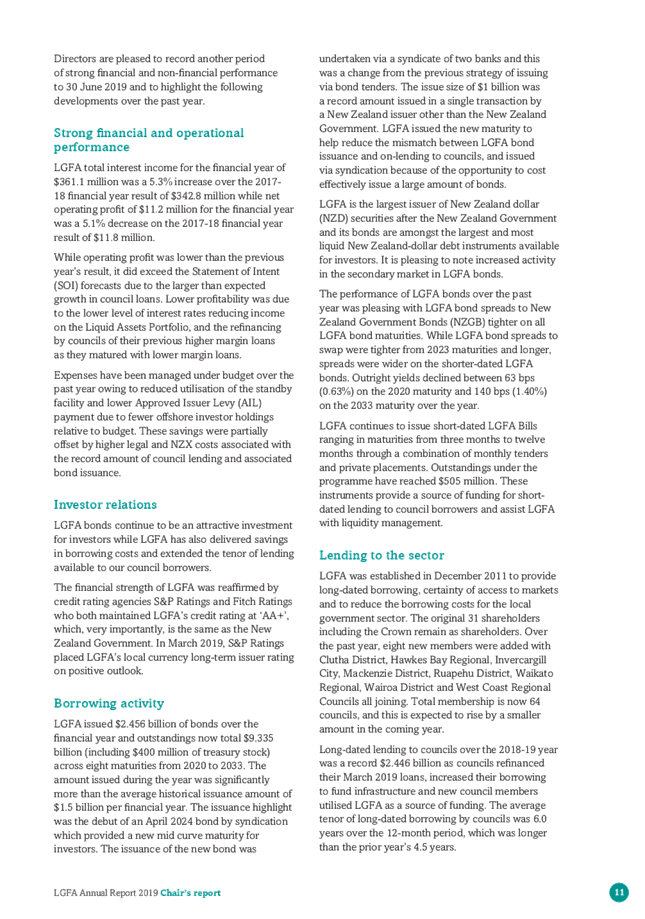

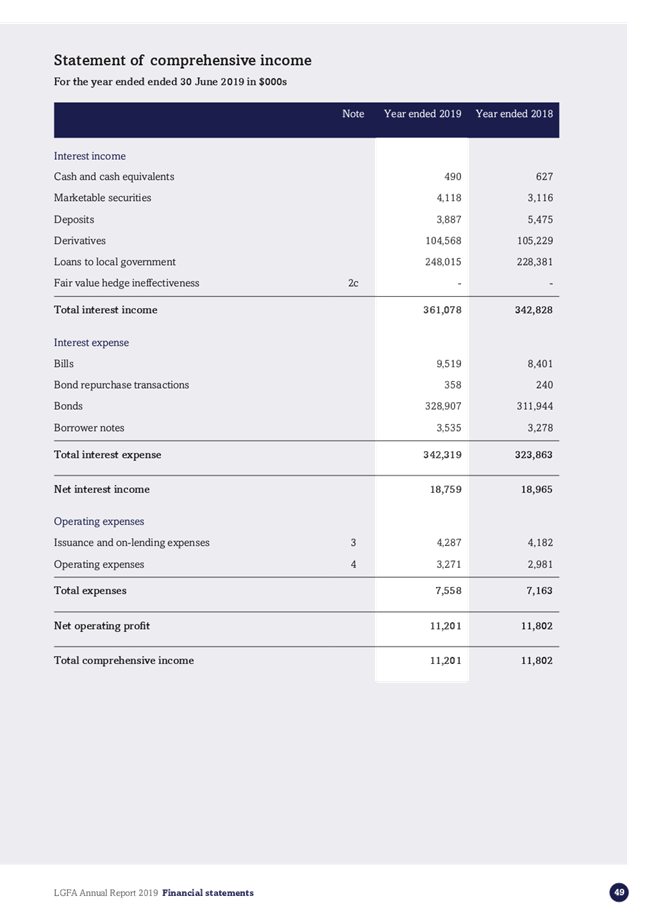

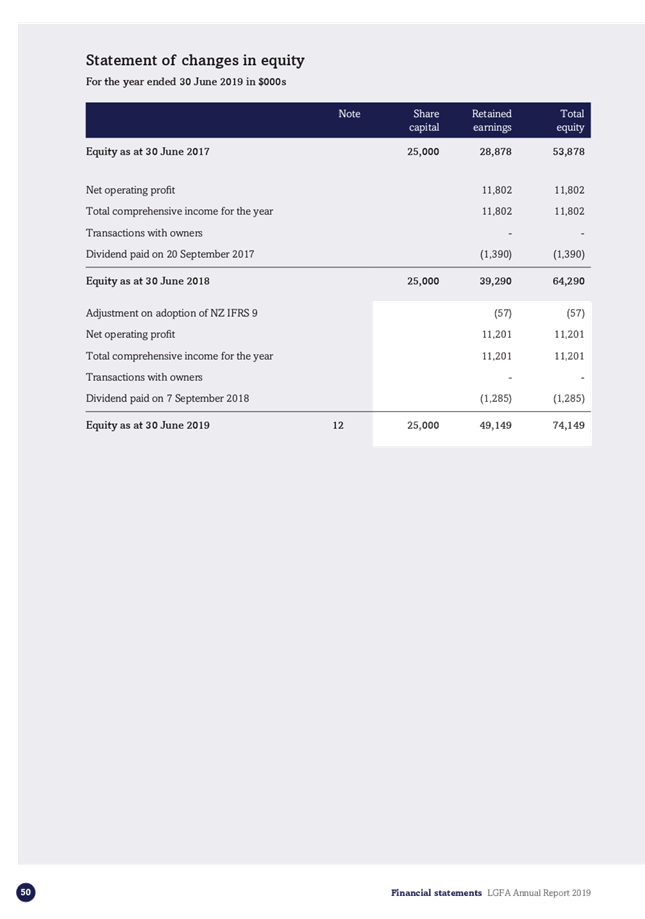

7 LGFA

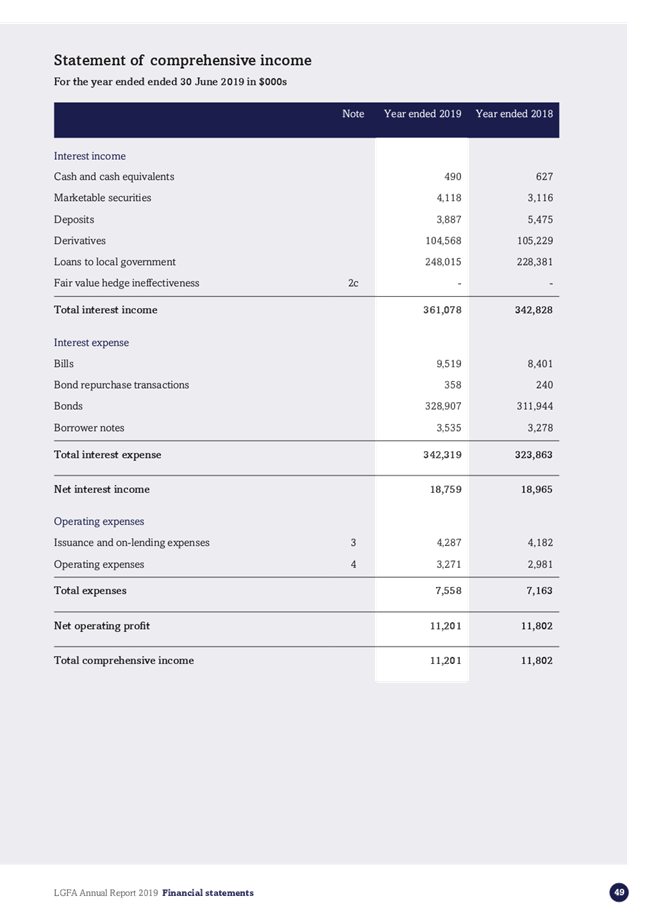

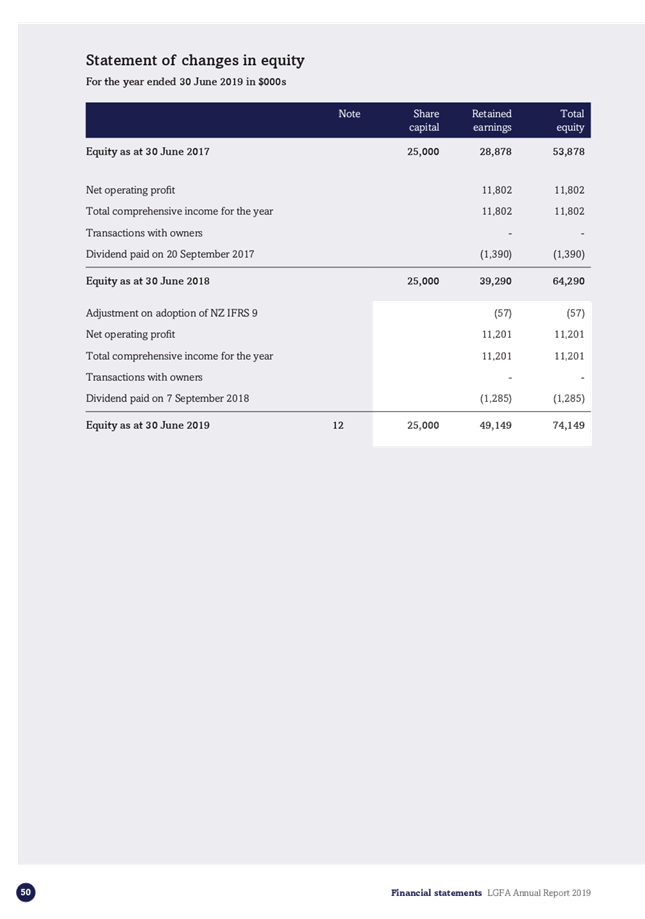

recorded a profit of $11.2 million for 2018/19. While this is significantly

ahead of the budgeted $10.9 million profit it is less than the $11.8 million

profit recorded in 2017/18. Total interest income in 2018/19 was 5.3% higher

than in 2017/18 however total interest expense was 5.7% higher than 2017/18.

8 In

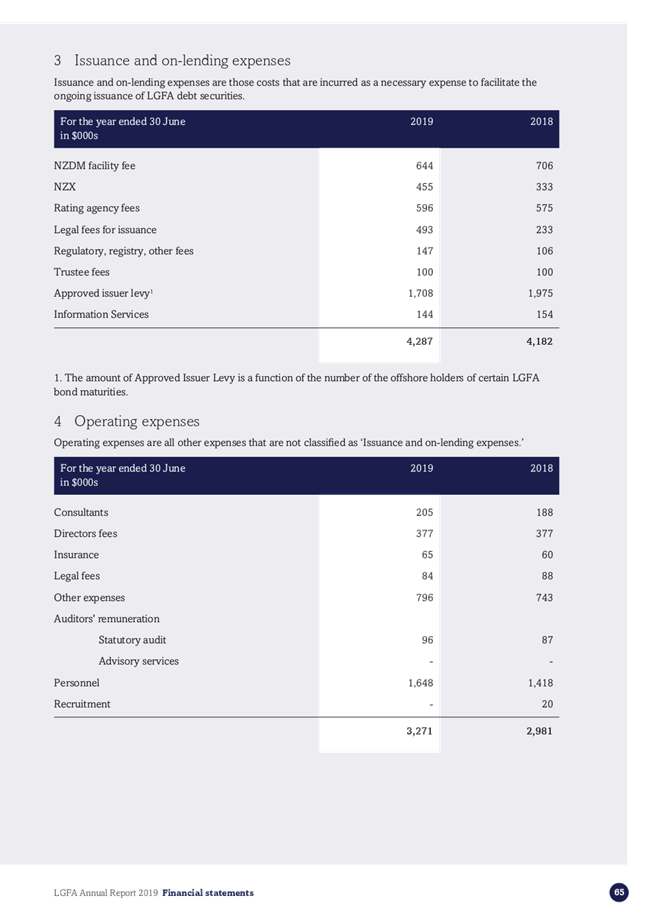

addition, the 2018/19 issuance, on-lending and other operating expenses were

5.5% higher than the previous year. While the percentage variances between the

two years are relatively minor, the overall impact is a profit that is $600,000

less than the previous year and derived from a higher total income.

9 The

LGFA asserts that its lower profitability was due to the lower interest rates

which resulted in lower income for its liquid assets portfolio, and councils

refinancing previously higher margin loans and replacing them with lower margin

loans.

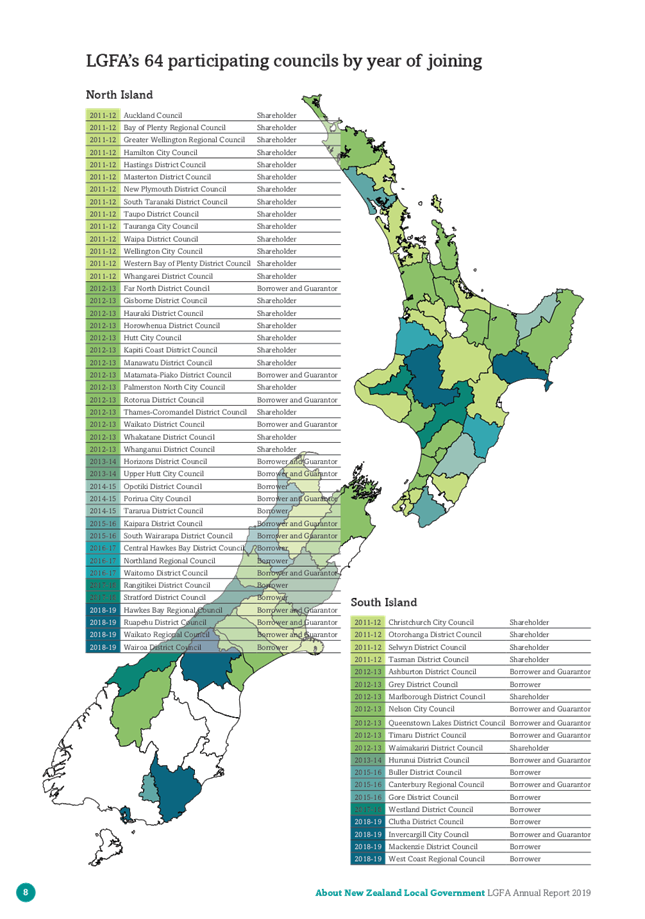

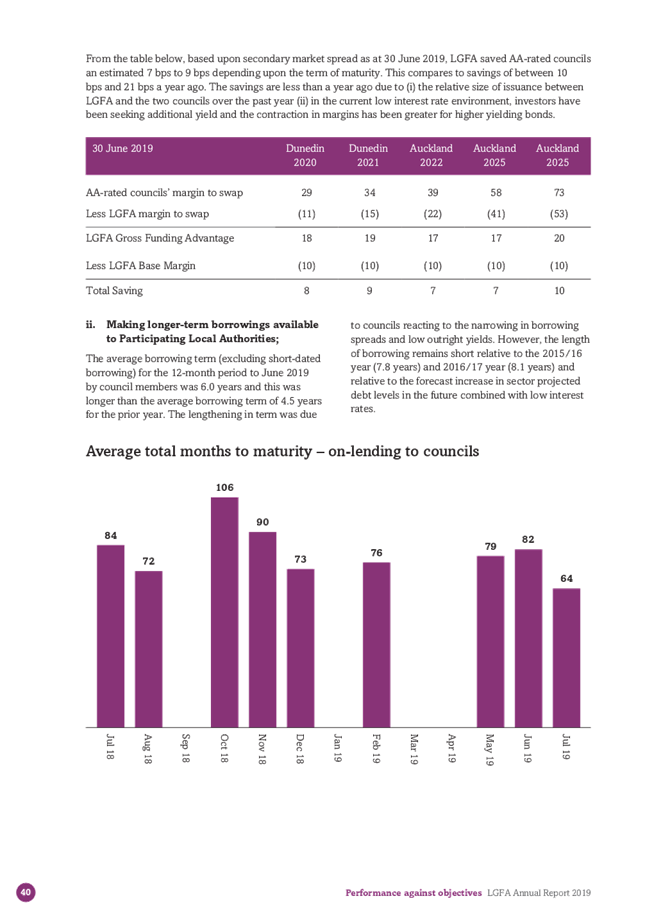

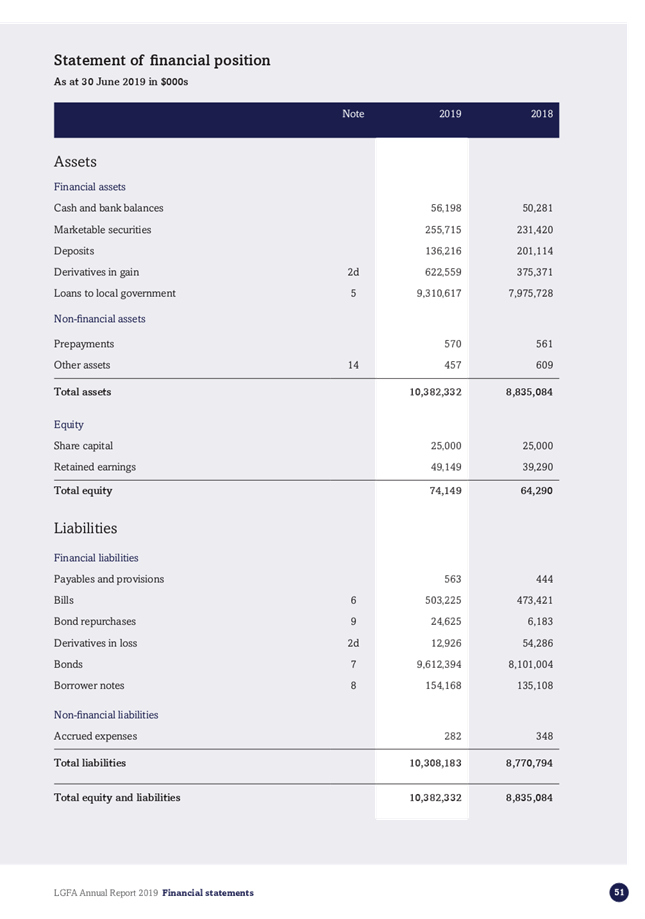

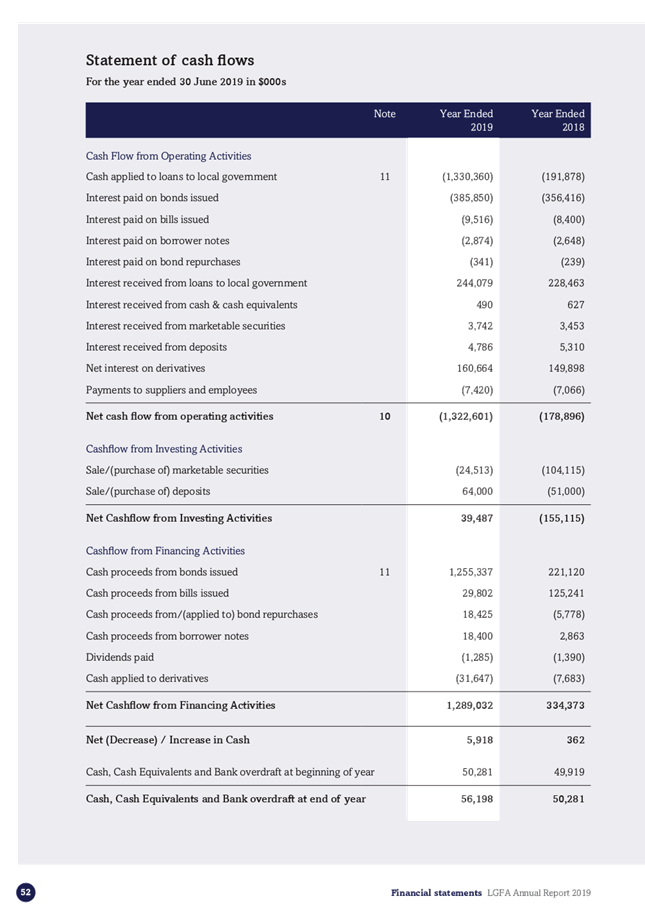

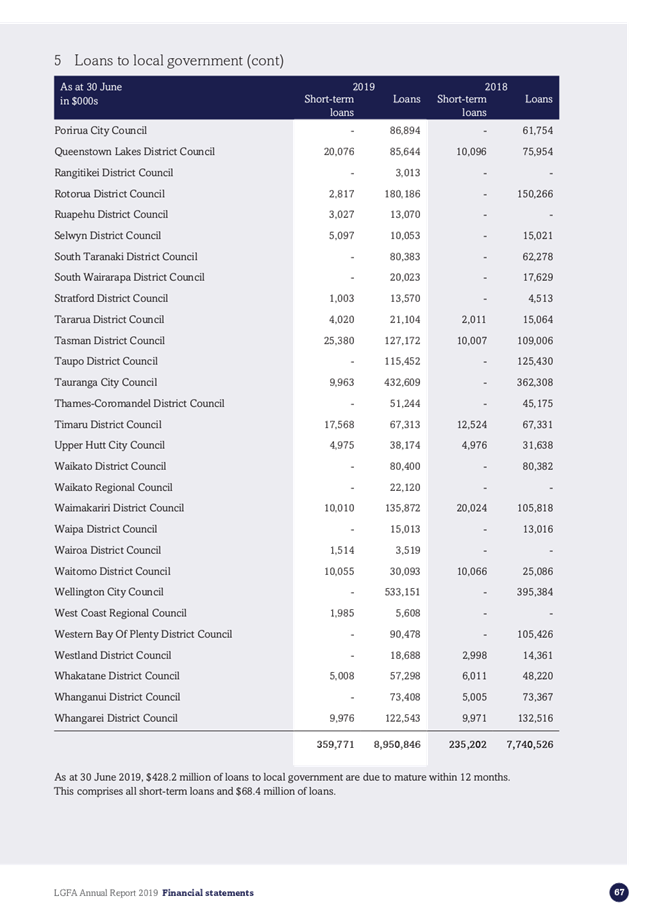

10 The

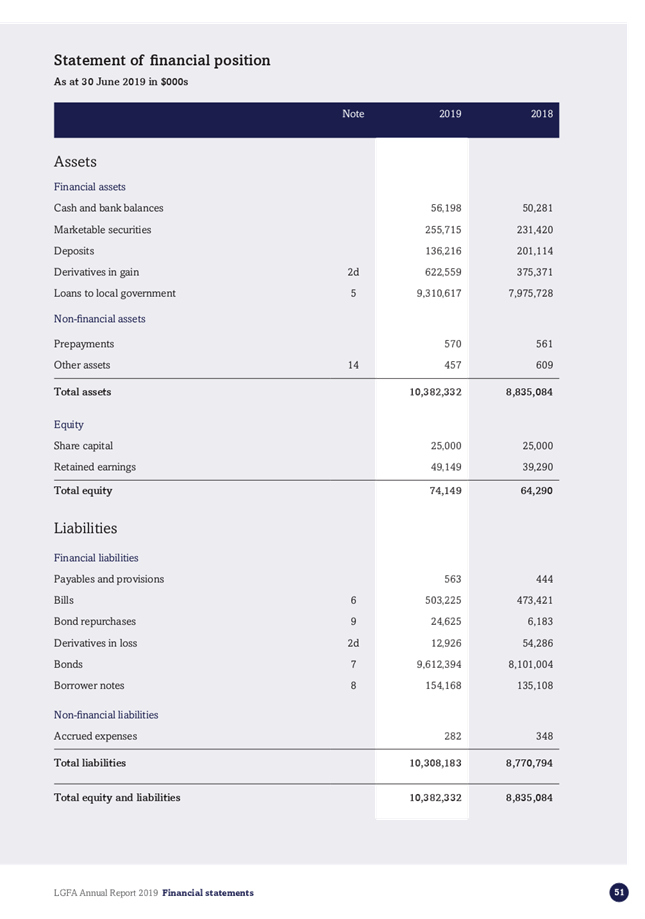

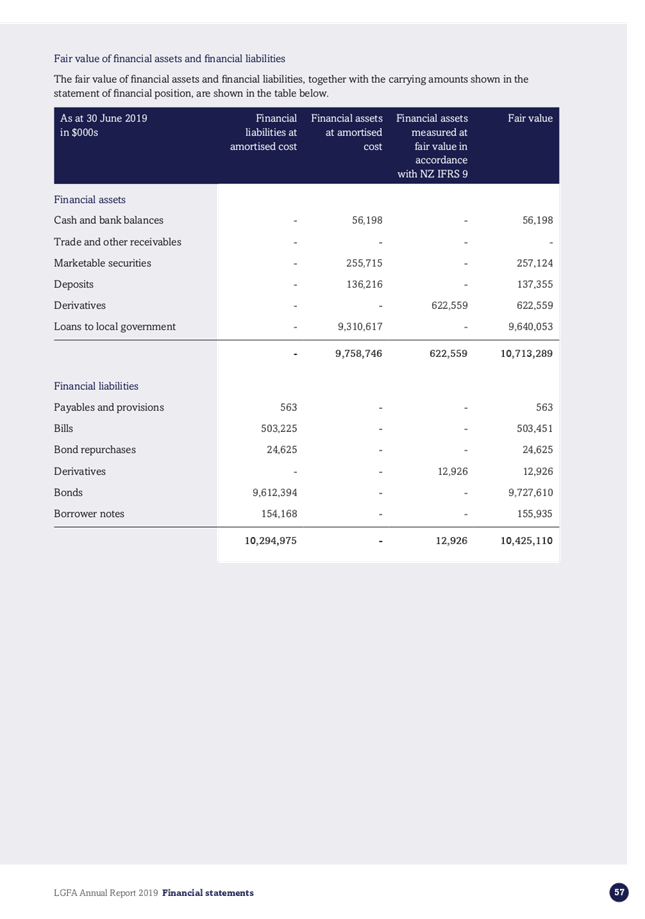

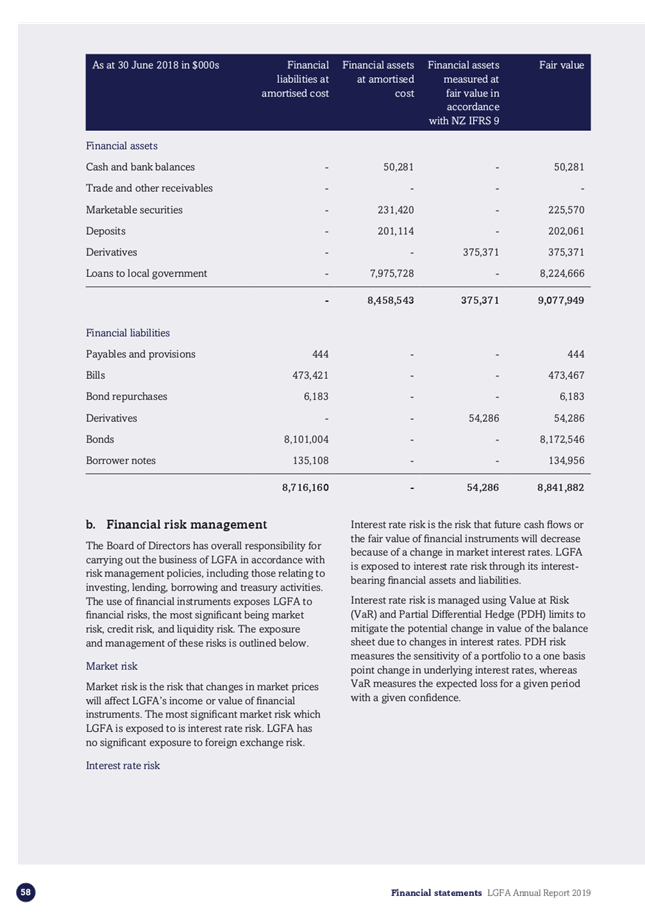

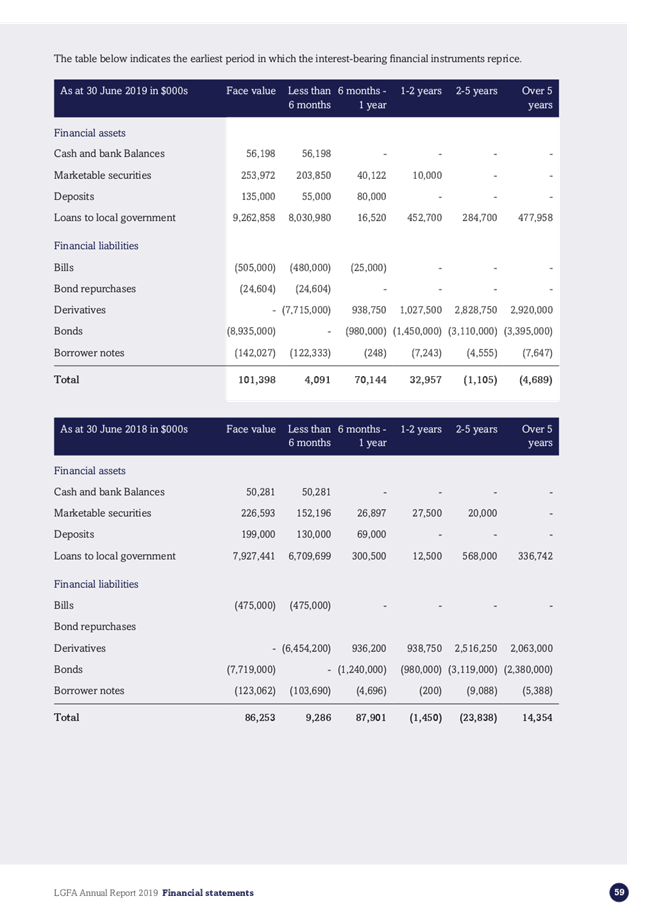

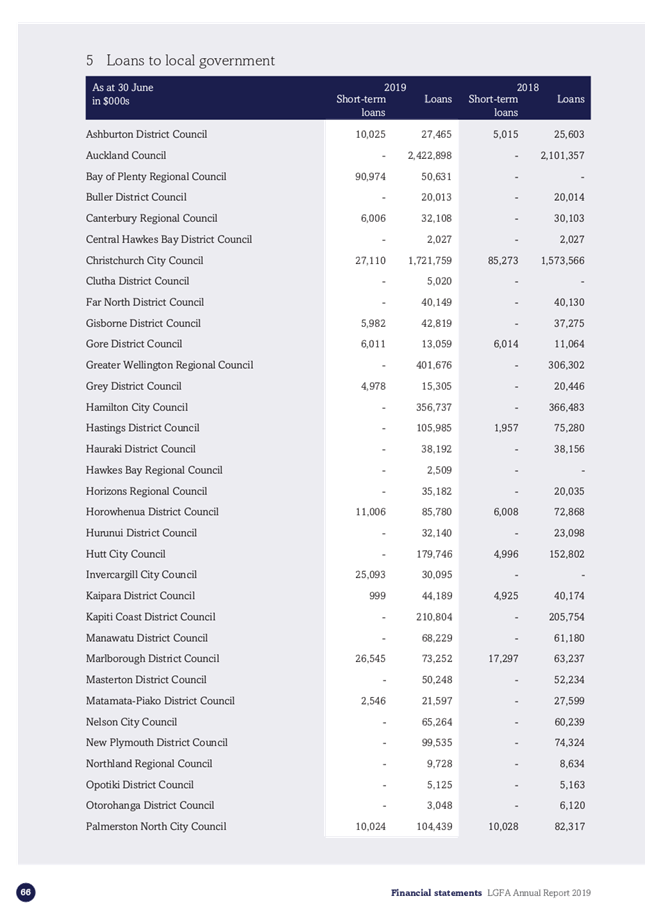

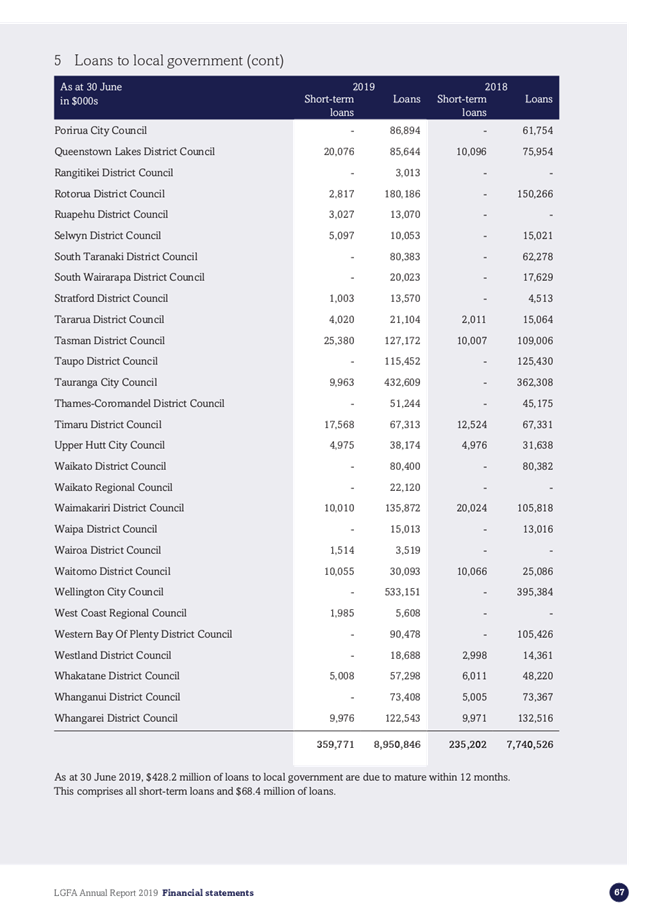

LGFA continues to grow, both in terms of its balance sheet with total loans to

councils reaching $9.31 billion at 30 June 2019 (2018: $7.98 billion) and

participating councils growing from 56 to 64 during the year.

11 Auckland

Council is the LGFA’s largest borrower ($2.4 billion), followed by

Christchurch City Council ($1.7 billion). As at 30 June 2019, Kāpiti Coast

District Council ranked as the 7th largest borrower with $210.8

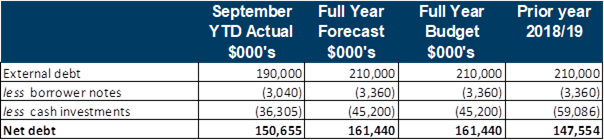

million in gross borrowings. Net borrowings, taking account of cash, borrower

notes and term deposits to prefund borrowings was $147.6 million as at

30 June 2019.

12 The

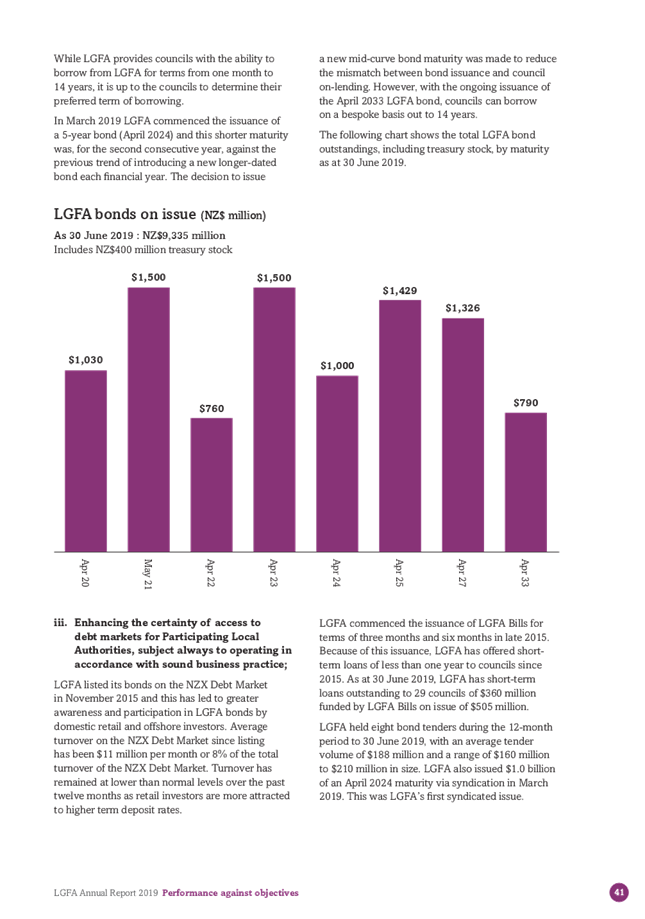

LGFA has a number of primary objectives including making longer-term borrowings

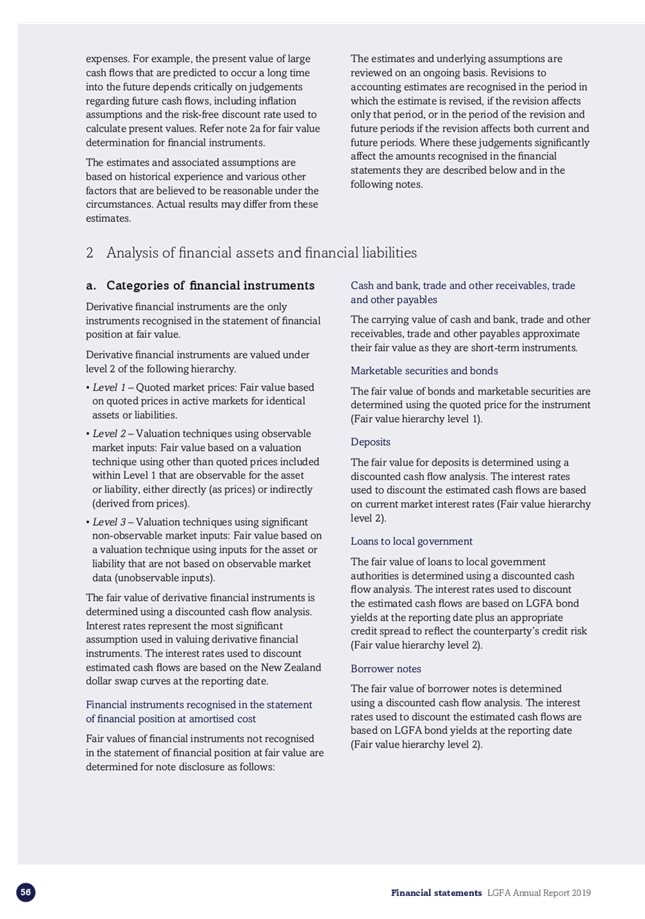

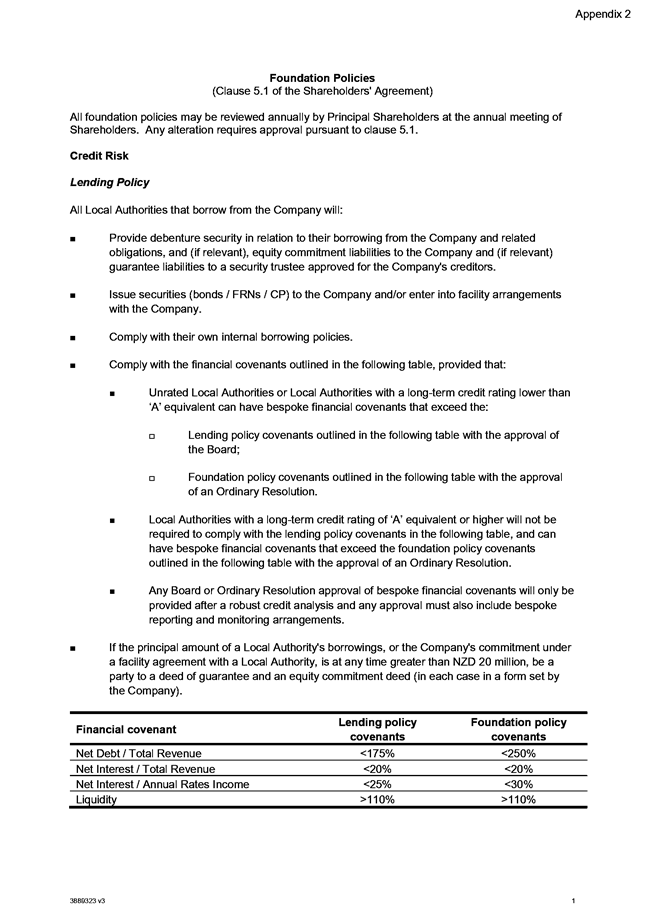

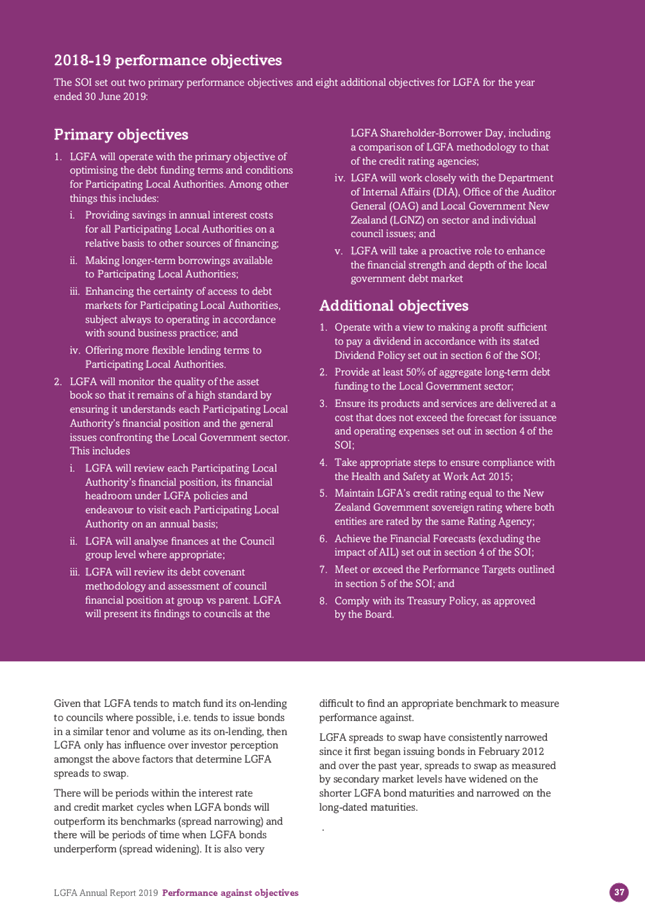

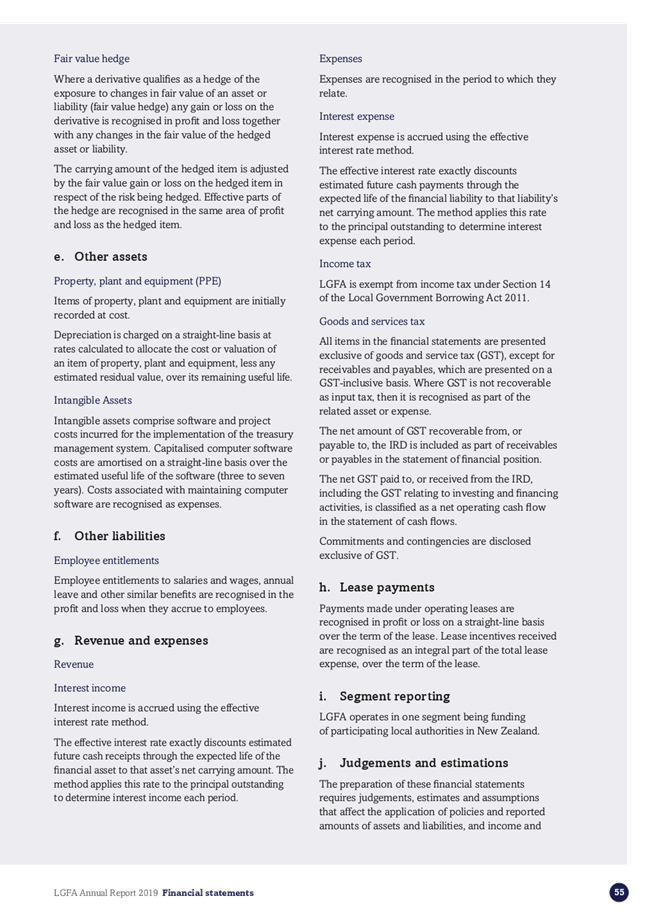

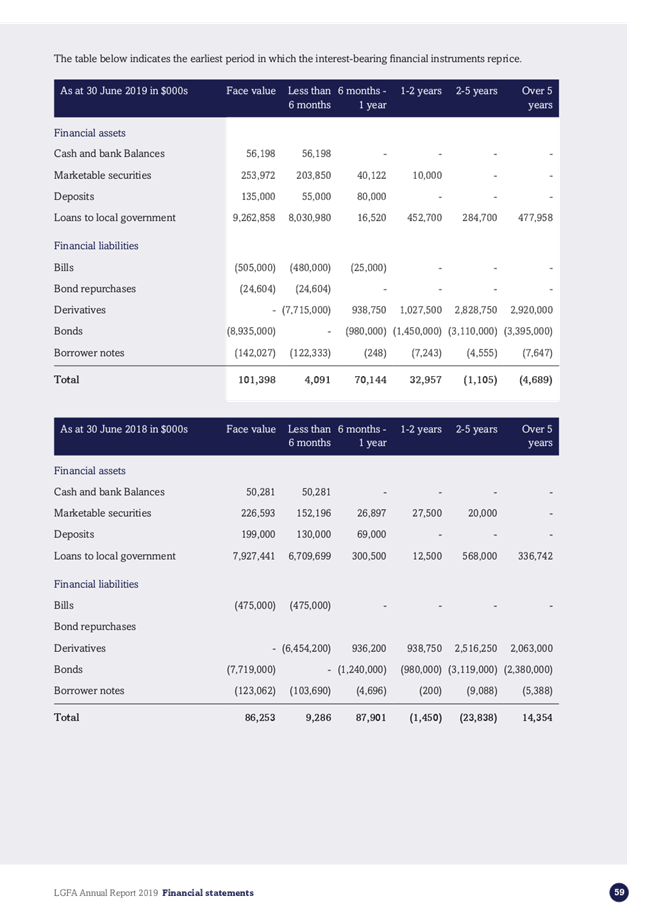

available, offering flexible lending and enhancing the certainty of access to

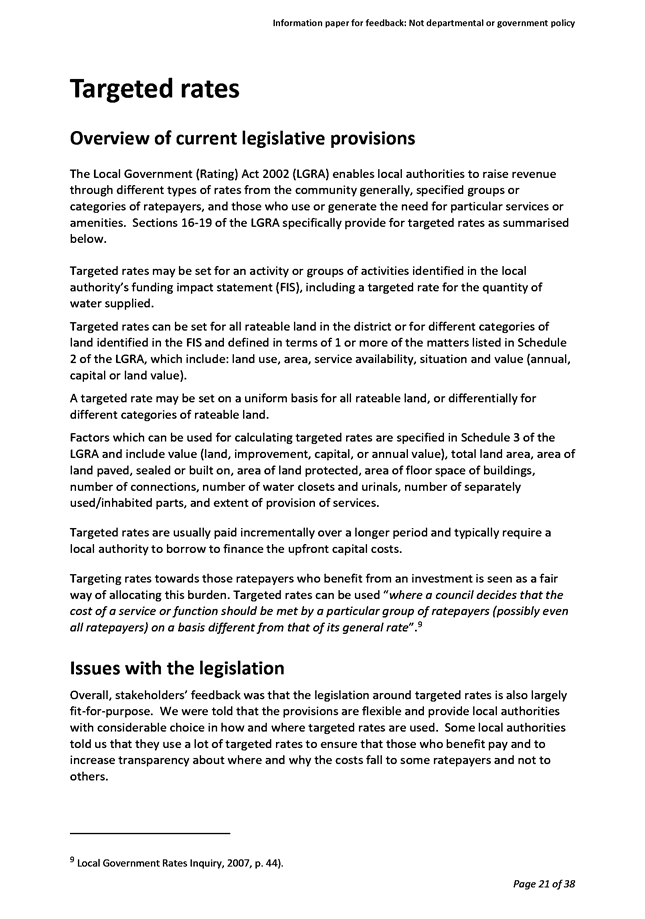

debt markets. The table below shows the LGFA’s results against its key

performance:

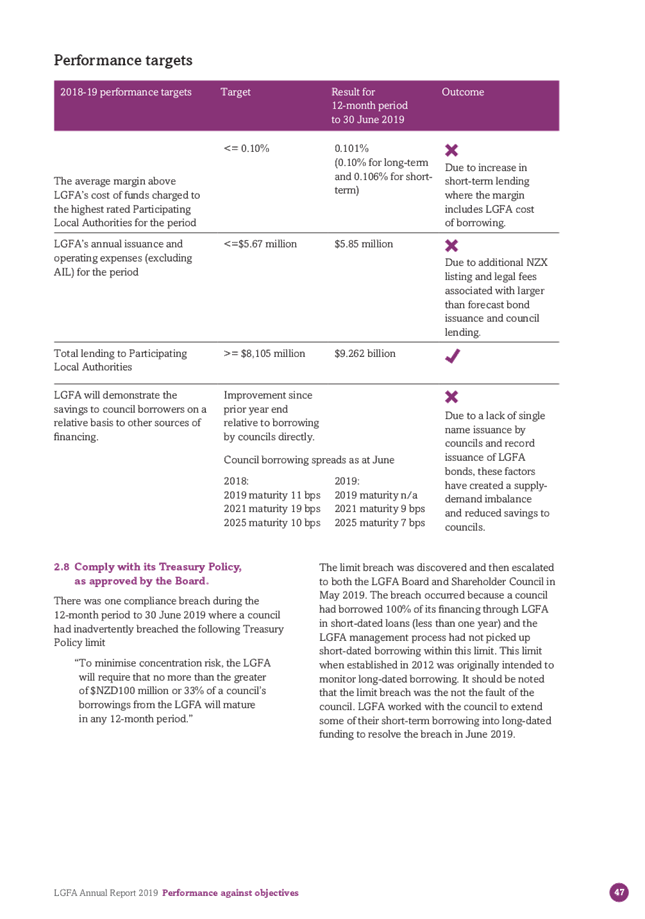

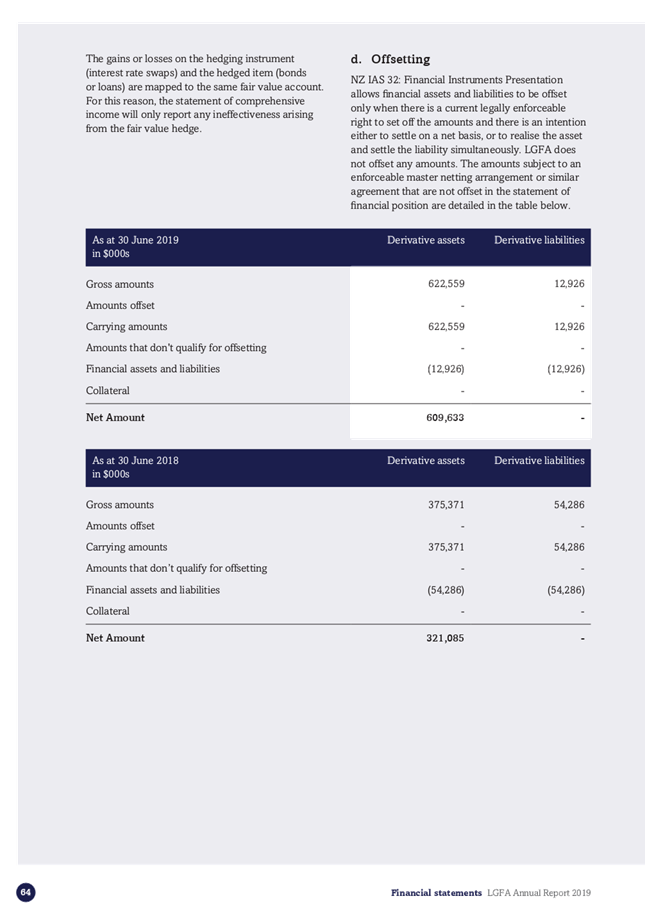

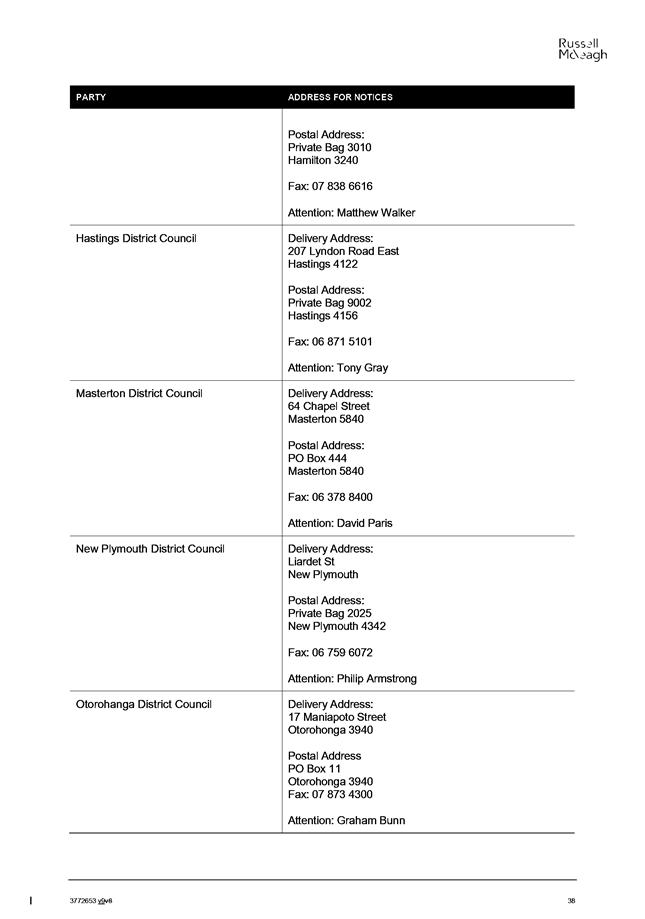

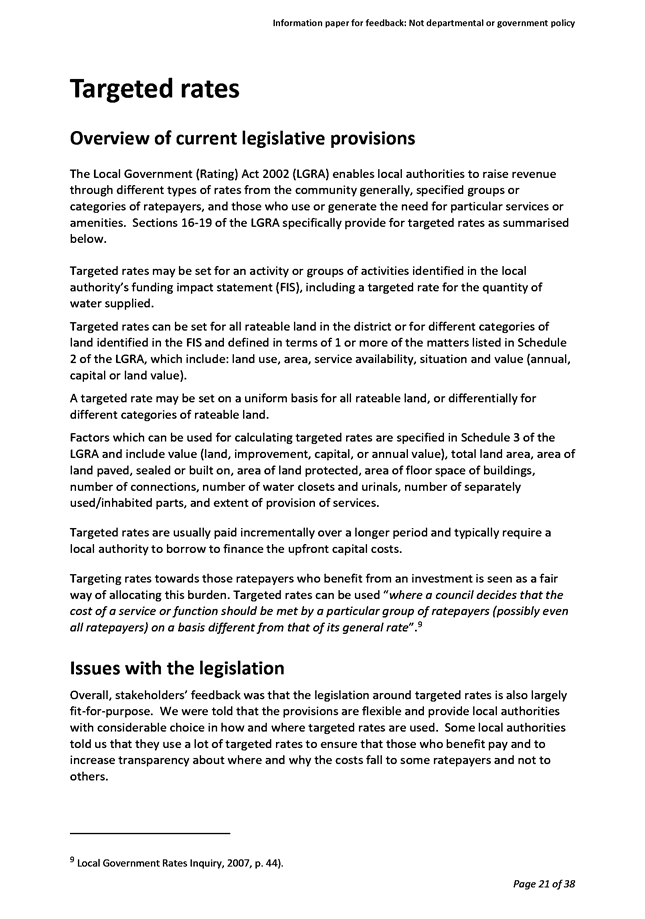

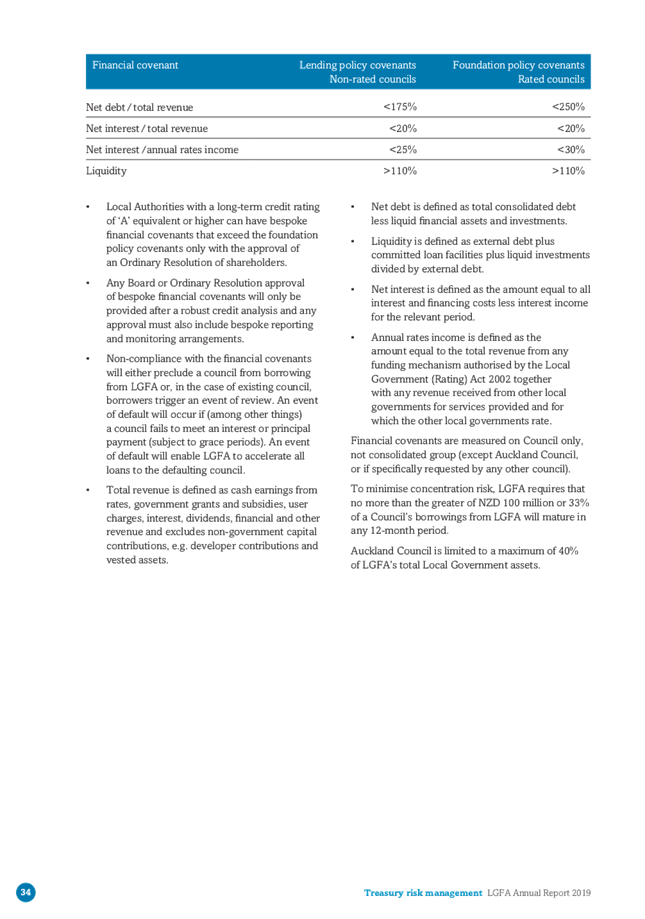

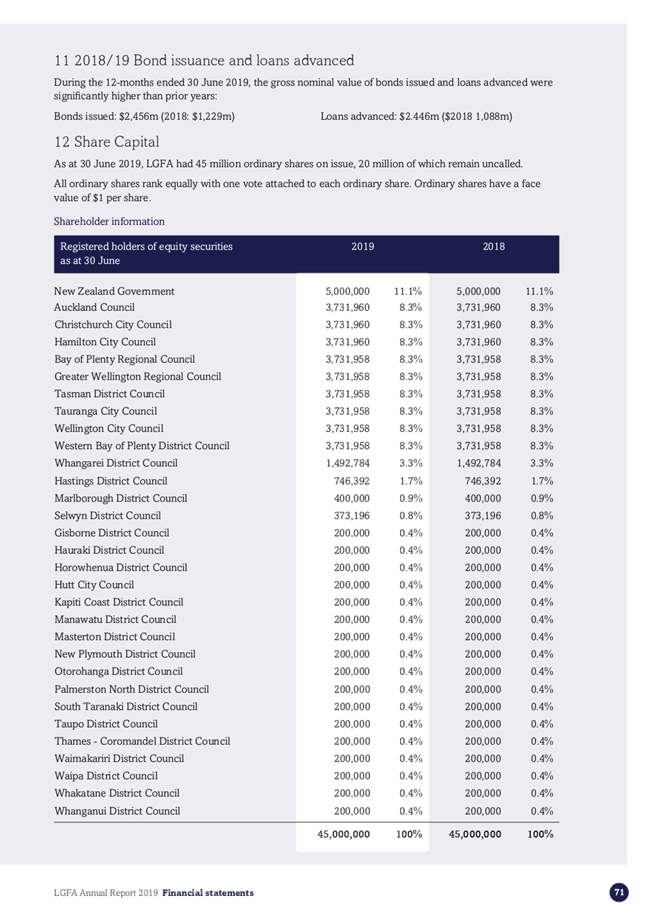

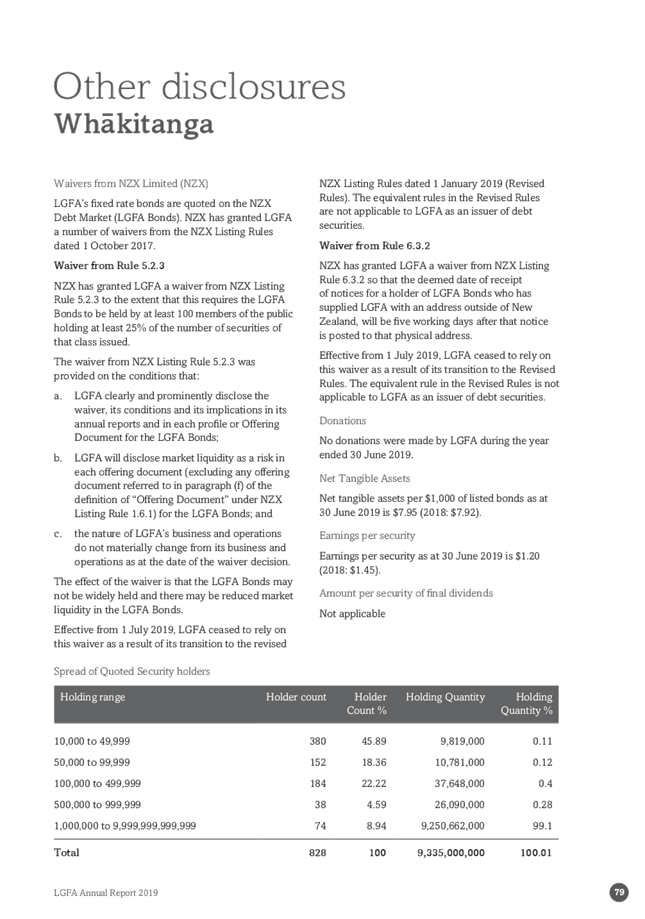

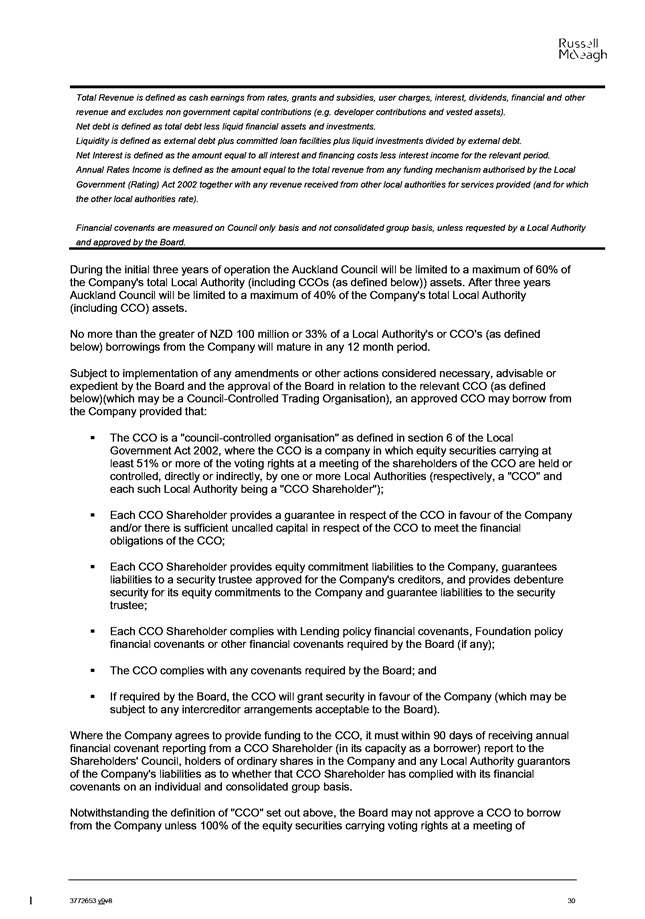

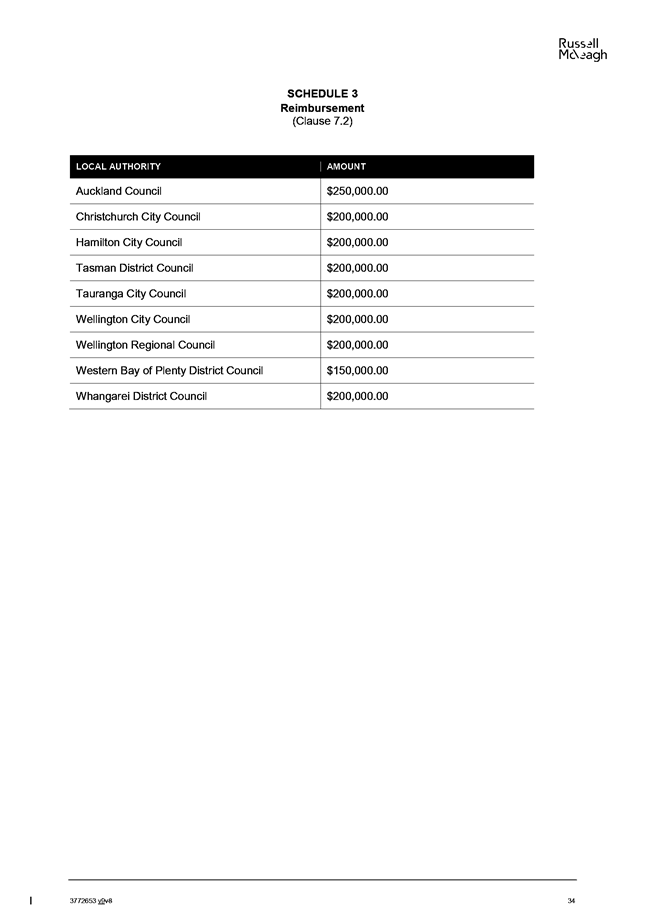

|

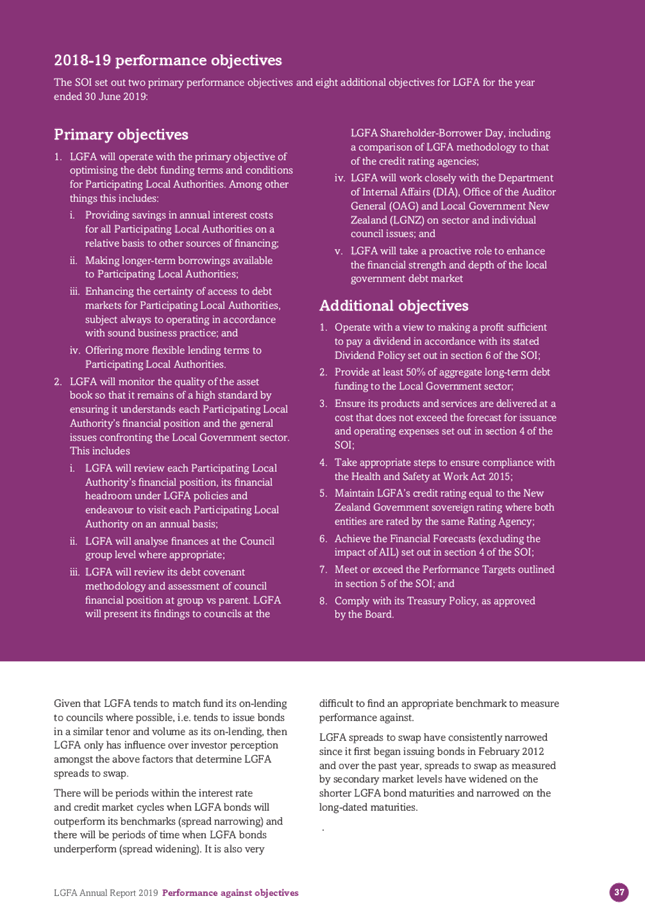

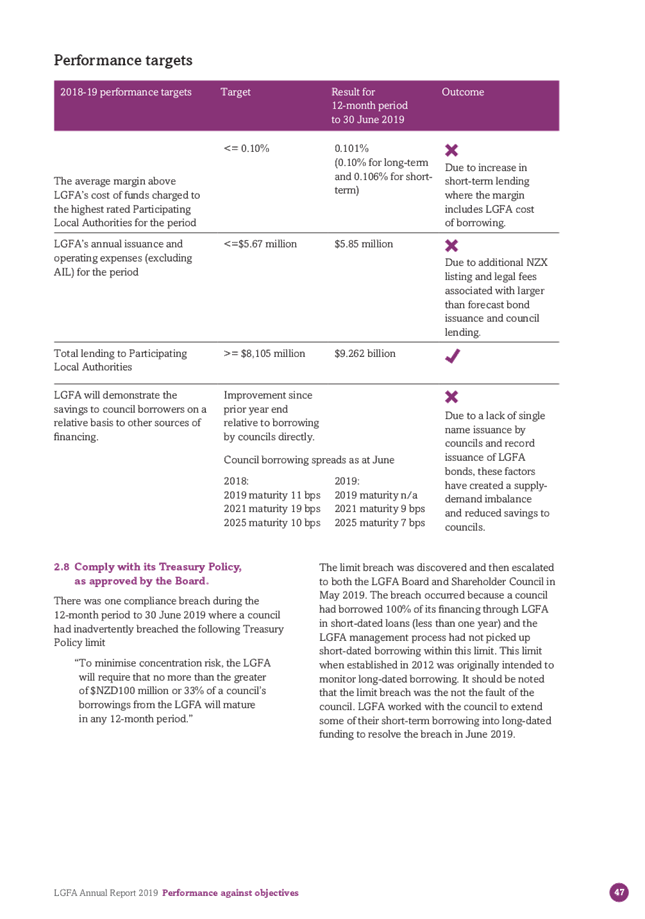

2018-19 performance targets

|

Target

|

Result for 12-month period to 30 June 2019

|

Outcome

|

|

The average margin above LGFA’s cost of funds

charged to the highest rated Participating Local Authorities for the period

|

<= 0.10%

|

0.101%

(0.10% for long-term and 0.106% for short-term)

|

r

Due to increase in short-term lending where the margin

includes LGFA cost of borrowing.

|

|

LGFA’s annual issuance and operating expenses

(excluding AIL) for the period

|

<= $5.67 million

|

$5.85 million

|

r

Due to additional NZX listing and legal fees

associated with larger than forecast bond issuance and council lending.

|

|

Total lending to Participating Local Authorities

|

>= $8.105 billion

|

$9.262 billion

|

a

|

|

LGFA will demonstrate the savings to council borrowers

on a relative basis to other sources of financing.

|

Improvement since prior year end relative to borrowing

by councils directly.

|

|

r

Due to a lack of single name issuance by councils and

record issuance of LGFA bonds, these factors have created a supply-demand

balance and reduced savings to councils.

|

|

Council borrowing spreads as at June

|

|

2018:

2019 maturity 11 bps

2021 maturity 19 bps

2025 maturity 10 bps

|

2019:

2019 maturity n/a

2021 maturity 9 bps

2025 maturity 7 bps

|

13 As

can be seen, the LGFA has only achieved one of its four key performance

targets. It’s likely that the most important performance measure for all

the LGFA’s borrowers is providing annual interest costs to Participating

Local Authorities (PALs) on a competitive basis compared to other sources of

finance.

14 There

was also a compliance breach during the year when one of the council borrowers

exceeded the concentration risk control measure of its total borrowings from

the LGFA not exceeding the greater of, $100 million or 33%, of its total

borrowings in a 12-month period. The breach arose through the council using

100% short-term borrowings which was not picked up by the LGFA management

processes which had been set up to manage long-term borrowings. The situation

was quickly addressed and the LGFA processes updated to incorporate the

increasing uptake of short-term borrowing by councils.

15 The

LGFA undoubtedly provides savings to councils and seeks to incorporate

comprehensive risk and financial management systems into its operations. The

compliance breach and the lower than perhaps expected profit are not

significant concerns but they do highlight the importance of the

Council’s ongoing monitoring of the organisation.

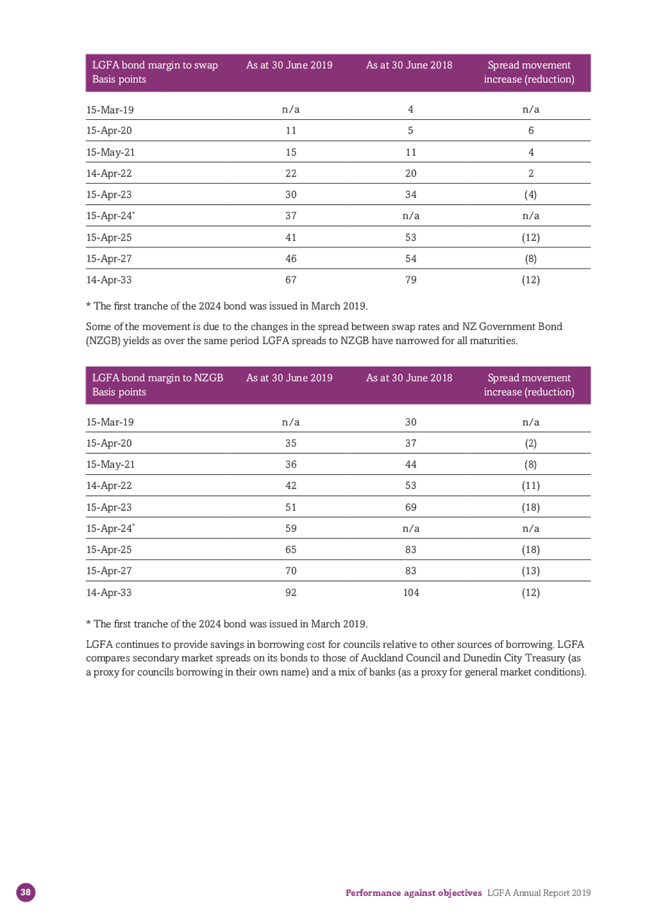

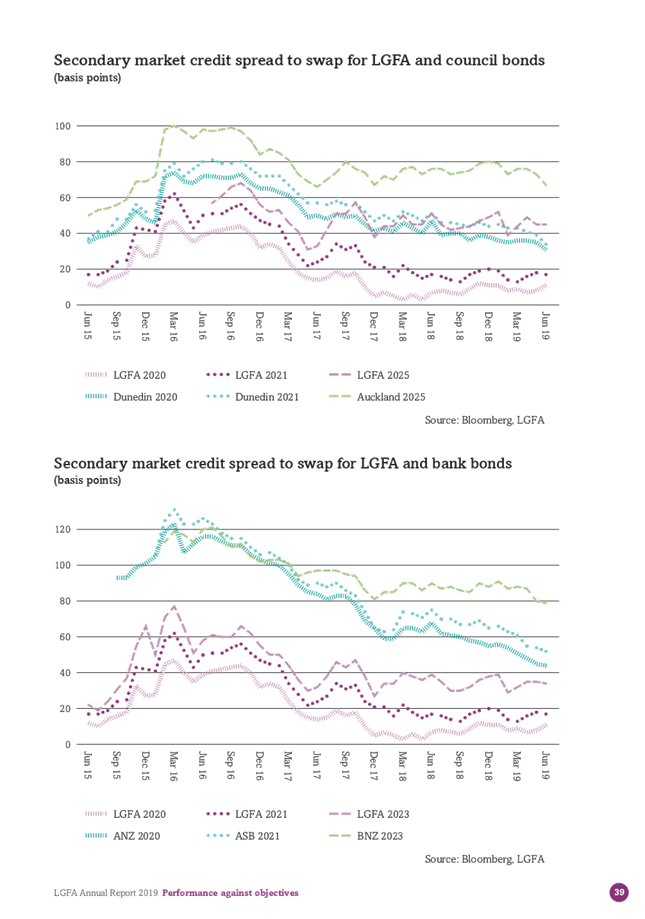

16 The

LGFA estimates that as at 30 June 2019, it was saving AA-rated councils between

7 and 9 basis points (bps) depending upon the term of the maturity. The

Kāpiti Coast District Council has recently received an upgraded Standard

and Poor’s credit rating of AA. Based on the Council’s LGFA loans

of 210.8 million as at June 2019, a 7bps saving equates to around $147,000 per

year.

17 From

the perspective of the Kāpiti Coast District Council, the LGFA has

provided borrowing with interest rates and lending terms that have enabled the

Council to meet its financial objectives and to stay within its financial

targets.

18 The

full LGFA 2018/19 Annual Report is attached as Appendix 1.

Considerations

Policy

considerations

19 In

accordance with the LGA 2002, the Council must provide information on all of

its CCOs in its Long Term Plan (LTP). Accordingly, the Council’s 2018-38

LTP contains information on the LGFA, including key performance targets and

other performance metrics

Legal

considerations

20 There

are no legal considerations arising from the matters in this report.

Financial

considerations

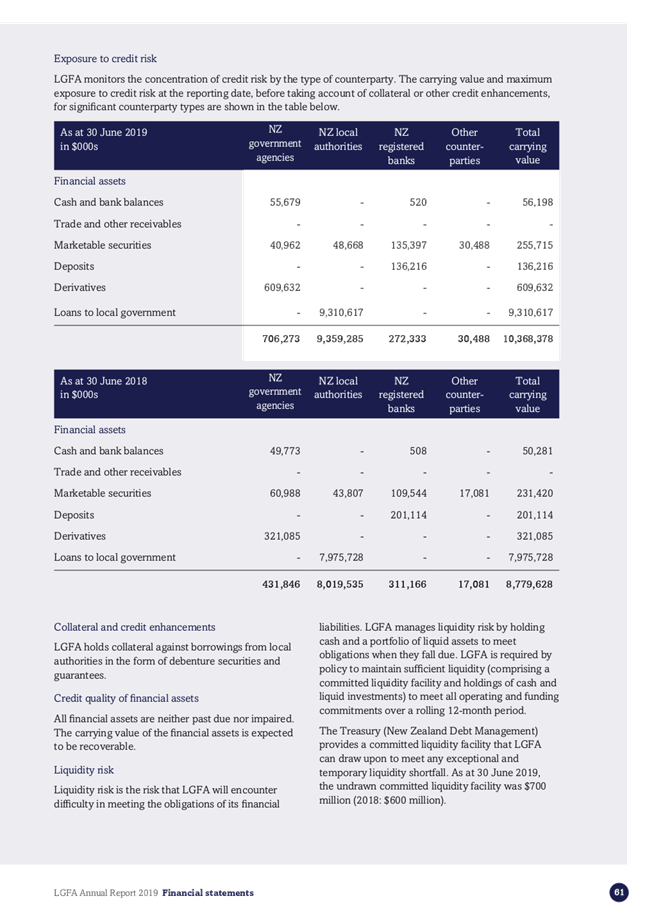

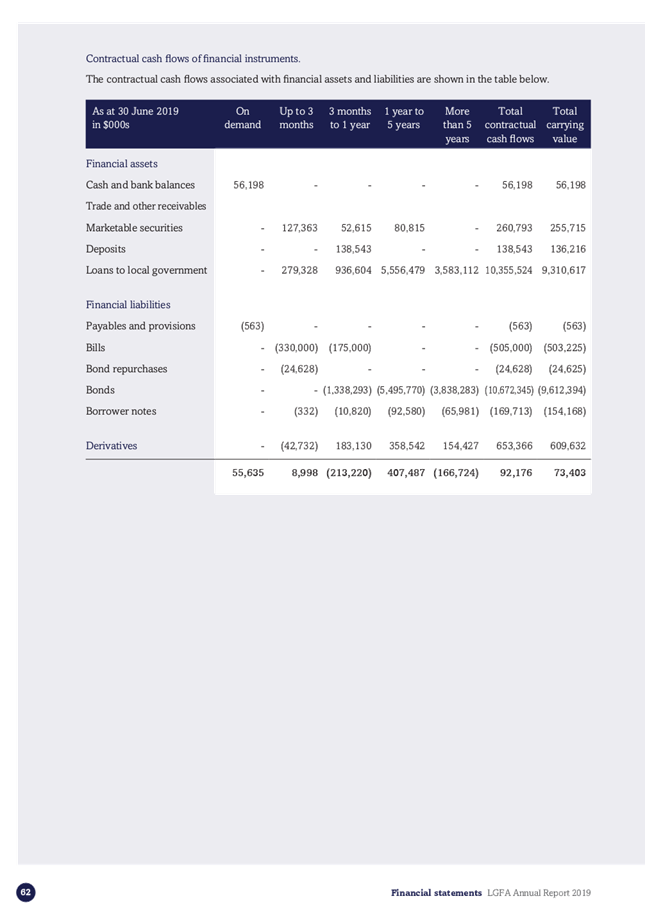

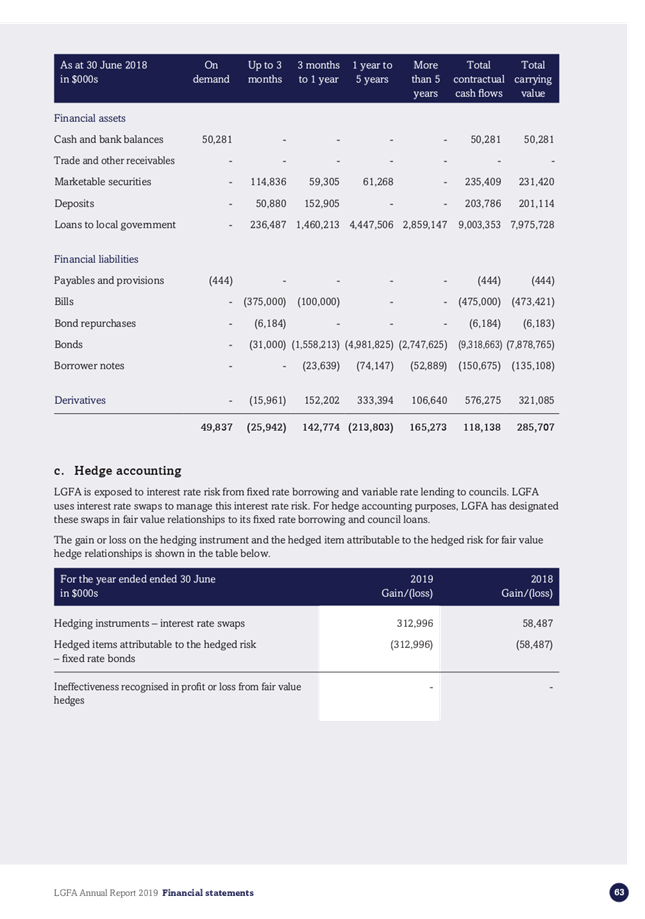

21 Council

is one of 31 local authority shareholders of the LGFA and has an obligation in

respect of uncalled capital of $100,000.

22 At

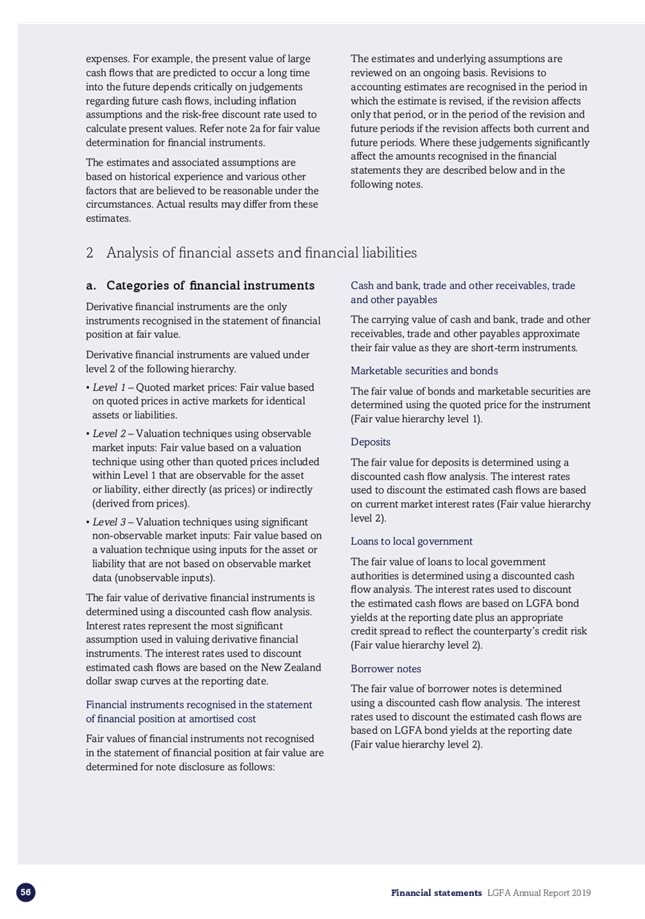

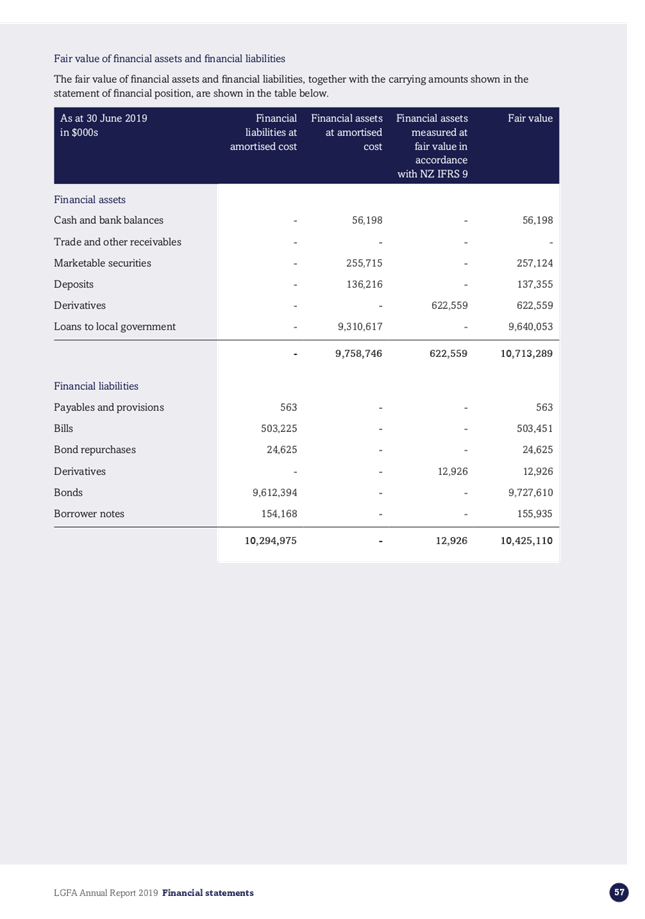

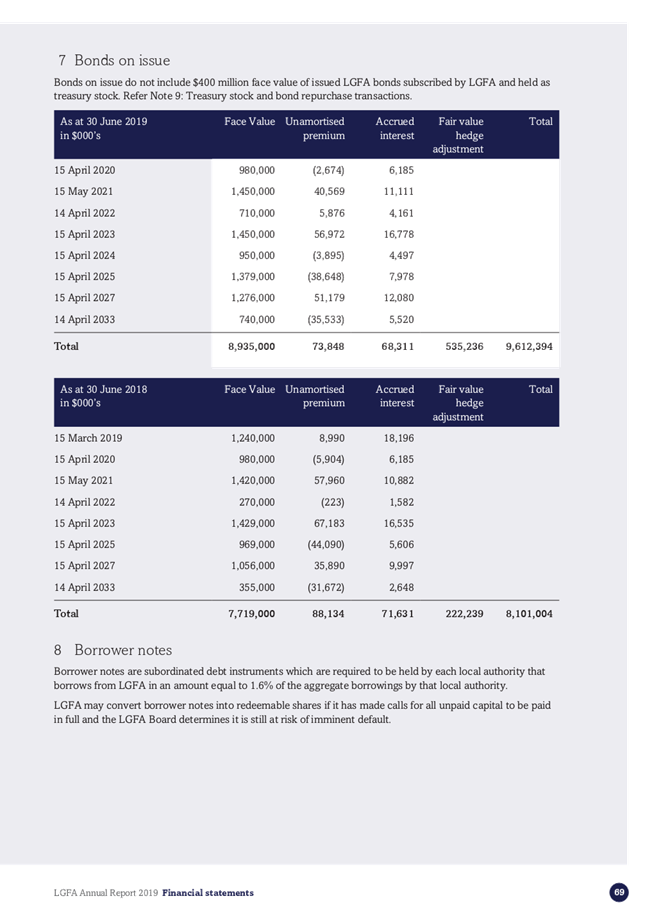

30 June 2019, the LGFA had borrowings totalling $9.612 billion (2018: $8.272

billion).

23 Council

considers the risk of the LGFA defaulting on repayment of interest or capital

to be very low on the basis that:

(a) The

only circumstance where LGFA would default on its debt is the event where a

council defaulted on a loan obligation that exceeded LGFA’s available

liquidity assets. As at 30 June 2019, this would need to be a single council

default event that exceeded the sum of:

· cash

and deposits of $192.4 million,

· LGFA

borrower notes of $154.2 million,

· LGFA

credit facility of $700 million, and

· uncalled

share capital of $20 million from LGFA shareholders.

(b) In

the event of an LGFA default, the call on the guarantee is made on the

Council’s proportion of their share of the underlying rate base.

24 In

the event of a default exceeding the LGFA’s available liquid assets, the

council would be called for 1.1% of the overall call (less than the

council’s 2.2% of LGFA’s loan assets).

Tāngata

whenua considerations

25 There

are no Tāngata whenua considerations.

Strategic

considerations

26 The

prudent use of the LGFA for all the Council’s borrowing requirements

contributes to the key 10-year outcome of improved financial position against

financial constraints by allowing the Council to achieve lower interest rate

costs.

Significance and Engagement

Significance

policy

27 The

prudent use of the LGFA for all the Council’s borrowing requirements

contributes to the key 10-year outcome of improved financial position against

financial constraints by allowing the Council to achieve lower interest rate

costs

Consultation

already undertaken

28 There

is no need to consult on the matters discussed in this report.

Engagement

planning

29 An

engagement plan is not needed for this report to be considered.

Publicity

30 There

are no publicity considerations.

|

Recommendations

31 That

the Strategy and Operations Committee notes the performance of the Local

Government Funding Agency as set out in its 2018/19 Annual Report, attached

as Appendix 1 to this report.

|

Appendices

1. LGFA

Annual Report ⇩

|

Strategy

and Operations Committee Meeting Agenda

|

5 December 2019

|

8.5 CONFIRMATION

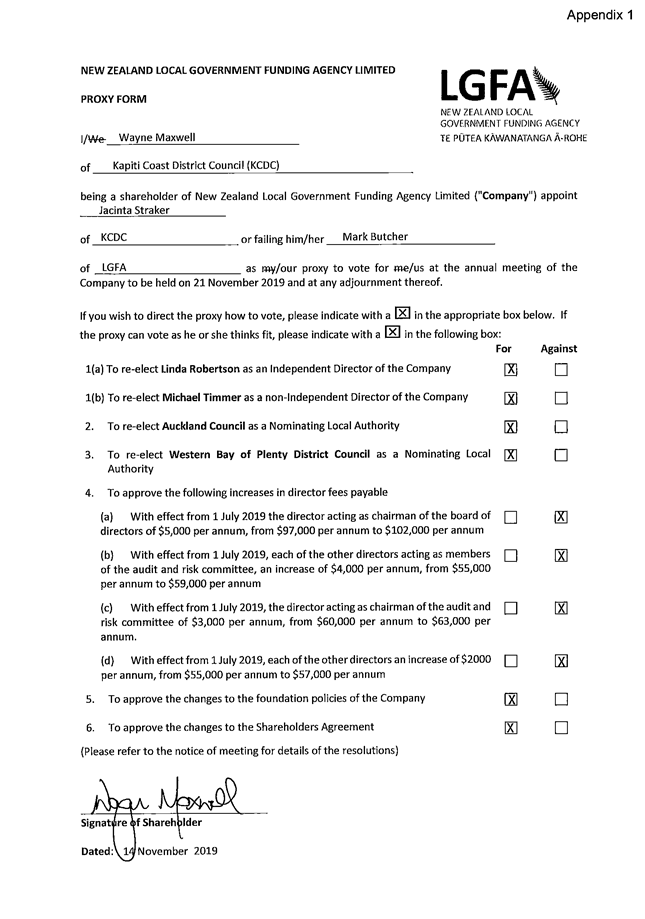

OF THE COUNCIL'S VOTE AT THE LOCAL GOVERNMENT FUNDING AGENCY'S 2019 ANNUAL

GENERAL MEETING

Author: Jacinta

Straker, Chief Financial Officer

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

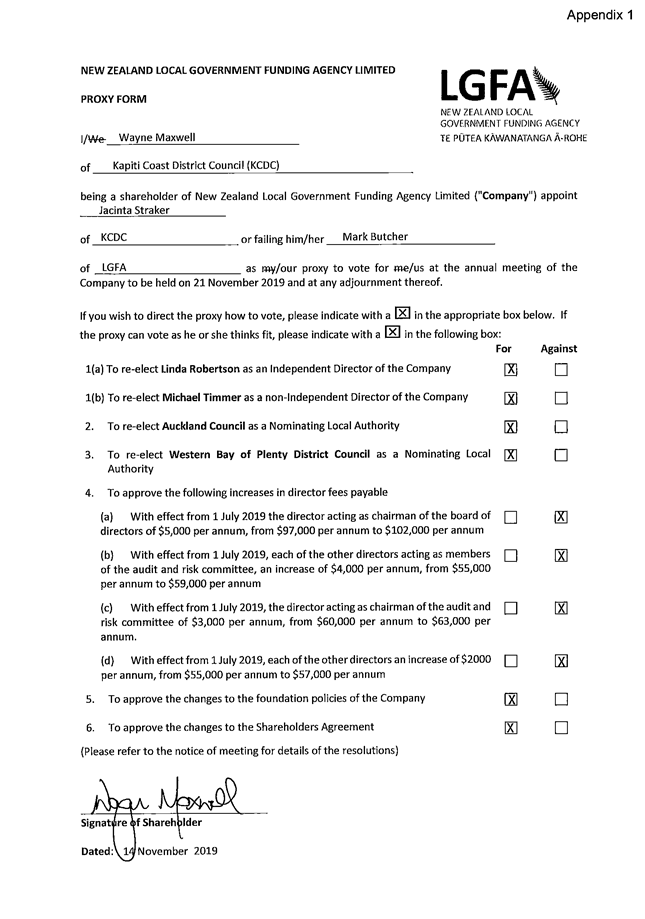

1 The

purpose of this report is to provide the Strategy and Operations Committee with

the Agenda for the recently held Annual General Meeting (AGM) of the Local

Government Funding Agency (LGFA) and to confirm the Council’s vote for

each agenda item.

Delegation

2 While

noting that this report is for information, the Strategy and Operations

Committee, with its broad role of financial management, including risk

mitigation, has the delegation to consider this report.

Background

3 On

30 November 2012, the Council became a Principal Shareholding Local Authority

in the LGFA. The LGFA was incorporated on 1 December 2011 with the primary

objective of optimising the debt funding terms and conditions for Participating

Local Authorities. This includes providing savings in annual interest costs,

making longer-term borrowings available and enhancing the certainty of access to

debt markets.

4 The

LGFA issues bonds to wholesale and retail investors and on-lends the funds

raised to participating local authorities with borrowing needs. The quality of

the LFGA’s credit rating, and the liquidity created by issuing homogenous

local authority paper, ensures that participating councils can raise funds on

better terms than if they were issuing in their own name.

5 The

LGFA meets the Local Government Act 2002 (the Act) definition of a Council

Controlled Organisation (CCO) as one or more local authorities have the right,

directly or indirectly, to appoint 50% or more of the directors.

6 The

LGFA recently held its AGM on 21 November 2019 in Wellington and the Agenda

items included:

· election of directors to the LGFA Board;

· election of Nominating Local Authorities (NLA) to the

Shareholders’ Council;

· approval of directors’ fees; and

· approval of proposed changes to the Foundation Policy and to the

Shareholders Agreement to increase the Treasury Policy limits and to allow the

LGFA to lend directly to CCOs.

Issues and Options

Election of directors

7 The

LGFA Shareholders Agreement requires the Board to comprise five independent

directors and one non-independent director. Currently, the five independent

directors are John Avery, Philip Cory-Wright, Anthony Quirk, Linda Robertson

and Craig Stobo and the non-independent director is Mike Timmer.

8 Independent

directors are defined in the Shareholders’ Agreement as a director

“who is not an employee of any shareholder, employee of a CCO owned (in

whole or in part) by any shareholder or a councillor of any Local Authority

which is a shareholder and was not such an employee or councillor at any time

in the five years prior to the time that person’s appointment as a

director. For the avoidance of doubt, a director (or former director) of a CCO

shall not by virtue of this reason alone be precluded from being an independent

director.”

9 The

Shareholders’ Agreement sets out that one of the independent directors

and the non-independent director must retire by rotation each year. If they

wish, they can offer themselves for re-election.

10 Accordingly,

this year Linda Robertson retires by rotation and offers herself for

re-election as an independent director and Mike Timmer retires by rotation and

offers himself for re-election as a non-independent director.

11 Both

Linda Robertson and Mike Timmer have the support of the Shareholders’

Council and the LGFA Board to continue as directors of LGFA.

Officers’

Recommendation

12 Officers

find no reason to vote against the candidates standing for re-election as

directors on the LGFA Board, for the following reasons:

· the effective performance to date of the LGFA; and

· the skills and experience of the nominated directors.

Election of Nominating Local Authorities to the Shareholders’

Council

13 A

Principal Shareholder may be appointed or removed as a nominator of membership

to the Shareholders' Council. Each NLA may appoint or remove one member of the

Shareholders' Council.

14 Each

member appointed by a NLA must be an employee or councillor of that NLA. In

addition, the New Zealand Government (for so long as it is a Shareholder) may

appoint or remove one other member of the Shareholders' Council.

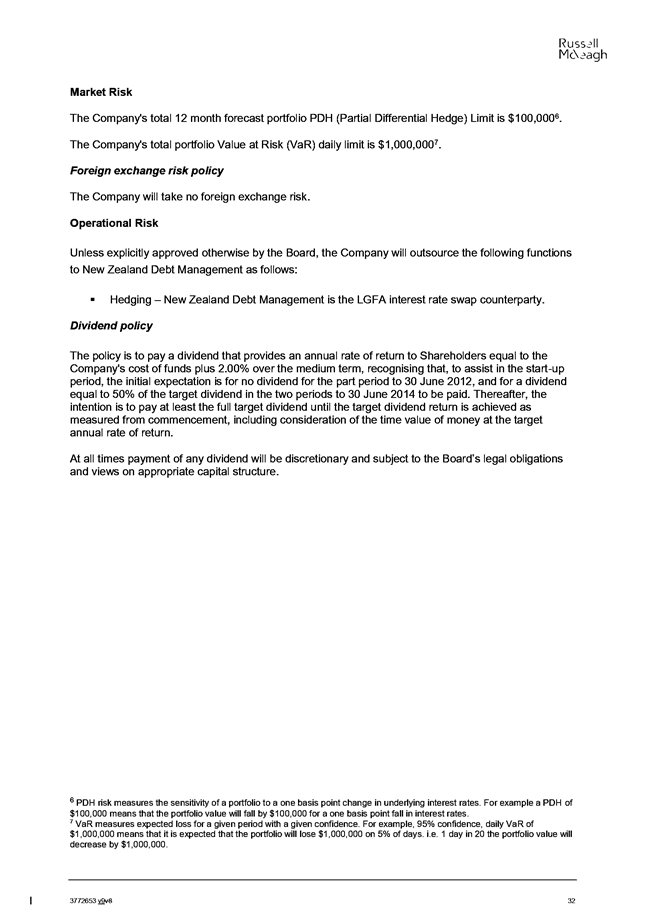

15 The

Shareholders’ Council comprises between five and 10 members with the

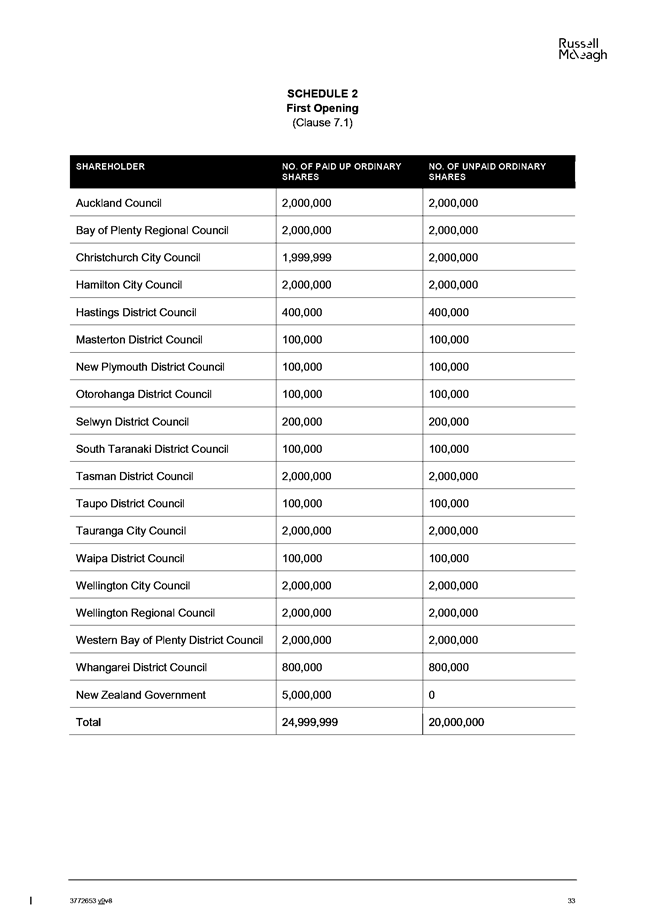

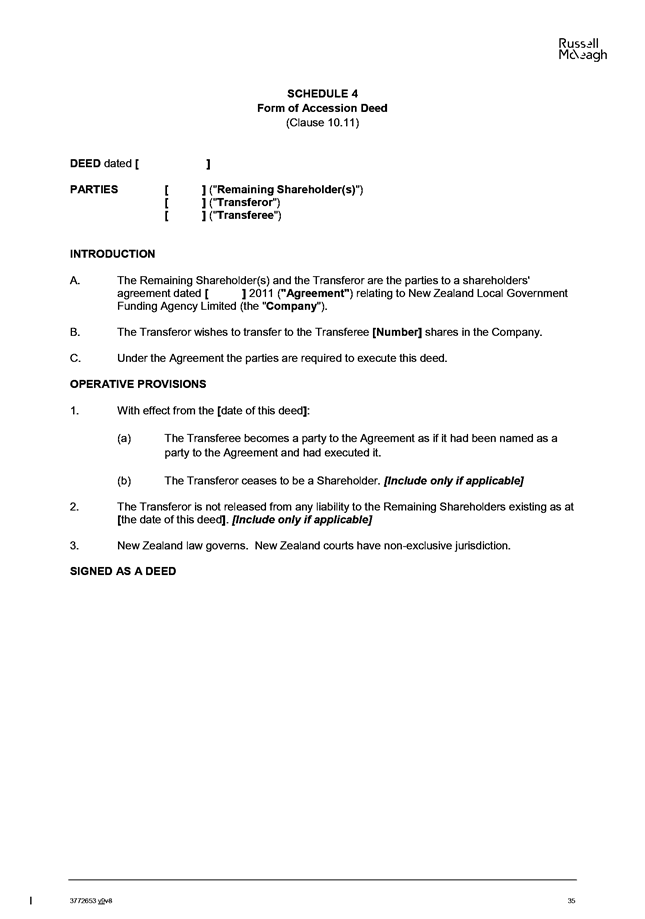

current members being the Crown and nine Council members. The current NLAs are:

· Auckland

Council;

· Bay

of Plenty Regional Council;

· Christchurch

City Council;

· Hamilton

City Council;

· Tasman

District Council;

· Tauranga

City Council;

· Wellington

City Council;

· Western

Bay of Plenty District Council, and

· Whangarei

District Council.

16 The

Shareholders Agreement requires two NLA members to retire by rotation each

year. If they wish, they can offer themselves for re-election.

17 Accordingly,

this year Auckland Council and Western Bay of Plenty District Council will

retire and seek re-election.

18 Since

the LGFA was established in 2011, the local authority membership of the

Shareholders’ Council has come almost entirely from the ‘tight nine‘

group of councils that promoted and steered the establishment of the LGFA, plus

the Bay of Plenty Regional Council, which was also a foundation member. These

members also have the largest shareholdings in the LGFA.

19 At

last year’s AGM, Council Officers recommended voting for the candidates

standing for re-election however Officers also recommended that the matter of

‘refreshing’ the composition of the Shareholders’ Council

also be raised with the LGFA and the Shareholders’ Council.

20 The

reasons for seeking to refresh the Shareholders Council composition are:

· because

all LGFA shareholders regularly transact with the LGFA and having a greater

shareholding (as a result of being a foundation member) does not mean that a

council is any better placed to assess the governance or operations of an

organisation than other councils with smaller shareholdings;

· other

councils, for example, those undertaking more business with the LGFA are as

well if not better placed to be considered as NLA appointments. Using the value

of loans held at 30 June 2019 as a proxy for the amount of business done with

the LGFA, officer’s analysis suggests that the Greater Wellington

Regional Council, Kāpiti Coast District Council, Rotorua District Council

and Hutt City Council are worthy of consideration to become NLAs;

· to

facilitate greater representation from the regions given that the majority of

the current members of the Shareholders’ Council are large metropolitan

councils, whose views may not reflect those of their more provincial

counterparts; and

· the

continued uninterrupted membership of the Shareholders’ Council might

lead to ‘staleness’ of the existing membership. The introduction of

a ‘fresh pair of eyes’ from outside can bring new ideas, greater

inclusiveness and ultimately more assurance for all members

Officers’

Recommendation

21 Officers

recommend the re-election of the retiring NLAs - Auckland Council and Western

Bay of Plenty District Council - while continuing to engage with the LGFA, the

Shareholders Council and other shareholders to consider refreshment of the

Shareholder Council composition.

Approval of director fee increases

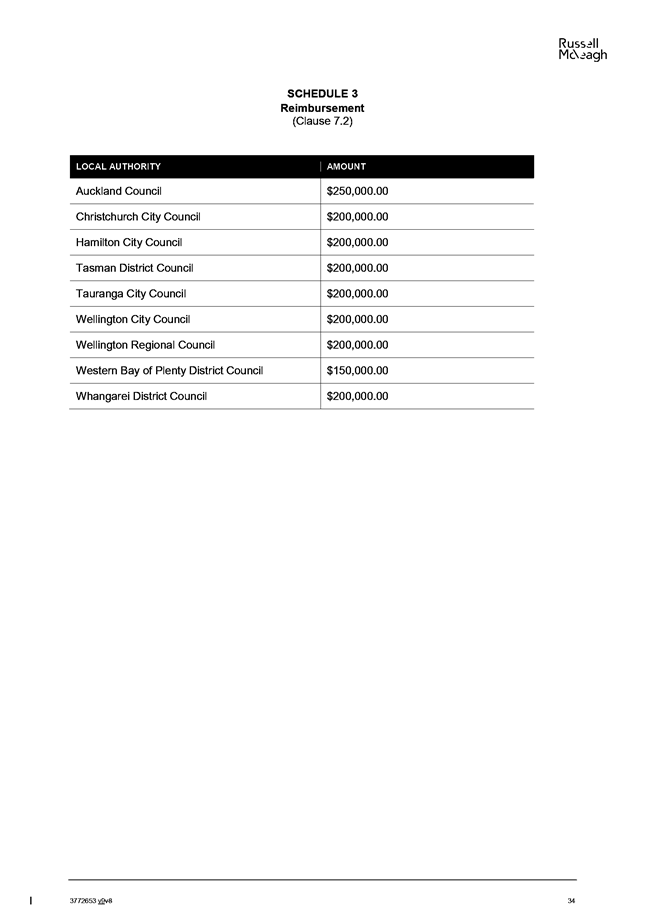

22 The

LGFA has proposed the following increases with effect from 1 July 2019:

(a) increasing

the board chair’s fees from $97,000 to $102,000 per year;

(b) increasing

audit and risk committee members’ fees from $55,000 to $59,000 per year;

(c) increasing

the audit and risk committee chair’s fee from $60,000 to $63,000 per

year; and

(d) increasing

all other directors’ fees from $55,000 to $57,000.

23 A

review of the fees from 2016 shows that approving the proposed increases would

result in all four positions receiving an average 7-8% increase over each of

the last three years.

24 While

there are no specific concerns with the LGFA’s performance, further fees

increases are difficult to agree with. The continued increase of the fees from

the already very reasonable levels is at odds with the Council’s current

context of fiscal restraint, an approach likely shared by many of the LGFA’s

other borrowers.

Officers’

Recommendation

25 Officers

recommend that none of the proposed fee increases be approved.

Changes to the LGFA Foundation Policy and Shareholders Agreement

26 All

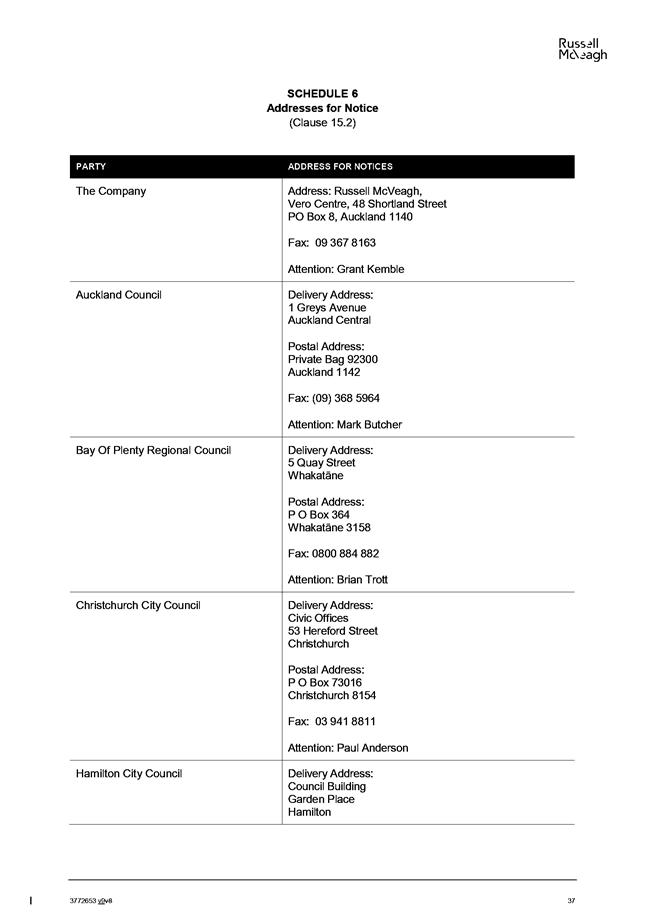

shareholder councils must comply with the ‘Foundation Policies’

outlined in the Shareholders Agreement. Any changes to the Foundation Policies

and the Shareholders Agreement are effected by way of an Ordinary Resolution of

the shareholders.

27 There

are two proposed changes to the Foundation Policy requiring shareholder

approval by Ordinary Resolution:

i. an

increase in Treasury Policy limits due to the increased size of the

LGFA’s balance sheet; and

ii. putting

in place direct lending to CCOs.

28 There

are some minor changes to the Shareholders Agreement to reflect the potential

lending to CCOs, which also requires shareholder approval by Ordinary

Resolution:

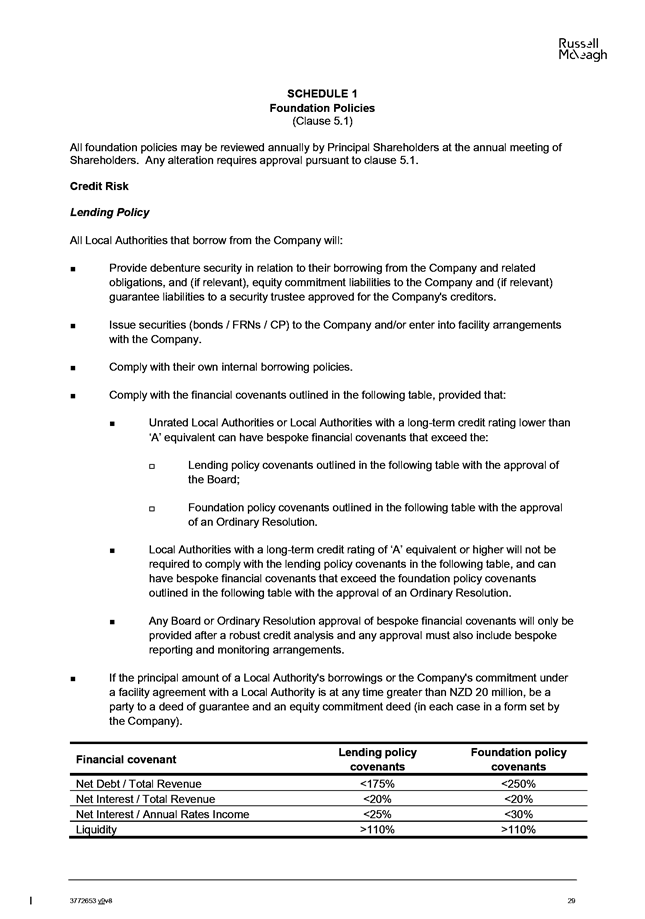

Increase in Treasury Policy limits

29 The

LGFA’s business has both grown and changed over the last few years and

since it was established in 2011. The total assets have grown from $3.92

billion in 2014 to $10.38 billion in 2019 and the liquid assets portfolio has

grown from $101.7 million in 2014 to $448.1 million in 2019. The liquid

assets portfolio was 4.3% of total assets in 2019, compared to 2.6% in 2014.

This significant change reflects the increased bespoke and short-term lending

that the LGFA is now providing for councils, and which subsequently requires

some increases to the LGFA’s Treasury Policy limits.

30 The

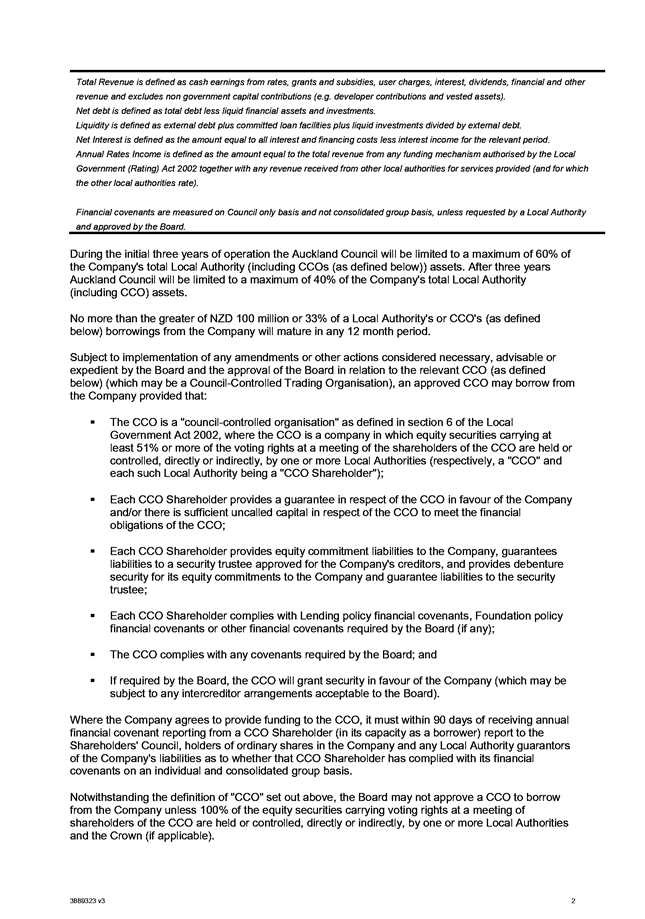

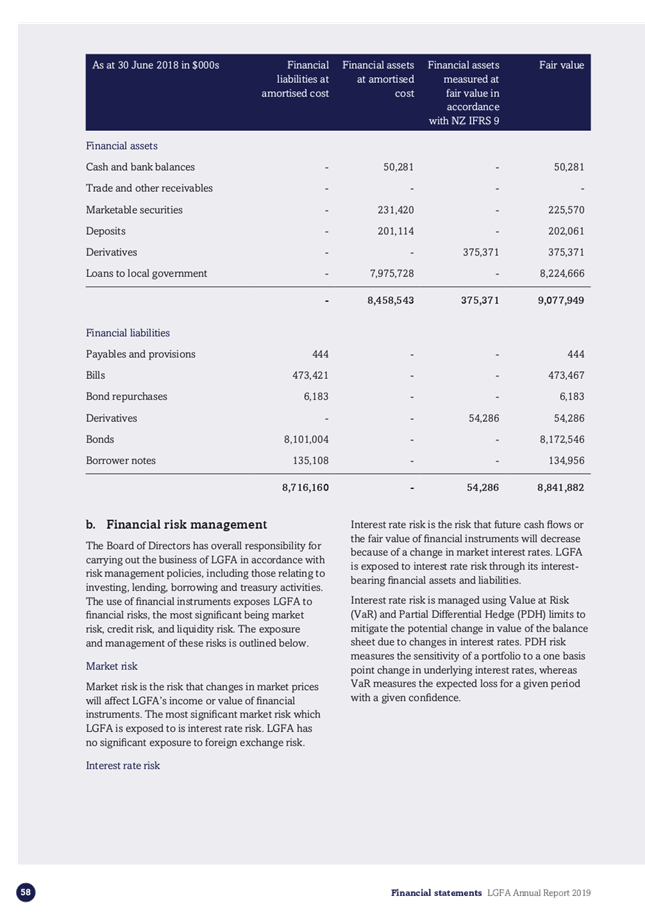

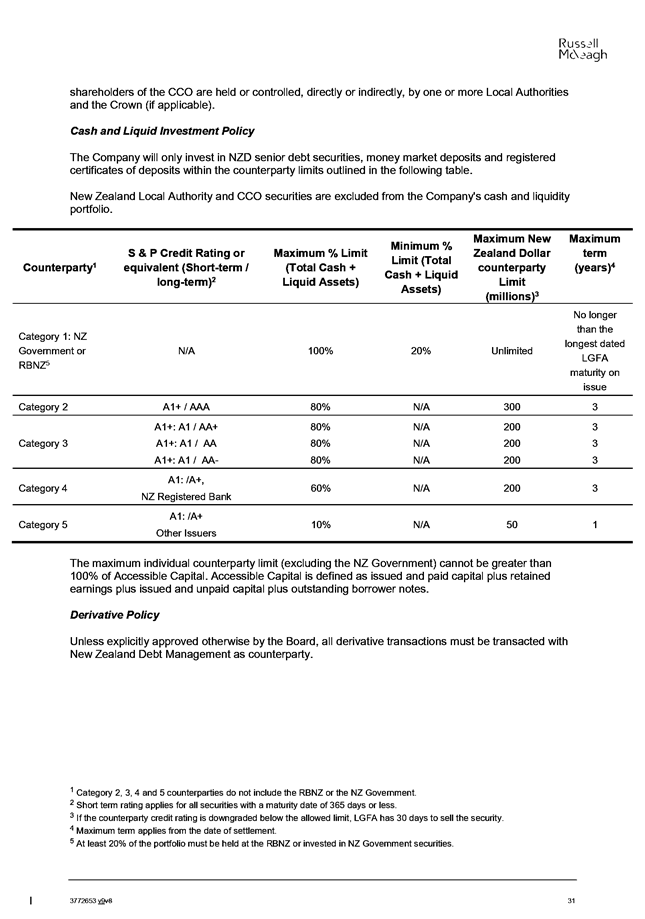

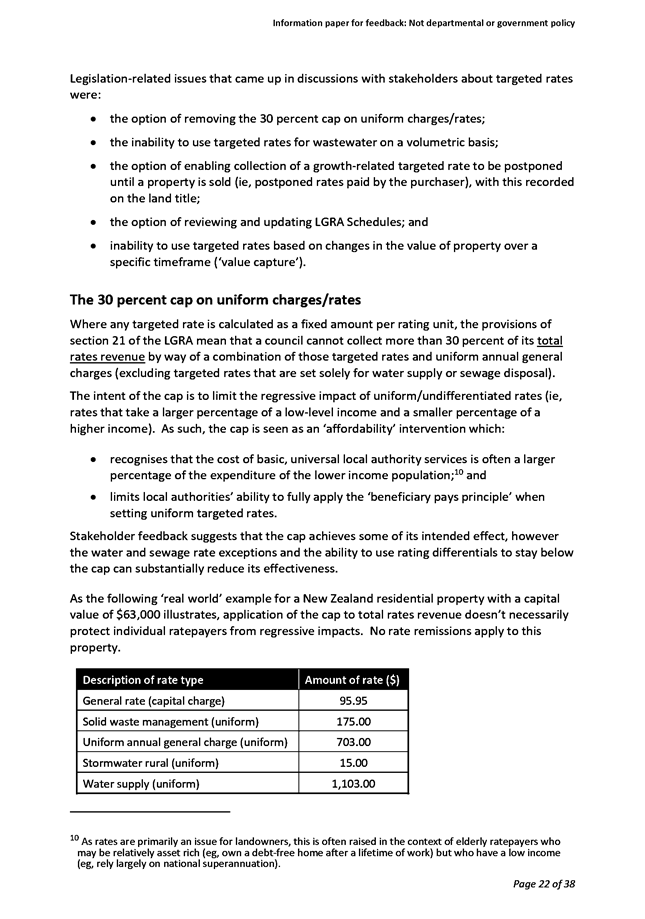

proposed changes are shown in the table below, along with the rationale for the

changes.

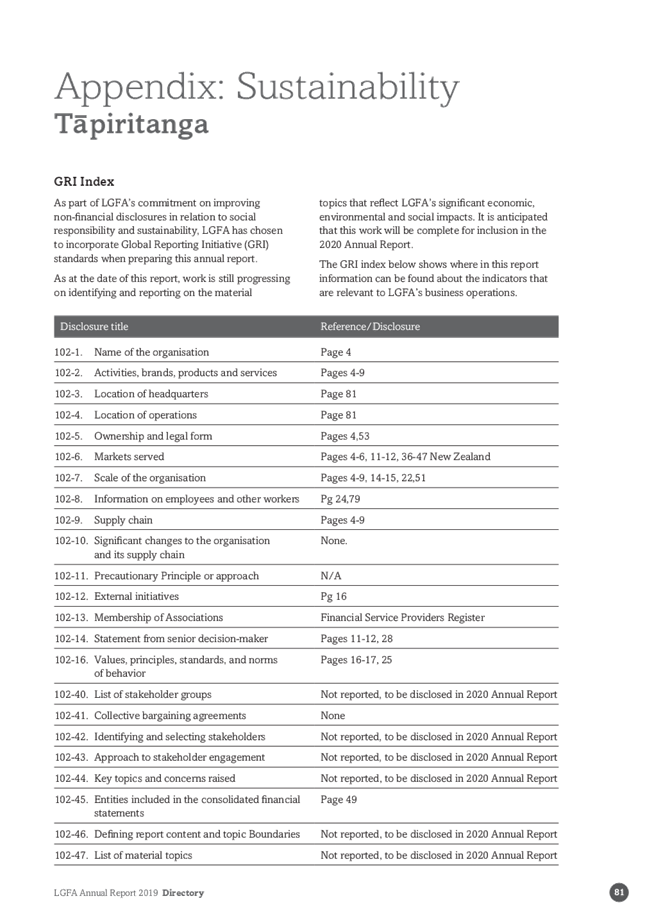

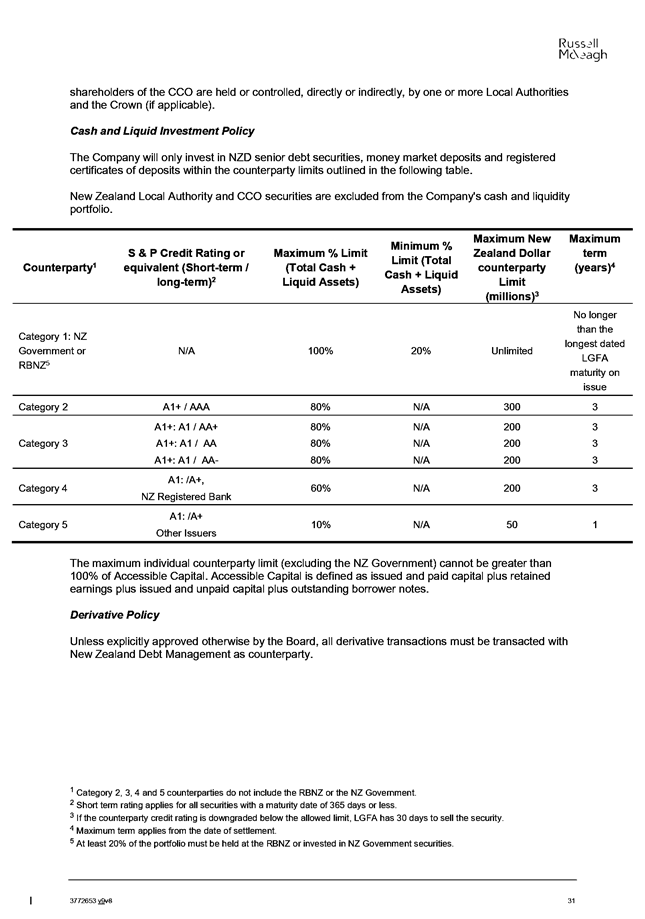

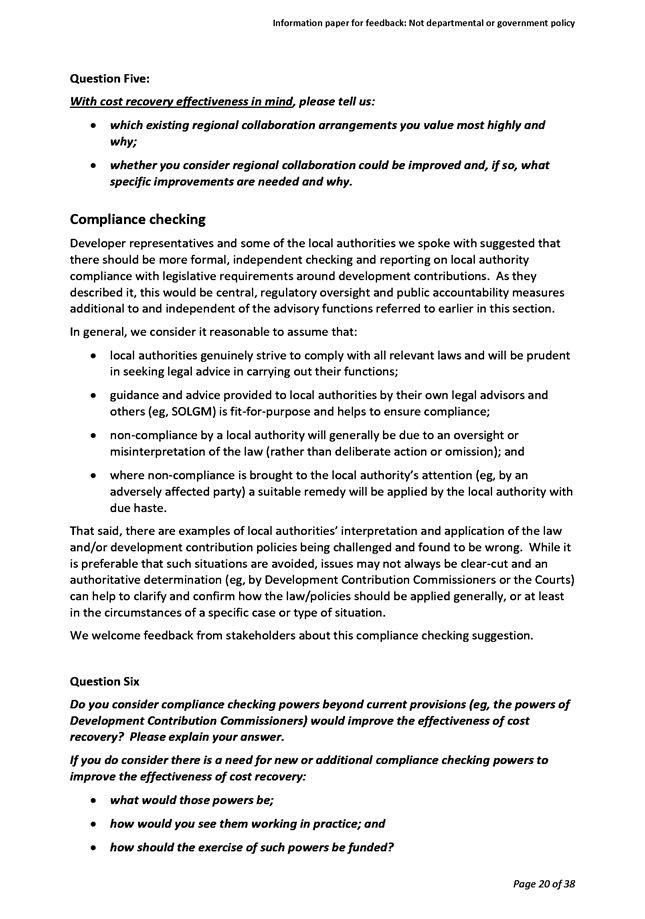

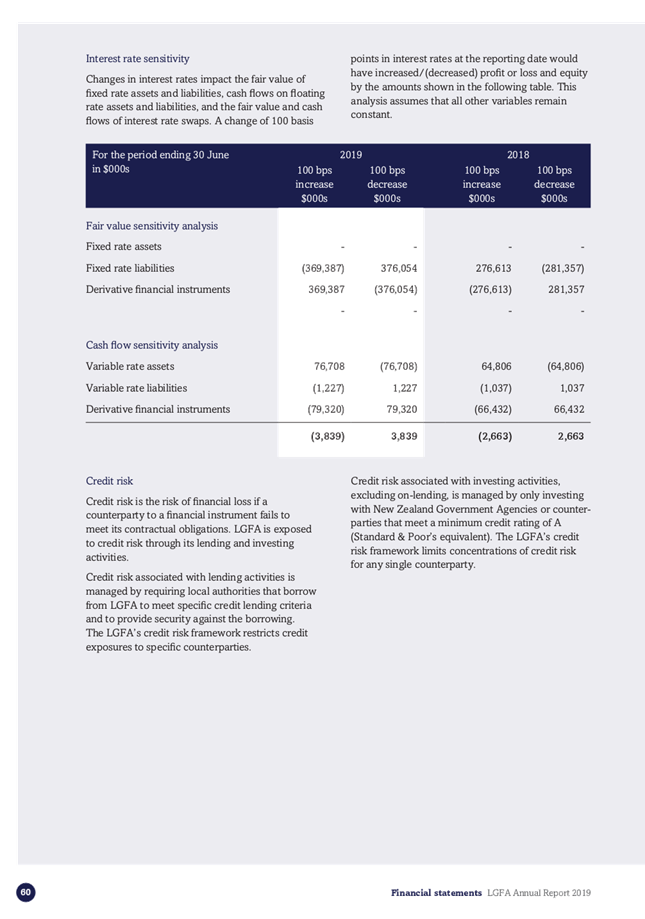

|

Current

|

Proposed

change

|

Rationale

for change

|

|

Category 2 Assets

Maximum individual counterparty limit of

$200 million.

Maximum of 80% of assets.

Maximum term of 3 years.

|

Category 2 Assets

Maximum individual counterparty limit of

$300 million.

Maximum 80% of assets.

Maximum term of 3 years.

|

The increase in the LGFA balance sheet,

the amount of bespoke lending outside of the regular tender schedule and

increased short term lending requires a larger Liquid Asset Portfolio.

Individual category volume limits need to be increased to reflect the

increasing size of the Liquid Asset Portfolio.

|

|

Category 3 Assets

Maximum individual counterparty limits

of $125 million (AA-) and $150 million (AA and AA+).

Maximum of 80% of assets rated

“AA-" or better.

Maximum term of 3 years.

|

Category 3 Assets

Maximum individual counterparty limits

increased to $200 million for AA-, AA and AA+.

Maximum of 80% allocation to assets

rated “AA-" or better.

Maximum term of 3 years.

|

The increase in the LGFA balance sheet,

the amount of bespoke lending outside of the regular tender schedule and

increased short term lending requires a larger Liquid Asset Portfolio.

Individual category volume limits need to be increased to reflect the

increasing size of the Liquid Asset Portfolio. The four major NZ banks are

rated AA- so counterparty limits need to be adjusted to reflect their relative

size.

|

|

Category 4 Assets

Maximum individual counterparty limit of

$125 million for a NZ Registered Bank.

Maximum individual counterparty limit of

$30 million for other issuers. Minimum credit rating for assets of

“A1" short term rating and "A" long term rating.

Maximum term of 1 year.

|

Category 4 Assets

NZ Registered Bank

Maximum individual counterparty limit of

$200 million for a NZ Registered Bank.

Maximum of 60% allocation to NZ

Registered Bank assets rated “A+ “.

Maximum term of 3 years.

|

The addition of limits for NZ Registered

Banks allows for the possibility that the credit ratings of the Australasian

parents of the NZ Registered Banks could be downgraded. If this should occur,

then the credit ratings of the NZ subsidiaries would also be downgraded.

Given the systemic importance of the NZ Registered Banks and RBNZ supervision

we are comfortable holding their assets in the Liquid Asset Portfolio. The

maximum term is to be extended to 3 years to ensure consistency with the

maximum term for NZ Registered Banks with a credit rating of AA- or better.

|

|

|

Category 5 Assets

Other Issuers

Maximum individual counterparty limit of

$50 million for other issuers.

Maximum of 10% allocation to Non-NZ

Registered Bank assets rated “A+ “.

Maximum term of 1 year.

|

It is preferred to distinguish between

NZ Registered Banks and non-bank issuers. Non-bank issuers are not supervised

and therefore a lower individual counterparty limit, maximum allocation limit

and shorter maximum term are preferred.

|

|

Derivative Policy

The Company will only enter into

derivative transactions with New Zealand Debt Management Office as

counterparty.

|

Unless explicitly approved otherwise by

the Board, all derivative transactions must be transacted with New Zealand

Debt Management as counterparty.

|

LGFA has ISDAs in place with three NZ

Registered Banks, in case New Zealand Debt Management cannot provide

derivatives to LGFA. This is for BCP.

|

|

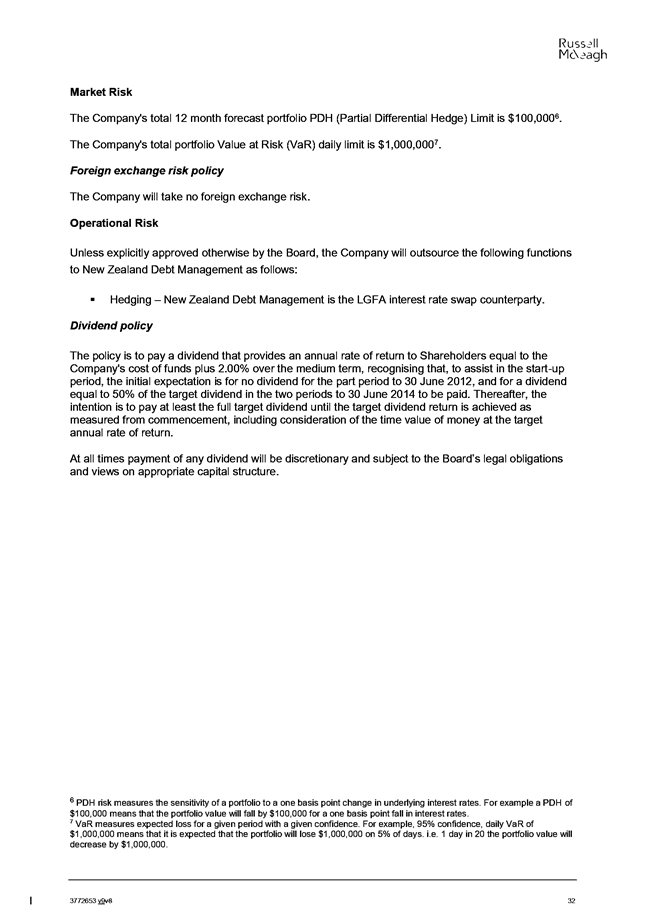

Market Risk

The Company's total 12 month forecast

portfolio PDH (Partial Differential Hedge) Limit is $40,000.

The Company's total portfolio VAR (Value

at Risk) daily limit is $400,000.

|

The Company's total 12 month forecast

portfolio PDH (Partial Differential Hedge) Limit is $100,000.

The Company's total portfolio VAR daily

limit is $1,000,000.

|

The current size of LGFA's balance sheet

exceeds the original forecast and is projected to grow further in the next

three years. Hence the need for a larger PDH limit. The larger balance sheet

impacts on the size of the 3-month bank bill rate sets. Market volatility has

also increased, resulting in an increase in VAR, holding all other variables

constant.

The LGFA Board will manage the exposure

by having a lower limit threshold in the Treasury Policy.

|

Officers’

Recommendation

31 Officers

recommend that all of the above Treasury Policy limits be approved to help

facilitate the LGFA’s increased use of short-term and bespoke lending, to

the benefit of its borrowers.

Direct Lending to CCOs

32 Currently

the LGFA only lends to the parent council and not to any other related

entities. This is not ideal as:

· Several

councils borrow funds directly and then on-lend to their CCOs, for example

Auckland Council (on-lends to Watercare); Christchurch City Council (on-lends

to Christchurch City Holdings Limited); New Plymouth District Council (on-lends

to New Plymouth Airport); and Rotorua District Council (on-lends to Rotorua

Regional Airport).

· The

LGFA cannot currently lend to multiple owned CCOs. While there are currently

very few of these entities which have borrowings, they may be established in

the future.

· Dunedin

City Council (DCC) borrows via its Council Controlled Trading Organisation

subsidiary company, Dunedin City Treasury Limited. This is one reason why DCC

cannot become a member of LGFA.

33 The

LGFA received shareholder approval in November 2018 to proceed with

establishing a framework and process for it to lend directly to CCOs; this

Council voted in support of that process.

34 The

documentation, structure and process for putting CCO lending in place has been

influenced by the following:

· LGFA

will only lend to CCOs or council-controlled trading organisations

("CCTOs") if:

- in the case of CCOs, its

obligations are guaranteed by its council parent; or

- in the case of CCTOs, it

is supported by uncalled capital within the CCTO;

· All

parent council shareholders must be guarantors of LGFA;

· Any

CCO/CCTO borrower must be wholly owned, directly or indirectly, by one or more

councils and Central Government (if applicable);

· Council

shareholder(s) must agree to their CCO/CCTO joining LGFA. All shareholders of

the CCO/CCTO must countersign the relevant accession deeds to the Notes

Subscription Agreement and the Multi-Issuer Deed;

· CCO/CCTO

holds the Borrower Notes, but prior to conversion the Borrower Notes are

transferred to the relevant council shareholder(s);

· LGFA

Board to approve each CCO/CCTO to join. LGFA to undertake financial and credit

analysis of each CCO /CCTO before its accession, with ongoing surveillance. The

LGFA’s solicitors will review each CCO/CCTO's council shareholders'

Debenture Trust Deed and CCO/CCTO security structure as part of the acceptance

process by the LGFA Board;

· Bespoke

covenants are to be negotiated between LGFA and each CCO/CCTO. LGFA may allow

no covenants if LGFA is sufficiently comfortable with the guarantee/uncalled

capital structure and the credit quality of the council shareholder(s);

· Annual

testing of the CCO/CCTO compliance with financial covenants (if relevant) and

reporting as per council membership;

· Credit

analysis of the council shareholders and ongoing compliance with LGFA covenants

will be undertaken on a parent basis and reported on a parent and consolidated

group basis;

· Borrowing

process to be as close as possible to the borrowing process for council lending;

· Pricing

on CCO/CCTO loans in line with council shareholder borrowing, but set by LGFA;

· Lending

to CCO/CCTO by LGFA is expected to be on the same (or better) security terms

than their existing banking security;

· Redemption

of LGFA loans to CCO/CCTO if the CCO ceases to be a CCO; and

· Reporting

to LGFA shareholders on a quarterly basis as to breakdown of CCO/CCTO

lending.

Officers’ Recommendation

35 Officers

support the proposed changes to the Foundation Policy to facilitate lending to

CCOs for the following reasons:

· There

are some council members who currently borrow and on-lend to their CCO

subsidiaries, so establishing lending to CCO will give them the option to

streamline the borrowing process and provide more flexibility in how they restructure

their borrowings.

· There

is no increased risk to the LGFA - all councils must remain compliant with the

LGFA covenants and the LGFA has recourse over rates revenue as security.

Additionally, where a CCO borrows from the LGFA, the LGFA has the benefit of a

parent council uncalled capital or guarantee.

· The

LGFA do not feel that credit rating agencies or investors would be concerned

with the introduction of lending to CCOs because all councils must remain

compliant with the LGFA covenants and the underlying security remains

unchanged. Lending to CCOs will also diversify the LGFA lending book and could

bring in new council members to the LGFA.

· The

proposed changes will not make it easier for councils to borrow more or to

avoid a covenant breach because the Board approves testing of a council at the

group or parent level.

Changes to the LGFA Foundation Policy and Shareholders

Agreement

36 A

number of minor amendments have been made to the Shareholders Agreement to

reflect the LGFA’s proposed ability to be able to lend to CCOs.

37 Officers

are supportive of all these changes

Considerations

Policy

considerations

38 There

are no policy considerations.

Legal

considerations

39 The

Council’s voting intentions were clearly set out on the Proxy Form delivered

to the LGFA prior to the AGM and attached as Appendix 1.

40 The

LGFA received notice from the Council, authorising the proxy to vote on its

behalf not later than 48 hours before the start of the AGM, which was 2pm on

Wednesday, 21 November 2019.

Financial

considerations

41 There

are no financial considerations in addition to those already discussed within

this report.

Tāngata

whenua considerations

42 There

are no issues requiring specific consideration by Tāngata whenua.

Strategic

considerations

43 The

prudent use of the LGFA for all the Council’s borrowing requirements

contributes to the key 10-year outcome of improved financial position against

financial constraints by allowing the Council to achieve lower interest rate

costs.

Significance and Engagement

Significance

policy

44 This

matter has a low level of significance under the Council’s Significance

and Engagement Policy.

Consultation

already undertaken

45 No

consultation has been undertaken in the development of this report.

Engagement

planning

46 An

engagement plan is not needed for this report to be considered.

Publicity

47 There

are no publicity considerations.

|

Recommendations

50 That

the Strategy and Operations Committee:

i. receives

the report, including the proposed changes to the Local Government Funding

Agency Foundation Policy and Shareholders Agreement, attached as Appendices 2

and 3 to the report; and

ii. recommends

that the Strategy and Operations Committee:

a) notes that the

Chief Executive authorised Jacinta Straker (Chief Financial Officer) to vote

on behalf of the Council, at the Local Government Funding Agency’s 2019

Annual General Meeting to be held on 21 November 2019, in accordance

with the Council’s votes on recommendations (aa) to (jj) inclusive,

noting Committee recommendations in bold;

or, if Council officers were unable to attend the Annual General

Meeting:

b) notes that the

Chief Executive authorised Mark Butcher (Chief Executive Officer, LGFA) as

the Council’s proxy to vote on behalf of the Council, at the Local

Government Funding Agency’s 2019 Annual General Meeting to be held on

21 November 2019, in accordance with the Council’s votes on

recommendations (aa) to (jj) inclusive, noting Committee recommendations in

bold:

(aa) re-elect Linda Robertson as an

independent director of the LGFA - (For/Against); and

(bb) re-elect Michael Timmer as

non-independent director of the LGFA - (For/Against); and

(cc) re-elect Auckland Council as a

Nominating Local Authority - (For/Against); and

(dd) re-elect Western Bay of Plenty

District Council as a Nominating Local Authority - (For/Against);

(ee) With effect from 1 July 2019,

approve an increase in fees payable for the director acting as chairman of

the board of directors of $5,000 per annum, from $97,000 per annum to

$102,000 per annum - (For/Against);

(ff) With effect from 1 July

2019, approve an increase in fees payable for each of the other directors

acting as members of the audit and risk committee, an increase of $4,000 per

annum, from $55,000 per annum to $59,000 per annum - (For/Against);

(gg) With effect from 1 July 2019,

approve an increase in fees payable for the director acting as chairman of

the audit and risk committee of $3,000 per annum, from $60,000 per annum to

$63,000 per annum - (For/Against);

(hh) With effect from 1 July 2019,

approve an increase in fees payable for each of the other directors of $2,000

per annum, from $55,000 per annum to $57,000 per annum - (For/Against);

(ii) approve,

the amendments to the Foundation Policy of the LGFA - (For/Against);

and

(jj) approve, the amendments to the

Shareholders Agreement of the LGFA - (For/Against).

iii authorises

officers to continue to engage with the LGFA, the Shareholders’ Council

and other shareholders on the matter of refreshing the composition of the

Shareholders’ Council.

|

Appendices

1. AGM

Proxy Form ⇩

2. Updated

Foundation Policies ⇩

3. Updated

Shareholders' Agreement ⇩

|

Strategy

and Operations Committee Meeting Agenda

|

5 December 2019

|

|

Strategy and Operations Committee Meeting

Agenda

|

5 December 2019

|

|

Strategy and Operations Committee Meeting

Agenda

|

5 December 2019

|

8.6 Activity

Report: 1 July to 30 September 2019

Author: Terry

Creighton, Corporate Monitoring Officer

Authoriser: Mark

de Haast, Group Manager

Purpose of Report

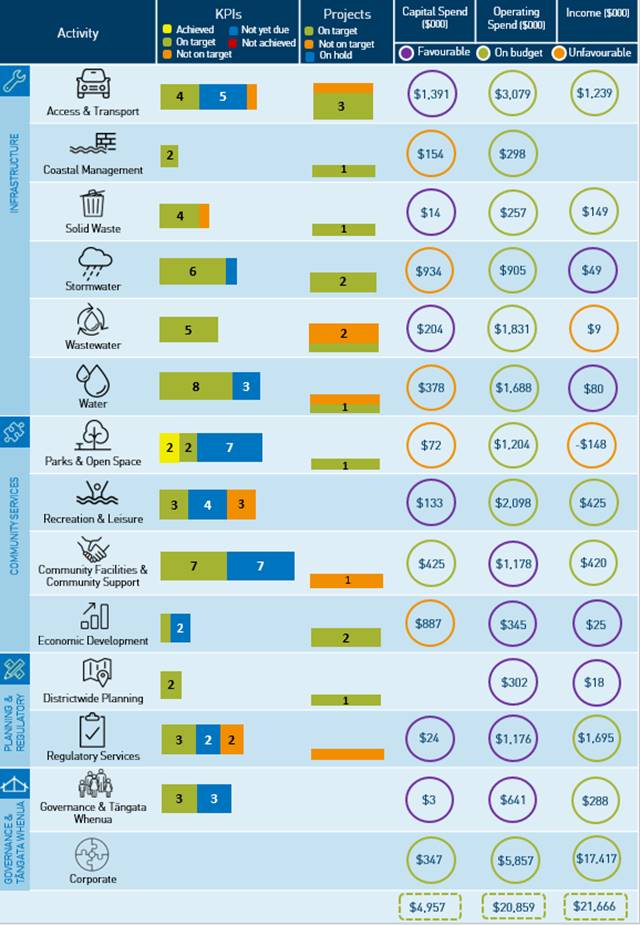

1 This

report provides the Strategy and Operations Committee with a quarterly

performance overview for the first quarter of the 2019/20 financial year for

each activity published in the 2018-38 Long Term Plan.

Delegation

2 The

Strategy and Operations Committee has delegated authority to consider this

report under the responsibilities delegated in Section B.1 of Governance

Structure and Delegations. In particular, the Committee’s key

responsibilities include:

· Overviewing

strategic programmes

· Financial

management, including risk mitigation

Background

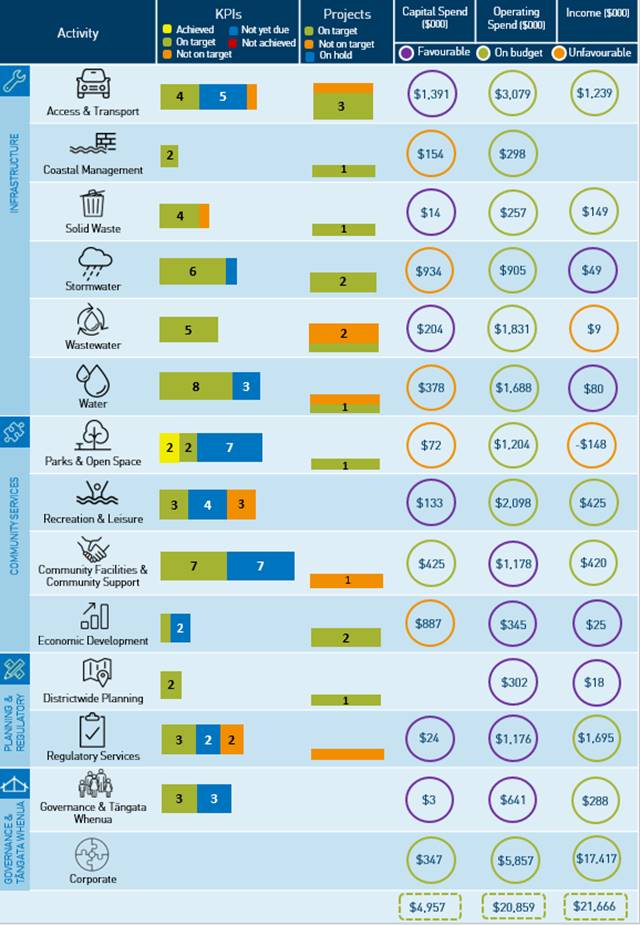

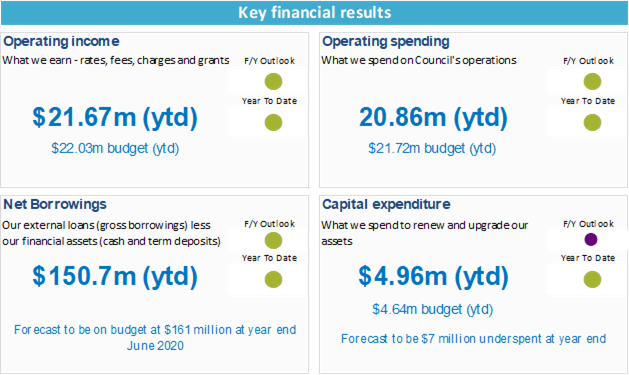

3 The

dashboard graphic on the following page gives a snapshot of performance across

all council activities and is intended to highlight at a glance where there

might be issues that need attention.

4 Section

1 of this report gives an overview of progress on projects and results for key

performance indicators (KPIs) across the council as a whole.

5 Section

2 reports on the ‘Across council work programmes’.

6 Sections

3 to 6 reports on the activity cluster groupings. These sections report on the

status of projects (with a brief explanation where projects are not on target),

present other key development highlights and provide more detail on KPI

performance.

7 This

report is a summary of work programme and activity reports. Further and more

detailed information is included in the following appendices:

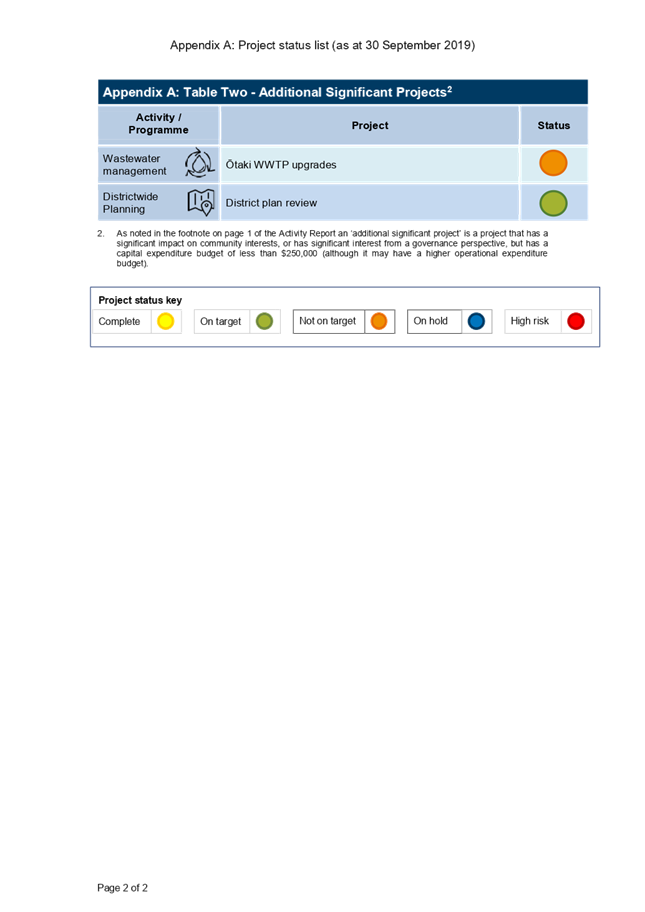

· Appendix

A provides a status list of the significant projects. Table 1 shows the status

of the major capital expenditure projects ($250,000 and above) while Table 2

shows the status of the additional significant projects[1].

· Appendix

B contains detailed activity chapters which present an overview of performance

across a range of projects and work programmes, recent developments in those

activities and performance against key performance measures published in the

2018–38 long term plan.

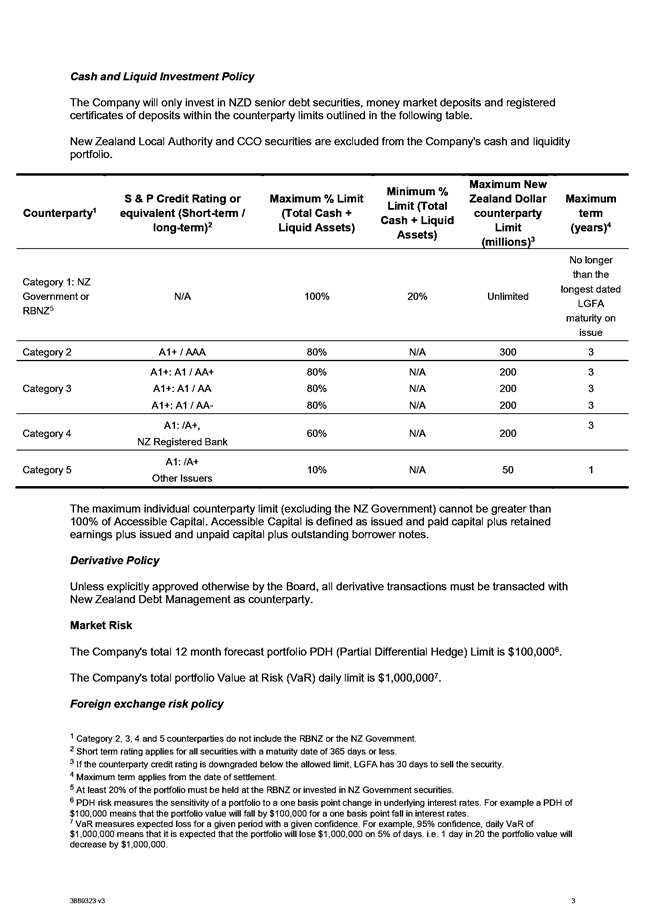

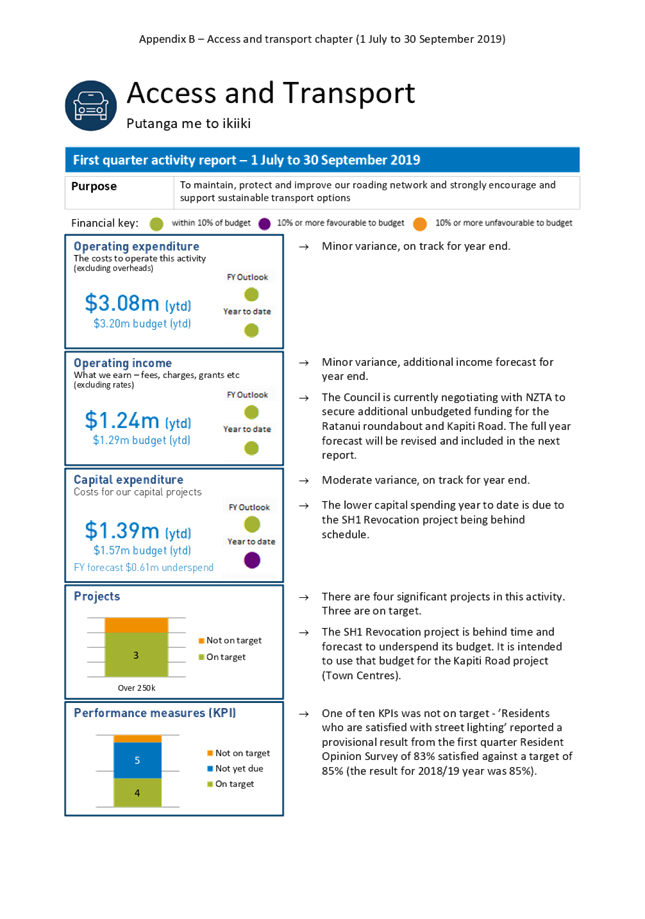

Activity overview dashboard

for the first quarter 2019/20

Considerations

Section

1: Overview of KPIs and Projects

Summary

of significant projects

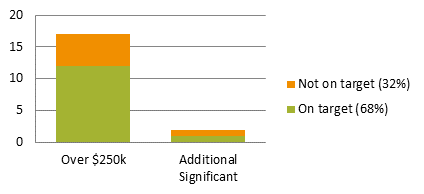

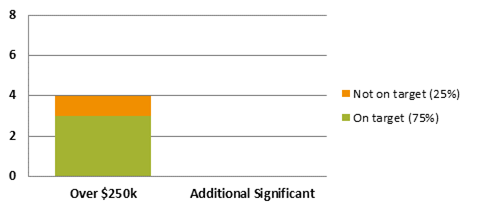

8 There

are 19 significant projects being undertaken

by Council in the activities reported below (compared to 29 last year). Of

these, 17 are Capital Expenditure Projects with a value of $250,000 and above

and two are additional significant projects. Figure 1 below provides a

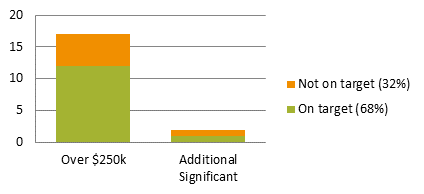

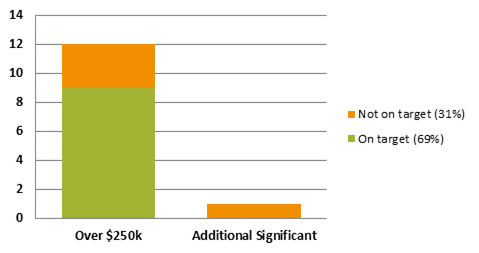

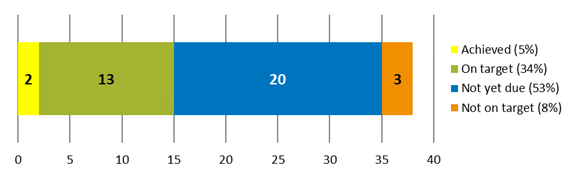

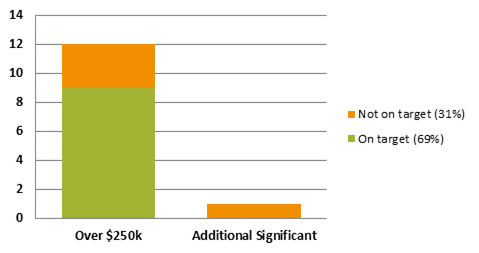

performance summary of these projects. [2]

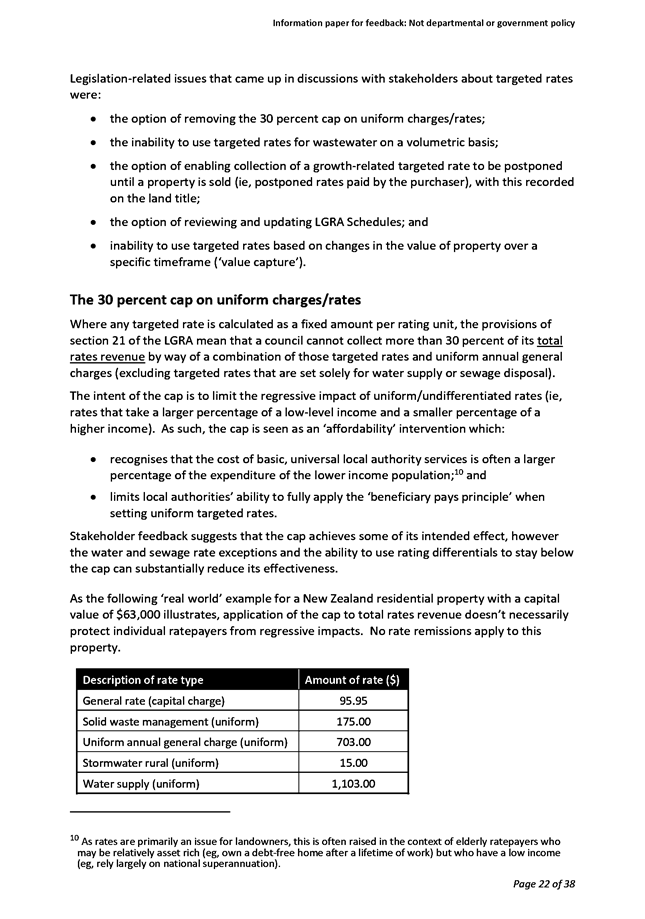

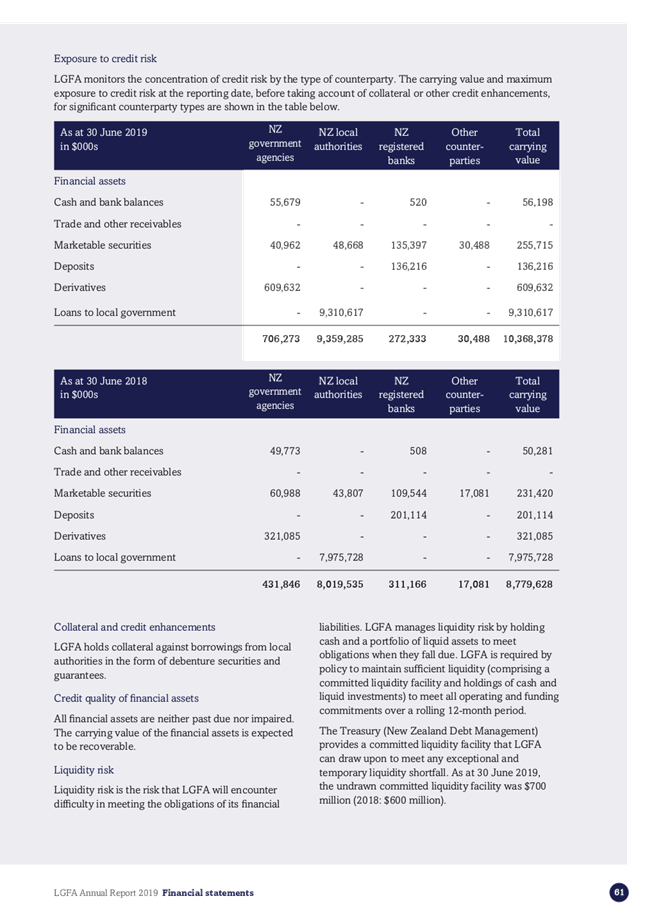

Figure 1: Status summary

of significant projects

as at 30 September 2019

9 Thirteen

projects were on target as at 30 September 2019.

10 Six

projects were not on target for a range of reasons.

These are summarised in paras 27-28,

56-57 and 78 below, and reported on in the activity chapters in Appendix B.

Summary of key performance

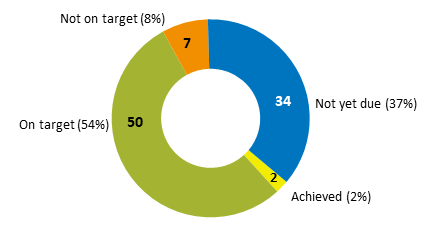

indicators

11 There

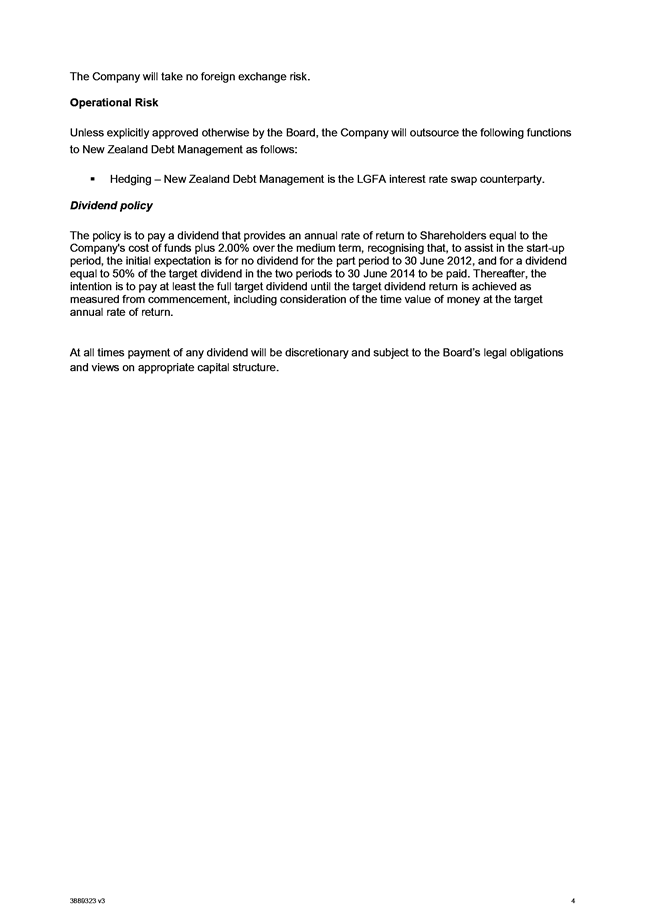

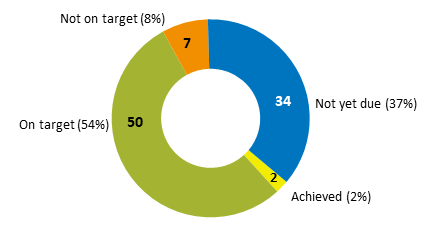

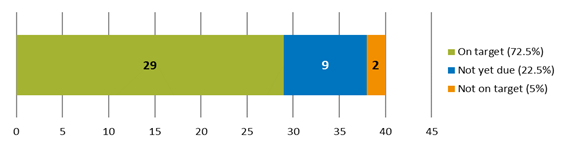

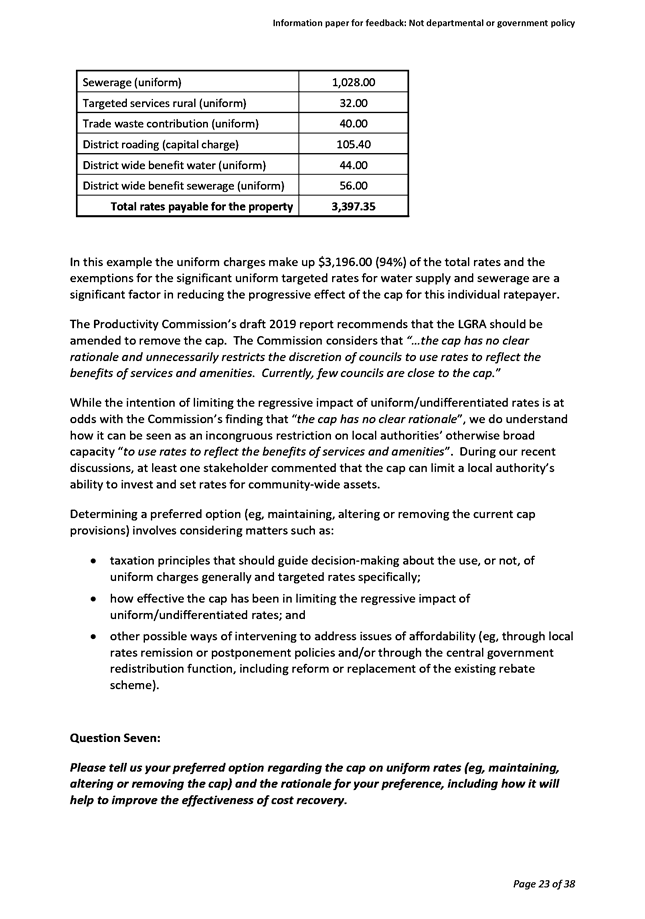

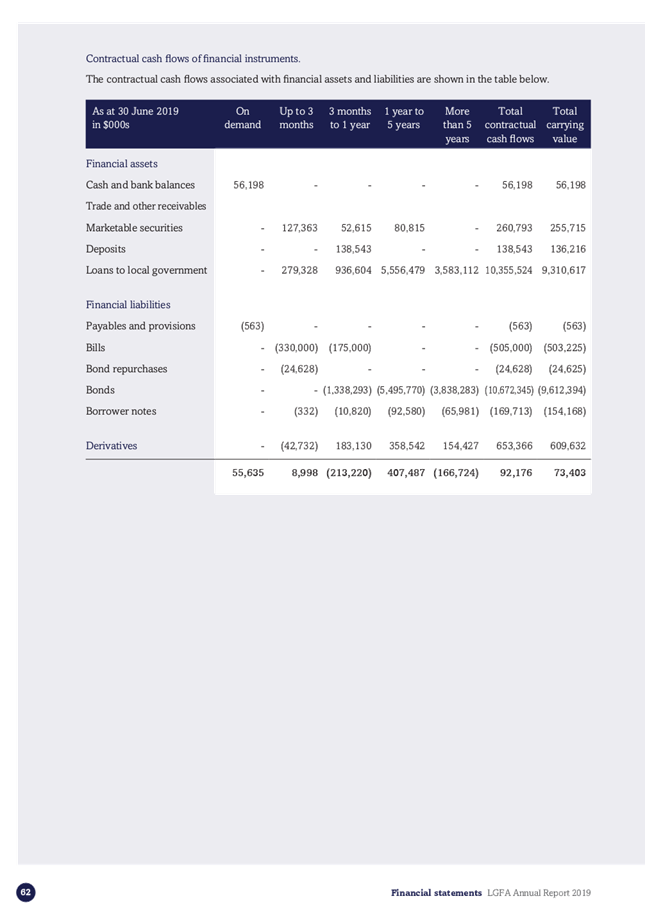

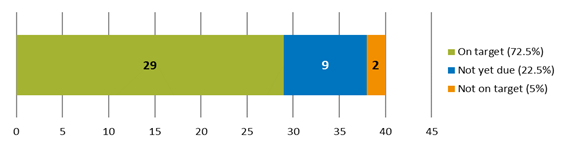

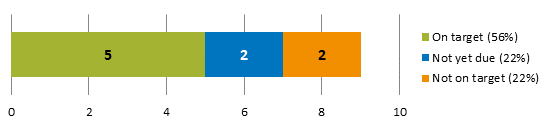

are 93 KPIs which have targets this year. Figure 2 below reports on KPI results

against their targets.

Figure

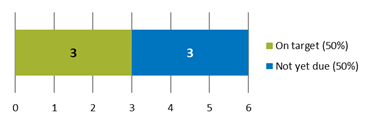

2: Key Performance Indicators

as at 30 September 2019

12 Two

KPIs were achieved and fifty were on target at the end of the first quarter. Of

the remainder, 34 were not yet due and seven were not on target. These are

summarised in paragraphs 50-53, 74-76, 84-85 and 96-97 and reported in more

detail in the activity chapters in Appendix B.

Section 2: Across Council Work Programmes

13 There

are several programmes of work that carry across a number of activities. These

are discussed briefly below, and in more detail in the ‘Across Council

Work Programmes’ chapter in Appendix B.

Provincial Growth

Fund

Key

developments

14 Regional

Economic Development Minister Shane Jones visited Ōtaki and announced four

successful applications to the Provincial Growth Fund (PGF): Omeo Technologies,