|

|

|

RĀRANGI TAKE

AGENDA

Hui Kaunihera | Council Meeting

|

|

I hereby give notice that a Meeting of the Kāpiti

Coast District Council will be held on:

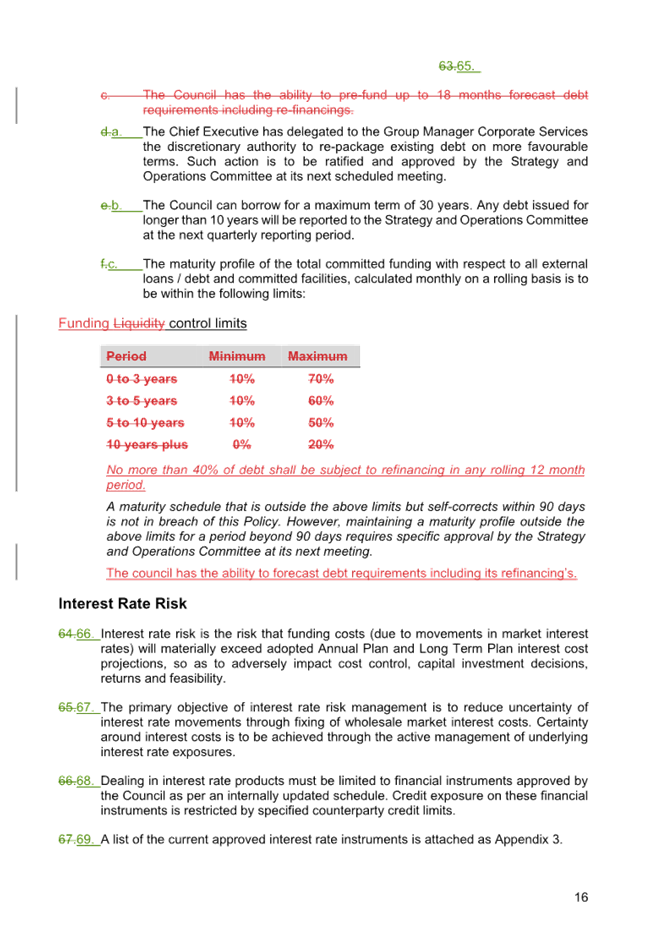

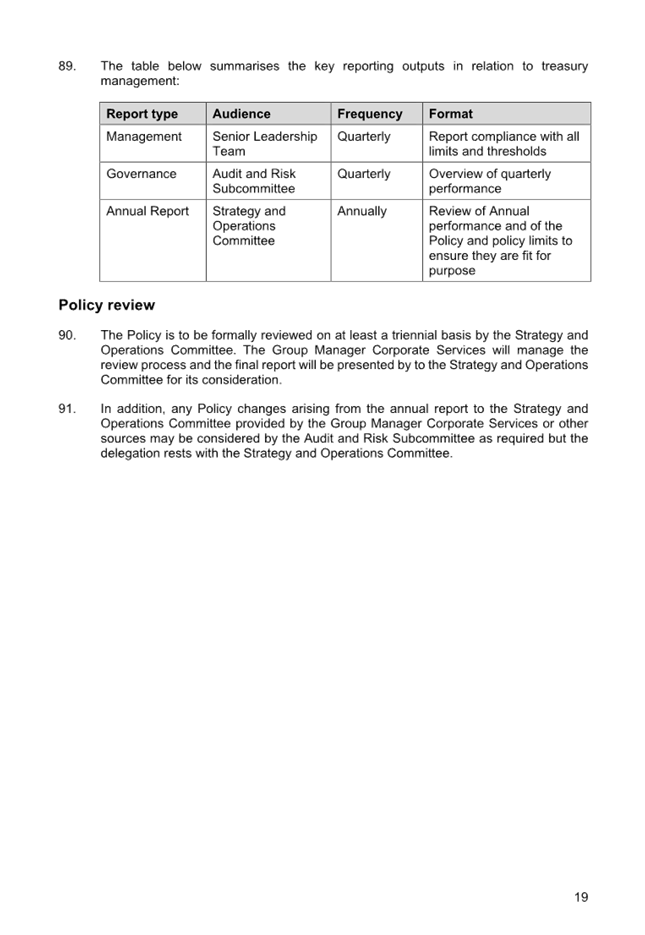

|

|

Te Rā | Date:

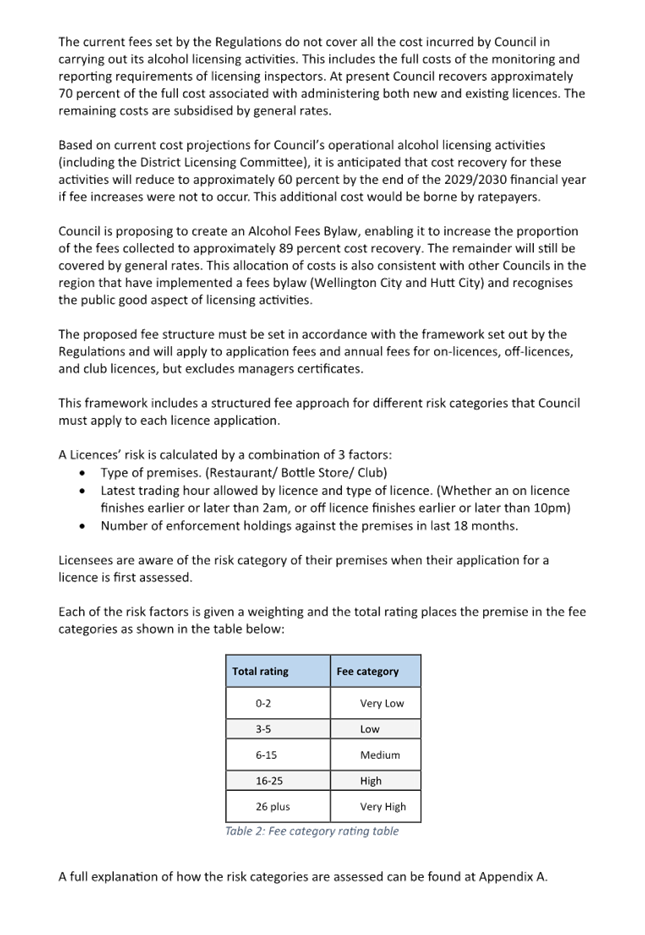

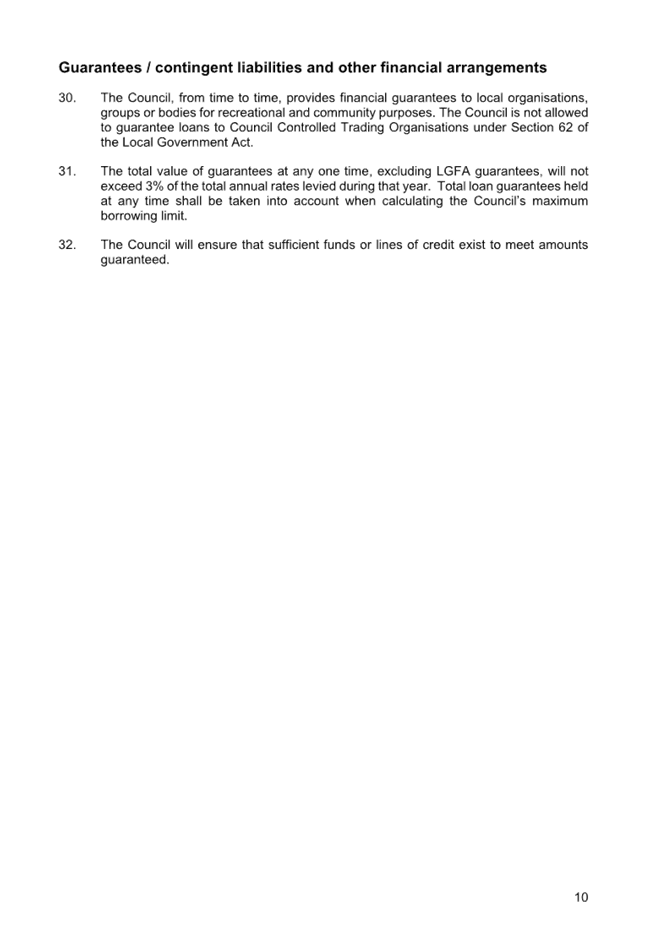

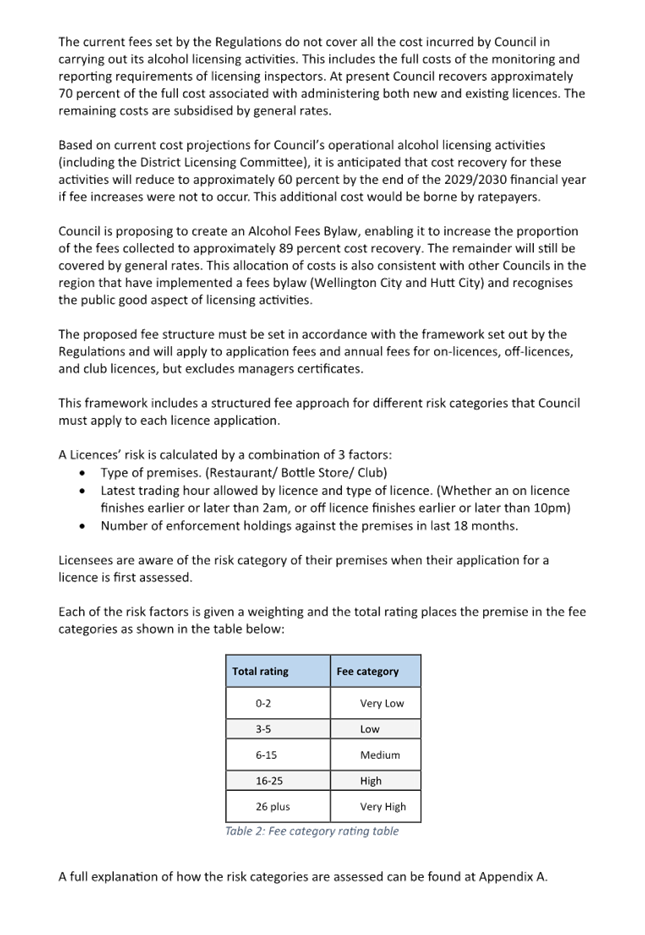

|

Thursday, 28 March 2024

|

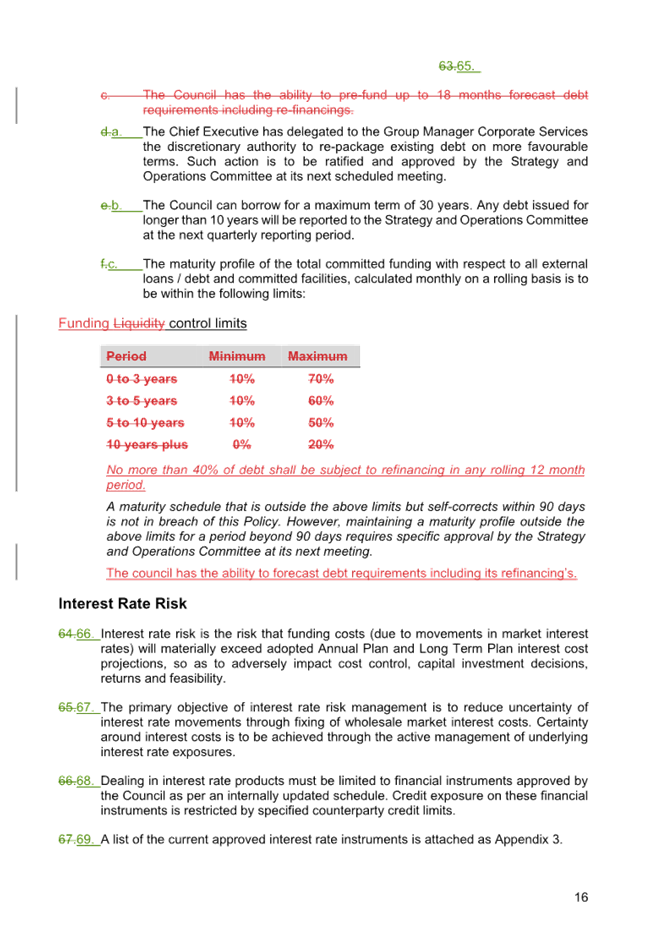

|

Te Wā | Time:

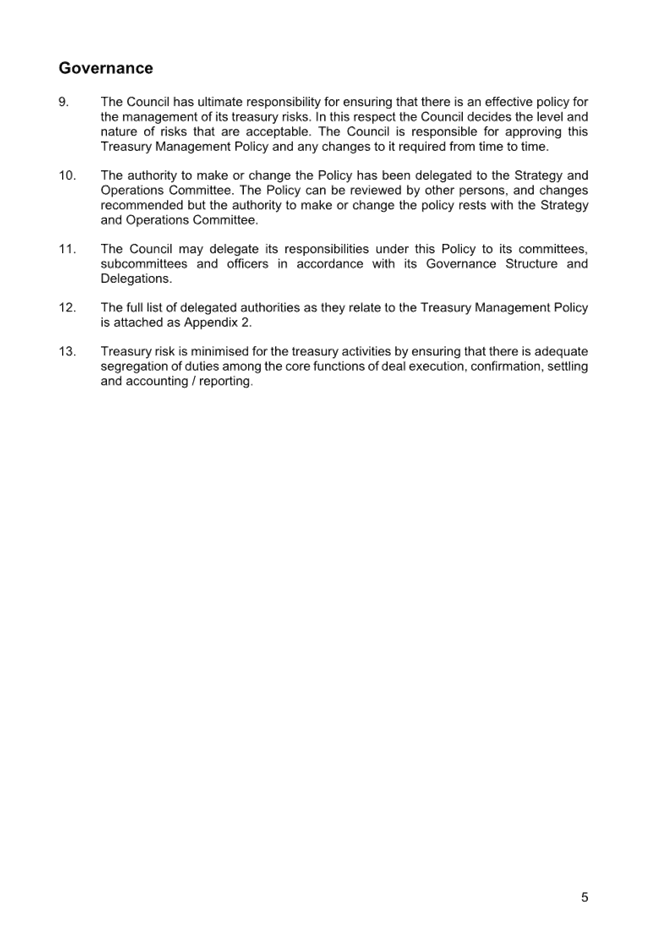

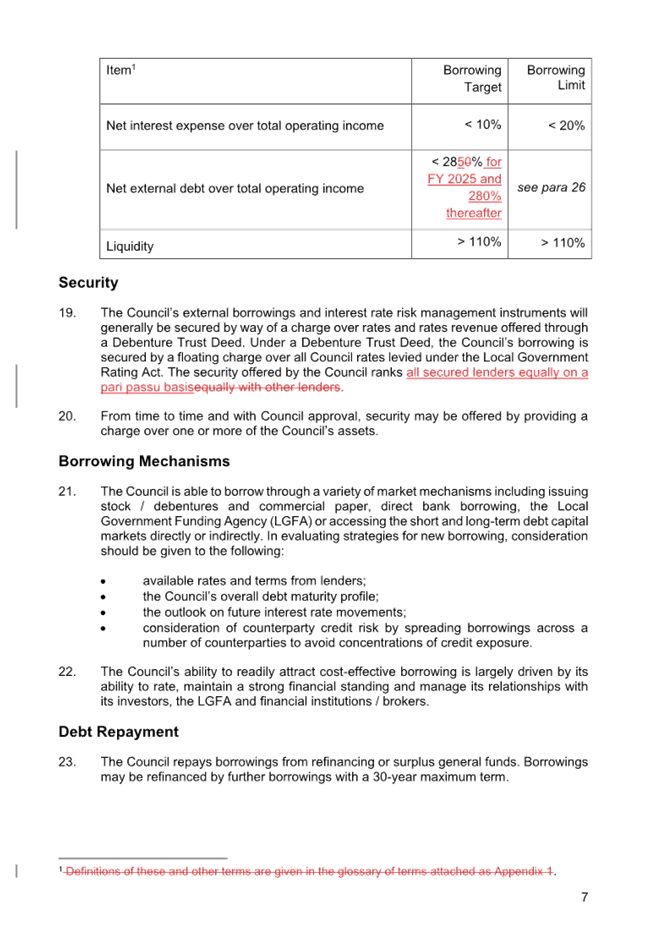

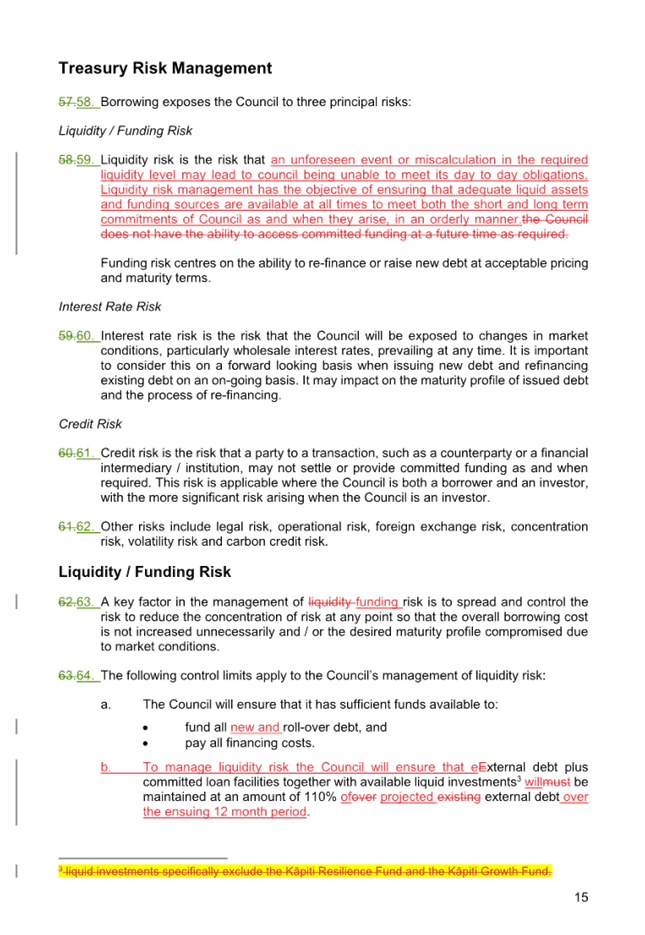

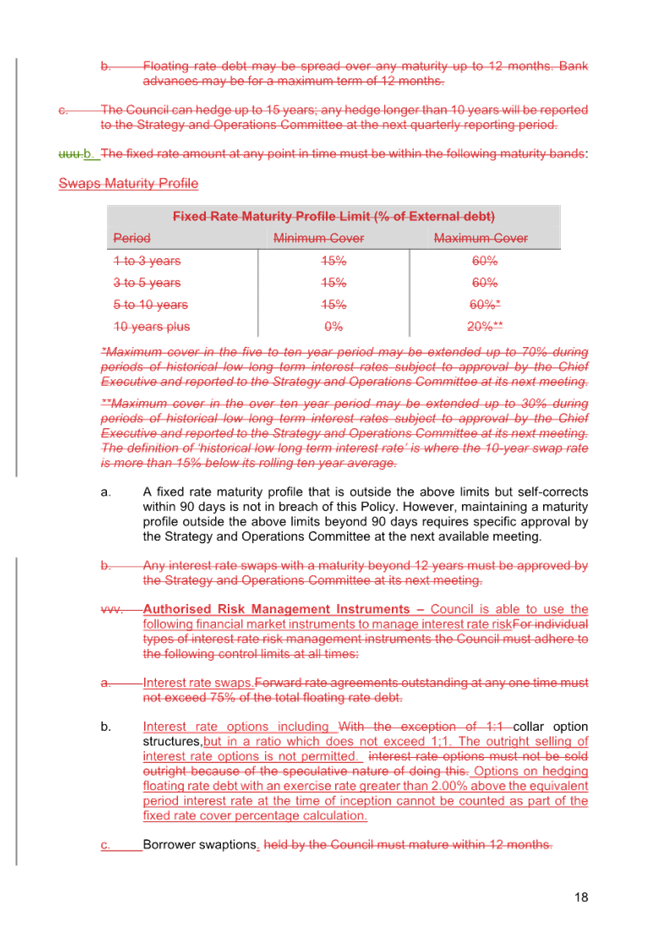

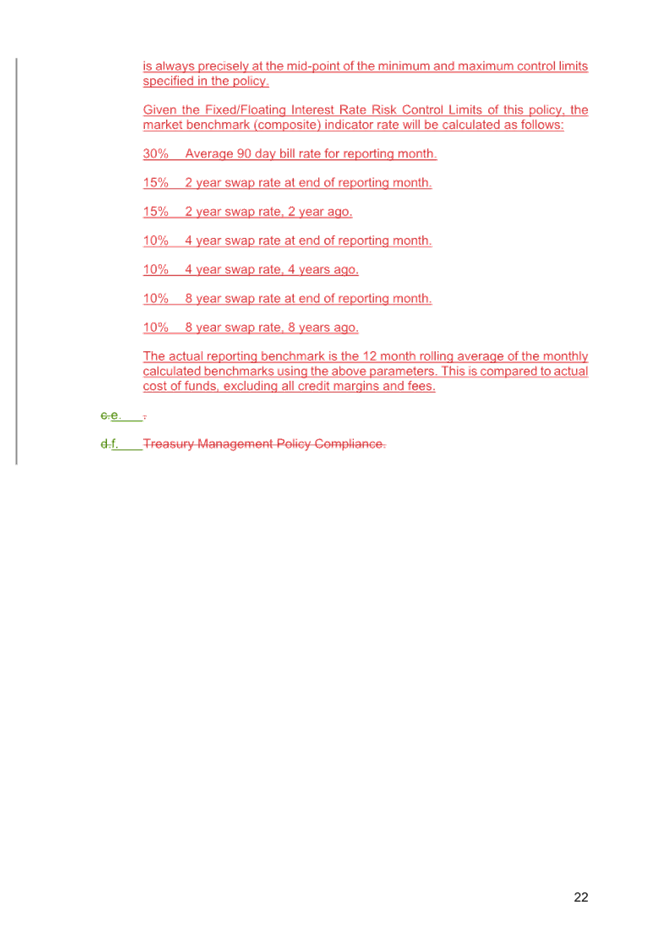

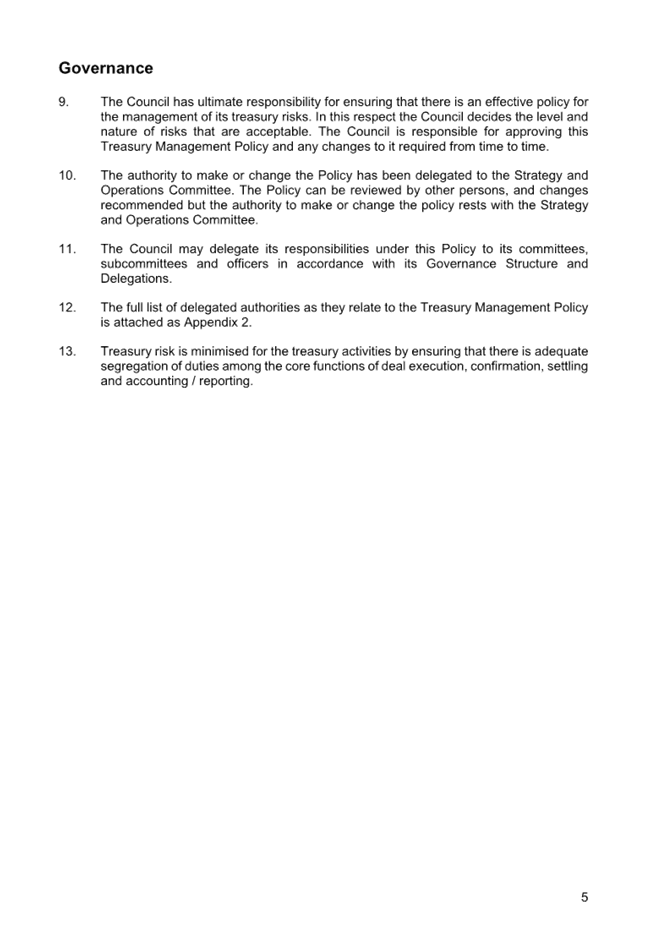

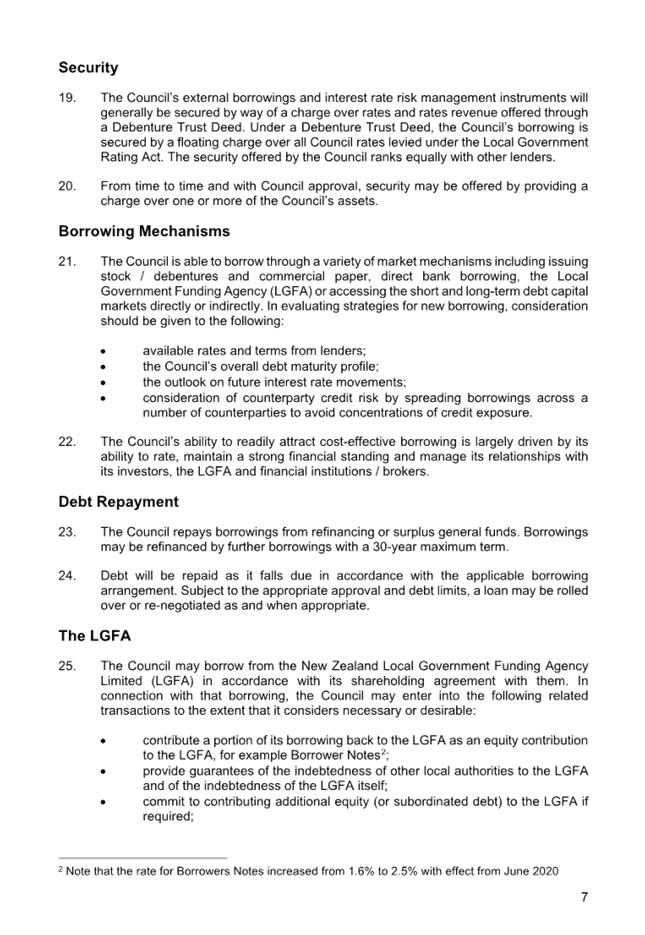

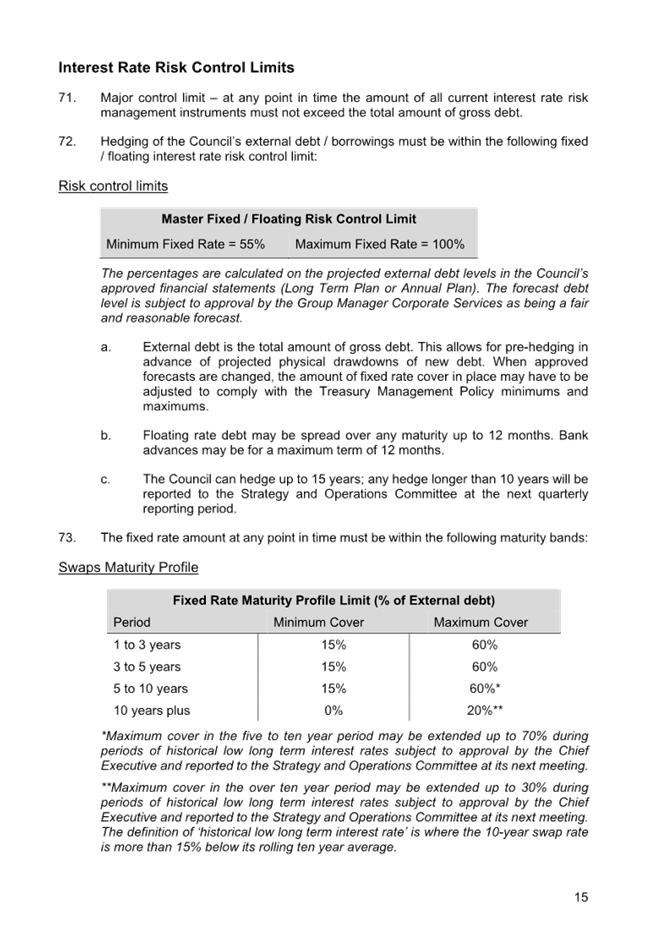

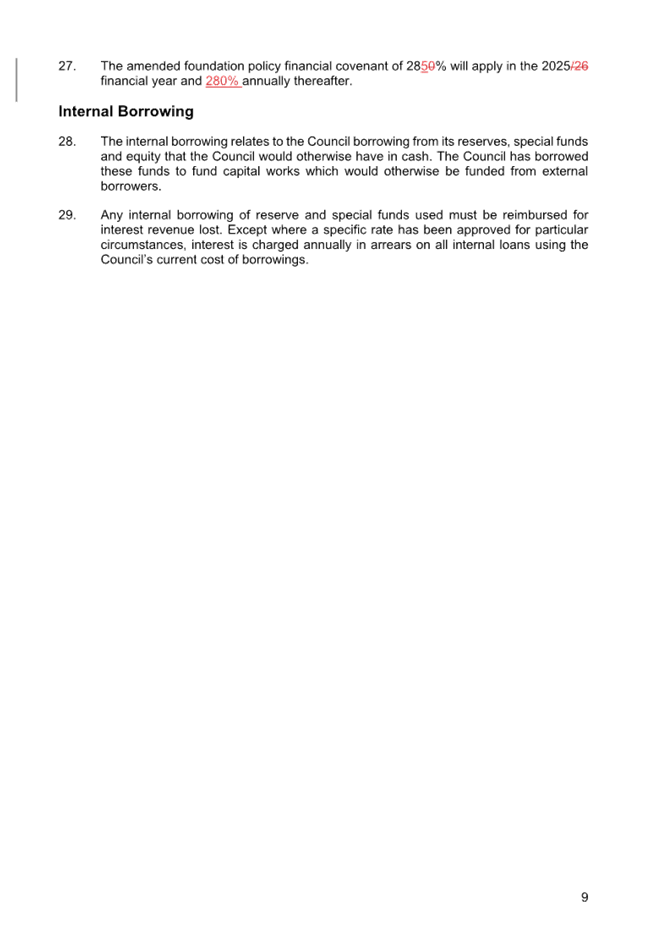

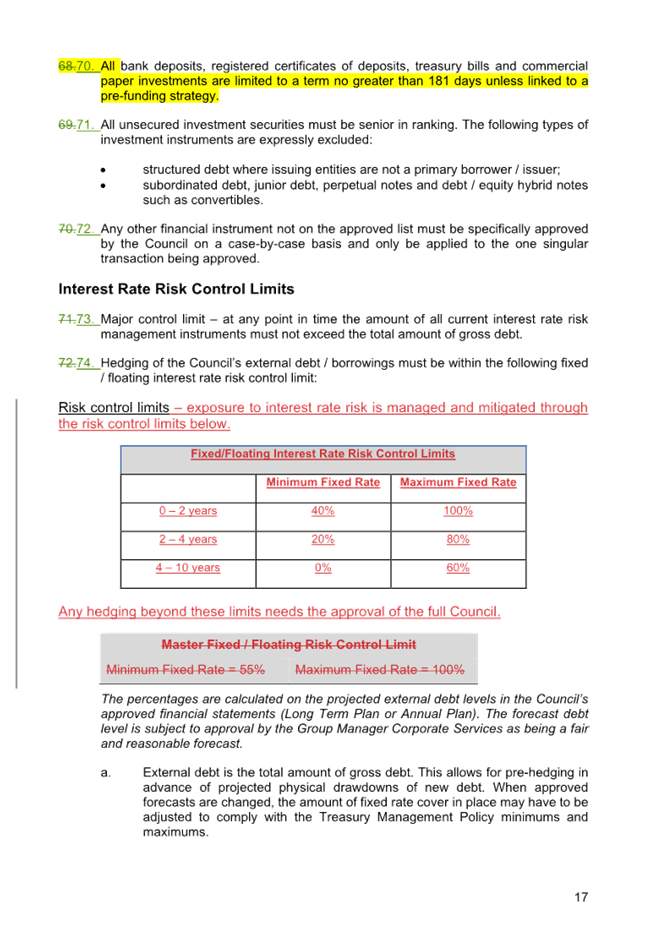

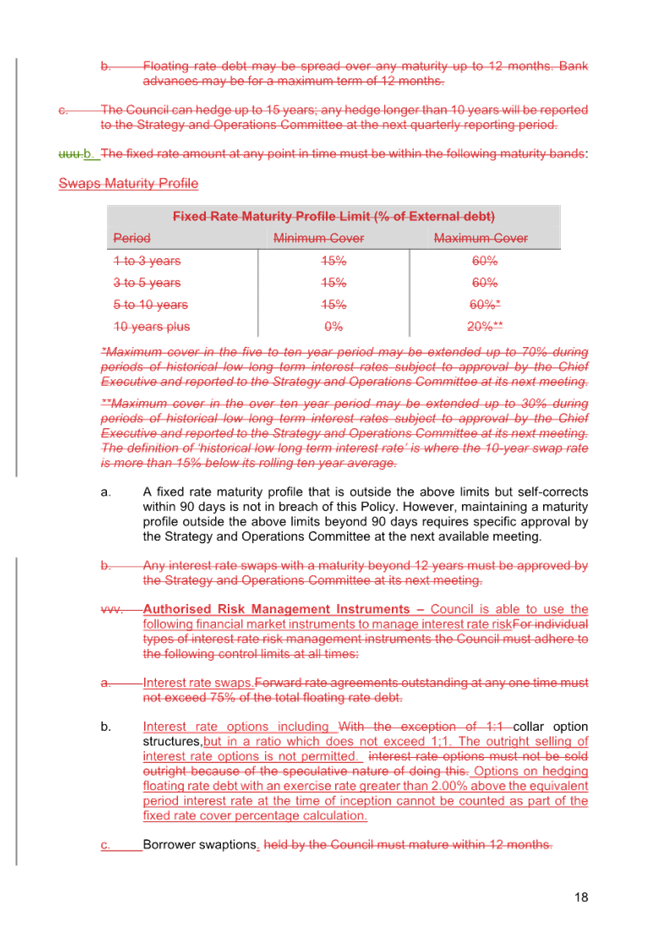

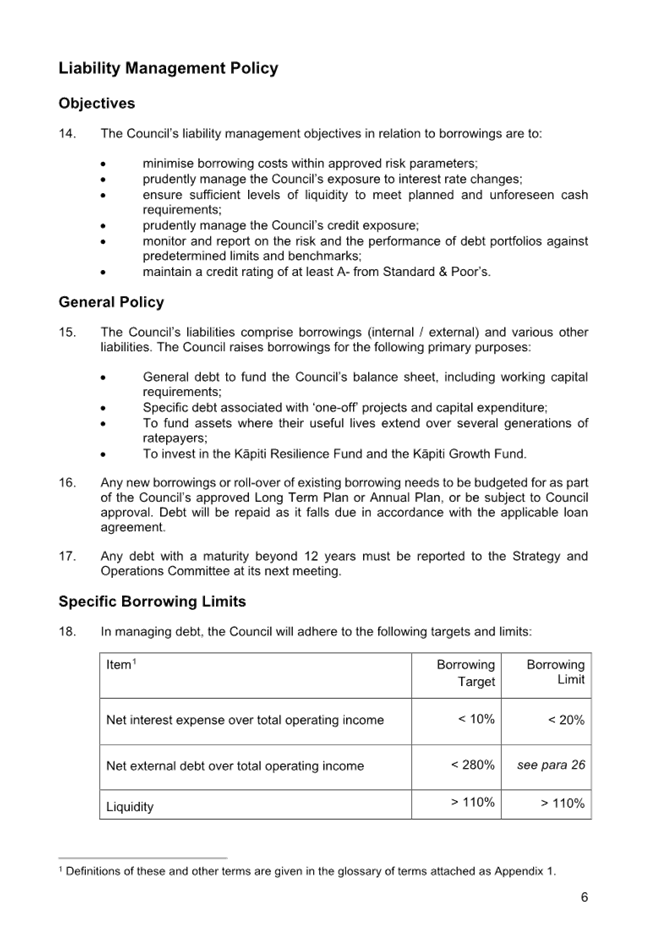

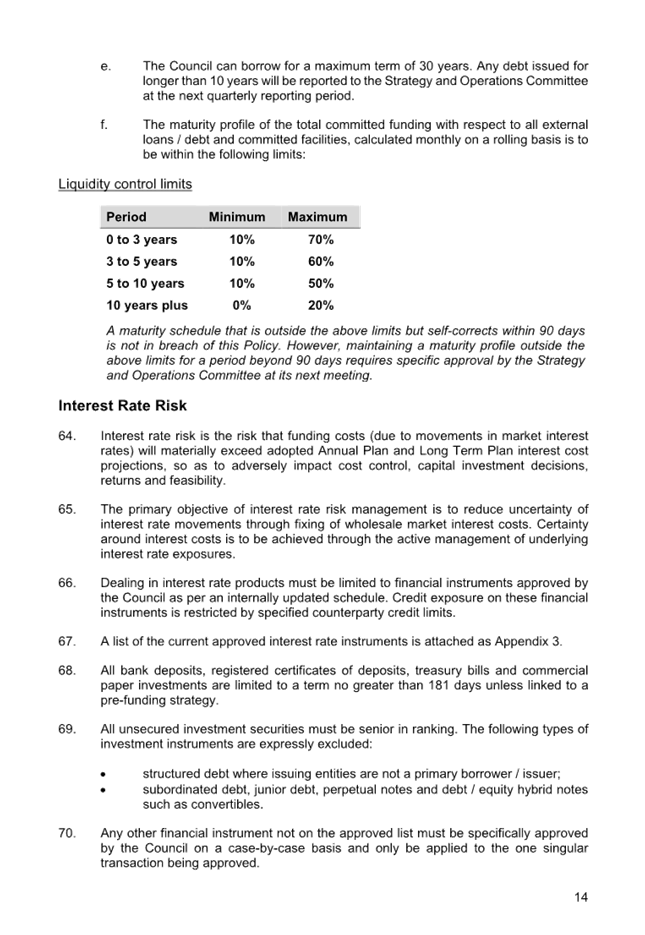

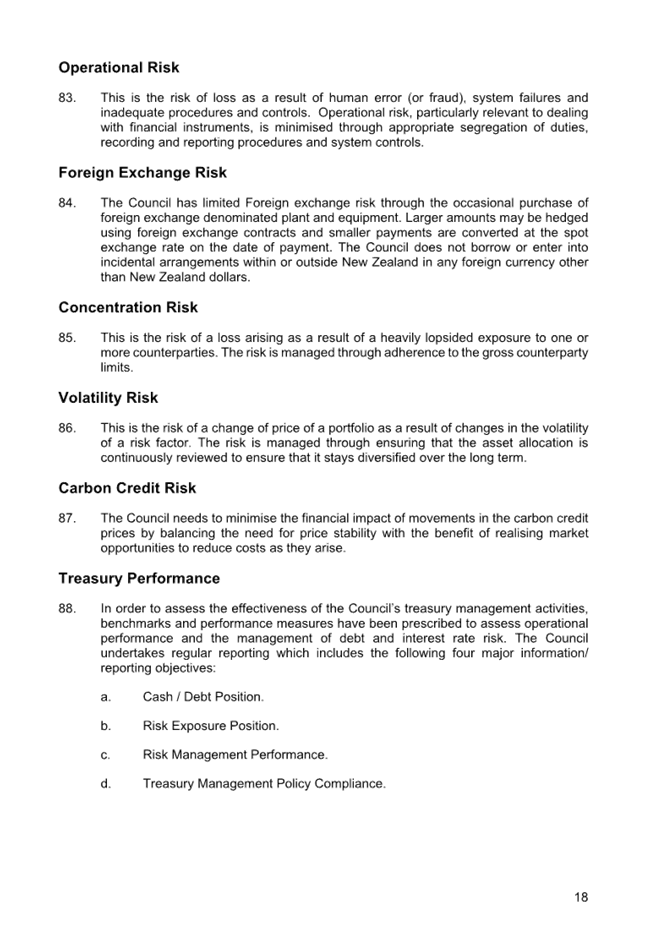

|

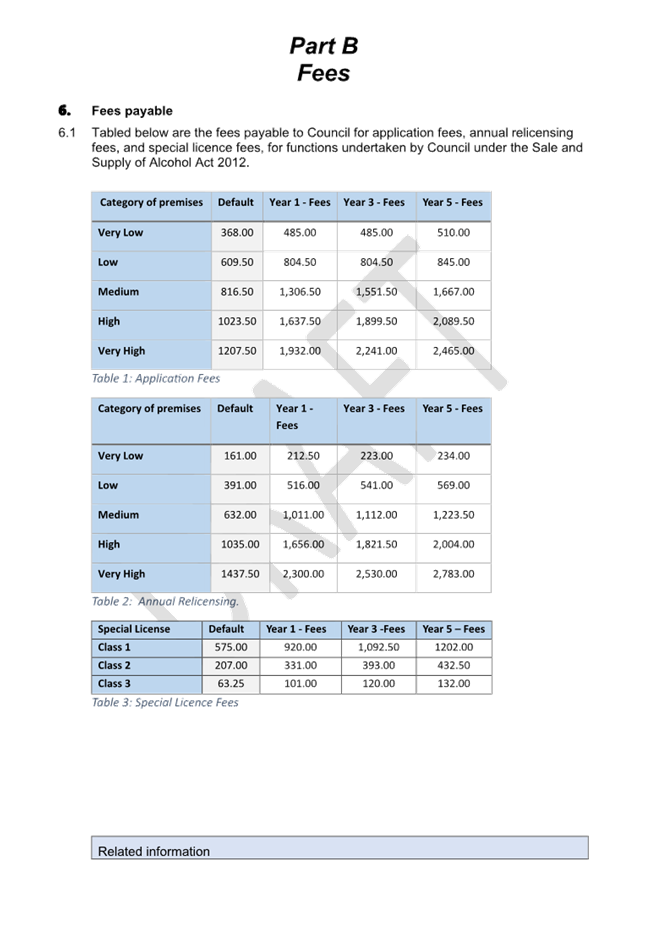

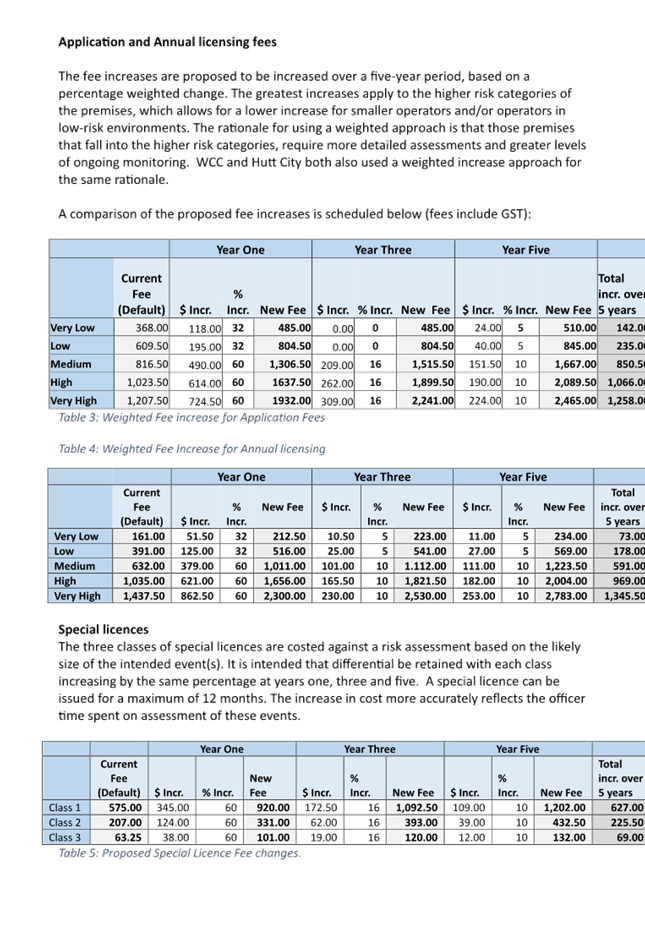

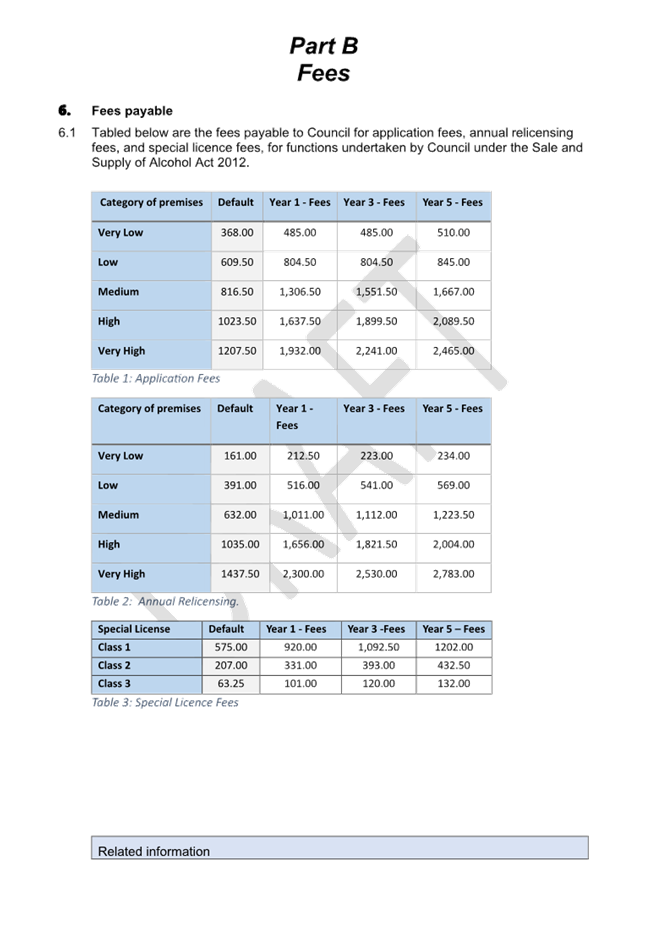

9.30am

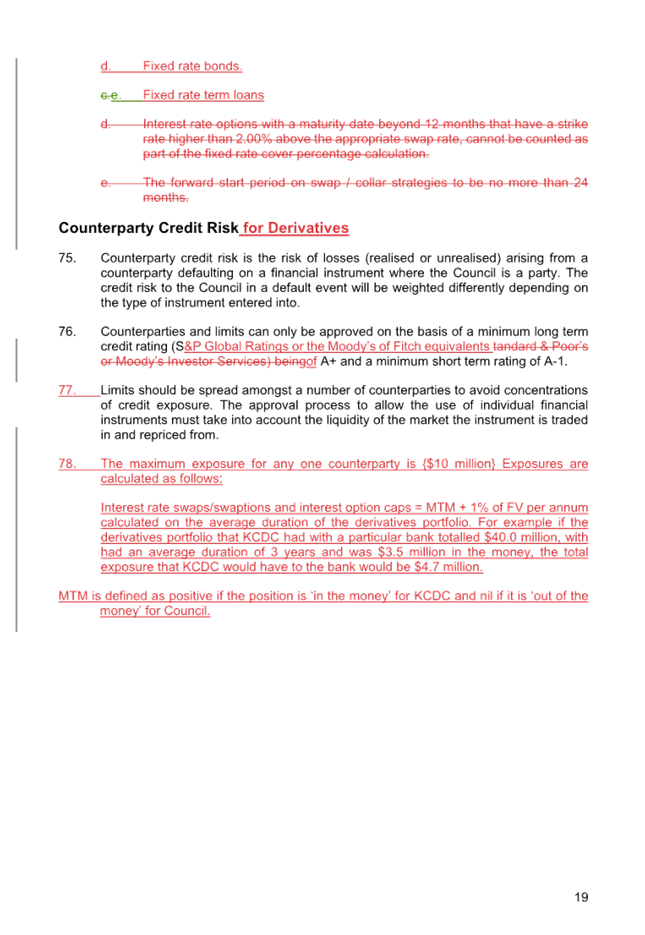

|

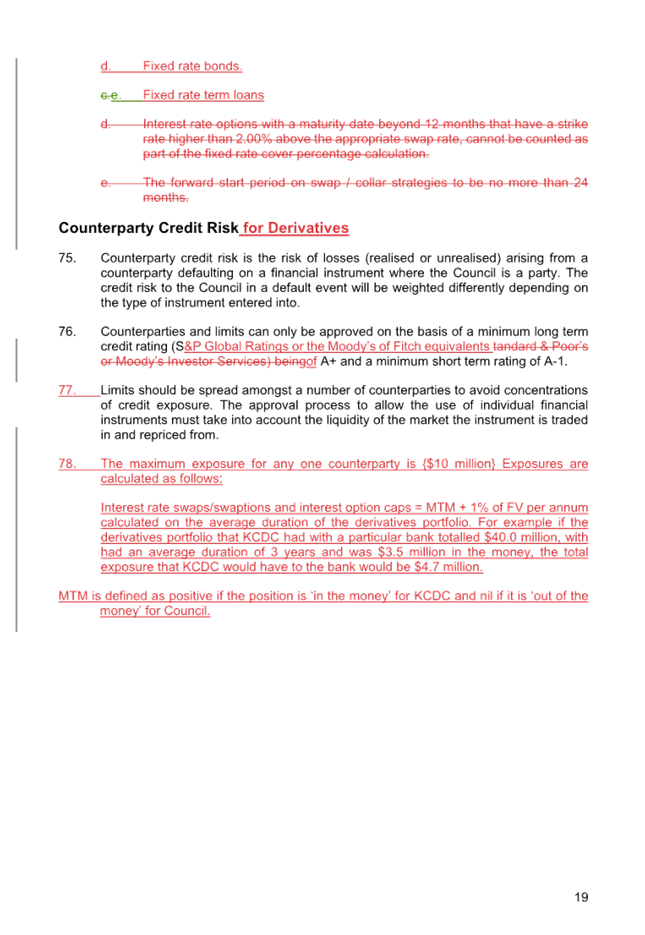

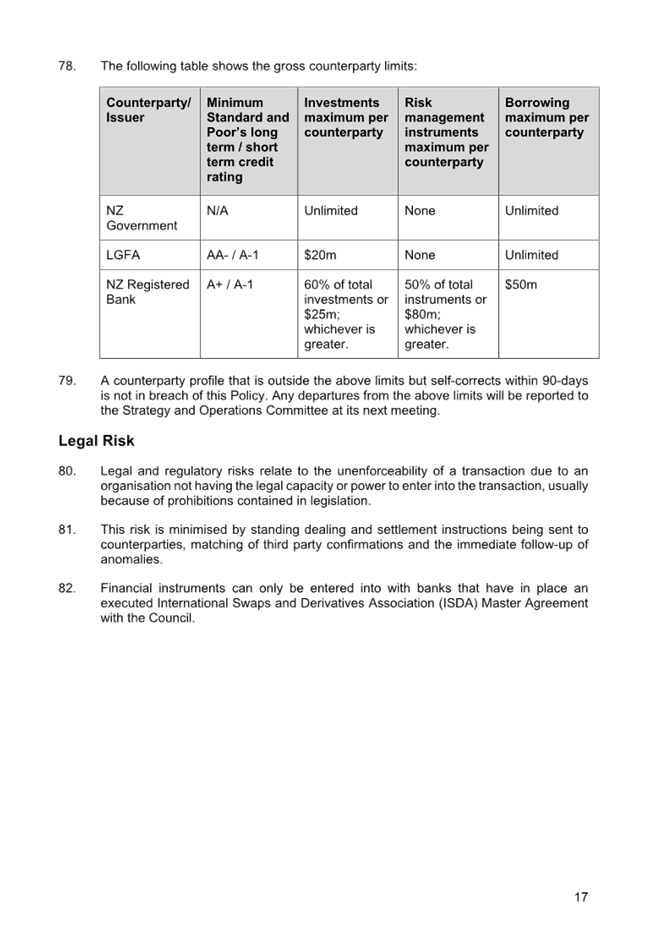

|

Te Wāhi | Location:

|

Council

Chamber

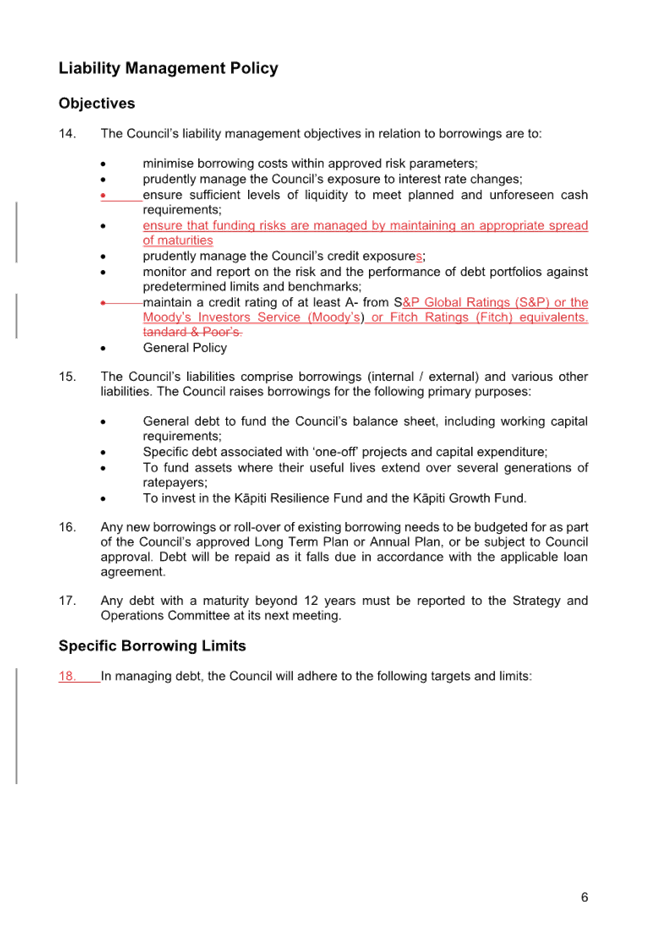

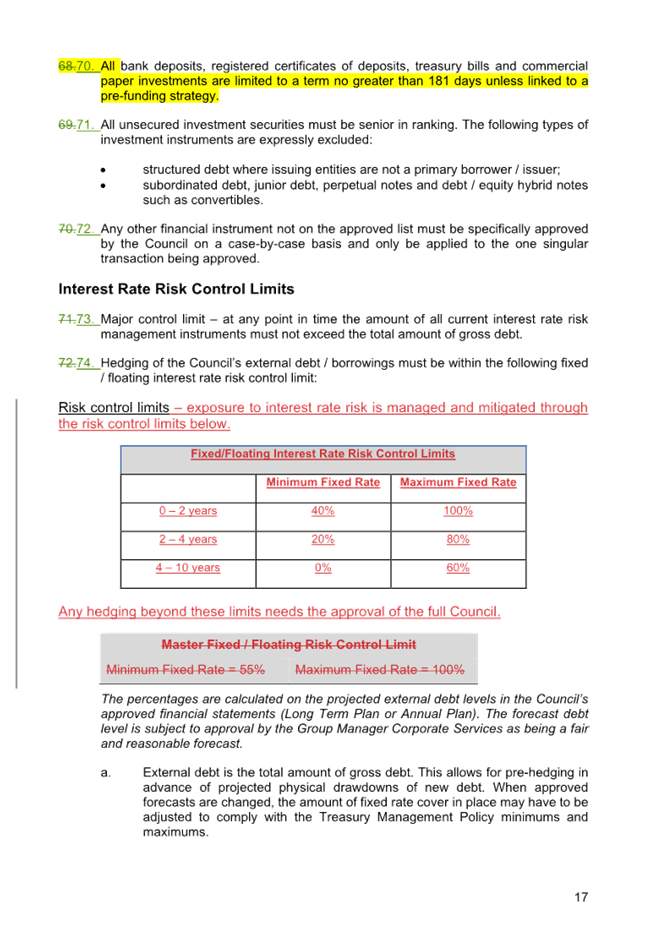

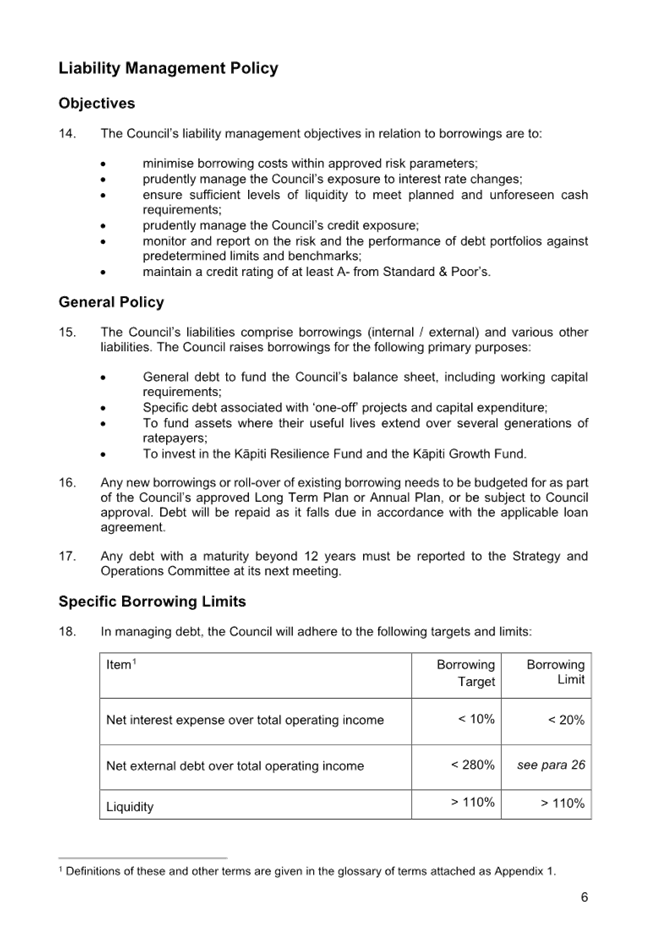

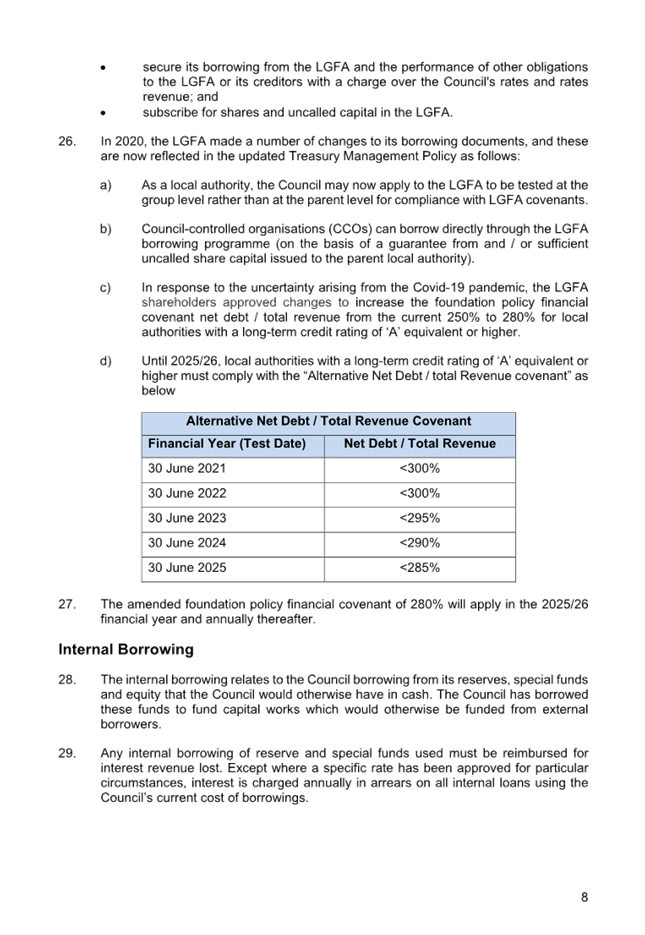

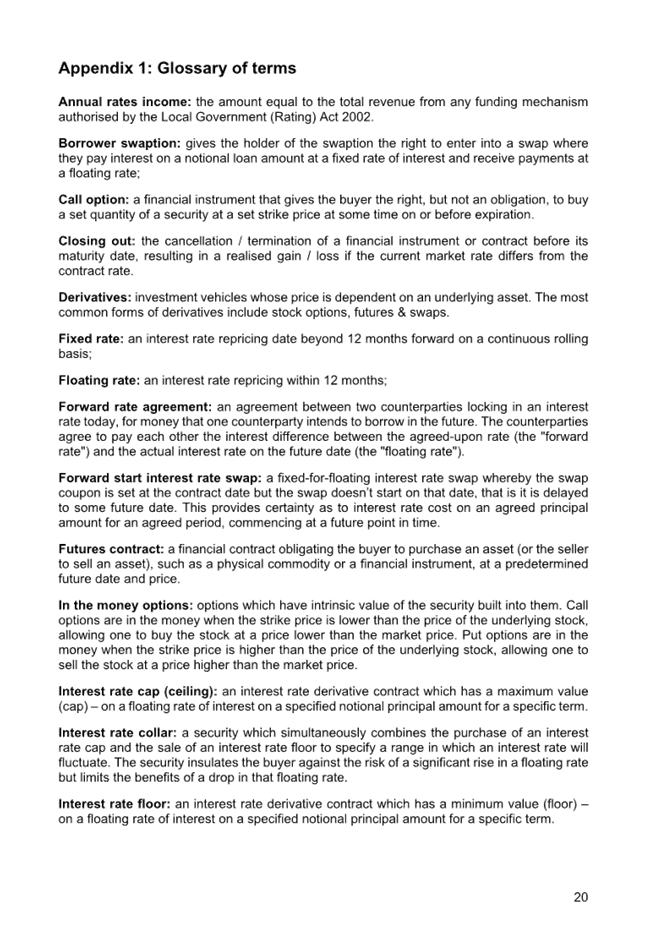

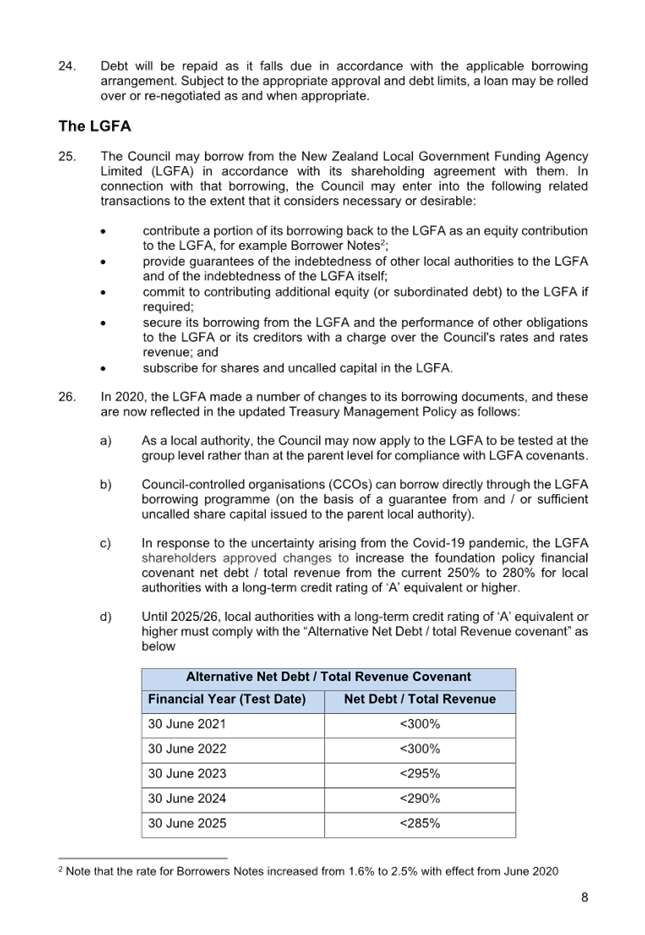

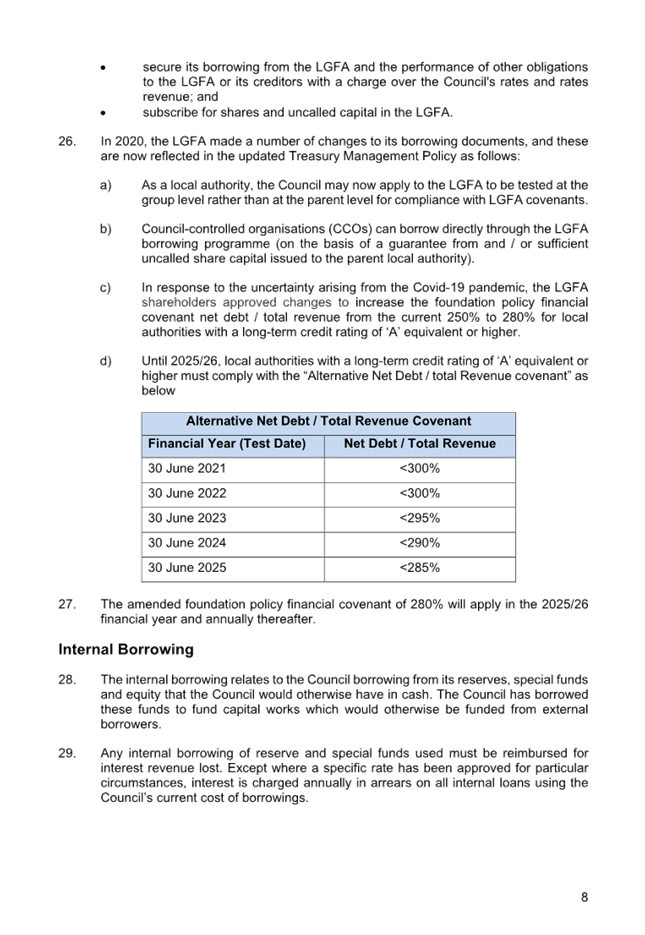

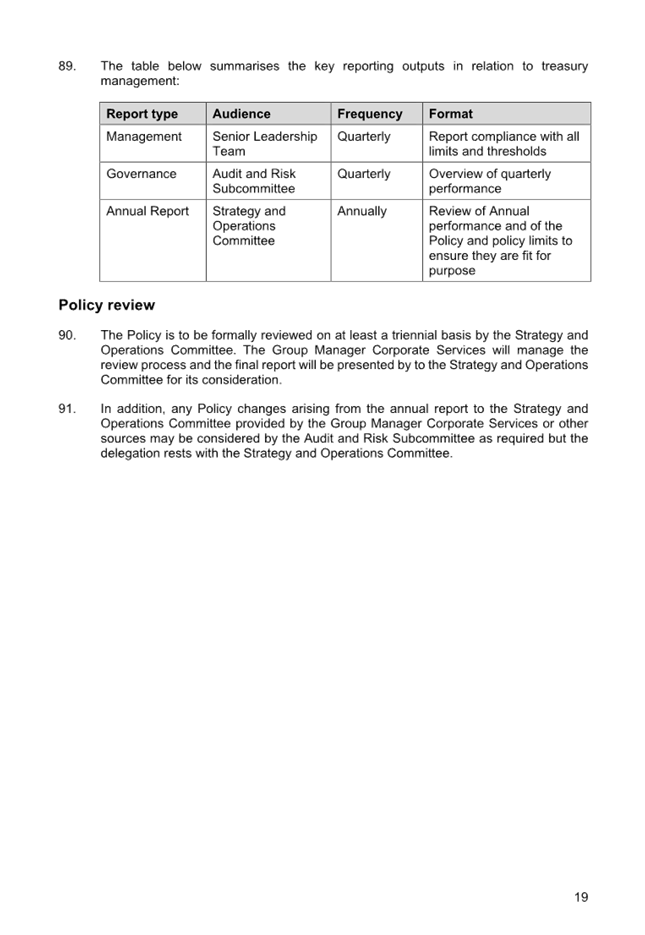

Ground

Floor, 175 Rimu Road

Paraparaumu

|

|

Darren Edwards

Chief Executive

|

|

Council Meeting Agenda

|

28 March 2024

|

Kāpiti Coast District Council

Notice is hereby given

that a meeting of the Kāpiti Coast District Council will be held in the Council Chamber, Ground Floor, 175 Rimu Road,

Paraparaumu, on Thursday 28 March 2024, 9.30am.

Kaunihera | Council

Members

|

Mayor

Janet Holborow

|

Chair

|

|

Deputy

Mayor Lawrence Kirby

|

Deputy

|

|

Cr

Glen Cooper

|

Member

|

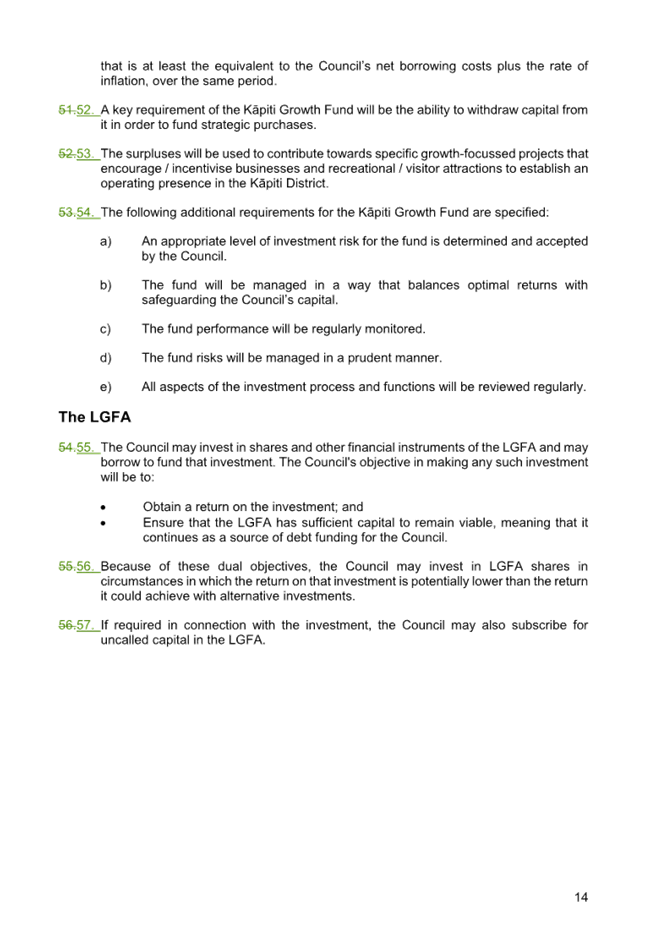

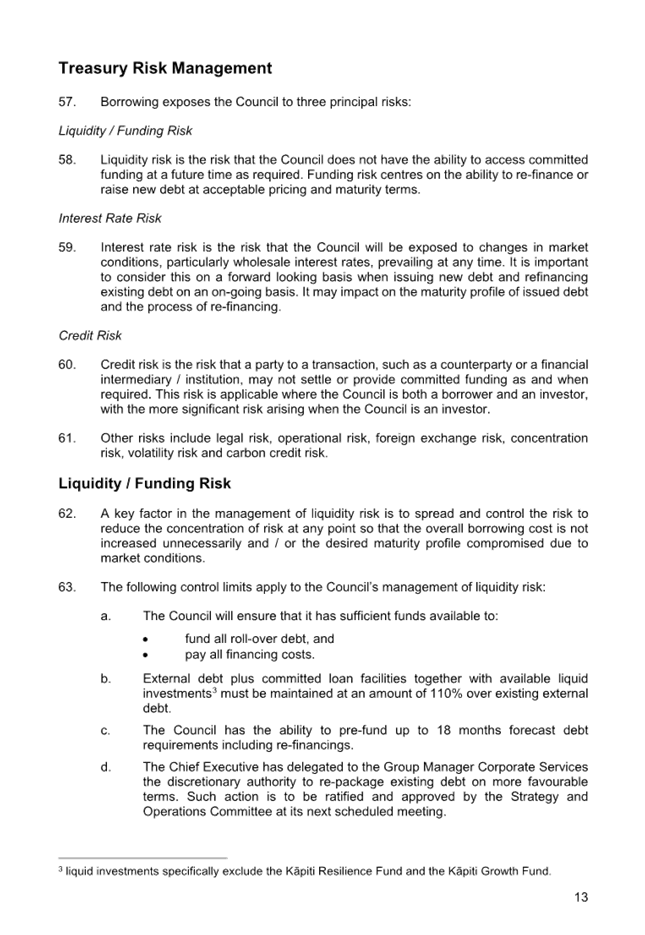

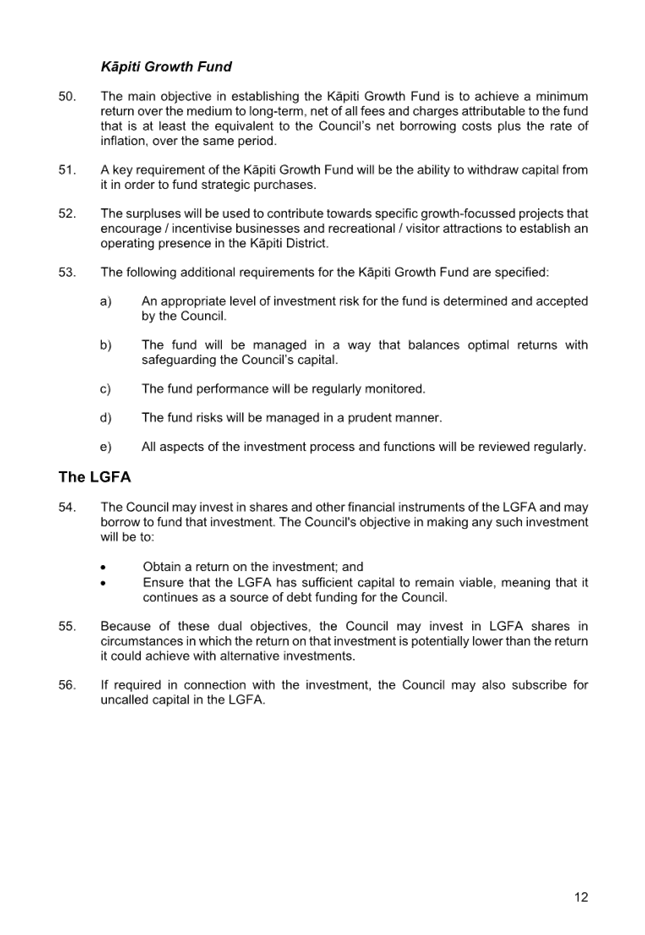

|

Cr

Martin Halliday

|

Member

|

|

Cr

Sophie Handford

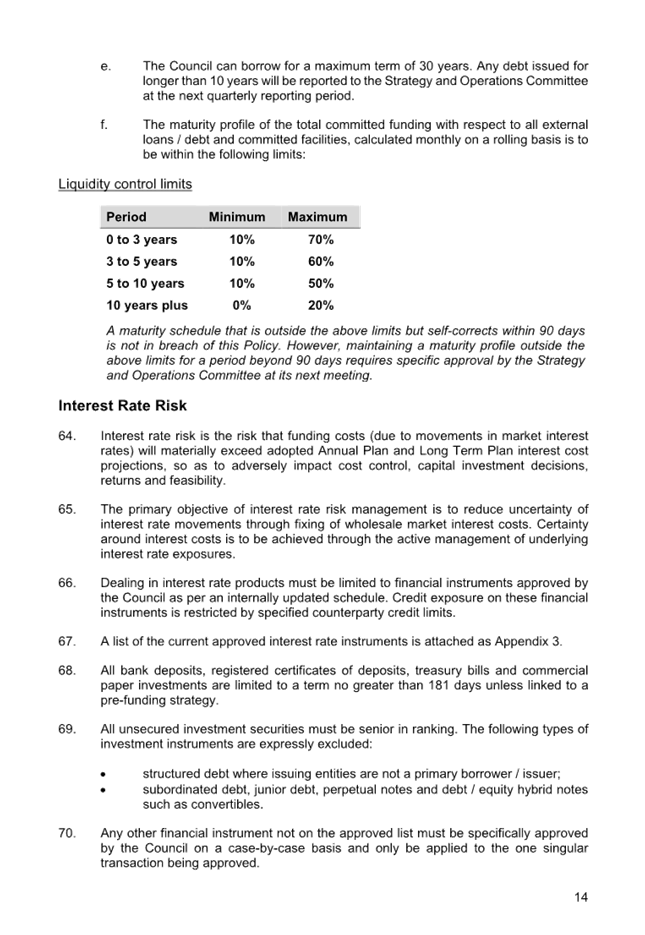

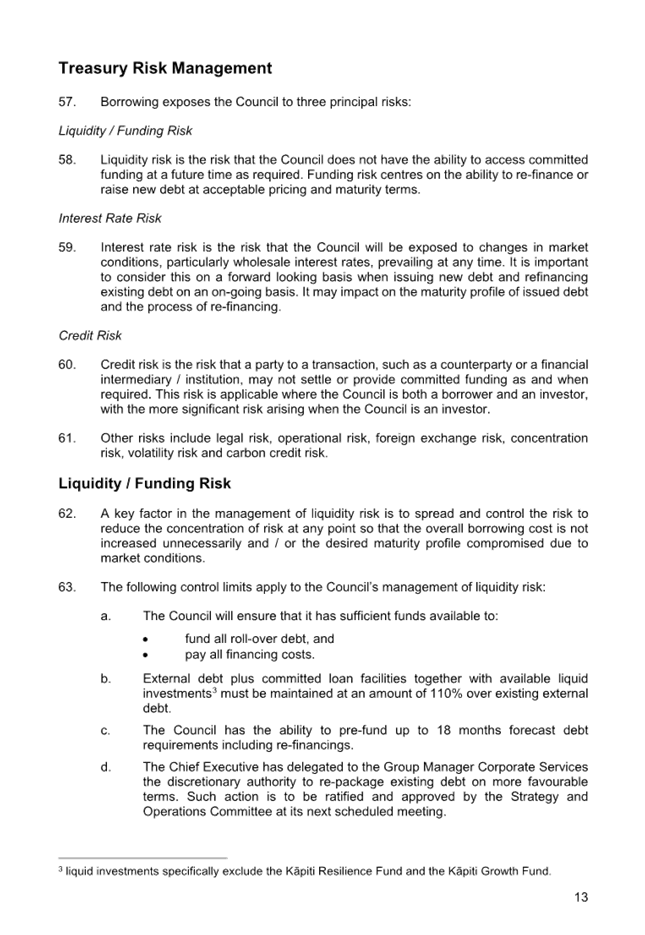

|

Member

|

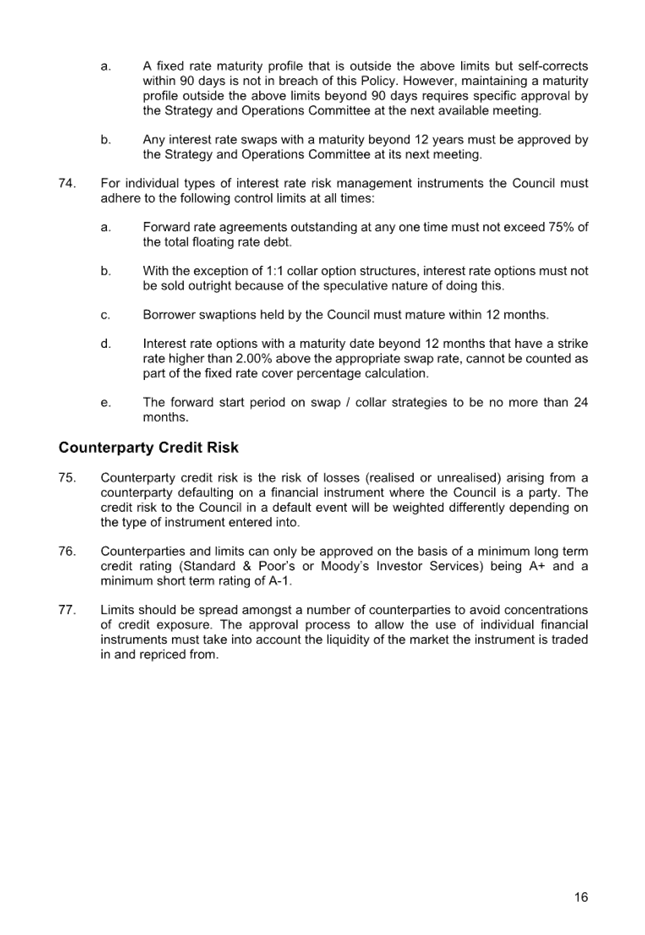

|

Cr

Rob Kofoed

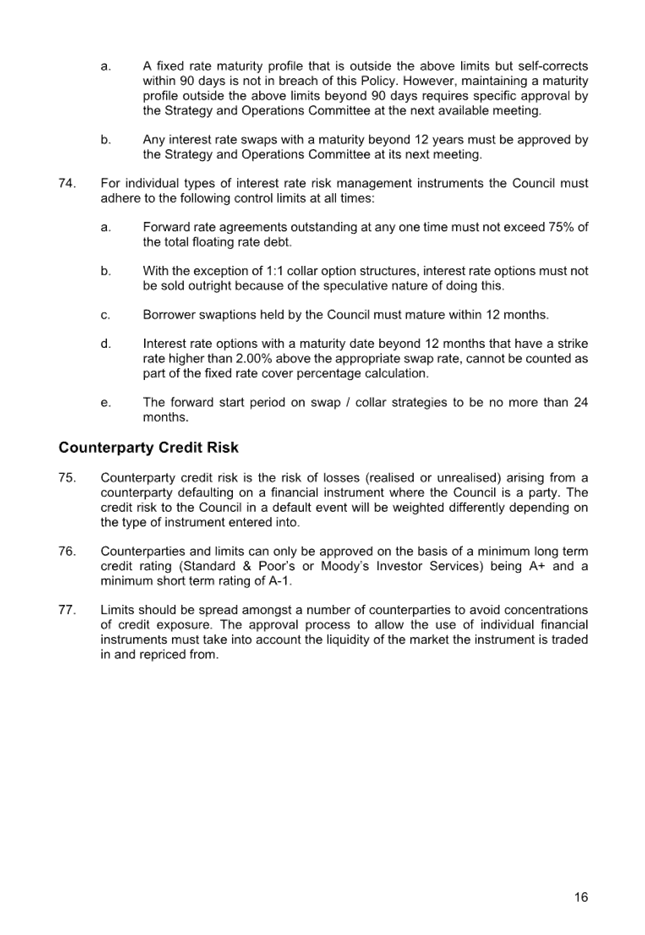

|

Member

|

|

Cr

Liz Koh

|

Member

|

|

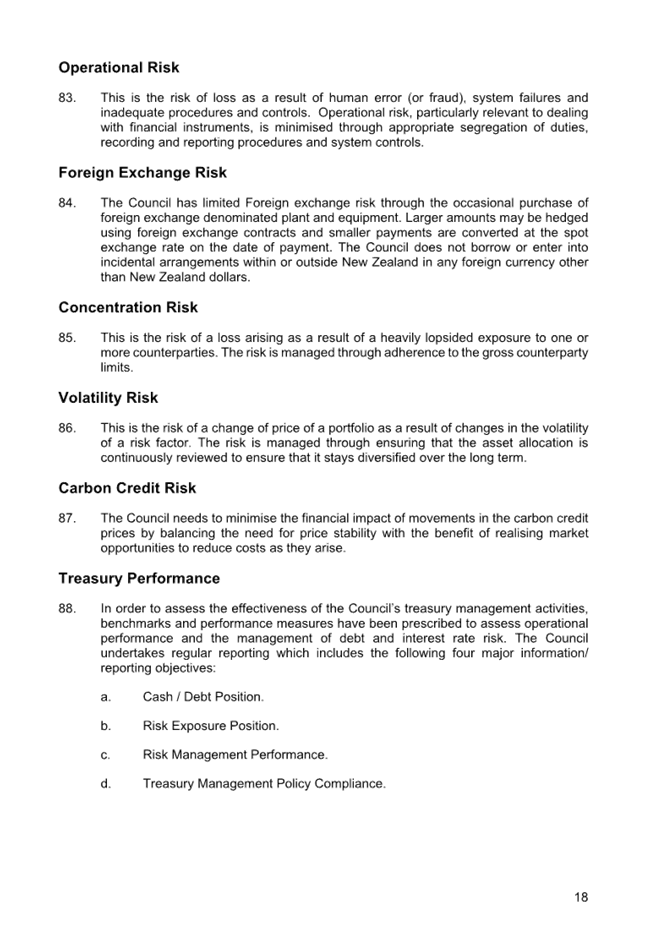

Cr

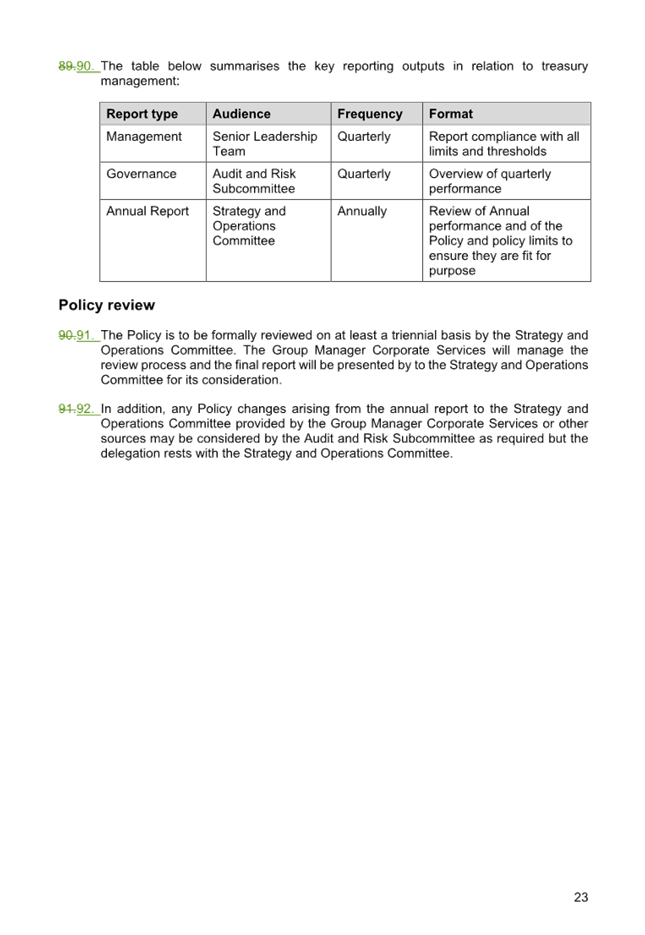

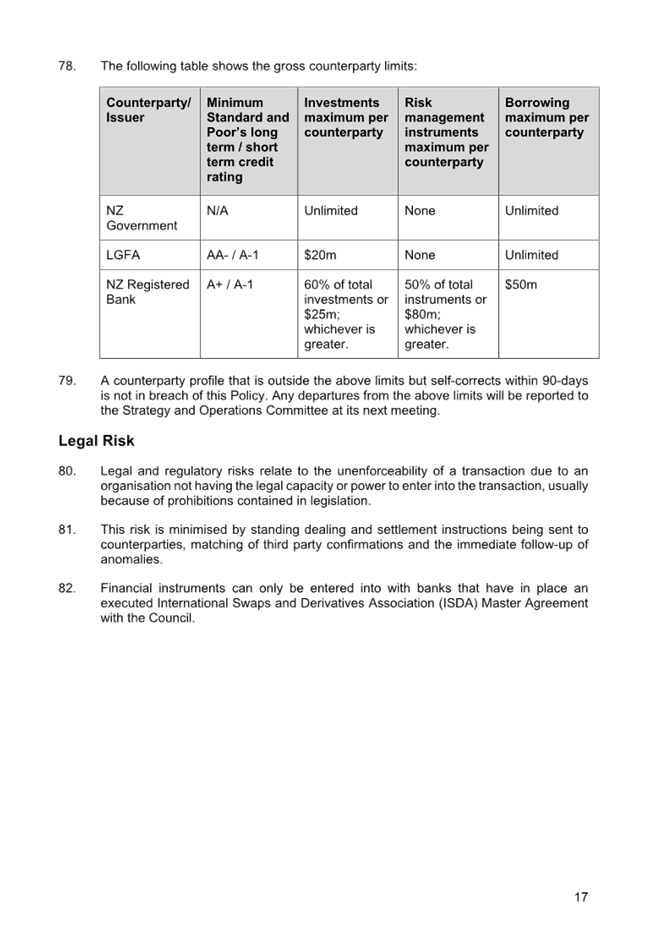

Jocelyn Prvanov

|

Member

|

|

Cr

Kathy Spiers

|

Member

|

|

Cr

Shelly Warwick

|

Member

|

|

Cr

Nigel Wilson

|

Member

|

|

Council Meeting Agenda

|

28 March 2024

|

10 Pūrongo

| Reports

10.1 Adoption

of Draft 2024-2034 Long-Term Plan Consultation Document and Supporting

Information

Kaituhi |

Author: Sheryl

Gavin, Principal Advisor Corporate Services

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake |

Purpose

1 To

recommend the adoption of the Consultation Document (CD) and Supporting

Information for the Long-Term Plan (LTP) 2024-34.

He

whakarāpopoto | EXecutive summary

2 An

Executive Summary is not required for this report.

Te tuku haepapa

| Delegation

3 Only

the Council may approve components of a Long-term Plan and the Long-term Plan

consultation document as stated under Section A2(2) Council Mayoral Powers of

the Governance Structure and Delegations:

“… only Council may

perform the following: To lead the development of the LTP and Annual Plan,

together with policies and budgets.”

Taunakitanga | RECOMMENDATIONS

That Council:

A. Adopts

the supporting information as information that is relied upon by the content of

the Consultation Document in accordance with section 95A(4) of the Local

Government Act:

A.1 The

proposed Financial Strategy for 2024-34

A.2 The

proposed Infrastructure Strategy for 2024-54

A.3 The

proposed Capital Works Programme

A.4 Forecast

Financial Statements

A.5 Funding

Impact Statements

A.6 Forecast

Funding Impact Statement (Rates)

A.7 Significant

Forecasting Assumptions

A.8 Proposed

Rates Remission policy

A.9 Proposed

Revenue and Financing policy

A.10 Proposed

Development Contributions policy

A.11 Proposed

Development Contributions Limited Remission policy

A.12 Proposed

Significance and Engagement policy

A.13 Proposed

Fees and Charges for 2024/25

B. Adopts

the Consultation Document for the Long-term Plan 2024-34.

C. Delegates

the Mayor and the Chief Executive the authority to approve minor editorial

changes to the material adopted.

Tūāpapa | Background

4 The

Local Government Act 2002 (LGA) requires councils to consult with their

communities on their proposed LTPs through the special consultative procedure

(SCP) in accordance with the requirements of sections 83 and 93.

5 A

series of briefings were held from August 2023 through to March 2024 to agree

Council’s direction on its financial and infrastructure strategies,

proposed forecast financials, policies, levels of service and the content and

messaging of the Consultation Document itself.

6 These

briefings, along with what we heard from the community during Vision Kapiti

engagement activities have driven the content of the attached CD.

He

kōrerorero | Discussion

7 As

required by the Local Government Act 2002, the Council has produced a CD

setting out strategic direction, the proposed financial and infrastructure

strategies, key change proposals and other important matters on which Council

would like the community’s feedback on.

8 The

description and analysis of options meets the requirements of legislation and

have been through Council’s auditors Ernst & Young and the Office of

the Auditor General (OAG) for review.

9 Ernst

and Young are continuing their audit of Council’s draft CD and supporting

information and have not yet issued their audit opinion at the time of

publishing this agenda. The CD is scheduled to be considered by the Opinion

Review Committee of the OAG on Tuesday 26 March 2024.

10 Ernst

& Young will be joining the Council meeting via Zoom to update the Council

on their audit of the CD.

He

take | Issues

11 Subject

to findings from Ernst & Young, this report seeks Council adoption of the

CD and supporting information for public consultation to commence on the 28

March 2024.

Ngā

kōwhiringa | Options

12 There

are no options arising from this report.

Mana whenua

13. Mana

whenua representatives were invited to Council workshops and briefings throughout

the development of the CD for the 2024-34 Long-term Plan.

Panonitanga Āhuarangi me te Taiao | Climate change

and Environment

14. There

are no climate change issues in addition to those already covered in the

Appendices of this report.

Ahumoni me ngā rawa | Financial

and resourcing

15 There

are no financial and resourcing considerations in addition to those already

covered in the CD and supporting information.

Tūraru ā-Ture me te Whakahaere

| Legal and Organisational Risk

16 By

adopting the CD and supporting information Council meets its obligations under

the Local Government Act 2002.

Ngā pānga ki ngā kaupapa here | Policy impact

17 The

CD and supporting information form the basis for the 2024-34 Long-term Plan.

Relevant policy impacts are consulted on as part of the Special Consultative

Procedure (s83 of the Local Government Act 2002).

TE whakawhiti kōrero me te

tūhono | Communications &

engagement

18 Formal

community consultation runs from 28 March to 28 April 2024.

Te mahere tūhono | Engagement

planning

19 The

CD and supporting information will be accessible online on Council’s

website at haveyoursay.kapiticoast.govt.nz. Printed copies will be available at

libraries and service centres from approximately 4 April 2024.

20 The

community is invited to provide feedback through a range of channels. We

encourage online submissions but also welcome submissions on a printed form, by

email, or letter.

21 Throughout

the consultation period several informal opportunities to speak to Elected

Members have been arranged.

22 Submitters

may speak to their submissions at hearings on 2 May from 9.30am.

Whakatairanga |

Publicity

23 A

communications plan has been developed to guide consultation activities for the

2024-34 Long-term Plan.

24 Promotion

to encourage the community to make submissions will include media releases,

local newspaper and radio advertising, a special edition of Everything Kapiti,

a social media campaign, and planned Elected Member videos and Mayoral

interviews.

Ngā āpitihanga | Attachments

1. Draft

Financial Strategy 2024-34 (under separate cover)

2. Draft

Infrastructure Strategy 2024-54 (under separate cover)

3. Draft

Capital Works Programme 2024-34 (under separate cover)

4. Forecast

Financial Statements 2024-34 (under separate cover)

5. Forecast

Funding Impact Statements 2024-34 (under separate cover)

6. Draft

Funding Impact Statement for Rates 2024/25 (under separate cover)

7. Draft

Significant Forecasting Assumptions 2024-34 (under separate cover)

8. Draft

Rates Remission Policy 2024 (under separate cover)

9. Draft

Development Contributions Policy (under separate cover)

10. Draft Revenue

& Financing Policy 2024 (under separate cover)

11. Draft

Development Contributions Limited Remission Policy 2024 (under separate cover)

12. Draft

Significance & Engagement Policy 2024 (under separate cover)

13. Draft

Schedule of Fees and Charges for 2024/25 (under separate cover)

14. 2024-34

Long Term Plan Consultation Document (under separate cover)

|

Council Meeting Agenda

|

28 March 2024

|

10.2 Treasury

Management Policy

Kaituhi |

Author: Mark

de Haast, Group Manager Corporate Services

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake |

Purpose

1 The

purpose of this report is to discuss the proposed changes to Council’s

current Treasury Management Policy (TMP) and seek Council approval to adopt a

revised TMP attached as Appendix 2 to this report.

He

whakarāpopoto | EXecutive summary

2 Not

required for this report.

Te tuku haepapa

| Delegation

3 Only

the Council may approve components of a Long-term Plan and the Long-term Plan

consultation document as stated under Section A2(2) Council Mayoral Powers of

the Governance Structure and Delegations:

“…Adopt policies

required under the Act in association with the LTP or the local governance

statement”

Taunakitanga | RECOMMENDATIONS

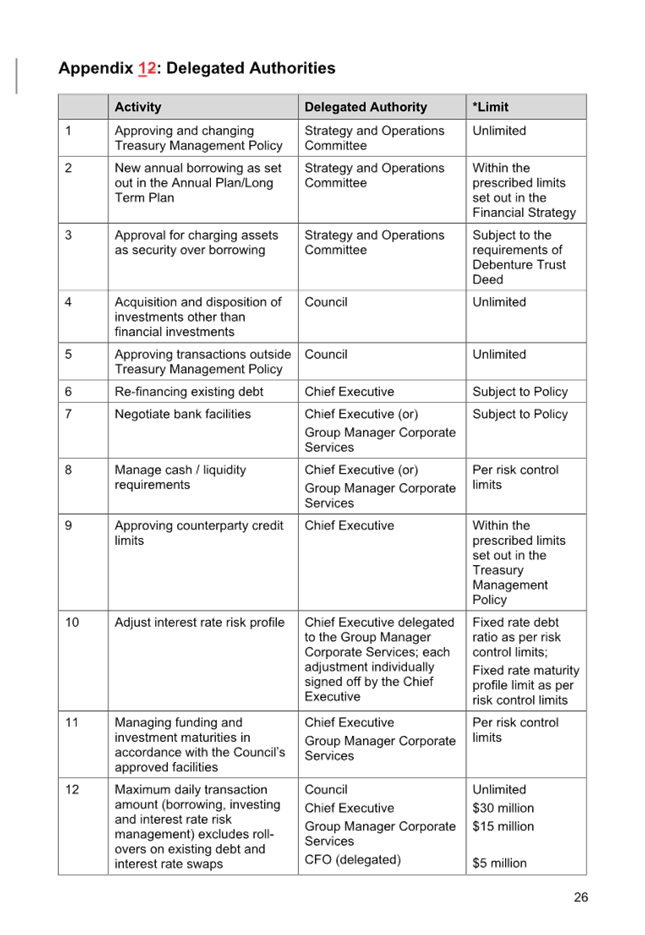

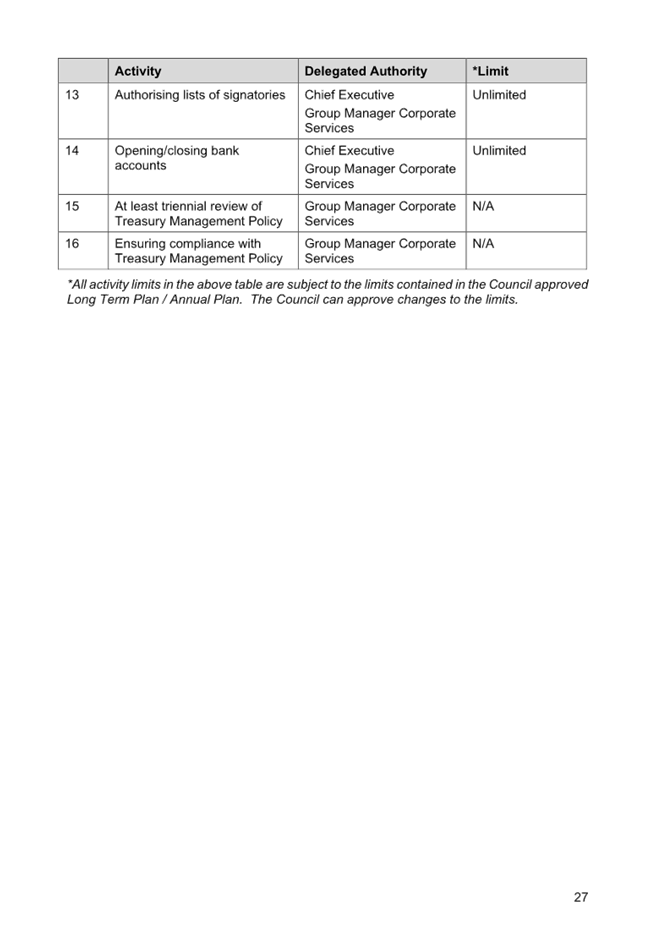

A. That

Council receives and notes this report including Appendices 1 and 2 to this

report.

B. That

Council approves the recommended changes from Bancorp Treasury Services

Limited, as detailed in paragraphs 10 to 25 of this report and shown in

Appendix 1 to this report.

C. The

Council delegate authority to the Mayor and the Chief Executive to make further

editorial changes to the Treasury Management Policy to remove the section on

Managed Funds and the Glossary in Appendix 1 and 2 to this report

D. The

Council delegate authority to the Mayor and the Chief Executive to make further

minor editorial changes to reflect current Governance Structure and Delegations

and as may be required by the Council auditors Ernst & Young and/or Bancorp

Treasury Services limited.

Tūāpapa | Background

4 The

current TMP was first adopted in 2017 as

part of the 2018-2021 Long Term Plan process. The TMP incorporates the

Liability Management Policy and the Investment Policy. This is attached as

Appendix 2 to this report.

5 This review of the TMP is focused on developing

appropriate recommendations for additions, deletions or amendments to the TMP

to enable the treasury activities of Council to be carried out under a set of

market best practice standards.

6 Council

use Bancorp Treasury Services Limited as their independent treasury advisors.

All treasury transactions, particularly new debt issuances and interest rate

swap transactions, are first fully consulted on with Bancorp Treasury Services

Limited.

7 This

report details the changes recommended to Council’s TMP by Bancorp

Treasury Services Limited (“Bancorp Treasury”) and Council

Officers.

8 There are a number of minor editorial changes.

These and the other more substantive changes are shown in “Track

Change” format in the TMP attached as Appendix 1 to this report.

9 For convenience, all changes are shown a

“No Mark Up” format in the TMP, attached as Appendix 2 to this

report.

He

kōrerorero | Discussion

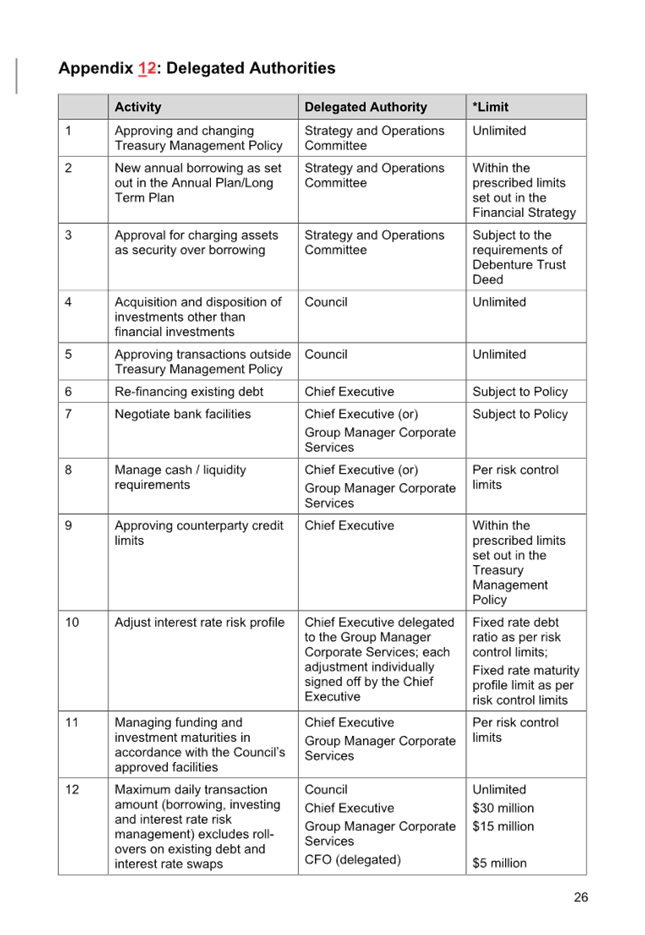

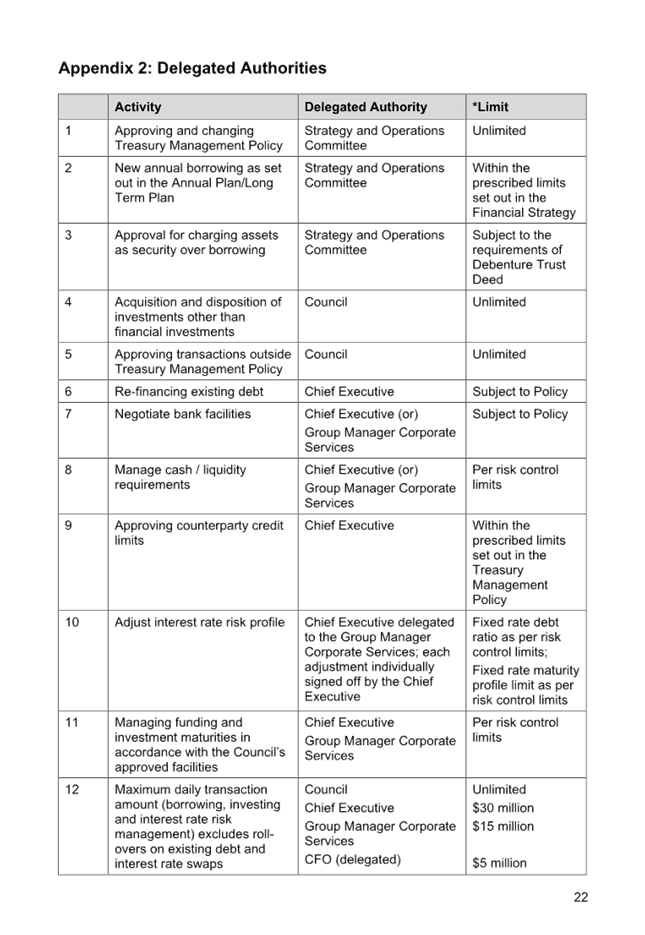

10 The more

substantive changes to the TMP, as recommended by Bancorp Treasury Services

Limited, are discussed separately below. All section references refer to

Appendix 1 to this report.

11 In Section 21 titled ‘’Borrowing

Mechanisms” we recommend deleting the last bullet point which requires

Council should give consideration to ‘’counterparty credit risk by

spreading borrowings across a number of counterparties to avoid concentrations

of credit exposure.’’ This is not practical as all of

Council’s borrowings are from the Local Government Funding Agency

(“LGFA”) which provides considerably cheaper funding than the

banking sector and the capital markets which includes standalone bond issuance.

12 In Section 44 titled ‘’Financial

Investments’’ we recommend that this section be deleted as it is

superseded by the new investment matrix included in Appendix 3 which is

commented on later in this letter.

13 In Section 59 titled “Liquidity/Funding

Risk” we recommend a more extensive definition of liquidity which clarifies the management of liquidity risk.

14 In Section 63 (b) titled “Liquidity/Funding

Risk” we recommend amending the provision relating to maintaining 110% of

liquidity, to include projected external debt rather than external debt as this

is the calculation that the LGFA uses i.e. projected external debt.

15 In Section 64 (c) titled “Liquidity/Funding

Risk” which states “The Council has the ability to pre-fund up to

18 months forecast debt requirements including re-financings” we

recommend that the 18 month restriction be deleted as it restricts KCDC from

pre-funding past 18 months even if it is advantageous to do so.

16 In Section 64 (f) titled “Liquidity/Funding

Risk” which details the Funding control limits we recommend that the four

time buckets be deleted and replaced with a requirement that “No more

than 40% of debt shall mature in any rolling 12 month period”. This

amendment alleviates the need to micromanage exposures to merely comply with

the policy, but which in reality may hinder the cost of compliance and add

unnecessary complexity to the risk management process.

17 We recommend that Section 70 be deleted as a

181-day restriction on the types of investments is too restrictive and the

provision is superseded by the new investment matrix in Appendix 4.

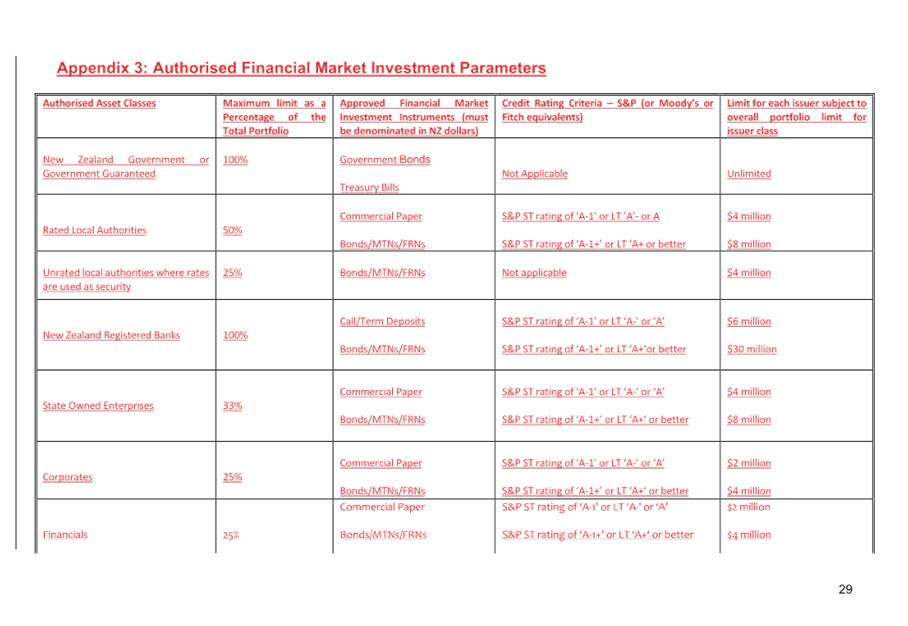

18 We recommend that the current Interest Rate

Control Limits in Section 74 which refers to a Master / Floating Control Limit

and parameters relating to a Swaps Maturity Profile in Section 74 (b) be deleted and replaced with the following Risk

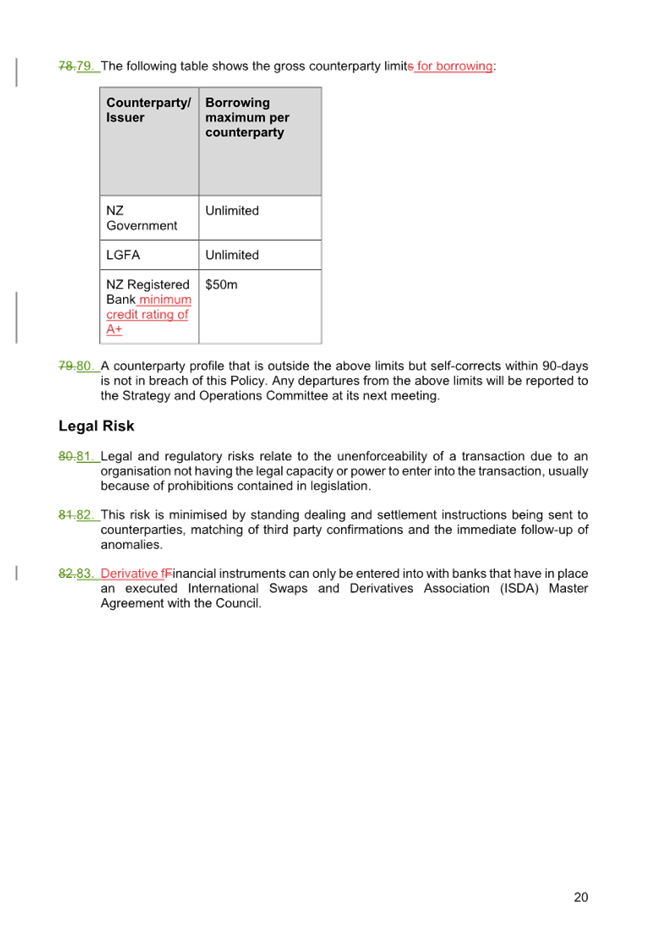

Control Limits.

|

Fixed/Floating Interest Rate Risk

Control Limits

|

|

|

Minimum Fixed Rate

|

Maximum Fixed Rate

|

|

0–2 years

|

40%

|

100%

|

|

2–4 years

|

20%

|

80%

|

|

4–10 years

|

0%

|

60%

|

We

find the existing Risk Control Limits difficult to understand and from our

interpretation, it appears that basing the level of cover on swap maturities is

completely arbitrary and ignores the fundamental point of an interest rate

swap, i.e. the duration of fixed cover it provides. For example, if an entity

were to have $200 million of debt and 1x $25 million interest rate swap with a

maturity in 8 years’ time, then we would view that swap as providing

interest rate cover at 12.5% of total debt for 8 years. However, under the

current policy, this swap would not count as cover in the 1-3 year and 3-5 year

time buckets because there is no swap maturity in these buckets, it would only

count in the 5-10 year time bucket. It would need to be split into smaller

swaps that start when the previous one matures to be counted across all three

time buckets.

We

find the complexity of this policy type which incorporates the (‘Master

Band’) as unnecessary and most of the policies like this we have come

across aren’t completely understood by the people who are tasked with

following them. We favour our approach because of its simplicity not only to

understand but also to implement. We understand that the originator of the

current bands no longer uses them and utilises Risk Control Limits that are

very similar to the ones that we are proposing.

19 In Section 74 which is titled “Authorised

Risk Management Instruments” we recommend deleting Forward Rate

Agreements as these are no longer used and including Fixed Rate Bonds and Fixed

Rate Term Loans as these are valid funding instruments that provide fixed rate

cover as well.

20 In

Section 74 which is titled Counterparty Credit Risk we recommend inserting the

title Counterparty Credit Risk for Derivatives, which is what it is intended to

manage. The risks associated with financial market investments are dealt with

in Appendix 3. We recommend adding the methodology in the new Section 77 which

details how exposures to derivatives are calculated.

21 We

recommend deleting parts of the table in Section 79 as the differing types of

exposures are dealt with in separate sections e.g. investments in Appendix 3

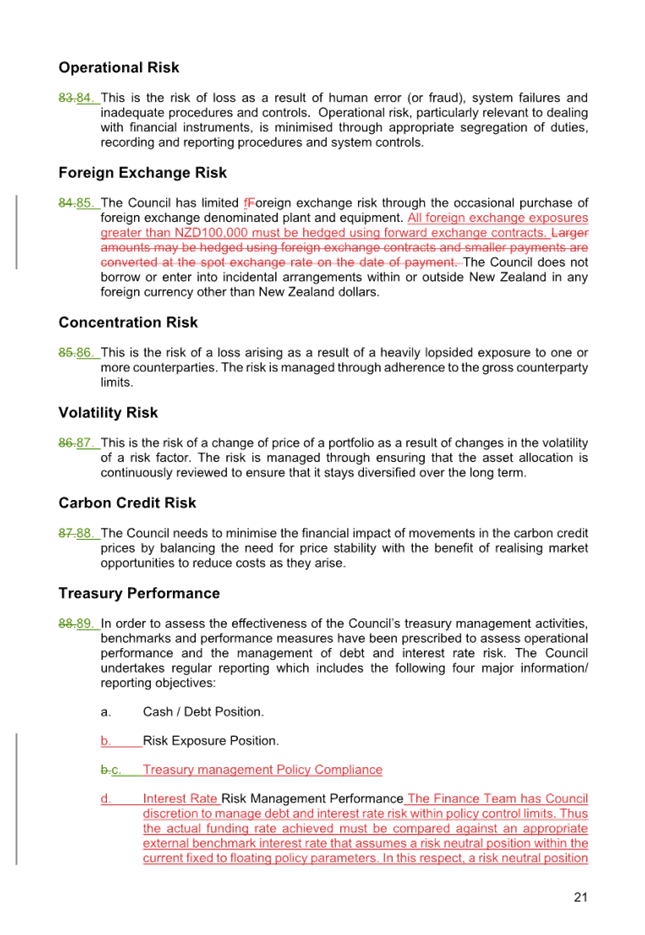

and derivatives in the new Section 77, but provisions relating to borrowing are

continued.

22 In

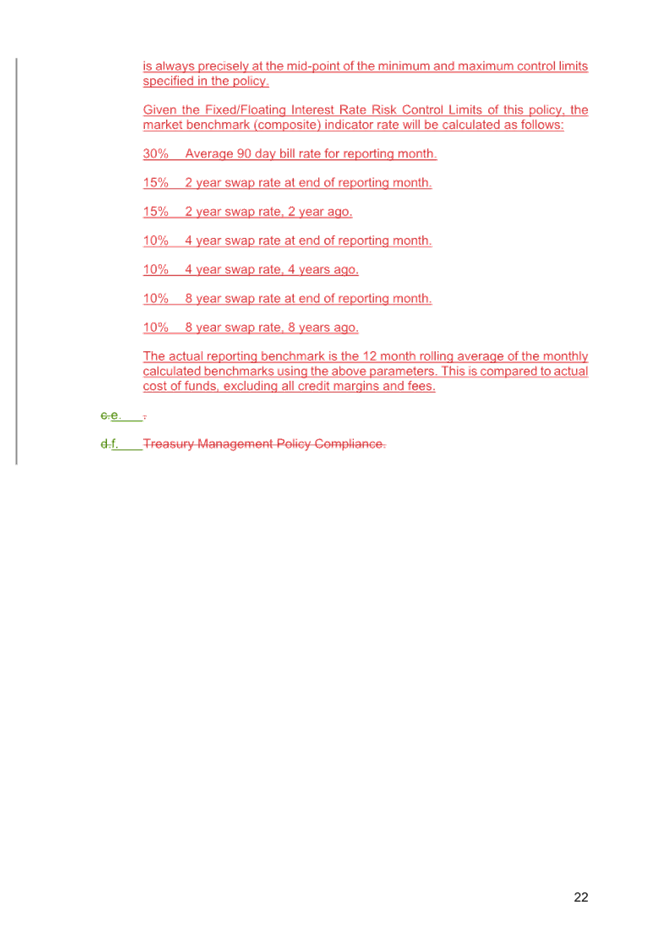

Section 89 (d) under the title “Treasury Performance” we recommend

including the benchmarking matrix which provides an external and objective

measurement of the way KCDC manages its debt. We recommend amending the table

Section 79 as the differing types of exposures are dealt with in separate

sections e.g. investments in Appendix 3 and derivatives in Section 78.

Benchmarking the borrowing performance indicates the effectiveness of the

current risk management parameters and the way that the actual debt exposures

are being managed at an operational level.

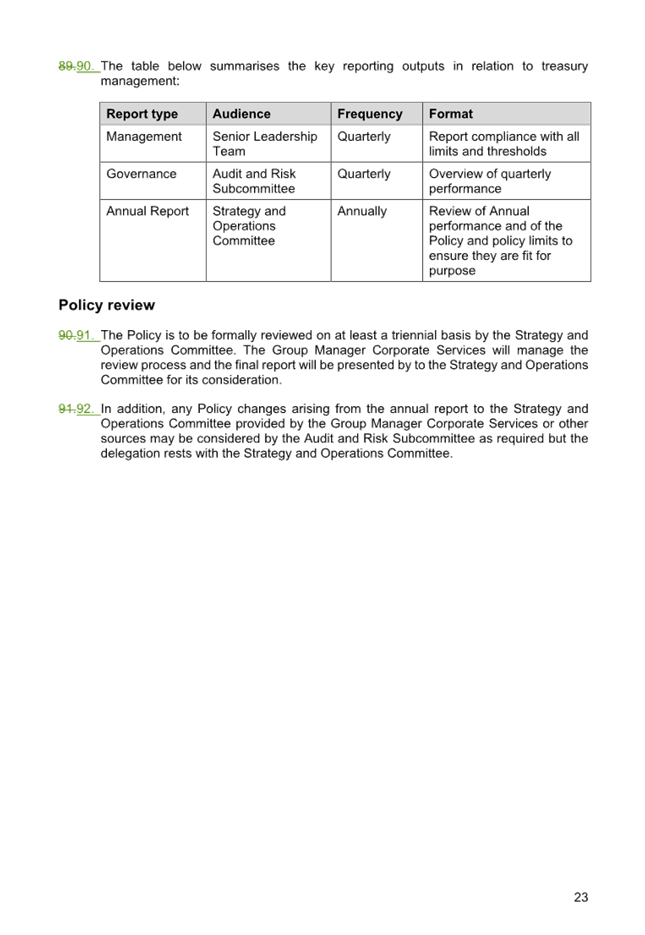

23 We

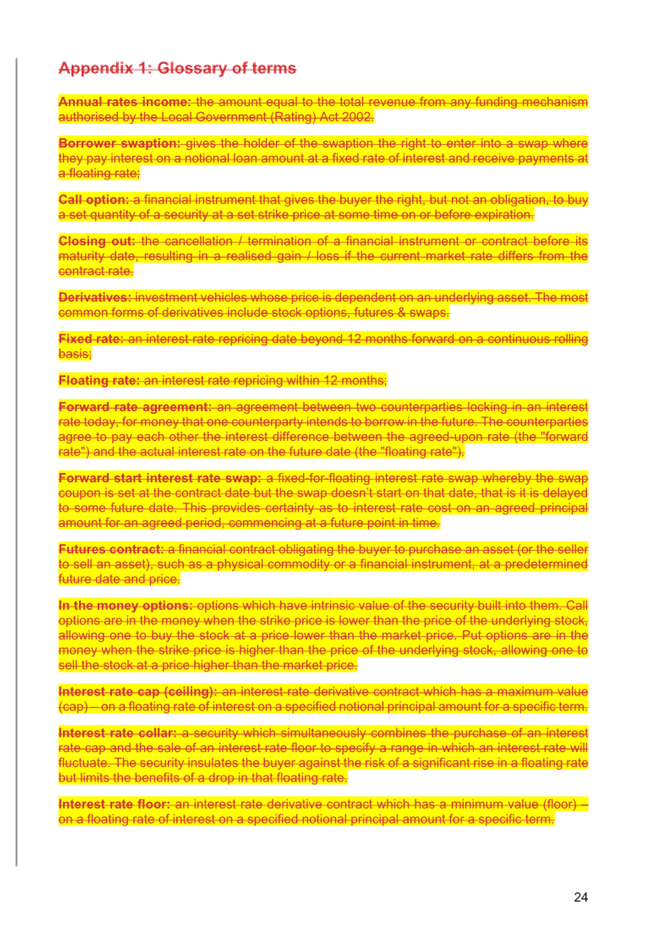

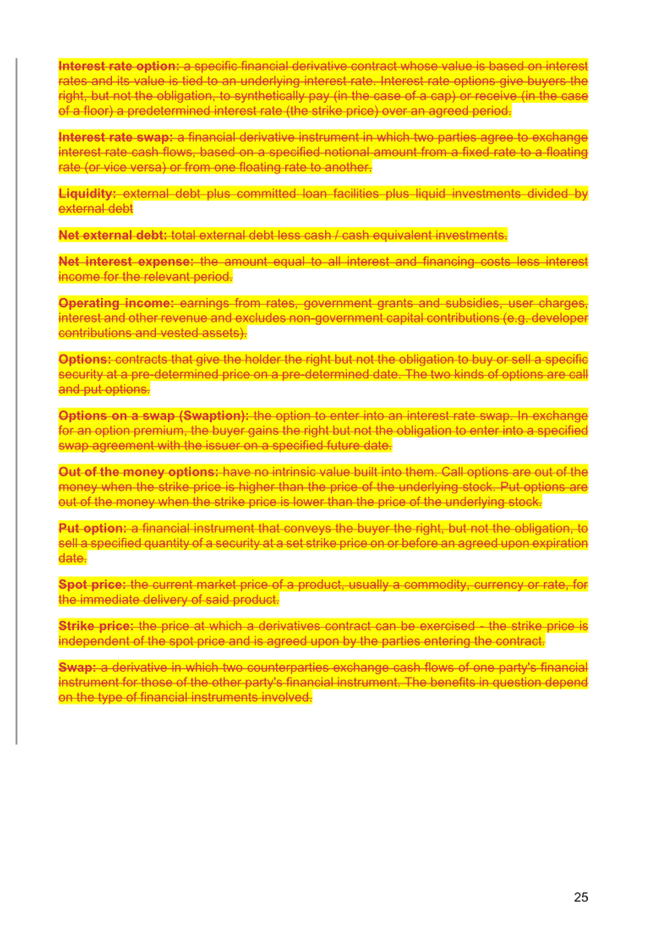

recommend deleting Appendix 1 Glossary of Terms in order to shorten the policy,

with a glossary potentially being included in an Operations Manual.

24 In

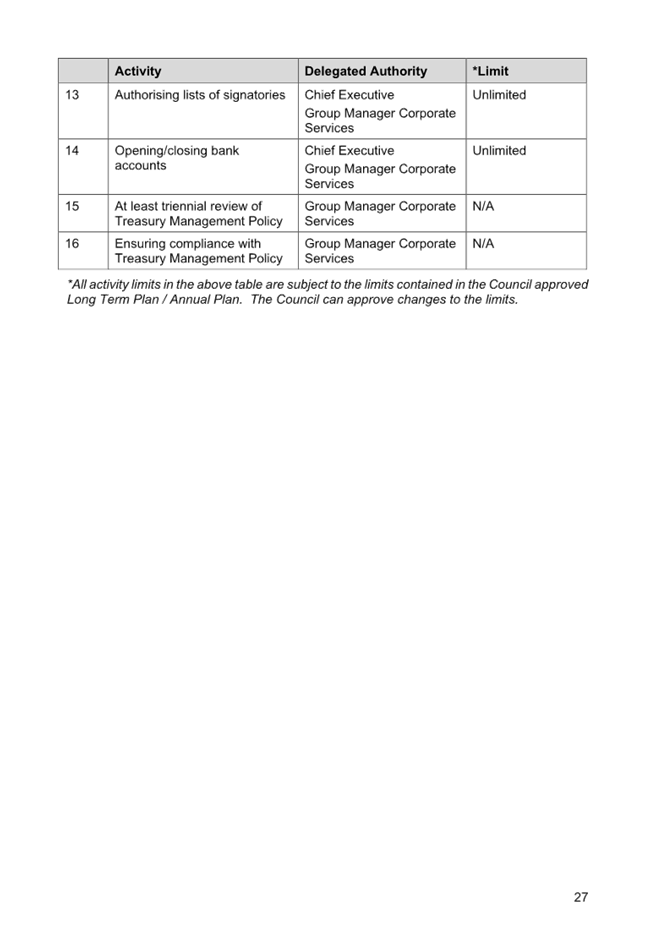

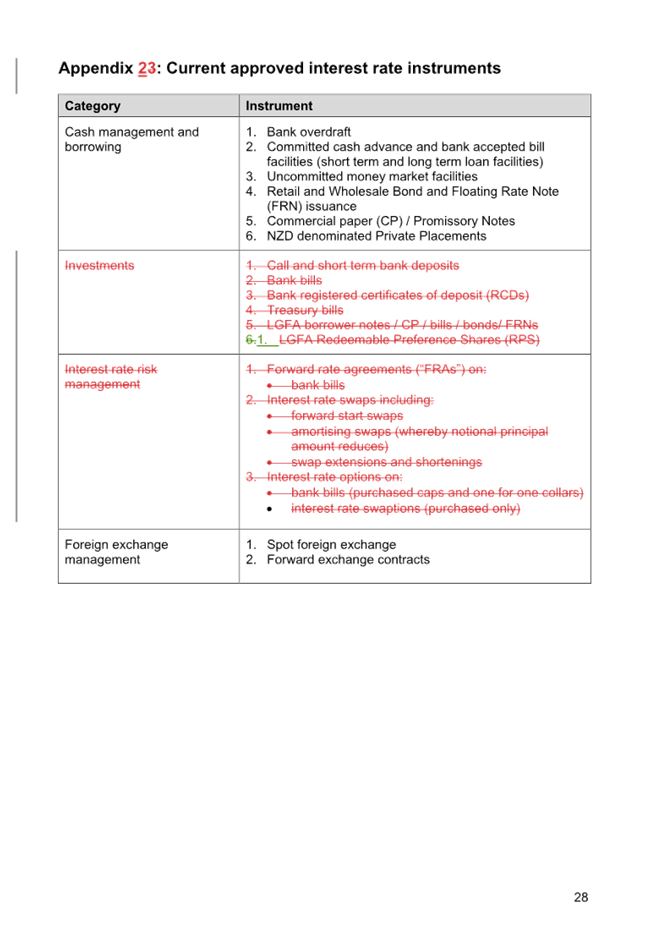

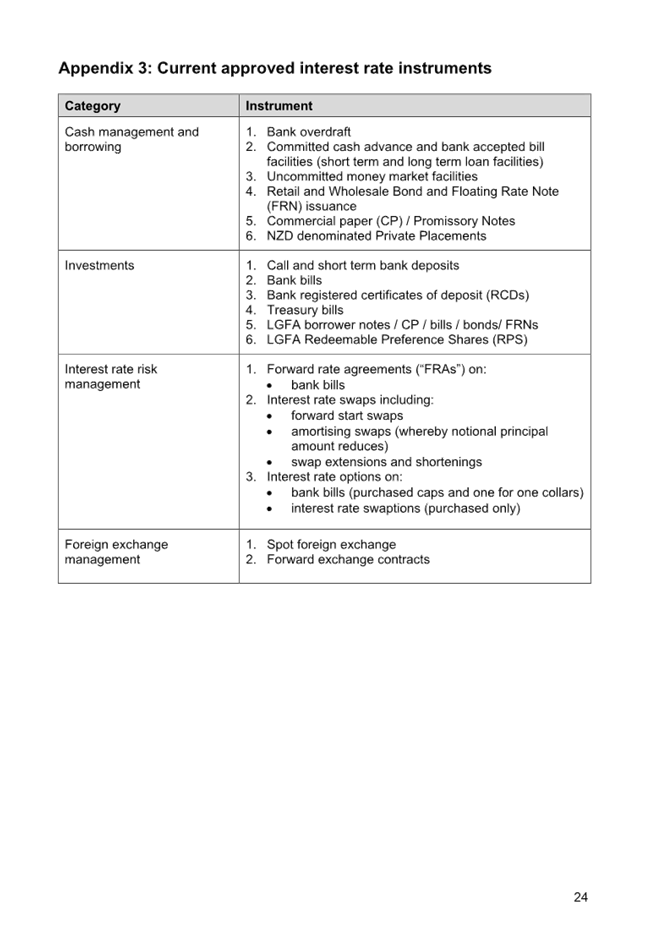

Appendix 2 titled “Current approved interest rate instruments” we

recommend deleting Investments as these are dealt with in the new Appendix 3

and the interest rate risk management category as this is dealt with in Section

74.

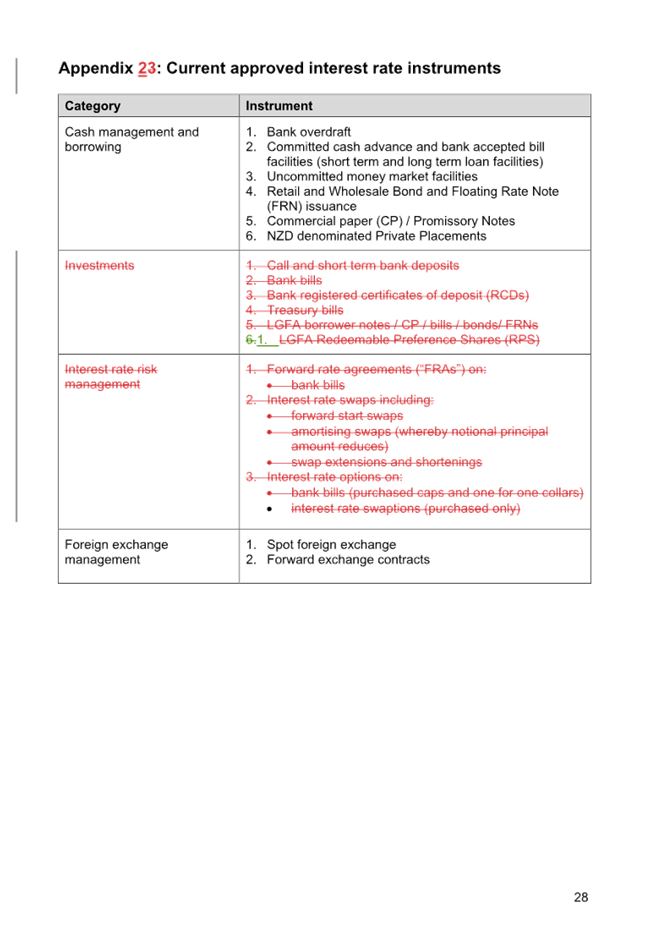

25 We

recommend the inclusion of a new Appendix 3 which is titled “Authorised

Financial Market Investment Parameters”. This is a comprehensive matrix

which incorporates five separate criteria as follows, Authorised Asset Classes,

the limits for each of these classes, the approved investment instruments, the

credit rating criteria and the limit for each issuer. With these criteria, KCDC

has a wide investment horizon but also has multiple safeguards built

in.

26 It is also recommended by Officers to accept the

comments from Bancorp Treasury Services Limited to remove the Managed Funds and

Glossary sections of the TMP, as shown in Appendix 1 and 2 to this report.

27 It is further recommended by Officers to make any

subsequent changes to reflect current Governance Structure and Delegations in

the TMP once Council has fully considered the change recommendations as

detailed above by Bancorp Treasury Services Limited.

He

take | Issues

28 There

are no issues in addition to those already discussed arising from this report.

Ngā

kōwhiringa | Options

29 There

are no options arising directly from this report.

Mana whenua

30 There

are no specific mana whenua considerations arising from this report.

Panonitanga Āhuarangi me te Taiao | Climate change

and Environment

31 There

are no specific climate change and environment considerations arising from this

report.

Ahumoni me ngā rawa | Financial

and resourcing

32 There

are no financial considerations in addition to those already detailed arising

from this report.

Tūraru ā-Ture me te Whakahaere

| Legal and Organisational Risk

33 There

are no legal and organisational risk considerations arising from this report.

Ngā pānga ki ngā kaupapa here | Policy impact

34 This

report details proposed changes to the Council’s TMP. Track changes

against the current policy are attached as Appendix 1 and 2 to this report. The

revised TMP including all proposed changes are attached as Appendix 2 to this

report.

35 There

are no additional policy considerations arising from this report.

TE whakawhiti kōrero me te

tūhono | Communications &

engagement

36 There

is no communications and engagement considerations arising directly from this

report.

Te mahere tūhono | Engagement

planning

Whakatairanga |

Publicity

37 There is no media

release or other publicity planned specifically for this report.

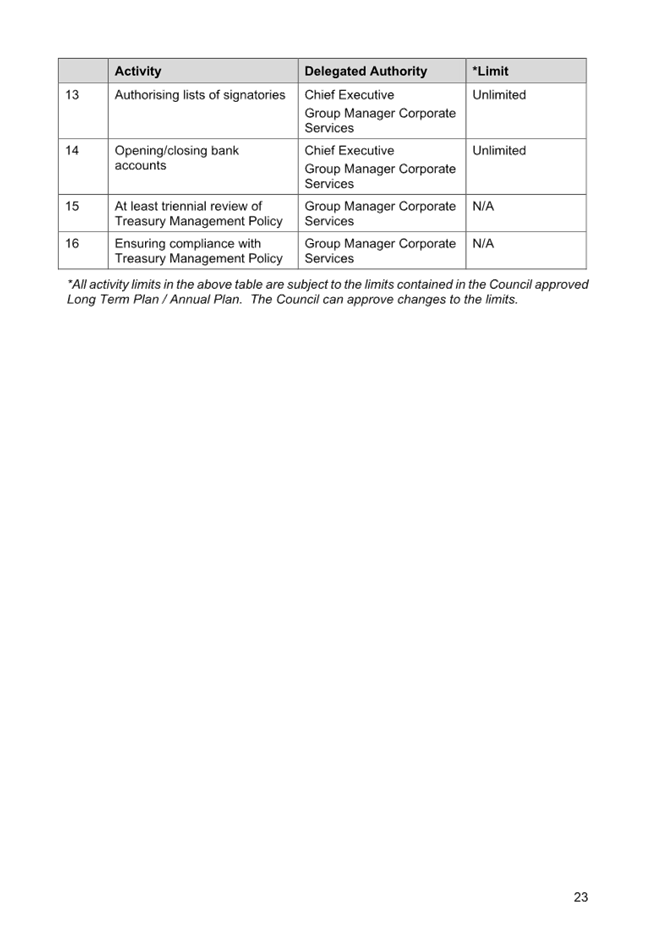

Ngā āpitihanga | Attachments

1. Council's

Treasury Management Policy reviewed by Bancorp Treasury Services with track

changes Dec 2023 ⇩

2. Council's

current Treasury Management Policy July 2021 ⇩

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

10.3 Proposed

Alcohol Licensing Fees Bylaw

Kaituhi |

Author: Chris

Worth, Principal Policy Advisor

Kaiwhakamana

| Authoriser: Kris Pervan, Group Manager Strategy & Growth

Te pūtake |

Purpose

1 This

report seeks Council’s approval to consult on a draft proposed Alcohol Licensing

Fees Bylaw to increase the fees taken to fund Council’s Alcohol Licencing

function.

He

whakarāpopoto | EXecutive summary

2 This

proposed bylaw enables Council to prescribe its own alcohol licensing fees. The

introduction of a bylaw would supersede current fees set out in the Sale and

Supply of Alcohol Regulations 2013 for the Alcohol Licensing function. The

Regulations must be reviewed every five years and were last reviewed in 2017.

However, fees have not been increased since they were introduced in 2013.

3 Council

is currently recovering approximately 70% of the cost of its Alcohol Licensing

function and associated activities, with a growing gap between the costs to

administer the Licensing functions and the income received from fees to support

the activity.

4 It

is proposed that fees for this function be increased to help recover increasing

costs. This can only be done through a bylaw adopted under section 405 of the

Sale and Supply of Alcohol Act 2012, and the Sale and Supply of Alcohol

(Fee-setting Bylaws) Order 2013.

5 Under

the Local Government Act, the funding needs of the local authority must be met

from sources that the local authority determines appropriate. These sources

include rates, and fees and charges, to reflect the public/private cost/benefit

of Council’s functions or activities.

6 Consulting

on a proposed bylaw alongside the proposed Long-term Plan 2024-2034 would

enable new fees to be considered and if adopted, to come into effect from 1

July 2024 for the 2024/2025 financial year; alternatively, a bylaw could be

progressed more slowly, subsequently adopted through the Annual Plan, and come

into effect later in the triennium.

Te tuku haepapa

| Delegation.

7 Section

405 of Sale and Supply of Alcohol Act 2012 gives Council the power to make a

bylaw for the purposes of setting fees and Council has the delegation for

making decisions on bylaws under the Governance Structure and Delegations for

the 2022-2025 Triennium.

Taunakitanga | RECOMMENDATIONS

That the Council:

A. Receives

the report “Proposed Alcohol Licensing Fees Bylaw” dated 28 March

2024.

B. Agrees

to consult on a proposed Alcohol Licensing Fees Bylaw to prescribe fees for its

Alcohol Licensing functions and activities on the basis of:

B.1 Level

of cost recovery and fees change - Option 1, paragraph 29 of the report.

B.2 Timing

of change – Option 1, paragraph 32 of the report.

B.3 Weighting

of fees – Option 1, paragraph 37 of the report.

C. Approve

the Consultation Document (Attachment 1) and draft Alcohol Licensing Fees Bylaw

(Attachment 2) for consultation alongside the LTP 2024-2034 (Option 1,

paragraph 41 of the report.).

D. Delegates

power to the Mayor and Chief Executive to make amendments to the

Consultation Document (Attachment 1) and draft Alcohol Licensing Fees Bylaw

(Attachment 2) to incorporate any substantive feedback from the Committee.

Tūāpapa | Background

Sale and

Supply of Alcohol Act 2012 and Council’s responsibilities

8 The

Sale and Supply of Alcohol Act 2012 (the Act) puts in place a system of control

for the sale, supply, and consumption of alcohol.

9 As

the territorial local authority (TLA) for its district, Council is responsible

for administering the operational and regulatory requirements of the Act. This

includes the safe and responsible sale, supply and consumption of alcohol, and

minimisation of harm caused by the excessive or inappropriate consumption of

alcohol.

10 Council’s

operational and regulatory functions under the Act include appointing and

providing support to the District Licensing Committee (DLC). This support

includes receiving and processing licence applications and manager’s

certificates for DLC decision making, as well as preparing material for the DLC

to meet their reporting requirements to the Alcohol Regulatory and Licensing

Authority (ARLA).

11 Council

also has monitoring and compliance responsibilities. These include inspections

of premises and providing education to licensees to operate within the

requirements of the Act. Both functions require Council staff to work closely

with Police and the Medical Officer of Health and other regulatory agencies to

meet the responsibilities and functions of the Act.

Prescribed licensing process and fees

12 Any

person wanting to sell and supply alcohol for the purposes of consumption must

have an alcohol licence[1].

There are four kinds of licences[2]:

on-licences, off-licences, club licences, and special licences. Additionally,

any licenced premises must be managed by a person holding a manager’s

certificate.

13 Charges

for a particular licence are set under the Sale and Supply of Alcohol

Regulations 2013 (the Regulations) according to the risk category of the

premises and apply to the initial licence fee and subsequent licence renewals.

The five risk categories are based on assessment of three weighted risk

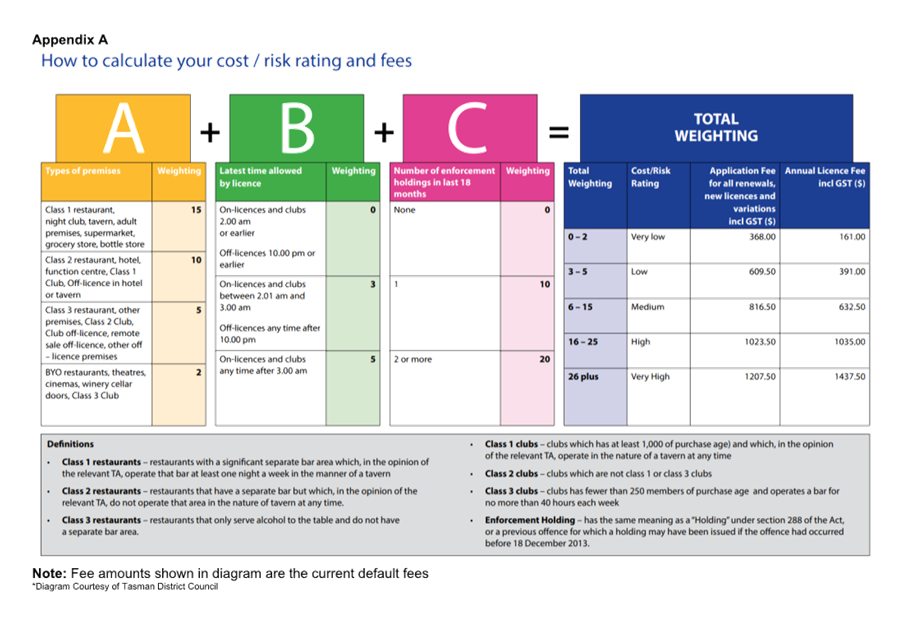

factors:

· the type of

premises (Restaurant/ Bottle Store/ Club etc.);

· the latest trading

hour allowed by licence and type of licence. (Whether an on-licence finishes

earlier or later than 2am, or off-licence finishes earlier or later than 10pm);

and,

· the number of

enforcement holdings[3]

against the premises in last 18 months.

14 Licensees are aware of

the risk category of their premises when their application for a licence is

first assessed. Council currently has 144 Licensees, made up of 62 on-licences,

1 BYO, 30 club, and 51 off licences. The distribution of current licensees by

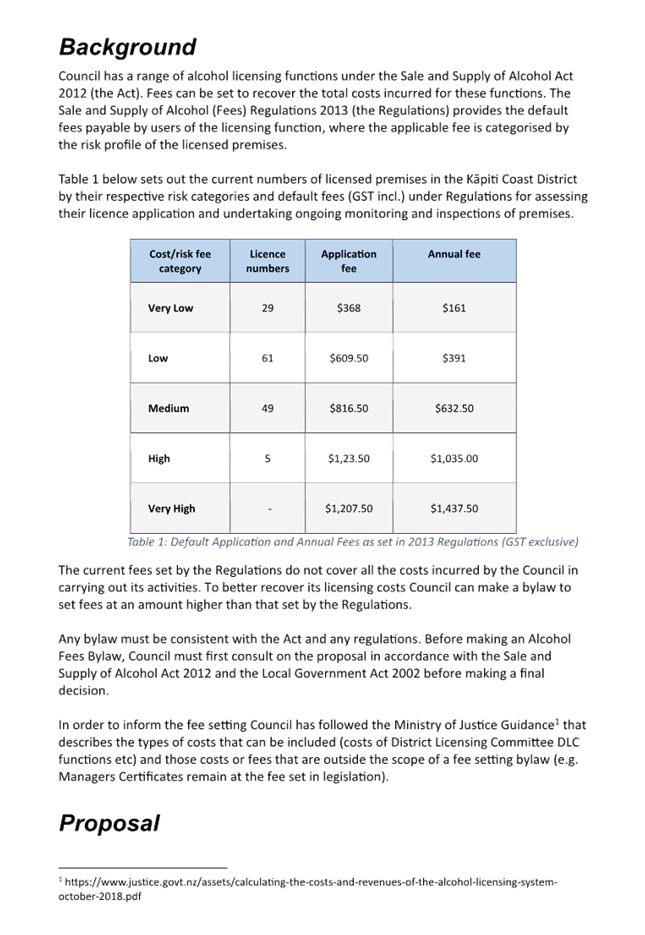

risk category and fees under the Regulations are set out below in Table 1.

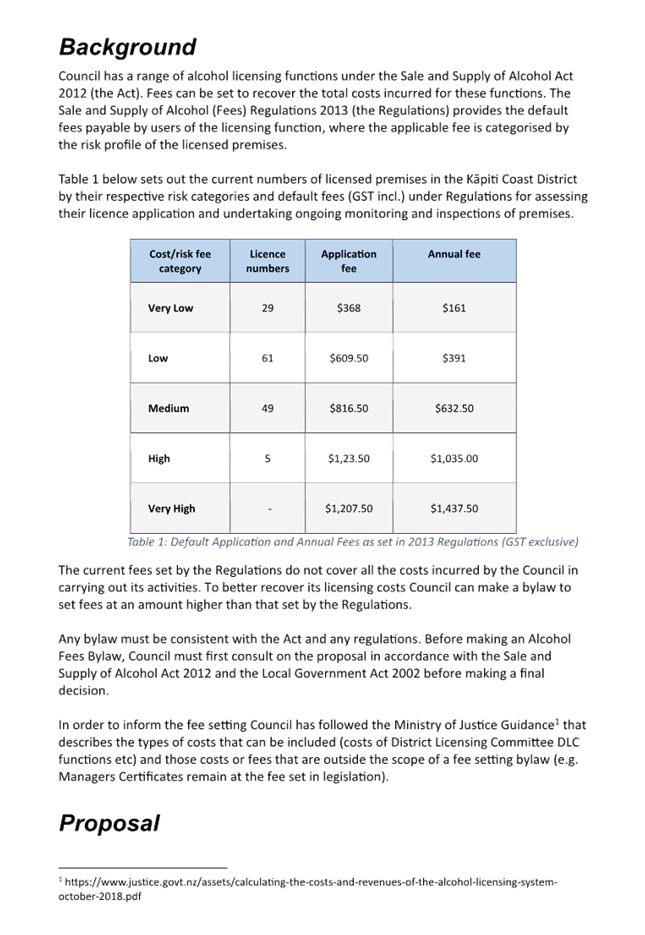

|

Table 1:

Risk categories, licence numbers and fees set in regulation (GST Incl.)

|

|

Cost/risk fee category

|

Licence numbers

|

Application fee

|

Annual fee

|

|

Very Low

|

29

|

$368.00

|

$161.00

|

|

Low

|

61

|

$609.50

|

$391.00

|

|

Medium

|

49

|

$816.50

|

$632.50

|

|

High[4]

|

5

|

$1,023.50

|

$1,035.00

|

|

Very High

|

-

|

$1,207.50

|

$1,437.50

|

15 Special

licences can also be issued for specific events in specified places/premises.

They can cover one or more events and may apply for events over a period of up

to twelve months. Special licenses and their fees are categorised into three

classes based on their potential risk, reflecting the size of the event (number

of attendees), the number of events covered by the special licence, and the

type of premises.

The ability

for Council’s to change alcohol licensing fees

16 Section

405 provides for Council to charge for any matter for which fees are payable to

support it undertaking its functions under the Act. This ability is supported

in the same section by providing for Councils to vary fees set under the

Regulations by making an Alcohol Licensing Fees Bylaw.

17 A

Council can use a bylaw to cover fees for licence applications (and renewals),

annual licensing fees and special licence fees, but cannot alter the framework

for determining cost/risk ratings and fees categories or change fees for

manager’s certificates or temporary authorities.

He

kōrerorero | Discussion

He

take | Issues

The Issue and the Proposal

18 The

current fees for Alcohol Licensing were set in 2013, and although reviewed in

2017, have not been increased since introduced. As a consequence, the level of

recovery of (increased) costs by Council has steadily reduced over time.

19 To

ensure appropriate cost recovery is in place, it is proposed that Council adopt

an Alcohol Licensing Fees Bylaw which will introduce increased fees as per the

amounts in Tables 2a to 2c (all figures GST inclusive. Note: figures are

rounded to nearest $0.50)

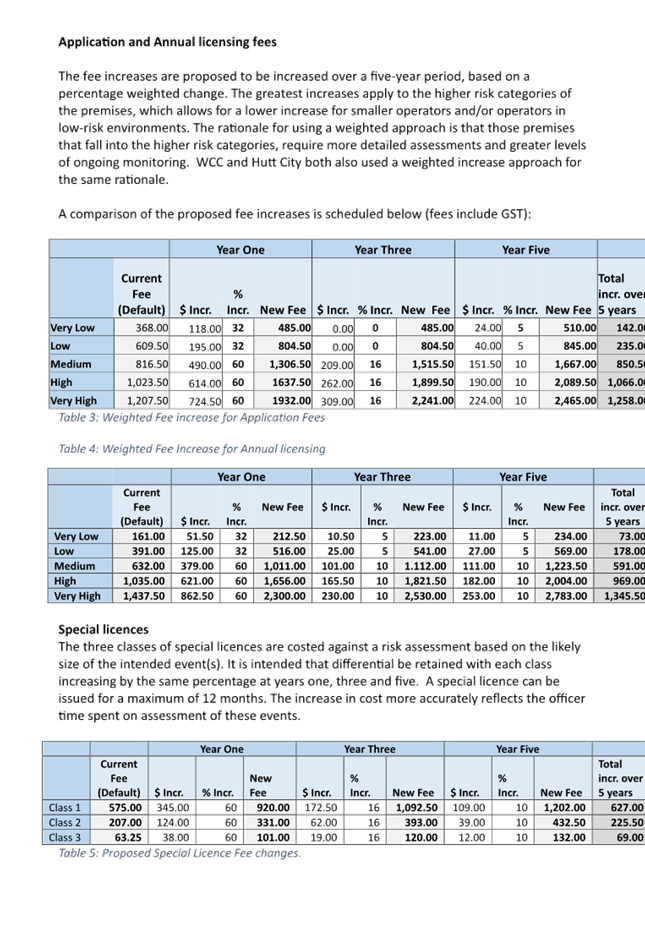

|

Table

2a: Proposed Weighted Fee increase for Alcohol Licence Application Fees

|

|

|

Current Fee (Default)

|

Year 1

Fee

|

Year 3 Fee

|

Year 5

Fee

|

Total

incr.

over 5 years

|

|

Very Low

|

368.00

|

486.00

|

486.00

|

510.00

|

142.00

|

|

Low

|

609.50

|

804.50

|

804.50

|

845.00

|

235.00

|

|

Medium

|

816.50

|

1,306.50

|

1,515.50

|

1,667.00

|

850.50

|

|

High

|

1,023.50

|

1,637.50

|

1,899.50

|

2,089.50

|

1,066.00

|

|

Very High

|

1,207.50

|

1,932.00

|

2,241.00

|

2,465.00

|

1,258.00

|

|

Table 2b: Proposed Weighted

Fee Increase for Annual licensing

|

|

|

Current Fee (Default)

|

New Fee

|

New Fee

|

New Fee

|

Total incr.

over 5 years

|

|

Very Low

|

161.00

|

212.50

|

223.00

|

234.00

|

73.00

|

|

Low

|

391.00

|

516.00

|

542.00

|

569.00

|

178.00

|

|

Medium

|

632.00

|

1,011.00

|

1,112.00

|

1,223.50

|

591.50

|

|

High

|

1,035.00

|

1,656.00

|

1,821.60

|

2,004.00

|

969.00

|

|

Very High

|

1,437.50

|

2,300.00

|

2,530.00

|

2,783.00

|

1,345.50

|

|

Table

2c: Proposed Special Licence Fee changes

|

|

|

Current

Fee

|

Year 1 Fee

|

Year 3 Fee

|

Year 5 Fee

|

Total incr.

over 5 years

|

|

Class 1

|

575.00

|

920.00

|

1,092.50

|

1,202.00

|

627.00

|

|

Class 2

|

207.00

|

331.00

|

393.00

|

432.00

|

225.00

|

|

Class 3

|

63.00

|

101.00

|

120.00

|

132.00

|

69.00

|

20 The

proposed increases would bring in a further $387,000 over the five years and

take cost recovery from the current 70% up to 90% by year five, reducing the

level of subsidisation from the general rate. A full breakdown of the proposed

fee increases can be found in the Consultation Document for the Proposed

Alcohol Fees Bylaw 2024, at Attachment 2.

21 There

are three questions that arise in considering whether to adopt an Alcohol

Licensing Fees Bylaw to set higher fees:

· Level of cost

recovery: that Council considers appropriate for the Alcohol Licensing

function and its associated activities;

· Timeframe for

implementation: three options have been considered:- a one-off

‘all at once’ increase; incremental increases each year out to year

5; or staged increases at years 1,3 and 5.

· Weighting of

fees: how any increases are applied across the different fees (application

and renewal fees) and shared across the regulated cost/risk categories (flat or

weighted application).

22 There

is also a further process timing issue that Council needs to be

comfortable with. The proposal for an Alcohol Licensing Fees Bylaw is being put

forward at this time so that it may be considered, and the proposed new fees

included in the Long-term Plan’s (LTP) Fees and Charges Schedule.

However, should Council prefer, the bylaw proposal can be undertaken on an

independent track. Doing so would mean that any subsequent changes to Alcohol

Licensing Fees would not be immediate and need to be progressed through

subsequent Annual Plan processes.

Level of

cost recovery

The issue

23 The

Act provides for the recovery of fees for undertaking the alcohol licensing

function. Without any changes to the Regulations, and with Councils increasing costs,

current cost recovery levels have fallen to approximately 70%. With no

adjustment in licensing fees revenue, recovery for alcohol licensing is

forecast to reduce further to 60% within five years. In practical terms:

23.1 Council’s

costs are expected to increase at 2.93% LGCI[5]

per annum over the next five years.

23.2 Under

current settings, with no increase in revenue over the same period, Council

will potentially not recoup $633,000 of recoverable costs for the period.

23.3 Maintaining

current arrangements would mean that this funding gap will need to be met

through increasing the general rates subsidy.

24 Further

to this, with current revenues from licence and manager certificates

applications and renewals not covering the cost of the Alcohol Licensing

function and its associated activities, the intent of section 405 of the Act,

which anticipates a user pays framework, is not met.

25 The

minimising of alcohol-related harm in our community is consistent with

Council's responsibilities under the LGA to promote the wellbeing of its

communities in the present and for the future. The two limbs of the Act's

object infer a balancing between two of Council's community outcomes for strong

communities and a vibrant economy.

26 Council

can determine its mix and use of funding and fees to support its functions and

levels of service. Choice of funding source(s) should be determined after

considering community outcomes, distribution of benefits, the period over which

those benefits accrue, and the extent that action or inaction by an individual

or group may contribute to the need for the activity.

27 In

making this assessment Council is assessing the relative levels of

public/private cost/benefit of an activity. In having the alcohol licensing

function and its activities funded by a mix of user fees and general rates

income Council recognises:

27.1 that

this function and its activities provide primary benefit to licensees to

lawfully operate a business within a clear operating framework and level

operating field;

27.2 with

the public funding supporting health, safety, and wellbeing through:

27.2.1 the

facilitation of amenity (the right of individuals to enjoy alcohol);

27.2.2 public

involvement in licensing applications (the right of the public to have a say in

what is happening in their community); and,

27.2.3 the

minimisation of alcohol-related harm (the right of society to protect itself

from the harms of alcohol)[6].

28 This

balance is reflected in a proposed increase of fees to recover 90% of the

private benefits of the services and the public benefits reflected by the

remaining 10%, supported through general rates.

The Options

29 There

are three options Council can take in respect to the cost recovery amount

issue. These are set out in Table 3 along with the effect of each option, its

impact on licensees and on the community, and the mechanism to implement any

change.

|

Table 3: Cost Recovery Options and Impacts

|

|

Option

|

Effect

|

Impact on licensees

|

Impact on community

|

Mechanism

|

|

Option

1:

Change

public/private split (increase fees through a new fees bylaw) (Recommended)

|

Maintains

levels of service to at least those currently achieved.

|

· Small $ impact, fees differentially changed across years

· Small $ increase for smaller premises/ low risk settings

· Larger increases for larger premises/ higher risk settings.

· Increases relative and minimal to premises’ turnover.

|

· Impact on general rate minimal and reducing over time

· Licensing regime managed to ensure responsible sale, supply, and

consumption of alcohol in district.

· Alcohol-related harm minimised.

|

· Fees

bylaw adopted under s.405 of the Act,

and the Sale and Supply of Alcohol (Fee-setting

Bylaws) Order 2013

· Long-term

Plan Revenue & Financing Policy reflects change.

|

|

Option 2:

Change public/private split (Increase rates funding)

|

Maintains levels of service to at least those currently

achieved.

|

· Impact on licensees minimal and static

|

· Impact on general rate significant and

increasing over time ($633k over 5 years)

· Licensing regime managed to ensure

responsible sale, supply, and consumption of alcohol in district

· Alcohol-related harm minimised.

|

· Long-term Plan Revenue & Financing

Policy.

|

|

Option 3:

Reduce levels of service (to statutory minimum)

|

Levels of service are reduced to bare minimum required under the

Act.

|

· Potential reduced compliance by

licensees.

|

· On-going but lesser impact on general

rate.

· Reduced management of alcohol-related

harm

· Council is not implementing the Act

responsibly

· Potentially more DLC hearings (not

directly recoverable), as other partners try to address the risk of harm.

|

· Long-term plan’s Levels of Service

Statements.

|

30 Option

1 is recommended as, increasing the cost recovery level to 90% over five

years:

30.1 reflects

the intention of the national legislation to support Council to:

· carry out its functions under the Act, and

to

· recover the cost of doing so, while

· ensuring a robust licencing system, and

· the better monitoring of licensees for

compliance.

30.2 retains

an element of public good funding from rates recognising Council role in

minimising alcohol related harm in the district and administering the

Act’s licensing regime for the benefit of the whole community; and,

30.3 reduces

the significant level of rates subsidy of private businesses arising from the

current under-recovery of costs.

Timing and staging of fees

The Issue

31 There

are a number of timeframes over which the fees could be set and increased. Each

has a differing impact on licensees and Council.

The Options

32 Implementation

of any fees increases could be through:

|

Table 4: Timing of fees and Impacts

|

|

Option

|

Effect

|

Impact on licensees

|

Impact on community

|

|

Option

1:

A

staged approach, with fees increases at years 1, 3, and 5

(a

larger increase in year one, and smaller increases in years 3 and 5). (Recommended)

|

The

year 1 increase to ‘catch-up’ on the historic underfunding and

years 3 and 5 to progress to the 90% recovery mark.

|

· Smaller increment changes at years 2 and 4, provide businesses time

to absorb the increased costs

· Increases at years 3 and 5 are quite small in $ terms relative to the

levels of turnover of the businesses in the risk categories. This option

provides a middle ground in impact on licensees and on rates.

|

· Reducing the impact on general rates is slower

· Perception that community is paying unfairly for business benefits.

|

|

Option 2:

A one-off adjustment

|

An increase bridging the recovery gap to 90% is made in one

step.

|

· A full one-off correction to the fees

level would place an unnecessary burden on licensees, especially the smaller

operators.

· Perception that Council is making it

harder to do business in Kapiti, for those operators who face significant

cost increases.

|

· Existing impact on general rates is

addressed immediately.

|

|

Option 3:

Smoothing the increase evenly across the five years

|

Same $ increase each year until a 90% cost recovery is reached.

|

· It is likely the most manageable for licensees,

especially smaller operations.

|

· Provides the slowest increase out to 90%

recovery and has the greatest impact year-on-year on rates

· Perception that community is paying

unfairly for business benefits.

|

33 A

staged approach is recommended, with increases introduced over years 1, 3

and 5 to ensure a significant recover of the current deficit while managing the

impacts of change on business over a more measured timeframe.

Weighting of fees

Issue

34 Currently

under the Regulations, fee categories are tied to the risk profile of the

premises. This approach to categorisation must be maintained in the bylaw.

However, Council is not required to follow the same cost weightings between

categories.

35 Premises

that are in the medium, high, and very high categories are there because of

higher risk factors, whether this is due to the overall level of activity

(number of patrons/members), longer operating hours in the higher risk hours of

the day, or past issues (Holdings) with operating within general requirements

of the Act (e.g. host responsibility, serving underage persons etc.) or

specific licence conditions (e.g. opening/trading hours).

36 Because

of these risk factors, premises in the medium to very high categories require

more complex considerations requiring more detailed

assessments and greater levels of ongoing monitoring. To recognise this,

and, in turn, recognise that small establishments in less risky environments

require less time and resource in application assessment and compliance

monitoring, weighted fees and fee increases could be applied. This has also

been the approach from our neighbouring Councils.[7]

Options

37 Options

for how fees could be weighted include:

|

Table 5: Weighting of fees and Impacts

|

|

Option

|

Effect

|

Impact on licensees

|

Impact on community

|

|

Option

1:

A

weighted increase between lower and higher risk licensees

(Recommended)

|

Distributes

costs on key criteria to ensure ‘fairness’ based on complexity

and monitoring requirements.

|

· The fee reflects level of work for Council in processing less/more

complex applications (including potential DLC hearings), and monitoring

requirements.

· Fees are aligned with size of premises and likely ability to pay, and

the fees burden on smaller operators/safer environments is reduced in

relative terms.

|

· Council is seen to apply rules fairly and to support business to

operate in Kāpiti.

|

|

Option 2:

Proportionate increases based on existing fees

|

Distributes overall costs across all risk categories.

|

· This would see a potentially higher

increase of fees on smaller, lower risk licensees, that could have a more

significant impact on their operation and business.

|

· Council is seen to make it harder to do

business in Kāpiti, for those operators who can least afford it.

|

38 A

weighted increase is recommended, as it reflects the size, turnover

and risk of businesses as well as the supporting capacity required to undertake

licensing functions.

Timing of consideration and adoption of a Fees Bylaw

39 The

issue of the reducing level of cost recovery and its associated increase in

rates funding became apparent as budgets were being developed for the upcoming

2024 to 2034 LTP.

40 Consultation

is required if Council proceeds with proposing the Fees Bylaw, however there

are two options for doing so:

40.1 With

the LTP 2024-2034: there are some advantages for this consultation to be done

at the same time as consultation on the LTP. This timing would allow the bylaw

to be adopted in time for the new fees to be included in the 2024-2034 LTP Fees

and Charges Schedule.

40.2 Consideration

of the bylaw could be placed on a slower track, with consultation carried out

separately from the LTP process.

41 The

Impacts of these options is as follows:

|

Table 5: Timing of considering the introduction of the Fees

Bylaw and Impacts

|

|

Option

|

Effect

|

Impact on licensees

|

Impact on community

|

|

Option

1:

Take

the bylaw out to consultation with the LTP.

(Recommended)

|

The

Fees Bylaw would apply for the LTP 2024-2034.

|

· Clarity on fee changes but shorter timeframe to prepare for impacts

to business operations.

|

· The recovery gap is addressed immediately.

· The new fees regime for Alcohol Licensing, if adopted, would apply

immediately for the LTP 2024-34.

· Lower costs of consultation.

|

|

Option 2:

Consultation and adoption of the bylaw is a discrete process

that Council undertakes separately from the LTP process

|

The Fees Bylaw would not immediately apply for the LTP 2024-34.

|

· Longer timeframe to prepare for the

change to business operations.

|

· The recovery gap would take longer to

address.

· An amendment to the LTP could be

required, which attracts additional undue cost. Or changes would be made at a

later time through the 2025/26 Annual Plan delaying adoption of the new

fees’ regime.

|

42 Should

the adoption of the bylaw occur after the adoption of the 2024-2034 Long-term

Plan and the fees and charges schedule, the new fees could be incorporated

through amendment to the LTP and fees and charges schedule. This could occur as

the bylaw would have been through a public consultation process including the

issuing of a Statement of Proposal, as required for an amendment to the LTP.

The Statement of Proposal would need to clearly indicate that the bylaw will

amend the fees and changes schedule in the LTP.

43 Option

1 is recommended, enabling the proposed bylaw to go out and be consulted,

and subject to decision, adopted for the new financial year.

Mana whenua

44 There

are no specific or general impacts on mana whenua, or tangata whenua more

broadly, from using an Alcohol Licensing Fees Bylaw as the mechanism for cost

recovery of the Alcohol Licensing function. However, Council is aware of the

interest our iwi partners have in alcohol licensing matters and in any

initiatives that can help reduce alcohol related harm in the community.

Maintaining a robust Alcohol Licensing inspectorate delivers on this.

Panonitanga Āhuarangi me te Taiao | Climate change

and Environment

45 There

are no climate change implications associated with implementing an Alcohol

Licensing Fees Bylaw.

Ahumoni me ngā rawa | Financial

and resourcing

46 The

proposed bylaw implements new fee amounts and charging regime for existing

functions and associated activities, replacing existing fees. The new fees will

be included within any update of Council’s Fees and Charges Schedules for

the new financial year (if to be included in the LTP). There may be a small

operational cost in publicity for the fee changes which will be met within

baselines.

Tūraru ā-Ture me te Whakahaere

| Legal and Organisational Risk

47 The

fees bylaw is being proposed in accordance with s.405 of the Act and the Sale

and Supply of Alcohol (Fee-setting Bylaws) Order 2013.

48 A

consultation document has been developed outlining the background issues and a

proposed response, and the proposed increases in fees. In accordance with

s.405(4) of the Act, officers will also directly contact affected parties

(licensees) indicating where information on the proposed bylaw is available and

the means through which they can have their say.

49 This

consultation approach meets the principles for consultation in the LGA and

specific requirements of the Act, covering Council’s obligations to

consult with affected parties and provides an opportunity for members of the

general public to have their say.

Ngā pānga ki ngā kaupapa here | Policy impact

50 As

the fees will apply as new licence applications come in throughout the year and

existing licences come up for renewal, an increase in cost recovery will

unlikely exceed existing Revenue and Financing Policy splits. However, for the

2025-2026 Annual Plan, the Revenue and Financing Policy will need to be

reviewed and potentially amended to adjust, if necessary, the public/private

cost/benefit split.

51 The

Act does not prescribe any particular review period for an Alcohol Licensing

Fees Bylaw, although the fees regulations, which the bylaw supersedes within

the district, must be reviewed every five years. The bylaw is proposing to set

fees for the next five years, beginning 1 July 2024. A five-yearly review of

the bylaw would therefore be appropriate.

TE whakawhiti kōrero me te

tūhono | Communications &

engagement

Te mahere tūhono | Engagement

planning

52 Consultation

for the proposed bylaw will meet the requirements of Section 405 of the Sale

and Supply of Alcohol Act 2012 by consulting with affected persons affected by

the changes proposed. As a matter of good practice, Council will also look to

reflect the principles of consultation as outlined in the Local Government Act,

providing for the opportunity to be heard through oral presentation of

submission, in the making of the bylaw.

53 Currently

it is proposed that the consultation period will run from 25 March to 28 April,

in concert with the Long-Term Plan consultation. A consultation document along

with the draft bylaw will be sent out to affected parties and made available

through Council’s usual consultation channels, with submissions (via

website, by email, mail and drop-box at service centres and libraries) invited

during that period. Submitters will be provided an opportunity to speak to

their submissions at a hearing.

54 A

letter indicating Council’s consideration of a proposed Alcohol Licensing

Fees Bylaws was sent to licensees on 14 March 2024.

Whakatairanga |

Publicity

55 Subject

to the decision to consult, the draft Alcohol Licensing Fees Bylaw will be

publicised on the Council website and licensees will be notified.

Ngā āpitihanga | Attachments

1. Alcohol

Fees Bylaw 2024 Consultation Document ⇩

2. Proposed

Alcohol Fees Bylaw 2024 ⇩

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

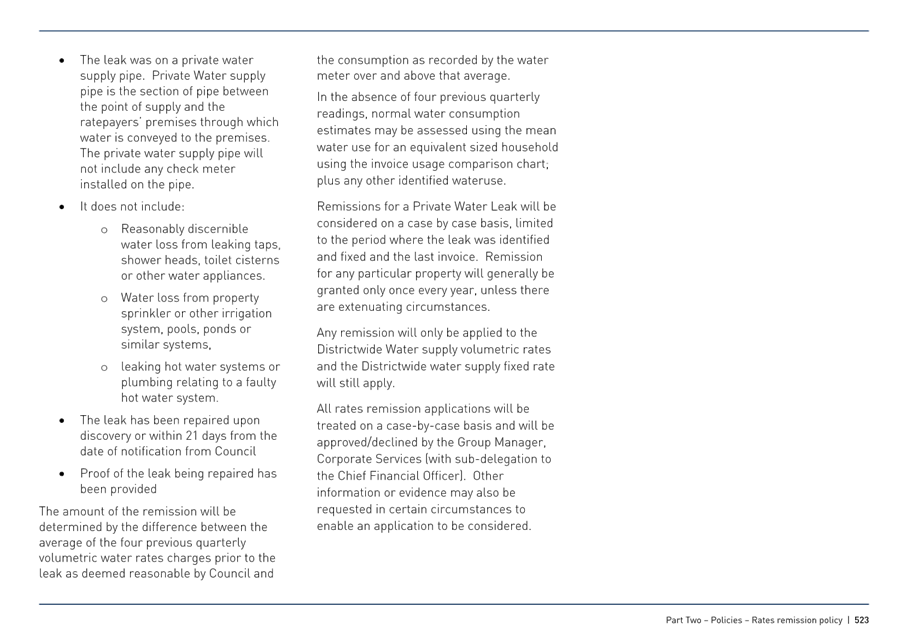

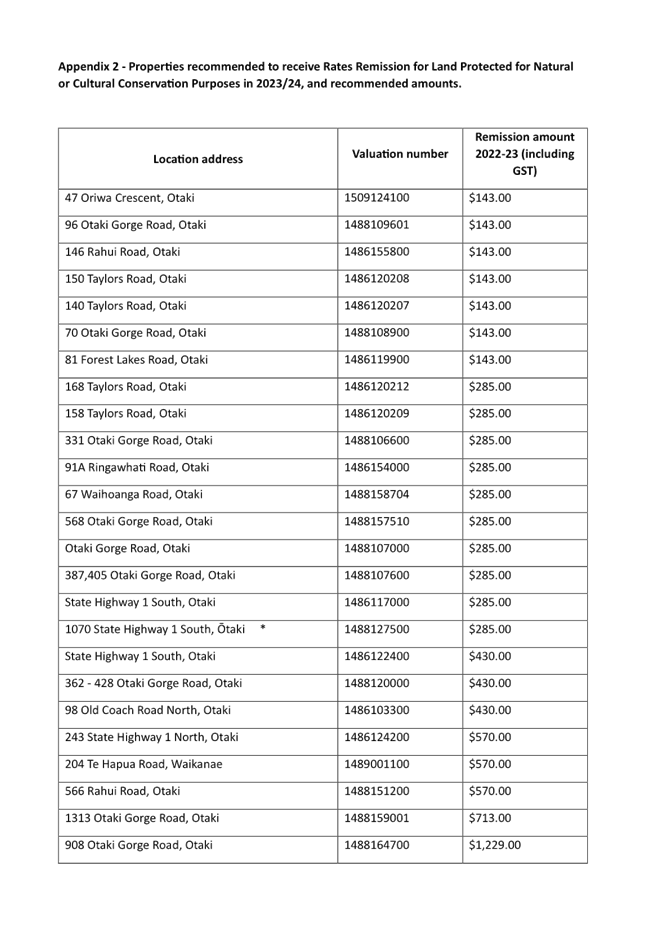

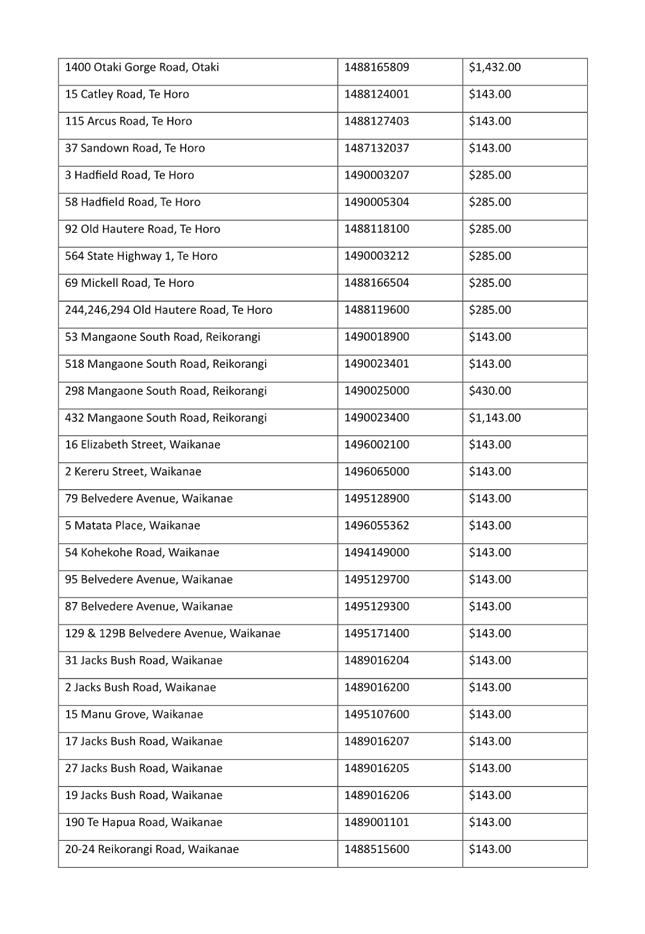

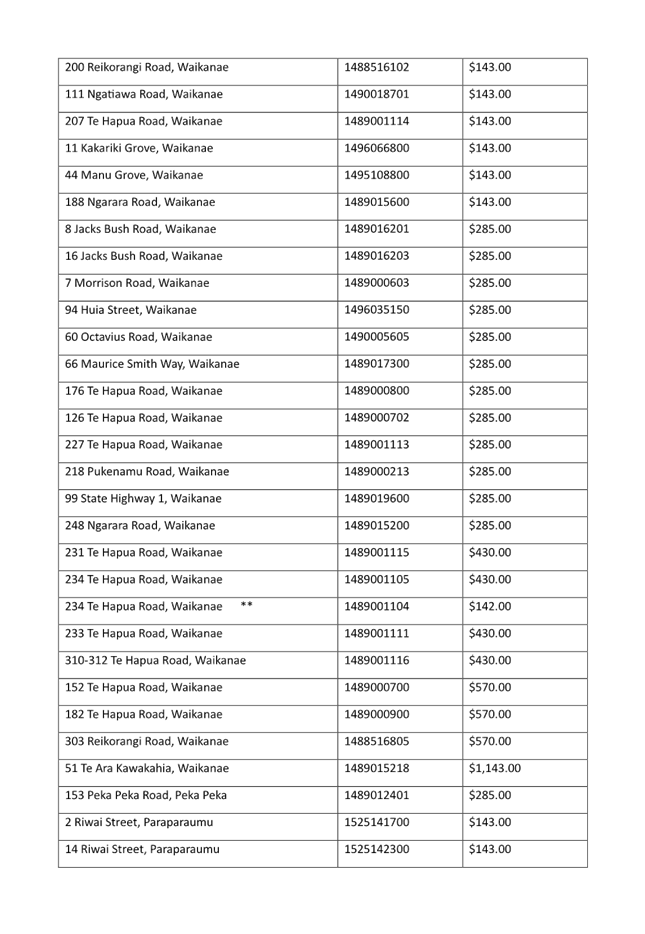

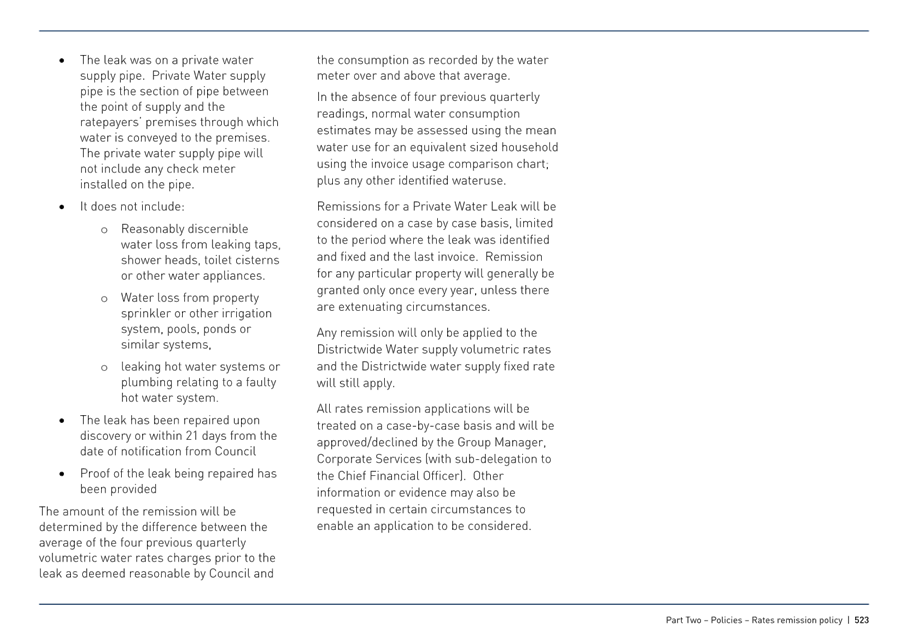

10.4 Rates

Remission for Land Protected for Natural or Cultural Conservation Purposes

Kaituhi |

Author: Rachael

Ashdown, Biodiversity Advisor

Kaiwhakamana

| Authoriser: Sonja Williams, Acting Group Manager Customer and

Community

Te pūtake |

Purpose

1 This

report tables the rates remission applications for Land Protected for Natural

or Cultural Conservation Purposes for the 2023/24 year and seeks approval for

recommended allocations.

He

whakarāpopoto | EXecutive summary

Te tuku haepapa

| Delegation

2 The

Council has the delegation to make this decision.

Taunakitanga | RECOMMENDATIONS

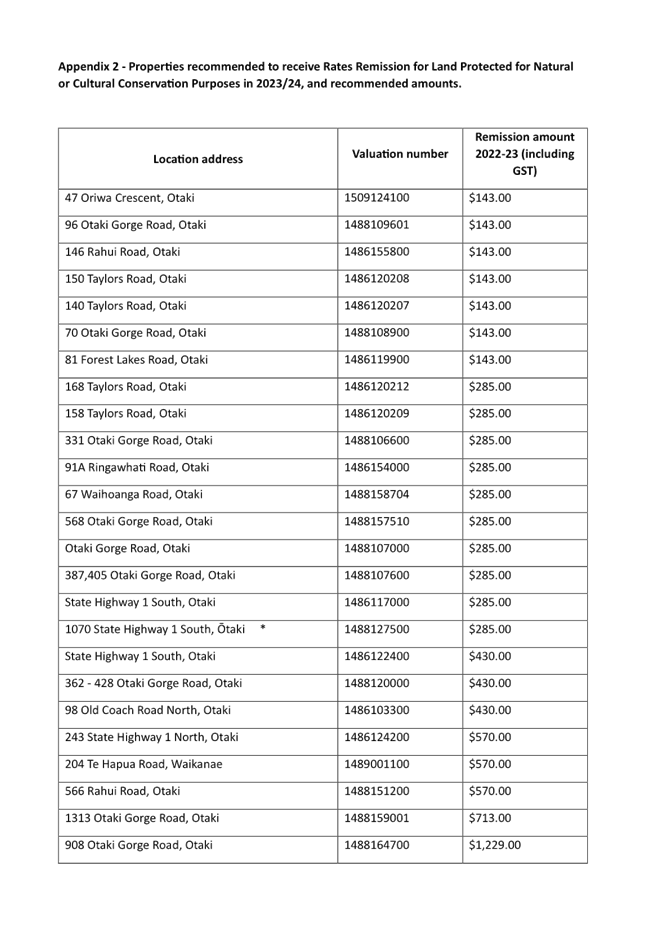

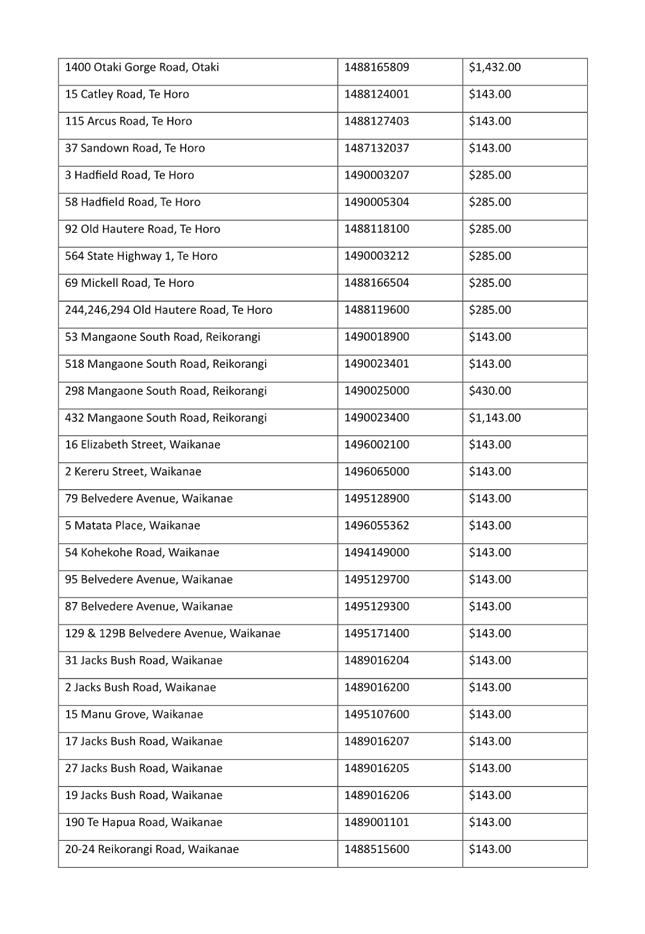

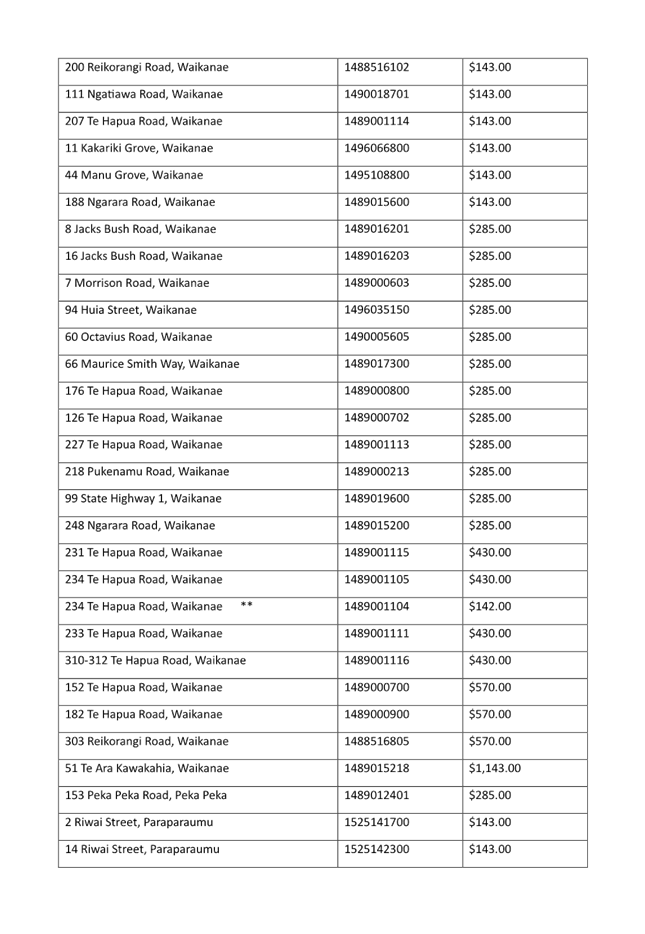

A. That the Council approves the amounts of

rates remission to the properties set out in Appendix 2 of this report in

accordance with Council’s Policy for Rates Remission for Land Protected

for Natural or Cultural Conservation Purposes.

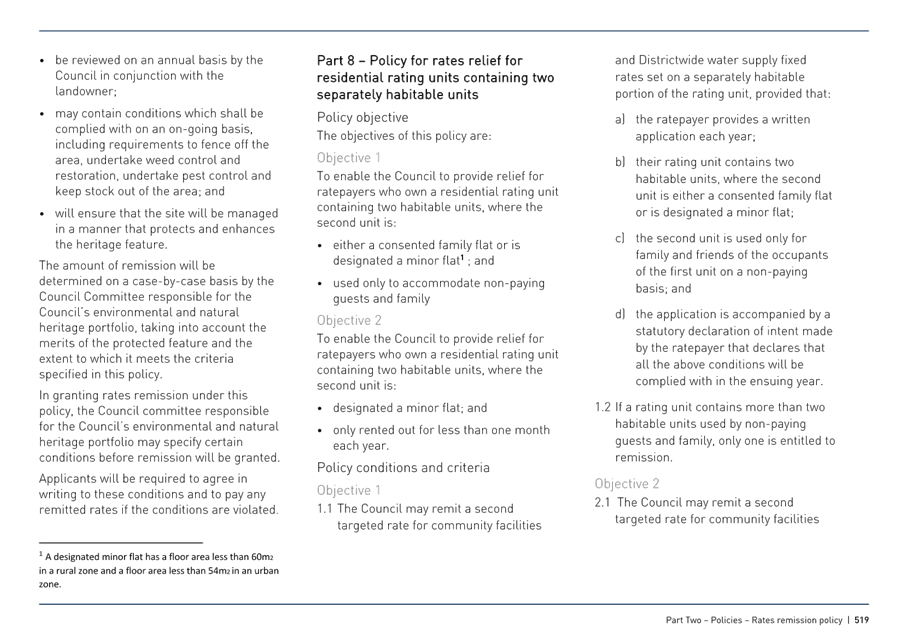

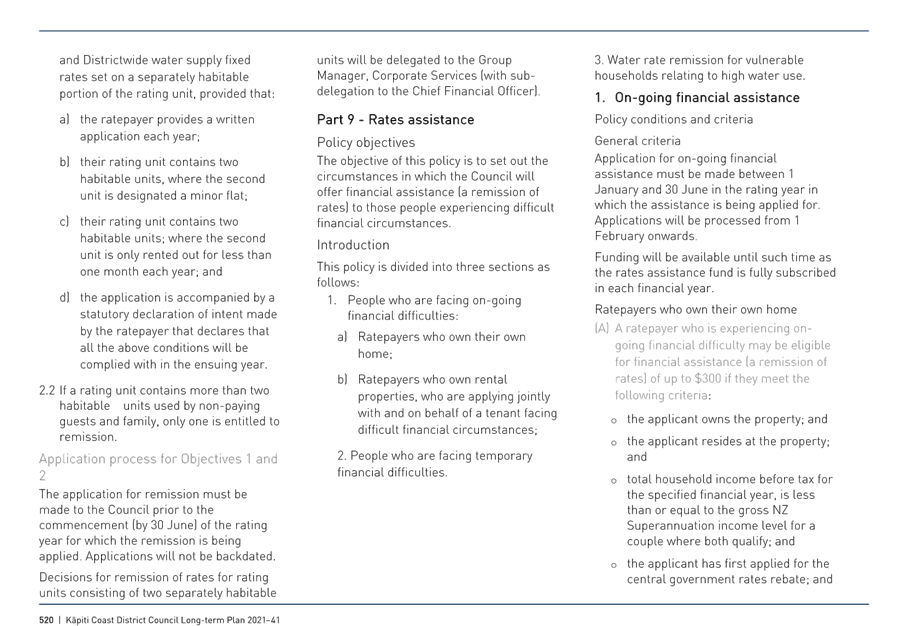

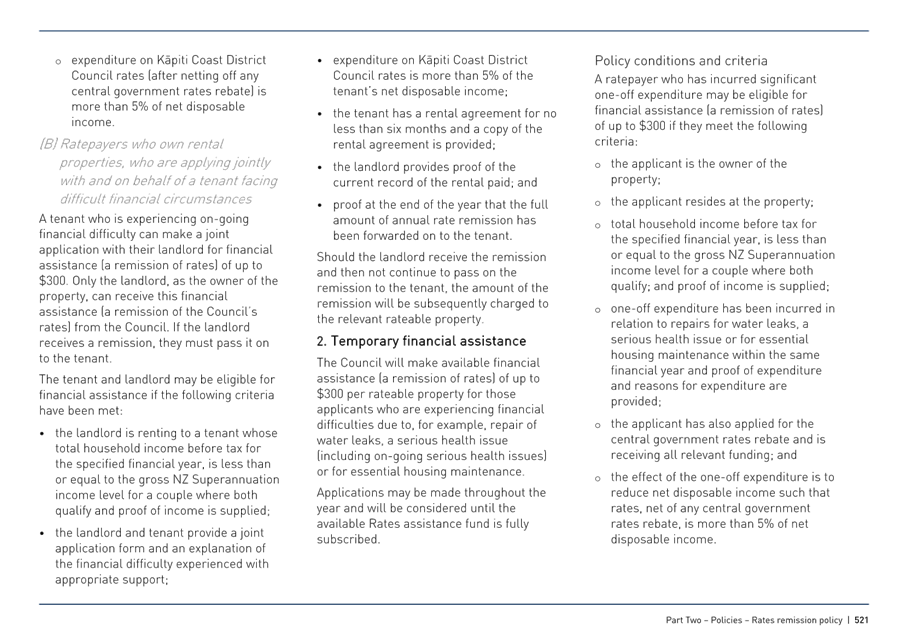

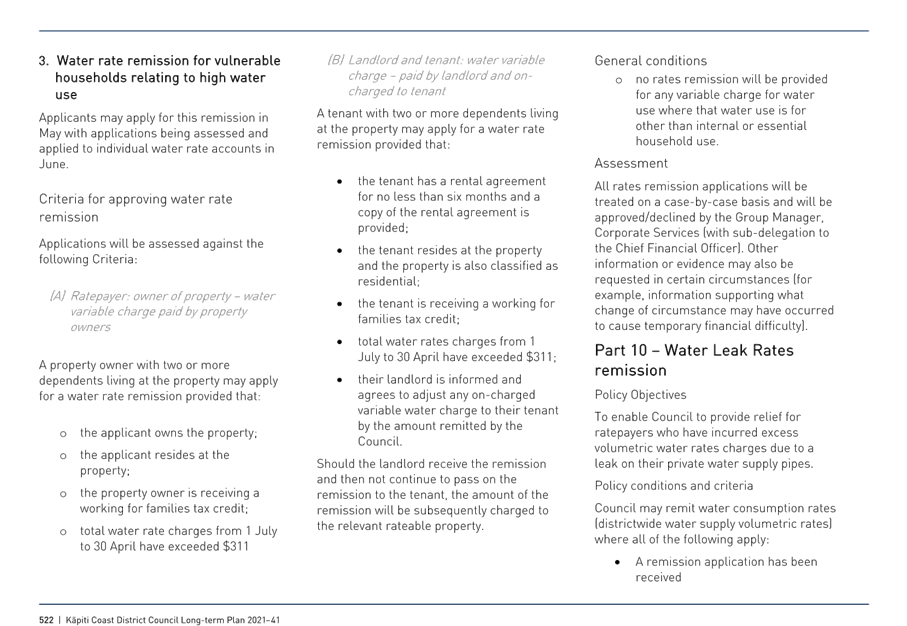

Tūāpapa | Background

3 The

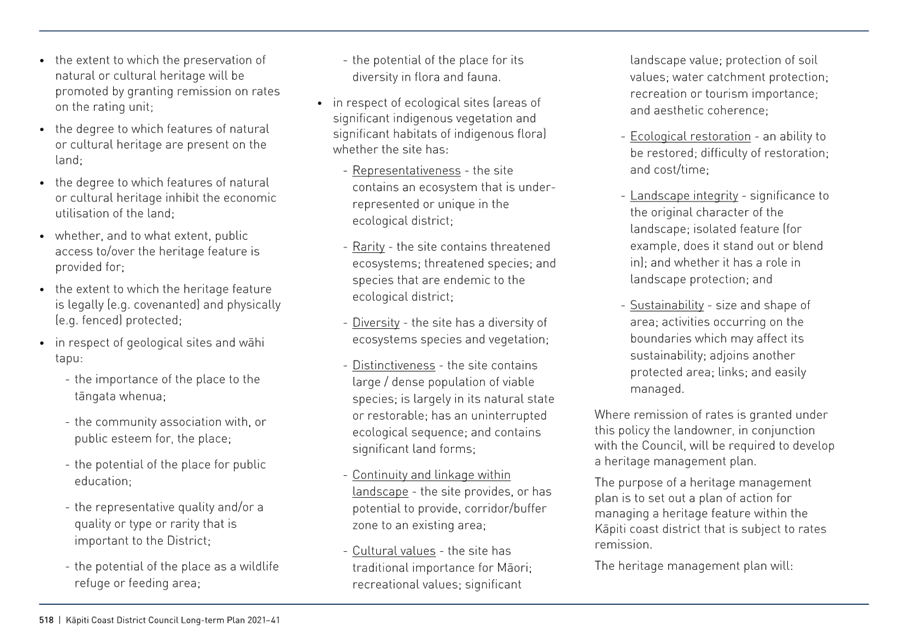

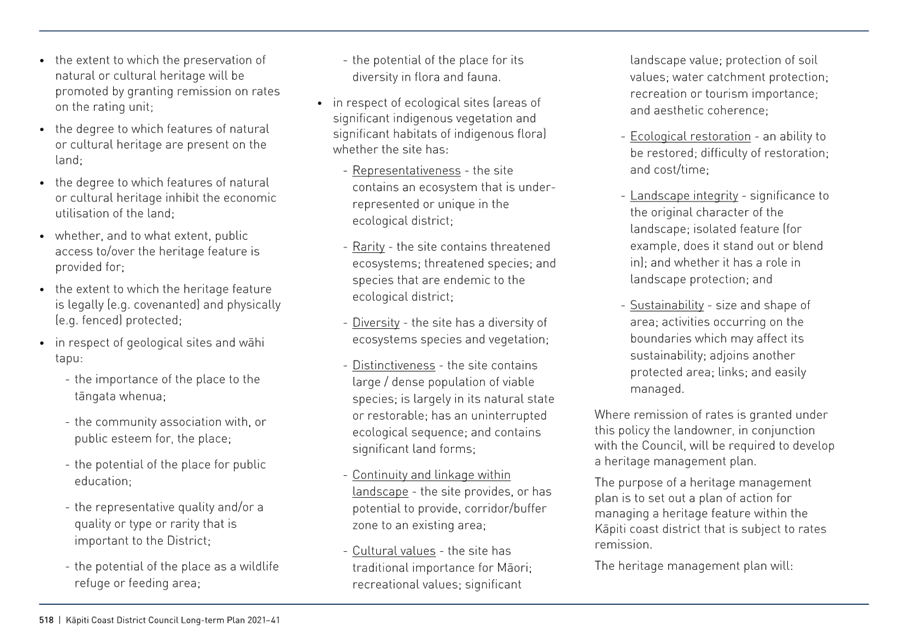

Long Term Plan 2021-41 references a policy for Rates Remission for Land

Protected for Natural or Cultural Conservation Purposes. The detail of this

policy is included in the Long Term Plan as Part 7 of the Rates Remission

Policy, and attached as Appendix 1 to this report.

4 Part

7 of the Rates Remission Policy supports the provisions of the Kāpiti

Coast District Plan regarding incentives for heritage feature management and

protection. It recognises that most heritage features are already

protected by rules in the District Plan and encourages landowners to maintain,

enhance and protect heritage features by offering a financial incentive.

5 The

granting of a rates remission as an incentive for encouraging the protection

and management of heritage features is consistent with Council’s

responsibilities under the Resource Management Act 1991 and the Historic Places

Act 1993.

6 The

2023/24 budget for Rates Remission for Land Protected for Natural or Cultural

Conservation Purposes is $46,112.

7 A

total of 108 ratepayers benefited from the policy in 2022/23. Having applied

successfully for rates remission, ratepayers may continue receiving it,

provided they meet the rates remission policy criteria. Each applicant has been

reviewed and the owners of the properties listed in Appendix 2 are recommended

to receive remission in 2023/24.

He

kōrerorero | Discussion

8 The

following paragraphs discuss the principles of rates remission, present the

proposed amounts of remission in a table format (Table 1), and make a

recommendation on which properties receive rates remission in 2023/24.

9 The

rates remission programme’s guiding principle is recognition of the

conservation efforts of ratepayers and the positive contribution their actions

make to protecting the District’s cultural and biodiversity heritage.

10 The

owners of these properties are often motivated solely by the desire to protect

and manage their environment, and their actions are voluntary. Many are keen

conservationists while others may fence off a bush remnant as the pasture gain

is negligible or to better manage stock movement. Whatever their motivation,

addressing significant pressures such as stock grazing or noxious pests has a

positive impact on the Kāpiti Coast environment.

11 Landowners

could use the rates remission for the upkeep of stock-proof fencing or pest

animal and weed control. However, in most instances the amount of remission is

far less than the true cost of these protective measures.

12 Rates

remission is an added incentive for landowners to respect the conservation

values of parts of their properties that have a feature of natural or cultural

value. Further, rates remission is one of the non-regulatory incentives for

protecting and maintaining sites of conservation value. The provision of rates

remission also provides a good basis for on-going partnerships between Council

and landowners.

13 Rates

remission amounts are calculated according to the size of the heritage feature

as shown in Table 1. This method is coarsely related to the level of

contribution towards the environment as larger areas of forest or wetland are

generally more significant. This does not take into account, however, the

presence of rare and endangered species or the amount of time and effort put

into management.

14 The

rates remission amounts in Table 1 have been increased from the 2022/23

financial year by using a consumer price index (CPI) figure of 2.6%.

15 Table 1 – Rates Remission

Amounts

|

Rate remission bracket

|

Size of protected area/feature (ha)

|

Rates Remission ($) 2023-24

|

|

1

1

|

Up to 1.0 ha

|

2 143

|

|

3 2

|

1.001 – 5.0 ha

|

4 285

|

|

5 3

|

5.001 – 10.0 ha

|

6 430

|

|

7 4

|

10.001 – 20.0 ha

|

8 570

|

|

9 5

|

20.001 – 30.0 ha

|

10 713

|

|

11 6

|

30.001 – 40.0 ha

|

12 857

|

|

13 7

|

40.001 – 50.0 ha

|

14 999

|

|

15 8

|

50.001 – 70.0 ha

|

16 1143

|

|

17 9

|

70.001 – 100.0 ha

|

18 1229

|

|

19 10

|

More than 100 ha

|

20 1432

|

He

take | Issues

16 One

new application for Rates Remission for Land Protected for Natural or Cultural

Conservation Purposes was received for the 2023/24 financial year and is

recommended for approval. This property is listed in Appendix 2, marked with an

asterisk.

17 One

property was incorrectly placed in remission bracket 2 in the 2022/23 year, the

correct bracket for that property is remission bracket 3. The difference

has been added to their remission amount for 2023/24, marked by a double

asterisk in Appendix 2.

18 A

total of 109 properties are recommended for remission.

Ngā

kōwhiringa | Options

Mana whenua

19 Mana

whenua have not been consulted as part of this report.

Panonitanga Āhuarangi me te Taiao | Climate change

and Environment

20 By

encouraging landowners to protect and enhance natural ecosystems, Rates

Remission for Land Protected for Natural or Cultural Conservation Purposes

contributes to the vision and principles of the Climate Emergency Action

Framework by directly sequestering and storing carbon.

Ahumoni me ngā rawa | Financial

and resourcing

21 The

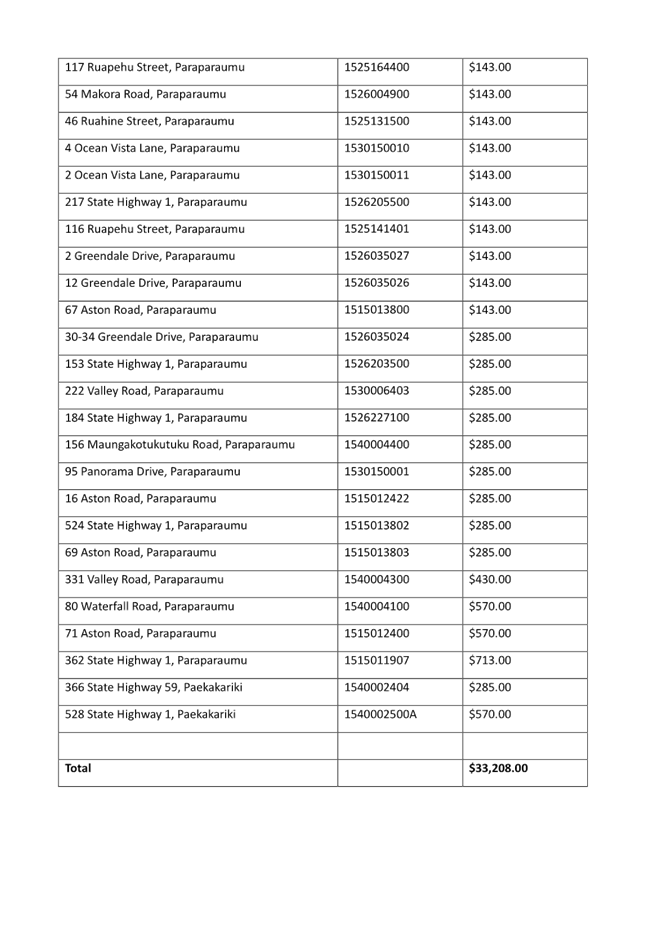

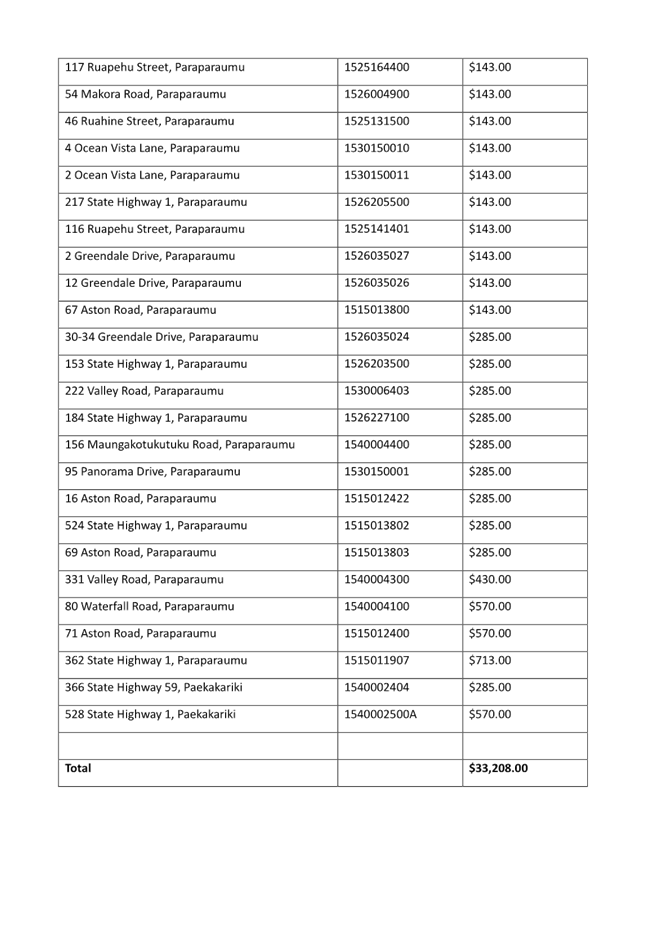

total amount of rates remission allocated in 2023/24 would be $33,208

(including GST), within the 2023/24 budget of $46,211 (excluding GST).

Tūraru ā-Ture me te Whakahaere

| Legal and Organisational Risk

22 There

are no legal considerations.

Ngā pānga ki ngā kaupapa here | Policy impact

23 The

granting of Rates Remission for Land Protected for Natural or Cultural

Conservation Purposes is in accordance with Part 7 of the Rates Remission

Policy (Attachment 1) contained in the Long Term Plan 2021-41.

TE whakawhiti kōrero me te

tūhono | Communications &

engagement

24 This

matter has a low level of significance under Council’s Significance and

Engagement Policy.

Te mahere tūhono | Engagement

planning

25 Engagement planning it not required for

the contents of this report.

Whakatairanga |

Publicity

26 Advertising

and publicity channels will not be used to communicate the decisions in this

report.

Ngā āpitihanga | Attachments

1. Rates

Remission Policy ⇩

2. Properties

recommended to receive Rates Remission for Land Protected for Natural or

Cultural Conservation Purposes in 2023/24, and recommended amounts ⇩

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

|

Council Meeting Agenda

|

28 March 2024

|

10.5 Regional

Collaboration on a Water Services Delivery Plan

Kaituhi |

Author: Sean

Mallon, Group Manager Infrastructure and Asset Management

Kaiwhakamana

| Authoriser: Darren Edwards, Chief Executive

Te pūtake |

Purpose

1 Provide an overview of the Government’s intended

legislative changes to give effect to Local Water Done Well policy, including

the requirement on councils to develop a water service delivery plan.

2 Ask the council to sign a Memorandum of Understanding

(MoU) to collaboratively develop a water service delivery plan working

including consideration of future delivery models with the other councils in

the Wellington region.

3 Ask the council to nominate an elected member to be

council’s representative on the Advisory Oversight Group for the joint

water service delivery plan process.

He

whakarāpopoto | EXecutive summary

Te tuku haepapa

| Delegation

4 The

Council has authority to make this decision.

Taunakitanga | RECOMMENDATIONS

That the

Council:

a) Notes

the Government’s intended legislative changes to give effect to Local

Water Done Well policy, including the requirement on councils to develop a

water service delivery plan

b) Approves

signing of an MoU to jointly develop a water service delivery plan with the

other councils in the Wellington region;

c) Agrees

to delegate authority to the Chief Executive to finalise the MoU,

consistent with discussions and any amendments made by the council;

d) Agrees

to nominate …………………….as the

elected member to be council’s representative on the Advisory Oversight

Group for the joint water service delivery plan process.

Tūāpapa | Background

5 Change

is coming to how water is regulated and managed by local authorities. The

Government has repealed the Water Service Entities Act 2022 and set out the

process and legislative changes required to give effect to their Local Water

Done Well policy.

6 Local

Water Done Well policy is based on a clear premise that change is required and

will happen. The policy is still under development, but indicatively will

be based on the following requirements:

7 Councils

to develop a water services plan: Within a year, councils must develop a

plan to transition to a new water service delivery model that can meet

regulatory and investment requirements.

8 Increased

regulation in relation

· Water

quality regulation

· Infrastructure

investment regulation

9 Financial

sustainability – water services models must be financially

sustainable, based on:

· Revenue

sufficiency

· Ringfencing

to fund investment

· Funding

for growth

10 The

Government has signalled that it intends to give effect to this policy through

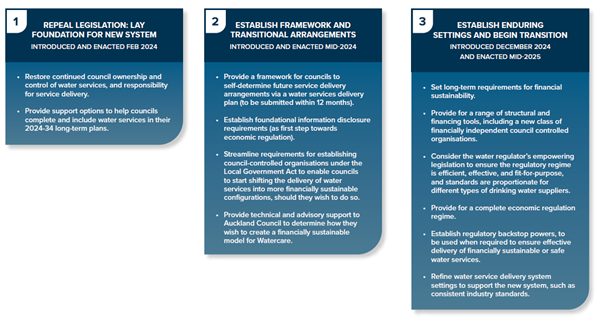

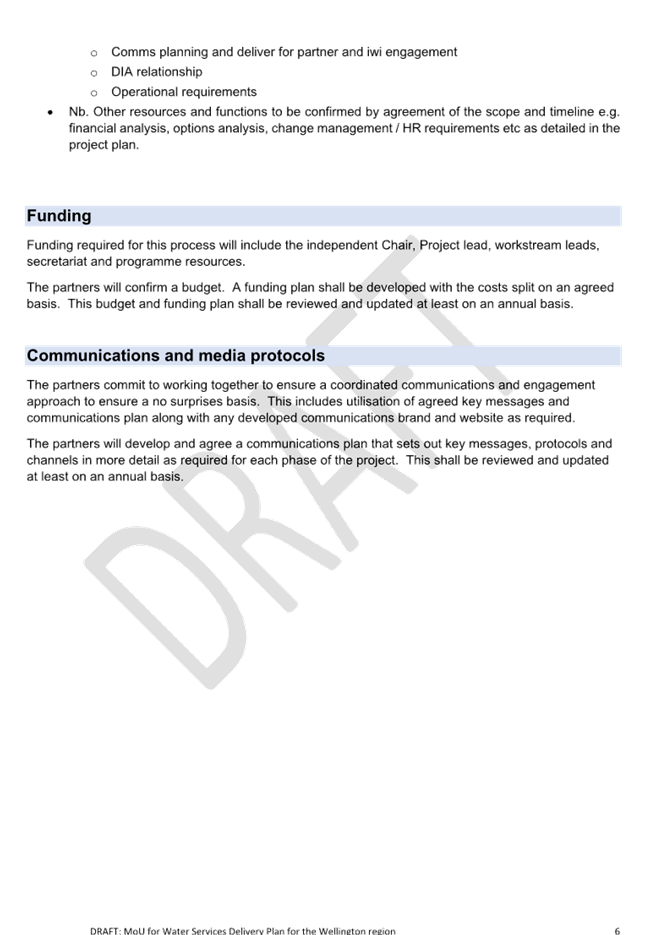

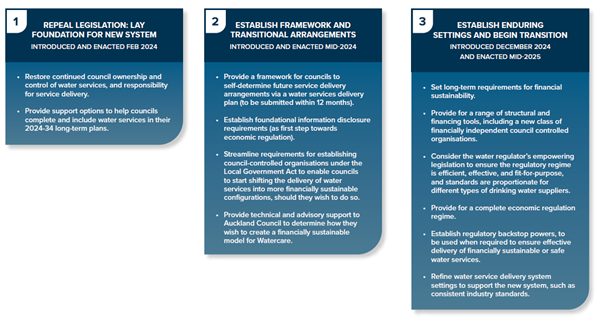

two further pieces of legislation (refer Figure 1 below).

Figure 1

11 The

first new bill (stage 2 in figure 1), is expected to be introduced and enacted

mid-2024. This bill is being informed by an expert Technical Advisory

Group. This legislation is expected to set out a clear framework for

councils to develop a future water service delivery plan within 12 months of

enactment. It is also expected to set out the foundations for economic

regulation and streamline requirements for establishing council-controlled

organisations under the Local Government Act. This will enable councils

to move to different models, should they choose to do so.

12 The

second bill (Stage 3 in figure 1), is expected to be introduced in late 2024

and enacted by mid-2025. This is expected to set out provisions relating

to long-term requirements for financial sustainability, provide for a complete

economic regulation regime, and a new range of structural and financing tools,

including a new type of financially independent council-controlled

organisation.

13 The

second bill will also establish regulatory backstop powers, to be used when

required to ensure effective delivery of financially sustainable or safe water

services. In addition, it will make amendments to the water regulator’s

legislation to be used to ensure delivery of financially sustainable or safe

water services.

14 All

legislation to support the implementation of Local Water Done Well is expected

to be passed by mid-2025 – ahead of the local government elections in

October 2025.

He

kōrerorero | Discussion

15 The need

for change to how water services are funded and delivered has been the subject

of several major reviews, policy processes and legislative reform since at

least 2016. Two major reviews (the Havelock North Drinking Water Inquiry

2016-2017, the Three Waters Review - 2017-2019), all concluded that councils

were struggling to maintain and renew their ageing water infrastructure.

16 These

reviews have confirmed that significant and sustained investment is required

over the coming decades to ensure councils can continue to enable growth,

provide safe drinking water, improve environmental water quality, and are

resilient to future seismic and climate change events. This level of

investment is not possible for local government under current borrowing

settings and any attempts to increase expenditure through rates will be

unaffordable for communities.

17 For

council, the key issues being faced are:

17.1 Council has invested heavily in its 3 waters

Infrastructure assets to ensure they are fit for purpose and provide a

resilient and robust network for our community. This investment currently

reflects a projected level of debt as at 30 June 2024 of close to $154 Million.

This level of debt significantly limits Councils ability to continue to invest

in the needs of the community in other critical services we provide.

17.2 The level of future investment required in our 3

waters under current council financial settings will continue to put pressure

on Council borrowing limits and is not able to continue to load debt onto

balance sheets. A new approach is needed that will address the balance sheet

limitations for council.

17.3 Ongoing increases to rates will be unacceptable and

unaffordable. Investment cannot be based on borrowing only and must also

be based on a balance of funding between current and future users to ensure a

fair share of the true cost of the service. To ensure long term financial

sustainability, water investment for asset renewals must be structured on an

equitable intergenerational basis.

17.4 The ability to meet increased regulatory

requirements (both costs and processes), for environmental, drinking water and

economic regulation will be challenging and costly.

18 Based

on direction from Government to date and expected legislative change, council

will be required to develop a water service delivery plan by around

mid-2025. Council has options to develop this independently, or to work

with other councils in the region.

19 Developing

the plan independently would reduce some complexities of process and

decision-making requirements.

20 Working

with other councils in the region offers the opportunity to collectively engage

in legislative process, to ensure a sustainable, workable future model is

identified and can then be implemented. This may include a specific model for

council or some form of joint model with other councils.

21 While

there is no mandated future model, it is expected that the legislation will

create a new type of CCO / COC (Council Owned Company). This indicates

that the Government has a preferred model in mind.

22 In

the context of other demands and pressures on council, there is value in

considering a collective approach. This does not commit council to any

particular model but allows for consideration of a collective approach in

conjunction with other models.

He

take | Issues

23 The

water services plan and future models and options to be considered will need to

respond to agreed objectives and consider future approaches that are workable,

affordable, sustainable and meet the needs of communities and the environment.

24 The

key deliverable from this joint process would be a joint water services plan

for the region, including options for future delivery models based on strategic

option selection and high-level design. This process and outputs do not

preclude any council from choosing to develop its own water services plan.

25 Critical

success factors are that the water services delivery plan and any future model:

25.1 Is

supported by all councils and Iwi / Māori partners which are part of this

process

25.2 Is

supported by the Government and enabled through legislative change

25.3 Is

based on a sustainable funding model

25.4 Enables

commitment from councils and Government to move to subsequent phases to deliver

the plan – detailed design and implementation

26 The

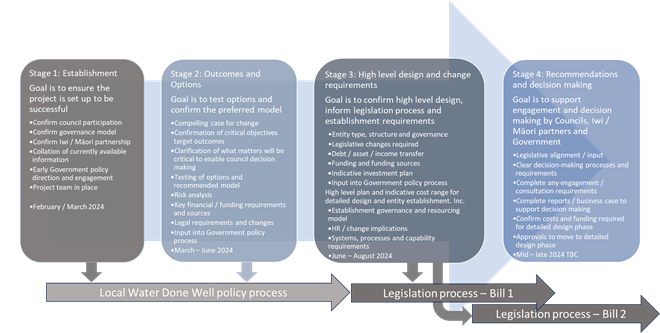

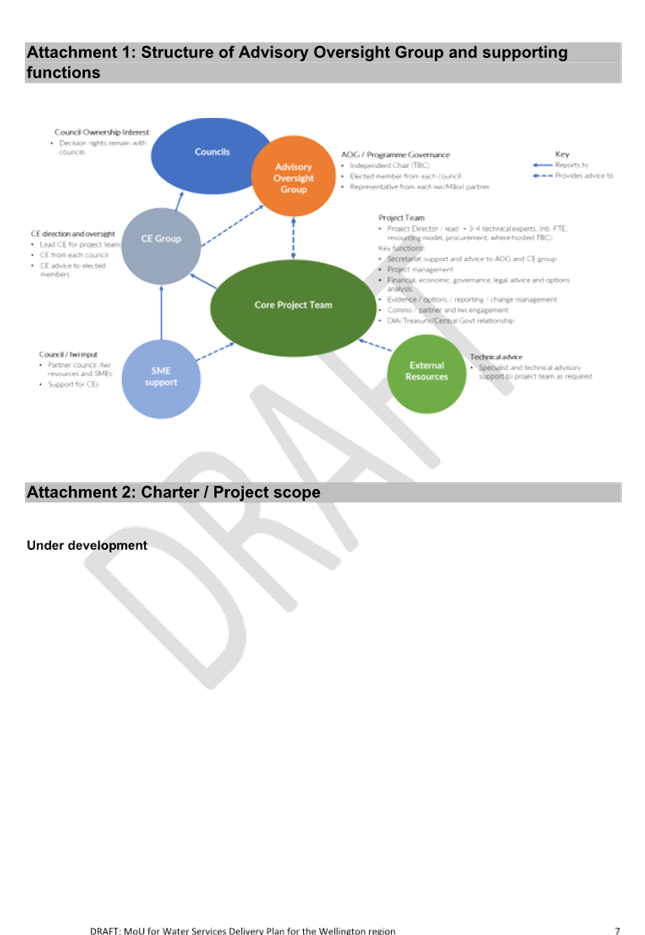

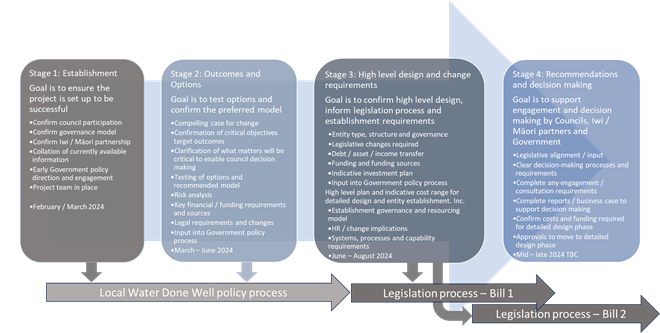

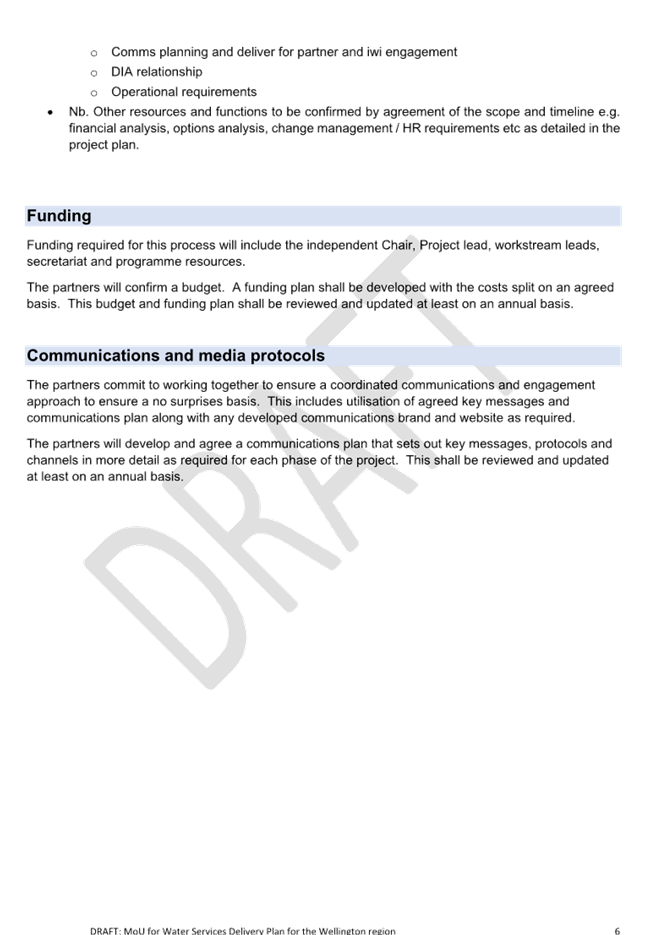

high-level process and timing for this approach is shown in Figure 3.

This is still being developed and would be tested and refined working with the

AOG.

Figure 3

27 This

process anticipates a staged approach to development of a water services plan aligned

with the development of legislation. This would be focused on clear

testing of options based on agreed outcomes by around mid-2024. This

would inform the development of a high-level design for a future model to

support any required engagement and decision-making happening around late

2024. This would enable the completion of the water services plan by

early to mid-2025, aligned with the expected requirements of legislation.

Ngā

kōwhiringa | Options

28 Informed

on these considerations, an approach to enable regional collaboration on a

water services plan has been developed for council’s consideration.

This is based on a collaborative and non-binding partnership between councils

in the Wellington region to work through this process robustly and

efficiently.

29 Importantly, the process would not

transfer any formal decision-making responsibilities or delegations from

council. Any future decisions on a water service plan, preferred models

or commitments to future change would remain with council.

30 A commitment to regional collaboration

would be confirmed by signing a joint MoU. The draft MoU is attached see

(Attachment 1).

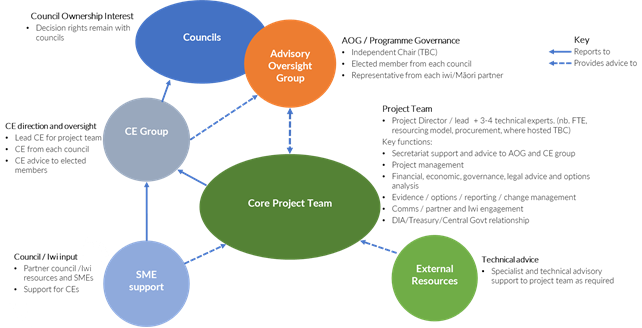

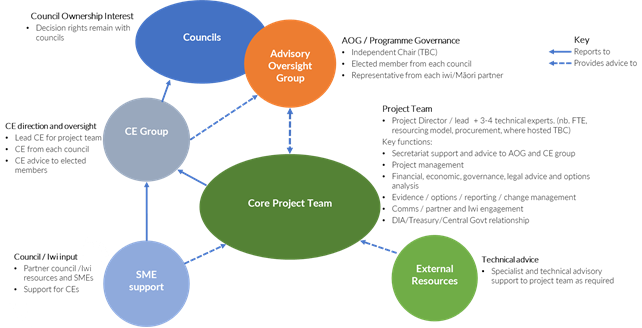

31 As part of this approach, councils

would establish a joint governance oversight group called the ‘Advisory

Oversight Group’ (AOG) made up of elected members. Iwi / Māori

partner representatives will also form part of this group, with the approach to

be confirmed working with Iwi / Māori partners during the establishment

phase.

32 The AOG would be chaired by an

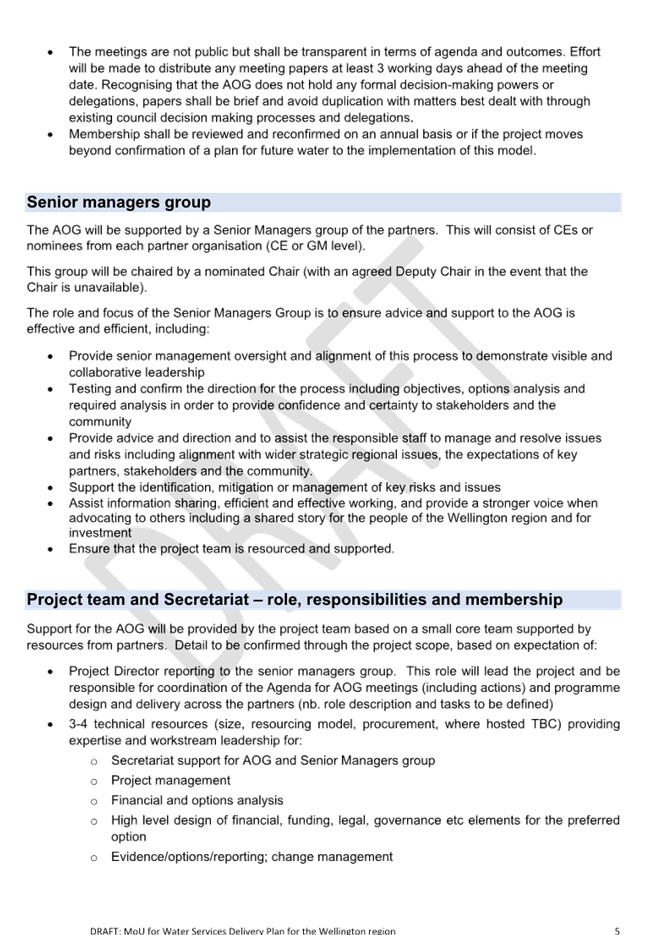

independent chair with suitable expertise in local government, financial models

and large scale utility operations.

33 The draft terms of reference for the

AOG is appended to the MoU, see Attachment 1. The AOG is not a formal

joint committee and has no formal decision making rights. Support would

be provided by Chief Executives and a joint project team.

34 Formation of the AOG and signing of

the MoU would signal a commitment by councils and Iwi / Māori partners to

work together through a collaborative and non-binding process. Council can

choose to exit this process at any stage.

35 The proposed structure for a

Wellington regional collaborative approach is shown below in Figure 2.

Figure 2

Mana whenua

36 Changes to water management will raise

a range of significant issues for Iwi / Māori including water quality,

priorities for investment and how to give effect to te mana o te wai.

37 As part of this process, council will

need to confirm an approach of how to effectively work with Iwi / Māori

partners. This approach would be confirmed working with Iwi / Māori

partners during the establishment phase.

Panonitanga Āhuarangi me te Taiao | Climate change

and Environment

38 The

ongoing impacts of climate change on councils 3 waters assets has a significant

potential impact both on operational costs associated with more frequent and

intense rainfall events, and capital expenditure on increased network capacity

and treatment plant improvements.

Ahumoni me ngā rawa | Financial

and resourcing

39 There are no immediate financial

implications of this paper.

40 The financial implications of

committing to this process will be confirmed as part of the establishment phase

of the project and are expected to be met using existing three waters

transitional funding.

41 The medium to longer term implications

of legislative change and any future water services plan are expected to be

significant. These will be a key consideration for the process and any

future decisions required of council.

Tūraru ā-Ture me te Whakahaere

| Legal and Organisational Risk

42 The proposed legislative changes and

water services plans will raise a range of legal issues and considerations for

councils to work through. These are expected to be confirmed as part of the two