|

|

|

AGENDA

Audit and Risk Sub-committee Meeting

|

|

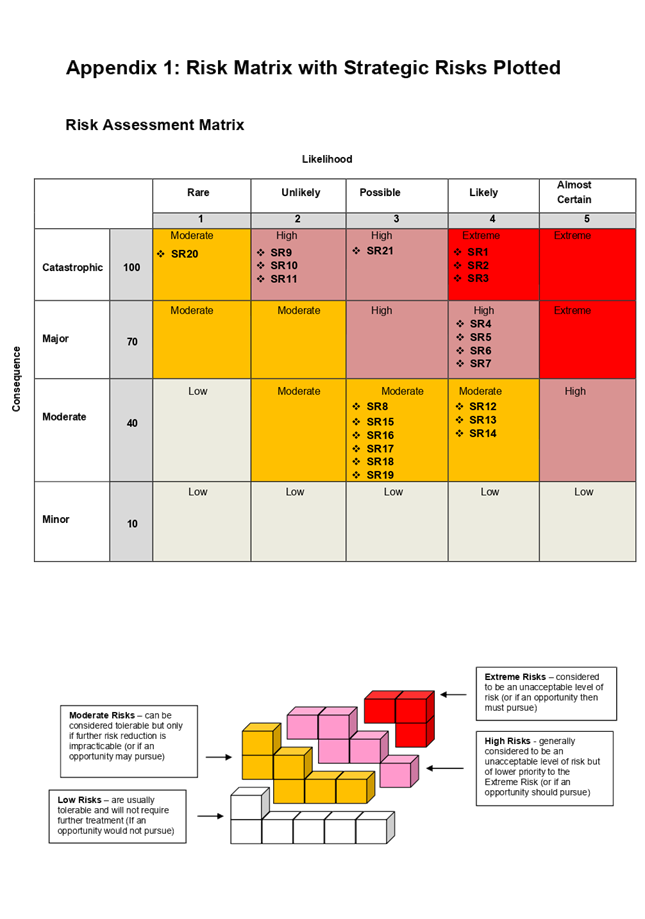

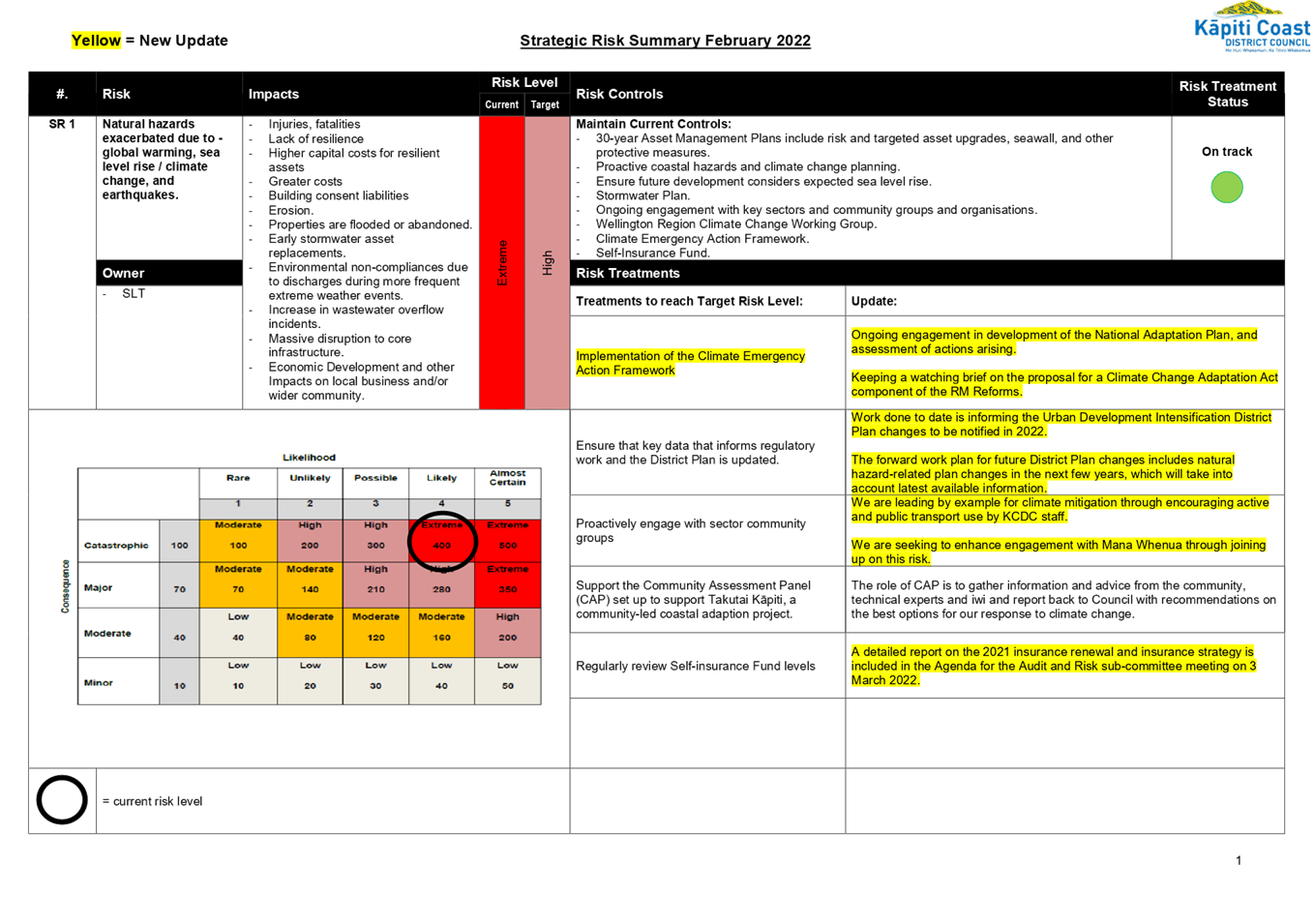

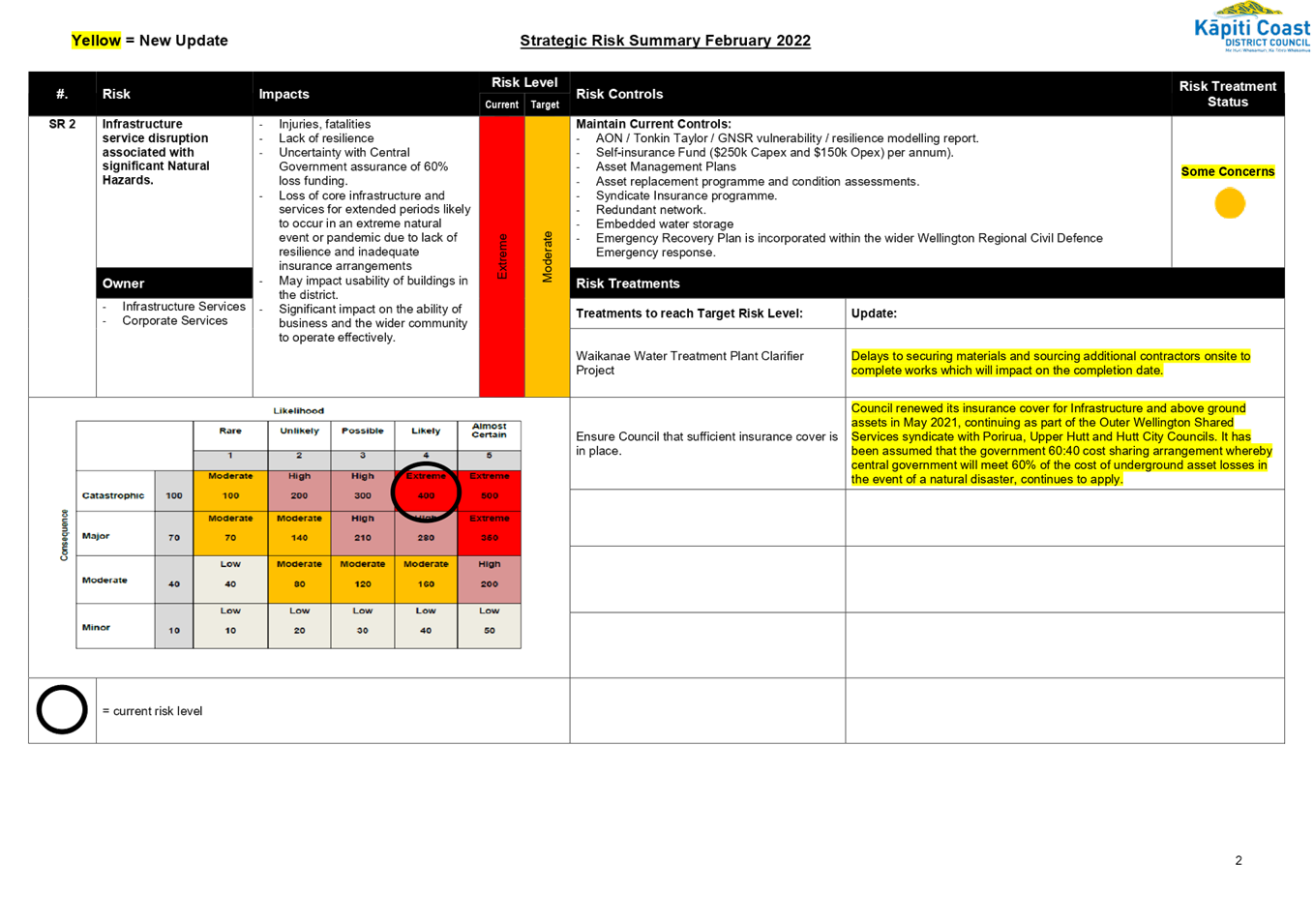

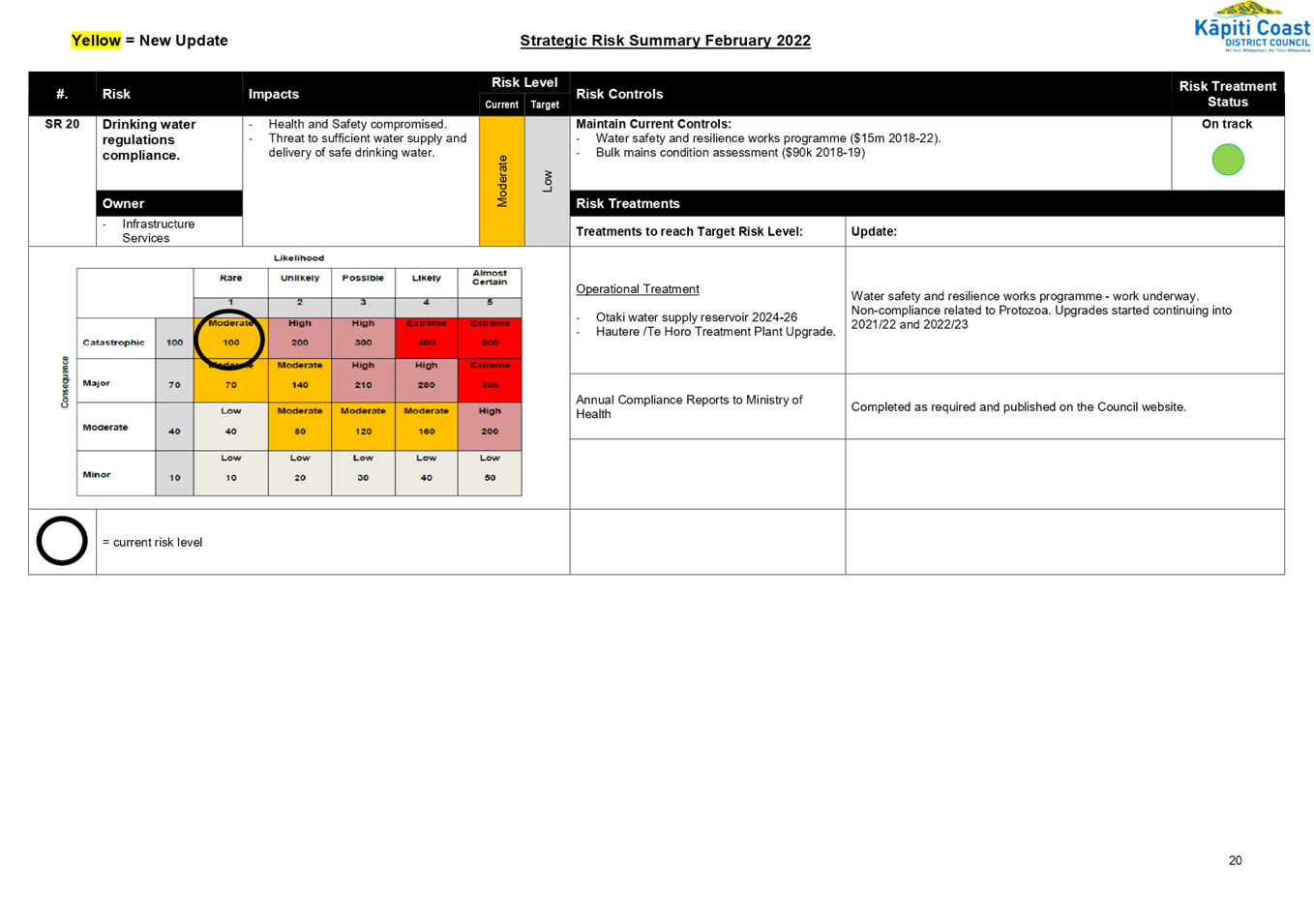

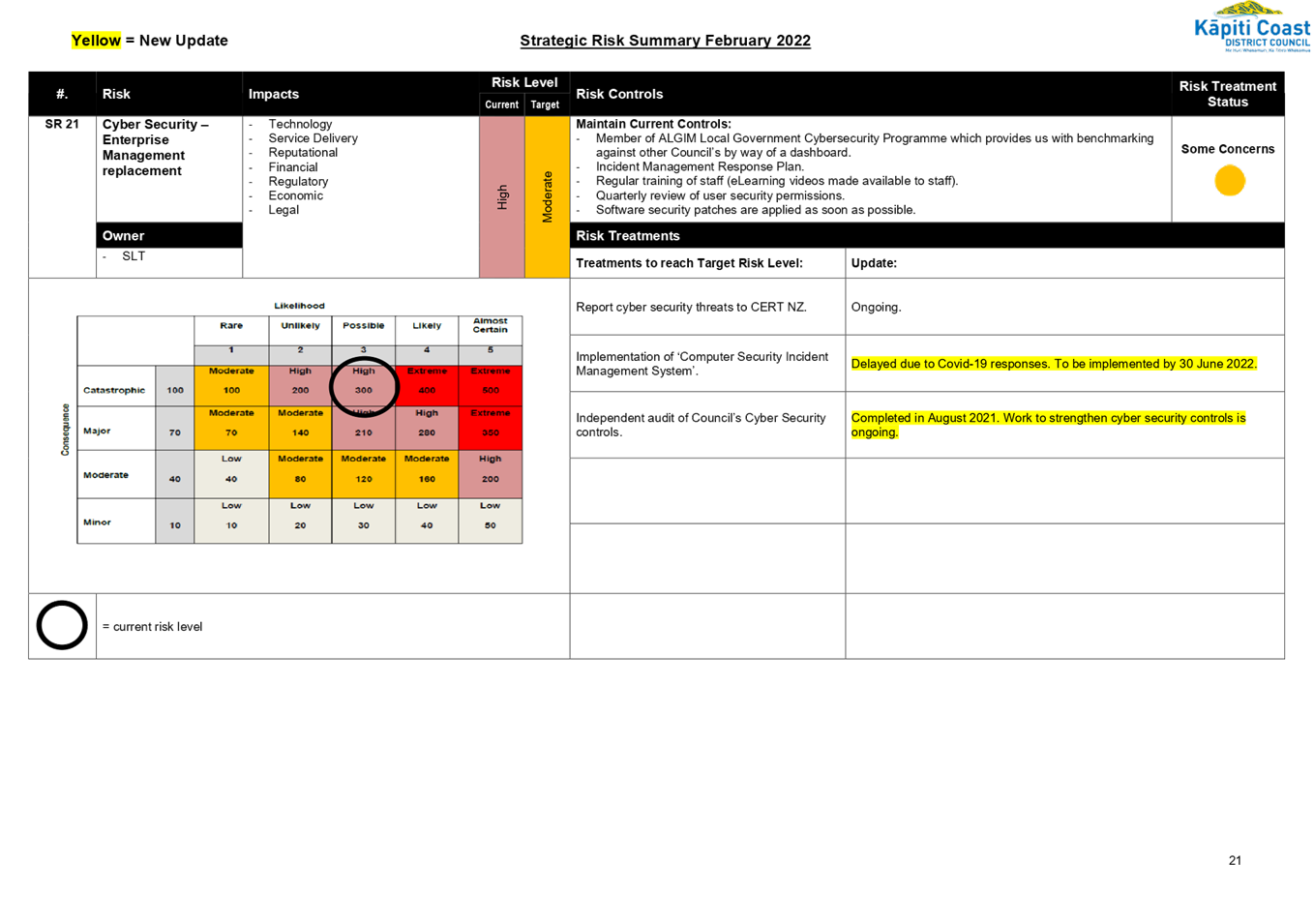

I hereby give notice that a Meeting of the Audit and Risk Subcommittee will be held on:

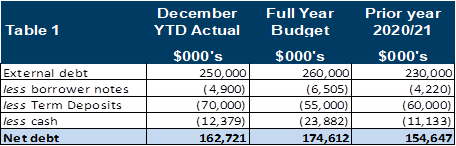

|

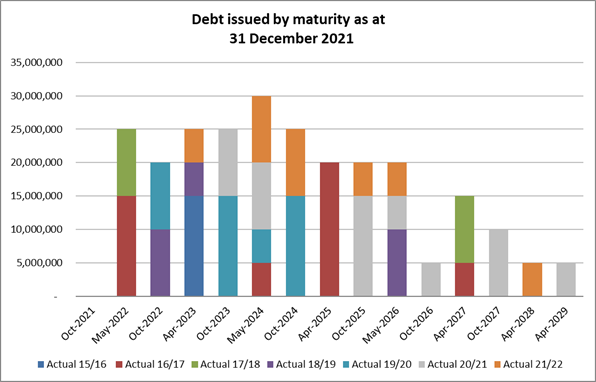

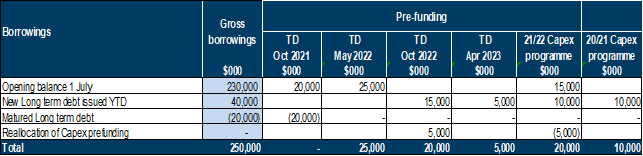

|

Date:

|

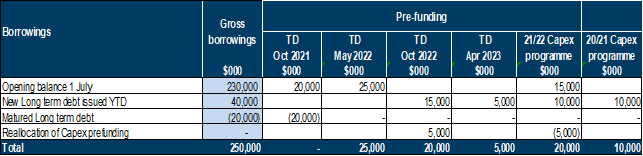

Thursday, 3 March 2022

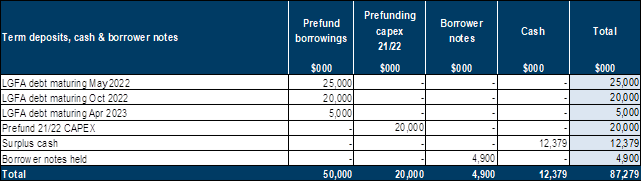

|

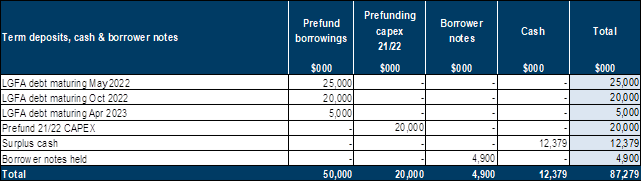

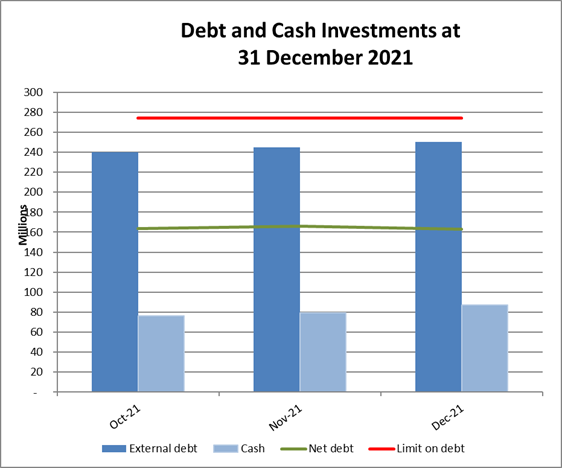

|

Time:

|

9.30am

|

|

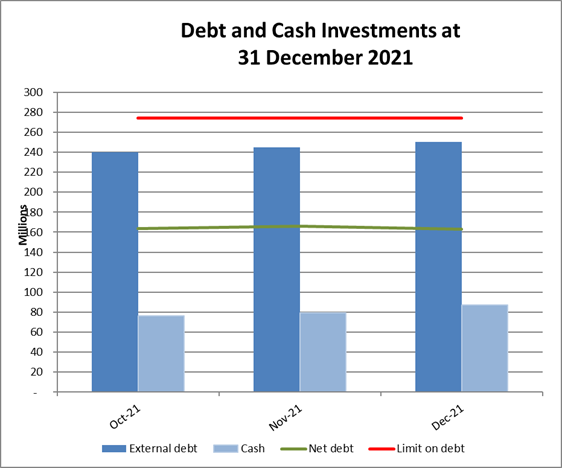

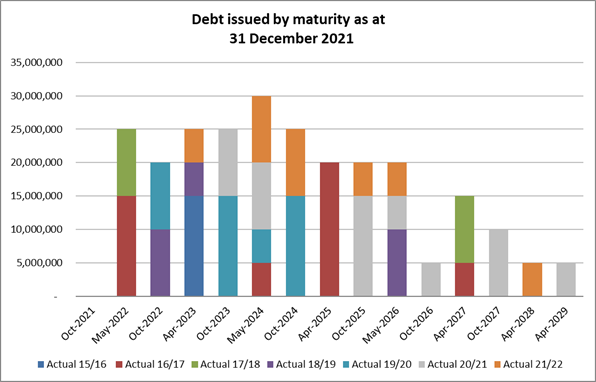

Location:

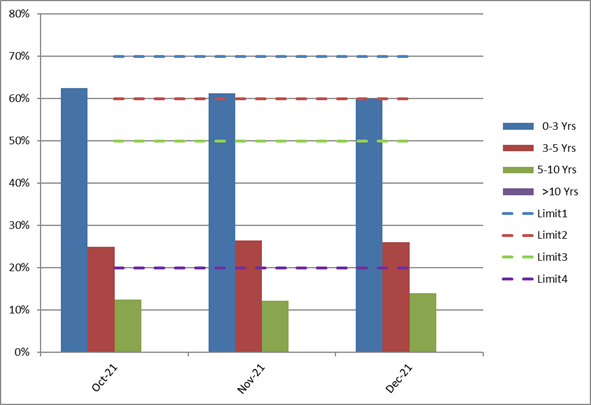

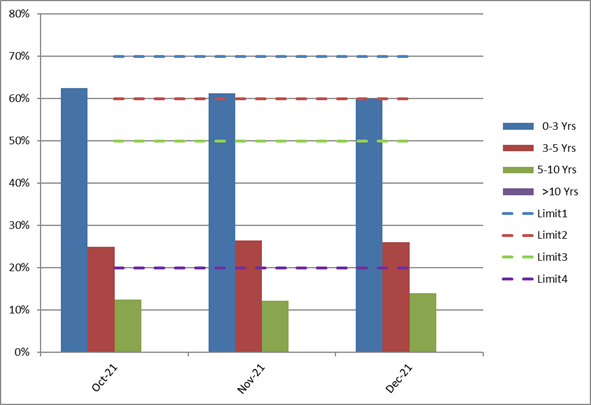

|

Online

via Zoom

|

|

Mark de Haast

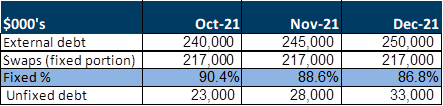

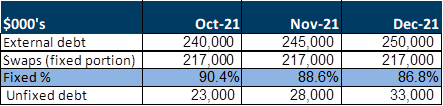

Group Manager Corporate Services

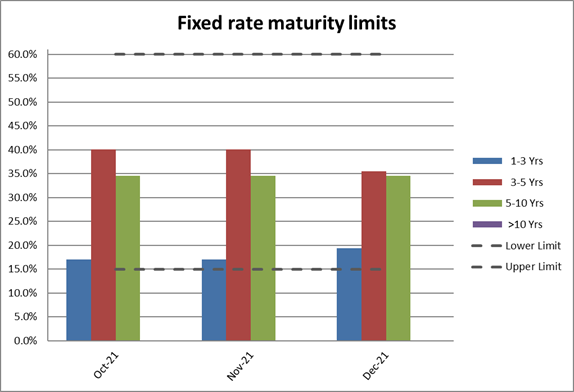

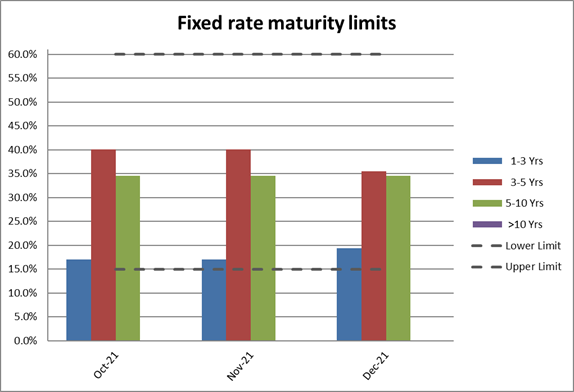

|

|

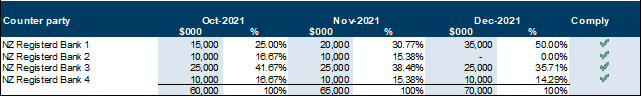

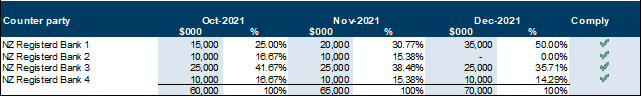

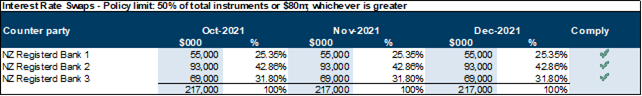

Audit and Risk

Sub-committee Meeting Agenda

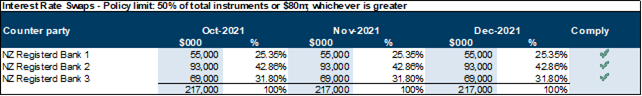

|

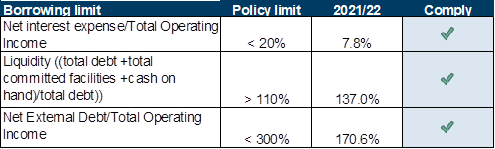

3 March 2022

|

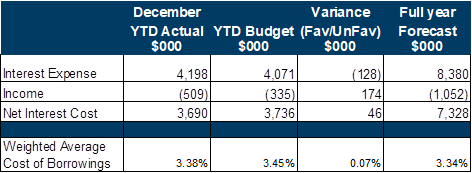

Kapiti Coast District Council

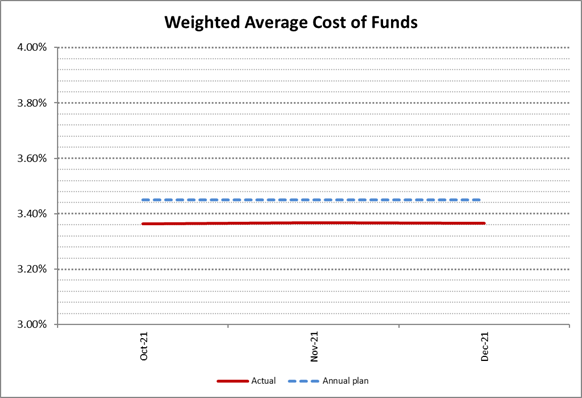

Notice is hereby given

that a meeting of the Audit and

Risk Subcommittee will be held in

the Online via Zoom, on Thursday 3

March 2022, 9.30am.

Audit and Risk

Subcommittee Members

|

Mr

Bryan Jackson

|

Chair

|

|

Cr

Angela Buswell

|

Deputy

|

|

Mayor

K Gurunathan

|

Member

|

|

Deputy

Mayor Janet Holborow

|

Member

|

|

Cr

Gwynn Compton

|

Member

|

|

Mr

Gary Simpson

|

Independent

|

2 Council

Blessing

“As we deliberate on the

issues before us, we trust that we will reflect positively on the communities

we serve. Let us all seek to be effective and just, so that with courage,

vision and energy, we provide positive leadership in a spirit of harmony and

compassion.”

I a mātou e whiriwhiri ana

i ngā take kei mua i ō mātou aroaro, e pono ana mātou ka

kaha tonu ki te whakapau mahara huapai mō ngā hapori e mahi nei

mātou. Me kaha hoki mātou katoa kia whaihua, kia tōtika

tā mātou mahi, ā, mā te māia, te tiro whakamua me te

hihiri ka taea te arahi i roto i te kotahitanga me te aroha.

3 Apologies

4 Declarations

of Interest Relating to Items on the Agenda

Notification from Elected

Members of:

4.1 – any interests that

may create a conflict with their role as an elected member relating to the items

of business for this meeting, and

4.2 – any interests in

items in which they have a direct or indirect pecuniary interest as provided

for in the Local Authorities (Members’ Interests) Act 1968

5 Public

Speaking Time for Items Relating to the Agenda

6 Members’

Business

(a)

Public Speaking Time Responses

(b)

Leave of Absence

(c)

Matters of an Urgent Nature (advice to be provided to the Chair prior to

the commencement of the meeting)

7 Updates

Nil

8 Reports

8.1 Insurance

Overview

Kaituhi |

Author: Ian

Georgeson, Chief Financial Officer

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake | Purpose

1 This

report summarises 2021 insurance renewals and seeks endorsement of the proposed

future direction.

He whakarāpopoto | Executive summary

2 Not

required.

Te tuku haepapa | Delegation

3 The

Audit and Risk Sub-Committee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

Ensuring that the Council has in place

a current and comprehensive risk management framework and making

recommendations to the Council on risk mitigation.

Taunakitanga | Recommendations

A. That the

Audit and Risk Sub-Committee:

A.1 notes

the insurance renewal outlined in this paper; and

A.2 agrees

the Council should commission a feasibility review of alternative

self-insurance options, and report back to the Audit and Risk Sub-Committee in

due course.

Tūāpapa | Background

4 The

Kāpiti Coast District Council’s (Council) Property and Underground

Infrastructure insurances, which account for the majority of our insurance

cover, renewed on 1 May 2021. Aon are our insurance advisers.

5 The

Council, together with Porirua, Hutt City and Upper Hutt City councils

(collectively known as the Outer Wellington Shared Services Insurance Group or

OWSS) has been purchasing insurance for their respective assets on a combined

basis since 2009. This syndicate was established to provide the OWSS with the

scale necessary to access wider domestic and off-shore insurers. In July 2016

Greater Wellington Regional Council joined the OWSS to insure their above

ground assets through the collective.

6 Over

recent years, insurance markets have been firming. New Zealand, and in

particular Wellington, is seen as increasingly challenging for underwriters due

to the seismic risk. Through the increasing severity and frequency of global

natural disaster and weather events insurance capital is increasingly demanding

higher returns. The most simple lever insurers have to meet these costs

is through increases in premium levels, which has been the recent trend.

7 Insurance

is only one method of transferring risk, and Council is exploring how best to

appropriately mitigate risks while optimising value to ratepayers.

Increasingly, entities are looking to retain greater risk themselves through,

for example, self-insuring certain assets or accepting higher deductible levels

in exchange for reduced premiums.

8 Through

the most recent renewal process, the Council explored reducing purchased

insurance of certain lower value, non-critical assets, and eventually opted to

exclude general parks equipment and low value structures (replacement cost

under $200,000), such as toilet blocks and sheds. These assets were not considered

critical to operations, and the risk of incurring a significant loss was

considered low given their dispersed nature and relatively low value on an

individual basis. The replacement value of these excluded assets totalled

around $40 million and self-insuring them is estimated to have reduced premiums

by approximately $110,000.

9 To

offset the additional risk assumed by the Council by no longer insuring these

assets, we continue to build our self-insurance reserve. This is discussed in

more detail later in this paper.

10 The

Council also explored through the renewal process the possibility of adopting

higher deductibles. This was not found to be a viable option, with insurers

offering negligible or no premium savings in return. As the Council does not

make frequent low-level claims, insurers are primarily concerned about major

loss events, in which case a deductible of an additional $1million (for

example) makes little difference to their total exposure. It is likely that

deductibles would need to be substantially higher (i.e. many millions of

dollars), before meaningful premium savings became available, and this was not

considered to be an acceptable risk.

|

Audit and Risk Sub-committee Meeting Agenda

|

3 March 2022

|

11 Significant

asset insurances, as renewed for the year commencing 1 May 2021, are summarised

in the following table:

|

Asset

|

Type of insurance

|

Value of assets

insured

|

Limit of cover

|

Deductible

|

|

Infrastructure assets

|

Material damage and business interruption in the event of

natural catastrophe

|

~$650 million

|

$600 million OWSS combined material damage and business

interruption limit for an event involving more than one council for any loss

or series of losses arising out of any one event.

Limited to a $130 million sub-limit for the Council.

|

The deductible is $1million per event.

|

|

Property, plant and equipment

|

Material damage and business interruption (MDBI)

|

~$172 million

|

$600 million OWSS combined limit for any one loss or

series of losses arising out of any one event and applying to material damage

and business interruption combined.

|

The natural disaster deductible is 5% of sum insured, with

a minimum deductible of $100,000.

For other events the deductible is $50,000 (except for

landslip or subsidence which is $250,000).

|

|

Residential property

|

Included within MDBI policy above

Earthquake Commission (EQC)

|

~$31 million

|

EQC: First $150,000 for each loss event per property to be

recovered from the EQC.

All other losses: as per MDBI policy above

|

The EQC deductible is 1% of sum insured with a minimum

deductible of $200, if claim is for land deductible is 10% with minimum of

$500.

All other deductibles: as per the MDBI policy above

|

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

12 Current

government policy allows for central government to reimburse local government

up to 60% of the cost of restoring infrastructure (known as the 60:40 cost

sharing arrangement). This policy has been in place for over 25 years.

Insurance cover has been based on the assumption that government will provide a

full contribution of up to 60%, and therefore, insurance has been placed which

covers approximately 40% of loss estimates.

13 The

Council’s infrastructure has a total replacement value of $650 million.

Maximum insurance cover is $130 million for natural catastrophe damage to

infrastructure assets, within a combined $600 million limit for OWSS. The $130

million limit is based on assessed Maximum Probable Loss event in Kapiti.

Of this $130 million limit, 40% is insured with offshore insurers with Central

Government responsible for the remaining 60% of the costs. There is a $1

million deductible per claim per event.

14 The

Council has a sum insured value of $172 million for material damage and

business interruption (MDBI) insurance to above ground assets, with a

deductible of $50,000 per claim per event. Losses suffered to above ground

assets by natural catastrophe/s trigger a deductible of 5% of the site sum

insured with a minimum $100,000 deductible per claim per event. The total limit

of cover available to the OWSS collective group is $600 million. The overall

limit will be shared among the five councils following an event.

15 Residential

assets have a sum insured of $31 million and are also covered under the MDBI

policy. EQC covers up to $150,000 per dwelling, with the balance of any loss

covered with the MDBI policy with a deductible of $50,000 per event.

16 In

addition to the above key policies, the Council also carries motor vehicle,

liability, professional indemnity and construction insurances, which renewed in

November 2021.

He kōrerorero | Discussion

premium and budget impacts of renewal

17 Renewal

premiums are summarised in the following table:

|

|

Renewed

premium

$000

|

Previous

premium

$000

|

Change

$000

|

Change

%

|

|

Infrastructure

|

605

|

552

|

53

|

9.6%

|

|

Above ground

|

1,027

|

928

|

99

|

10.6%

|

|

Other policies

|

345

|

278

|

67

|

24.1%

|

|

Premium refund – prior

period

|

(17)

|

-

|

(17)

|

-

|

|

Total

|

1,960

|

1,758

|

202

|

11.5%

|

18 As

shown, the total annual cost of 2021 renewals was $1.960 million, an increase

of $202,000 or 11.5% over the previous year. This is within the 2021-41

Long-Term Plan (LTP) budget allowance of $2.279m for 2021/22. In finalising the

LTP, the Council agreed that the uncommitted balance of the insurance premium

budget should be transferred to the self-insurance reserve, to further build

that fund.

self insurance

fund

19 Maintaining

a self-insurance fund is one way of offsetting the increased levels of risk

being assumed through self-insuring certain assets or accepting higher excess

levels. The Council has a self-insurance reserve on its balance sheet, which as

at 30 June 2021 stood at $312,000.

20 The

LTP contains self-insurance budgets for 2021/22, 2022/23, and 2023/24 of

$154,000, $210,000, and $269,000 respectively and as noted above, in finalising

the LTP the Council agreed that any uncommitted 2021/22 insurance premium

budget should also be transferred to the self-insurance fund. The 2021/22

uncommitted premium budget is estimated at $319,000.

21 In

total, assuming no losses are incurred, it is therefore estimated that

Council’s self-insurance fund will reach approximately $1.26 million by

the end the 2023/24 financial year, as shown in the following table:

|

|

Estimated

contribution in year

$000

|

Estimated

fund balance

$000

|

|

Balance as at 30 June 2021

|

|

312

|

|

2021/22: budgeted self-insurance

contribution

|

154

|

466

|

|

2021/22: uncommitted premium

budget (est.)

|

319

|

785

|

|

2022/23: budgeted self-insurance

contribution

|

210

|

995

|

|

2023/24: budgeted self-insurance

contribution

|

269

|

1,264

|

22 Looking

forward, as this fund grows, the Council intends to further explore options to

carry higher levels of risk ourselves in return for reduced premiums. If this

is achieved and associated premium savings are transferred to the reserve, the

fund balance will be correspondingly higher.

23 Aon

advise that depending on our longer-term strategy there are more sophisticated

self-insurance models that may be beneficial (as opposed to simply a reserve on

our balance sheet) which could be explored, specifically a captive or protected

cell.

24 A

captive is an insurance company owned by a non-insurance company parent (e.g.

the Council), which primarily insures the risks of its parent and/or affiliated

companies. Captives are usually formed in a specialised regulatory environment

- a domicile. At a very basic level a captive is a form of risk retention

mechanism (like a deductible) that is used to aggregate premium and loss

information for its parent. A captive can retain a portion of the risk

and seek co-insurance or reinsurance cover for the full risk amount. A

captive can make risk financing more cost effective and ultimately reduce the

total cost of risk. A captive will control the budget that is allocated to risk

management and will pay for the company’s losses.

25 A

Protected Cell, or Cellular Captive can provide similar risk retention

capabilities, with the flexibility of faster entry and exit and reduced

governance requirements. A protected cell entity is less onerous to

establish and administer than a captive and is likely to be the more suitable

form for our Council, should we wish to proceed in this direction.

26 Irrespective

of the form adopted, advantages of establishing an independent insurance

vehicle include:

a) achieving

a degree of formality and separation from the parent, allowing for arms length

management of insurances;

b) adopting

a level of risk retention separate from the parent;

c) assuming

no significant losses, the benefit of retaining some risk (and therefore some

of the premium budget) will accumulate in our self-insurance vehicle, rather

than being paid away to insurers;

d) fund

capital, while being retained to meet potential future losses, could be

invested and earn a return, subject to appropriate investment risk and

liquidity controls; and

e) the

ability to provide insurance cover for uninsurable or hard to insure assets.

27 It

is proposed that the Council commissions Aon to conduct a feasibility analysis

of establishing a captive or protective cell and reports back to the Audit and

Risk Sub-Committee in due course.

He take |

Issues

28 This

matter has a low level of significance under the Council’s Significance

and Engagement Policy.

Ngā kōwhiringa | Options

29 There

are no options in addition to those already noted in this report.

Tangata whenua

30 There

are no tāngata whenua considerations required with this

report.

Panonitanga āhuarangi | Climate change

31 There

are no climate change considerations required with this report.

Ahumoni me ngā rawa | Financial

and resourcing

32 All

financial impacts discussed in this report are within Long-term Plan budget

allowances.

Ture me ngā Tūraru | Legal

and risk

33 If

it is agreed to further explore alternative insurance vehicles, a legal review

will be included.

Ngā pānga ki ngā kaupapa here | Policy impact

34 This

report has no impact on the Council policies.

Te whakawhiti kōrero me te

tūhono | Communications &

engagement

Te mahere tūhono | Engagement

planning

35 There

are no engagement plans required for this report.

Whakatairanga |

Publicity

36 No

publicity is planned in relation to this report.

Ngā āpitihanga | Attachments

Nil

8.2 Ernst

& Young Audit Plan for the Year ended 30 June 2022

Kaituhi |

Author: Ian

Georgeson, Chief Financial Officer

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake | Purpose

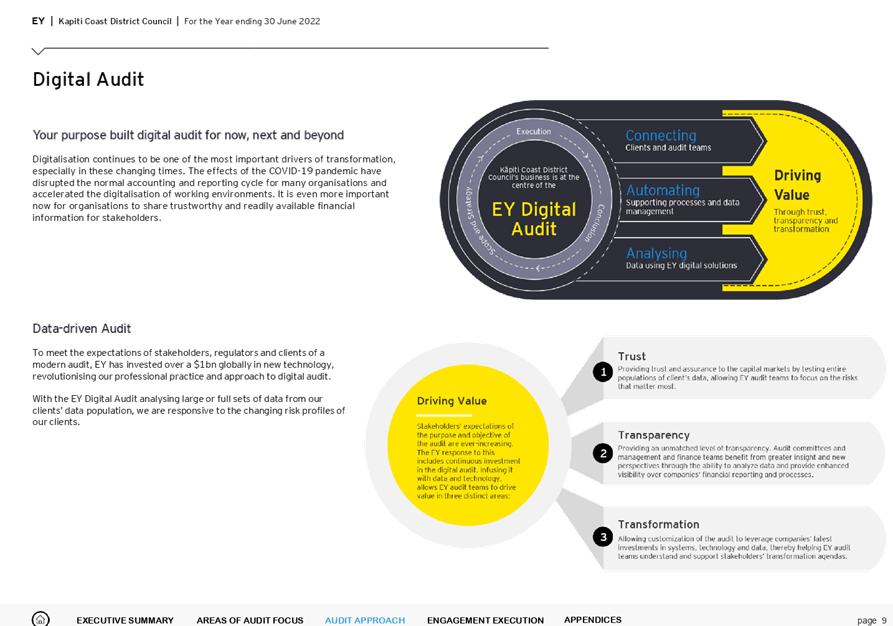

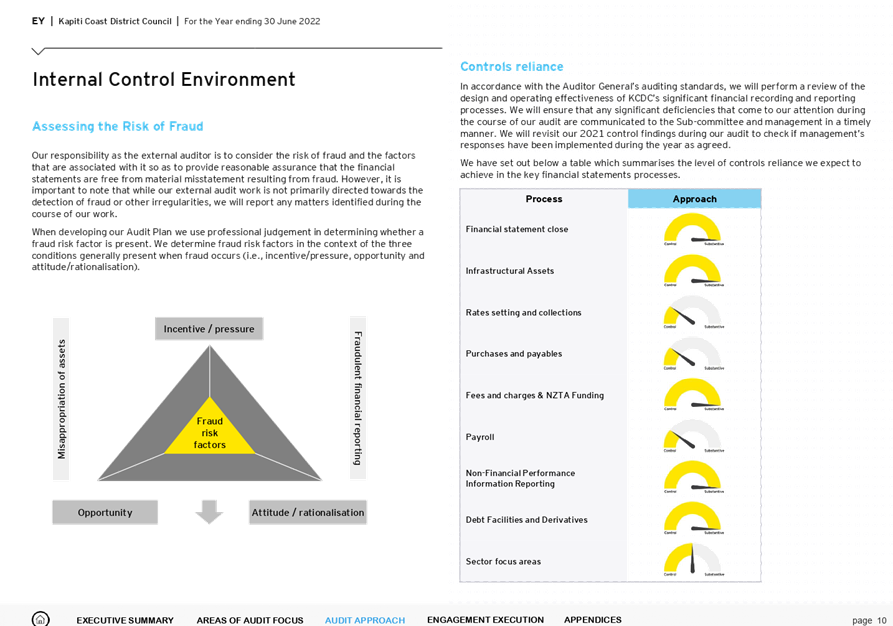

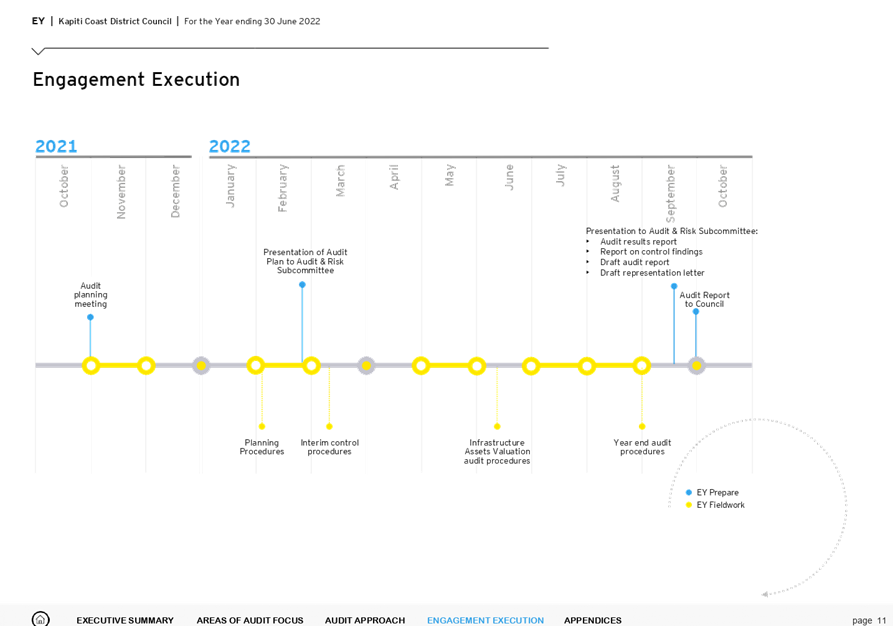

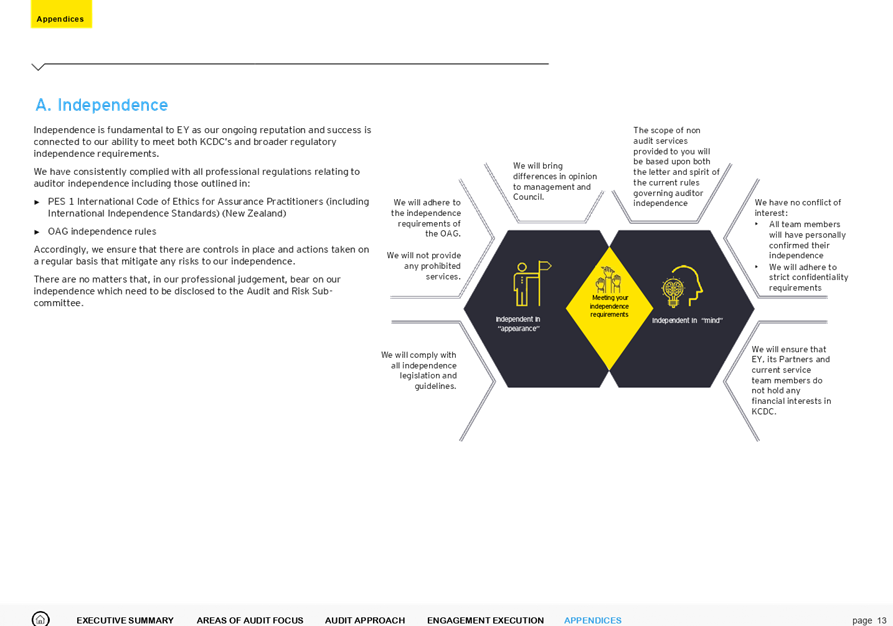

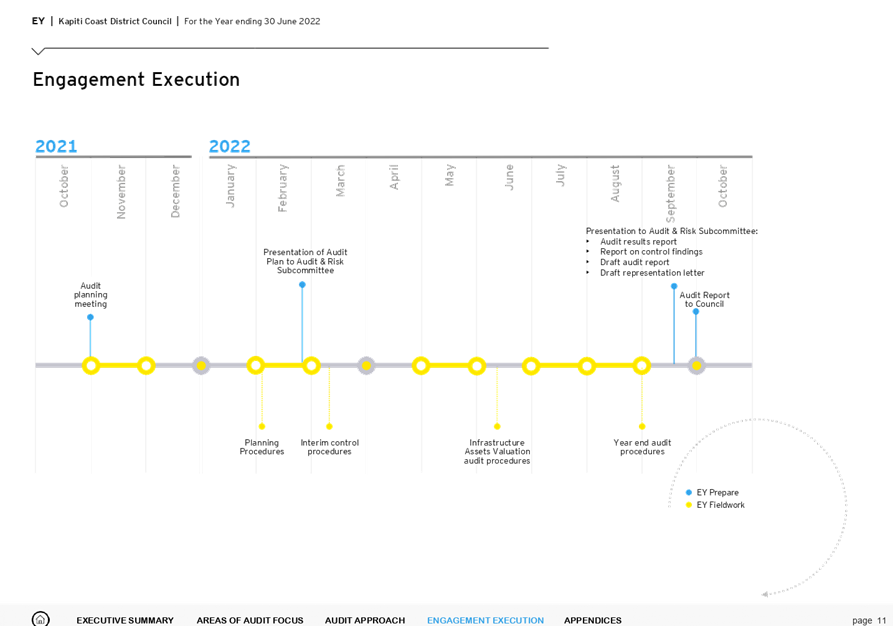

1 This

report provides the Audit and Risk Subcommittee with a summary of the Ernst

& Young Audit Plan for the year ending 30 June 2022.

He whakarāpopoto | Executive summary

2 This

report does not exceed four pages therefore there is no requirement for an Executive

Summary.

Te tuku haepapa | Delegation

3 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

· Confirming

the terms of engagement for each audit with a recommendation to the Council;

and receiving the external audit reports for recommendation to the Council.

· Obtaining from external auditors any information relevant to the

council’s financial statements and assessing whether appropriate action

has been taken by management in response to the above.

Taunakitanga | Recommendations

A. That

the Audit and Risk Subcommittee receives and notes the Ernst & Young Audit

Plan for the year ended 30 June 2022 attached as Appendix 1 to this report.

Tūāpapa | Background

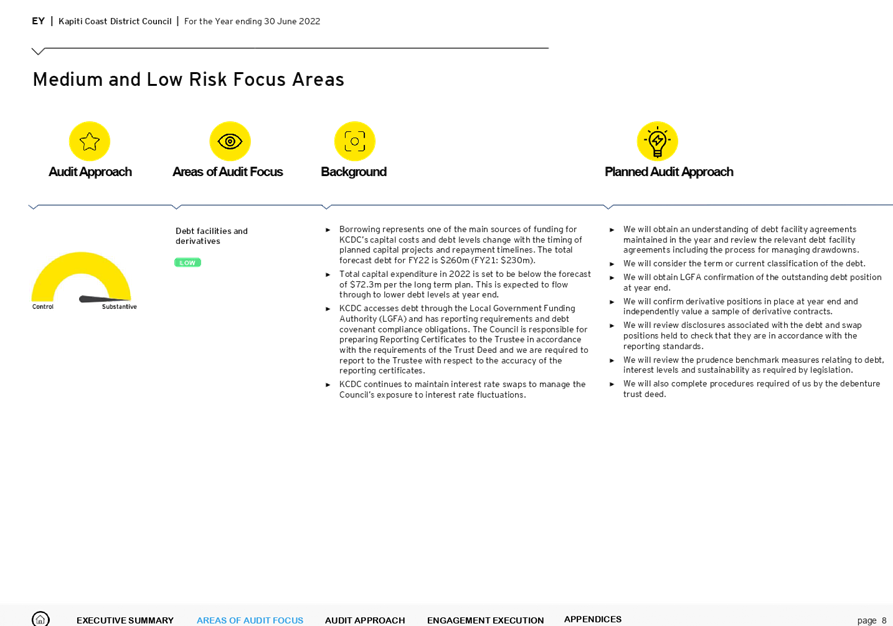

4 The

Council’s Auditors, Ernst & Young (Audit) has been engaged to

undertake the audit of the Council’s Annual Report, including the

Council’s Summary Annual Report and compliance with its Debenture Trust

Deed, for the year ended 30 June 2022.

5 The

Audit Plan is attached as Appendix 1 to this report. This provides an

overview of audit’s focus areas, their risk assessment and their audit

approach for the year ended 30 June 2022.

He kōrerorero | Discussion

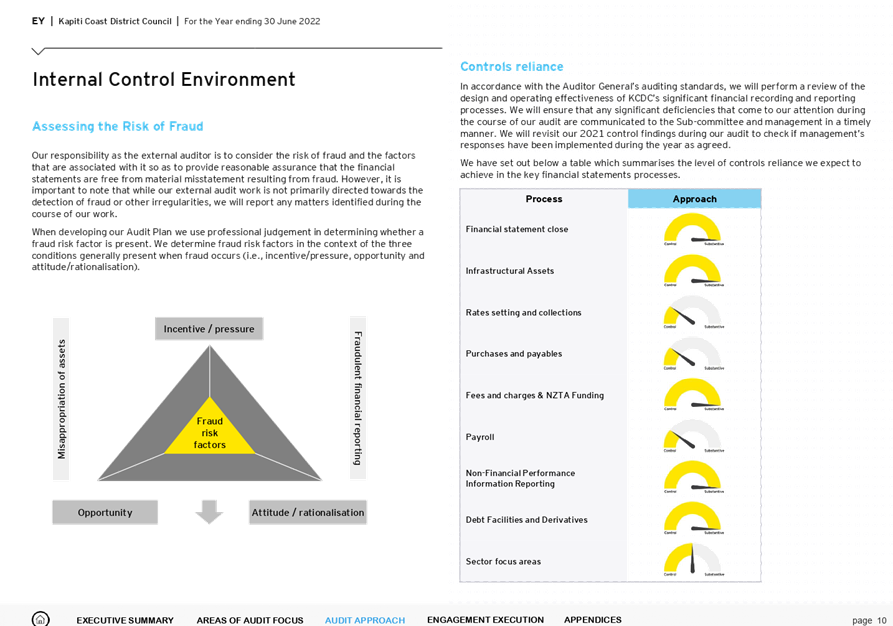

Audit

focus areas and risk assessment

6 The

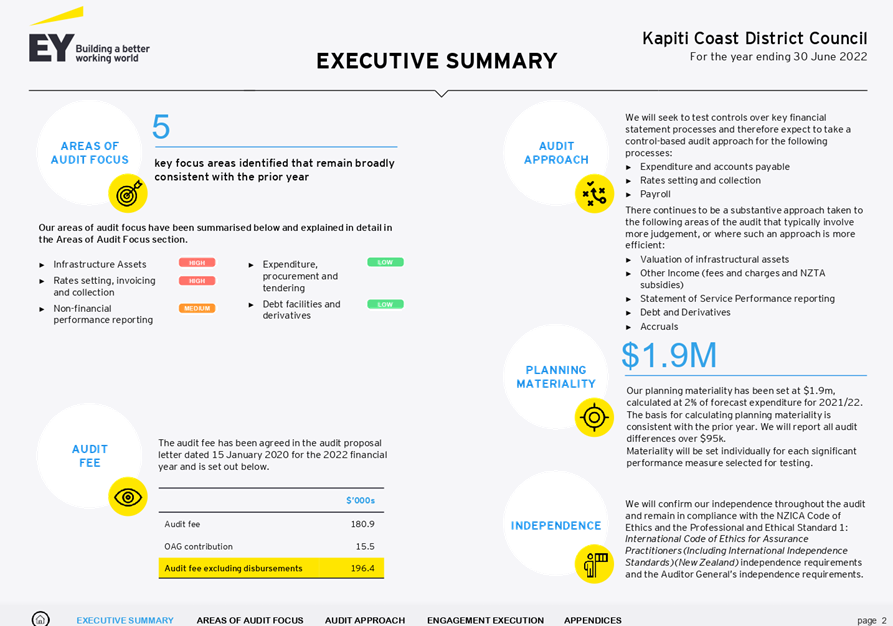

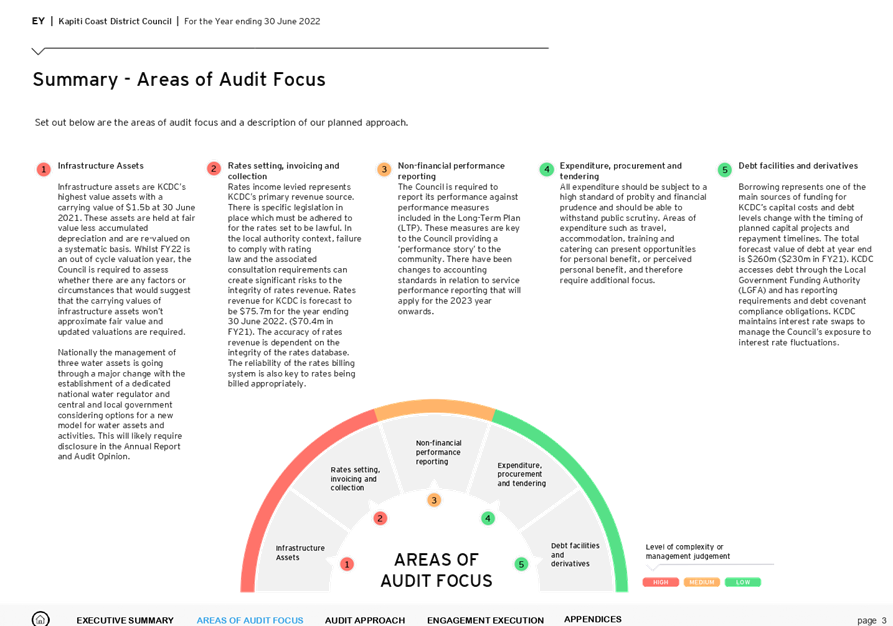

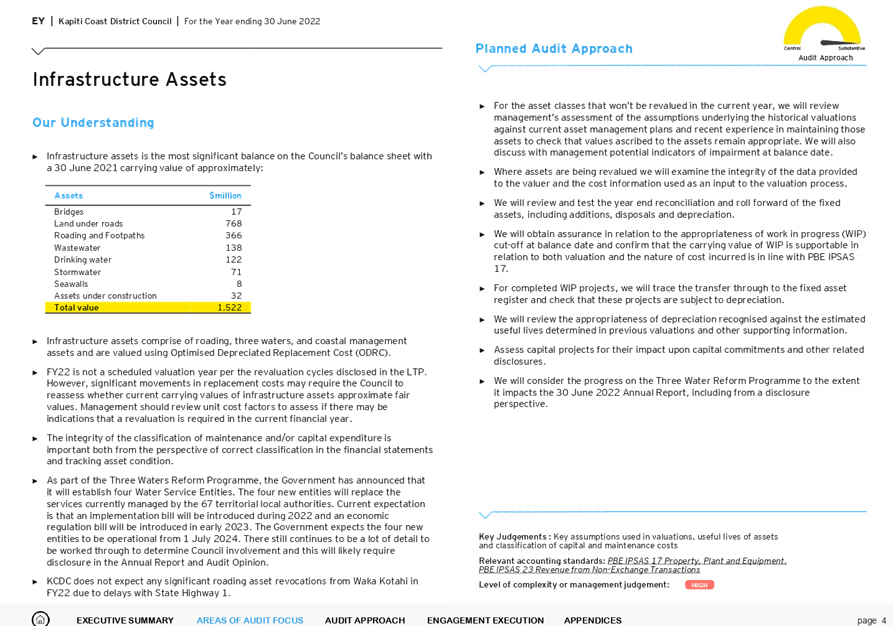

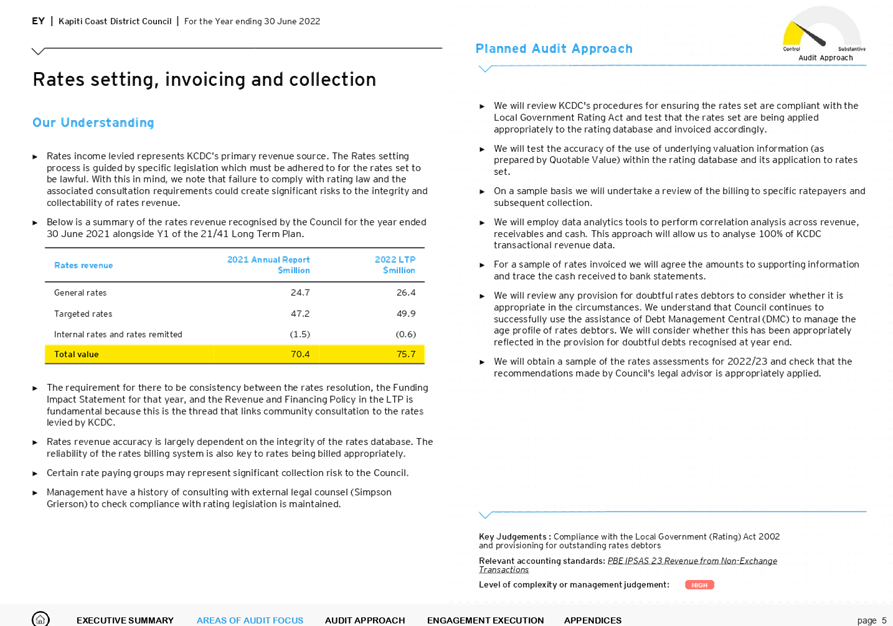

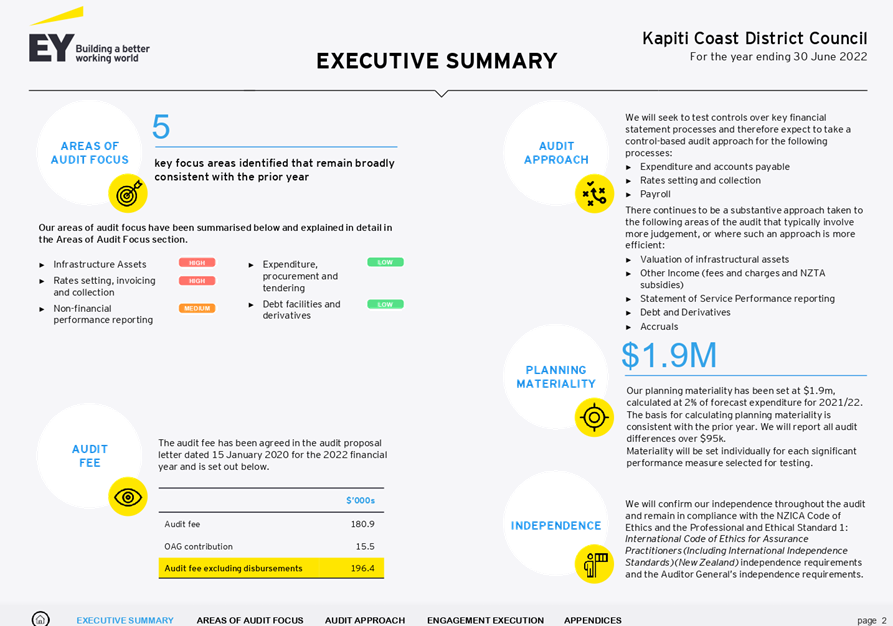

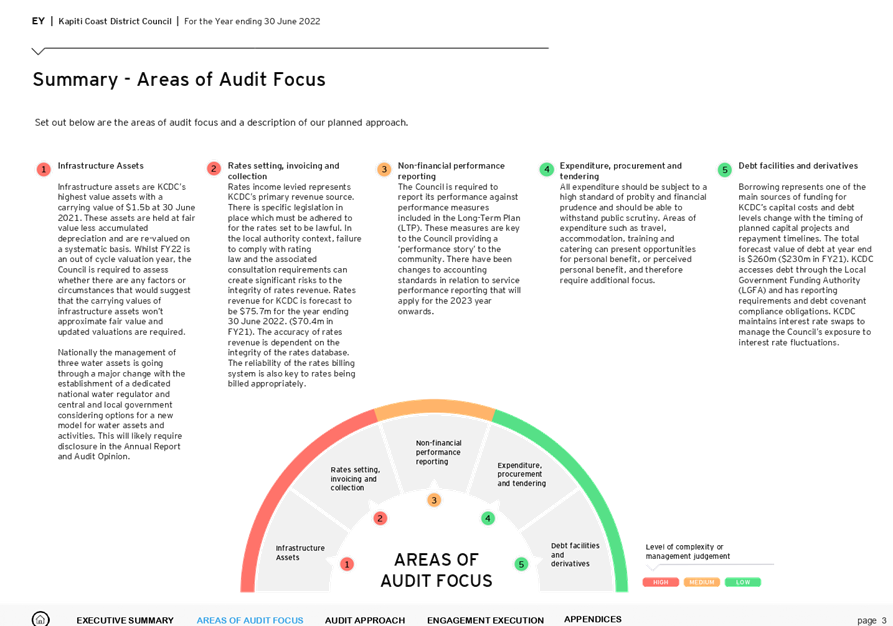

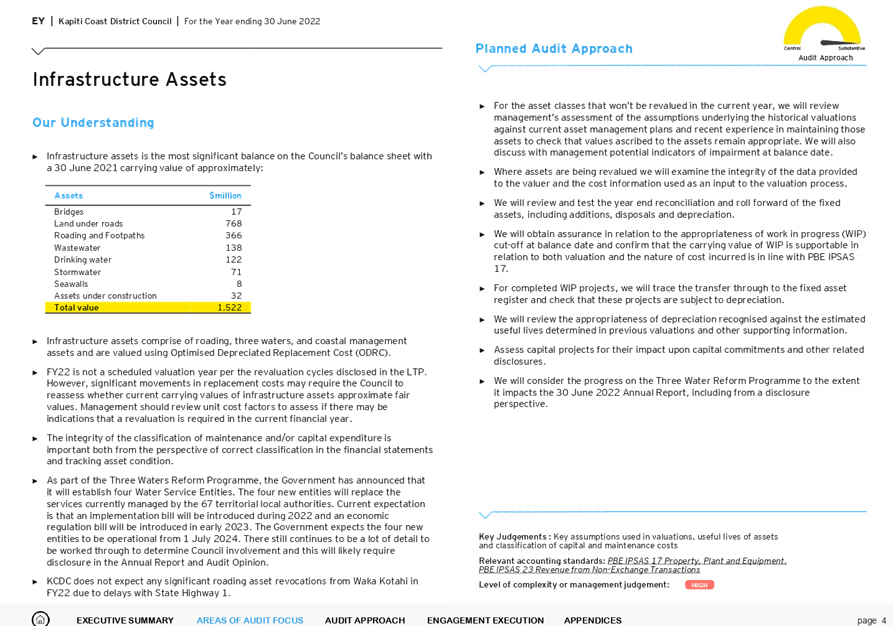

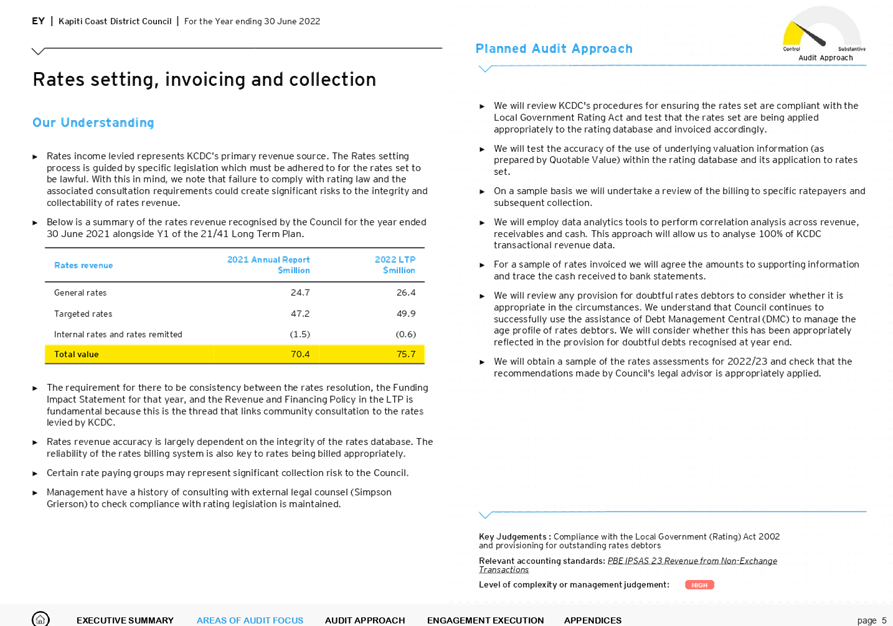

areas of audit focus, which are broadly consistent with the previous year are

summarised below:

· Infrastructure

assets;

· Rates

setting, rates invoicing and collection;

· Non-financial

performance reporting;

· Expenditure,

procurement and tendering;

· Debt

facilities and derivatives

Materiality

7 Audit

has set their materiality threshold at $1.9 million, being 2% of forecast

expenditure. Materiality is broadly defined as the quantum of any misstatements

(through error or otherwise), that would likely mislead users of the financial

statements. Any identified misstatements impacting on the Council’s

operating result by more than $95,000 will be reported to the Subcommittee by

way of Audit’s Closing Report on conclusion of their audit

He take |

Issues

8 This

matter has a low level of significance under the Council’s Significance

and Engagement Policy.

Ngā kōwhiringa | Options

9 There

are no options to be considered.

Tangata whenua

10 There

are no tāngata whenua considerations arising from this report.

Panonitanga āhuarangi | Climate change

11 There

are no climate change considerations within this report.

Ahumoni me ngā rawa | Financial

and resourcing

12 The

total audit fees payable to Ernst & Young for the year ended 30 June 2022

are estimated to be $196,400 plus disbursements and GST. This fee includes the

audit of the 2021/22 Annual Report and the Council’s compliance with its

Debenture Trust Deed for the year ended 30 June 2022. Provision for this audit

fee has been included in the 2021/22 operating budget.

Ture me ngā Tūraru | Legal

and risk

13 There

are no legal and risk issues arising from this report.

Ngā pānga ki ngā kaupapa here | Policy impact

14 There

are no policy implications arising from this report.

Te whakawhiti kōrero me te

tūhono | Communications &

engagement

Te mahere tūhono | Engagement

planning

15 An

engagement plan is not required for this report.

Whakatairanga |

Publicity

16 There

are no specific publicity considerations arising from this report.

Ngā

āpitihanga | Attachments

1. Ernst

and Young Audit Plan for the year ended 30 June 2022 ⇩

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

8.3 Health

and Safety Quarterly Report : 1 October 2021 - 31 December 2021

Kaituhi |

Author: Dianne

Andrew, Organisational Development Manager

Kaiwhakamana

| Authoriser: Wayne Maxwell, Chief Executive

Te pūtake | Purpose

1 This

report presents a Health and Safety report for the period 1 October 2021

– 31 December 2021

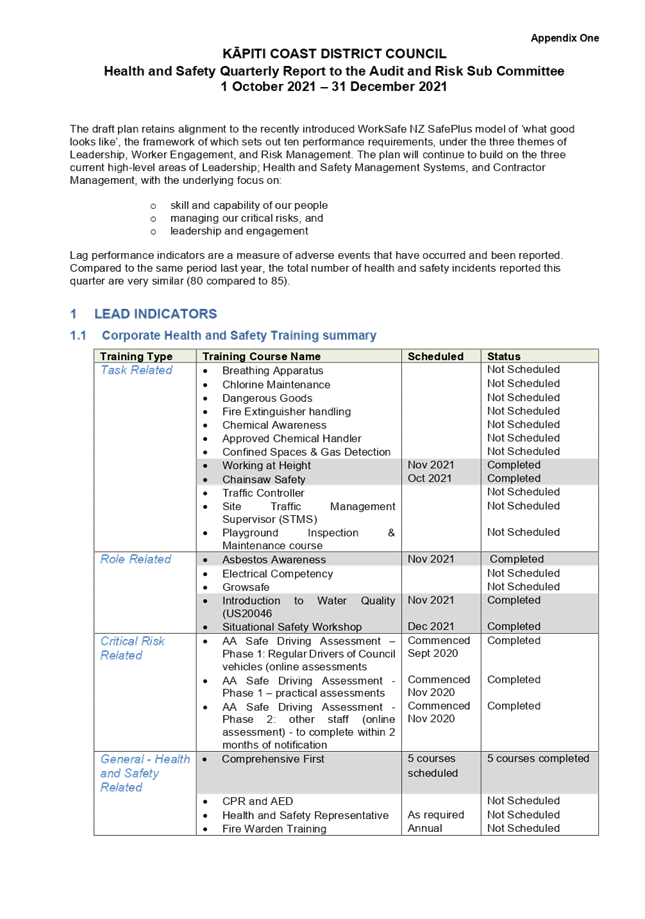

He whakarāpopoto | Executive summary

2 The

Health and Safety Quarterly Report links to the draft Health and Safety Plan

2020-2023 which retains alignment to the WorkSafe NZ SafePlus model of

‘what good looks like’, the framework of which sets out ten

performance requirements under the three themes of Leadership, Worker

Engagement and Risk Management. The Plan will continue to build on the three high

level areas of Leadership, Health and Safety Management Systems, and Contractor

Management all with an underlying focus on:

· skill

and capability of our people

· managing

our critical risks, and

· leadership

and engagement.

Te tuku haepapa | Delegation

3 Audit

and Risk Sub Committee has delegated authority to consider this report under

the following delegation in the Governance Structure, Section C.1:

· Ensuring

that the Council has in place a current and comprehensive risk management

framework and making recommendations to the Council on risk mitigation;

· Assisting

elected members in the discharge of their responsibilities by ensuring

compliance procedures are in place for all statutory requirements relating to

their role;

· Governance

role in regards to the Health and Safety Leadership Charter and Health and

Safety Plan.

Taunakitanga | Recommendations

A. That

the Audit and Risk Sub Committee notes the Health and Safety Quarterly Report

for the period 1 October 2021 – 31 December 2021 attached as Appendix One

to this Report.

Tūāpapa | Background

4 The

quarterly Health & Safety Performance Report is intended to provide the

Council with insight into initiatives and activities and their progress, as

part of our Council’s commitment to providing a safe and healthy place to

work. The contents and any subsequent discussions arising from this report can

support Officers to meet their due diligence obligations under the Health &

Safety at Work Act (HSWA) 2015.

5 Between

July and September 2017 the Simpson Grierson Health and Safety team were

engaged to review how the Council was progressing with changes and planned

initiatives following the introduction of the Health and Safety at Work Act

(HSWA) 2015. The findings were presented back to the Audit and Risk Committee

in November 2017. This review identified areas for improvement, in particular

some process improvements to further strengthen Council’s ability to more

effectively monitor and verify.

6 The

draft Health and Safety Plan period has been extended from two to three years

and will cover 2020 – 2023 to enable Covid-19 lockdown delays and

interruptions to be included.

7 A

draft of the Health and Safety Strategic Plan 2020-2023 has been adopted by the

Senior Leadership Team and was to be presented to this sub-committee following

a Discussion Forum which was to be scheduled before this meeting. However due

to the Covid-19 disruptions to work deliverables, the Discussion Forum has yet

to be confirmed. Work is however proceeding based on the deliverables stated in

the 2020-2023 plan.

8 Progress

on the 2020 – 2023 Health and Safety Plan will continue to be

incorporated into quarterly reports going forward

He kōrerorero | Discussion

9 Progress

on the initial Health and Safety 2018-2020 Plan initiatives continue to

progress however the alert level 4 and alert level 3 restrictions severely

disrupted planned health and safety related initiatives and training. Several

timelines continue to require extensions and this will be updated through the

regular reporting cycle.

10 Disruptions

as a result of previous and future Covid-19 alert level resurgence and/or

restrictions have been factored into the draft 2020 – 2023 Health and

Safety Plan but actions and deliverables are progressing, albeit slower than anticipated.

He take |

Issues

11 Training

for key competency/qualification requirements for specific roles has been

disrupted through Covid-19 restrictions and changes to alert and traffic light

systems however this training has been prioritised to ensure compliance where

required and where delays are out of the Council’s control, specific

measures are being put in place to manage this to minimise any potential for

organisational risk.

12 Planning

has been in progress this quarter in anticipation of an Omicron outbreak in the

community and minimising organisational risk to enable best opportunities to

continue a level of service delivery to our community during Covid-19

disruptions. Planning for this contingency includes the health and safety and

wellbeing of staff and customers, and members of the community and as such will

be contingent on Council’s resource availability and as such some

services may be reduced for a period of time.

Ngā kōwhiringa | Options

13 For

the delivery of key competency/qualification training, most will be remote

delivery for the next few months and where possible, staff in their team

‘bubble’ may gather in their bubble and complete the training. This

will be worked through team by team to ensure staff risk management is effective

balanced with the practical need to keep staff current in their skill areas as

required for their roles. Where roles do not have specific training for

compliance reasons, this training will continue to be prioritised and delivered

as and when appropriate given the limitations from Covid-19 restrictions at the

time.

Tangata whenua

14 There

are no tāngata whenua considerations arising from this report.

Panonitanga āhuarangi | Climate change

15 This

Report does not impact on the work programmes for climate change.

Ahumoni me ngā rawa | Financial

and resourcing

16 Budget

has been provided for implementation of the action plan initiatives as part of

the 2018-38 Long-term plan.

Ture me ngā Tūraru | Legal

and risk

17 There

are no legal and risk considerations in addition to those already noted in this

report.

Ngā pānga ki ngā kaupapa here | Policy impact

18 There

are no policy considerations arising from this report.

Te whakawhiti kōrero me te

tūhono | Communications &

engagement

19 There

are no communication and engagement considerations arising from this report.

Te mahere tūhono | Engagement

planning

Whakatairanga |

Publicity

21 There

are no publicity considerations.

Ngā

āpitihanga | Attachments

1. Health

and Safety Quarterly Report 1 October 2021-31 December 2021 ⇩

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

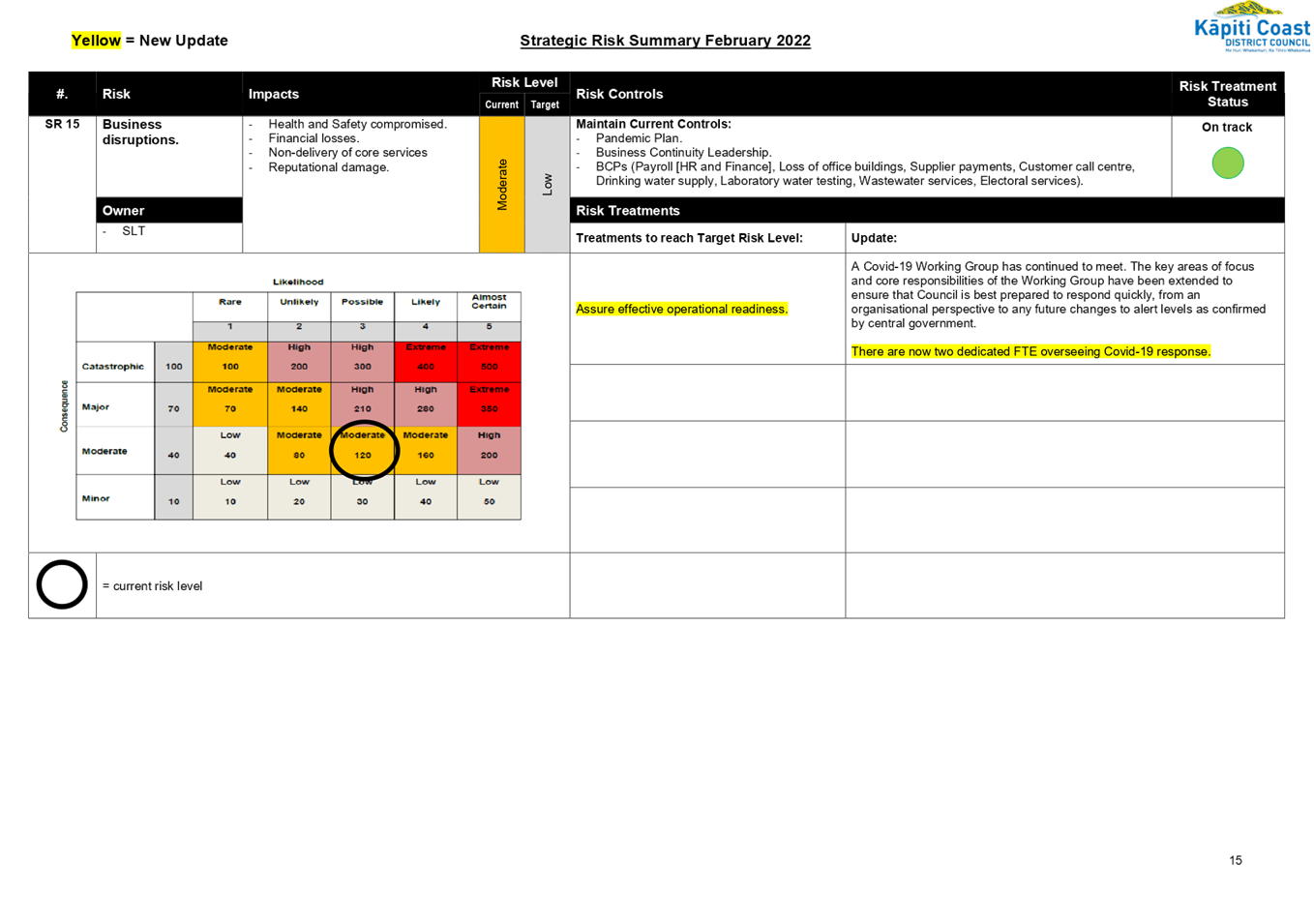

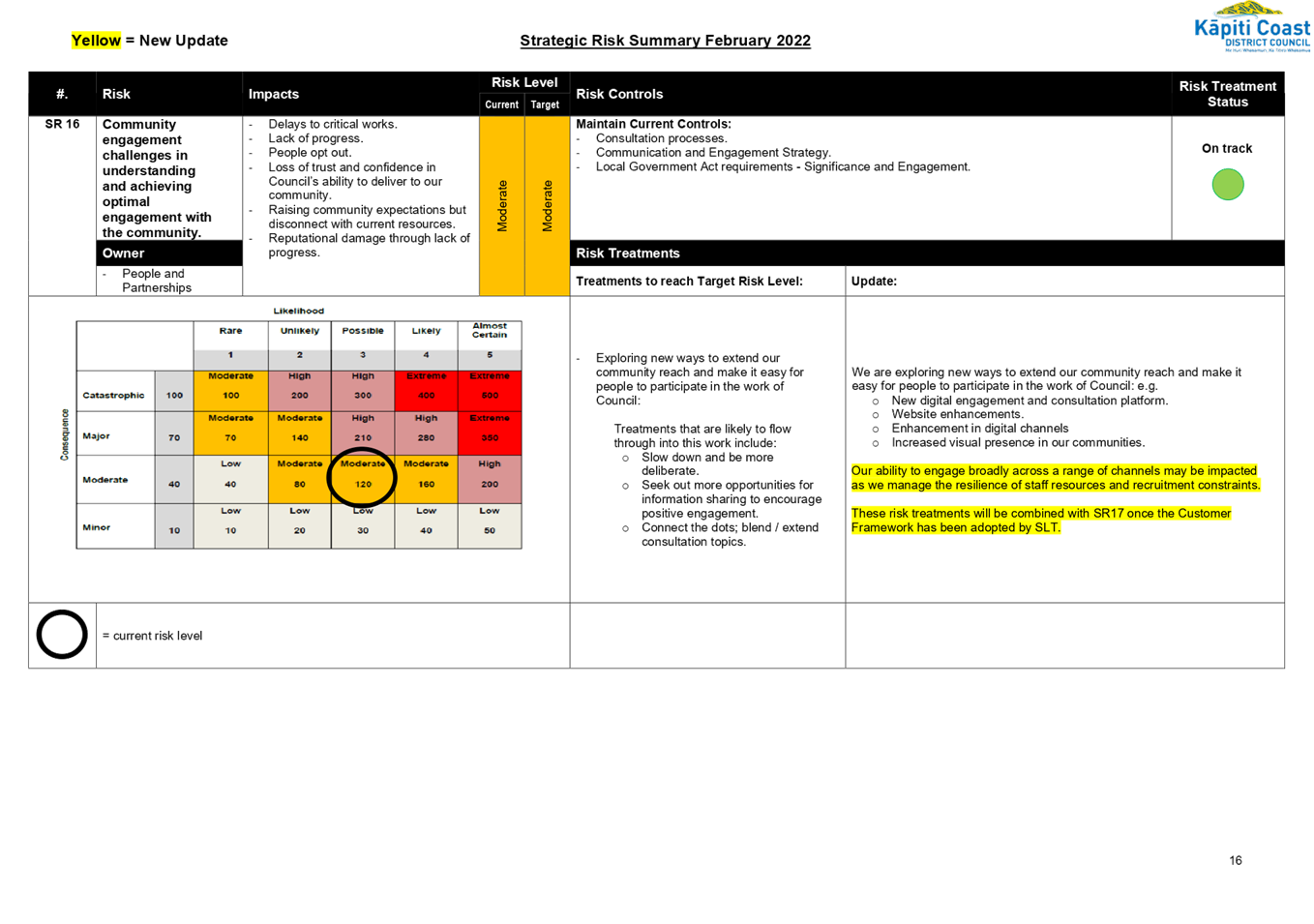

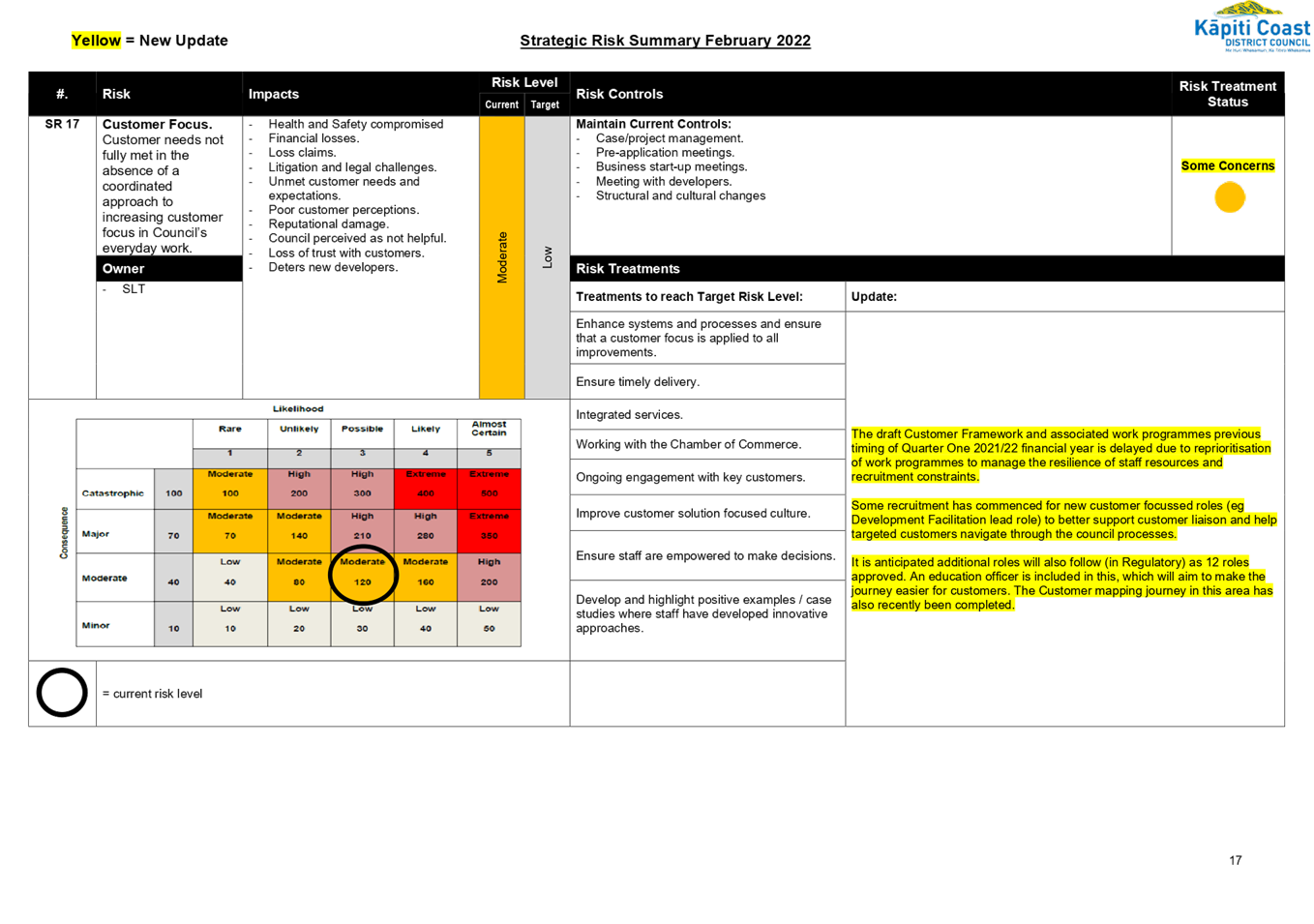

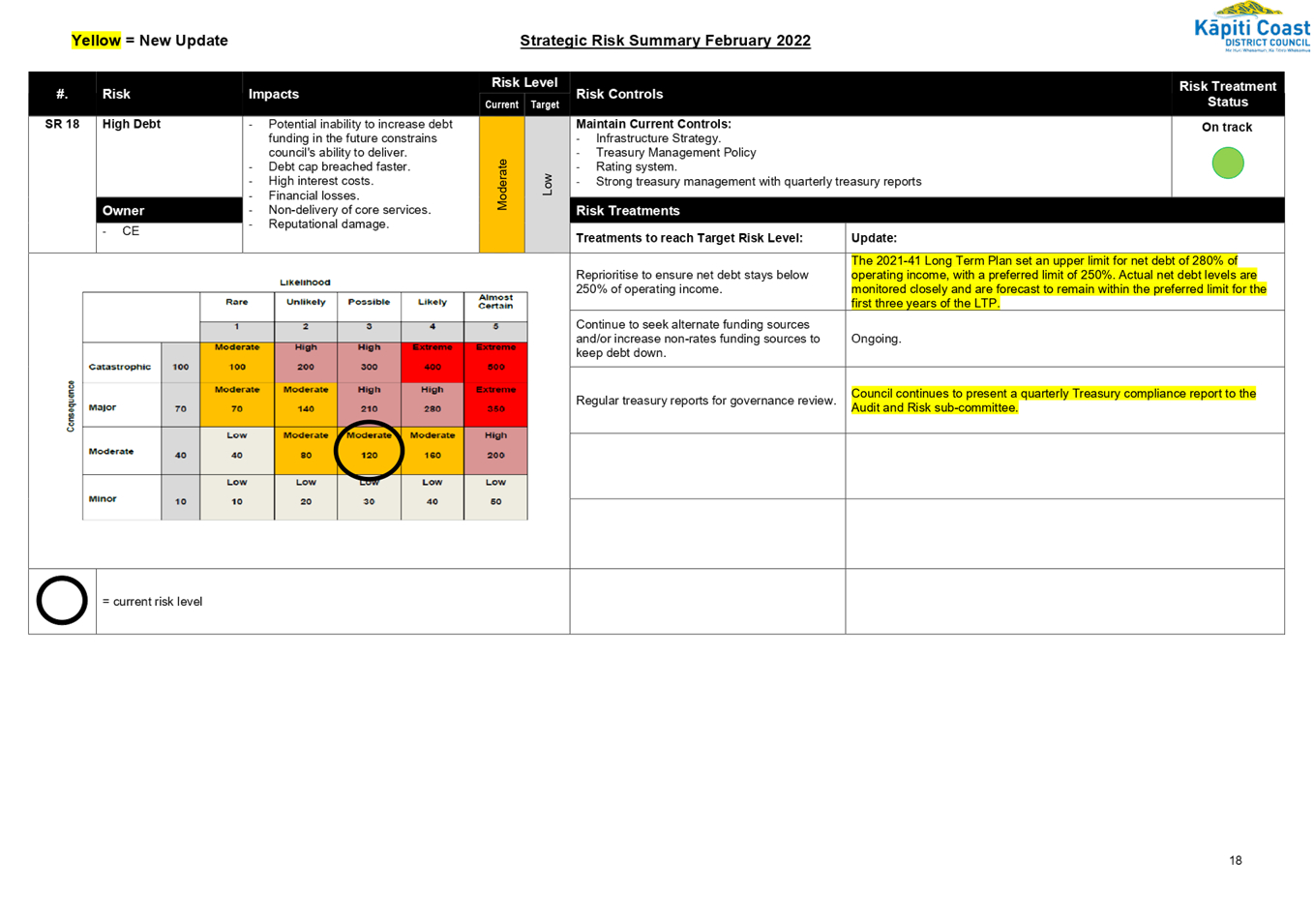

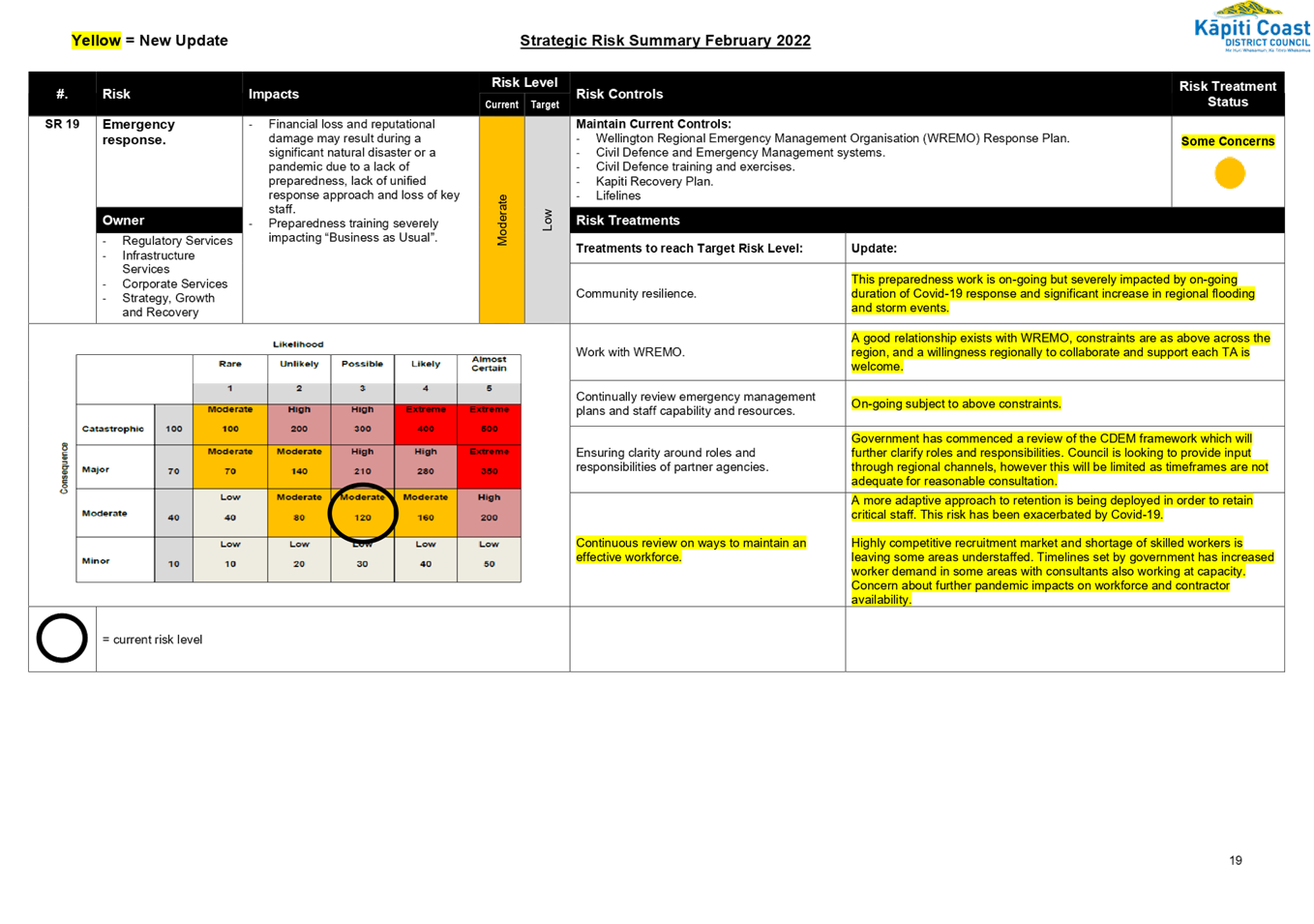

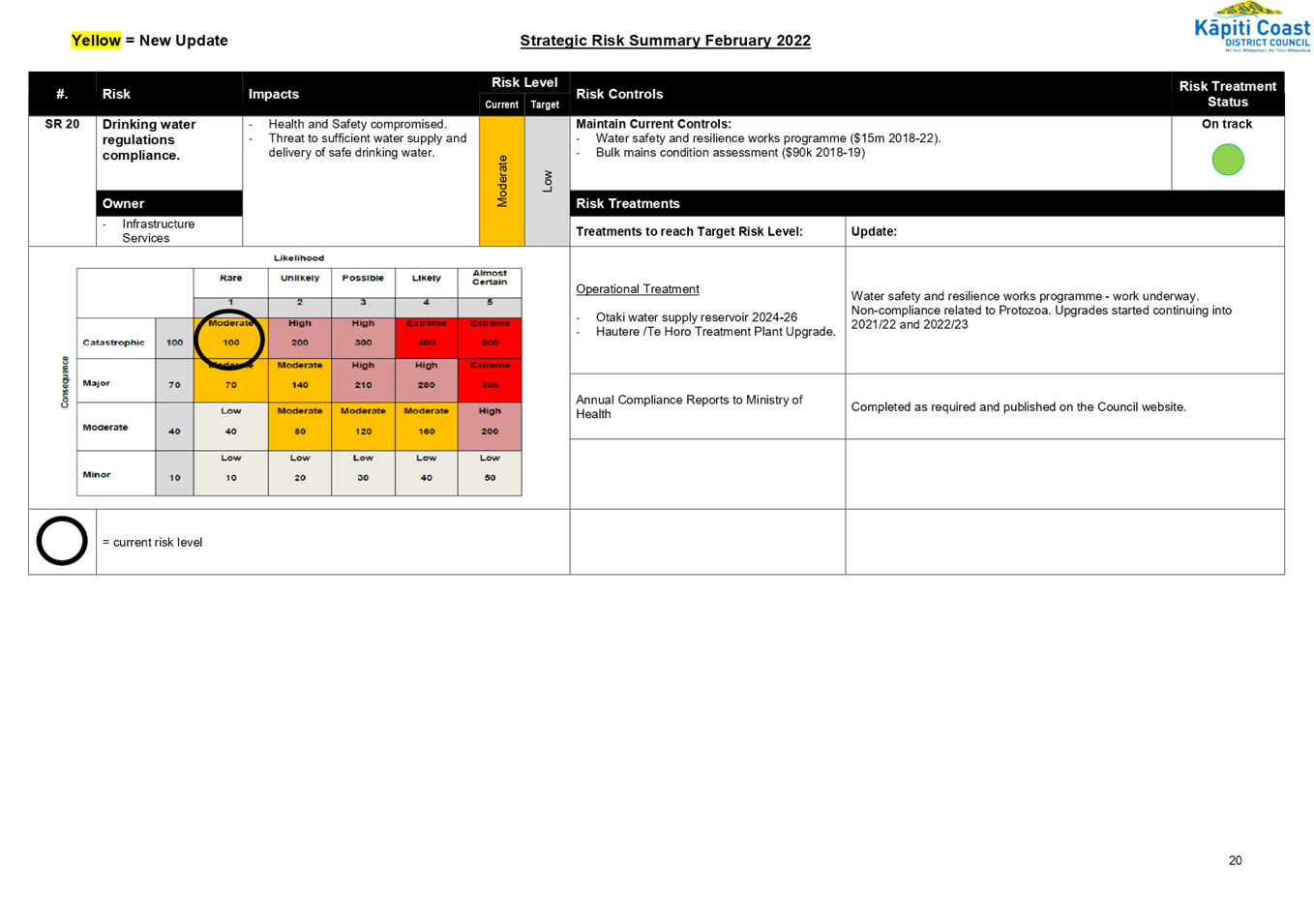

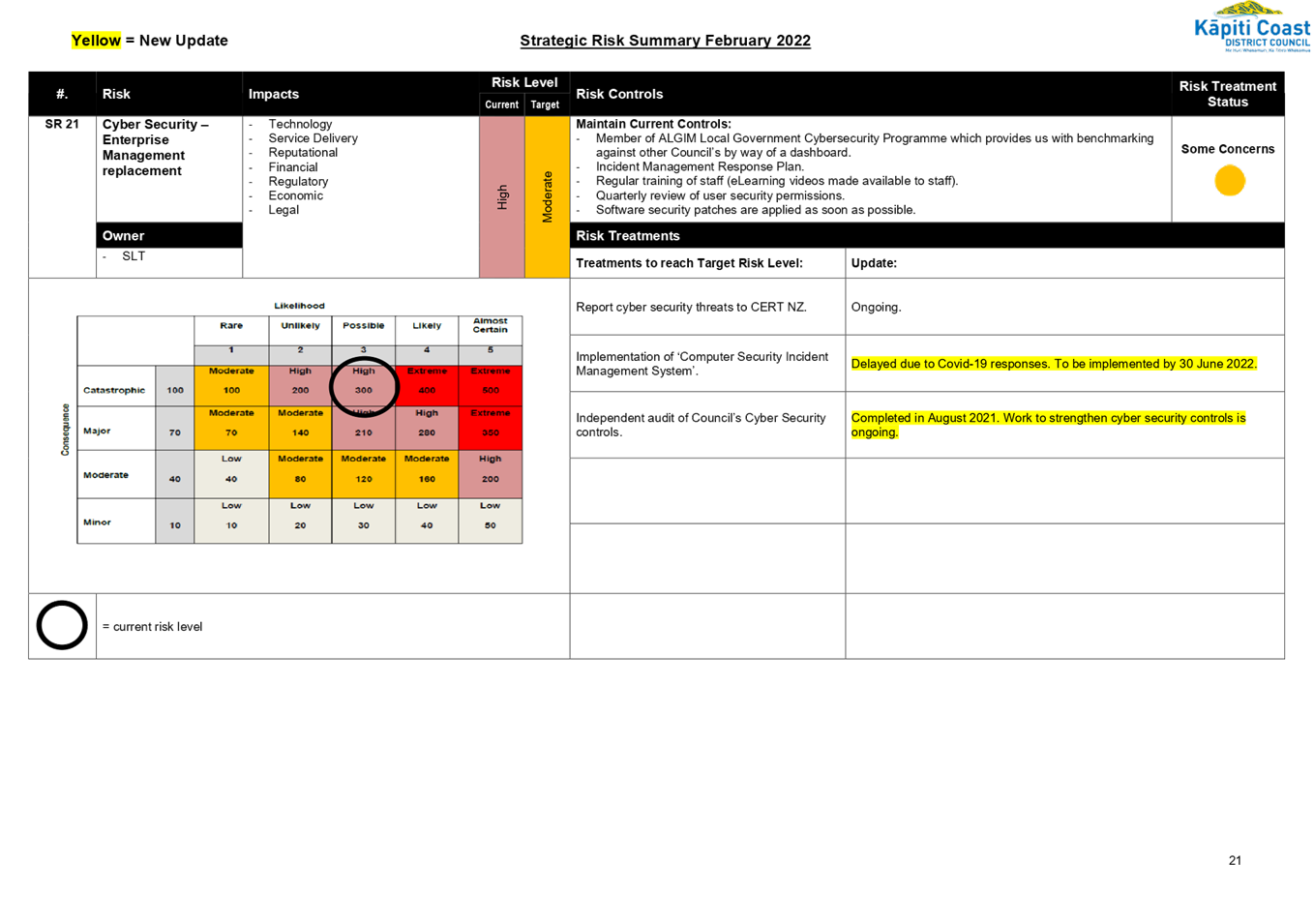

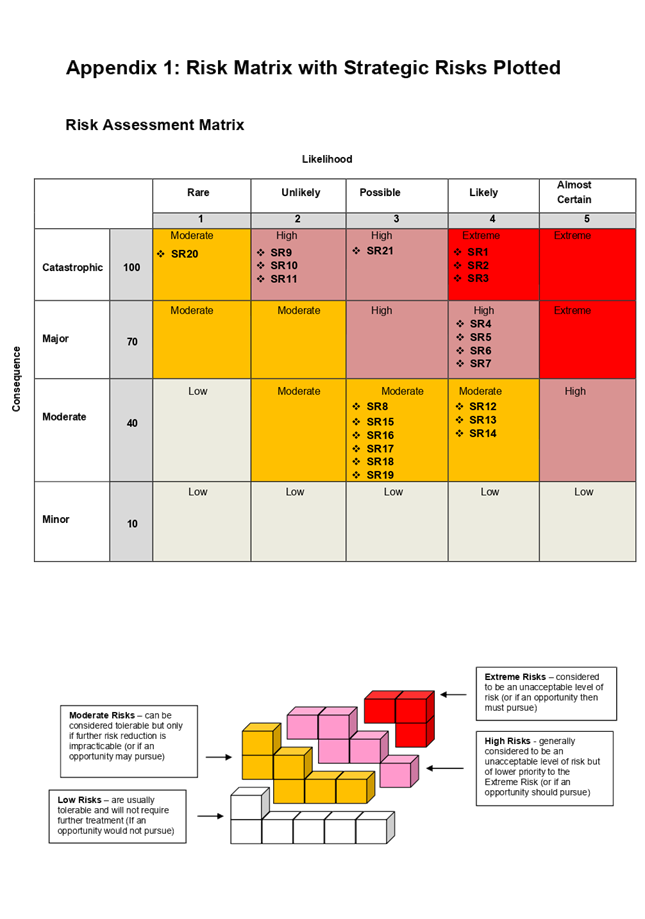

8.4 Risk

Management

Kaituhi | Author: Andrew

Gillespie, Risk Advisor

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake | Purpose

1 This

report updates the Audit and Risk Subcommittee on the on-going implementation

of the Enterprise Risk Management (ERM) framework.

He whakarāpopoto | Executive summary

2 This

report does not exceed four pages therefore there is no requirement for an

Executive Summary.

Te tuku haepapa | Delegation

3 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

- Ensuring

that the Council has in place a current and comprehensive risk management

framework and making recommendations to the Council on risk mitigation.

Taunakitanga | Recommendations

A. That

the Audit and Risk Subcommittee receives and notes this report, including

Appendices 1 and 2 to this report.

Tūāpapa | Background

4 The

key elements of the Enterprise Risk Management Framework include; risk

management, corporate business continuity management, procurement improvement

programme; and business risk and assurance.

5 The

main work streams are:

· regular

risk discussions with staff and managers and embed the day-to-day management of

risks in work streams such as: projects, activity delivery, and asset

management.

· communicate

and report risk up to Council/Committees.

· have

a Business Continuity Management System for effective response to a range of

potential business disruptions.

· provide

fraud awareness training.

· provide

business assurance oversight and complete business assurance work; and

· improve

the understanding and tools to support good procurement practices.

6 Risk

is defined as the effect of uncertainty on expected results and is managed on a

continual basis. The intended outcomes from performing this risk management

programme will assure:

· stakeholders,

external auditors, the Council and management that the real risks are being

identified and managed effectively. Risks can be negative or positive:

o a

negative risk is a threat and/or potential problem. It creates concern or

uncertainty around our delivery of overall programmes, projects, strategies, or

other expectations that can result in major health and safety, financial,

fraud, operational and reputational impacts. Identifying negative risks before

they occur means that we can take measures to mitigate or remove the threat, so

that it does not materialise.

o a positive risk is an

opportunity which has a positive impact on our objectives. When these are

identified the appropriate action is to make use of the opportunity and leverage

them to cause them to occur. For example, ensuring that everything is looked at

and actions are put in place to make risks as small as possible might highlight

the value of using new technology to increase quality assurance and improve

service delivery.

· better

decision making throughout the business through greater awareness of the real

risks and how these are going to be addressed; and

· clarification

and socialisation of the Council’s risk appetite and tolerance.

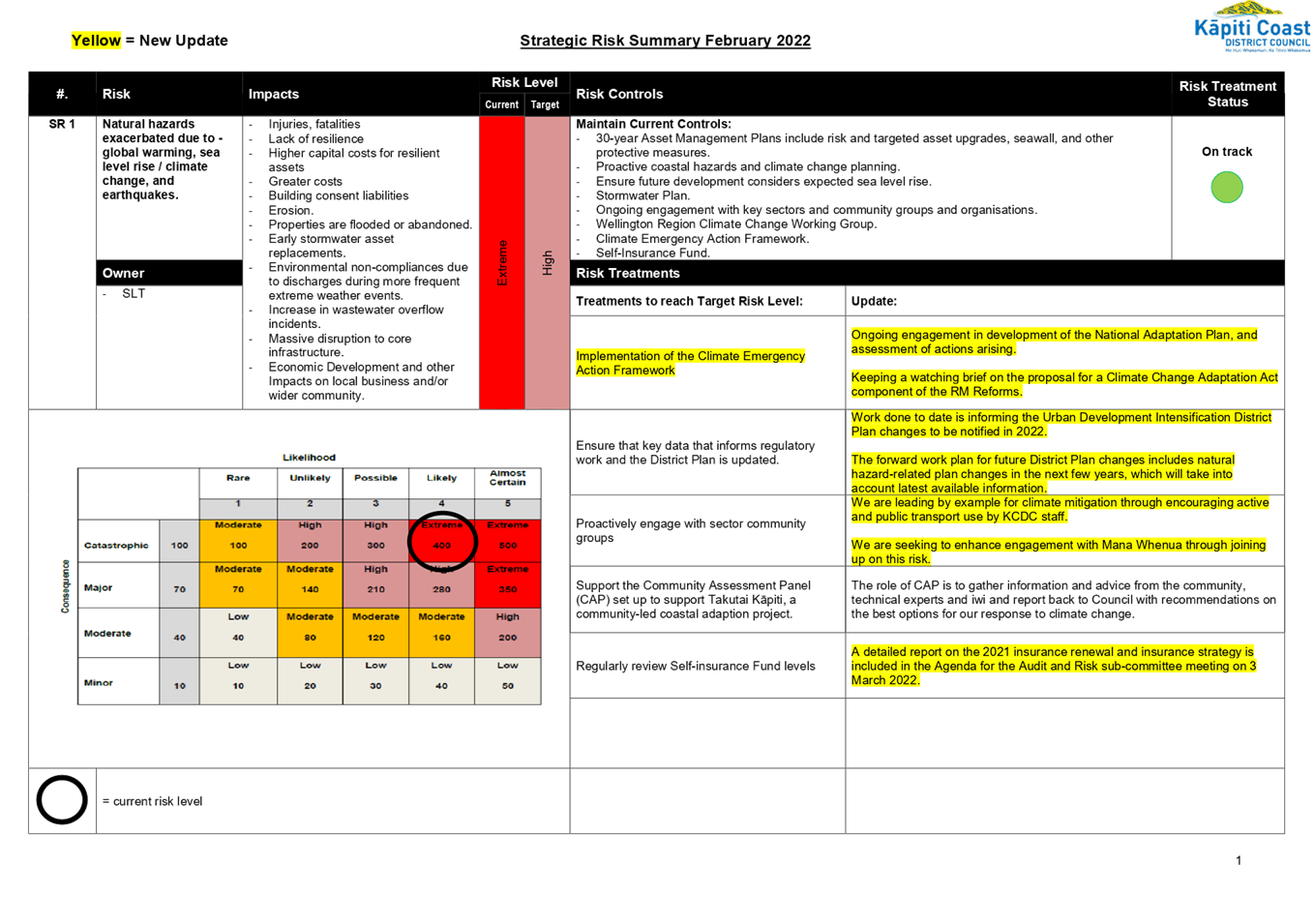

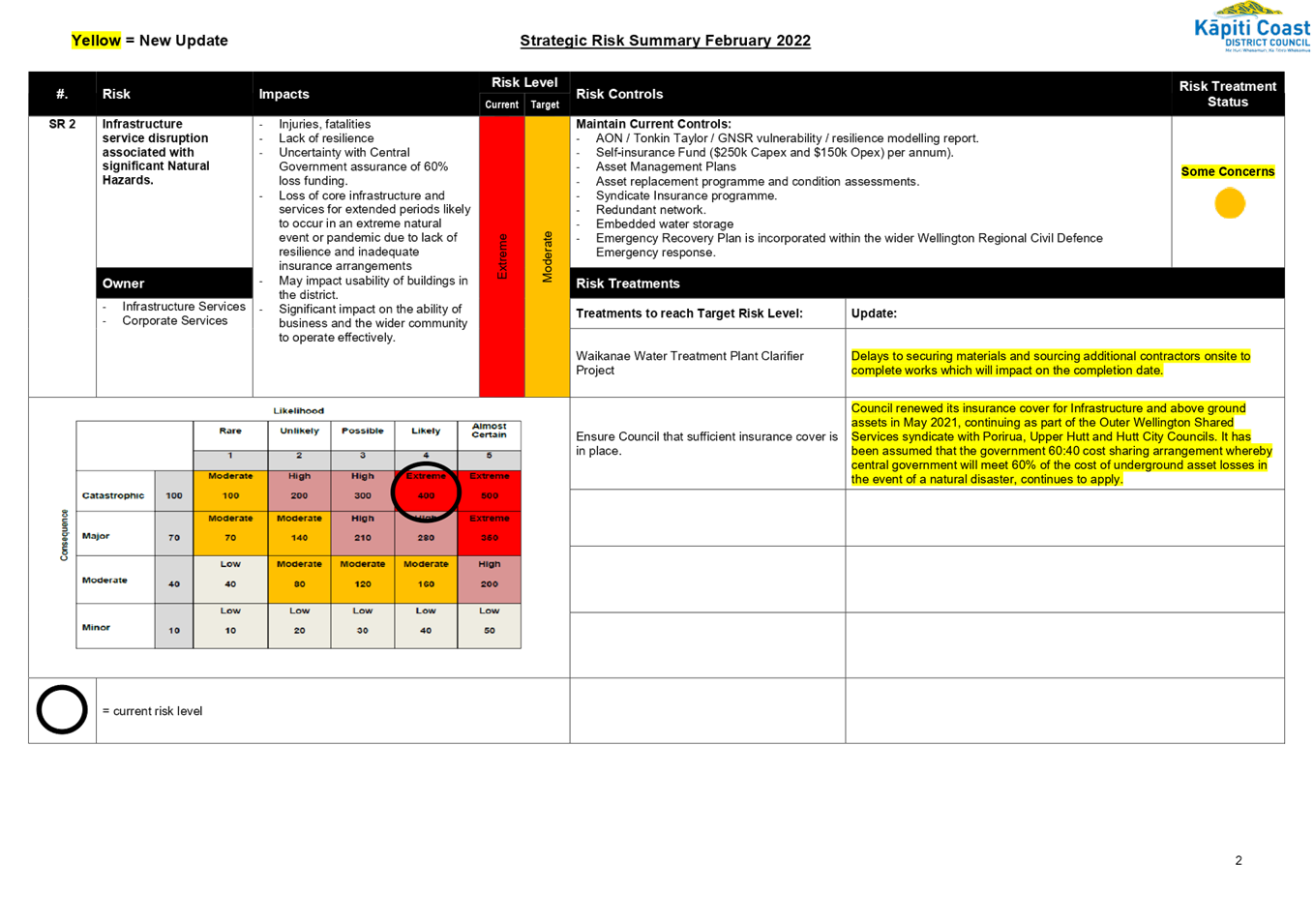

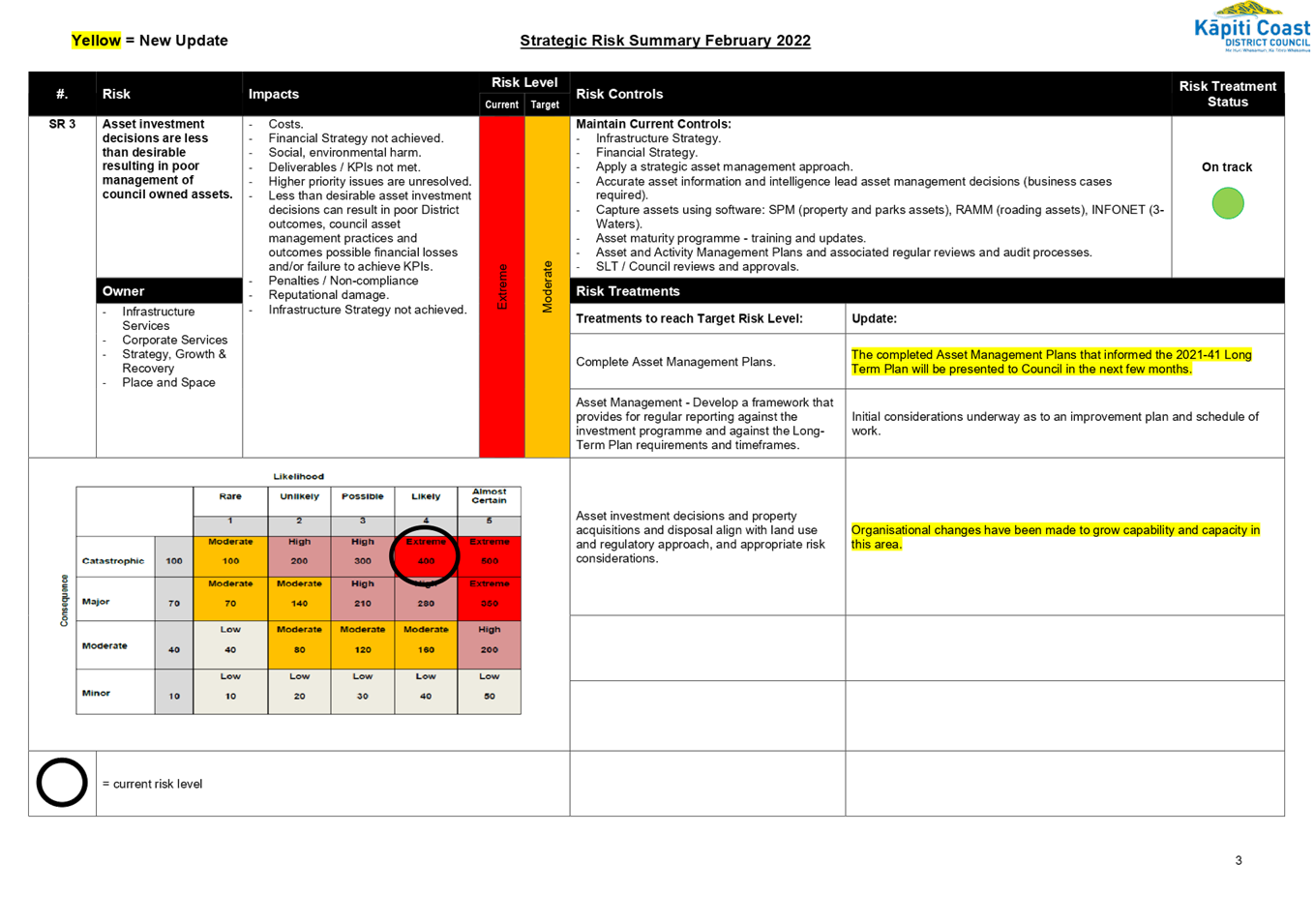

He kōrerorero | Discussion

Enterprise Risk Management Progress Update

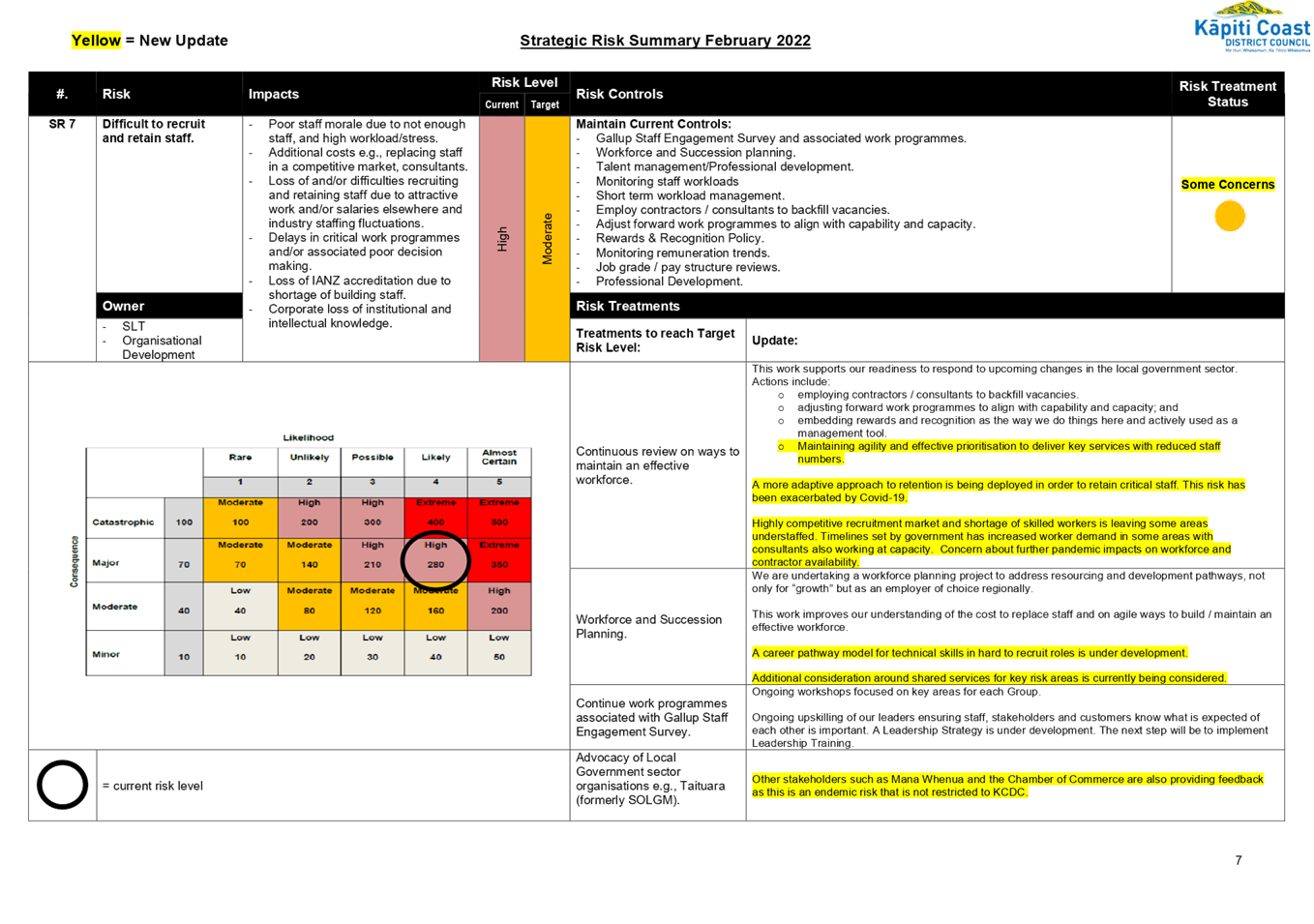

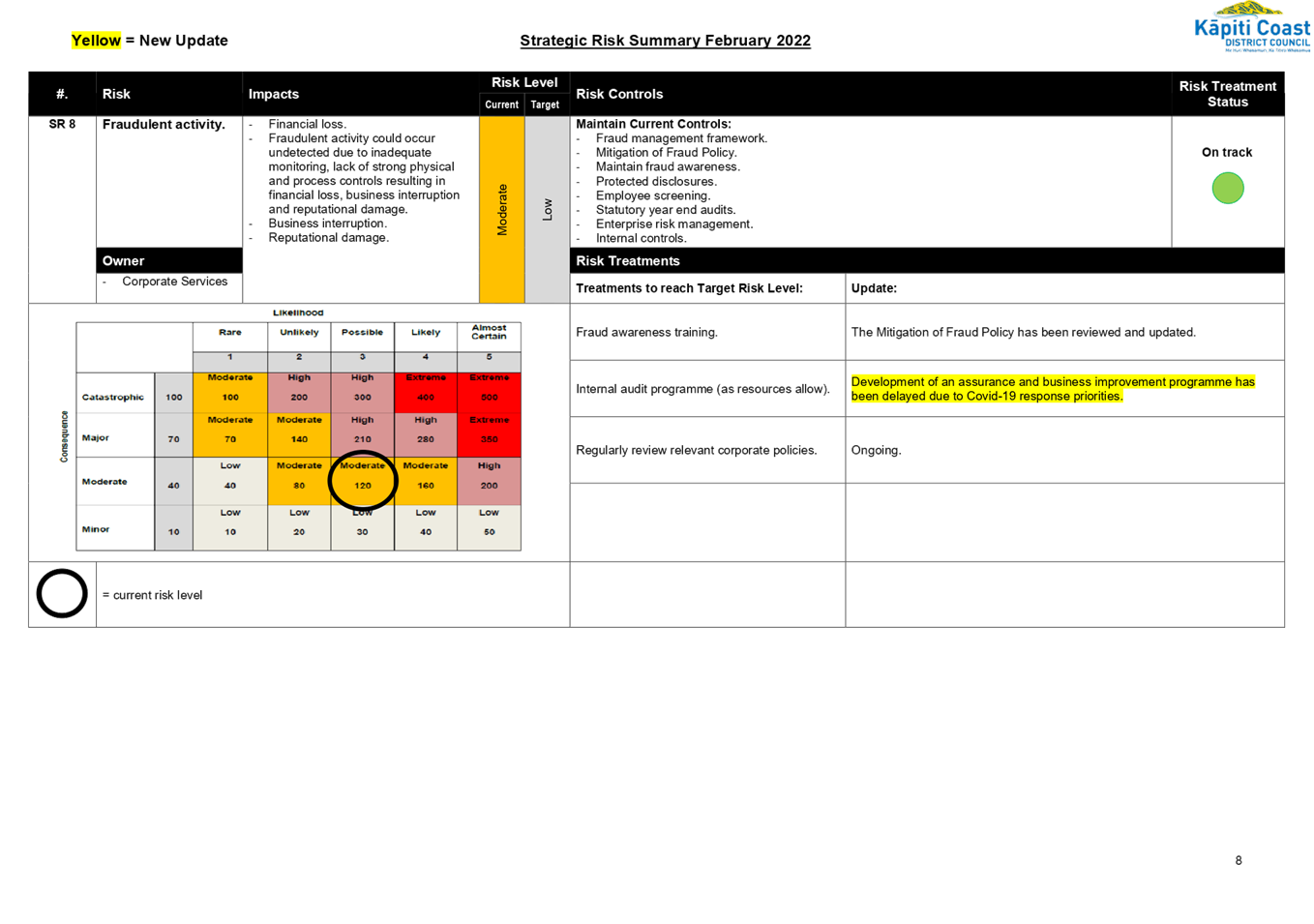

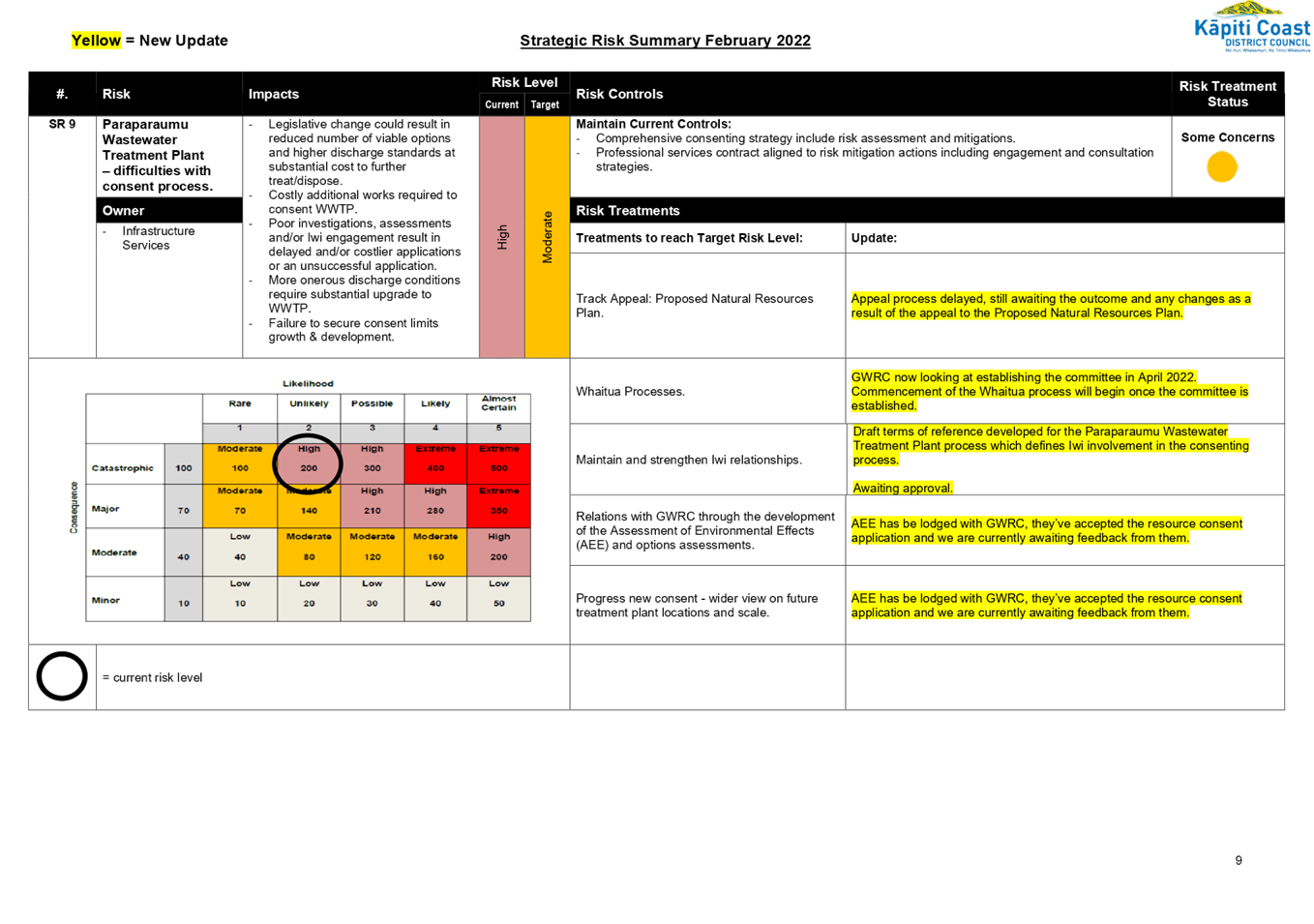

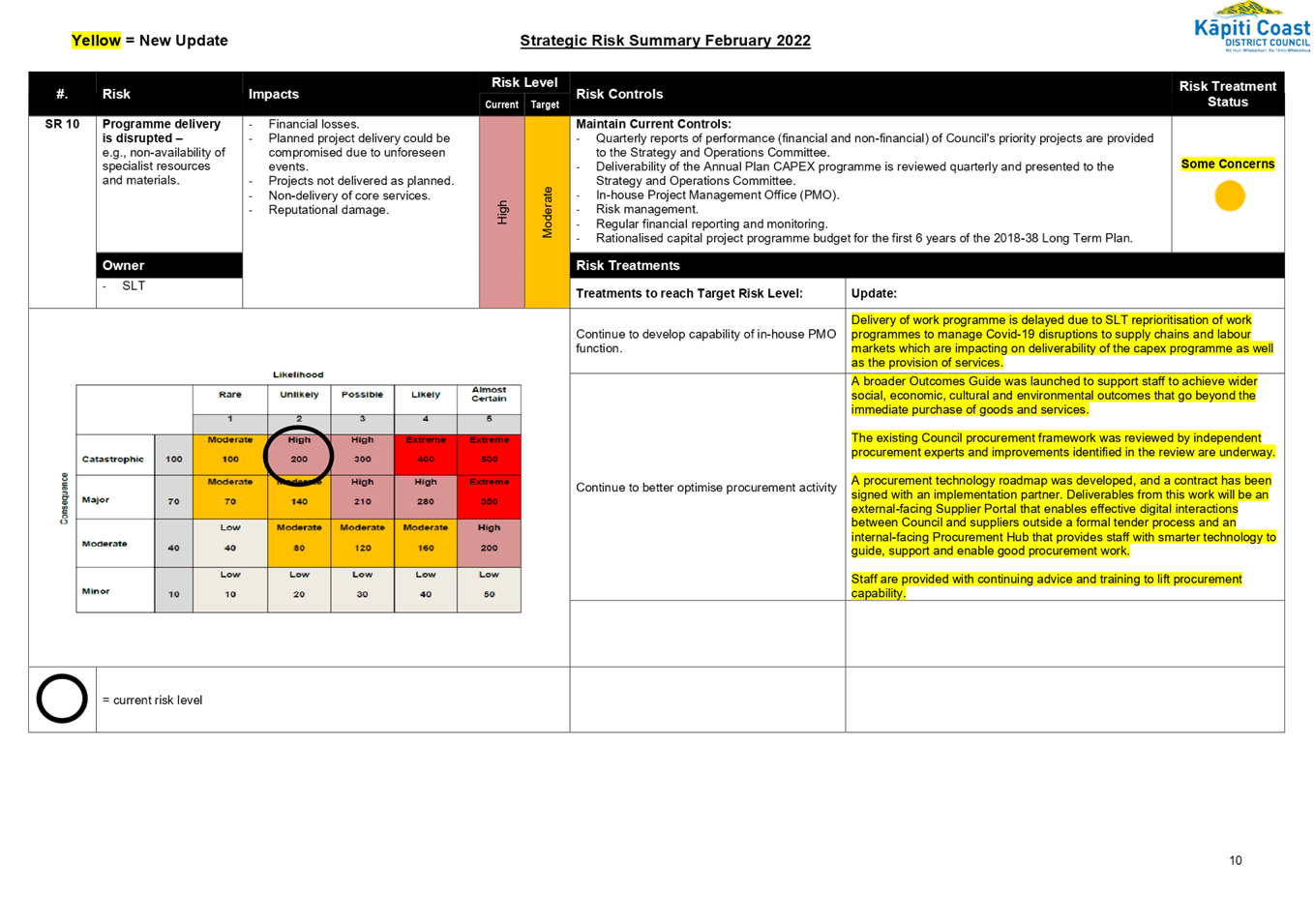

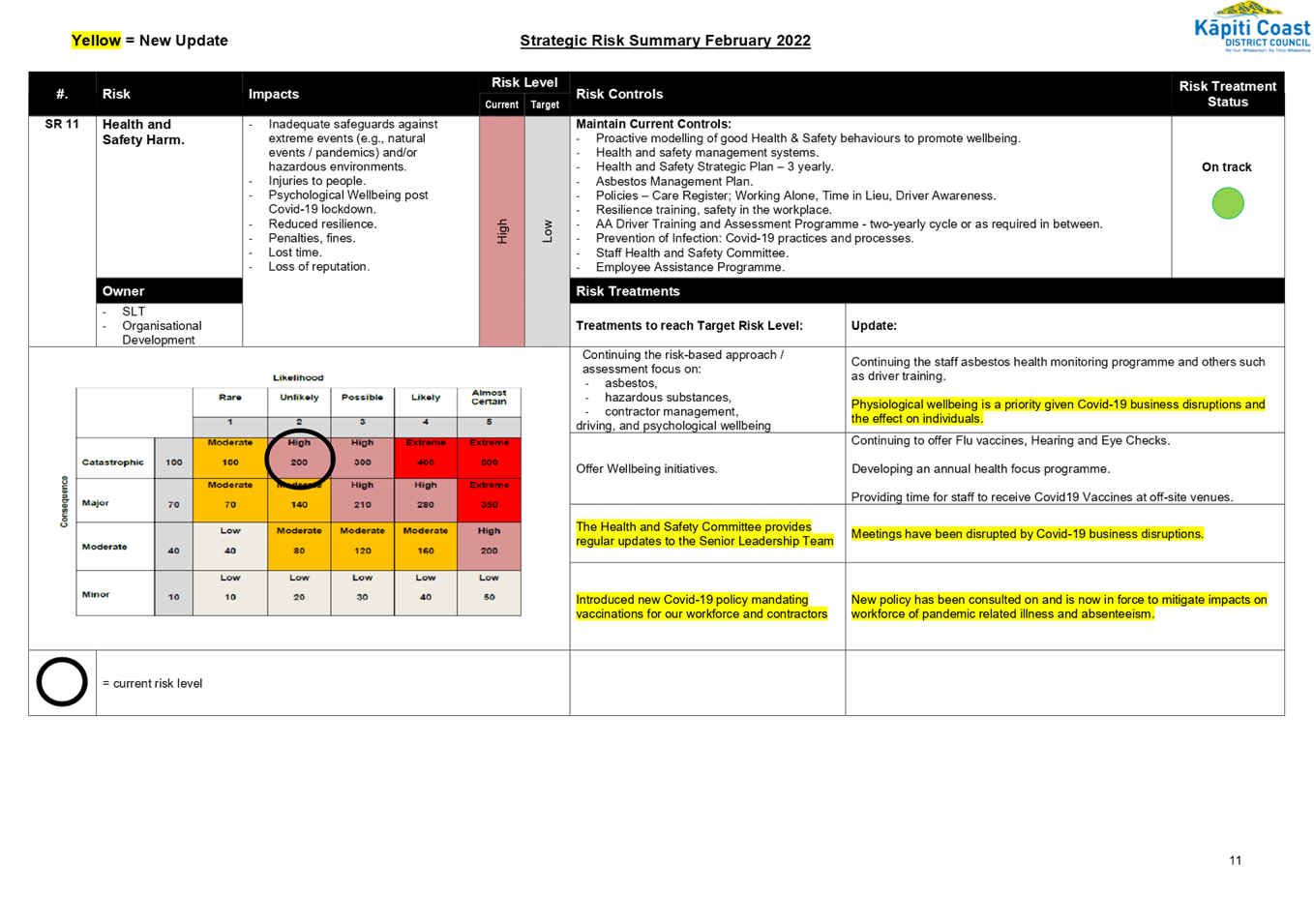

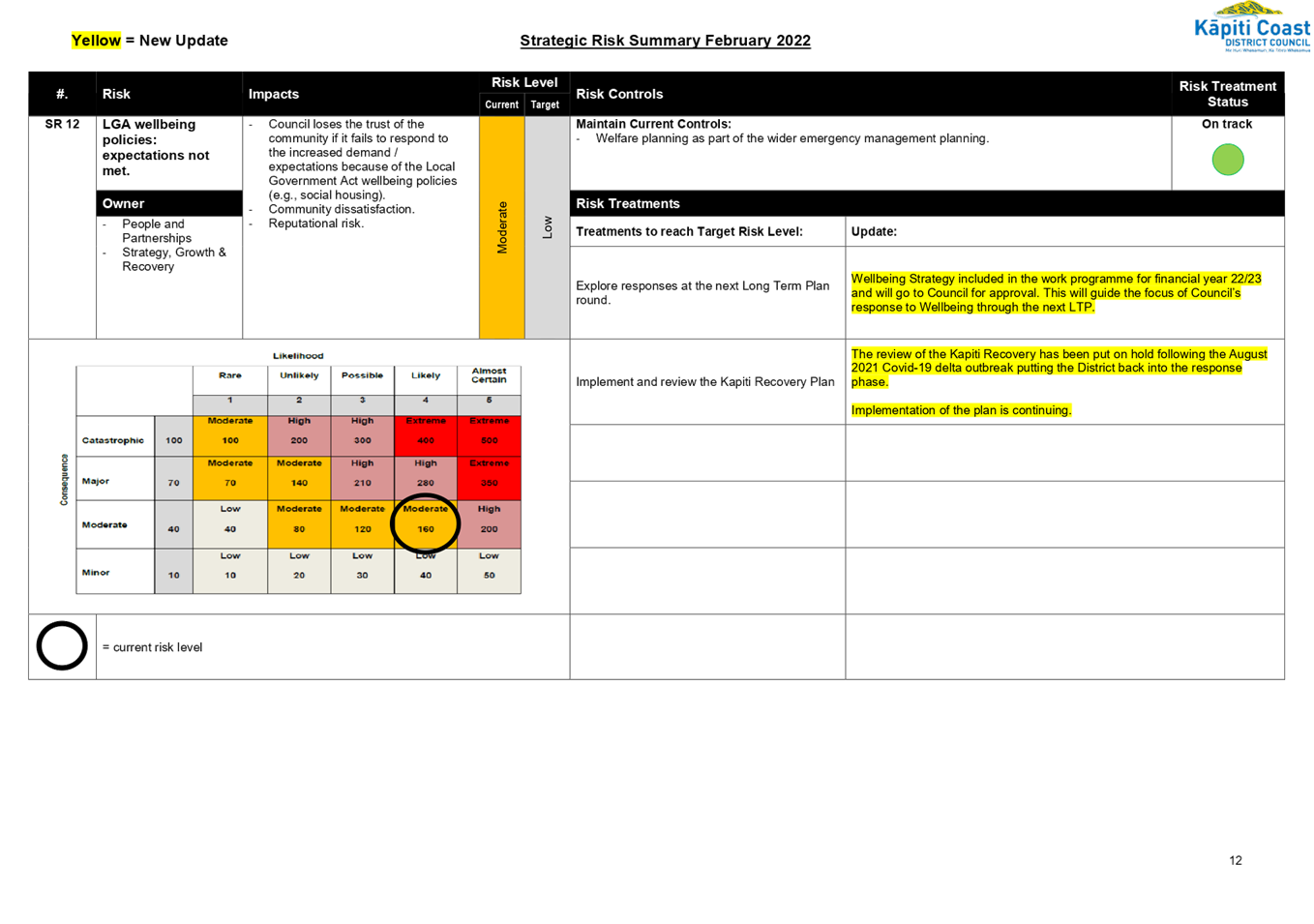

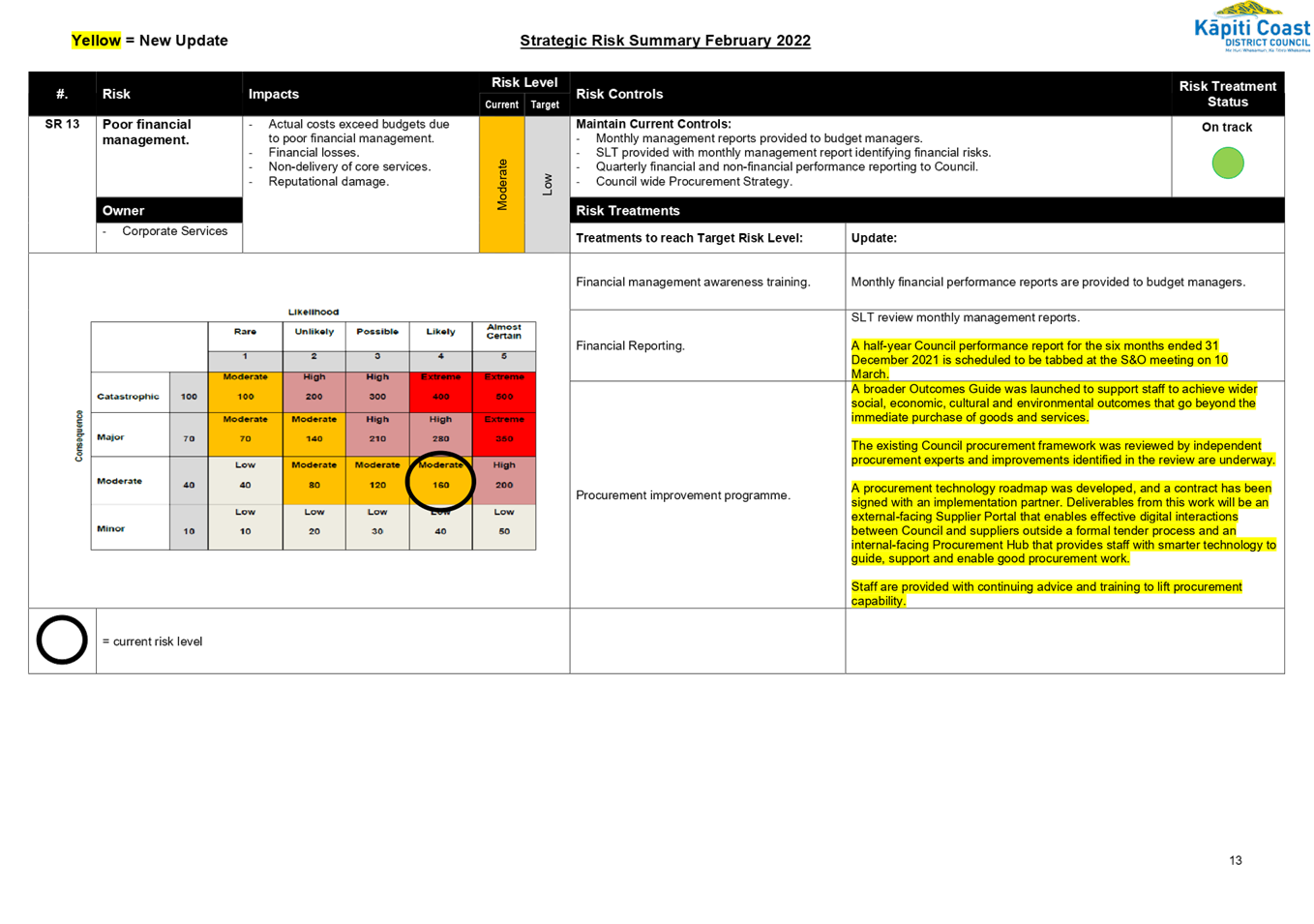

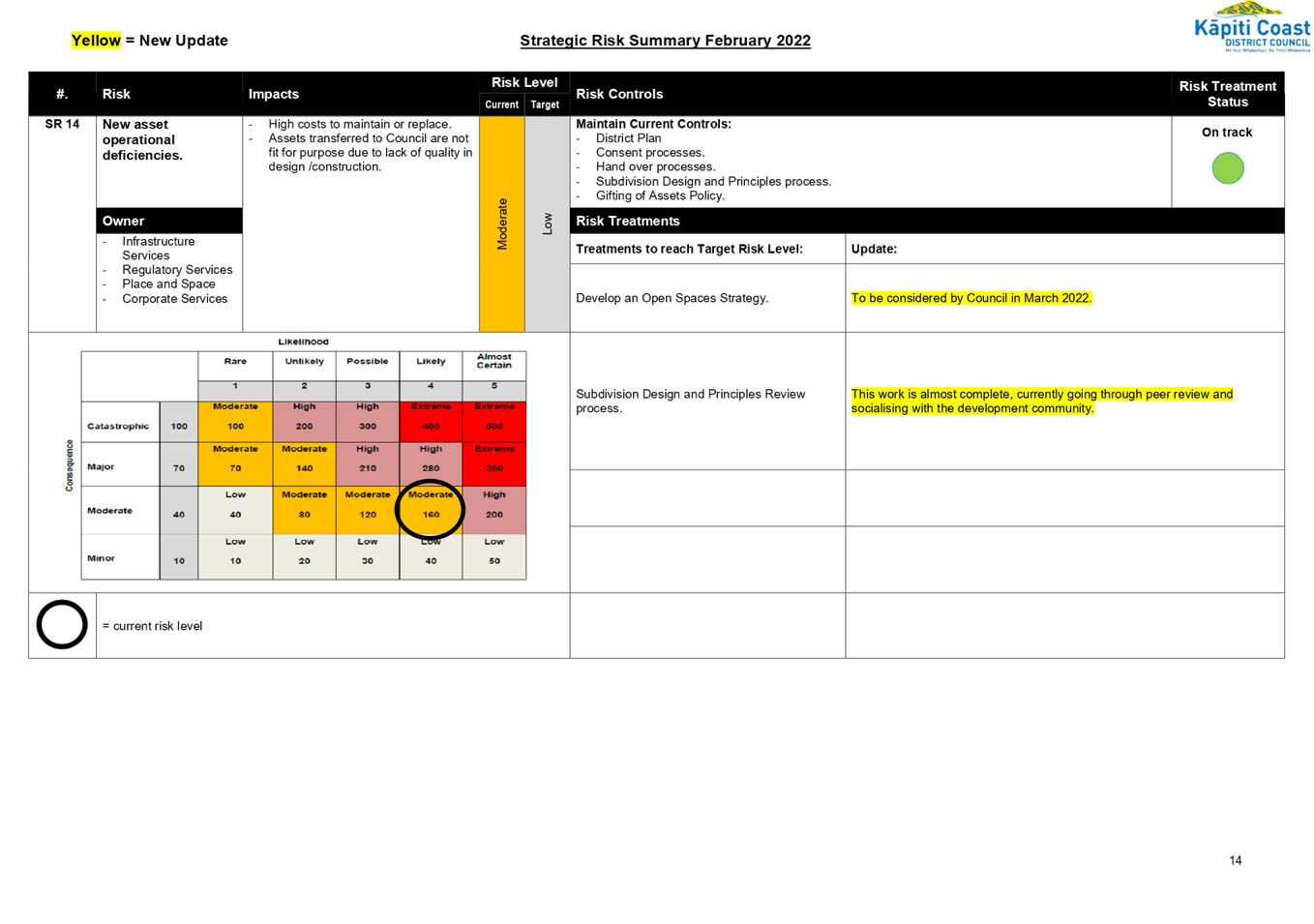

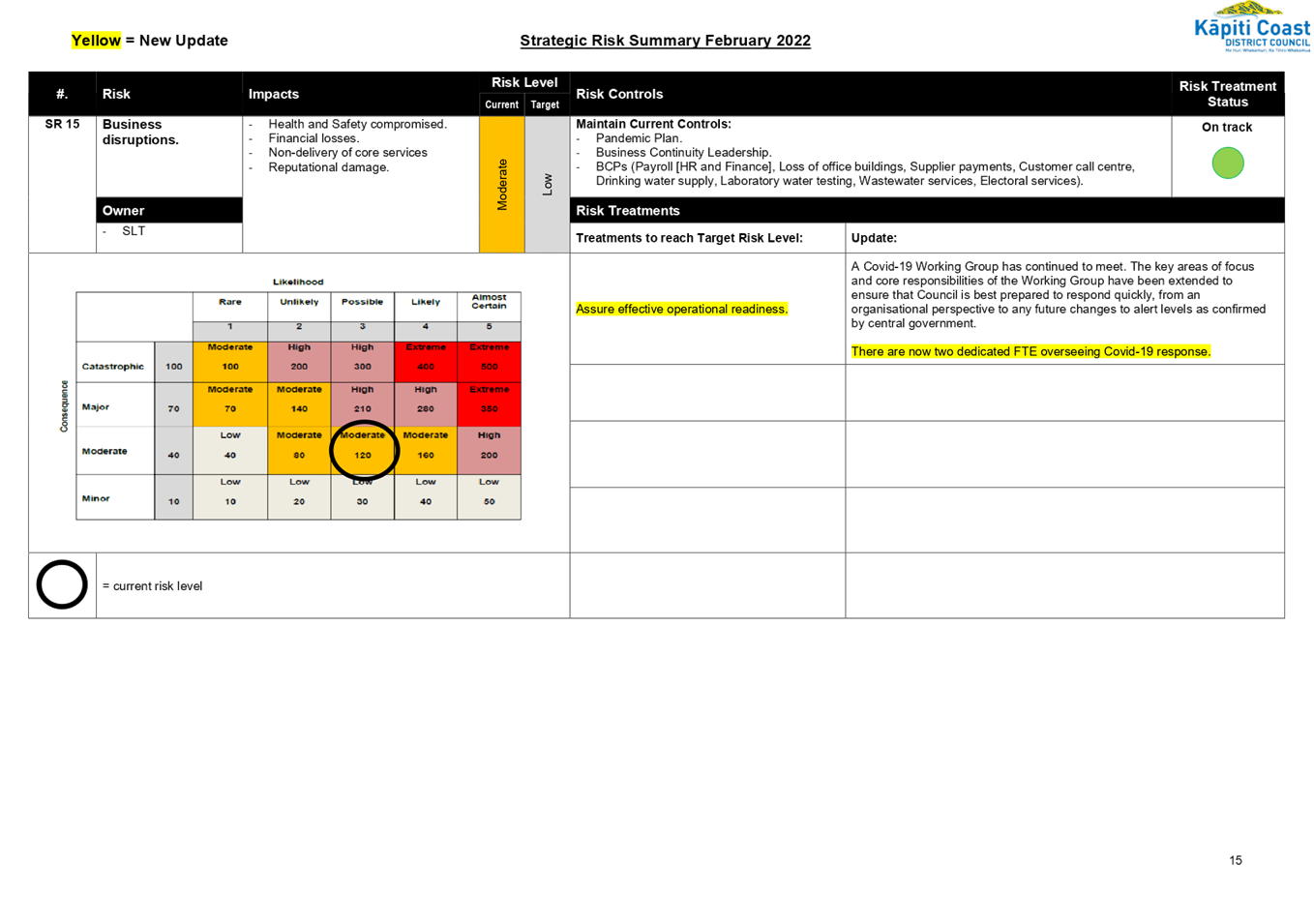

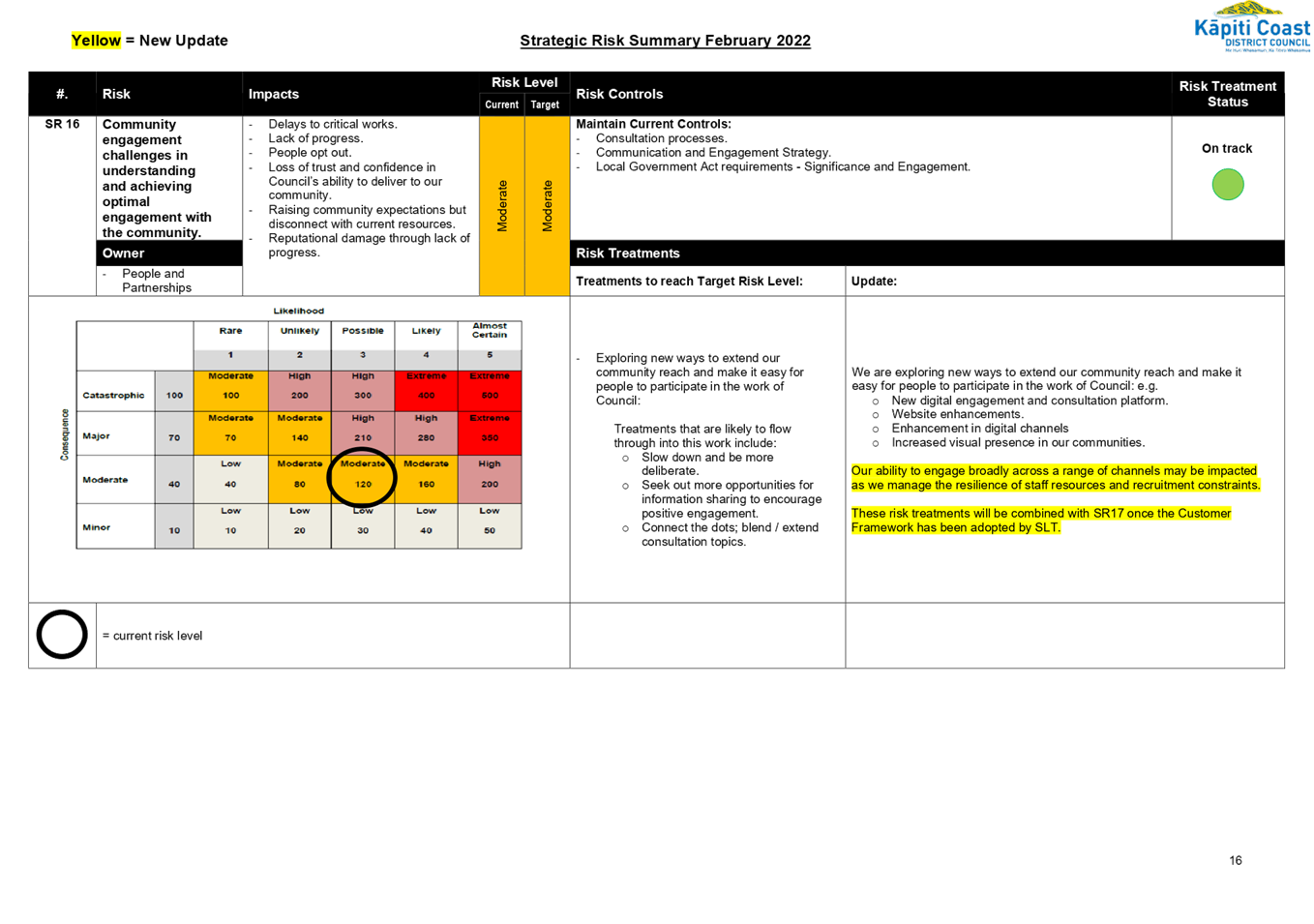

Strategic Risk Profile –

Summary Update

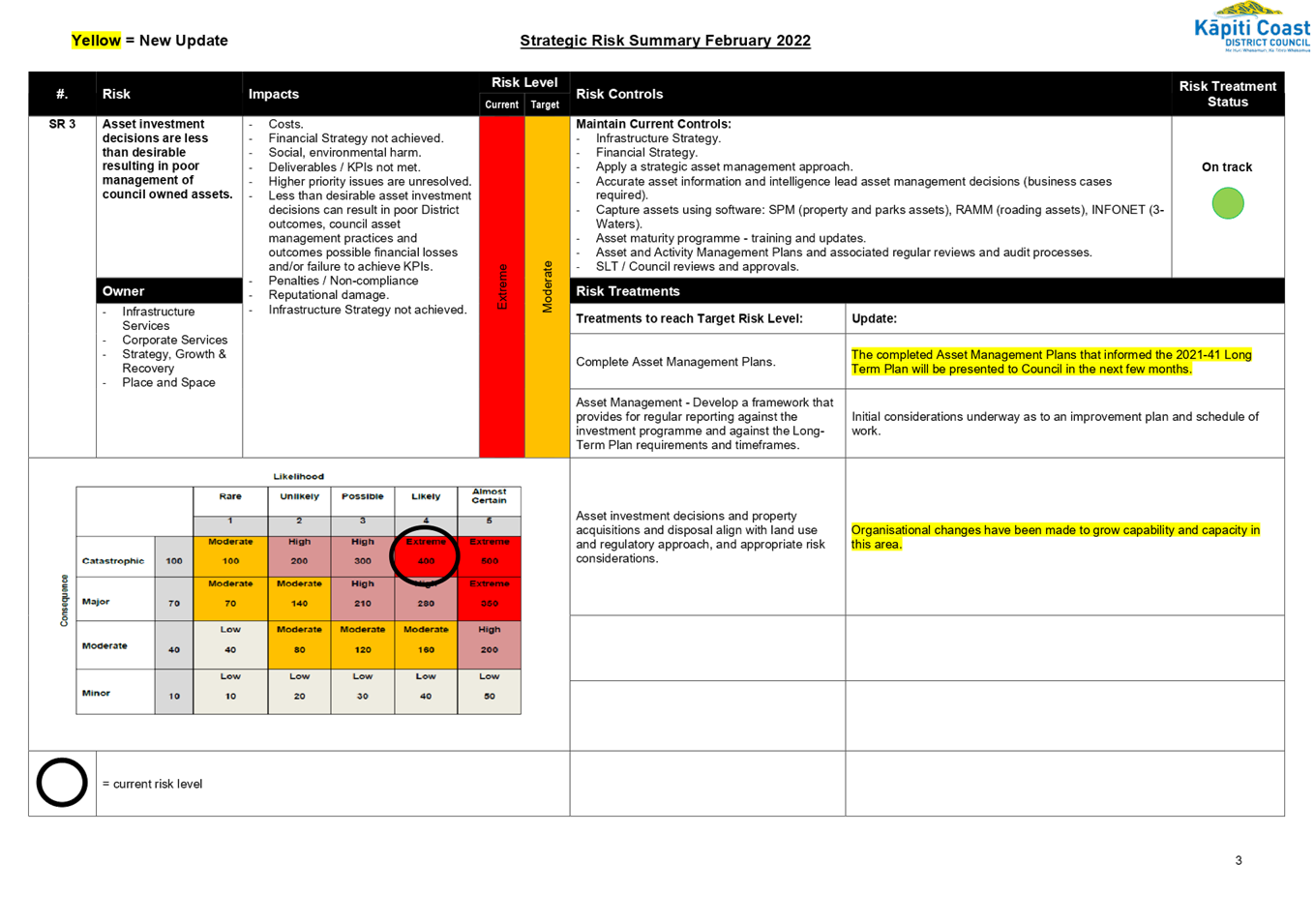

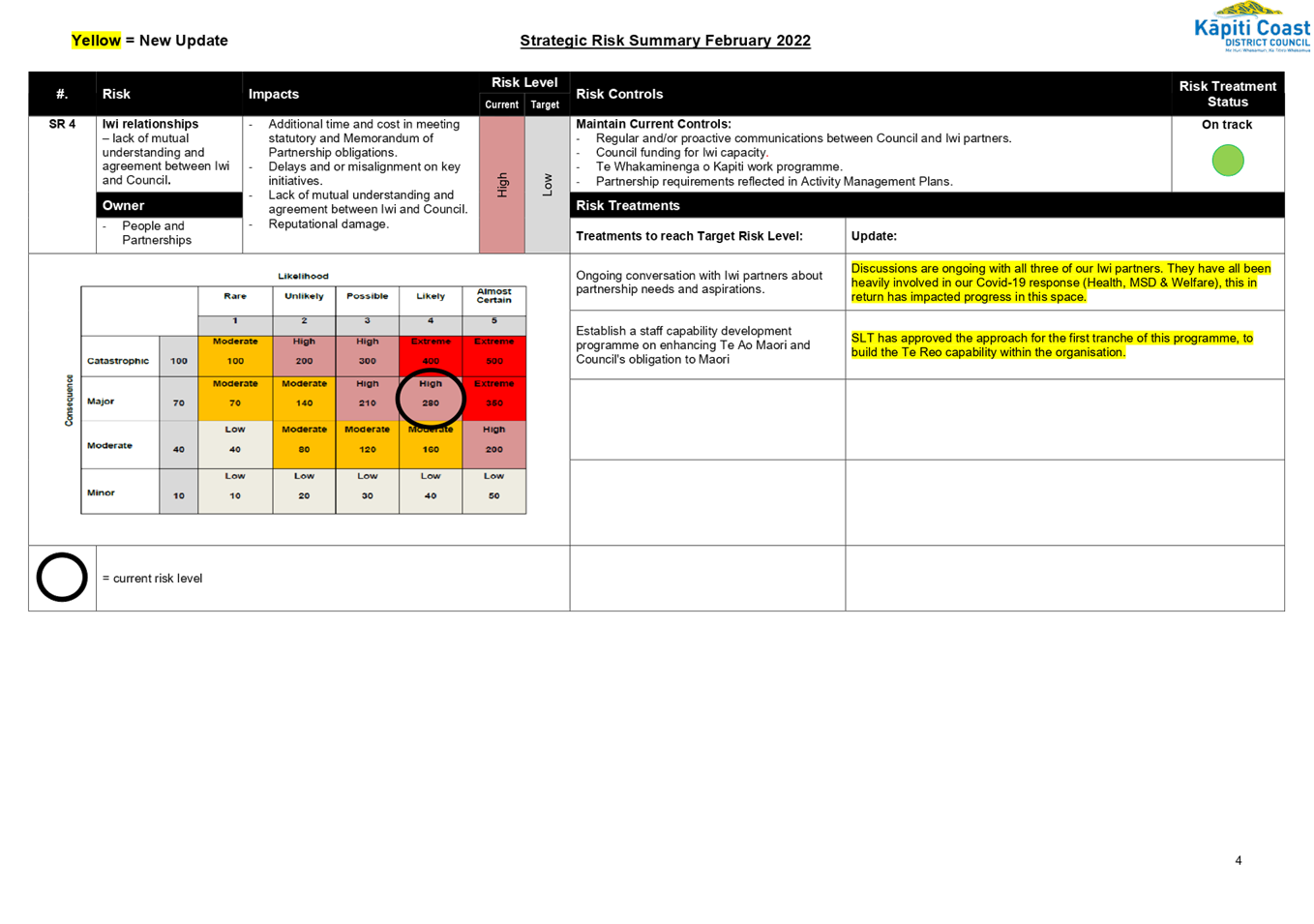

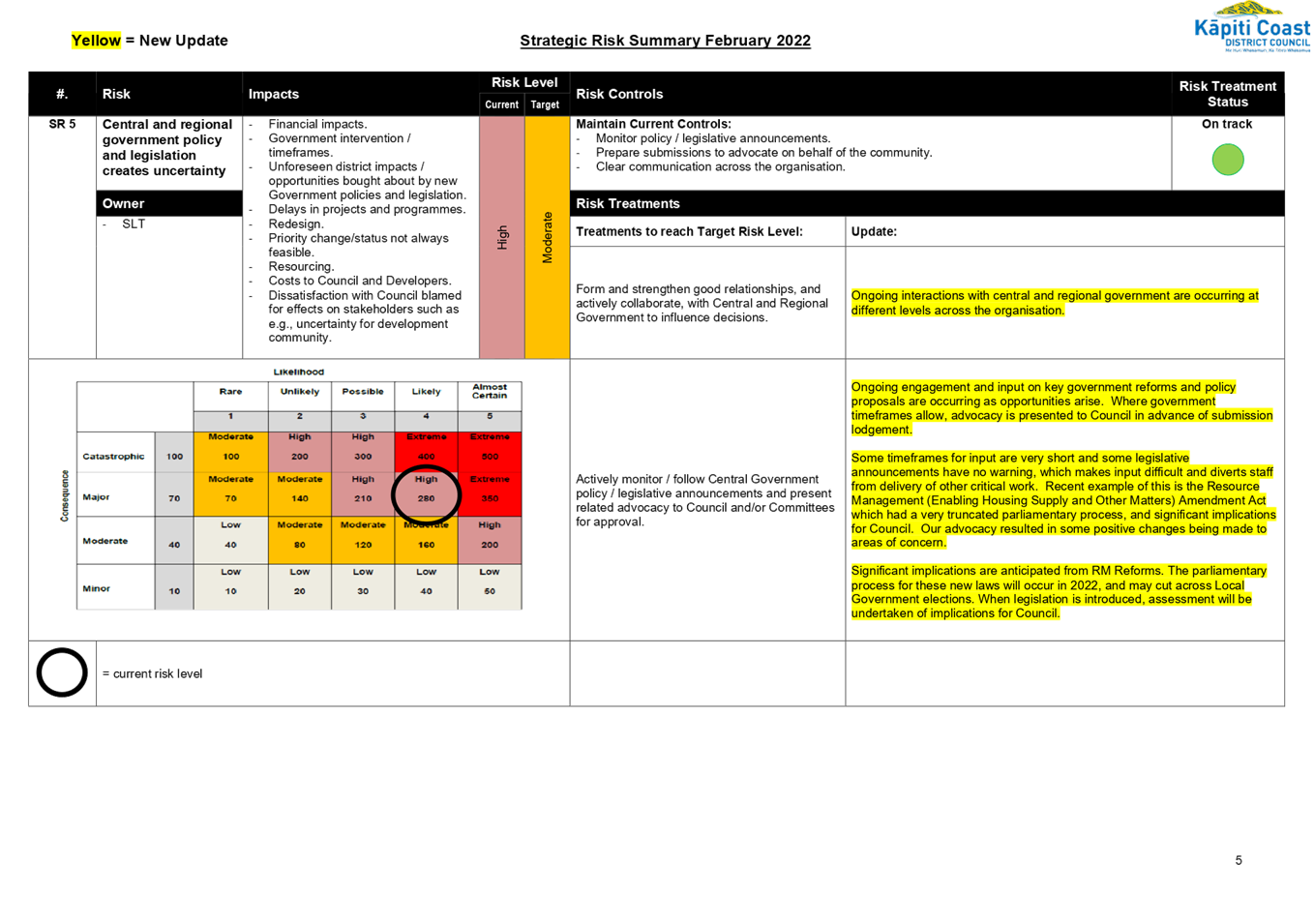

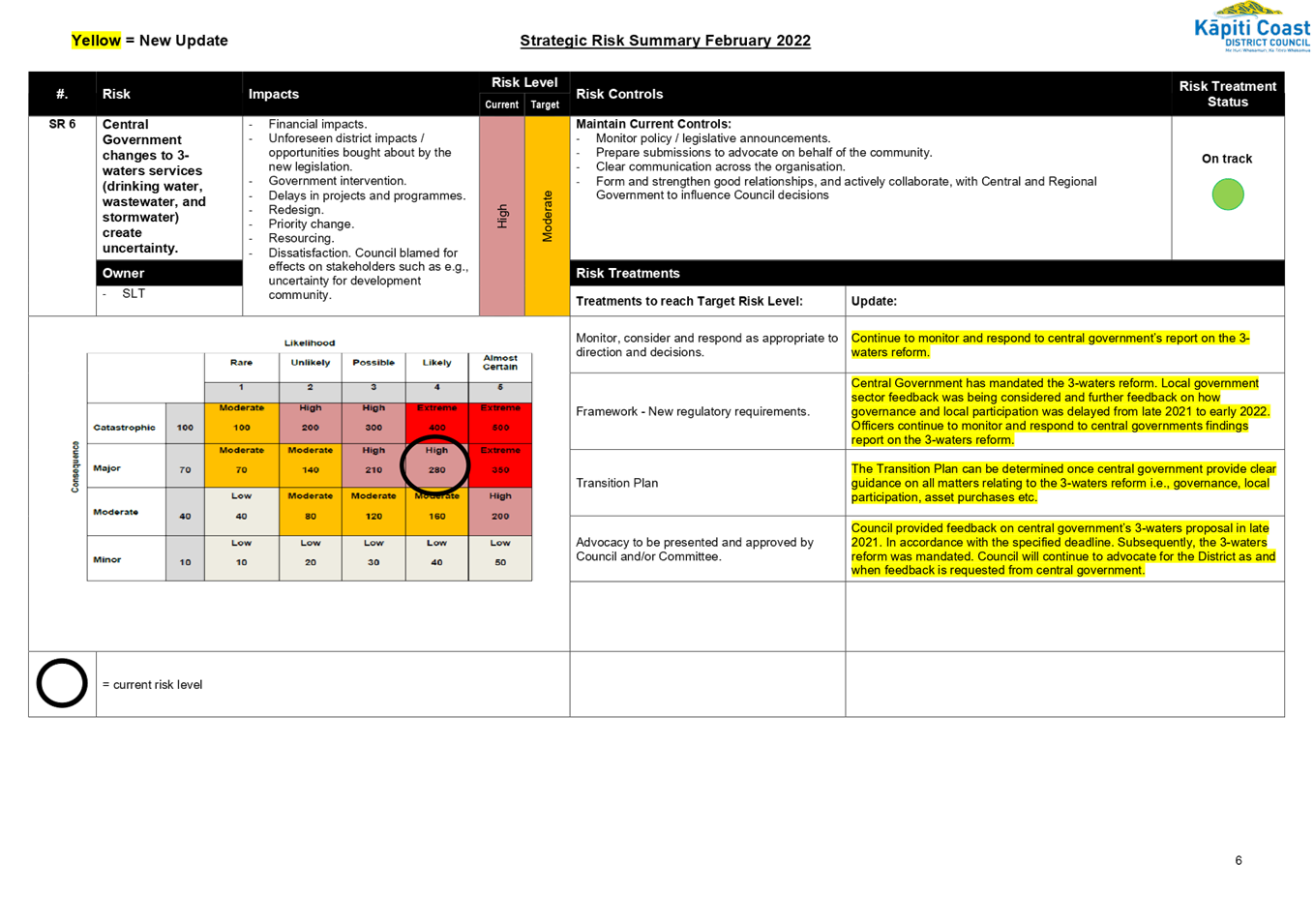

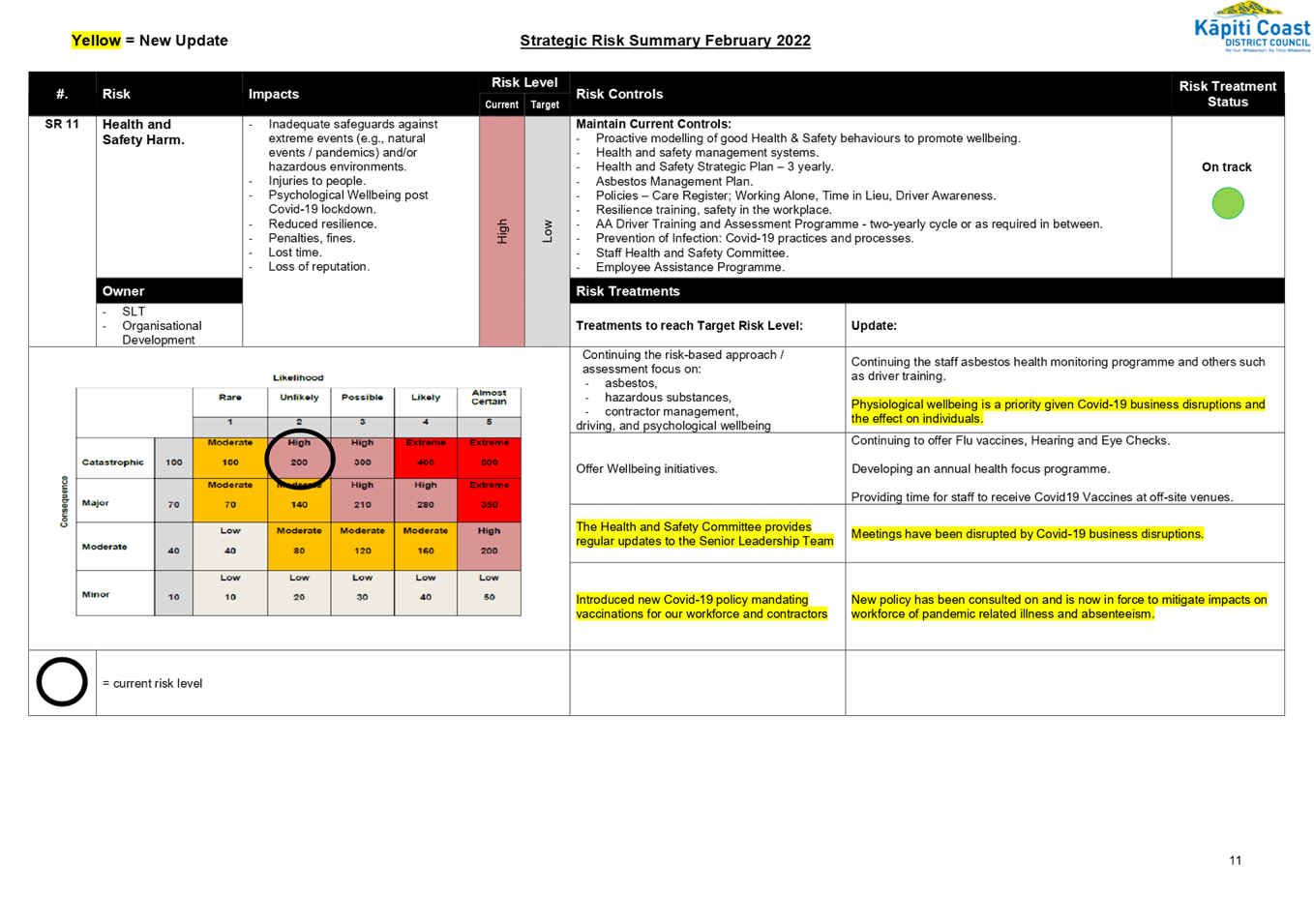

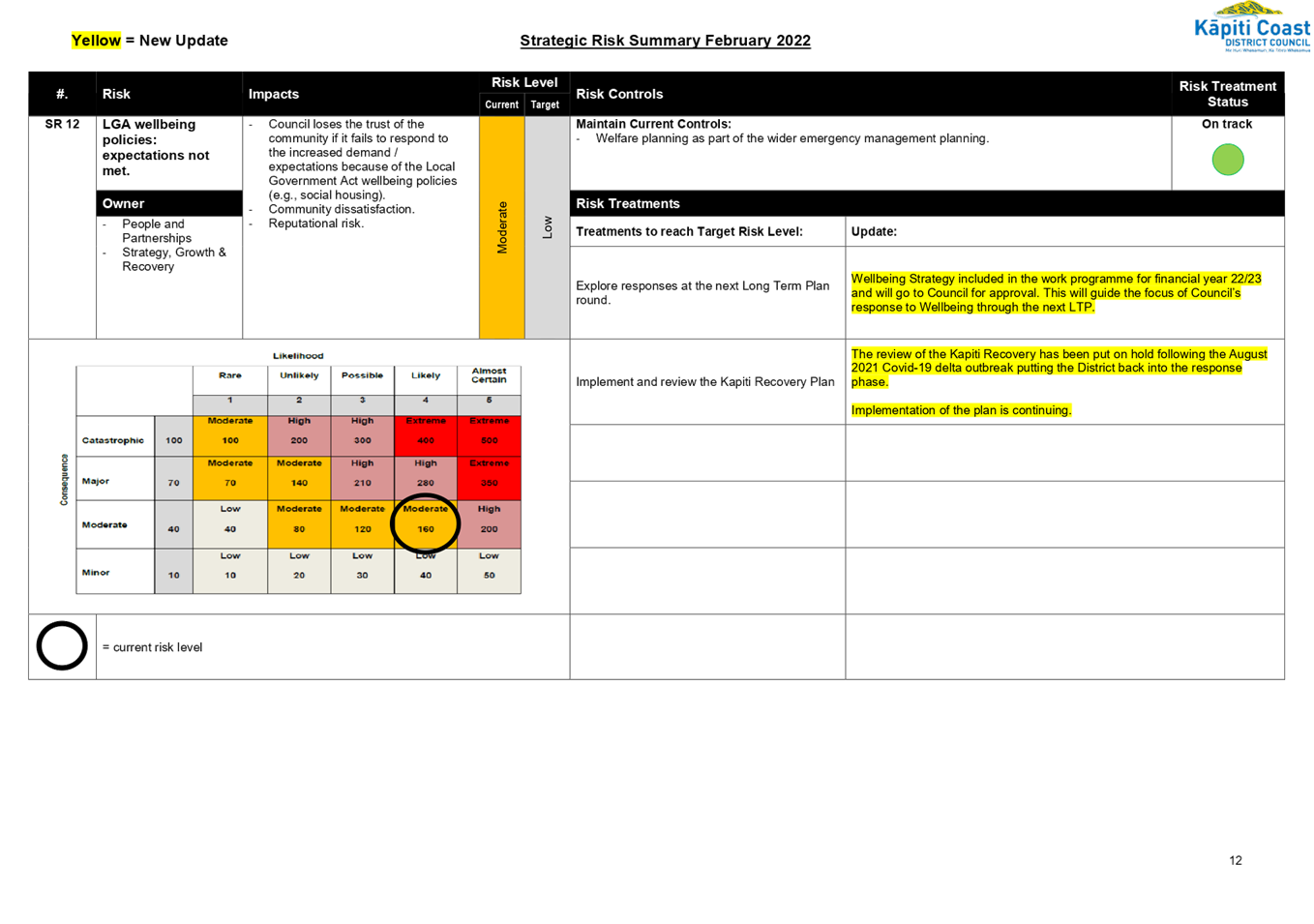

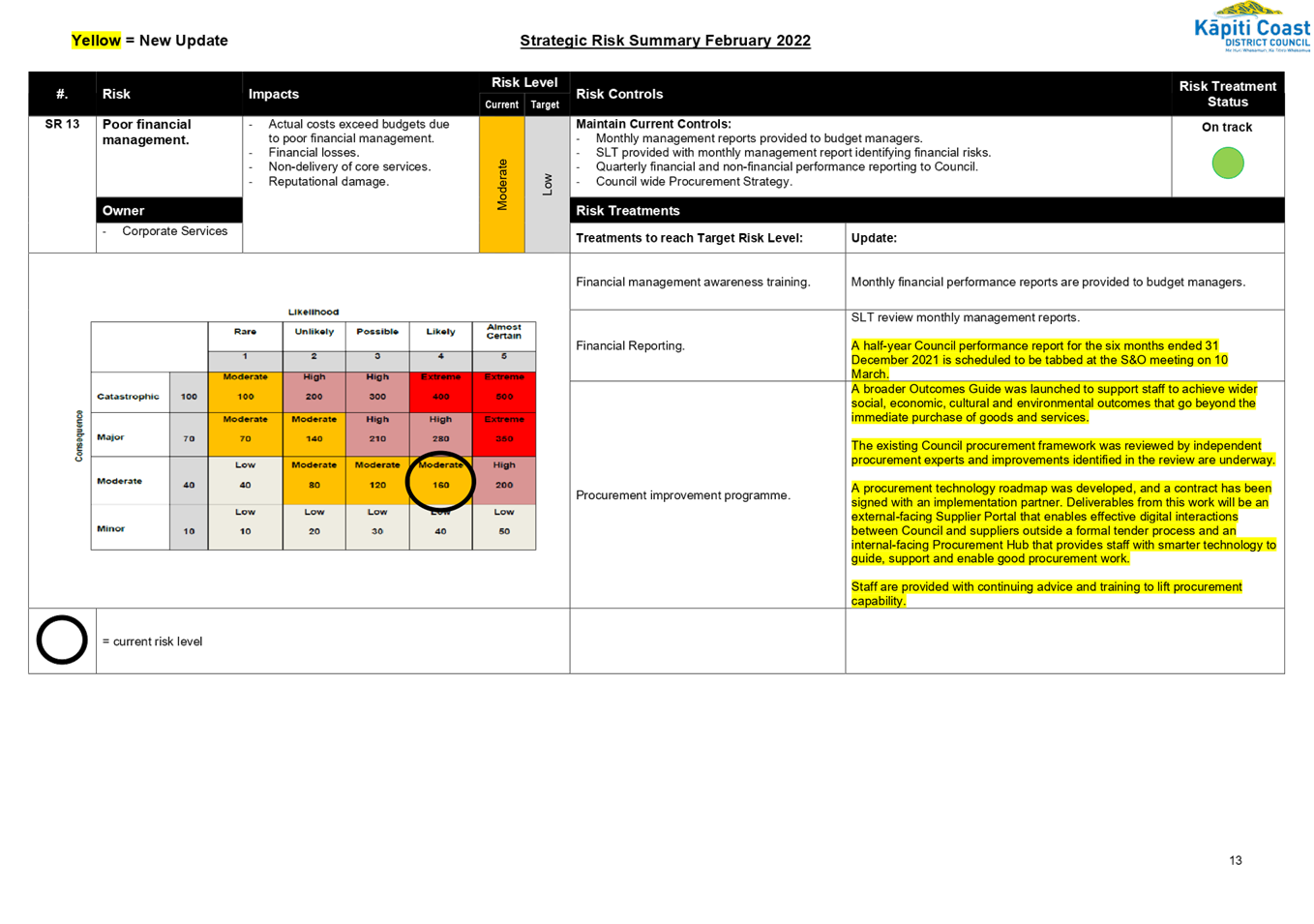

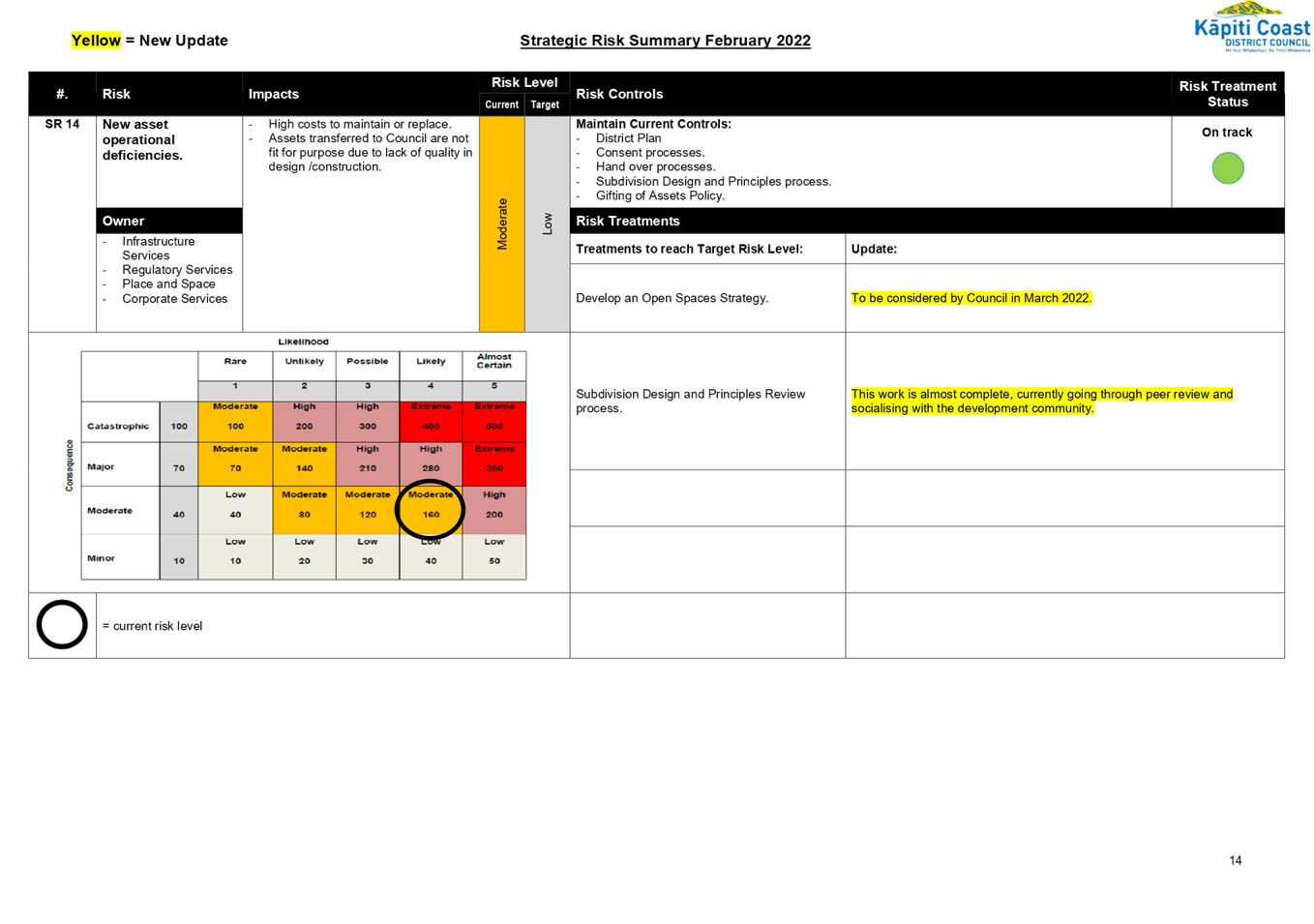

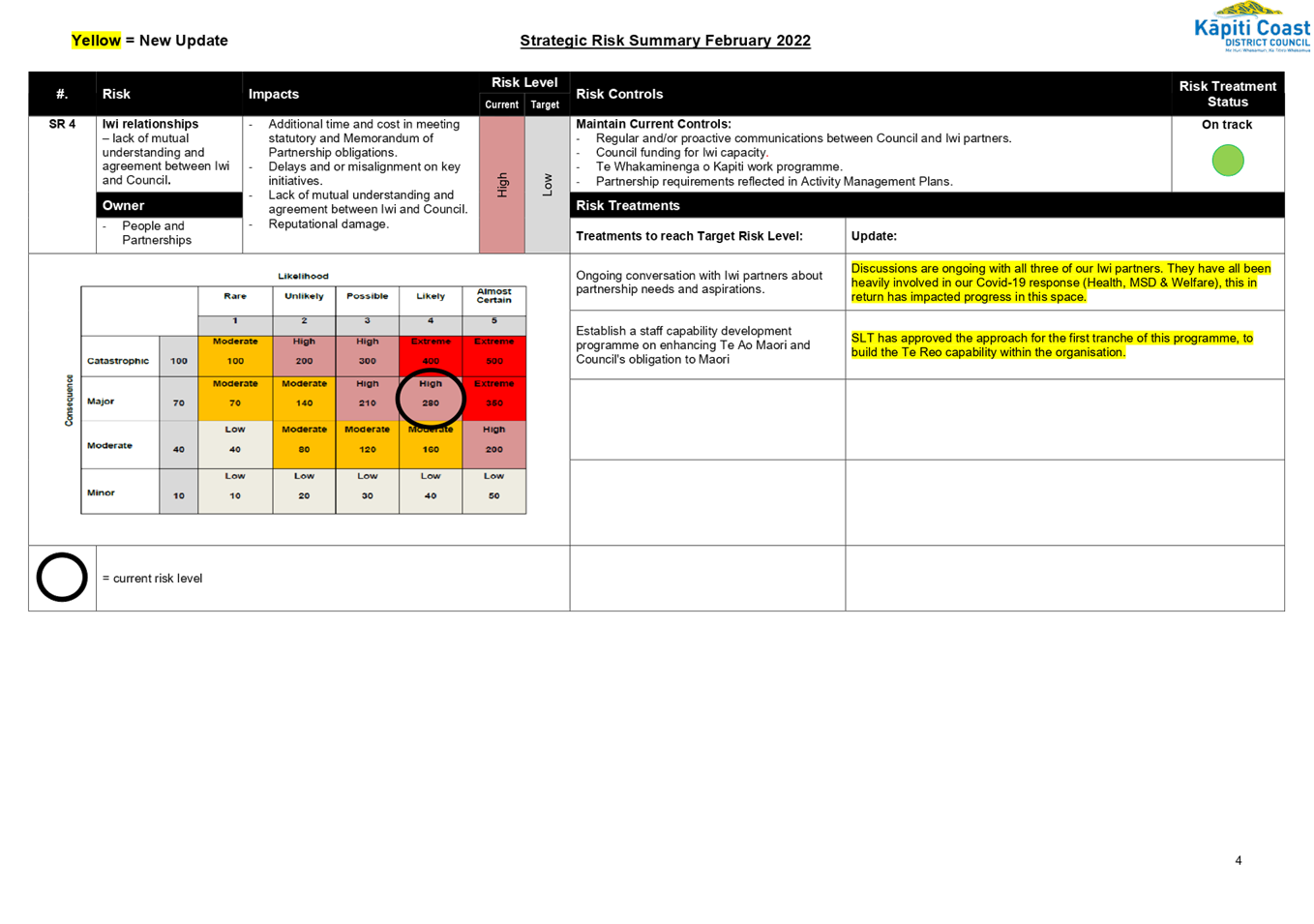

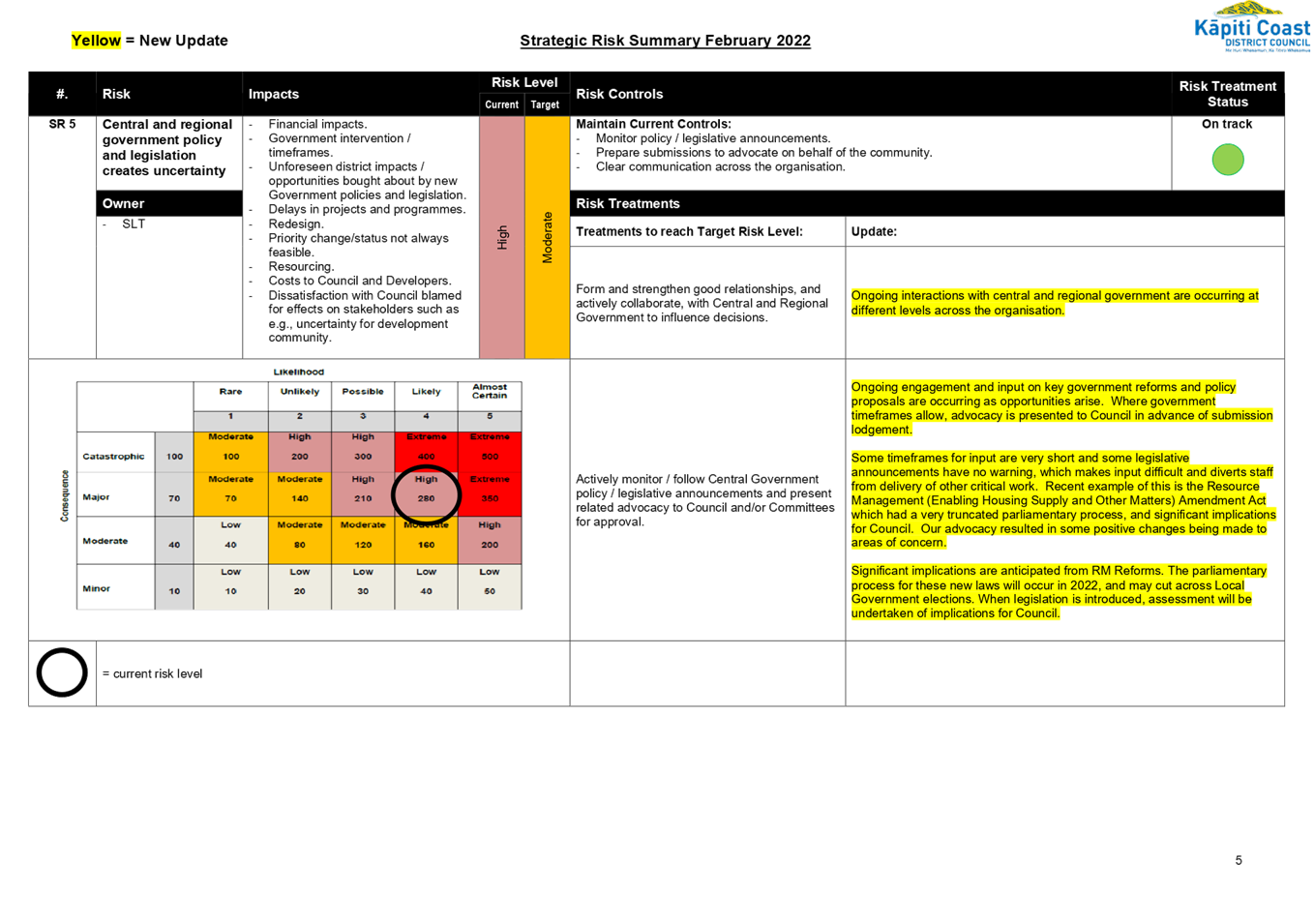

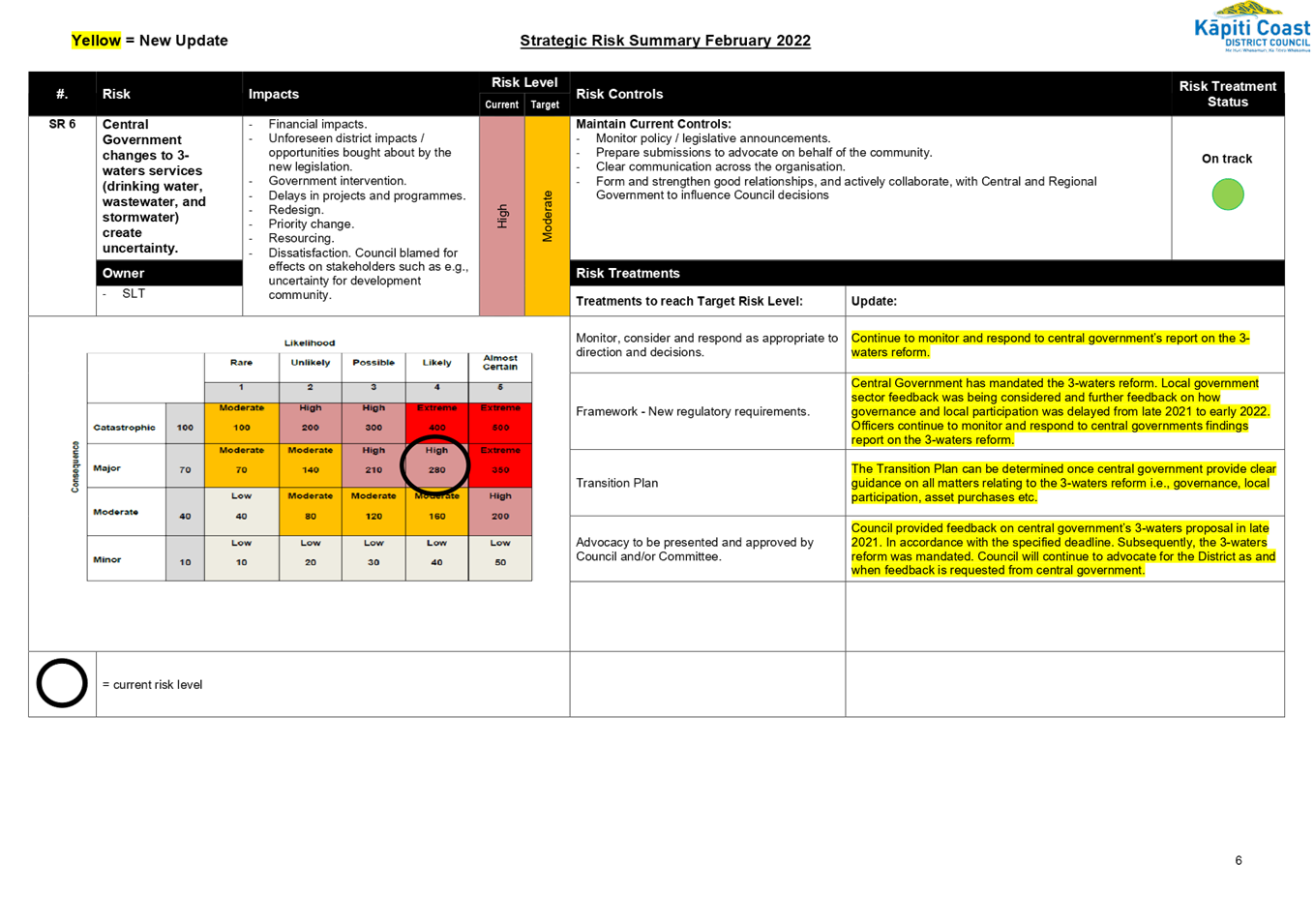

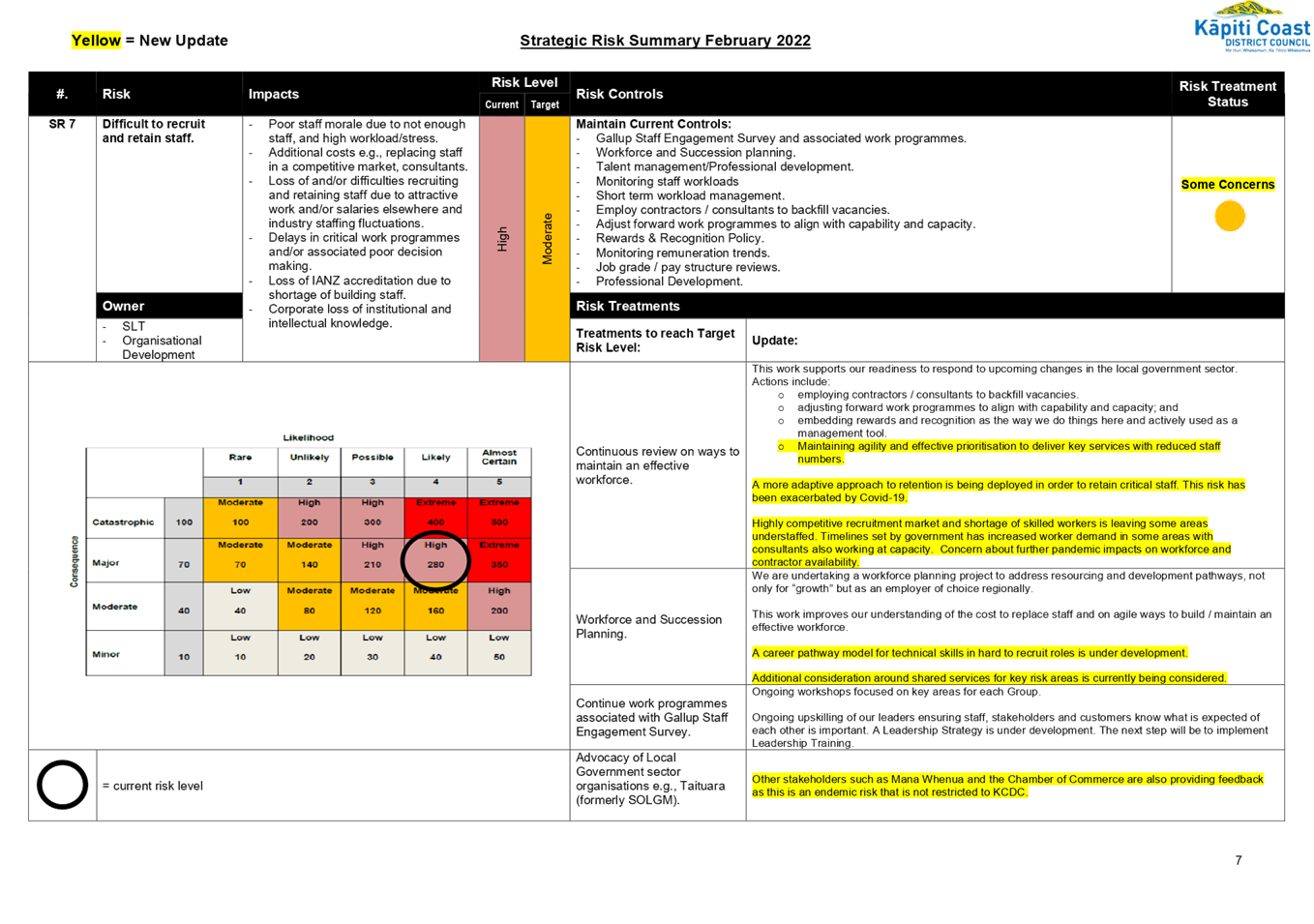

7 The

strategic risk profile is managed by a risk register and presented in the

associated Strategic Risk Summary attached as Appendix 2 to this report. This

Summary:

7.1 lists

the risk impacts, controls and treatments planned with updates to reach the

target risk level, and

7.2 plots

each Strategic Risk (SR) on the risk matrix.

8 The

risk treatment status is categorised as follows:

9 Engagement

on the strategic risk profile is through quarterly conversations with managers.

These conversations drive the responses in the update column of the Strategic

Risk Register attached as Appendix 2 to this report and are highlighted in

yellow to make for easier reading.

10 The

focus is on identifying, managing, and communicating the very highest strategic

and operational risks that the Council faces. Our approach to how we assess

risk is illustrated in diagrams in Appendices 1 and 2 to this report. Important

matters to note when reading the diagrams are that:

10.1 Likelihood

is how likely the risk is to materialise and is rated as rare, unlikely,

possible, likely, and almost certain.

10.2 Consequence

is the impact on the Council - not just financial, but also health and safety,

fraud, operational and reputational; and

10.3 This

assessment tool is subjective and is used as a prompt for a risk comparison and

ranking mechanism.

11 The

overall risk management culture and practice continues to improve, and the risk

conversations widen. The concept of risk acceptance is being further embedded

across the organisation, i.e. certain moderate level risks may be tolerated by

the business in the context of the costs or impracticalities to further

mitigate the risk.

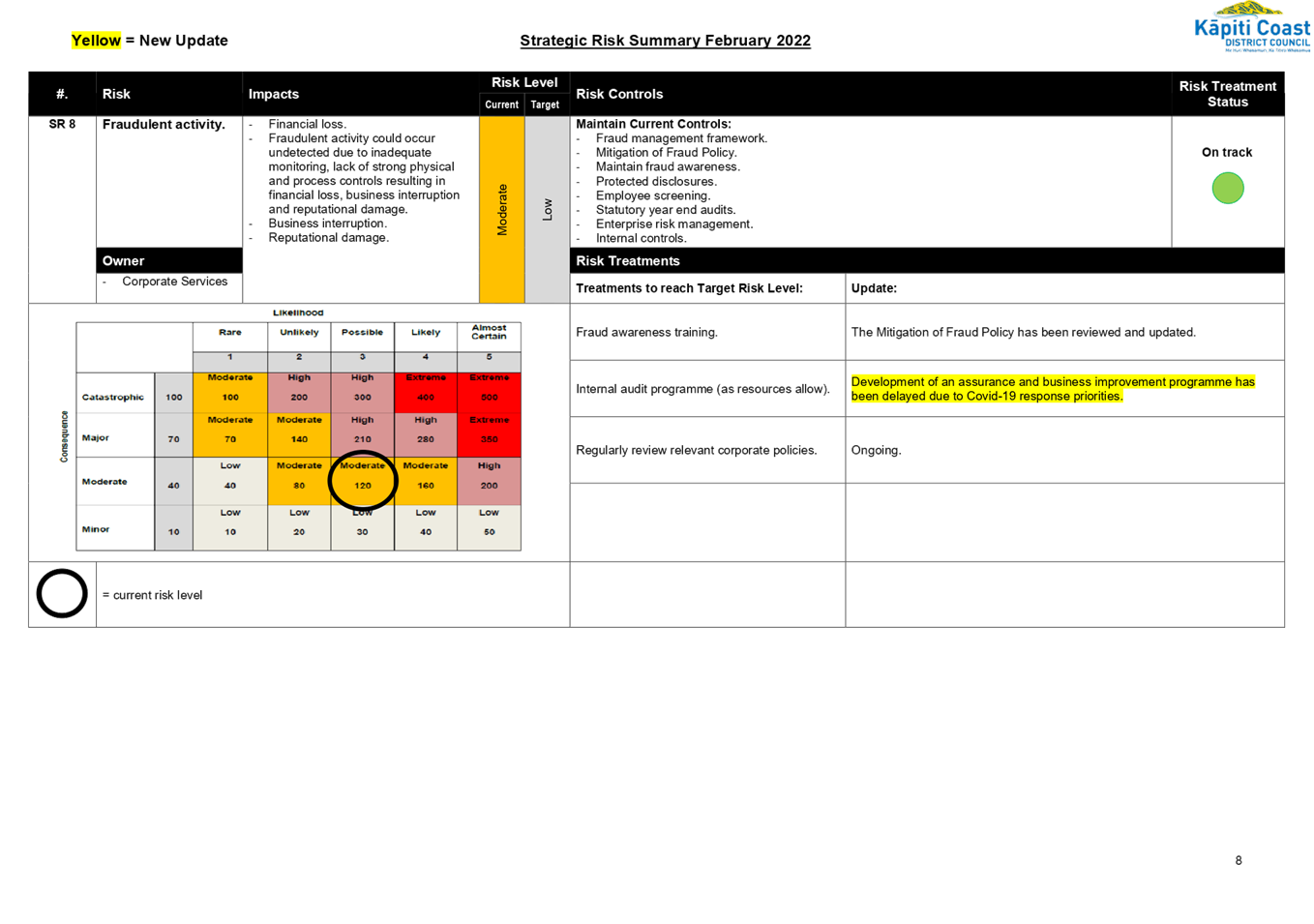

12 In

summary, our Strategic Risk Status is healthy. There are 21 strategic risks

presented in Appendix 2 to this report, 16 of which have maintained the same

status as previously reported to the 12 August 2021 meeting.

13 In

the meeting on 12 August 2021, it was agreed that ‘SR8 - Fraudulent

activity’ risk level be reduced from ‘High’ to

‘Moderate’. This change has been incorporated in the Strategic Risk

Summary attached as Appendix 2 to this report.

14 Seven

of the 21 total Strategic Risks are classified as “some concern”

(noted below) and the other 14 are classified as “on track”.

|

Risk #

|

Risk Treatment

Status

|

Risk Treatment Update

|

|

SR2 – Infrastructure service disruption associated

with significant Natural Hazards.

|

Some Concerns Some Concerns

|

Waikanae Wastewater

Treatment Plant Clarifier Project - Delays to securing materials and

sourcing additional contractors onsite to complete works which will impact on

the completion date.

|

|

SR7 - Difficult to recruit and retain staff.

|

Some Concerns Some Concerns

|

Due to a number of other

Strategic Risks being classified as ‘Some Concerns’ as a result

of staffing and recruitment constraints, this risk treatment status has been

classified as some concerns itself.

|

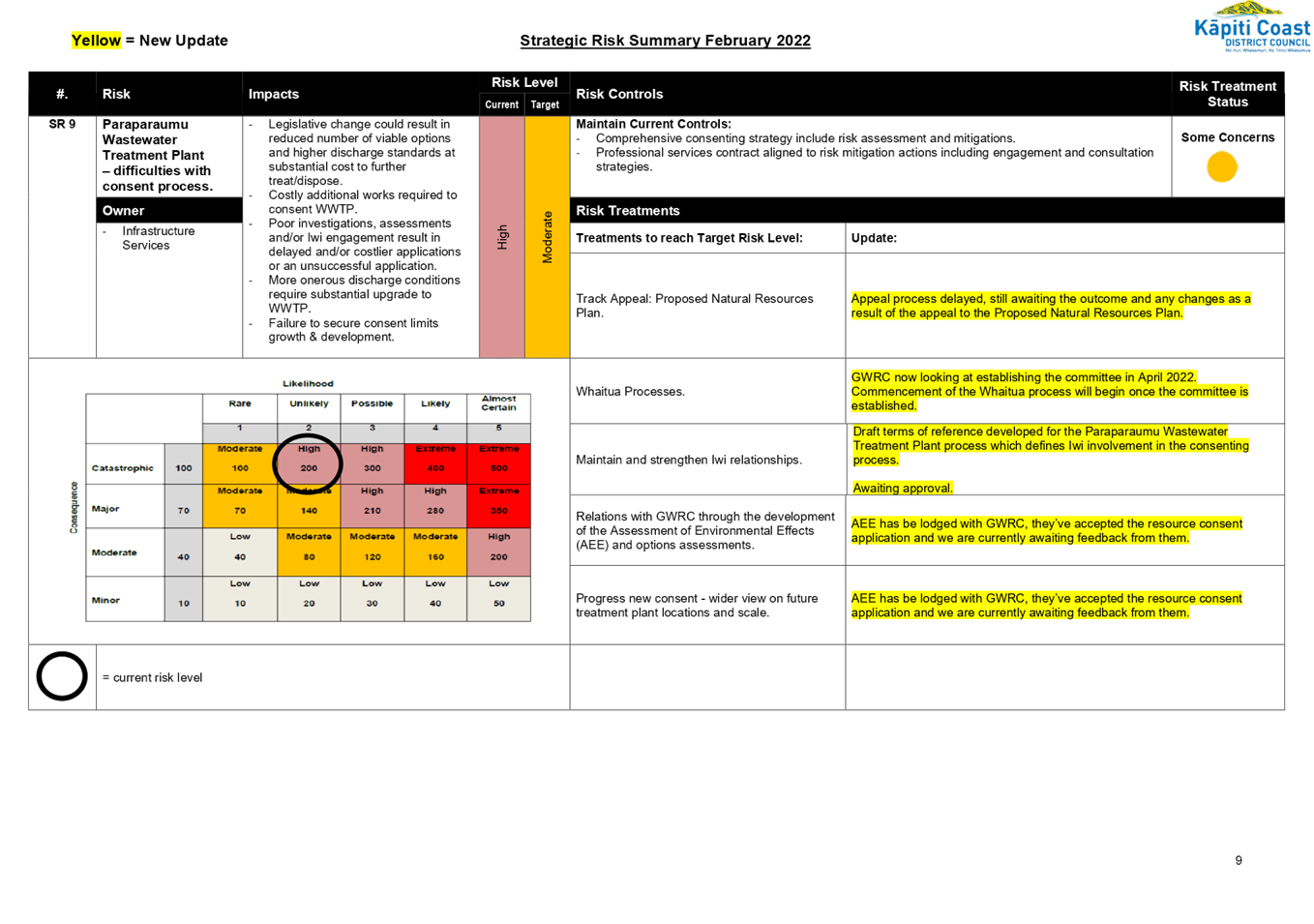

|

SR9 -

Paraparaumu Wastewater Treatment Plant – difficulties with consent

process.

|

Some Concerns Some Concerns

|

Appeal process delayed, still

awaiting the outcome and any changes as a result of the appeal to the

Proposed Natural Resources Plan.

Awaiting approval of the Draft

terms of reference developed for the Paraparaumu Wastewater Treatment Plant

process which defines Iwi involvement in the consenting process.

|

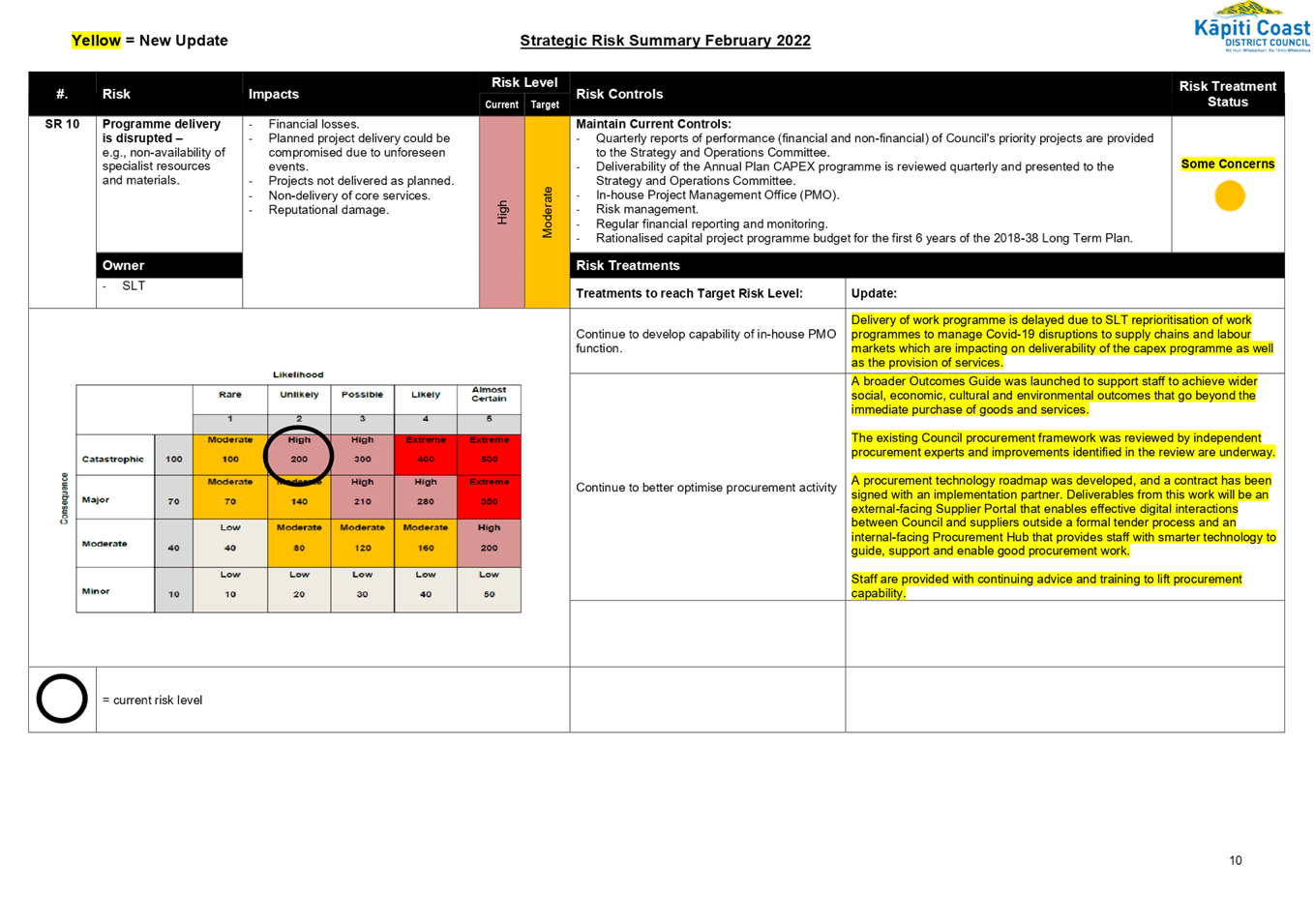

|

SR10 – Programme delivery is disrupted.

|

Some Concerns Some Concerns

|

Delivery of work programme is delayed due to SLT

reprioritisation of work programmes to manage Covid-19 disruptions to supply

chains and labour markets which are impacting on deliverability of the capex

programme as well as the provision of services.

|

|

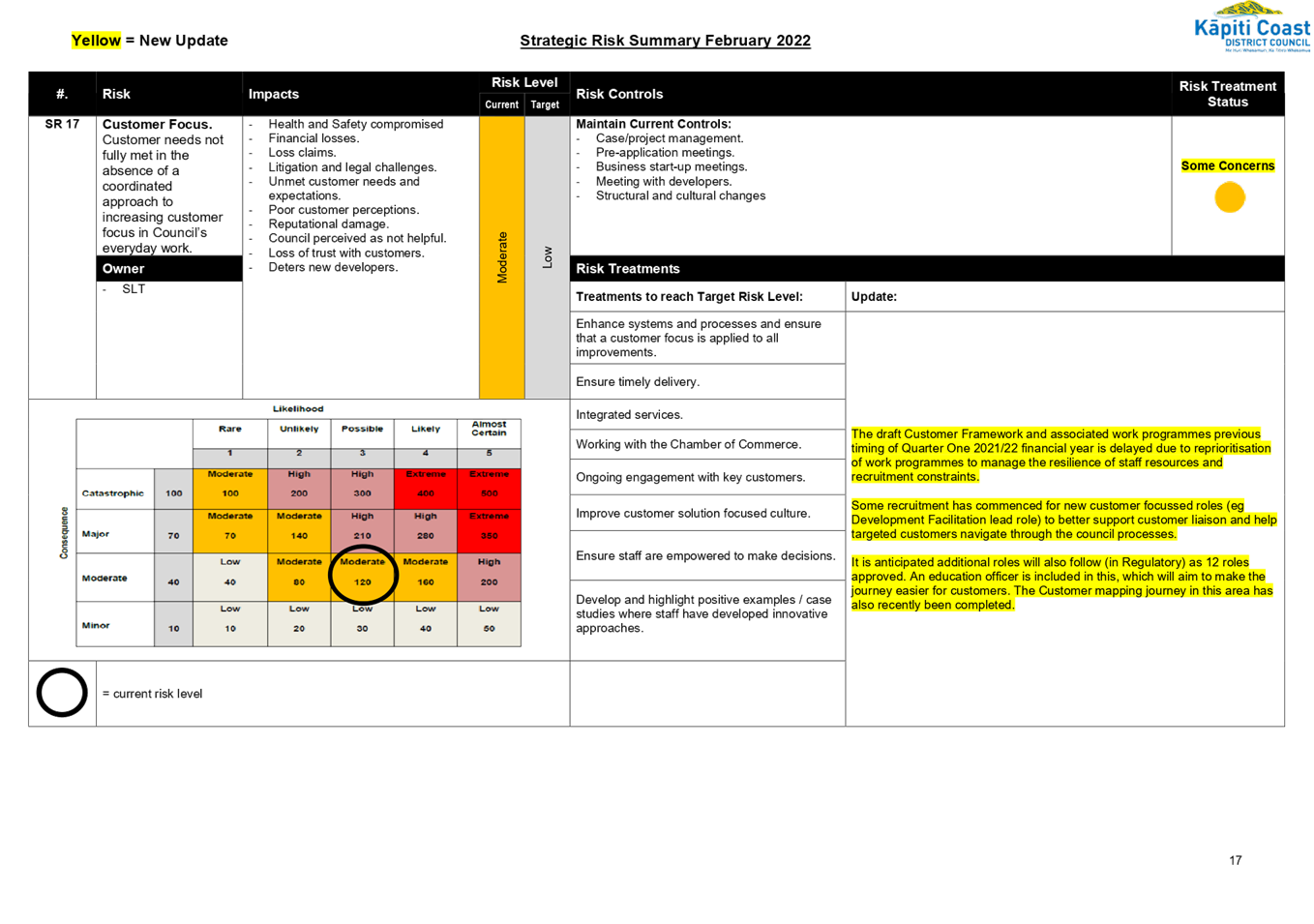

SR17 – Customer

Focus.

|

Some Concerns Some Concerns

|

The draft Customer Framework and associated work

programmes previous timing of Quarter One 2021/22 financial year is delayed

due to SLT reprioritisation of work programmes to manage the resilience of

staff resources and recruitment constraints.

|

|

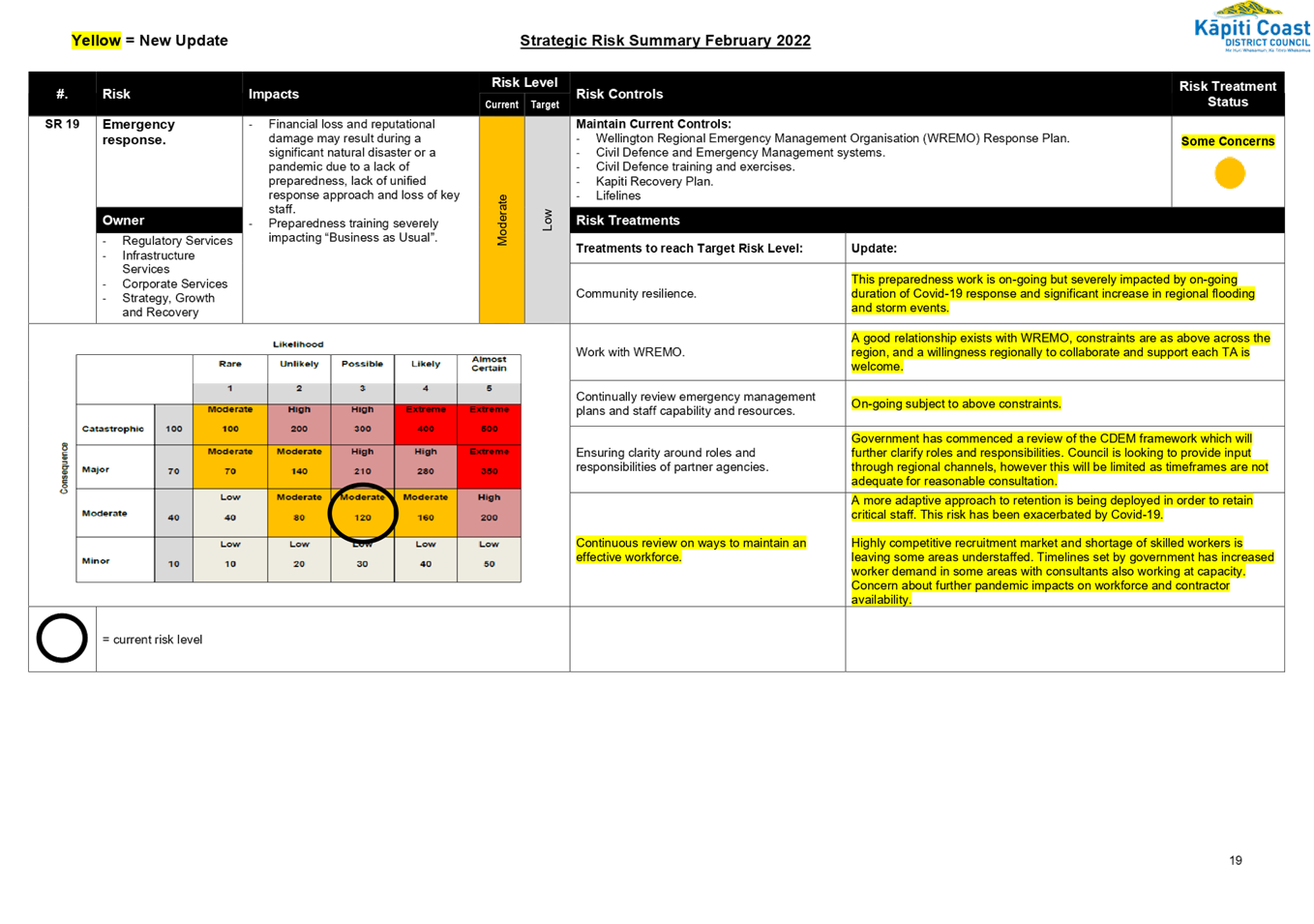

SR19 – Emergency response.

|

Some Concerns Some Concerns

|

A more adaptive approach to retention is being deployed in

order to retain critical staff. This risk has been exacerbated by Covid-19.

Highly competitive recruitment market and shortage of

skilled workers is leaving some areas understaffed. Timelines set by

government has increased worker demand in some areas with consultants also

working at capacity. Concern about further pandemic impacts on workforce and

contractor availability.

|

|

SR21

–

Cyber Security – Enterprise Management Replacement

|

Some Concerns Some Concerns

|

Organisations are doing far more digitally as a result of

Covid-19, this in turn increases the risk of a potential Cyber Security

attack.

|

Procurement

Improvement Programme

15 With the

Council-wide Procurement Strategy as the foundation, progress towards better

procurement maturity is well in hand. Work has continued to uplift procurement

capability and provide procurement support across the organisation.

16 A

broader Outcomes Guide was launched to support staff to achieve wider social,

economic, cultural and environmental outcomes that go beyond the immediate

purchase of goods and services. The existing Council procurement framework was

reviewed by independent procurement experts and improvements identified in the

review are underway.

17 A

procurement technology roadmap was developed, and a contract has been signed

with an implementation partner. Deliverables from this work will be an

external-facing Supplier Portal that enables effective digital interactions

between the Council and suppliers outside a formal tender process and an

internal-facing Procurement Hub that provides staff with smarter technology to

guide, support and enable good procurement work.

18 Staff are provided

with continuing advice and training to lift procurement capability.

Risk and Assurance

19 Development

of a Council-wide assurance and business improvement work programme remains on

hold due to limited resources and prioritising the Council’s Covid-19

response.

He take |

Issues

20 There

are no issues to be raised in this report.

Ngā kōwhiringa | Options

21 There

are no options to be raised in this report.

Tangata whenua

22 There

has been no direct engagement with tāngata whenua regarding this report

Panonitanga āhuarangi | Climate change

The

Strategic Risk Summary attached as Appendix 2 to this report includes

‘SR1 - Natural hazards exacerbated due to - global warming, sea level

rise / climate change, and earthquakes. This risk is reported on every quarter

to the Audit and Risk Subcommittee with updates to the treatments being

collated from the Senior Leadership Team. Ahumoni me ngā rawa | Financial

and resourcing

24 There

are no further financial and resourcing considerations arising from this

report.

Ture me ngā Tūraru | Legal

and risk

25 There

are no further legal considerations arising from this report.

Ngā pānga ki ngā kaupapa here | Policy impact

26 There

are no further policy implications arising from this report.

Te whakawhiti kōrero me te

tūhono | Communications & engagement

Te mahere tūhono | Engagement

planning

27 This

matter has a low level of significance under the Council’s Significance

and Engagement Policy.

Whakatairanga |

Publicity

28 There

are no publicity considerations.

Ngā

āpitihanga | Attachments

1. Appendix

1 - Strategic Risk Matrix with plotted risks ⇩

2. Appendix

2 - Strategic Risk Summary ⇩

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

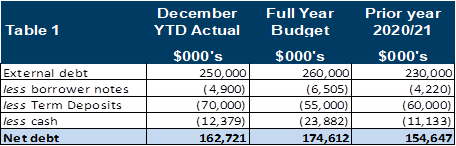

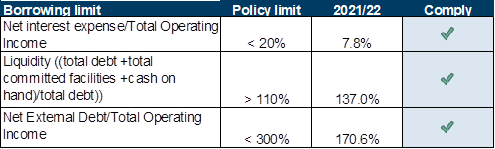

8.5 Quarterly Treasury Compliance

Kaituhi | Author: Ian

Georgeson, Chief Financial Officer

Kaiwhakamana | Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake | Purpose

1 This

report provides confirmation to the Audit and Risk Subcommittee of the

Council’s compliance with its Treasury Management Policy (Policy) for the

quarter ended 31 December 2021

He whakarāpopoto | Executive

summary

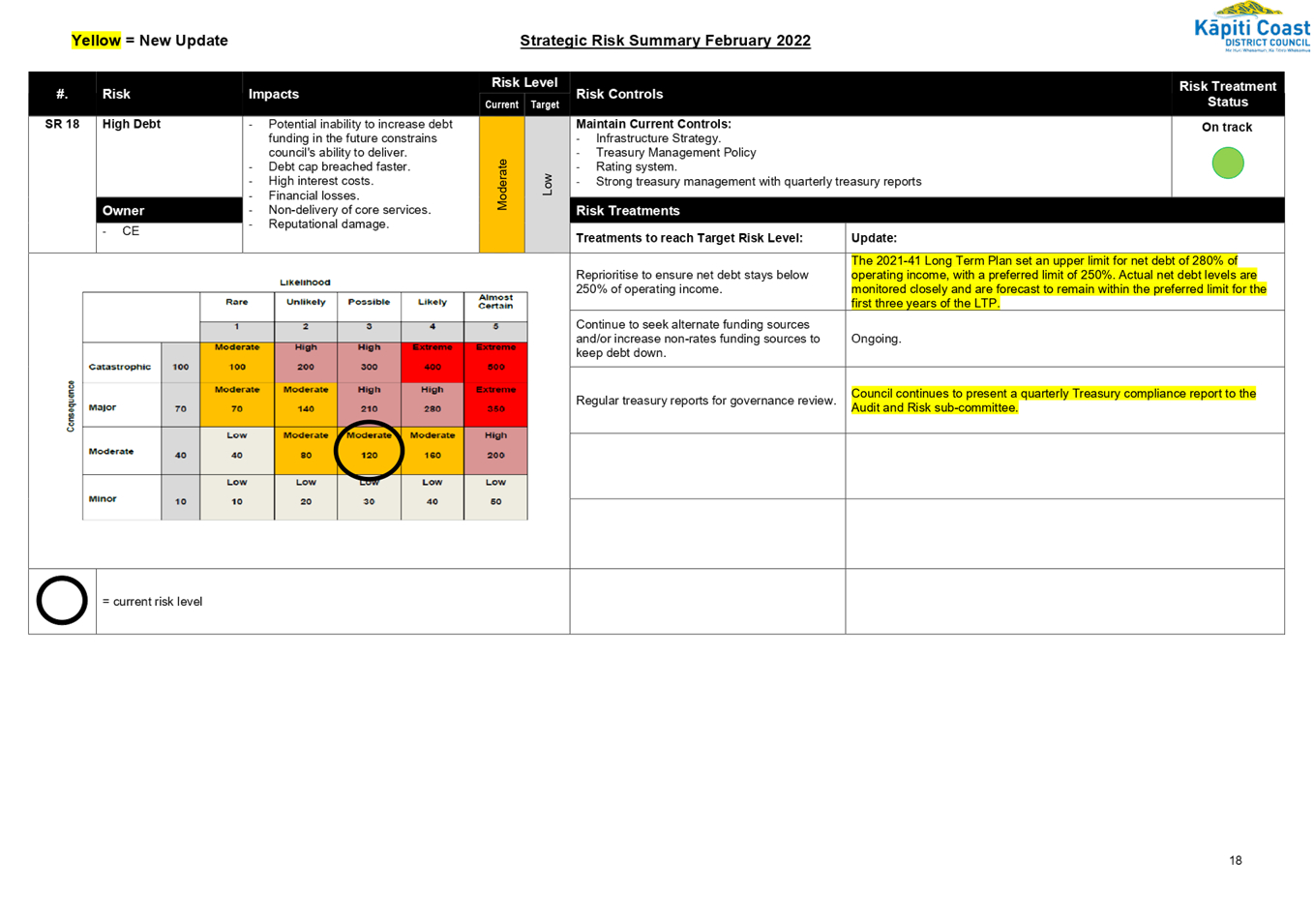

2 The Council had net debt of $162.7 million at 31 December 2021,

equating to 171% of operating income. This is within the LTP Financial Strategy

limit of 280%.

3 The Council’s Treasury policy contains a number of treasury

risk management limits or requirements designed to minimise risk. These policy

requirements are reported upon in this paper. The Council complied with all

policy requirements during the quarter.

Te tuku haepapa | Delegation

4 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

Ensuring that the

Council has in place a current and comprehensive risk management framework and

making recommendations to the Council on risk mitigation.

Taunakitanga | Recommendations

A. That the Audit and Risk

Subcommittee notes the Council’s full compliance with its Treasury

Management Policy for the three months ended 31 December 2021.

Tūāpapa | Background

5 The Policy sets out a

framework for the Council to manage its borrowing and investment activities in

accordance with the Council’s objectives and incorporates legislative

requirements.

6 The Policy mandates

regular treasury reporting to management and the Strategy and Operations

Committee, as well as quarterly compliance reporting to the Audit and Risk

Subcommittee.

7 In order to assess the

effectiveness of the Council’s treasury management activities and

compliance to the Policy, certain performance measures and parameters have been

prescribed. These are:

· cash/debt position;

· liquidity/funding control limits;

· interest rate risk control limits;

· counterparty credit risk;

· specific borrowing limits; and

· risk management performance.

He kōrerorero | Discussion

Cash/Debt Position

8 Table

1 below shows the Council’s net debt position as at 31 December 2021 against the 2021/22 full year budget and

the prior year closing balance.

9 During the past three

months, the Council has issued $10 million of new debt, bringing the total

amount of debt drawn during the past six months to $40 million.

10 The $10 million

issued this quarter was used to pre-fund the October 2022 ($5 million) and

April 2023 ($5 million) debt maturities.

11 In addition, $5

million of 2021/22 capex programme prefunding that was held on term deposit

matured in October and was reallocated to pre-fund the October 2022 debt

maturity. This took total 2021/22 capex prefunding down from $25 to $20

million, in line with the reduced capex expectation for the year.

12 The table below shows (a) the

movement in the Council’s external debt balance and (b) the movement in

the Council’s pre-funding programme by debt maturity, for the six months

ended 31 December 2021.

13 As at 31 December 2021 the Council

had $87.28 million of cash, borrower notes and term deposits on hand. This is

broken down as follows:

14 For the three months ended 31

December 2021, the Council has not breached its net debt upper limit, as shown

in the chart below:

1

15 The Council targeted through its

LTP 2021-41 financial strategy to keep net borrowings below 280% of total

operating income with a preferred limit of 250%. As at 31 December 2021, the

Council’s net borrowings are 171% of total operating income.

Liquidity/Funding control limits

16 Liquidity and funding management

focuses on reducing the concentration of risk at any point so that the overall

borrowings cost is not increased unnecessarily and/or the desired maturity

profile is not compromised due to market conditions. This risk is managed by

spreading and smoothing debt maturities and establishing maturity compliance

buckets.

17 Since October 2015 the

Council’s treasury strategy has included a debt pre-funding programme.

The Policy allows pre-funding of the Council debt maturities and Capex

programme up to 18 months in advance, including re-financing.

18 The strength of the Council’s

debt pre-funding programme was again highlighted by the Council’s

independent Credit Rating Agency, S&P Global Ratings (S&P), during

their July 2021 review. This has resulted in the Council’s credit rating

remaining at AA for the following year.

19 S&P has noted that the

Council’s liquidity coverage remains exceptional but has revised their

outlook on the Council to negative from stable due to the Council’s large

spending plans in the 2021-2041 long-term plan.

20 The following chart presents the Council’s

debt maturity dates in relation to the financial year in which the debt was

issued. This demonstrates that since 2016/17, the Council has actively reduced

risk concentration by spreading debt maturity dates and debt maturity values.

2

21 Debt maturities must fall within

maturity compliance buckets. These maturity buckets are as follows:

|

Maturity Period

|

Minimum

|

Maximum

|

|

0 to 3 years

|

10%

|

70%

|

|

3 to 5 years

|

10%

|

60%

|

|

5 to 10 years

|

10%

|

50%

|

|

10 years plus

|

0%

|

20%

|

22 For the three months ended 31 December

2021, the Council has been fully compliant with its debt maturity limits, as

shown by the chart below. The upper limits, as shown by dashed lines, relate to

the bars of the same colour. For example, the 0 to 3 year upper limit of 70% is in blue. Actual maturities in the 03-year bucket are represented by the

blue bars. The Council has no long-term debt maturing in ten years’ time

or beyond.

Interest rate risk control limits

23 The Council issues all debt on a

floating rate basis and uses fixed interest rate swaps (hedges) to minimise

exposure at any one time to interest rate fluctuations. This ensures more

certainty of interest rate costs when setting our Annual Plan and Long Term

Plan budgets.

24 Without such hedging, the Council

would have difficulty absorbing adverse interest rate movements. A 1% increase

in interest rates on $250 million of external debt would equate to additional

interest expense of $2.5 million per annum. Conversely, fixing interest rates

does however reduce the Council’s ability to benefit from falling and/or

more favourable interest rate movements.

25 The objectives of any treasury

strategy are therefore to smooth out the effects of interest rate movements,

while being aware of the direction of the market, and to be able to respond

accordingly.

26 The Policy sets out the following

interest rate limits:

Major control

limit where the total notional amount of all

interest rate risk management instruments (i.e. interest rate swaps) must not

exceed the Council’s total actual debt, and;

Fixed/Floating

Risk Control limit, that specifies that at least

55% of the Council’s borrowings must be fixed, up to a maximum of 100%.

27 The Council has been fully

compliant for the three months ended 31 December 2021, as shown by the table

below.

28 Similar to debt

maturities, hedging instrument maturities must also fall within maturity

compliance buckets. These maturity compliance buckets are as follows:

|

Period

|

Minimum

|

Maximum

|

|

1 to 3 years

|

15%

|

60%

|

|

3 to 5 years

|

15%

|

60%

|

|

5 to 10 years

|

15%

|

60%

|

|

10 years plus

|

0%

|

20%

|

29 The Council has been fully

compliant for the three months ended 31 December 2021, as shown by the

following chart. Note that maturities falling within 1 year are not included.

Counterparty Credit Risk

30 The policy sets maximum limits on

transactions with counterparties. The purpose of this is to ensure the Council

does not concentrate its investments or risk management instruments with a

single party.

31 The policy sets the gross

counterparty limits as follows:

|

Counterparty/Issuer

|

Minimum Standard and Poor’s long

term

|

Investments maximum per counterparty

|

Risk management instruments maximum per

counterparty

|

Borrowing maximum per counterparty

|

|

NZ

Government

|

N/A

|

Unlimited

|

None

|

Unlimited

|

|

LGFA

|

AA-/A-1

|

$20m

|

None

|

Unlimited

|

|

NZ Registered

Bank

|

A+/A-1

|

60% of total investments or $25m; whichever is

greater

|

50% of total instruments or $80m; whichever is

greater

|

$50m

|

32 The Council was in full compliance with all

counterparty credit limits for the three months ended 31 December 2021.

The tables below show the Council’s investments and risk management

instruments holdings per counterparty for this period.

Term deposits

*Policy Limit: 60% of total investments or

$25 million; whichever is greater

Interest rate swaps

*Policy

Limit: 50% of total instruments or $80 million; whichever is greater

Specific Borrowing Limits

33 In managing debt, the Council is

required to adhere to the specific borrowing limits.

34 The Council fully complied with

these limits for the three months ended 31 December 2021 (or a period as

otherwise specified) and the results are shown below:

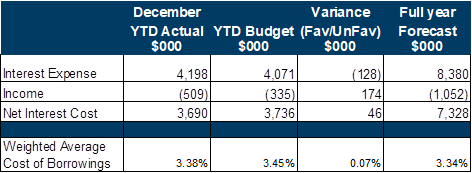

Risk Management Performance

35 The following table shows the

Council’s interest income and expense for the period ended

31 December 2021 together with the weighted average cost of borrowing

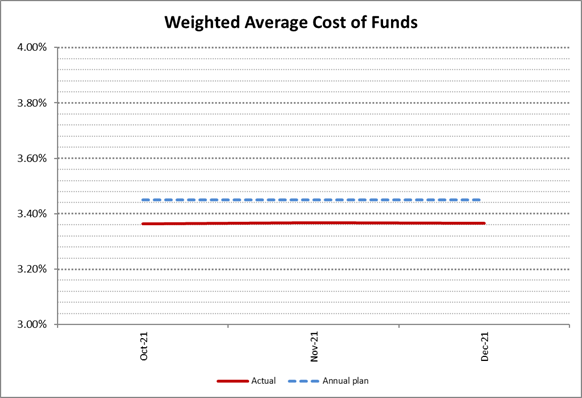

(WACB), compared to year-to-date budget and full year forecast.

36 The following graph shows the year

to date average cost of borrowings, for each month of the quarter.

He take | Issues

37 This report

has a low level of significance under the Council’s Significance and

Engagement Policy).

Ngā kōwhiringa | Options

38 There are

no options to be considered.

Tangata whenua

39 There are

no tāngata whenua considerations arising directly from this report.

Panonitanga āhuarangi | Climate change

40 There are

no climate change considerations within this report.

Ahumoni me ngā rawa | Financial and resourcing

41 There are

no financial and resourcing considerations in addition to those already noted

in this report.

Ture me ngā Tūraru | Legal and risk

42 There are

no legal and risk considerations arising from this report.

Ngā pānga ki ngā kaupapa here | Policy impact

43 There are

no policy considerations in addition to those already noted in this report.

Te whakawhiti kōrero me

te tūhono | Communications & engagement

Te mahere tūhono | Engagement planning

44 An

engagement plan is not required for this report.

Whakatairanga | Publicity

45 There are

no publicity considerations arising from this report.

Ngā

āpitihanga |

Attachments

Nil

8.6 Progress

Update regarding Audit Control Findings 2020/21

Kaituhi |

Author: Andrew

Gillespie, Risk Advisor

Kaiwhakamana

| Authoriser: Mark de Haast, Group Manager Corporate Services

Te pūtake | Purpose

1 This

report provides the Audit and Risk Subcommittee with a progress update regards

Ernst & Young’s (Audit) Report on Control Findings for the year ended

30 June 2021.

He whakarāpopoto | Executive summary

2 This

report does not exceed four pages therefore there is no requirement for an

Executive Summary.

Te tuku haepapa | Delegation

3 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section B.3.

· Reviewing

and maintaining the internal control framework.

· Obtaining

from external auditors any information relevant to the Council’s

financial statements and assessing whether appropriate action has been taken by

management in response to the above.

Taunakitanga | Recommendations

A. That

the Audit & Risk Sub-Committee notes:

A.1 the

progress update regarding Ernst & Young’s Report on Control Findings

for the year ended 30 June 2021, and

A.2 that

Ernst & Young will re-assess these as part of their audit for the year

ended 30 June 2022.

Tūāpapa | Background

4 In

accordance with New Zealand Auditing Standards, Audit performed a review of the

design and operating effectiveness of the Council’s significant financial

reporting processes as part of their audit for the year ended 30 June 2021.

5 Control

risk matters and/or issues are classified as high, moderate, or low. Control

risk definitions are as follows:

|

|

Ernst & Young – Risk Ranking System

|

|

High

|

Matters and/or issues considered to be fundamental to the

mitigation of material risk, maintenance of internal control or good

corporate governance. Action should be taken either immediately or within

three months.

|

|

Moderate

|

Matters and/or issues considered to be of major importance

to maintenance of internal control, good corporate governance, or best practice

for processes.

Action should normally be taken within six months.

|

|

Low

|

A weakness

which does not seriously detract from the internal control framework. If

required, action should be taken within 6 -12 months.

|

He kōrerorero | Discussion

6 Audit

identified six control risk issues in their Report on Control Findings for the year

ended 30 June 2021. One of the risk control issues was ranked as moderate and

five as low.

7 The

table below details the year-to-date progress against these control findings.

|

Risk Level

|

Control Findings year end 30 June 2021

|

As at March 2022

|

|

Status

|

Update

|

|

Moderate

|

2.1.1

|

Accuracy of response & resolution times

|

On track

l

|

· Work is underway

with the Digital Solutions team to simplify all data input fields in MagiQ to

ensure timely and accurate reporting against Council’s performance

measures.

|

|

Low

|

2.2.1

|

Approval of expenditure

|

On track

l

|

· Eight instances

were identified where an expense claim was authorised by a person who was not

one up from the person benefiting from the expenditure.

· Further investigation

has identified that the eight instances related to expense claims for (a) the

mayor or elected members, which were approved by the CE, or (b) the CE, which

were approved by the GM Corporate Services or, in two instances, the

Democracy Services Manager. These approvals are consistent with recent

council practice which are considered to be good practice, however management

accepts this should be clarified in council policy. This will be attended to

in the next revision of the Elected Member Expense and Remuneration Policy,

and the Delegations policy which is under development.

|

|

2.2.2

|

Purchase orders approved after receiving invoices

|

On track

l

|

· Four instances were identified where purchase orders were approved

after invoices were received. Management accepts that it is best practice for

purchase orders to be approved prior to work being commissioned and invoices

received. This will be reiterated to the budget managers involved with the

four identified exceptions.

|

|

2.2.3

|

Missing job sheet for water request for service

|

On track

l

|

· EY are engaging

an internal IT specialist to determine the best way that they can approach

testing service requests at year end, which would include assessing the IT general

control environment.

|

|

2.3.4

|

Transition to maintenance of records electronically

|

On track

l

|

· This Control

Finding relates to both SSP documentation and Payroll documentation that was

unable to be supplied to EY while we were in a Covid-19 lockdown last year.

· With regards to

the SSP documentation, the use of MagiQ ensures that this information is

captured electronically and has been clarified with EY.

· We are still

looking into solutions for the Payroll documentation and will bring a further

update to the Subcommittee in the next coming months.

|

|

2.3.5

|

Signed contract not available

|

On track

l

|

· A procurement

technology roadmap has been developed, and a contract has been signed with an

implementation partner. The implementation of the internally-facing

Procurement Hub and the organisation-wide contracts register are included in

the deliverables.

· Staff are

provided with continuing advice and training to lift procurement capability.

|

8 In

keeping with standard practice, Audit will consider whether these control

findings can be closed-out, as part of their audit for the year ended 30 June

2022.

He take |

Issues

9 There are

no issues to be raised in this report.

Ngā kōwhiringa | Options

10 There

are no options to be raised in this report.

Tangata whenua

11 There are no

tāngata whenua considerations arising from this report.

Panonitanga āhuarangi | Climate change

There

are no Climate Change issues arising from this report. Ahumoni me ngā rawa | Financial

and resourcing

13 Financial

considerations have been covered as part of this report.

Ture me ngā Tūraru | Legal

and risk

14 There

are no legal considerations arising from this report.

Ngā pānga ki ngā kaupapa here | Policy impact

15 There

are no policy implications arising from this report.

Te whakawhiti kōrero me te

tūhono | Communications &

engagement

Te mahere tūhono | Engagement

planning

16 This matter has a low

level of significance under the Council’s Significance and Engagement

Policy.

Whakatairanga |

Publicity

17 There are no publicity

considerations.

Ngā

āpitihanga | Attachments

Nil

9 Confirmation

of Minutes

9.1 Confirmation

of Minutes

Author: Jayne

Nock, Executive Secretary to Group Manager Corporate Services

Authoriser: Mark

de Haast, Group Manager Corporate Services

|

Recommendations

That the minutes of the Audit

and Risk Subcommittee meeting on 2 November 2021 be accepted as a true and

accurate record of the meeting

|

Appendices

1. Draft

Minutes of the Audit and Risk Sub-Committee of 2 November 2021 ⇩

|

Audit and Risk

Sub-committee Meeting Agenda

|

3 March 2022

|

11 Public

Excluded Reports

Resolution

to Exclude the Public

|

PUBLIC EXCLUDED ReSOLUtion

That, pursuant to Section 48 of the Local Government

Official Information and Meetings Act 1987, the public now be excluded from

the meeting for the reasons given below, while the following matters are

considered.

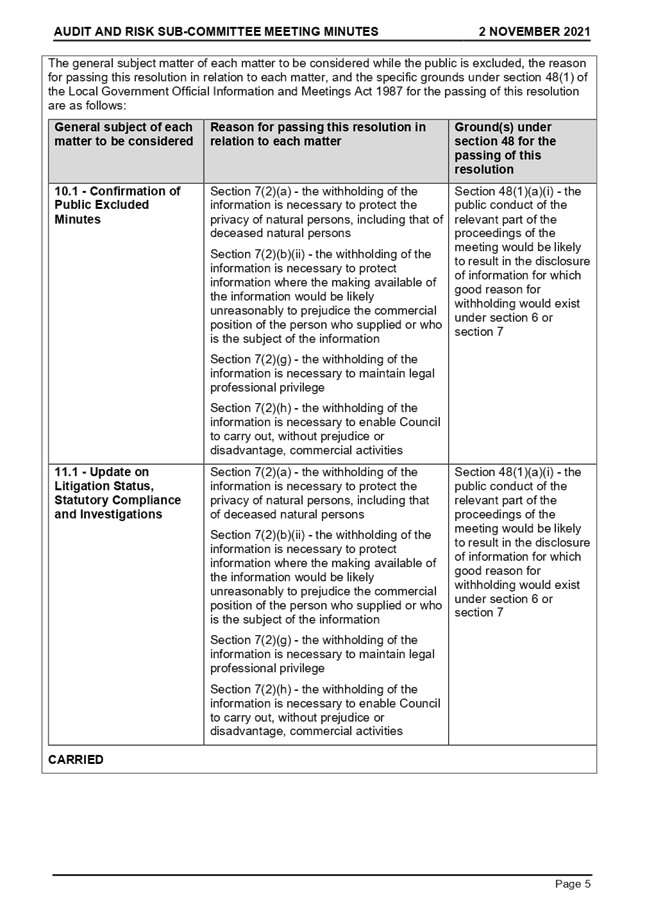

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each

matter to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section 48 for

the passing of this resolution

|

|

10.1 - Confirmation of Public Excluded Minutes

|

Section 7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

Section 7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

Section 7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

Section 7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

Section 48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

11.1 - Update on Litigation Status, Statutory

Compliance Issues and Investigations

|

Section 7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

Section 7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the information

would be likely unreasonably to prejudice the commercial position of the

person who supplied or who is the subject of the information

Section 7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

Section 48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|