|

|

|

AGENDA

Audit and Risk Sub-committee Meeting

|

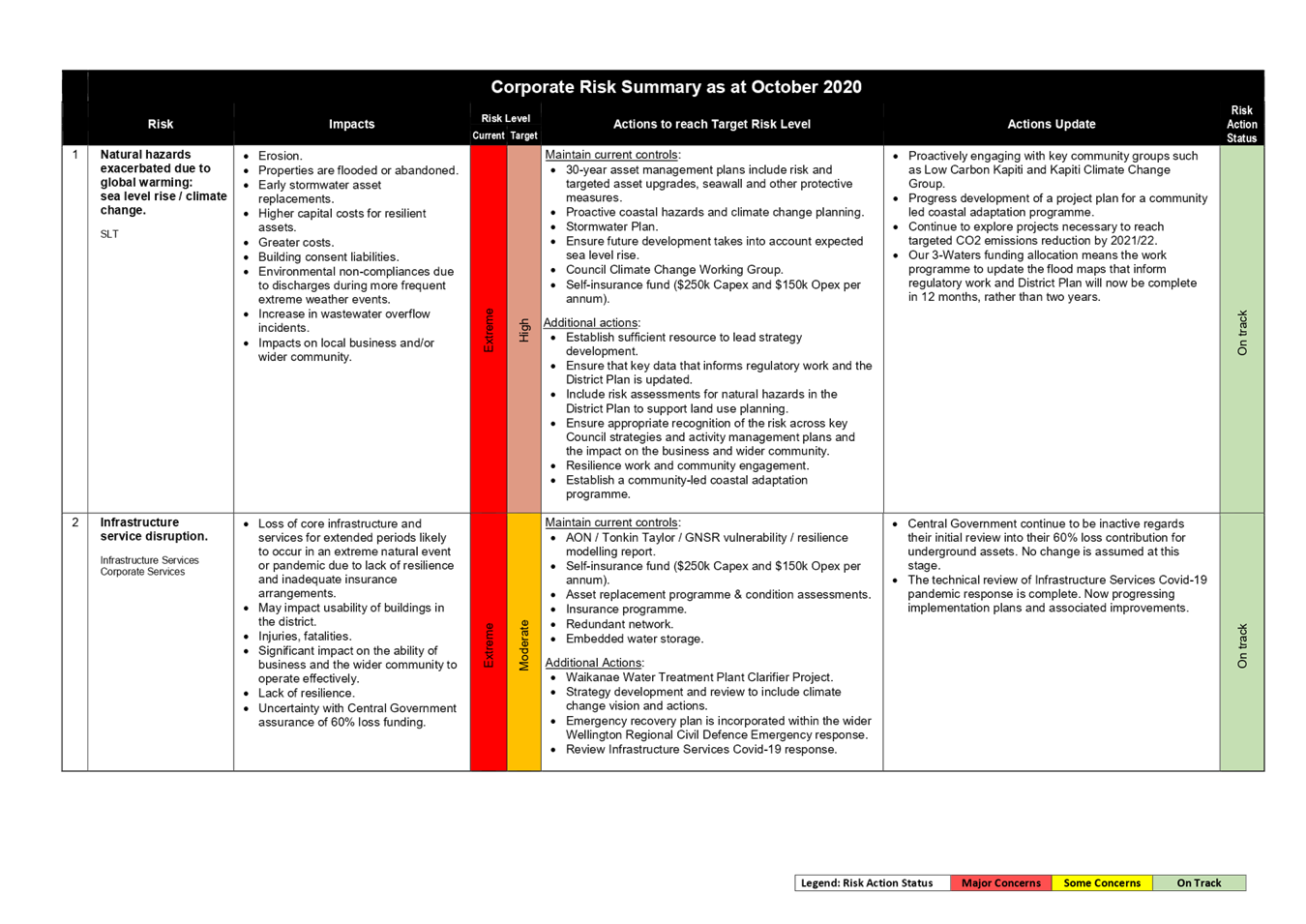

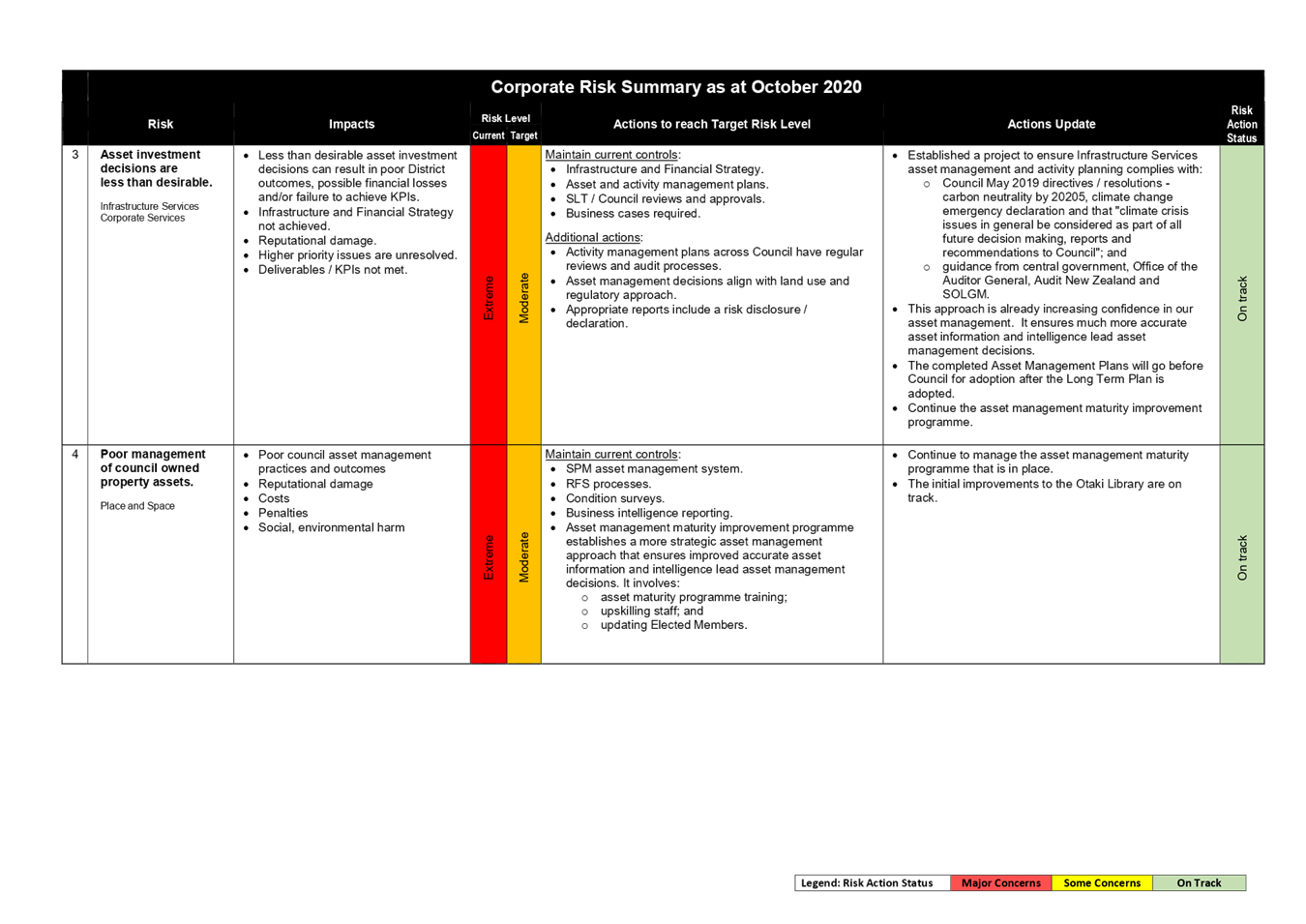

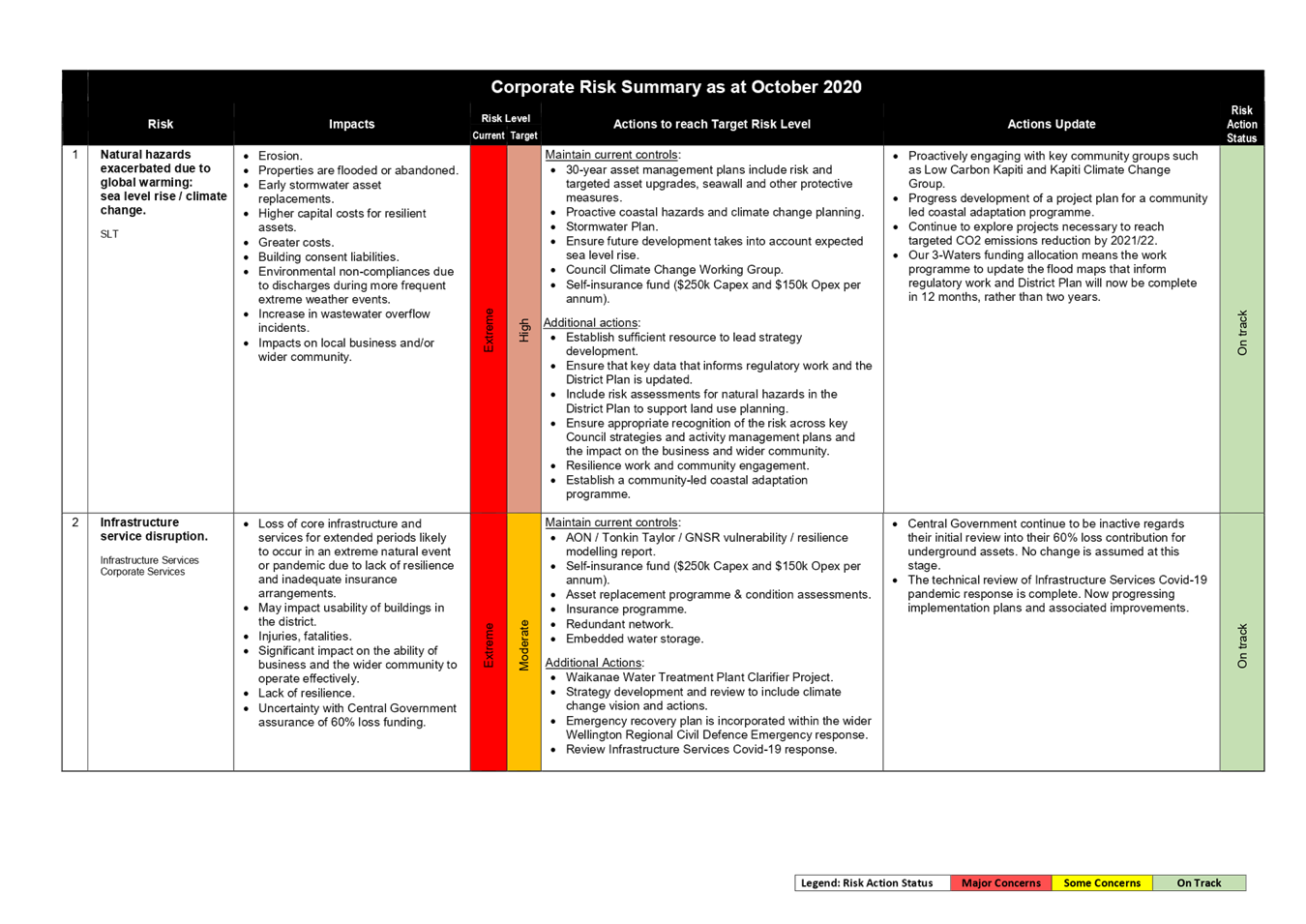

|

I hereby give notice that a Meeting of the Audit and Risk Subcommittee will be held on:

|

|

Date:

|

Thursday, 12 November

2020

|

|

Time:

|

1.30pm

|

|

Location:

|

Council Chamber

Ground Floor, 175 Rimu Road

Paraparaumu

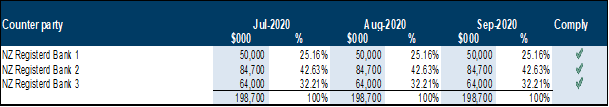

|

|

Mark de Haast

Group Manager Corporate

Services

|

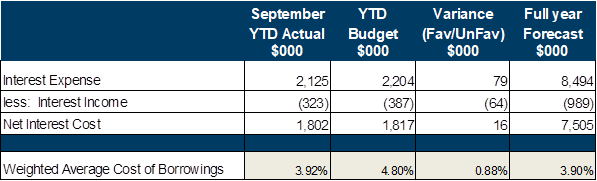

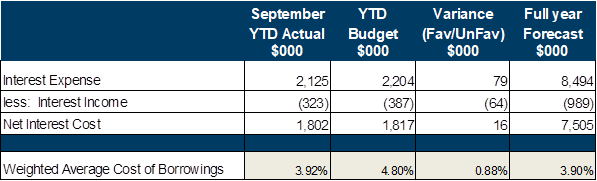

|

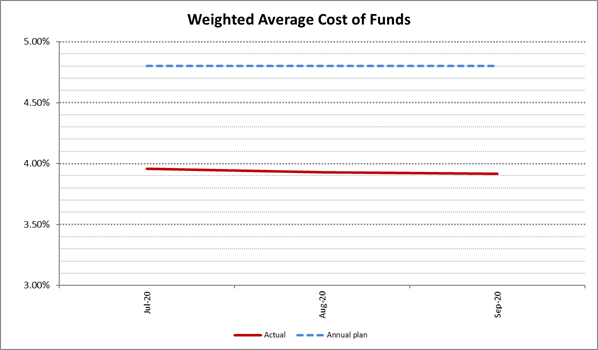

Audit

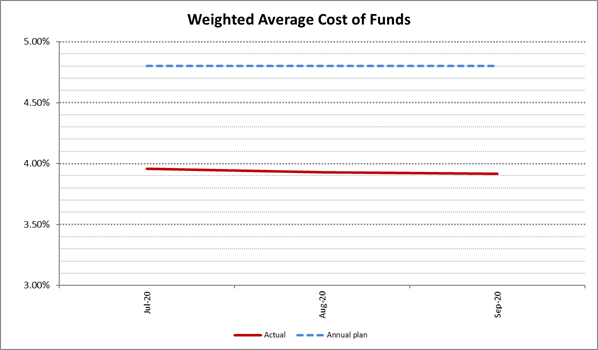

and Risk Sub-committee Meeting Agenda

|

12 November 2020

|

Kapiti Coast District Council

Notice

is hereby given that a meeting of the Audit and Risk Subcommittee will

be held in the Council Chamber,

Ground Floor, 175 Rimu Road, Paraparaumu, on Thursday 12 November 2020, 1.30pm.

Audit and Risk Subcommittee

Members

|

Mr Bryan Jackson

|

Chair

|

|

Cr Angela Buswell

|

Deputy

|

|

Mayor K Gurunathan

|

Member

|

|

Deputy Mayor Janet Holborow

|

Member

|

|

Cr Gwynn Compton

|

Member

|

|

Mr Gary Simpson

|

Independent

|

2 Council

Blessing

“As we deliberate on the

issues before us, we trust that we will reflect positively on the

communities we serve. Let us all seek to be effective and just, so that with

courage, vision and energy, we provide positive leadership in a spirit of

harmony and compassion.”

I a mātou e whiriwhiri ana

i ngā take kei mua i ō mātou aroaro, e pono ana mātou ka

kaha tonu ki te whakapau mahara huapai mō ngā hapori e mahi nei

mātou. Me kaha hoki mātou katoa kia whaihua, kia tōtika

tā mātou mahi, ā, mā te māia, te tiro whakamua me te

hihiri ka taea te arahi i roto i te kotahitanga me te aroha.

3 Apologies

4 Declarations

of Interest Relating to Items on the Agenda

Notification from Elected

Members of:

4.1 – any interests that

may create a conflict with their role as an elected member relating to the

items of business for this meeting, and

4.2 – any interests in

items in which they have a direct or indirect pecuniary interest as provided

for in the Local Authorities (Members’ Interests) Act 1968

5 Public

Speaking Time for Items Relating to the Agenda

6 Members’

Business

(a)

Public Speaking Time Responses

(b)

Leave of Absence

(c)

Matters of an Urgent Nature (advice to be provided to the Chair prior to

the commencement of the meeting)

7 Updates

Nil

8 Reports

8.1 Quarterly

Treasury Compliance Report

Author: Anelise

Horn, Manager Financial Accounting

Authoriser: Mark

de Haast, Group Manager Corporate Services

Purpose of Report

1 This

report provides confirmation to the Audit and Risk Subcommittee of the

Council’s compliance with its Treasury Management Policy (Policy) for the

three months ended 30 September 2020.

Delegation

2 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

Ensuring that

the Council has in place a current and comprehensive risk management framework

and making recommendations to the Council on risk mitigation.

Background

3 The

Policy sets out a framework for the Council to manage its borrowing and

investment activities in accordance with the Council’s objectives and

incorporates legislative requirements.

4 The

Policy mandates regular treasury reporting to management and the Strategy and

Operations Committee, as well as quarterly compliance reporting to the Audit

and Risk Subcommittee.

5 In

order to assess the effectiveness of the Council’s treasury management

activities and compliance to the Policy, certain performance measures and

parameters have been prescribed. These are:

· cash/debt

position;

· liquidity/funding

control limits;

· interest

rate risk control limits;

· counterparty

credit risk;

· specific

borrowing limits; and

· risk

management performance.

discussion

Cash/Debt Position

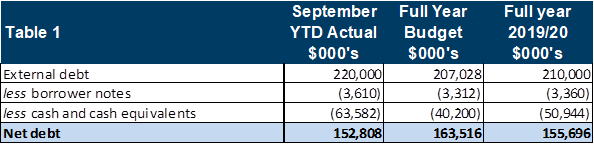

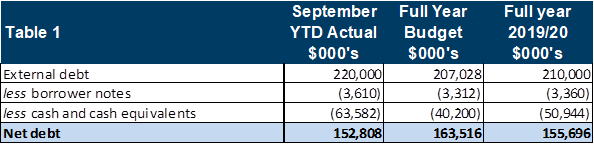

6 Table

1 below shows the Council’s net debt position as at 30 September 2020 against

the 2020/21 full year budget and the prior year closing balance.

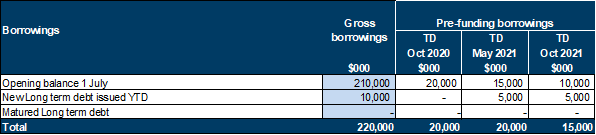

7 During

the past three months, the Council has issued $10 million of new debt.

8 $10

million was issued to pre-fund $5 million of the May 2021 and $5 million of the

October 2021 debt maturities. As part of the Council’s prefunding

programme, all prefunding is placed on term deposit, at the most favourable

market rates available at that time.

9 The

table below shows (a) the movement in the Council’s external debt balance

and (b) the movement in the Council’s pre-funding programme by debt

maturity, for the three months ended 30 September 2020.

10 As

at 30 September 2020 the Council had $67.2 million of cash, borrower notes and

term deposits on hand. This is broken down as follows:

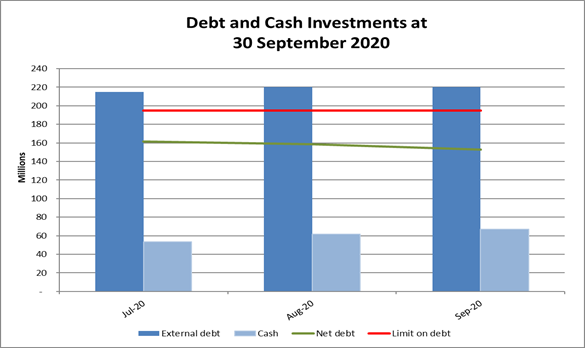

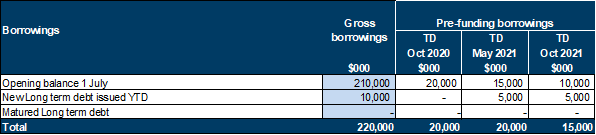

11 For

the three months ended 30 September 2020, the Council has not breached its net

debt upper limit, as shown in the chart below:

12 The

Council is however targeting through its financial strategy, to keep net

borrowings below 200% of total operating income. At 30 September 2020, the

Council’s net borrowings are forecast to be 182.8% of total operating

income at the 30 June 2021.

Liquidity/Funding control limits

13 Liquidity

and funding management focuses on reducing the concentration of risk at any

point so that the overall borrowings cost is not increased unnecessarily and/or

the desired maturity profile is not compromised due to market conditions. This

risk is managed by spreading and smoothing debt maturities and establishing

maturity compliance buckets.

14 Since

October 2015 the Council’s treasury strategy has included a debt

pre-funding programme. The Policy allows pre-funding of the Council debt

maturities up to 18 months in advance, including re-financing. Market

conditions have been favourable for this approach, where the Council draws down

debt early and is able to invest the funds on term deposit for a positive net

return.

15 The

strength of the Council’s debt pre-funding programme was again

highlighted by the Council’s independent Credit Rating Agency, Standard

& Poor’s (S&P), during their July 2020 review. This has resulted

in the Council’s credit rating remaining at AA with a stable outlook for

the following year. S&P noted that the Council’s liquidity coverage

remains exceptional.

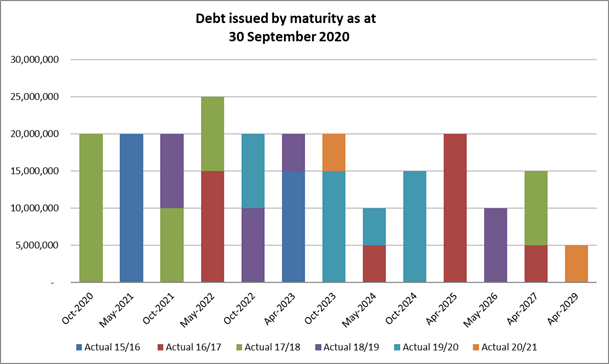

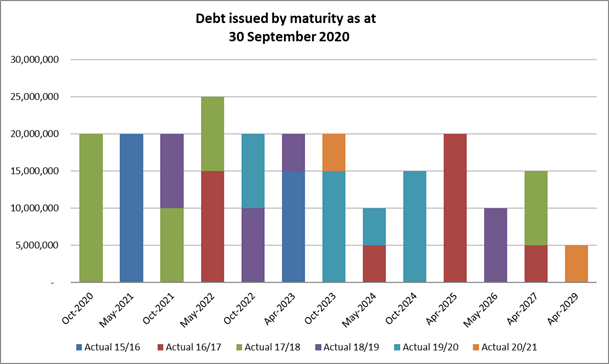

16 The

following chart presents the Council’s debt maturity dates in relation to

the financial year in which the debt was issued. This demonstrates that since

2016/17, the Council has actively reduced risk concentration by spreading debt

maturity dates and debt maturity values.

17 Debt

maturities must fall within maturity compliance buckets. These maturity buckets

are as follows:

|

Maturity Period

|

Minimum

|

Maximum

|

|

0 to 3 years

|

10%

|

70%

|

|

3 to 5 years

|

10%

|

60%

|

|

5 to 10 years

|

10%

|

50%

|

|

10 years plus

|

0%

|

20%

|

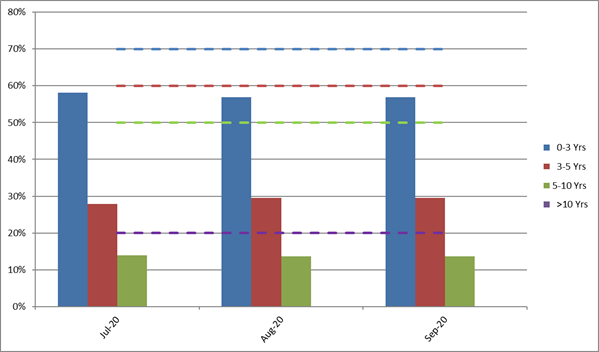

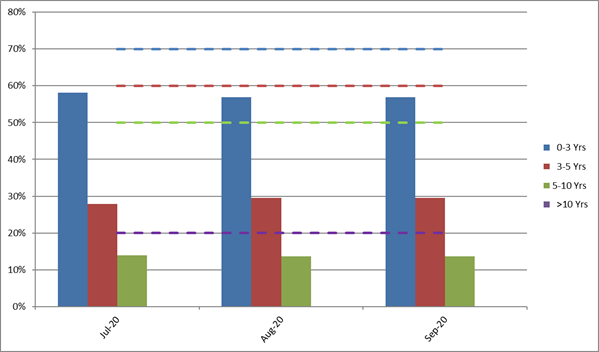

18 For

the three months ended 30 September 2020, the Council has been fully compliant

with its debt maturity limits, as shown by the chart below. The upper limits,

as shown by dashed lines, relate to the bars of the same colour. For example,

the 0 to 3 year upper limit of 70% is in blue. Actual maturities in the 03 year

bucket are represented by the blue bars. The Council has no long term debt

maturing in ten years’ time or beyond.

Interest rate risk control limits

19 The

Council issues all debt on a floating rate basis, as lower interest rates are

realised this way, and uses fixed interest rate swaps (hedges) to minimise

exposure at any one time to interest rate fluctuations. This ensures more

certainty of interest rate costs when setting our Annual Plan and Long Term

Plan budgets.

20 Without

such hedging, the Council would have difficulty absorbing adverse interest rate

movements. A 1% increase in interest rates on $220 million of external debt

would equate to additional interest expense of $2.2 million per annum.

Conversely, fixing interest rates does however reduce the Council’s

ability to benefit from falling and/or more favourable interest rate movements.

21 The

objectives of any treasury strategy are therefore to smooth out the effects of

interest rate movements, while being aware of the direction of the market, and

to be able to respond accordingly.

22 The

Policy sets out the following interest rate limits:

Major control limit where

the total notional amount of all interest rate risk management instruments

(i.e. interest rate swaps) must not exceed the Council’s total actual

debt, and;

Fixed/Floating Risk Control

limit, that specifies that at least 55% of the Council’s borrowings

must be fixed, up to a maximum of 100%.

23 The

Council has been fully compliant for the three months ended 30 September 2020,

as shown by the table below.

|

$000’s

|

Jul-20

|

Aug-20

|

Sep-20

|

|

External

Debt (floating rate)

|

215,000

|

220,000

|

220,000

|

|

Swaps (fixed

portion)

|

198,700

|

198,700

|

198,700

|

|

Fixed %

|

92.4%

|

90.3%

|

90.3%

|

|

Unfixed

debt

|

16,300

|

21,300

|

21,300

|

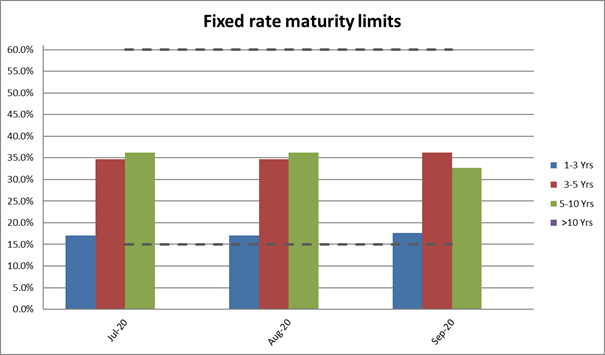

24 Similar to debt maturities, hedging

instrument maturities must also fall within maturity compliance buckets.

These maturity compliance buckets are as follows:

|

Period

|

Minimum

|

Maximum

|

|

1 to 3 years

|

15%

|

60%

|

|

3 to 5 years

|

15%

|

60%

|

|

5 to 10 years

|

15%

|

60%

|

|

10 years plus

|

0%

|

20%

|

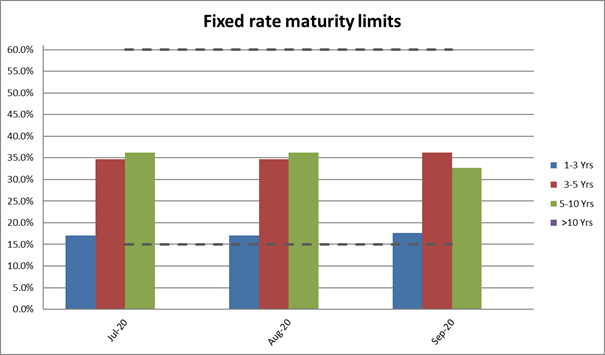

25 The

Council has been fully compliant for the three months ended 30 June 2020, as

shown by the following chart. Note that maturities falling within 1 year are

not included.

Counterparty Credit Risk

26 The

policy sets maximum limits on transactions with counterparties. The purpose of

this is to ensure the Council does not concentrate its investments or risk

management instruments with a single party.

27 The

policy sets the gross counterparty limits as follows:

|

Counterparty/Issuer

|

Minimum Standard and

Poor’s long term

|

Investments maximum per

counterparty

|

Risk management

instruments maximum per counterparty

|

Borrowing maximum per

counterparty

|

|

NZ Government

|

N/A

|

Unlimited

|

None

|

Unlimited

|

|

LGFA

|

AA-/A-1

|

$20m

|

None

|

Unlimited

|

|

NZ Registered Bank

|

A+/A-1

|

60% of total investments or

$25m; whichever is greater

|

50% of total instruments or

$80m; whichever is greater

|

$50m

|

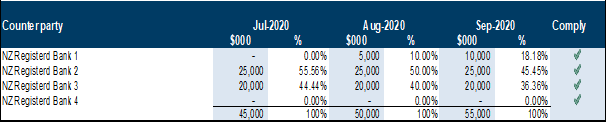

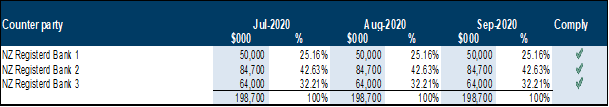

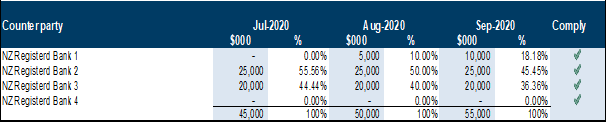

28 The

Council was in full compliance with all counterparty credit limits for the

three months ended 30 September 2020. The tables below show the

Council’s investments and risk management instruments holdings per

counterparty for this period.

Term

deposits

*Policy Limit: 60% of total investments or $25 million;

whichever is greater

Interest

rate swaps

*Policy

Limit: 50% of total instruments or $80 million; whichever is greater

Specific Borrowing Limits

29 In

managing debt, the Council is required to adhere to the specific borrowing

limits. The Net External debt/Total operating Income limit was updated during the

Policy review in August 2020 to align with the new interim LGFA borrowing

covenants in response to COVID-19.

30 Excluding

economic stimulus initiatives driven by central government, the Council remains

committed to complying with its financial strategy limit of not exceeding 200%

of total operating income for 2020/21.

31 The

Council fully complied with these limits for the 3 months ended 30 September

2020 (or a period as otherwise specified) and the results are shown below:

|

Borrowing limit

|

Policy limit

|

2020/21

|

|

Net interest expense/Total Operating Income

|

<20%

|

8.15%

|

|

Liquidity

((total debt + total committed

facilities + cash on hand) total debt)

|

>110%

|

137.99%

|

|

Net External Debt/Total Forecast Operating Income

|

<300%

|

182.80%

|

Risk Management Performance

32 The

following table shows the Council’s interest income and expense for the

three months ended 30 September 2020 together with the weighted average cost of

borrowing (WACB), compared to year to date budget and full year forecast.

33 The

Council has been effective in its treasury management with its weighted average

cost of funds being 0.88% lower than planned as at the 30 September 2020.

34 The

following graph shows the cost of borrowing each month.

Considerations

Policy

considerations

35 There

are no policy considerations in addition to those already noted in this

report.

Legal

considerations

36 There

are no legal considerations arising from this report.

Financial

considerations

37 There

are no financial considerations in addition to those already noted in this

report.

Tāngata

whenua considerations

38 There

are no tāngata whenua considerations arising directly from this

report.

Significance and Engagement

Significance

policy

39 This

matter has a low level of significance under the Council’s Significance

and Engagement Policy.

Publicity

40 There

are no publicity considerations arising from this report.

|

Recommendations

41 That

the Audit and Risk Subcommittee notes the Council’s full compliance

with its Treasury Management Policy for the three months ended 30 September

2020.

|

Appendices

Nil

8.2 Risk

Management - Business Assurance Update

Author: Sharon

Foss, Business Improvement Manager

Authoriser: Mark

de Haast, Group Manager Corporate Services

Purpose of Report

1 This

report updates the Audit and Risk Subcommittee on the on-going implementation

of the Enterprise Risk Management (ERM) framework.

Delegation

2 The

Audit and Risk Subcommittee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1.

Ensuring that Council has in

place a current and comprehensive risk management framework and making

recommendations to the Council on risk mitigation.

Background

3 The

key elements of the Enterprise Risk Management Framework include:

· risk

management;

· corporate

business continuity management;

· procurement

improvement programme; and

· business

risk and assurance.

4 The

key work streams within this area are:

· regularly

discuss risks with staff and managers and embed the day-to-day management of

risks in work streams such as: projects, activity delivery, and asset management;

· communicate

and report risk up to Council/Committees;

· have

a Business Continuity Management System for effective response to a range of

potential business disruptions;

· provide

fraud awareness training;

· provide

business assurance oversight and complete business assurance work; and

· improve

the understanding and tools to support good procurement practices.

5 Risk

is defined as the effect of uncertainty on expected results and is managed on a

continual basis. The intended outcomes from performing this risk

management programme well will assure:

· stakeholders,

external auditors, the Council and management that the real risks are being

identified and managed effectively. Risks can be negative or positive:

o a negative risk is a

threat and/or potential problem. It creates concern or uncertainty around our

delivery of overall programmes, projects, strategies, or other expectations

that can result in major health and safety, financial, fraud, operational and

reputational impacts. Identifying negative risks before they occur means

that we can take measures to mitigate or remove the threat, so that it does not

materialise.

o a positive risk is an

opportunity which has a positive impact on our objectives. When these are

identified the appropriate action is to make use of the opportunity and leverage

them to cause them to occur. For example, ensuring that everything is

looked at and actions are put in place to make risks as small as possible might

highlight the value of using new technology to increase quality assurance and

improve service delivery.

· better

decision making throughout the business through greater awareness of the real

risks and how these are going to be addressed; and

· clarification

and socialisation of the Council’s risk appetite and tolerance.

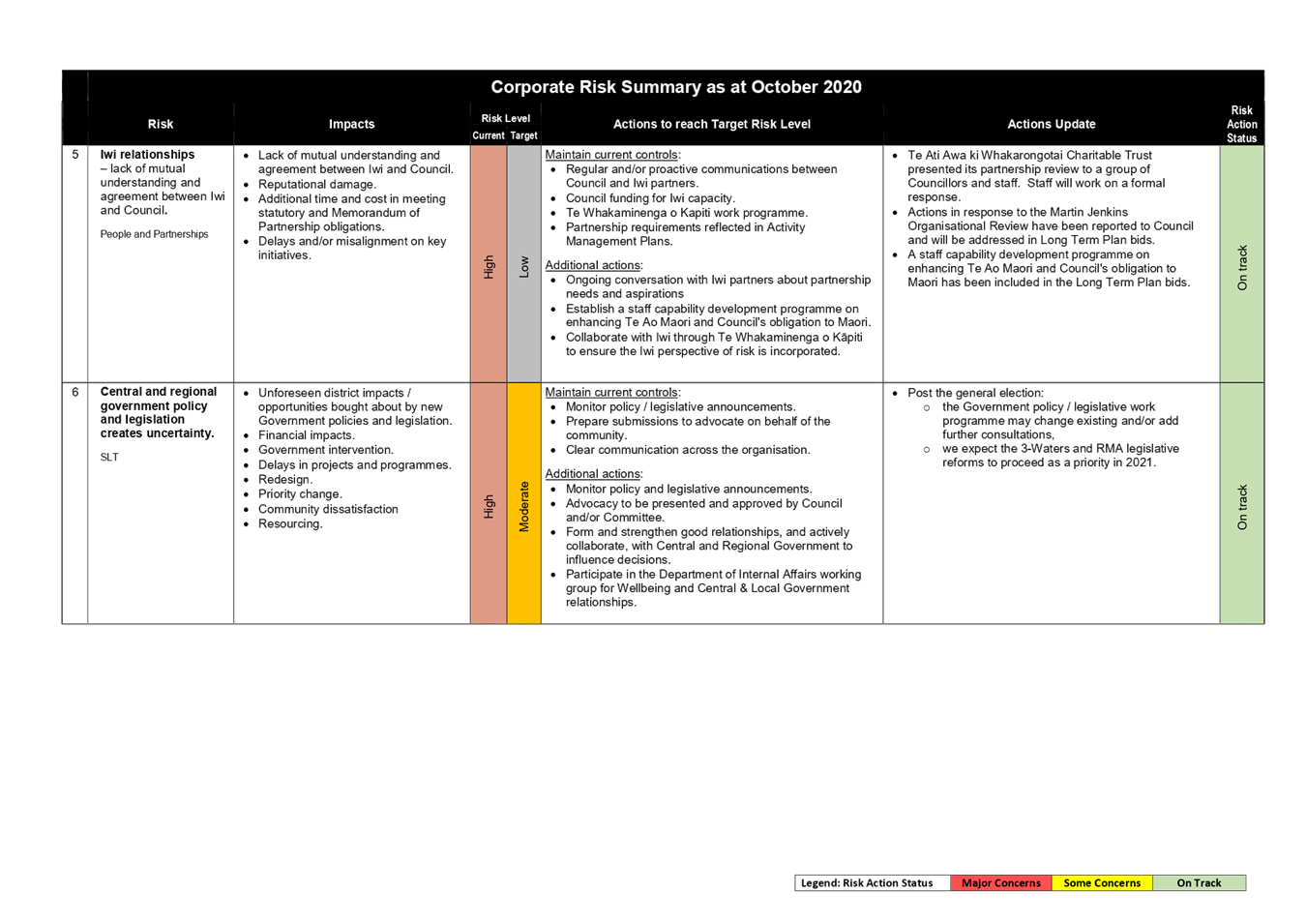

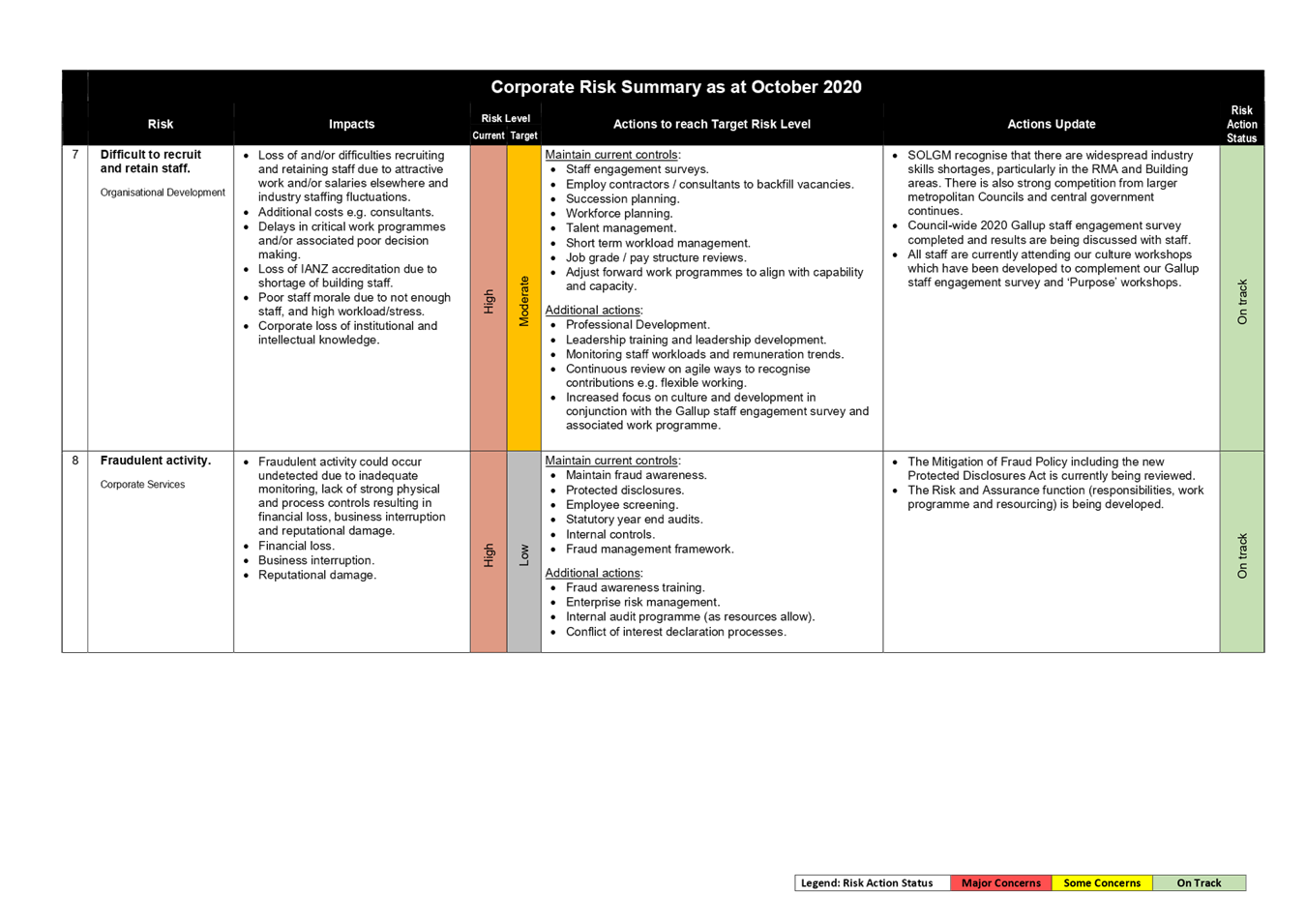

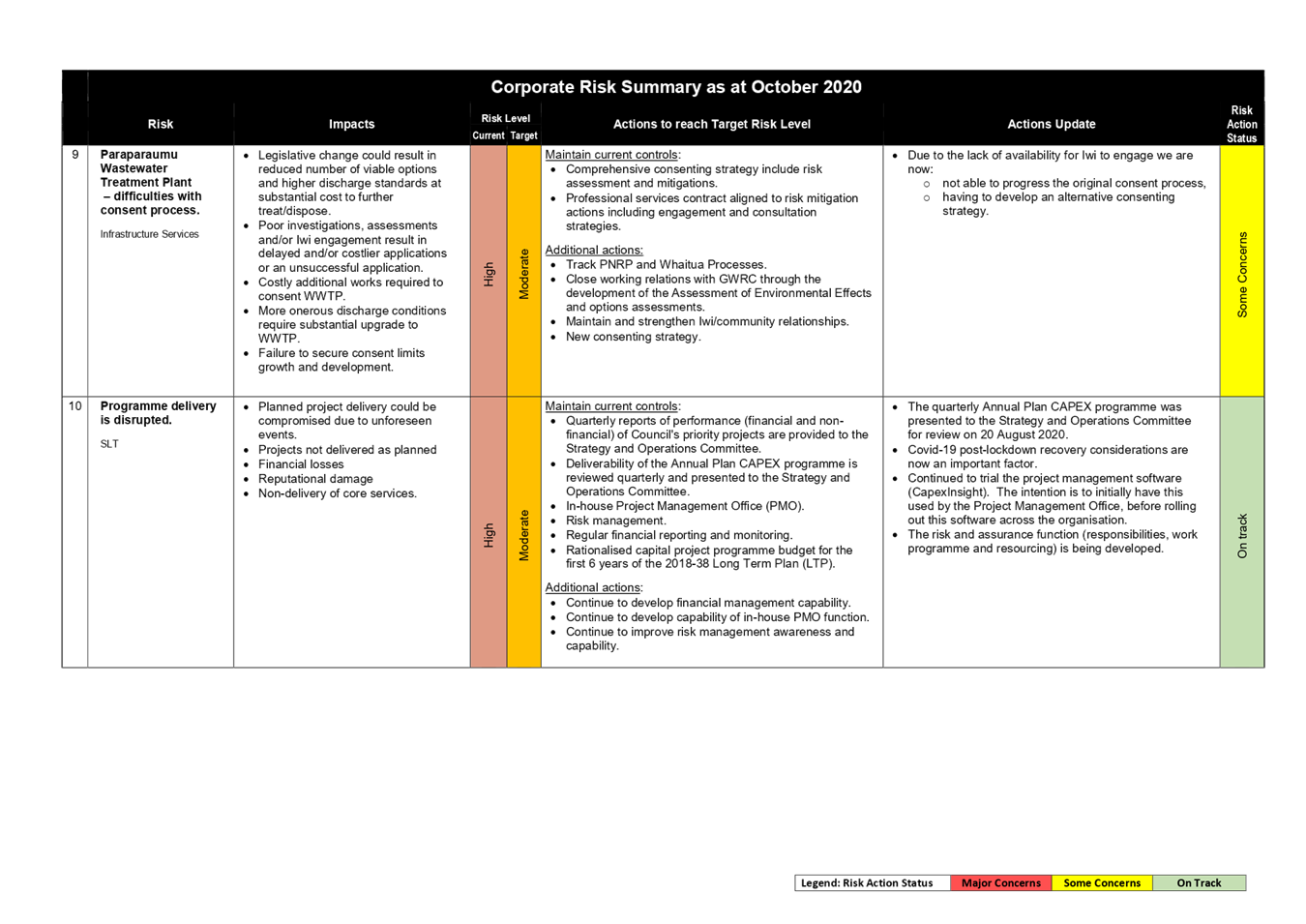

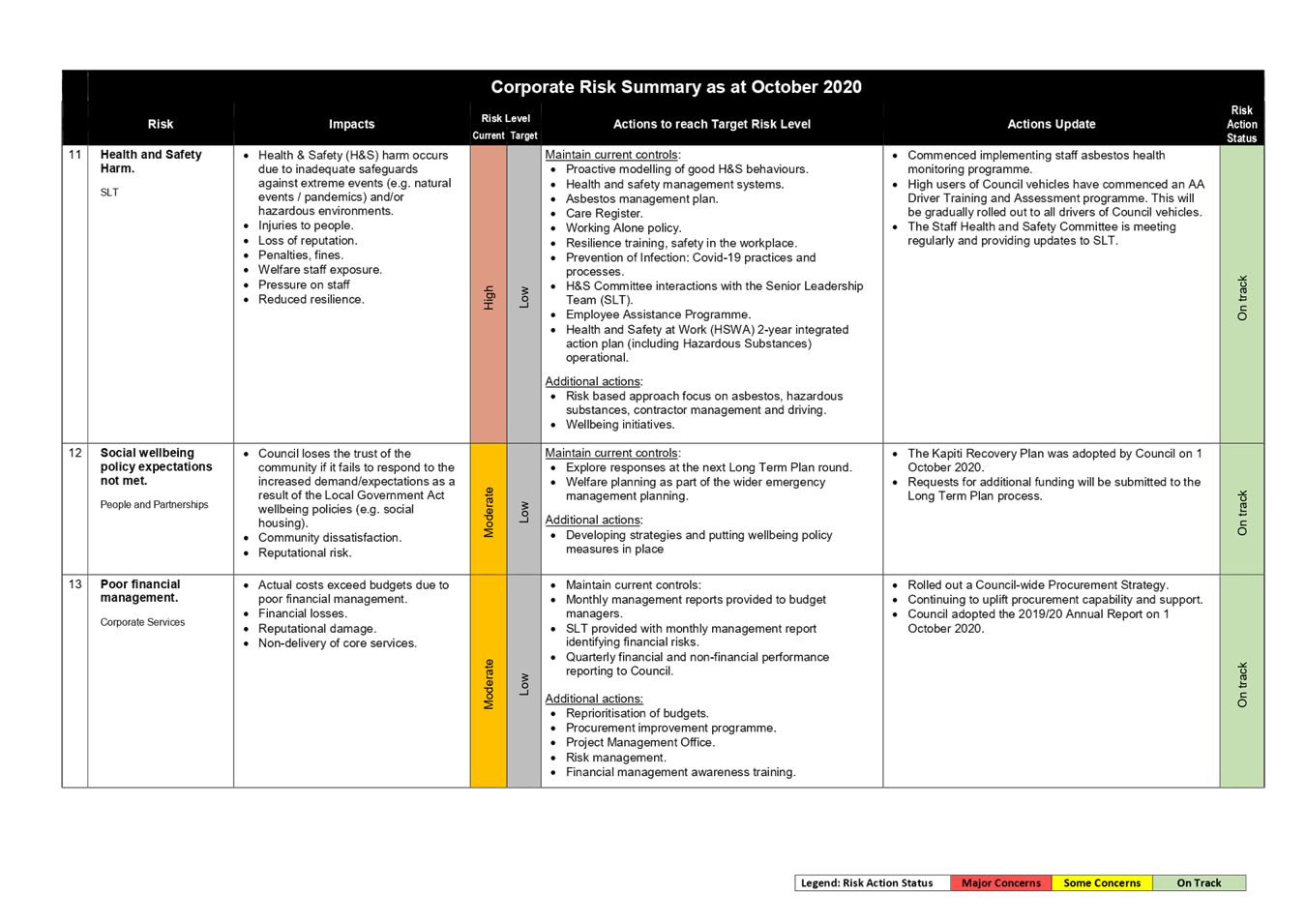

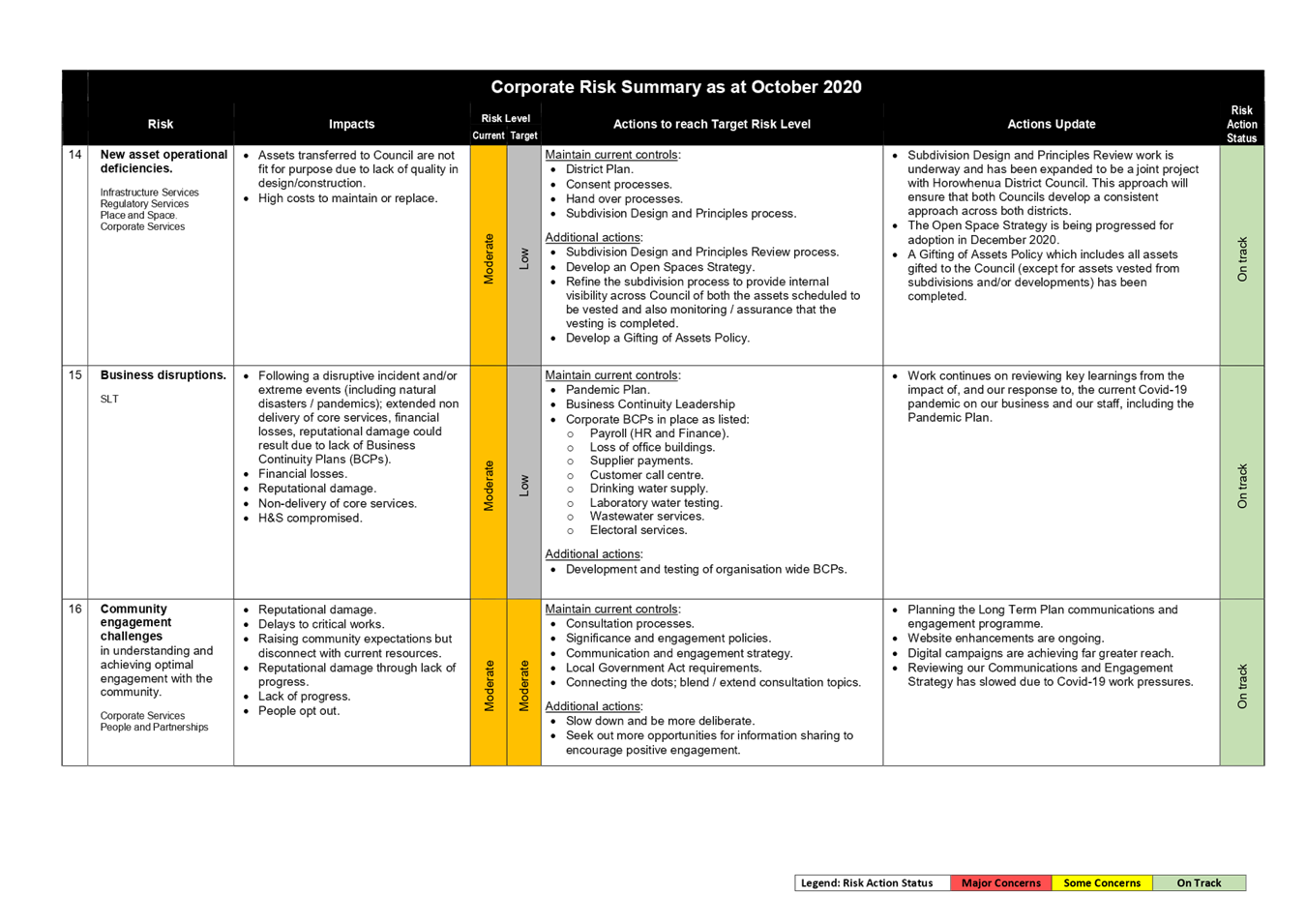

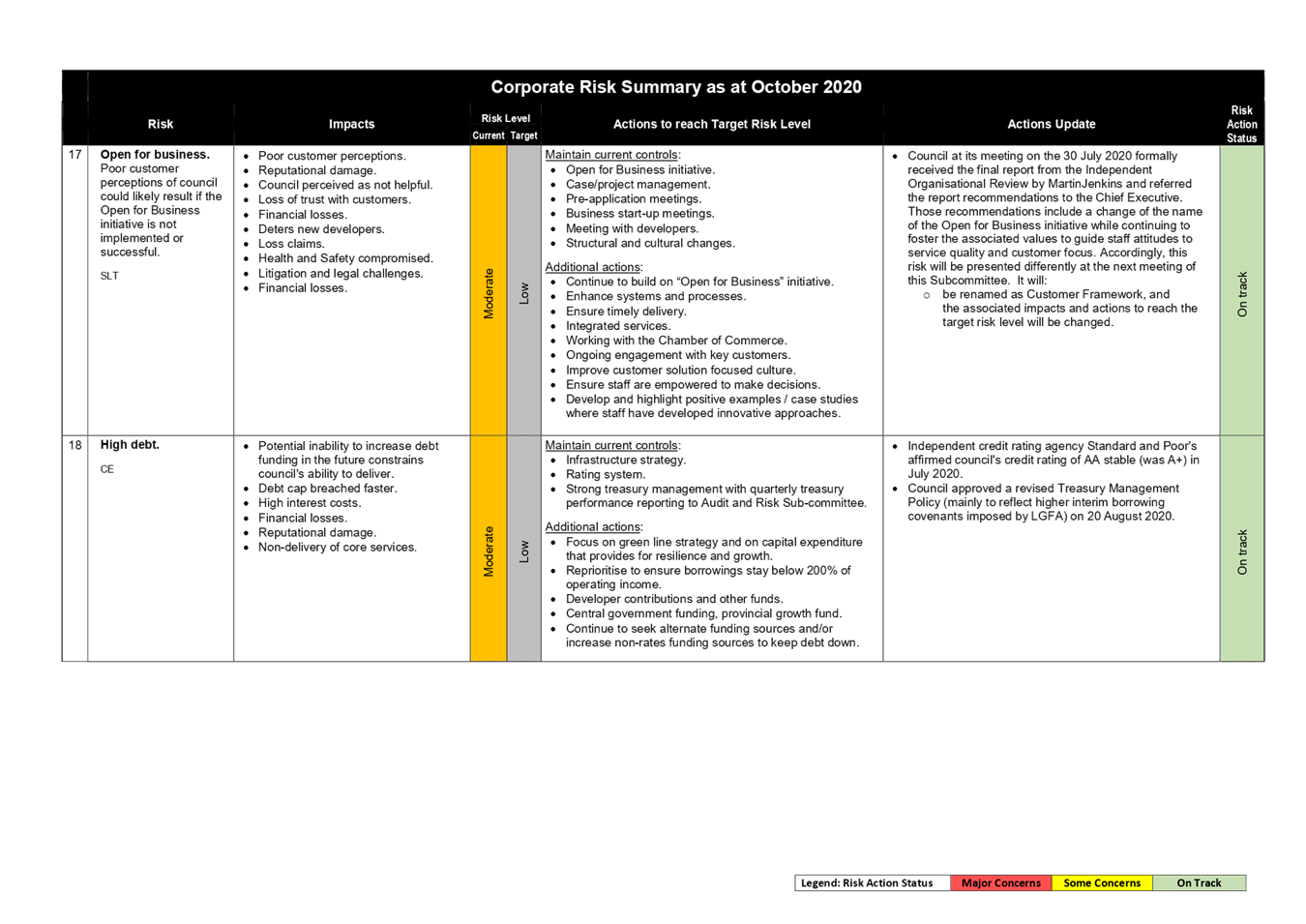

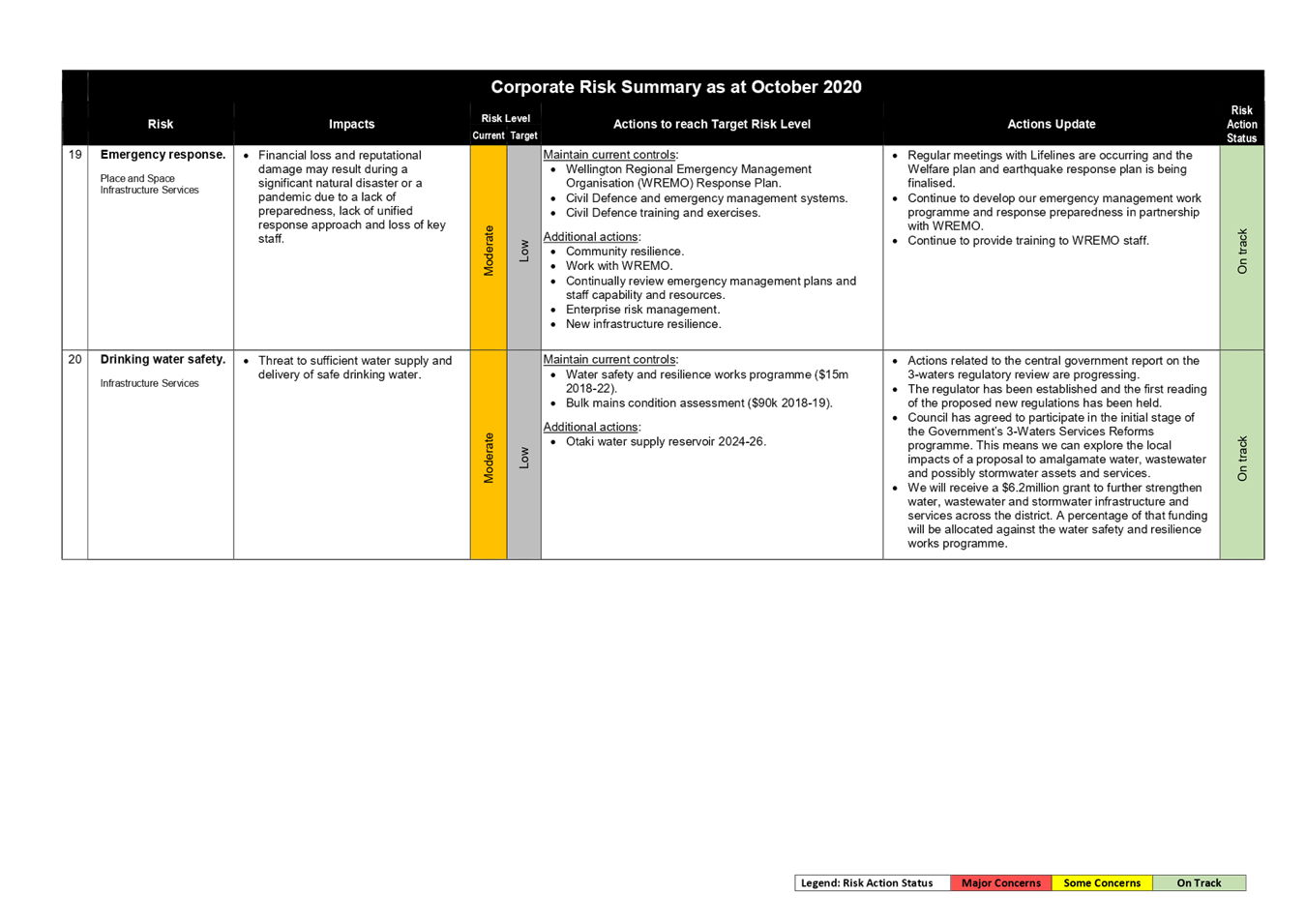

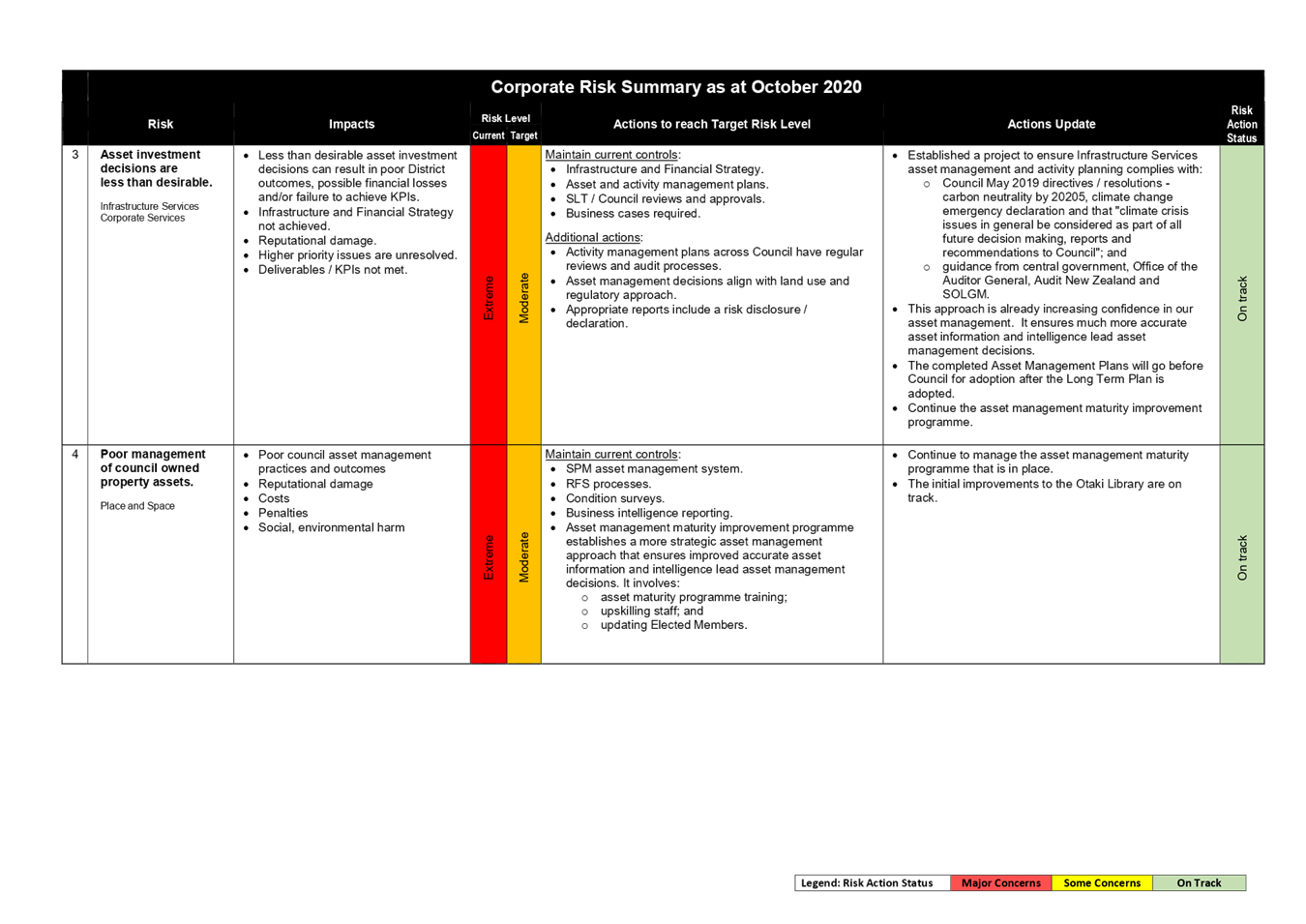

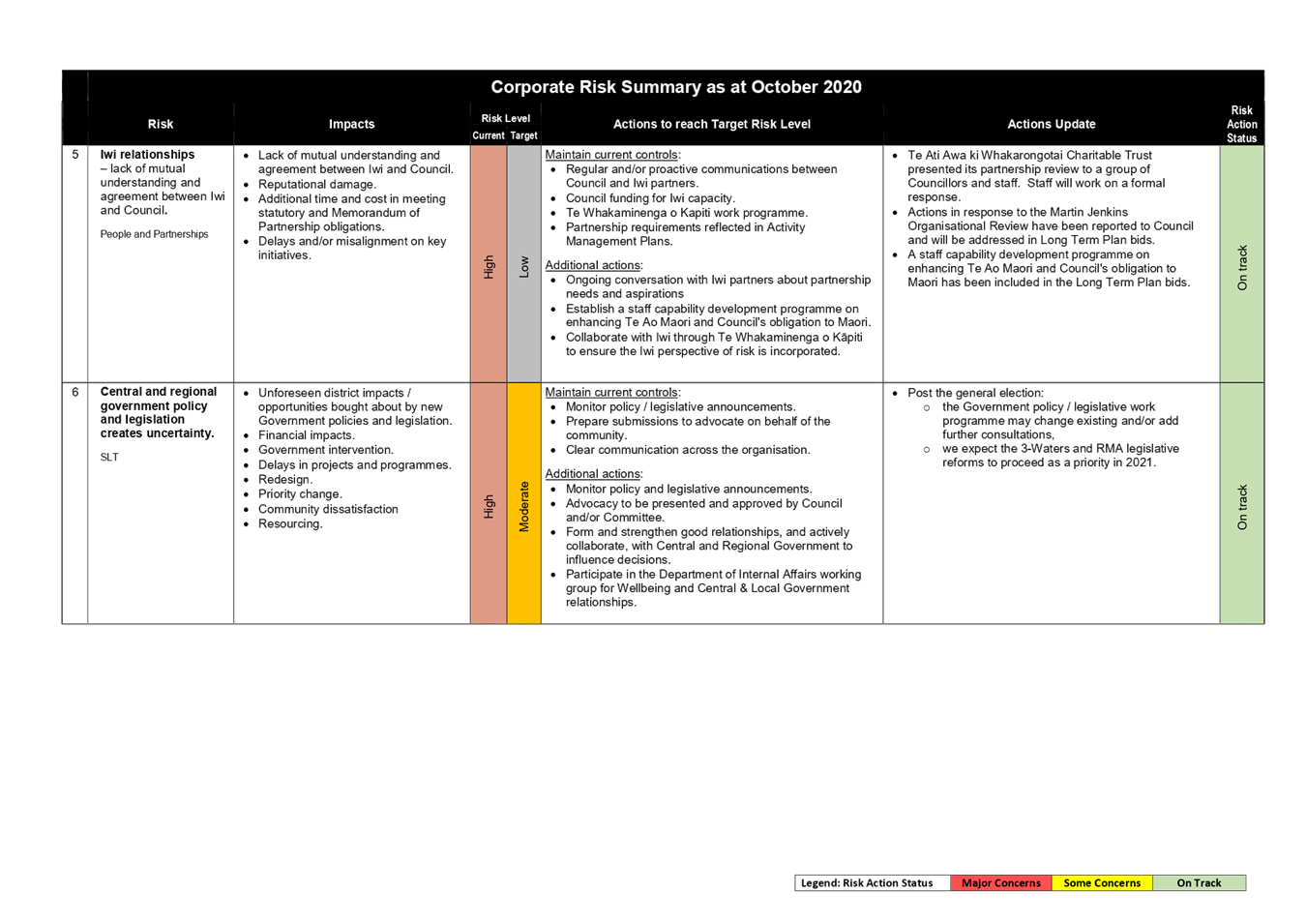

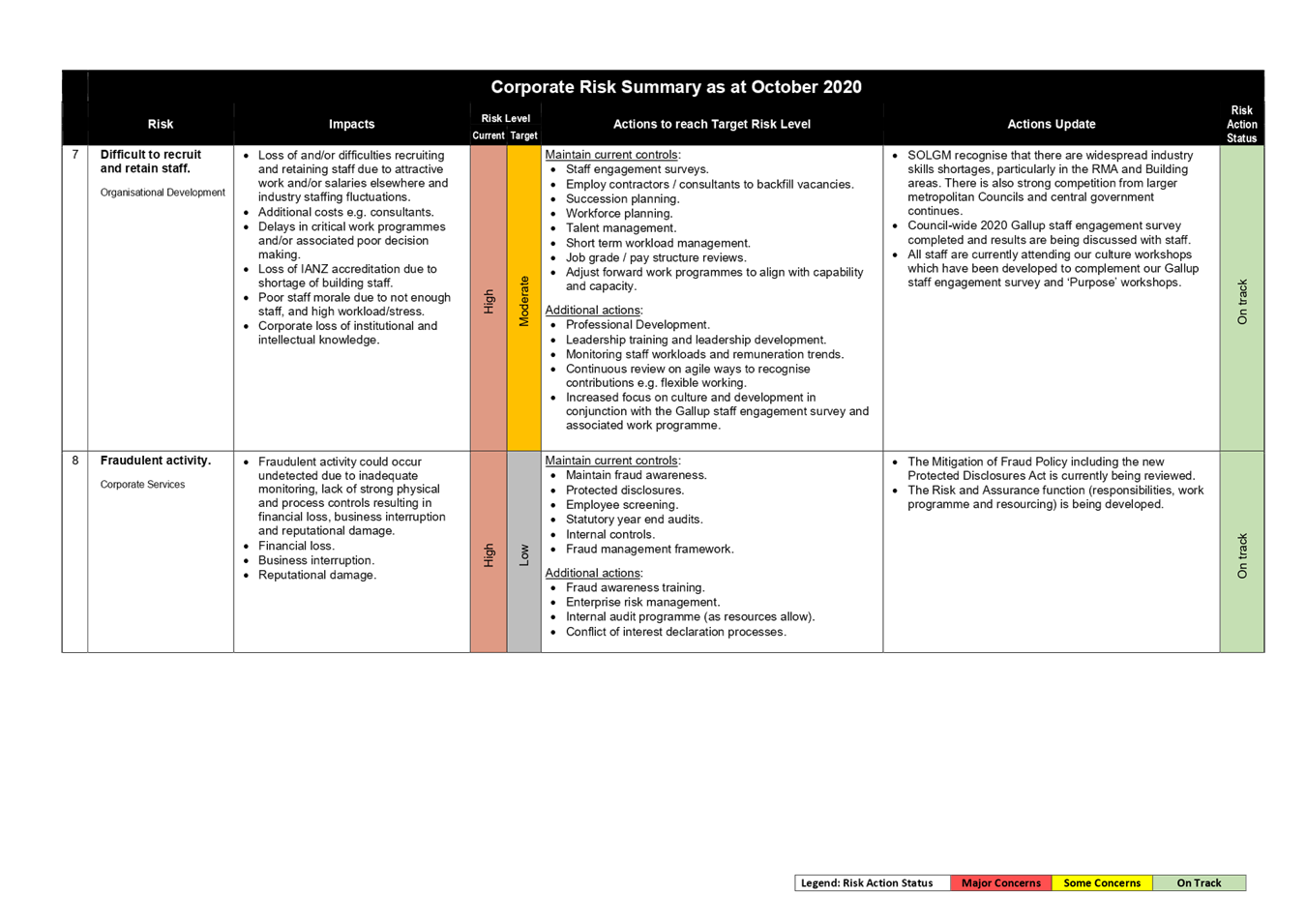

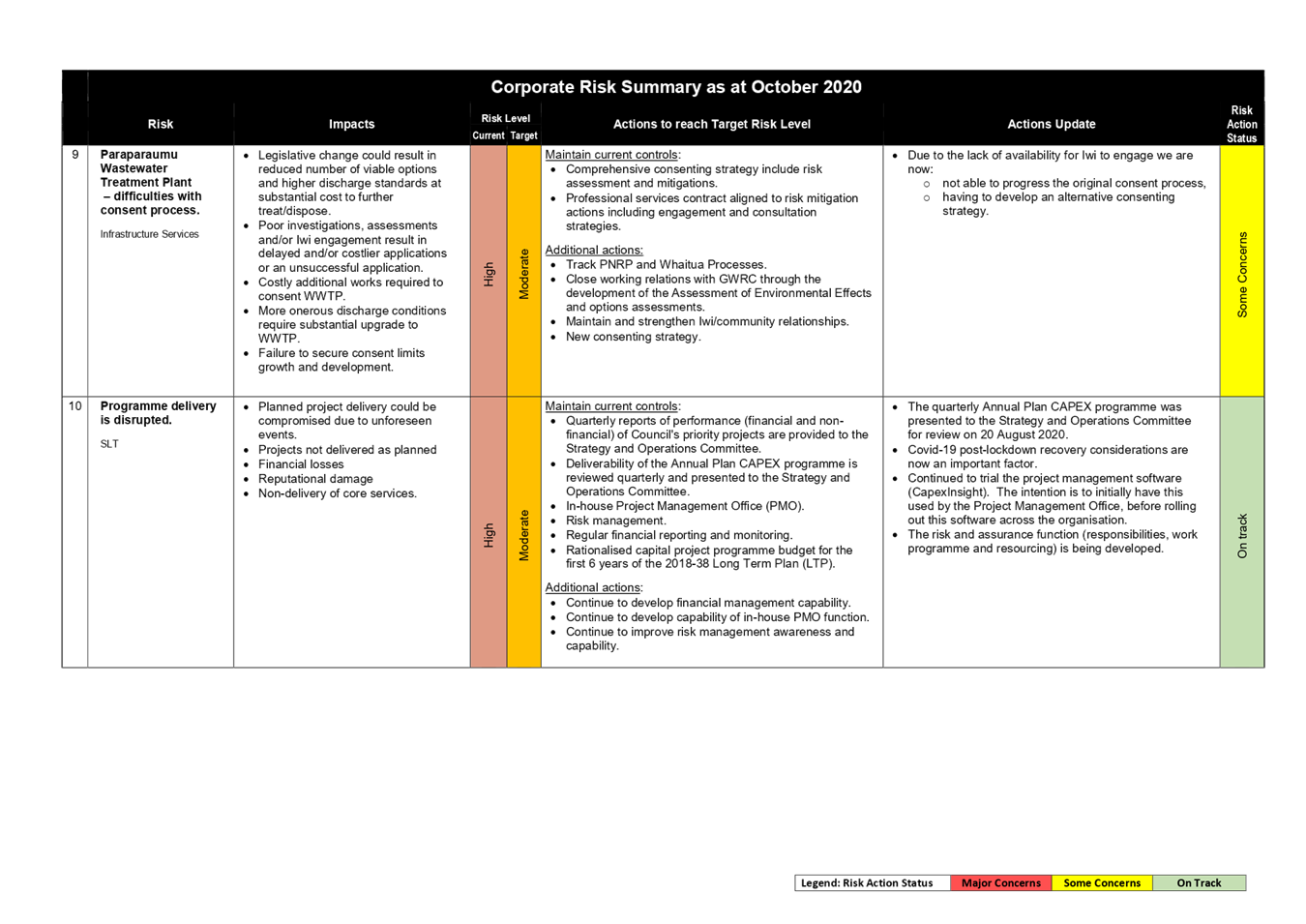

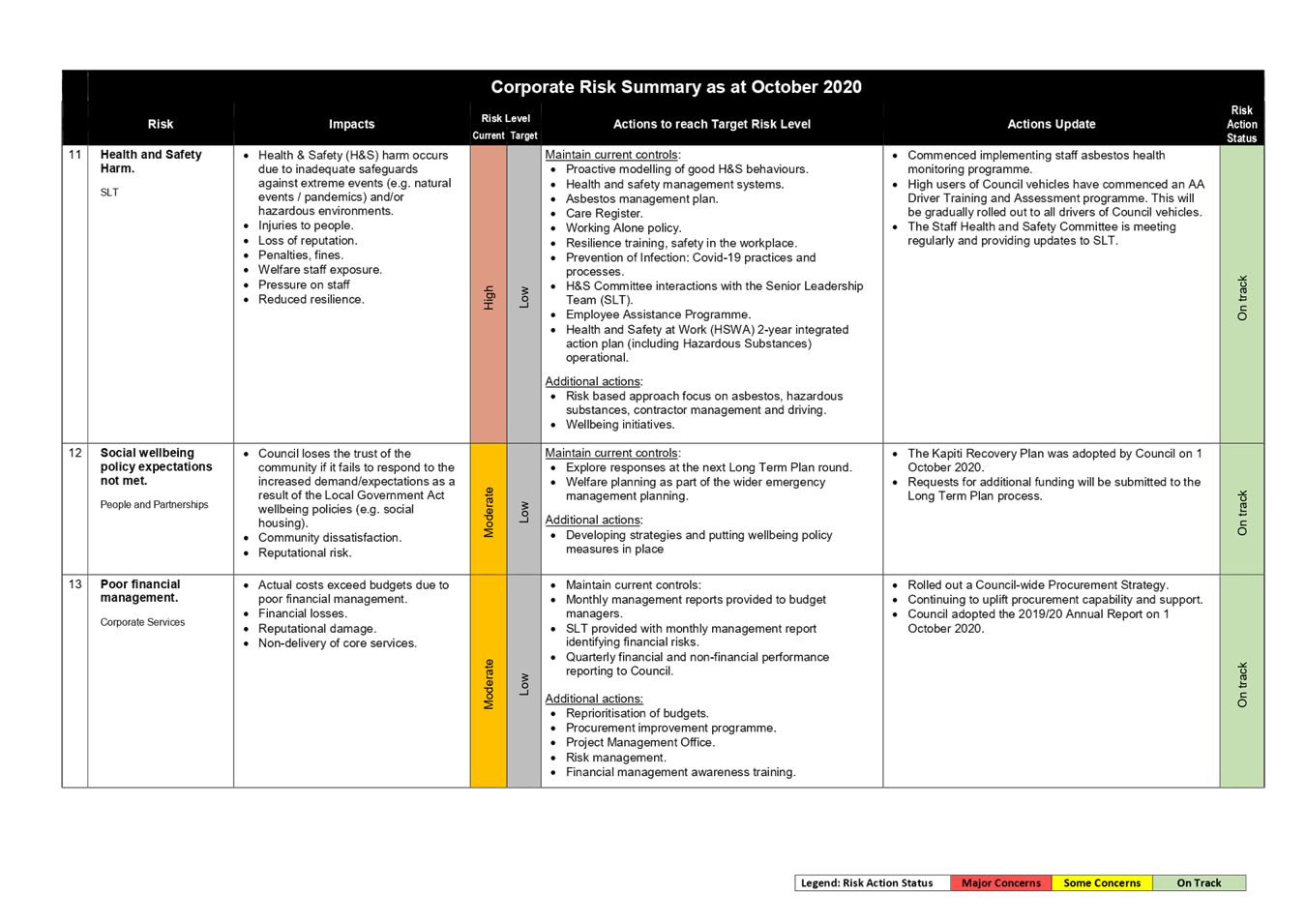

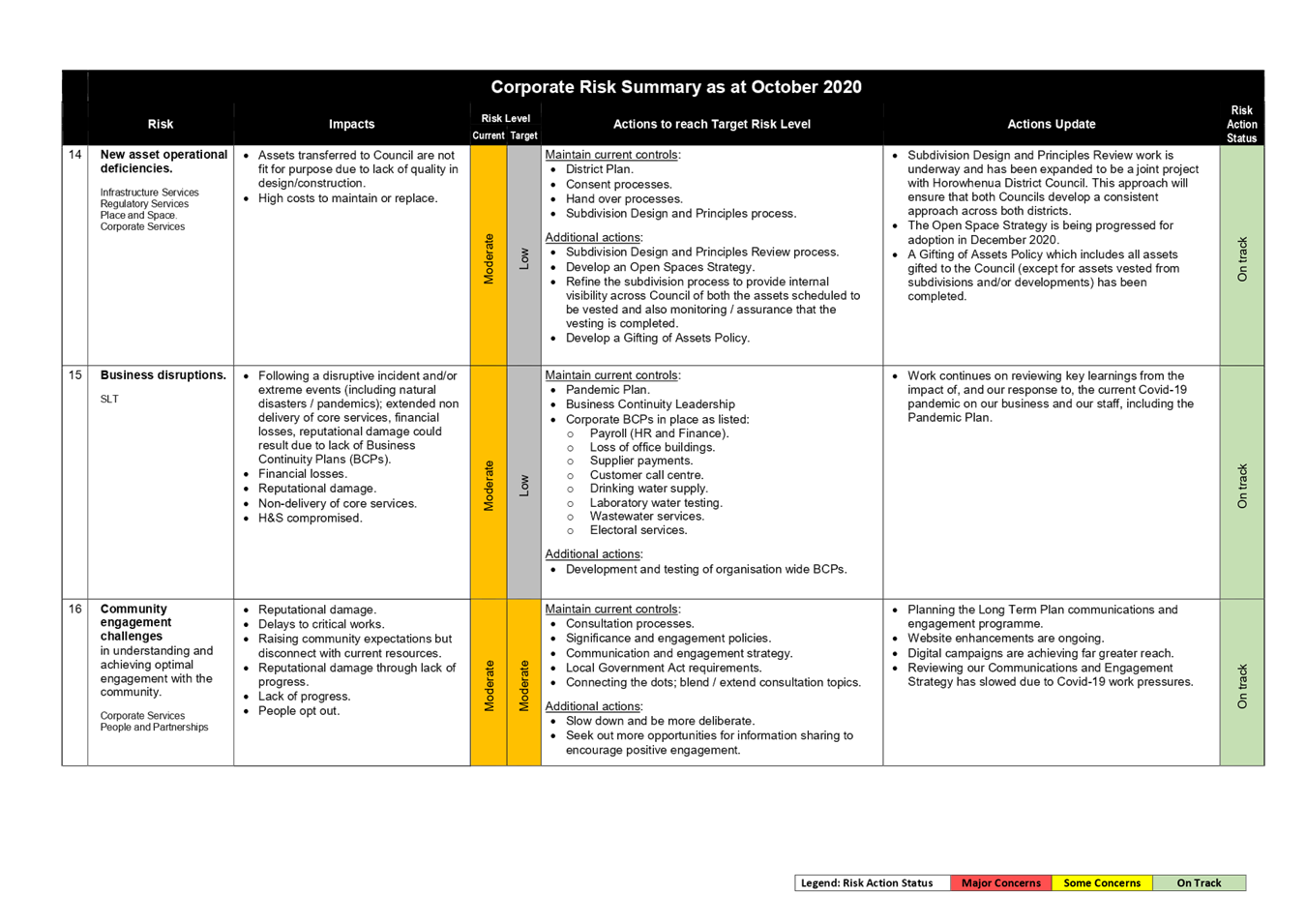

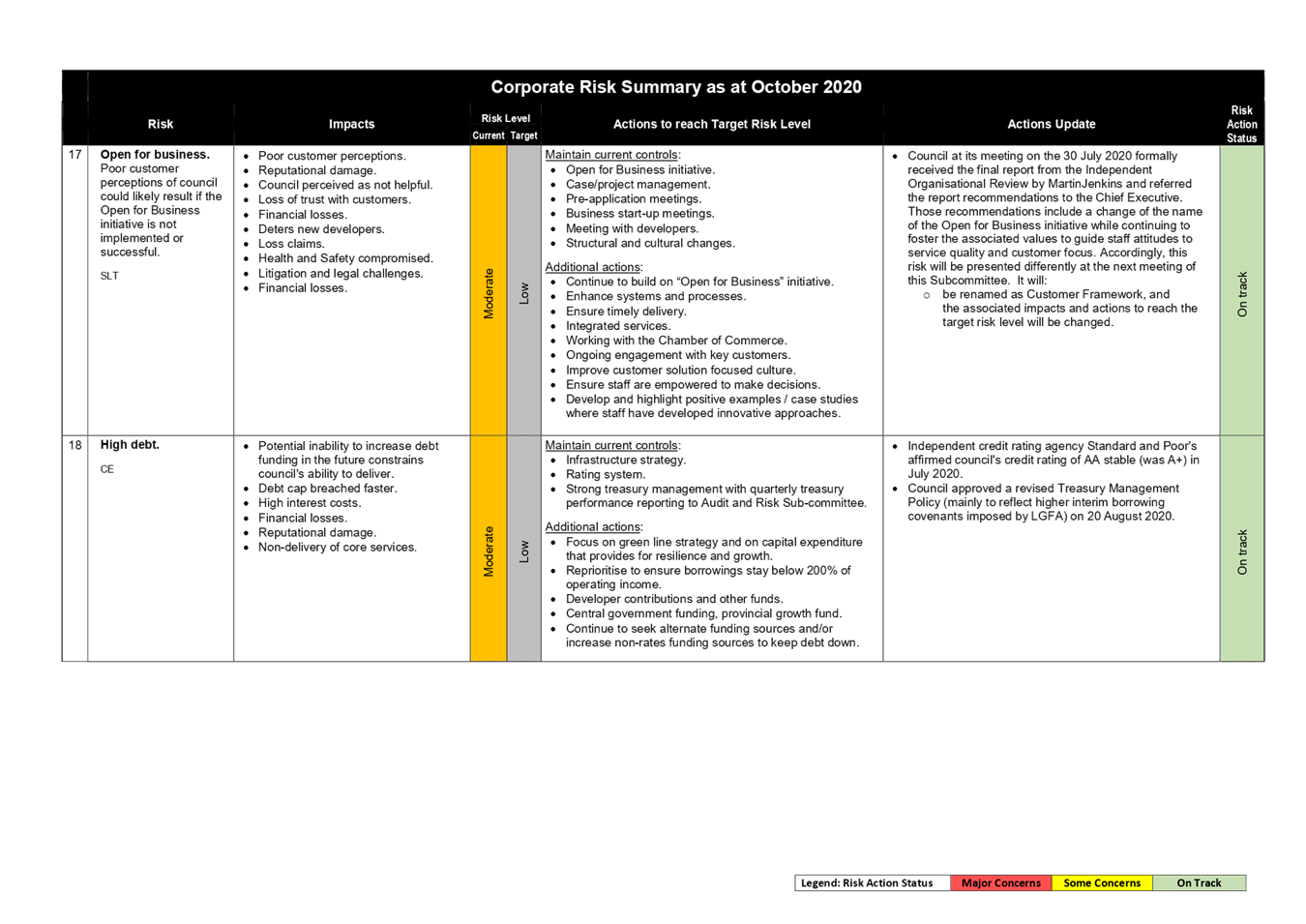

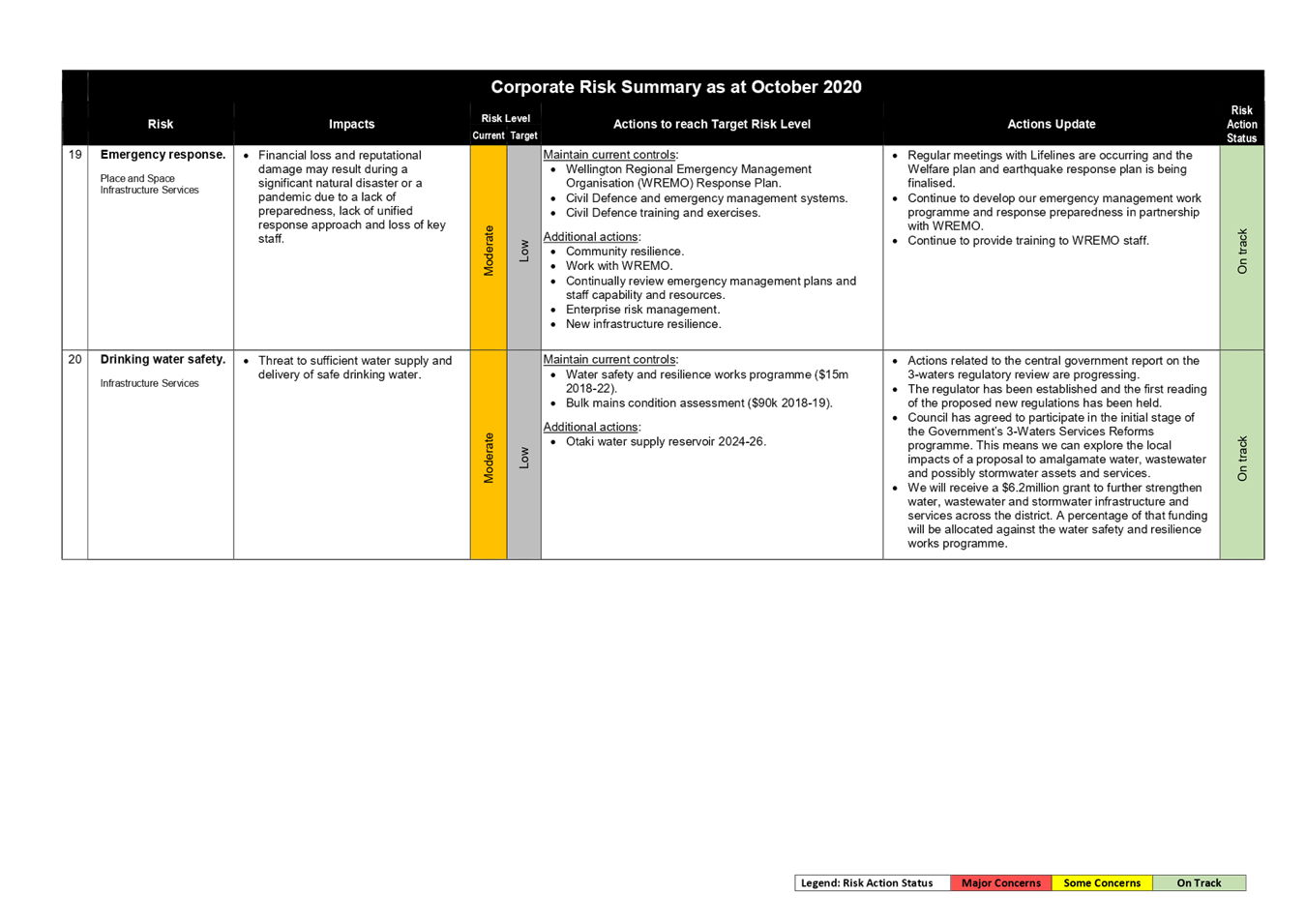

Enterprise Risk Management Progress Update

Corporate Risk Profile –

Summary Update

6 The

corporate risk profile is managed by a risk register and presented in the

associated Corporate Risk Summary attached as Appendix 1 to this report. This

Summary, lists the risk treatments (current controls and additional actions)

planned to reach the target risk level. The risk action status is categorised

as follows:

|

Risk Action Status

|

Major Concerns

|

Some Concerns

|

On Track

|

7 Engagement

on the corporate risk profile is through quarterly conversations with managers.

The focus is on identifying, managing and communicating the very highest

strategic and operational risks that the Council faces. Our approach to

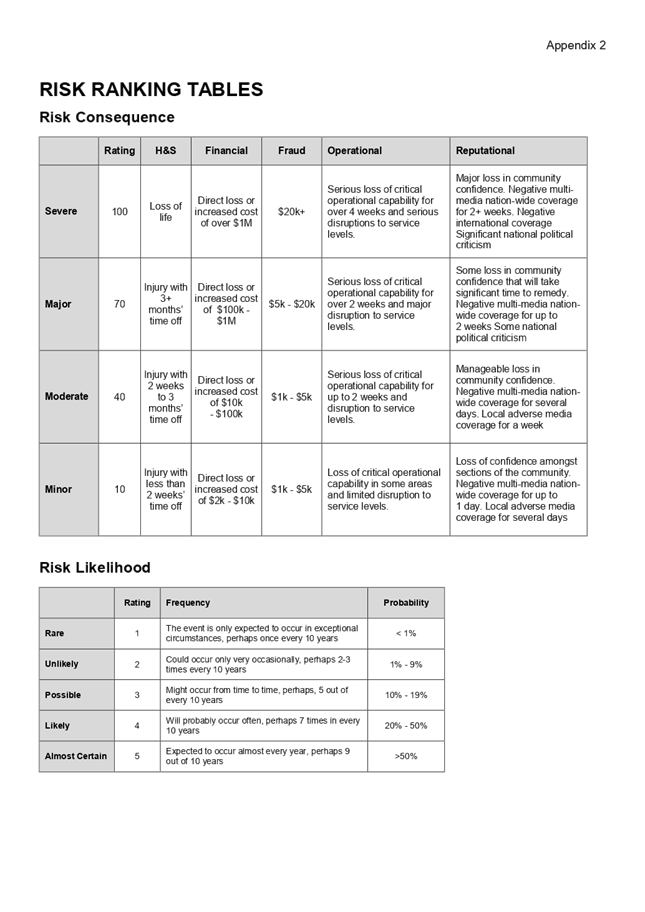

how we assess risk is illustrated in the diagrams in Appendix 2 to this

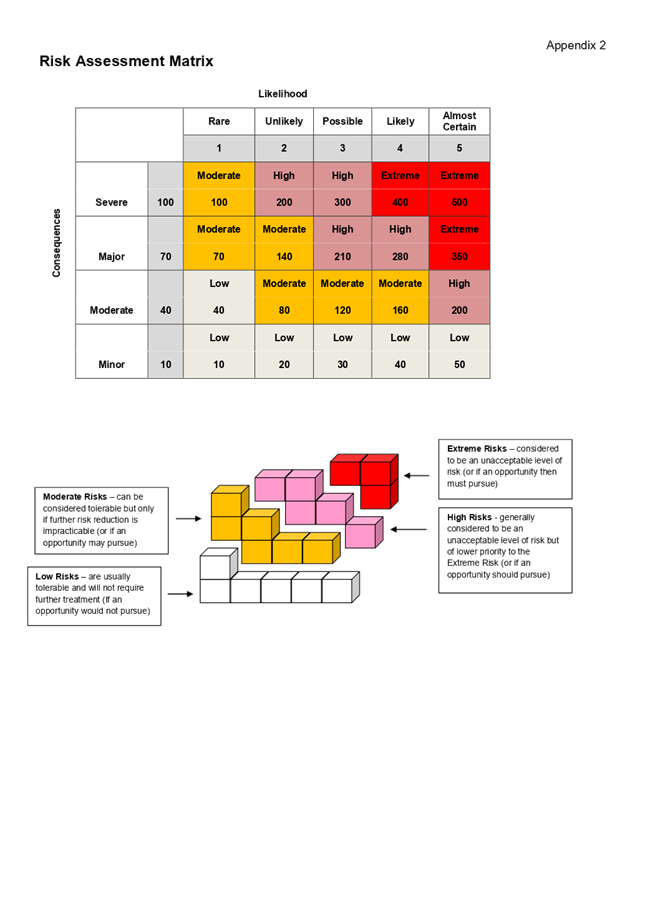

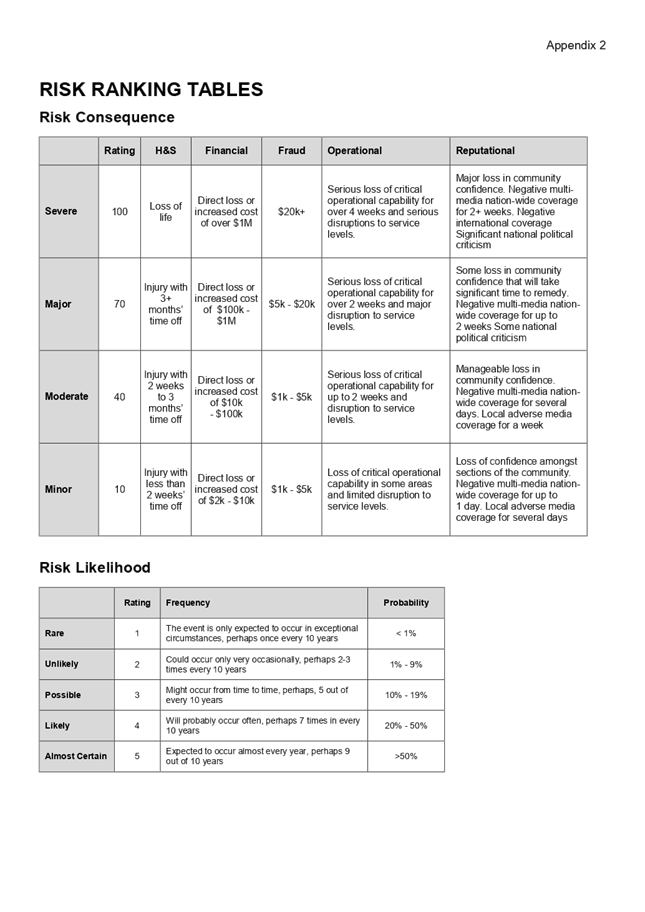

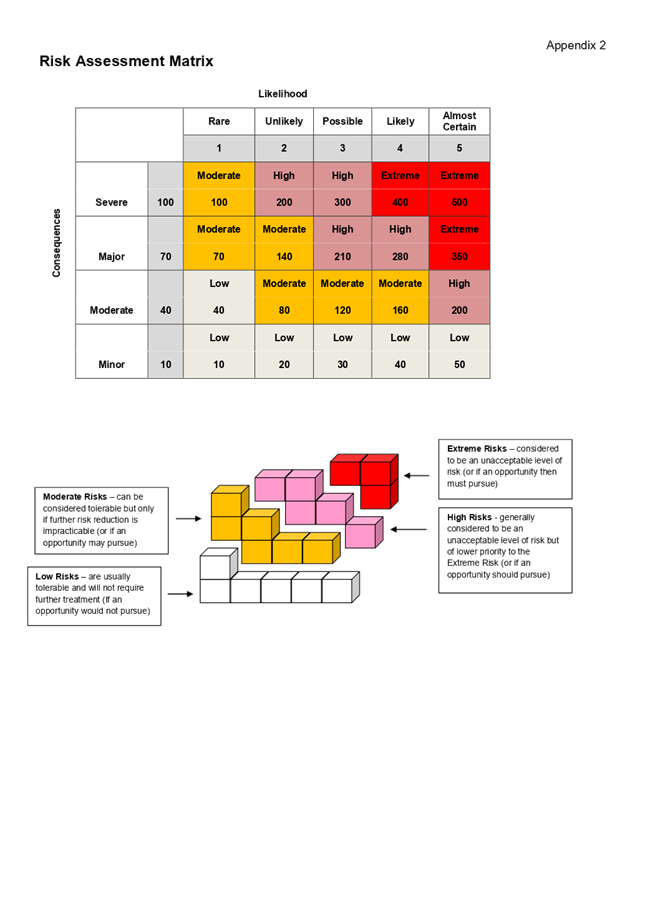

report. Important matters to note when reading the diagrams are that:

7.1 Likelihood

is how likely the risk is to materialise and is rated as rare, unlikely,

possible, likely and almost certain.

7.2 Consequence

is the impact on Council - not just financial, but also health and safety,

fraud, operational and reputational.

7.3 This

assessment tool is subjective and is used as a prompt for a risk comparison and

ranking mechanism.

8 The

overall risk management culture and practice continues to improve and the risk

conversations widen. The concept of risk acceptance is being further

embedded across the organisation, i.e. certain moderate level risks may be

tolerated by the business in the context of the costs or impracticalities to

further mitigate the risk.

9 Matters

for your particular attention in the Corporate Risk Summary attached at

Appendix 1 to this report are:

|

Risk

|

Risk Action Status

|

Comment

|

|

Risk

9

|

Paraparaumu

Wastewater Treatment Plant – difficulties with consent process

|

Some

concerns

|

Due to the

lack of availability for Iwi to engage the original consent process we are

now not able to progress the original consent process.

Instead an

alternative consenting strategy has had to be developed. This will incur additional

costs, over and above the original project estimates.

|

|

Risk

17

|

Open for business

|

On

Track

|

Note that this risk

and the associated impacts and actions to reach the target risk level will be

changed for the next report to this Subcommittee.

The risk will be

renamed Customer Framework while continuing to foster the associated values

to guide staff attitudes to service quality and customer focus.

This change follows

from the recommendations in the final report from the Independent

Organisational Review by MartinJenkins.

|

Preparedness for moving between Covid-19 alert levels

10 Covid-19

has created a new form of business disruption. We are currently assessed as a

moderate level risk (with a target risk level of low), in the Corporate Risk

Summary, attached as Appendix 1 to this report.

Corporate Preparedness

11 Our

Covid-19 Working Group led by key Activity Managers established during the

Covid-19 Alert Level 4 lockdown continues to operate during Level 1. Their

focus is to manage preparedness across the various Council work streams to

ensure the best overall approach to working safely under each Covid-19 Alert

Level. Critical to their success is their ability to consider and apply

key information from approved sources such as All-of Government updates,

legislation, and local government information from LGNZ and SOLGM.

12 Communication

across the organisation is key to preparedness. The Chief Executive and

his Senior Leadership Team are kept informed of the working group’s

considerations and actions. Staff are also updated via internal communications

either from the Chief Executive, their line manager and/or the Council

intranet.

Kāpiti Emergency

Operations Centre Preparedness

13 We

have developed a resurgence plan that clearly articulates roles,

responsibilities and primary focus areas should the country, region or in fact

district see a second wave of Covid-19 cases. This plan builds on the debrief

and learnings from our and regional experiences during Covid-19 first wave and

in particular builds on the strength of relationships developed with our

‘not for profit’, welfare and volunteer sectors here in

Kāpiti.

14 The

resurgence plan makes assumptions of the role of a variety of central

government agencies based on our experiences out of the first wave. It also

considers feedback given to these national organisations about the ‘all

of government response’ and the opportunities for improvement in

collaboration with local government.

Recovery

15 While

there is work underway for ensuring preparedness for the potential of Covid-19

resurgence, we are also getting on with delivering on recovery actions set out

in the Recovery Plan.

16 In

the event of resurgence, we will need to review and potentially pause some

recovery actions until the impact of any resurgence is known. In the

meantime, we are confident the current recovery actions are the right ones for

us to be focussing on for where we are currently at.

Procurement

Improvement Programme

17 Progress

toward better procurement maturity is well in hand. The Council-wide

Procurement Strategy has now been rolled out and work to uplift procurement

capability and support has continued.

Risk and Assurance

18 The

risk and assurance function (responsibilities, work programme and resourcing)

is currently being developed.

Considerations

Policy

considerations

19 There

are no further policy implications arising from this report.

Legal

considerations

20 There

are no further legal considerations arising from this report.

Financial

considerations

21 The

work described above is planned to be funded from the 2020/21 Annual Plan

budget by way of prioritised spending.

Tāngata

whenua considerations

22 There

has been no direct engagement with tāngata whenua regarding this report.

Strategic

considerations

23 This

enterprise risk management framework contributes to ensuring that the Council

is continuing to improve its financial position against financial constraints.

Significance and Engagement

24 This

matter has a low level of significance under the Council Policy.

|

Recommendations

25 That

the Audit and Risk Subcommittee receives and notes this report, including

Appendices 1 and 2 to this report.

|

Appendices

1. Corporate

Risk Summary ⇩

2. Risk

Comparison and Ranking Mechanism ⇩

|

Audit

and Risk Sub-committee Meeting Agenda

|

12 November 2020

|

|

Audit and Risk Sub-committee Meeting Agenda

|

12 November 2020

|

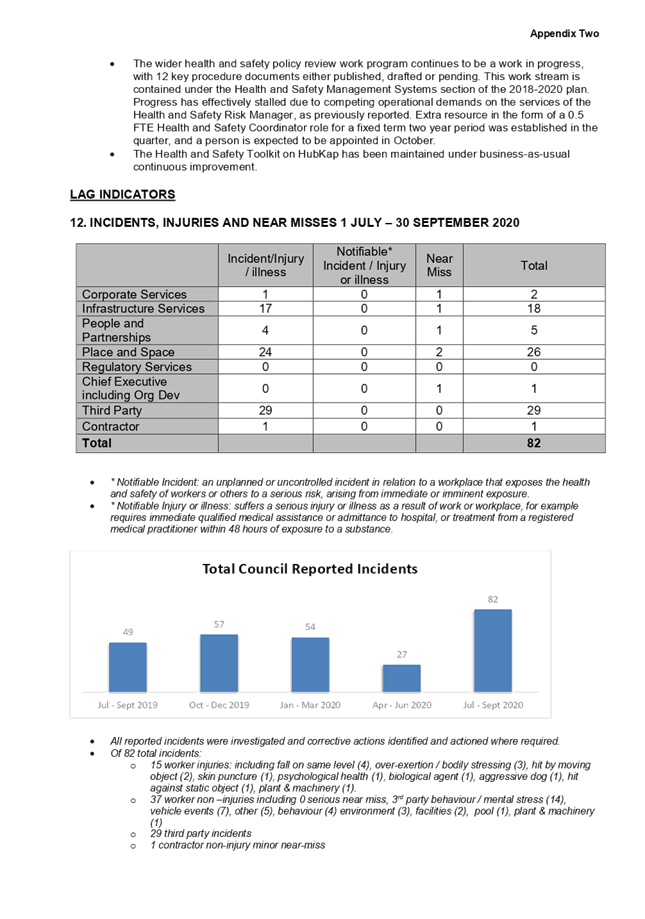

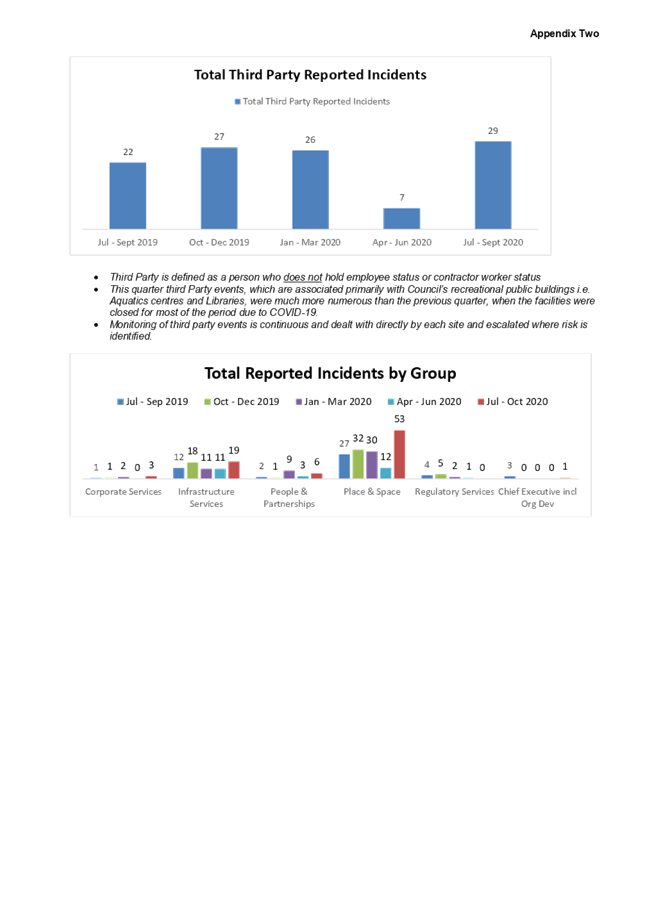

8.3 Health

and Safety Quarterly Report: 1 July 2020 - 30 September 2020

Author: Dianne

Andrew, Organisational Development Manager

Authoriser: Wayne

Maxwell, Chief Executive

Purpose of Report

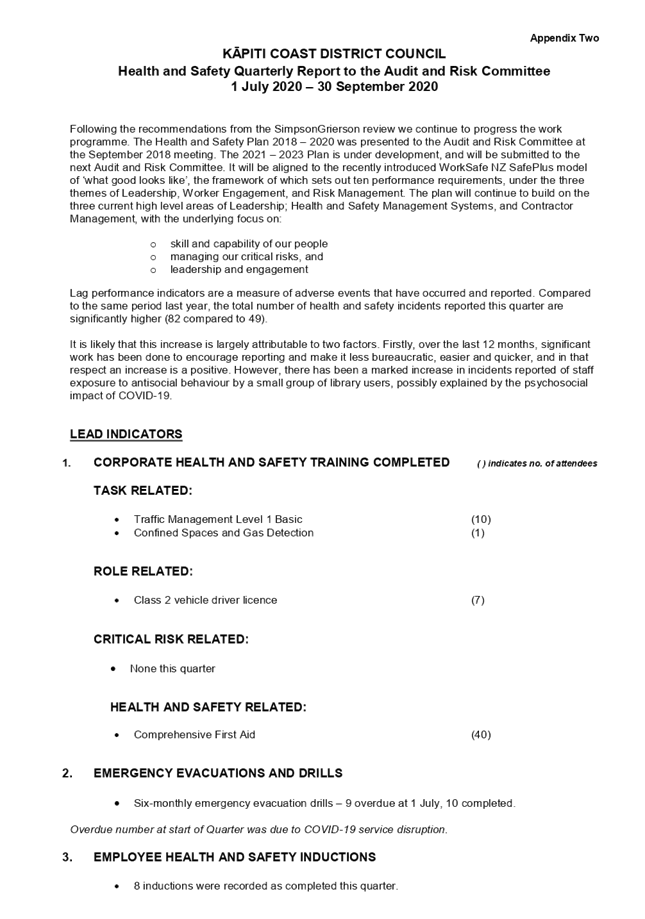

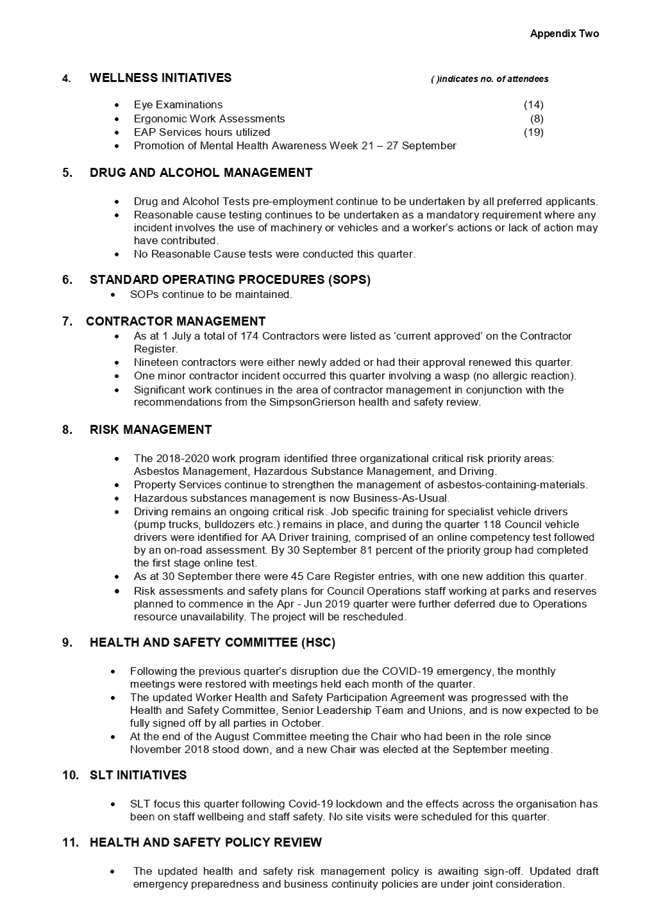

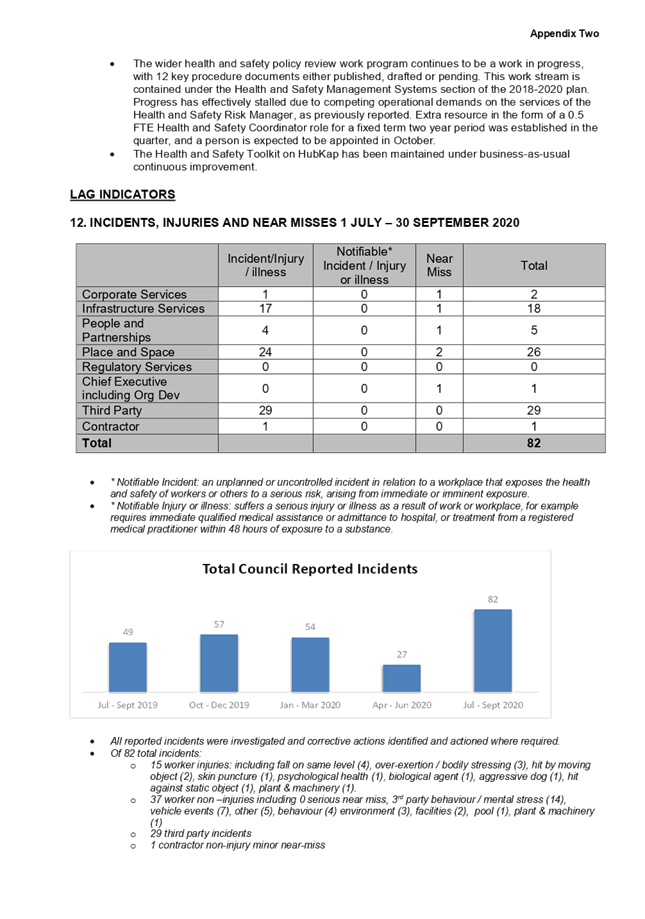

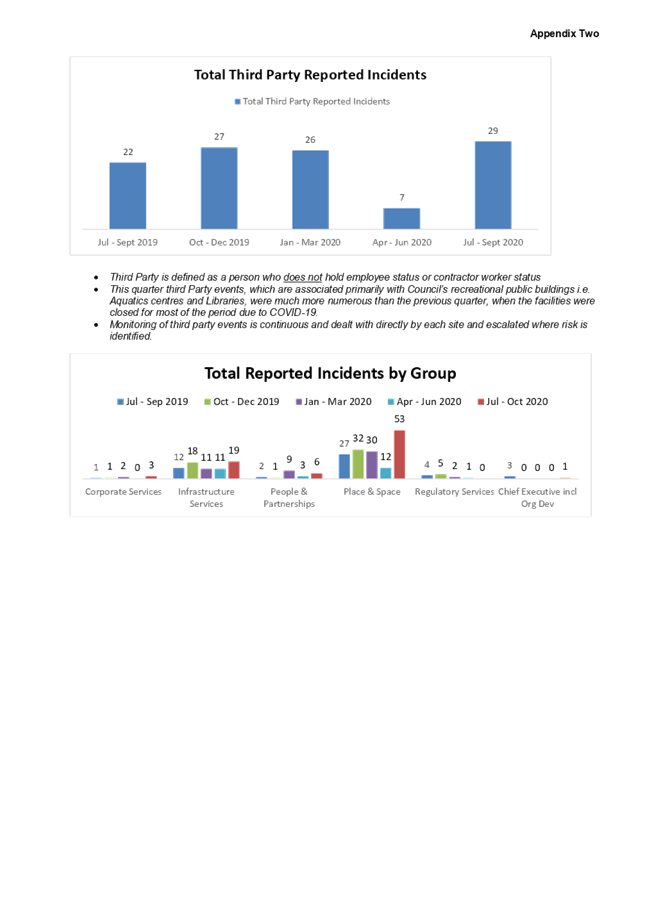

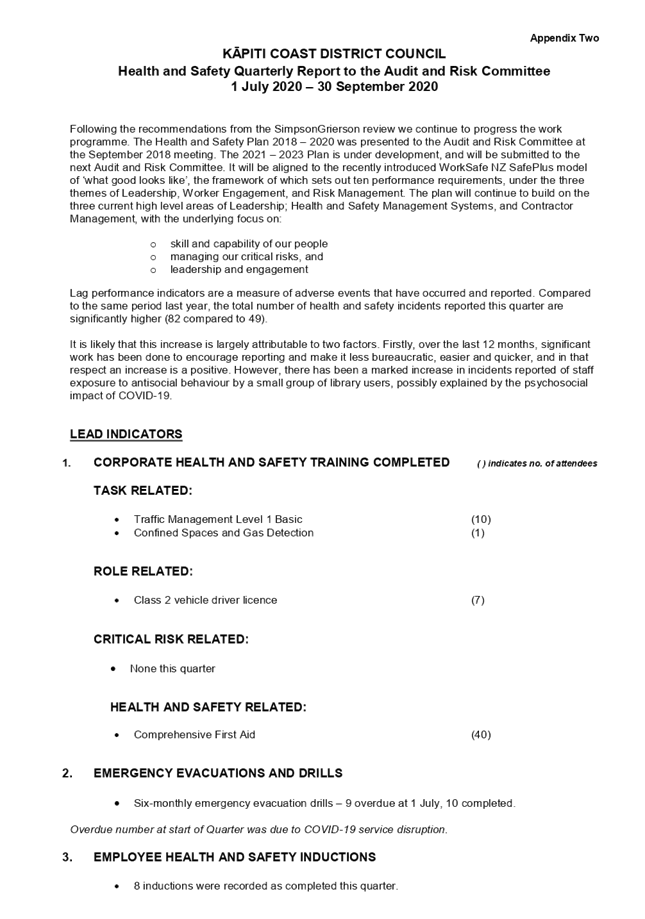

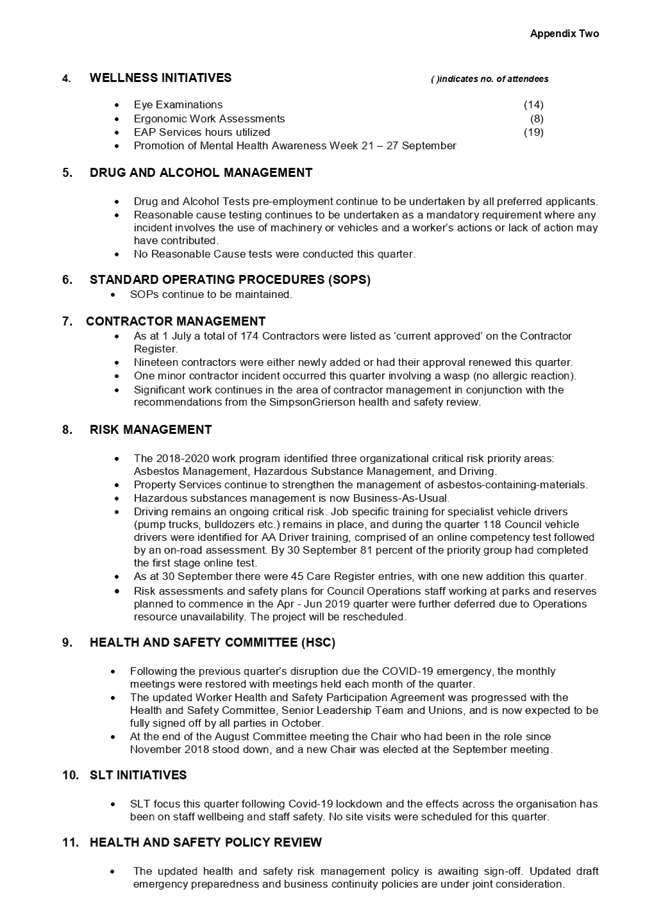

1 This

report presents a Health and Safety report for the period 1 July 2020 –

30 September 2020.

Delegation

2 The

Audit and Risk Sub Committee has delegated authority to consider this report

under the following delegation in the Governance Structure, Section C.1:

· Ensuring

that the Council has in place a current and comprehensive risk management

framework and making recommendations to the Council on risk mitigation;

· Assisting

elected members in the discharge of their responsibilities by ensuring

compliance procedures are in place for all statutory requirements relating to

their role;

· Governance

role in regards to the Health and Safety Leadership Charter and Health and

Safety Plan.

Background

3 The

quarterly Health & Safety Performance Report is intended to provide the

Council with insight into initiatives and activities, and their progress, as

part of our organisations commitment to providing a safe and healthy place to

work. The contents and any subsequent discussions arising from this report can

support Council officers to meet their due diligence obligations under the

Health & Safety at Work Act (HSWA) 2015.

4 Between

July and September 2017 the Simpson Grierson Health and Safety team were

engaged to review how the Council was progressing with changes and planned

initiatives following the introduction of the Health and Safety at Work Act

(HSWA) 2015. The findings were presented back to the Audit and Risk Committee

in November 2017. This review identified areas for improvement, in particular

where we can improve some current processes to further strengthen our ability

to more effectively monitor and verify.

5 A

draft Health and Safety Plan 2018 – 2020 was provided to the Committee at

the meeting 13 September 2018 and has since been adopted by the Senior

Leadership Team.

6 Progress

on the 2018 – 2020 Health and Safety Plan has been incorporated into

quarterly reports going forward.

Issues and Options

Issues

7 Progress

on the Health and Safety 2018-2020 Plan initiatives is progressing however the

alert level 4 and alert level 3 restrictions severely disrupted planned health

and safety related initiatives and training. Several time lines may continue to

be extended and this will be updated through the reporting cycle.

Considerations

Policy

considerations

8 There

are no Policy considerations.

Legal

considerations

9 There

are no legal considerations.

Financial

considerations

10 Budget

has been provided for implementation of the action plan initiatives as part of

the 2018-38 Long Term Plan.

Tāngata

whenua considerations

11 There

are no Tāngata whenua considerations.

Significance and Engagement

Significance

policy

12 This

report does not trigger the Council’s Significance and Engagement Policy.

Publicity

13 There

are no publicity considerations.

|

Recommendations

14 That

the Audit and Risk Sub Committee notes the Health and Safety Quarterly Report

for the period 1 July 2020 – 30 September 2020 attached as Appendix One

to this Report.

|

Appendices

1. Health

and Safety Quarterly Report 1 July 2020-30 September 2020 ⇩

|

Audit

and Risk Sub-committee Meeting Agenda

|

12 November 2020

|

9 Confirmation

of Minutes

9.1 Confirmation

of minutes

Author: Jayne

Nock, Executive Secretary to Group Manager Corporate Services

Authoriser: Mark

de Haast, Group Manager Corporate Services

|

Recommendations

That the minutes of the Audit

and Risk Subcommittee meeting on 24 September 2020 be accepted as a true and

accurate record of the meeting.

|

Appendices

1. Draft

Minutes of the Audit and Risk Subcommittee meeting 24 September 2020 ⇩

|

Audit

and Risk Sub-committee Meeting Agenda

|

12 November 2020

|

11 Public

Excluded Reports

Resolution

to Exclude the Public

|

PUBLIC EXCLUDED ReSOLUtion

That, pursuant to Section 48 of the Local Government

Official Information and Meetings Act 1987, the public now be excluded from

the meeting for the reasons given below, while the following matters are

considered.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

10.1 - Confirmation of Public Excluded Minutes

|

Section 7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

Section 7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

Section 7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

Section 7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

Section 48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

11.1 - Update on litigation status, statutory

compliance issues and investigations

|

Section 7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

Section 7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

Section 7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

Section 7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

Section 48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|